Subscribe our newsletter

Please Subscribe our news letter and get update.

DESCRIPTION

Over the last decade, the consumption of dietary supplements has witnessed a discernible rise in both developed and developing nations. The market for dietary supplements embodies a broad spectrum of natural as well as synthetic products with applications in industries for instance, personal care, food and beverages, cosmetics, and others. A recent study by IPSOS and The Council for Responsible Nutrition (CRN) on the US population found that close to 74% American adults in 2023 consume such supplements, with 55% using them regularly. The market is being mainly influenced by the awareness to address nutritional deficiencies, promote healthy lifestyles and overall wellbeing.

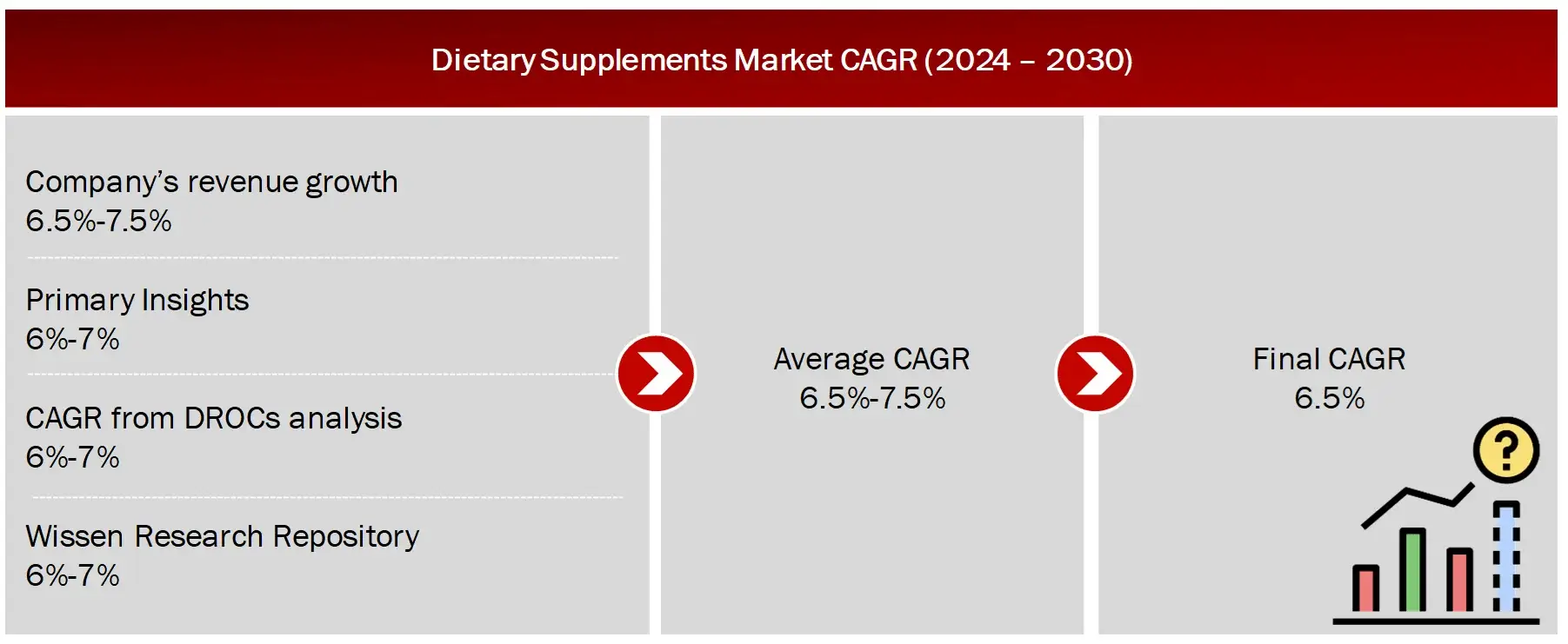

Wissen Research analyses that the global dietary supplements market is estimated at USD 143.7 billion in 2023 and is projected to reach USD 221.8 billion by 2030, expected to grow at a CAGR of 6.5% during the forecast period, 2024-2030.

