Prehistoric man’s only connection to sweetness came from honey and sweet fruit. Sucrose, starch-derived sugars, and artificial sweeteners were discovered as a result of humans’ hunt for different types of sweetness.

First natural sweetener

The first sweetener that human beings discovered was honey. India produced sugarcane beginning in the Vedic era (1200–1000 BCE). Mid-18th century Europe exploited sugar beetroot as a sugar source. An increase in sugar consumption was found to have negative impacts. As a result, the first artificial sweeteners in the world, including aspartame (APM), cyclamate, and sucralose, were created in Germany in 1879. Two potent sweeteners known as katemfe and the Serendipity Berry were discovered in 1972.

In recent times

Stevia is currently the most organic sweetener. It has anti-inflammatory, antiviral, anti-hypertension, and antioxidant effects. Erythritol and xylitol, two alcoholic sweeteners, are also regarded as natural since they are made from fermented fruits and wood hemicellulose, respectively. Natural sweeteners, therefore, have calories and nutrients. Due to consumer rejection of artificial food additives and health concerns related to high sugar intake, interest in natural sweeteners has increased significantly.

Types of sweeteners

Modern-day key global players

Our report offers a thorough review of the companies that provide sugar alternatives and rates the effectiveness of sugar reduction on a scale from 1 to 100%.

