Vascular trauma involves injuries to the blood vessels and can occur in three forms: blunt, penetrating, or a combination of both. These injuries can happen in both civilian and military settings, with penetrating injuries to the extremities accounting for 5 to 15 percent of traumas. Overall, vascular injuries constitute about 1 percent of all traumatic injuries to the extremities. While vascular trauma is relatively uncommon in civilian settings, it requires prompt evaluation and management to ensure optimal patient outcomes.

Symptoms of vascular injuries can vary and may include bleeding outside or inside the body, ischaemia (lack of blood reaching body parts), and pulsatile swellings called haematomas. Serious symptoms include the absence of a distal pulse, active haemorrhage, and acute ischaemia, while less serious symptoms include decreased distal pulse, injury near an important blood vessel, low blood pressure or shock, and neurological deficits.

Diagnosis of vascular injuries involves physical examination, assessment of the patient’s general state, location and extent of injuries, and various diagnostic imaging tests such as Doppler ultrasound, Computed Tomography Angiography (CTA), and Magnetic Resonance Angiography (MRA).

Treatment of vascular extremity trauma may involve both non-operative and operative approaches. Non-operative management includes monitoring, rest, and pain management for less severe cases, while operative management, such as vascular repair, is necessary for more significant injuries that threaten limb viability or cause severe bleeding.

The global market for vascular trauma management and treatment encompasses various medical devices, surgical tools, and pharmaceuticals. Companies specializing in vascular surgery equipment and medical devices play a critical role in providing the necessary tools for accurate diagnosis and effective treatment. Additionally, pharmaceutical companies play a significant role in developing medications used to manage pain, prevent infections, and facilitate the healing process in patients with vascular injuries.

Overall, the evaluation and management of vascular extremity trauma require collaboration among an inter-professional team of healthcare providers, including emergency medical personnel, trauma surgeons, vascular surgeons, interventional radiologists, anesthesiologists, and nurses. Effective communication and teamwork among team members are crucial to delivering well-coordinated care and enhancing outcomes for patients affected by vascular trauma.

In conclusion, vascular trauma can have serious consequences, and its management involves identifying symptoms, diagnostic imaging, and prompt intervention. Collaboration among healthcare professionals is essential to provide comprehensive care and ensure the best possible outcomes for patients with vascular extremity trauma. The global market for vascular trauma management encompasses various medical devices and pharmaceuticals, reflecting the importance of addressing this medical issue effectively.

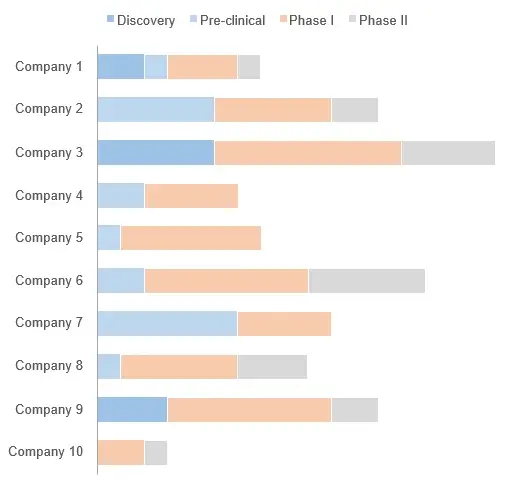

In order to evaluate the class competition in the short to mid long term, detailed understanding of the development pipeline is critical for positioning a product in the market