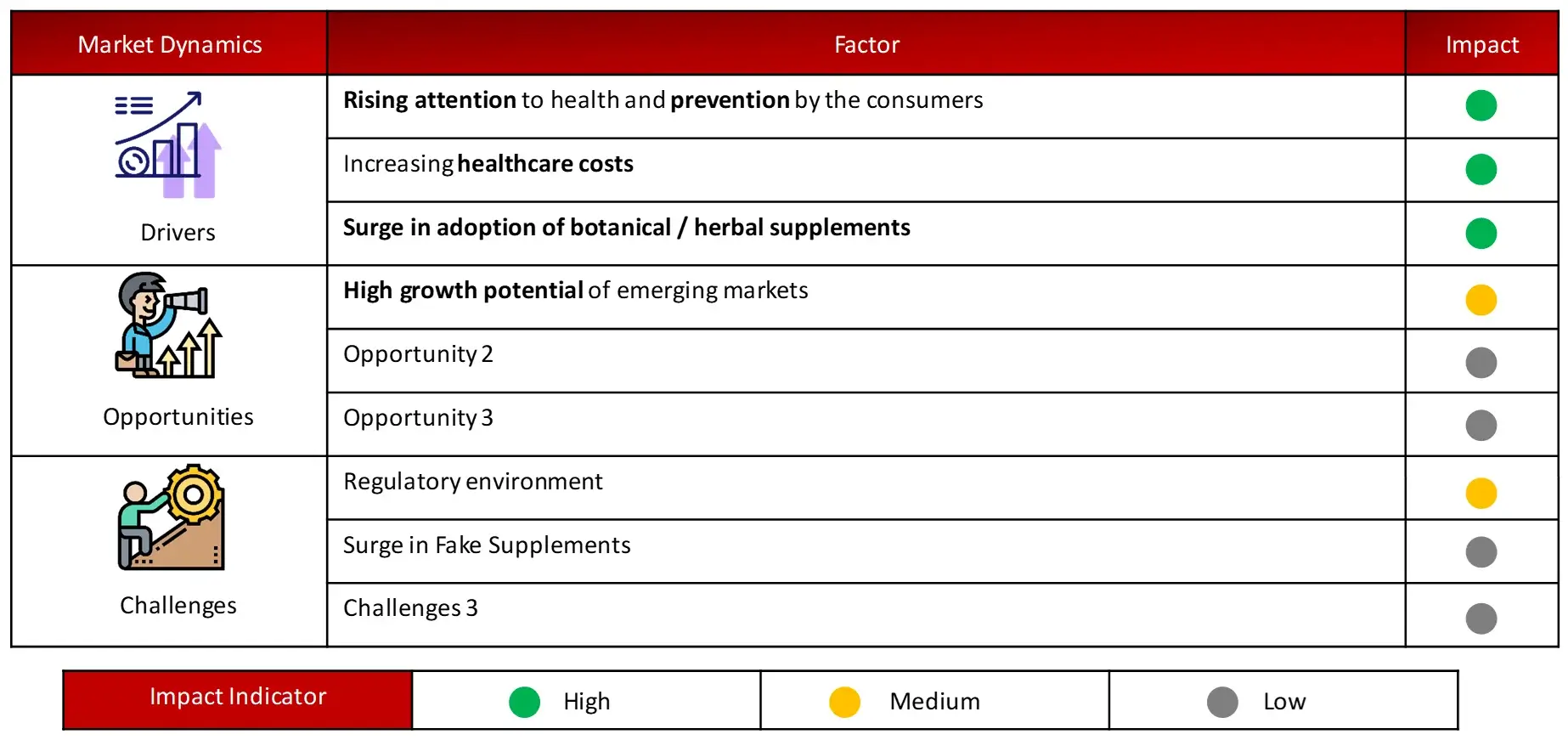

Dietary Supplements Market Dynamics:

Driving Factor: Rising Interest in Mood and Sleep Support Supplements

With the growing emphasis on mental wellness and importance of sleep on physical and mental wellbeing, the mood and sleep supporting supplements has witnessed continuous growth in product launches such as, magnesium, melatonin, tryptophan and others, in the past few years. It is worth mentioning that the rising stress levels among young populations and exposure to smart devices will drive the adoption of such supplements in the coming years.