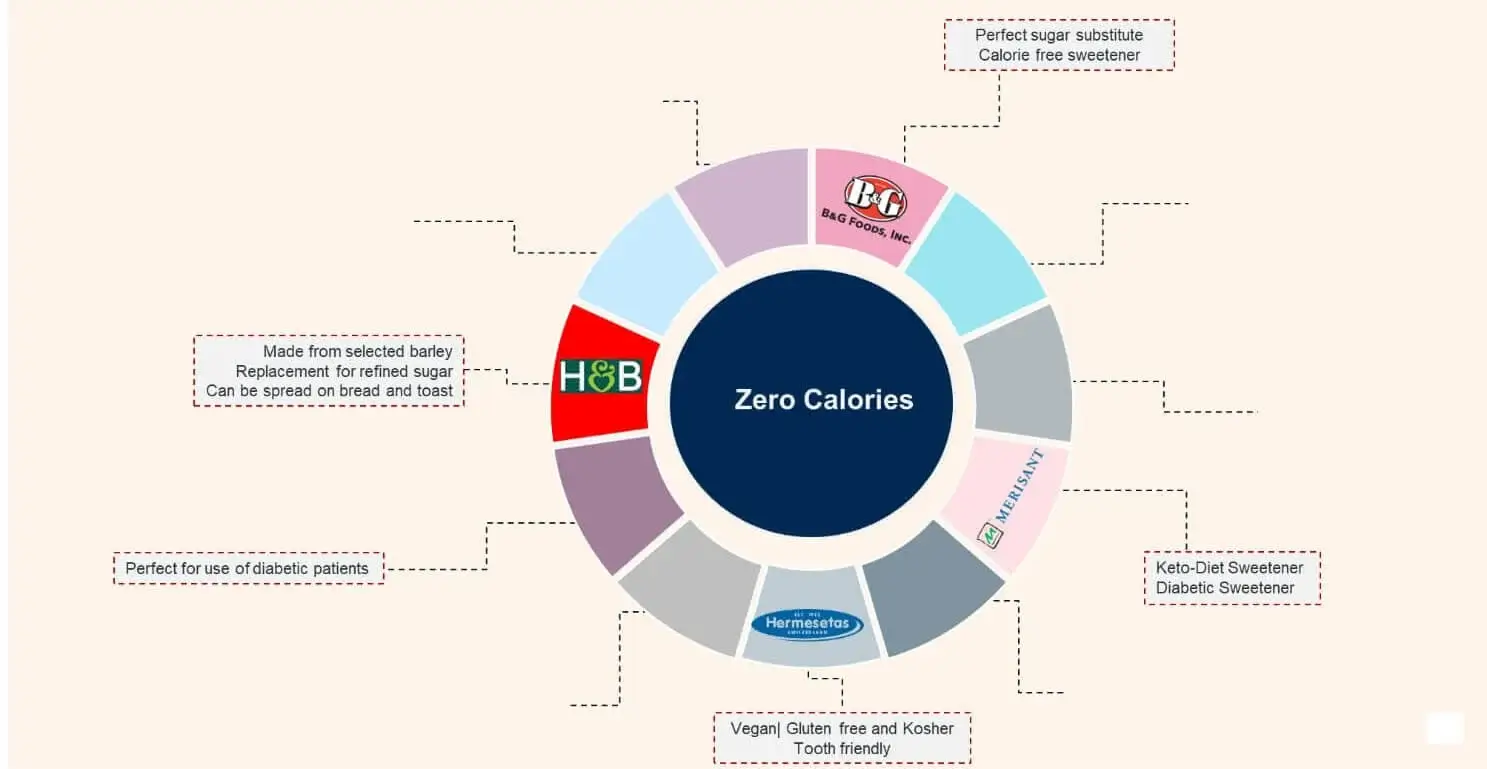

Weight loss and diabetes prevention are two of the main advantages of cutting less on sugar. Our report discusses the benefits of utilizing substitutes for sugar as well as the companies that offer calorie-free

alternatives for sugar. A few of them are listed below in the figure.

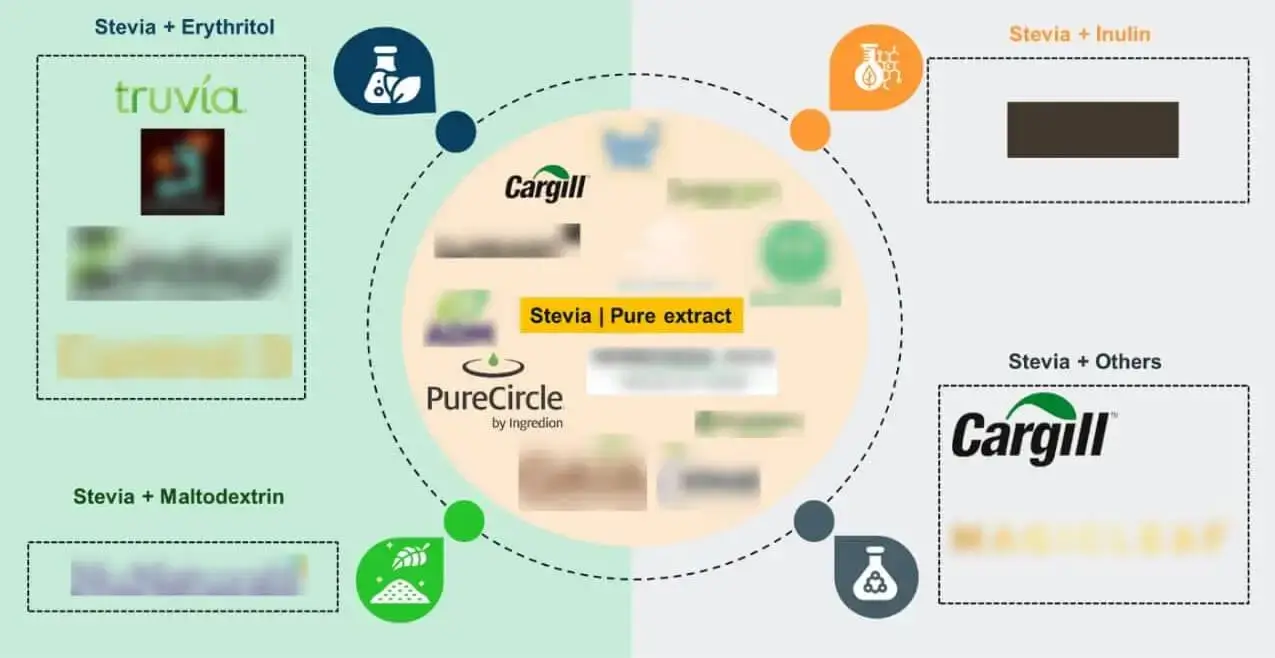

Our report covers detailed information about the various raw materials which can be used in the process of sugar reduction. There are companies which use Stevia as the only raw material in developing sweetener products. Also, the report mentions companies which use a combination of Stevia with other raw materials to develop sugar alternatives.