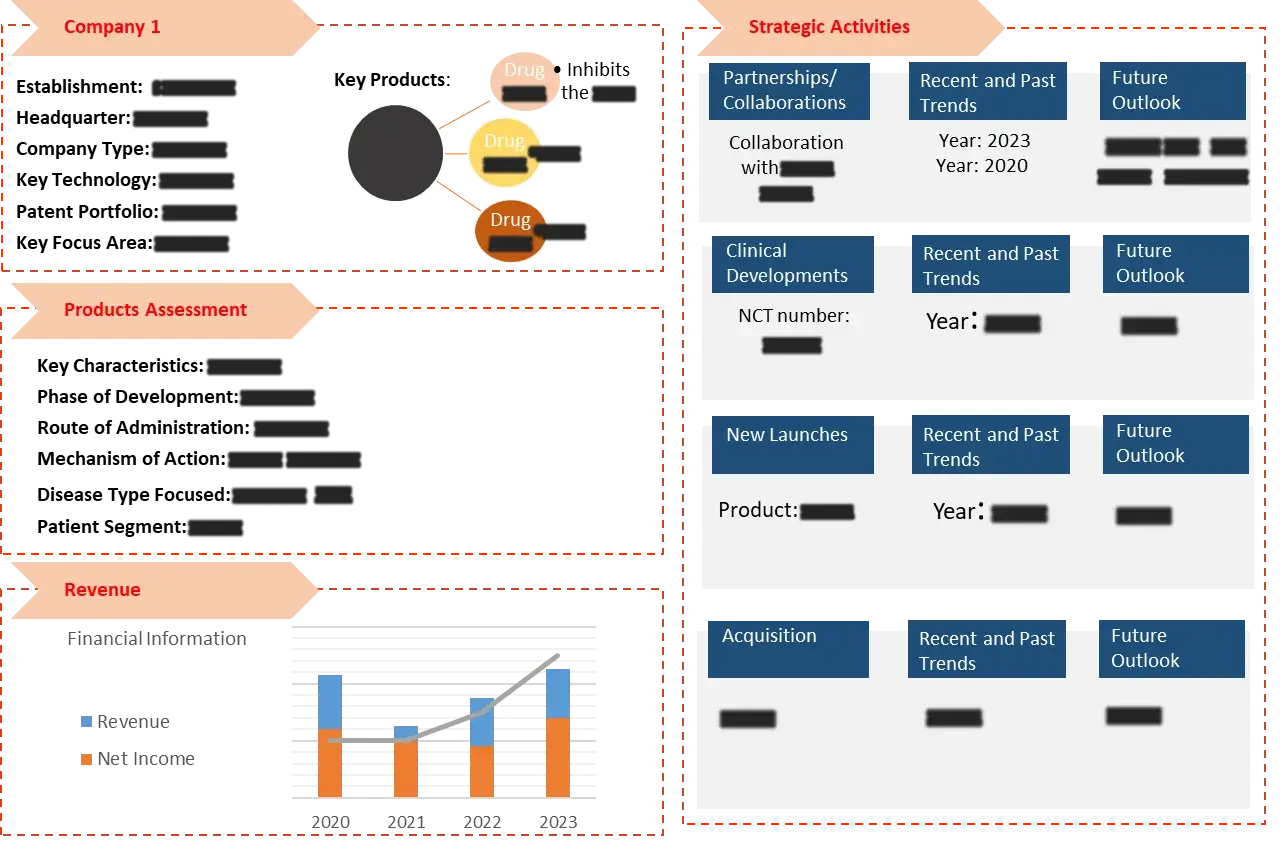

Stakeholders developing treatment solutions for Vascular Trauma are captured, featuring information on financials, product portfolio, and recent developments.