Opportunity: Increasing Shift towards Traditional Natural Products

Use of botanical / herbal dietary supplements has emerged as a popular alternative supplements. This can be attributed to the fact that botanical supplements appear to be effective and safer option compared to other dietary supplements with minimal risk of side effects. As more individuals adopt these natural supplements and personalized care, the market for dietary supplements is poised for significant expansion. Companies that leverage high nutritional clinically proven plant-based extracts effectively can gain a competitive edge and capitalize on the growing demand for nutritional solutions.

Challenge: Growing Influx of Counterfeit / Fake Supplements in the Market

Rising influx of unauthorized dietary supplements in the market has posed a significant challenge for the original producers which has further resulted into the growing consumer distrust over these products. For instance, in 2023, NOW Foods discovered sales of 11 different fake dietary supplements imitating its NOW brand on Amazon. Further, more than 40,000 cases against unsafe protein powder sample and dietary supplements were filled in India in 2022-2023.

The dietary supplements market report offers information on the latest advancements in the industry, as well as product portfolio analysis, supply chain/value chain analysis, market share, and the effects of localized and domestic players. It also analyzes potential revenue opportunities and changes in market regulations, as well as market size, category market growth, application dominance, product approvals, product launches, geographic expansions, and technological innovations. For an analyst brief and other information on the dietary supplements market, get in touch with Wissen Research. Our staff can assist you in making well-informed decisions that will lead to market expansion.

Botanical dietary supplements are anticipated to grow at highest rate within the dietary supplements market by product type

The dietary supplements market is segmented into vitamins, botanical, minerals, amino acids, fatty acids, probiotics and other types, based on type of product. Owing to their natural origin and effective healing qualities, the herbal / botanical based supplements demand is anticipated to increase at a noticeable yearly rate during the forecast period.

Tablets captured majority share of dietary supplements market by dosage form

Capsules, tablets, powers, gels, gummies, liquids, and other forms are the key segments that the dietary supplements are available in. In 2024, the tablets segment captures the largest share out of all these product types. This can be attributed to the fact that tablets are easy to ingest with fixed amount of active ingredients, therefore, ensuring controlled intake of dietary supplements. Further, innovations in tablet technology, such as improved bioavailability and controlled-release formulations, are likely to drive this trend.

North America to dominate the current dietary supplements market and Asia-Pacific to witness the highest growth

Currently, North America is expected to hold the largest portion of total dietary supplements market and this trend is likely to remain the same in the coming decade. Key elements supporting this trend in the region include rising elderly population, high rate of lifestyle related illnesses, growing healthcare costs, strong regulatory framework, presence of leading dietary supplement manufacturers, and higher disposable incomes, all of which are anticipated to fuel growth in North America.

Asia-Pacific is expected to experience the highest growth among all region during the forecast period owing to increasing awareness about health supplements a d disposable income. Further, due to the presence of variety of ayurveda based remedies / products the stakeholders are likely to invest on research and development for the production of new effective products in this region.