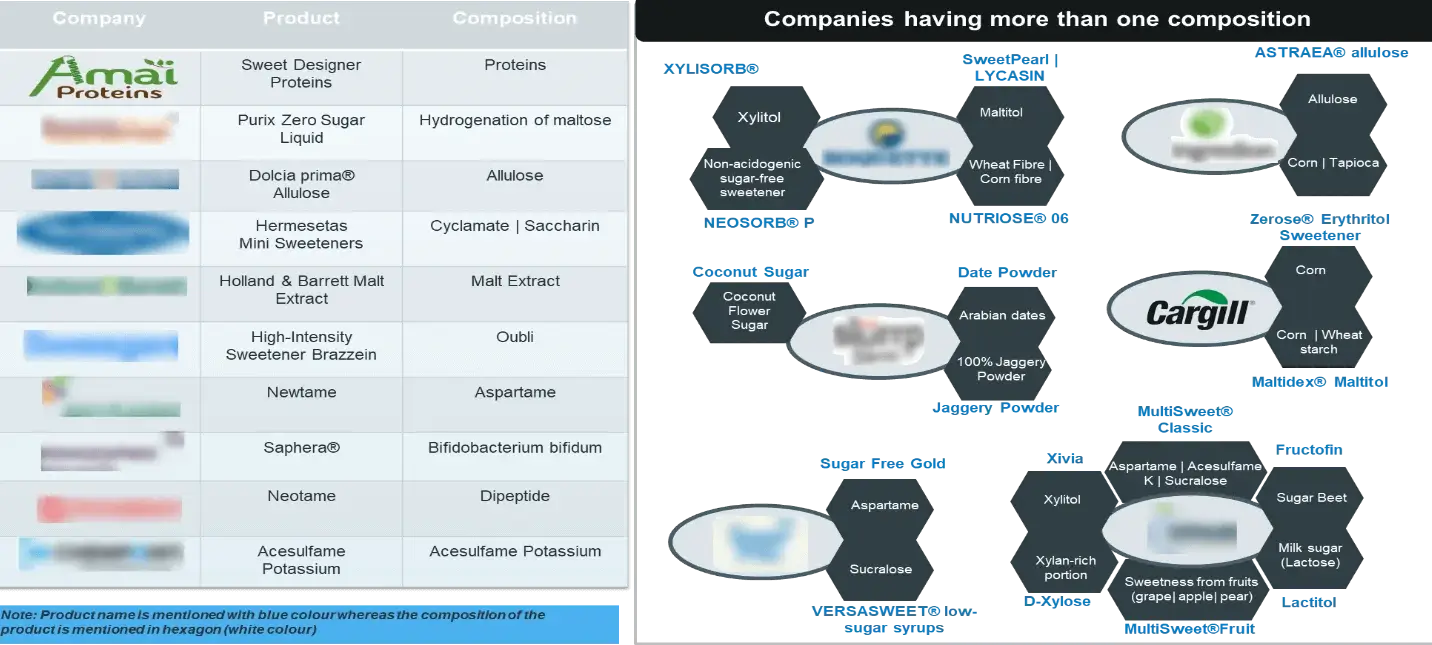

The use of stevia and its mixtures for the development of sugar substitutes is demonstrated in our report. Additionally, it highlights the businesses that employ many compositions in the creation of sugar alternatives and the most commonly used compositions. For example: Cargill, uses corn and wheat starch composition to develop its product.