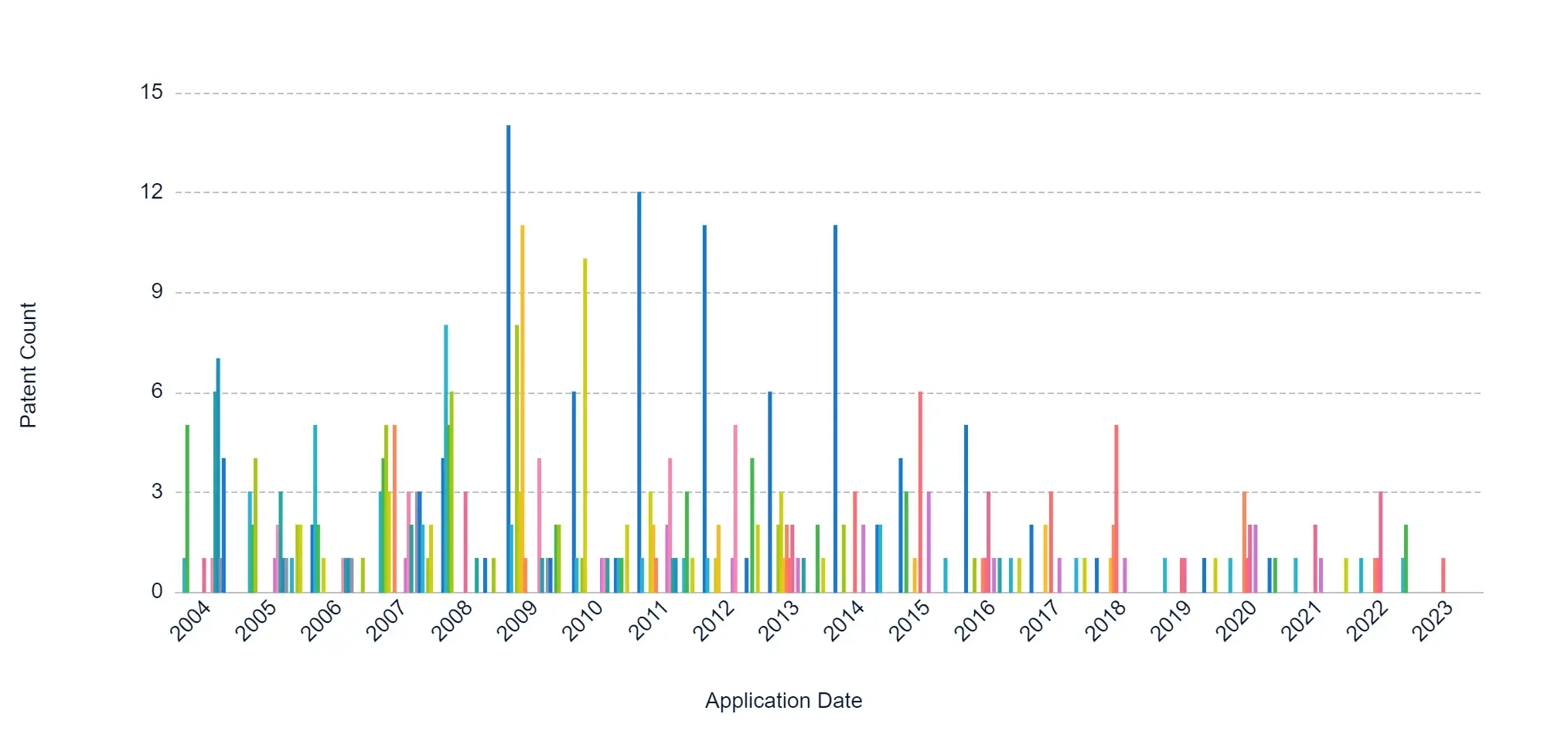

Patent analysis provides invaluable insights into the innovative developments and emerging technologies in the field of Vascular Trauma, allowing for a deeper understanding of novel treatment approaches.

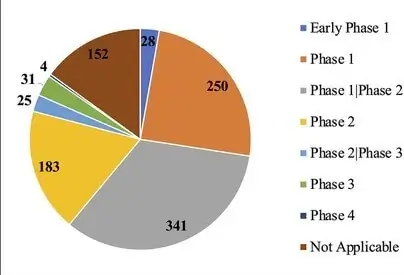

A number of drugs / therapies have been or are being evaluating in the clinical trials registered across different geographies have advanced to matured phases of development in the last five years

Example Illustration 1: Distribution by Key Geographical Areas

Example illustration 2: Distribution of Clinical Trials by Status:

Example illustration 3: Distribution of Clinical Trials by Phase of Development:

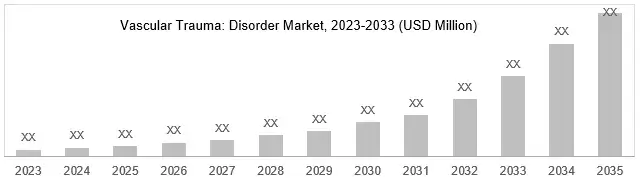

Owing to the fact that multiple drug candidates are approved and encouraging clinical results, the market is distributed across different segments and expected to witness significant growth during the next decade.