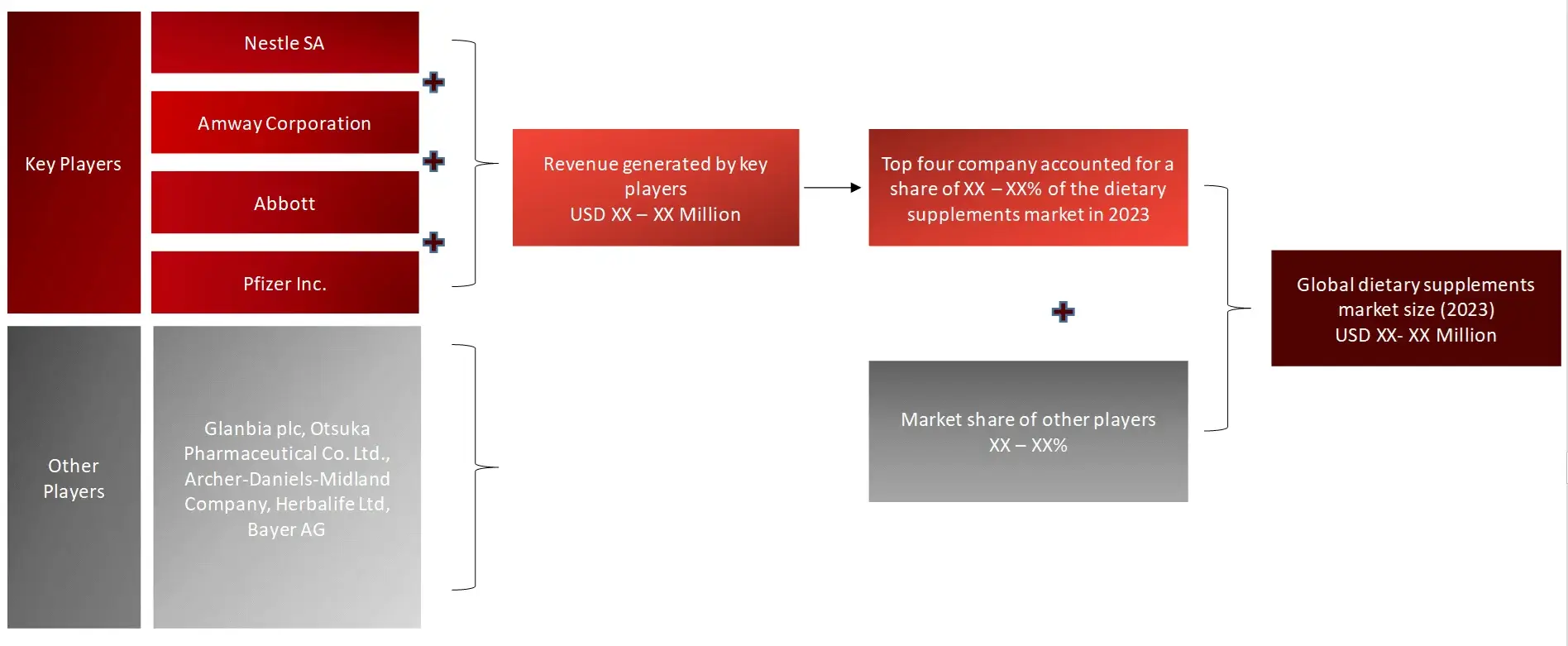

Major Companies and Market Share Insights

Major players operating in dietary supplements market are Nestle SA, Abbott, Amway, Pfizer, Archer-Daniels-Midland Company, Otsuka Pharmaceutical Co. Ltd., Glanbia plc, Herbalife Ltd., Bayer AG, Nature’s Sunshine Products Inc. among others. The overall dietary supplements market is consolidated with five key players holding majority share of the total dietary supplements market.

Recent Developments:

DIETARY SUPPLEMENTS MARKET SUMMARY

Particulars | Details |

Report | Dietary Supplements Market |

Forecast Period | 2024-2030 |

Base Year | 2023 |

Format | |

Estimated Market Size (2024) | USD 143,674 Million |

CAGR (2024-2030) | 6.5% |

Number of Pages | 177 |

Number of Tables | 171 |

Number of Figures | 33 |

Key Segments | By Product Type § Vitamins § Minerals § Botanical § Probiotics § Amino Acids § Fatty Acids

By Dosage Form § Tablets § Capsules § Liquid § Powder § Gels § Gummies § Others (Others include patches, inhalers, among others) By Target Population § Infants § Children § Adults § Pregnant Women § Seniors

By Target Application § Immunity § Stress Management § Energy § Sleep Management § Sports § Skin Health § Weight Management § Others (Others include brain health, bone health, hair and nail health, digestive health, heart health, among others) By Distribution Channel § Pharmacy § Supermarkets § E-commerce § Others (Others include direct selling, retail shops, social media, among others) |

Regions Covered | § North America: US and Canada § Europe: Germany, UK, France, Italy, Spain, and Rest of the Europe § Asia-Pacific: China, Japan, India, South Korea, Australia and New Zealand, and Rest of the Asia-Pacific § Latin America § Middle East and Africa |

Key Players Covered | Nestle S.A. (Switzerland), Abbott Laboratories (US), ARCHER-DANIELS-MIDLAND COMPANY (US), International Flavors and Fragrance Inc. (US), Otsuka Pharmaceutical Co. Ltd. (Japan), Glanbia Plc (Ireland), Bayer AG (Germany), Herbalife Ltd. (US), Nature’s Sunshine Products, Inc. (US), H&H Group (China), NU SKIN ENTERPRISES, INC. (US), Haleon Plc (UK), USANA HEALTH SCIENCES, INC. (US), and Amway Corporation (US). |

Introduction

Market Definition

Dietary Supplements are products manufactured naturally or synthetically that contains one or more dietary nutrients or their components. These supplements are designed to fill dietary gaps in everyday nutrition, improve health and strengthen immunity for people of different ages and specific requirements.