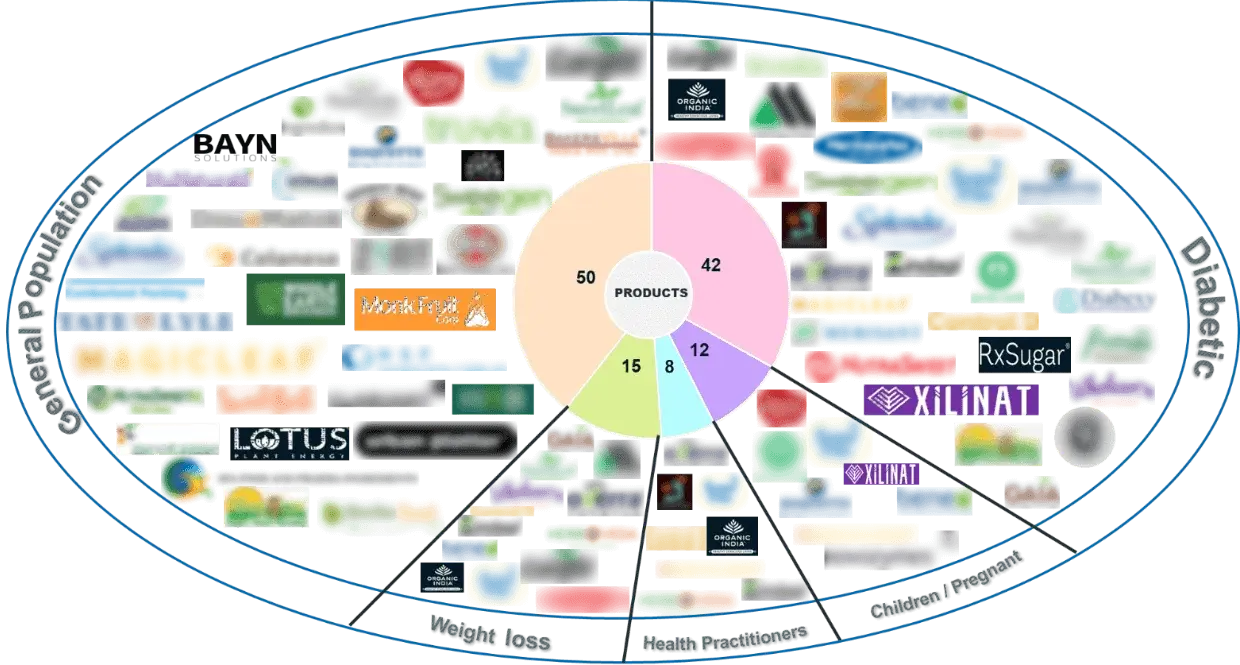

Our report shows the specific population targeted by the companies. Segmented categories include general population, weight loss expecting population, health practitioners, diabetic patients and pregnant women.

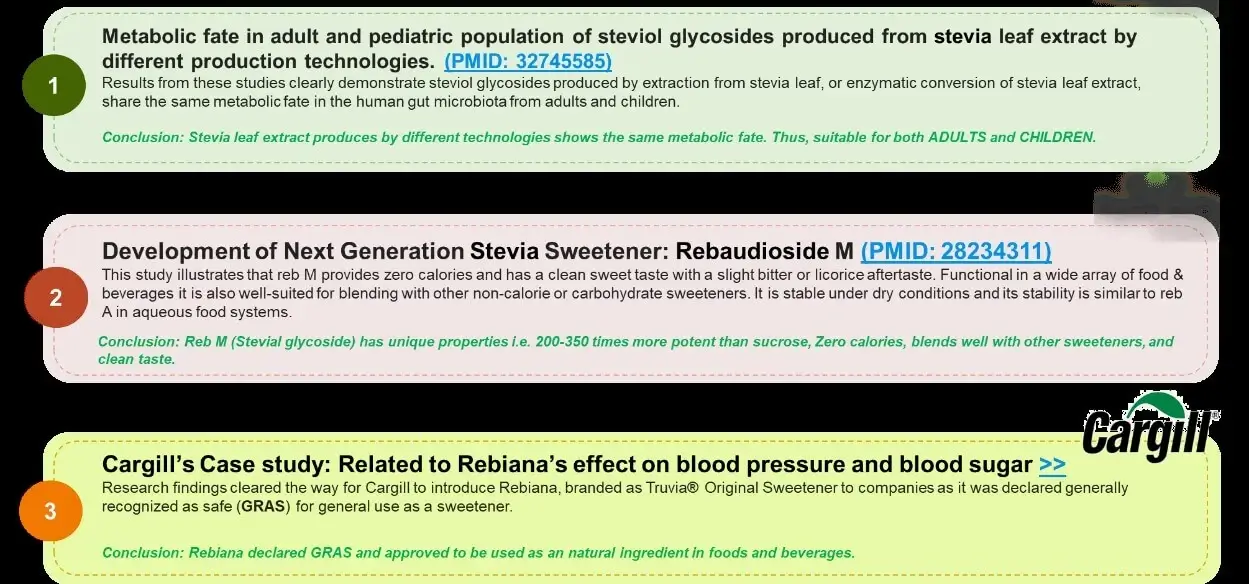

The report showcase studies of respective companies with specified results from a literature, to prove the positive effects of the raw materials used in their products.