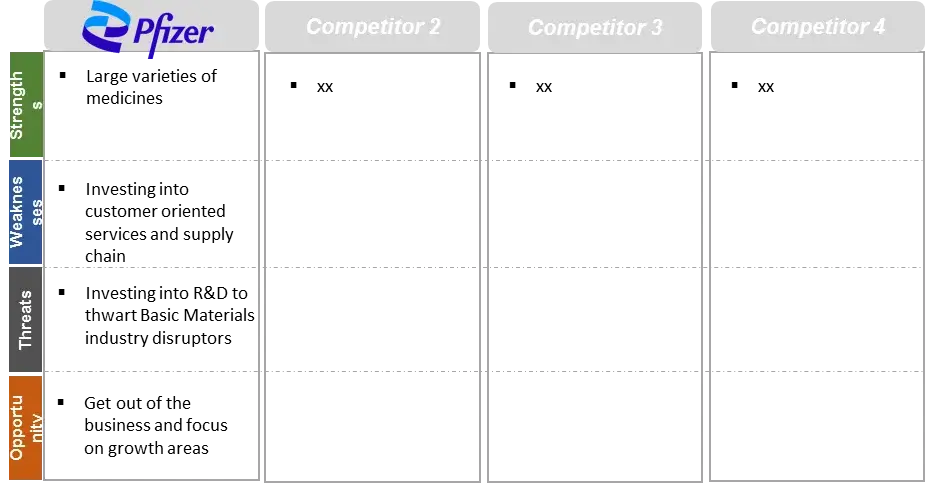

Owing to the fact that there are multiple companies working in the area of Vascular Trauma there can be potential competitors in the market that are trying to overpower.

In order to give the most precise estimations and forecasts, Wissen Research uses an extensive and iterative research approach that is focused on reducing deviation. The company blends top-down and bottom-up methodologies for market segmentation and quantitative estimation. In addition, data triangulation, which examines the market from three separate angles, is a recurrent topic present in all of our research studies. Important components of the approach used for all of our studies include the following:

Preliminary data mining

On a wide scale, unprocessed market data is collected. Continuous data filtering makes sure that only verified and authenticated sources are taken into account. Additionally, data is extracted from a wide range of reports in our repository and from a number of reputable premium databases. We gather information from raw material suppliers, distributors, and purchasers to help with this since understanding the entire value chain is crucial for a thorough understanding of the market.

Surveys, technical symposia, and trade magazines are used to gather information on technical concerns and trends. Technical information focusing on white space and freedom of movement is also obtained from an intellectual property standpoint. Additionally, information on the industry’s drivers, constraints, and pricing patterns is obtained. As a result, a variety of original data are included in the material that is then cross-validated and certified with published sources.

Statistical model

We use simulation models to generate our market projections and estimates. Every study receives a special model that is tailored to it. Data for market dynamics, the technology environment, application development, and pricing patterns are gathered and supplied into the model all at once for analysis. The relative relevance of these factors is investigated, and their impact on the forecast period is assessed, using correlation, regression, and time series analysis. The process of market forecasting combines technological analysis with economic strategies, practical business acumen, and subject expertise.

Econometric models are frequently used for short-term forecasting, but technology market models are typically employed for long-term forecasting. These are based on a confluence of the business environment, regulatory environment, economic projection, and technical landscape. In order to develop global estimates, it is preferable to estimate markets from the bottom up by integrating data from key regional markets. This is required to ensure accuracy and a complete comprehension of the subject. Among the variables taken into account for forecasting are:

Regulations and anticipated developments

We give these criteria weights and use weighted average analysis to assess their market influence in order to calculate the anticipated market growth rate.