Key Stakeholders

Key objectives of the Study

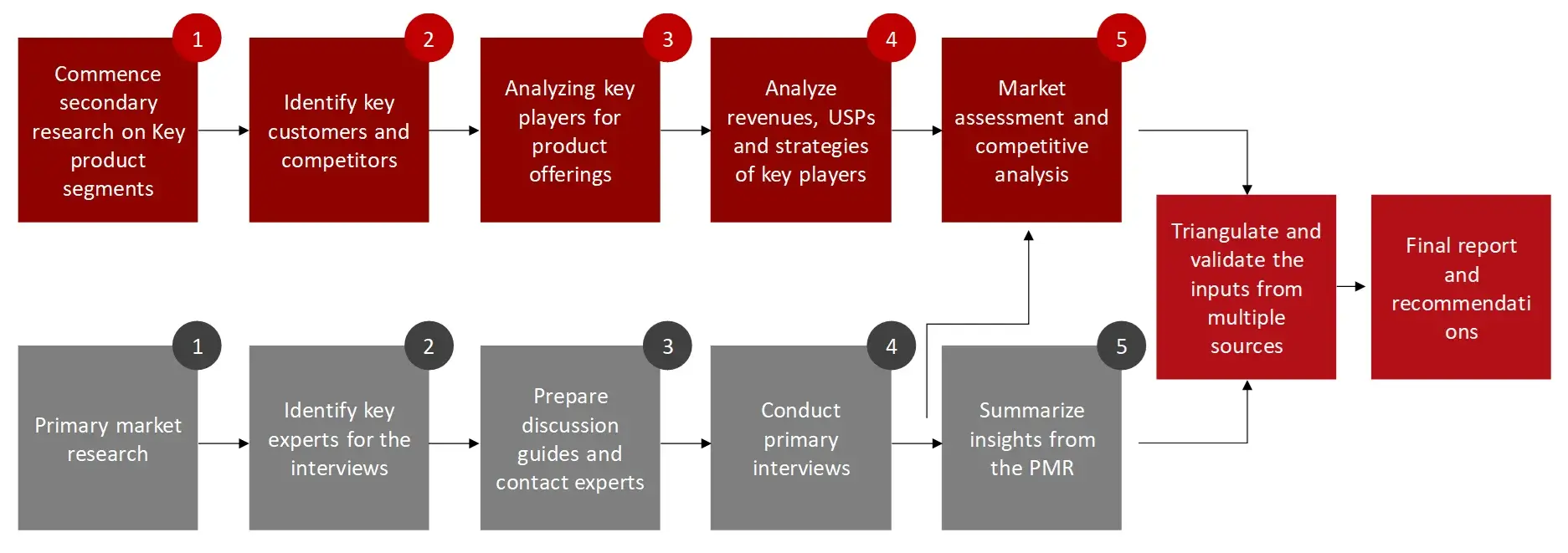

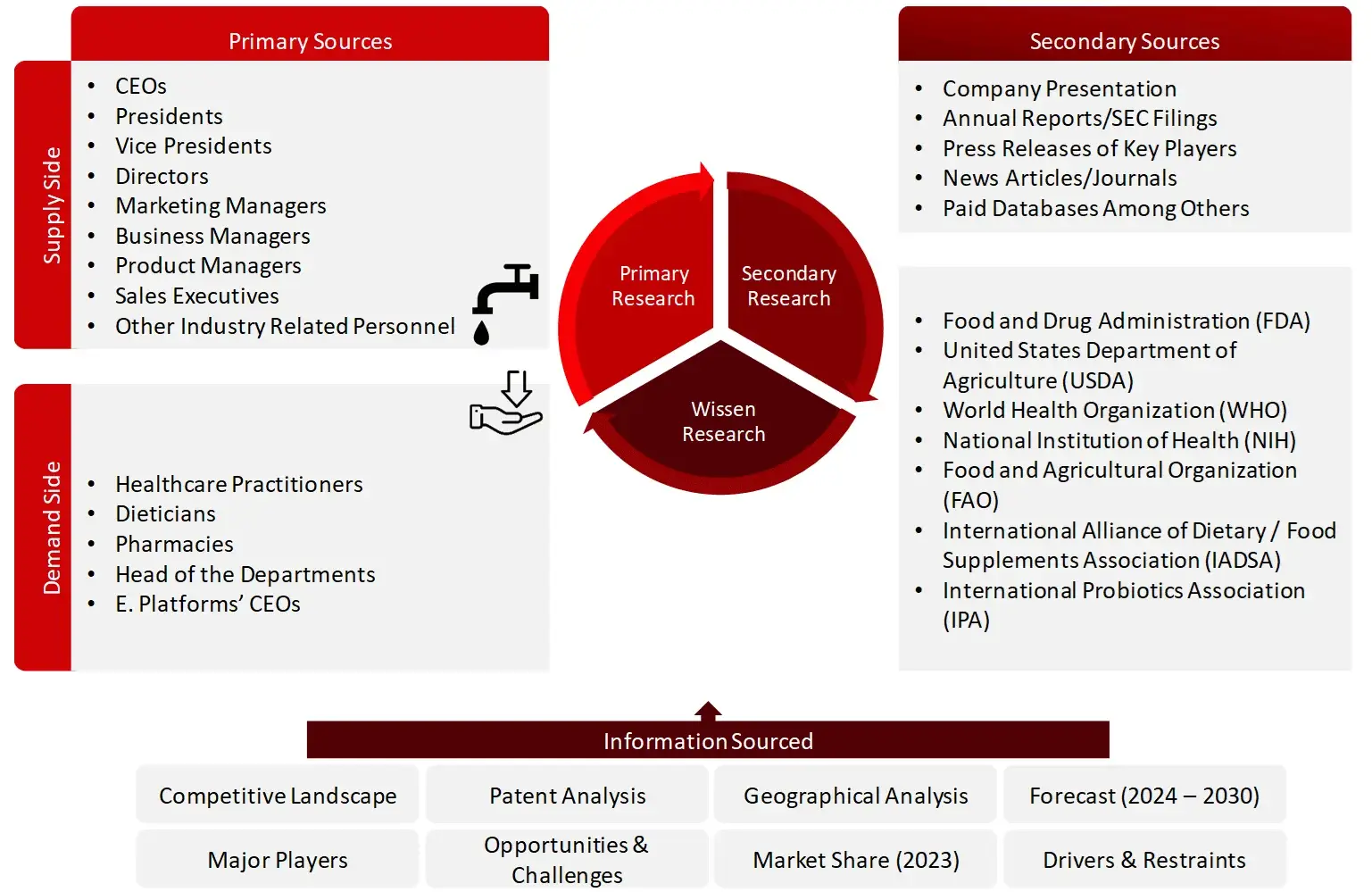

Research Methodology

The aim of the study is to examine the key market forces such as drivers, opportunities, restraints, challenges, and strategies of key leaders. To monitor company advancements such as patents granted, product launches, expansions, and collaborations of key players, analyzing their competitive landscape based on various parameters of business and product strategy. Markey size has been estimated using top-down and bottom-up approaches. Using market breakdown and data triangulation techniques, market sizing of segments and sub-segments has been estimated.

FIGURE: RESEARCH DESIGN

Research Approach

Collecting Secondary Data

The research study involved various secondary sources, directories such as Bloomberg business, Factiva, and Wall Street Journals, white papers, annual reports, company house documents, investor presentation, and SEC filings of the companies.

The secondary research approach has been used to identify and collect information useful for the extensive, technical, market oriented and commercial study of the dietary supplements market. It was also used to obtain important information about key players, market classification, and segments according to industry trends and key developments related to the market perspectives. A database of the key industry leaders has also been prepared using secondary research.

Collecting Primary Data

The primary research data was conducted after acquiring knowledge about the dietary supplements market scenario through secondary research. A significant number of primary interviews were conducted with stakeholders from both the demand and supply side (including various industry experts, such as Vice Presidents (VPs), Chief X Officers (CXOs), Directors from business development, marketing and product development teams, product manufacturers) across major countries of Europe, Asia-Pacific, North America, Latin America, and Middle East. Primary data for this report were collected through questionnaires, emails, and telephonic interviews.