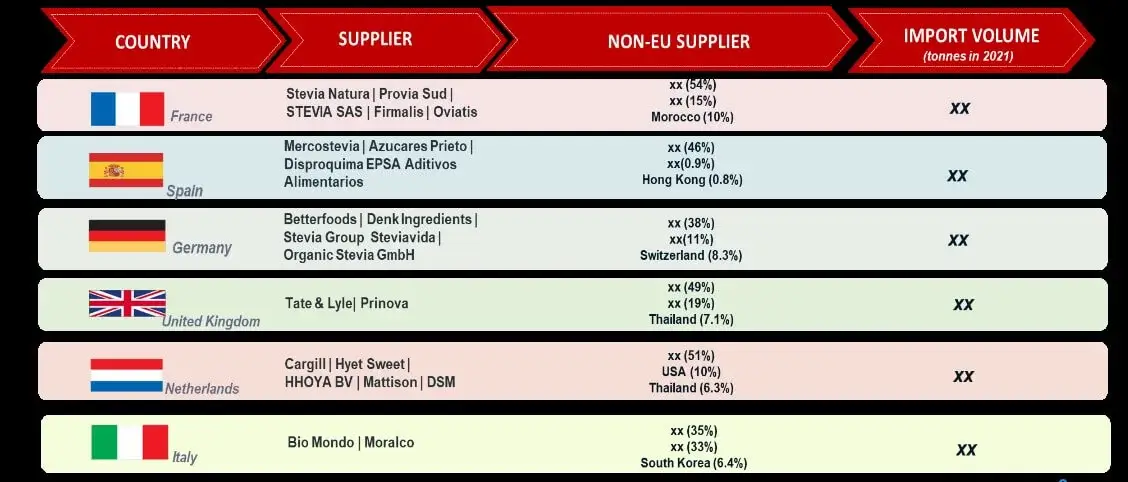

The report also shows European and non-European stevia suppling countries. France had the maximum import volume in 2021, amongst all other European countries.