Primary research | Secondary research |

· Manufacturers · Technology distributors and wholesalers · End-user surveys · Consumer surveys | · Company reports and publications · Government publications · Independent investigations · Economic and demographic data · Online searches · Literature studies · Research reviews · Case studies · Reference customers |

1.1 Overview of Vascular Trauma

1.1.1 Definition and Types of Vascular Trauma

1.1.2 Incidence and Prevalence of Vascular Trauma

1.2 Epidemiology and Incidence Rates

1.2.1 Vascular Trauma Incidence in Civilian and Military Settings

1.2.2 Prevalence of Blunt, Penetrating, and Combination Injuries

1.3 Symptoms and Diagnosis

1.3.1 Common Symptoms of Vascular Trauma

1.3.2 Diagnostic Methods and Imaging Techniques

1.4 Pathophysiology

1.4.1 Mechanisms of Vascular Injury

1.4.2 Physiological Consequences of Vascular Trauma

1.5 Causes and Risk Factors

1.5.1 Factors Contributing to Blunt Trauma

1.5.2 Risk Factors for Penetrating Injuries

1.6 Treatment

1.6.1 Non-Operative Management of Vascular Trauma

1.6.2 Operative Approaches and Vascular Repair Techniques

2.1 Anatomy and Classification of Vascular Injuries

2.1.1 Vascular Anatomy of the Extremities

2.1.2 Classification of Vascular Injuries (Arterial and Venous)

2.2 Clinical Presentation and Diagnostic Methods

2.2.1 Identifying Signs and Symptoms of Vascular Trauma

2.2.2 Diagnostic Imaging and Angiography

2.3 Staging and Prognostic Factors

2.3.1 Staging of Vascular Trauma

2.3.2 Prognostic Indicators for Treatment Outcomes

3.1 Non-Operative Management

3.1.1 Monitoring and Conservative Treatment

3.1.2 Pain Management and Limb Immobilization

3.2 Surgical Interventions

3.2.1 Vascular Repair and Revascularization

3.2.2 Role of Vascular Grafts and Anastomosis Techniques

3.3 Endovascular and Interventional Radiology

3.3.1 Minimally Invasive Techniques for Vascular Intervention

3.3.2 Embolization and Stent Placement

4.1 Global Vascular Trauma Market Overview

4.1.1 Market Size and Growth Trends

4.1.2 Geographical Distribution of Vascular Trauma Incidents

4.2 Market Trends in Vascular Trauma

4.2.1 Advancements in Vascular Trauma Treatment

4.2.2 Emerging Technologies and Innovations

4.3 Market Drivers and Challenges

4.3.1 Factors Influencing Market Growth

4.3.2 Challenges in Vascular Trauma Management

5.1 Ongoing Clinical Trials and Research Studies

5.1.1 Investigational Therapies and Treatment Approaches

5.1.2 Trial Progress and Patient Recruitment Status

5.2 Promising Therapies in Development

5.2.1 Novel Drugs and Medical Devices for Vascular Trauma

5.2.2 Potential Impact on Vascular Trauma Management

5.3 Advancements in Interventional Procedures

5.3.1 Innovations in Endovascular Techniques

5.3.2 Outcomes of Minimally Invasive Interventions

5.4 Drugs by Phase

5.4.1 Overview of Drugs in Different Development Stages

5.4.2 Pipeline Analysis and Potential Market Impact

5.5 Key Regulatory Events

5.5.1 FDA Approvals and Regulatory Updates in Vascular Trauma

5.5.2 Compliance and Safety Considerations

6.1 Medical Devices for Vascular Trauma

6.1.1 Vascular Stents and Grafts

6.1.2 Catheters and Guidewires

6.2 Emerging Therapeutic Products

6.2.1 New Drug Candidates in Vascular Trauma Treatment

6.2.2 Drug Delivery Systems and Formulations

6.3 Treatment Modalities and Delivery Systems

6.3.1 Trends in Vascular Trauma Management Techniques

6.3.2 Hybrid and Minimally Invasive Approaches

7.1 Key Patents in Vascular Trauma Therapeutics

7.1.1 Patent Landscape and Intellectual Property Trends

7.1.2 Notable Innovations and Patent Holders

8.1 Leading Companies in Vascular Trauma Therapeutics