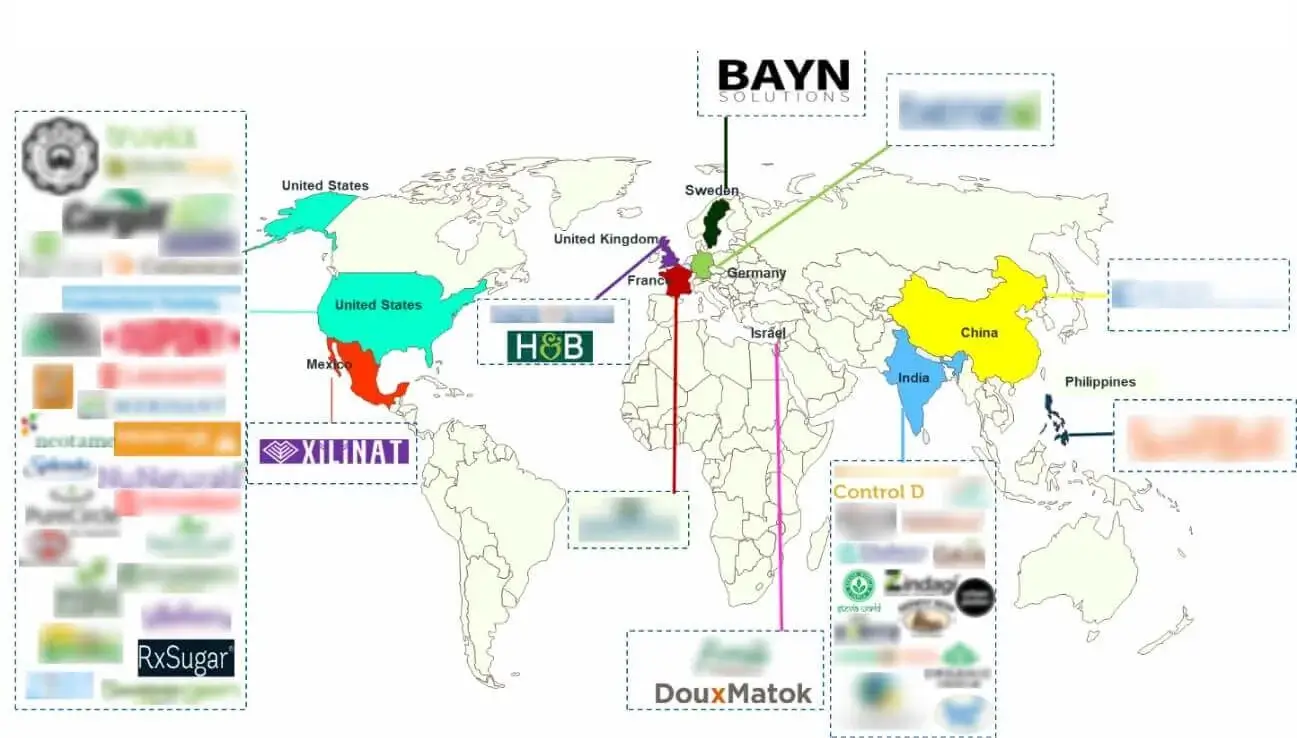

The report showcases the distribution of key sugar alternative producing companies across the globe, with respect to the country of origin.

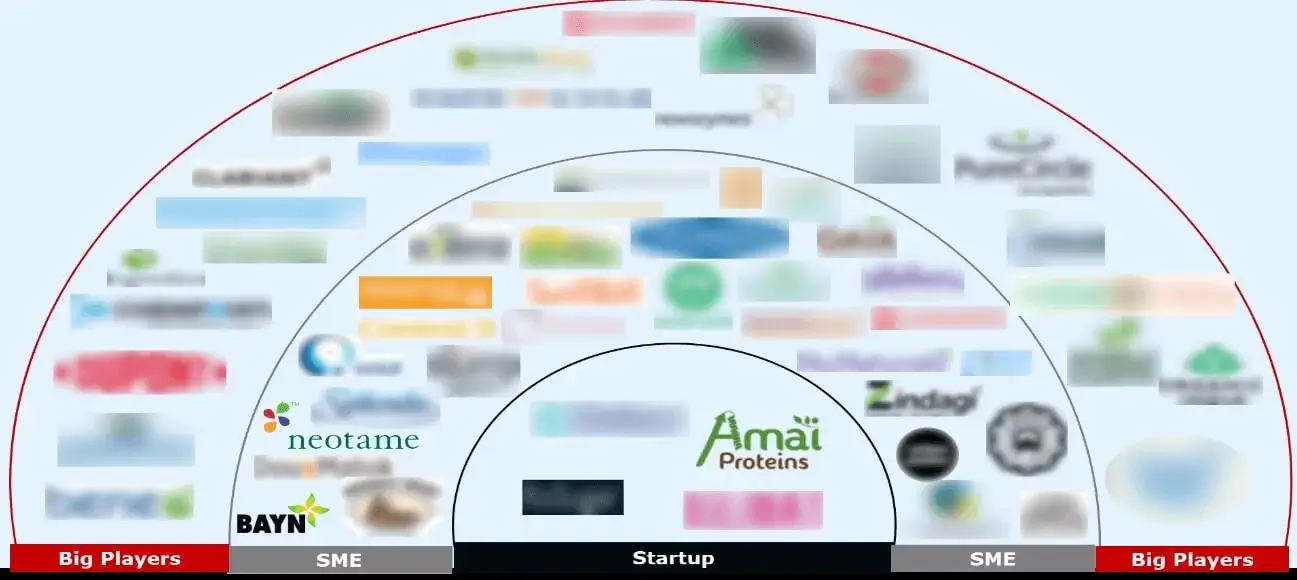

The report shows company segmentation on the basis of business size. The companies are divided as big players, SME, and startups.