8.1.1 Key Players and Market Presence

8.1.2 Product Portfolios and Research Initiatives

8.2 Company Profiles

8.2.1 Business Overview and Development Strategies

8.2.2 Collaborations and Mergers & Acquisitions

8.3 Market Share Analysis

8.3.1 Market Positioning of Key Companies

8.3.2 Competitive Landscape and Market Concentration

8.4 SWOT Analysis

8.4.1 Strengths, Weaknesses, Opportunities, and Threats of Key Players

8.4.2 SWOT Analysis of Vascular Trauma Market

8.5 Unmet Needs in Vascular Trauma Management

8.5.1 Challenges and Gaps in Current Treatment Strategies

8.5.2 Potential Areas for Future Research and Innovation

9.1 Projected Growth of Vascular Trauma Market

9.1.1 Market Size and Revenue Projections

9.1.2 Growth Opportunities and Forecast Factors

9.2 Market Opportunities and Potential Regions

9.2.1 Untapped Markets and Growth Regions

9.2.2 Strategic Expansion and Market Penetration

9.3 Predictions for Market Evolution

9.3.1 Emerging Trends and Market Dynamics

9.3.2 Long-term Outlook and Future Prospects

10.1 United States Market Size

10.1.1 Total Market Size of Vascular Trauma in the United States (2023-2033)

10.1.2 Market Size of Vascular Trauma by Treatment Modalities in the United States (2023-2033)

10.2 Europe Market Size

10.2.1 Total Market Size of Vascular Trauma in Europe (2023-2033)

10.2.2 Market Size of Vascular Trauma by Therapies in Europe (2023-2033)

10.3 Asia-Pacific Market Size

10.3.1 Total Market Size of Vascular Trauma in Asia-Pacific (2023-2033)

10.3.2 Market Size of Vascular Trauma by Therapies in Asia-Pacific (2023-2033)

11.1 Emerging Technologies in Vascular Trauma Research

11.1.1 Advancements in Diagnostic Imaging and Interventional Techniques

11.1.2 Potential Impact on Patient Outcomes

11.2 Personalized Medicine and Biomarker Development

11.2.1 Targeted Therapies and Precision Medicine Approaches

11.2.2 Biomarkers for Patient Stratification and Treatment Response Prediction

11.3 Potential Impact of Immunotherapies

11.3.1 Immunomodulatory Approaches in Vascular Trauma

11.3.2 Role of Immune Checkpoint Inhibitors

S.no | Key Highlights of Report | |

1. | Patent Analysis | · Top Assignee · Geography focus of top Assignees · Assignee Segmentation · Network analysis of the top collaborating entities in Vascular Trauma treatment patent applications · Technology Evolution · Key Patents · Application and Issued Trend · Key technology |

2. | Market analysis | · Current Treatment Options · Emerging Therapies and Research Developments (by product analysis and scientific analysis) · Strategic activities · Therapeutic activity of drugs · Company portfolio |

3. | Clinical Trials | · Analysis of clinical trial through graphical representation · Coverage of treatments from pre-clinical phases till commercialization (also including terminated and completed studies) |

4. | Forecast | · Detailed comprehension of the historic, current and forecasted trend of market by analysis of impact of these treatments on the market |

5. | Key Players | · Detailed profiles of the key players that are engaged in the development of approved drugs |

6. | Strategic activities of companies | · Collaboration/Mergers/Agreements/Partnerships/Acquisitions taken place by analyzed companies |

7. | Opportunity Analysis | · Technology evolution based on problem solution · Potential licensees · Geography of suppliers · Treatment trends |

8. | KOLs | · A detailed analysis and identification of the key opinion leaders (KOLs), shortlisted based on their contributions |

9. | SWOT | · SWOT analysis for treatments · Market Access |

10. | Drivers and Barrier | · Unmet needs · Drivers and barriers · Opportunity for new treatments |

LIST OF FIGURES

Figure number | Description |

Figure 1 | Terminology of Vascular Trauma Over The Years |

Figure 2 | Vascular Trauma Treatment– History and Present |

Figure 3 | Projection of Vascular Trauma till 2033 in different geographies |

Figure 4 | Technology Categorization Of Drug Delivery Methods For Vascular Trauma |

Figure 5 | Recent Technology Trends in Vascular Trauma |

Figure 6 | Technology Evolution in Drug Delivery Market of Vascular Trauma |

Figure 7 | Geographical Distribution of Patents of Top Assignees |

Figure 8 | Assignee Segmentation (Companies) |

Figure 9 | Assignee Segmentation (Educational Establishment) |

Figure 10 | Patent Based Key Insights Of xx |

Figure 11 | Patent Based Key insights of xx |

Figure 12 | Patent Based Key insights of xx |

Figure 13 | Geographic Distribution of the Universities/Research Organizations Filling Patents On Various Drug Delivery Approaches |

Figure 14 | Key Summary Regarding the Patent Filing On Vascular Trauma |

Figure 15 | Product Pipeline of Different Approaches with Companies Name |

Figure 16 | Portfolio for Approved Product |

Figure 17 | Clinical Trials Conducted till Date by Different Companies and Universities |

Figure 18 | Clinical Trials based Key Insights |

Figure 19 | Key Growth Drivers for Vascular Trauma Market |

Figure 20 | Restraints for Vascular Trauma Market |

Figure 21 | xx Portfolio (Top Player) |

Figure 22 | xx Portfolio (Top Player) |

Figure 23 | xx Portfolio (Top Player) |

Figure 24 | xx Portfolio (Top Player) |

Figure 25 | xx Portfolio (Top Player) |

Figure 26 | xx Portfolio (Start-up) |

Figure 27 | xx Portfolio (Start-up) |

Figure 28 | xx Portfolio (Start-up) |

Figure 29 | Strategic Activities Including Collaboration, Partnerships and Acquisitions |

Figure 30 | Research Methodology for Patent, Selection and Analysis |

Figure 31 | Research Methodology for Scientific Literature, Selection and Analysis |

Figure 32 | Research Methodology for Clinical Trials, Selection and Analysis |

LIST OF GRAPHS

Graph number |

Description |

Graph 1 | Number of people worldwide with Vascular Trauma |

Graph 2 | Problem Solution Analysis |

Graph 3 | Top Assignees in Vascular Trauma |

Graph 4 | Technology Focus of Top Assignees (IPC-CPC Classes) |

Graph 5 | Top Countries of Origin of Patents |

Graph 6 | New entrants in drug delivery field |

Graph 7 | Legal Status |

Graph 8 | Most Cited Patents |

Graph 9 | Patents with Largest Invention Families |

Graph 10 | Most Claim-Heavy Patents |

Graph 11 | Filing Trends |

Graph 12 | Literature Filling Trend During Time Period (2018 – 2023) |

Graph 13 | Clinical Trial Filing Timeline |

Graph 14 | Recruitment Status of the Clinical Trials Related to the Different Drug Delivery Approaches |

Graph 15 | Clinical Trials Phases with Respect to Specific Drug Delivery Approach |

Graph 16 | Weighted Scores for Top 64 Players According to Benchmarking Criteria |

Graph 17 | Vascular Trauma (CAGR: 2023-2033) |

Graph 18 | Vascular Trauma Market Share: Distribution by Key Geographical Area, 2023-2033 |

LIST OF TABLES

Table number | Description |

Table 1 | Parameters included and excluded for conducting the analysis |

Table 2 | Technology Classes with Definitions |

Table 3 | Patent Litigation |

Table 4 | Highest Market Valued Patents |

Table 5 | SWOT Analysis of Top 3 Players |

Table 6 | Parameters and their score for Benchmarking |

Table 7 | Weighted scores for top 5 players according to benchmarking criteria |

© Copyright 2024 – Wissen Research All Rights Reserved.