In order to give the most precise estimations and forecasts, Wissen Research uses an extensive and iterative research approach that is focused on reducing deviation. The company blends top-down and bottom-up methodologies for market segmentation and quantitative estimation. In addition, data triangulation, which examines the market from three separate angles, is a recurrent topic present in all of our research studies. Important components of the approach used for all of our studies include the following.:

Preliminary data mining

On a wide scale, unprocessed market data is collected. Continuous data filtering makes sure that only verified and authenticated sources are taken into account. Additionally, data is extracted from a wide range of reports in our repository and from a number of reputable premium databases. We gather information from raw material suppliers, distributors, and purchasers to help with this since understanding the entire value chain is crucial for a thorough understanding of the market.

Surveys, technical symposia, and trade magazines are used to gather information on technical concerns and trends. Technical information focusing on white space and freedom of movement is also obtained from an intellectual property standpoint. Additionally, information on the industry’s drivers, constraints, and pricing patterns is obtained. As a result, a variety of original data are included in the material that is then cross-validated and certified with published sources.

Statistical model

We use simulation models to generate our market projections and estimates. Every study receives a special model that is tailored to it. Data for market dynamics, the technology environment, application development, and pricing patterns are gathered and supplied into the model all at once for analysis. The relative relevance of these factors is investigated, and their impact on the forecast period is assessed, using correlation, regression, and time series analysis. The process of market forecasting combines technological analysis with economic strategies, practical business acumen, and subject expertise.

Econometric models are frequently used for short-term forecasting, but technology market models are typically employed for long-term forecasting. These are based on a confluence of the business environment, regulatory environment, economic projection, and technical landscape. In order to develop global estimates, it is preferable to estimate markets from the bottom up by integrating data from key regional markets. This is required to ensure accuracy and a complete comprehension of the subject. Among the variables taken into account for forecasting are:

scenario for raw materials and supply versus pricing patterns

Regulations and anticipated developments

We give these criteria weights and use weighted average analysis to assess their market influence in order to calculate the anticipated market growth rate.

Data Collection Matrix

Primary research | Secondary research |

|

|

1.1 Scope of Sugar Reduction Alternatives & Definition

1.1.1 Objective of Sugar Reduction

1.1.2 Technological Categorization

1.1.3 Inclusion & Exclusion

2.1 Ingredients of Sugar Reduction Alternatives

2.2 Advantages

3.1 Stevia

3.1.1 Health Benefits & Risks

3.2 Honey

3.2.1 Health Benefits & Risks

3.3 Erythritol

3.3.1 Health Benefits & Risks

3.4 Xylitol

3.4.1 Health Benefits & Risks

3.5 Yakon Syrup

3.5.1 Health Benefits & Risks

3.6 Monkfruit

3.6.1 Health Benefits & Risks

4.Technological Analysis

4.1 Most Used compositions

4.2 Composition used in combination

4.3 Recent Sugar Reduction Technologies

5.1 Efficiency

5.2 Zero calories

6.1 Composition and Target Population

6.2 Scientific Evidence for Composition

7.1 European Market Suppliers

7.2 Geography Analysis

7.3 Product Analysis

7.4 Sugar Reduction Products

7.5 Company Segmentation

7.6 Strategic Activities

S.No | Key highlight of Report | |

1. | Patent Analysis | · Top Assignees · Assignee segmentation · Geographical distribution of top assignees · Filling Trends · Litigations · Legal Status · Patents owned by big companies for stevia and other compositions |

2. | Product Analysis

| · Product analysis through graphical representation · Product type analysis · Company Segmentation · Key Insights |

3. | Technology Assessment | · Efficiency of sugar alternatives · Zero calorie sugar alternatives · Compositions with stevia alone as well as with other alternatives · Most used compositions as sugar alternatives · Companies making sugar alternatives from more than one compositions · Labelling and certifications · Target population · Scientific evidence for compositions |

4. | Market Analysis | · Stevia suppliers in European market · Geographic analysis · Strategic activities |

Figure number | Description |

1 | Efficiency for sugar reduction |

2 | Zero calories and advantages |

3 | More than one composition |

4 | Target population |

5 | Scientific evidence for composition |

6 | Stevia suppliers for European market |

7 | Geographical analysis of big players |

8 | Company segmentation |

© Copyright 2024 – Wissen Research All Rights Reserved.