FIGURE: BREAKDOWN OF PRIMARY INTERVIEWS FROM SUPPLY SIDE

FIGURE: BREAKDOWN OF PRIMARY INTERVIEWS FROM DEMAND SIDE

FIGURE: PROPOSED PRIMARY PARTICIPANTS FROM DEMAND AND SUPPLY SIDE

Market Size Estimation

All major manufacturers offering various dietary supplements were identified at the global / regional level. Revenue mapping was done for the major players, which was further be extrapolated to arrive at the global market value of each type of segment. The market value of dietary supplements market was also split into various segments and sub segments at the region level based on:

FIGURE: SUPPLY SIDE (ILLUSTRATION)

FIGURE: REVENUE SHARE ANALYSIS OF KEY PLAYERS (SUPPLY SIDE)

FIGURE: MARKET SIZE ESTIMATION TOP-DOWN AND BOTTOM-UP APPROACH

FIGURE: ANALYSIS OF DROCS FOR GROWTH FORECAST

FIGURE: GROWTH FORECAST ANALYSIS UTILIZING MULTIPLE PARAMETERS

Research Design

Data triangulation involved the combination of primary research, secondary research, and the Wissen Research Analysis. Once the data points were sourced from the secondary market research, we sanitized the data points to make the market sizing and growth forecast more accurate by developing our own assumptions based on the inputs and insights we gather through the primary interviews with the industry experts. Once the data was thoroughly validated through primary interviews from both, demand and supply side of the market, our team of analyst and other team members involved finalized the market sizing and growth forecast.

1. INTRODUCTION

1.1 MARKET DEFINITION

1.1.1 INCLUSIONS & EXCLUSIONS

1.2 KEY OBJECTIVES OF THE STUDY

1.3 SCOPE OF THE STUDY

1.3.1 MARKETS COVERED

1.4 KEY STAKEHOLDERS

1.5 CURRENCIES CONSIDERED

2. RESEARCH METHODOLOGY

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 KEY DATA FROM SECONDARY SOURCES

2.2 MARKET SIZE ESTIMATION

2.2.1 TOTAL MARKET SIZE: DIETARY SUPPLEMENTS MARKET

2.2.2 GEOGRAPHICAL MARKET ASSESSMENT (BY REGION AND COUNTRY)

2.2.3 MARKET SEGMENT ASSESSMENT

2.2.4 GROWTH FORECAST

2.3 DATA TRIANGULATION AND MARKET BREAKDOWN

2.4 MARKET SHARE ESTIMATION

2.5 ASSUMPTIONS

2.6 LIMITATIONS

2.6.1 SCOPE-RELATED LIMITATIONS

2.6.2 METHODOLOGY-RELATED LIMITATIONS

2.7 RISK ASSESSMENT

3. EXECUTIVE SUMMARY AND PREMIUM CONTENT

3.1 EXECUTIVE SUMMARY

3.2 PREMIUM CONTENT

3.2.1 DIETARY SUPPLEMENTS MARKET OVERVIEW

3.2.2 ASIA-PACIFIC DIETARY SUPPLEMENT MARKET, BY PRODUCT AND COUNTRY (2023)

3.2.3 DIETARY SUPPLEMENTS MARKET: REGIONAL GROWTH OPPORTUNITY

3.2.4 GEOGRAPHIC MIX: DIETARY SUPPLEMENTS MARKET

3.2.5 DIETARY SUPPLEMENTS MARKET: DEVELOPED VS EMERGING MARKETS

4. MARKET OVERVIEW

4.1 MARKET DYNAMICS

4.1.1 MARKET DRIVERS

4.1.1.1 DESIRE FOR HEALTHY AND ACTIVE LIFESTYLE

4.1.1.2 INCREASING HEALTHCARE COST

4.1.1.3 INCREASING DISPOSABLE INCOME

4.1.1.4 RISING E-COMMERCE ENGAGEMENT

4.1.2 RESTRAINTS

4.1.2.1 SUPPLY CHAIN BOTTLENECKS

4.1.2.2 HIGH COST OF DIETARY SUPPLEMENTS

4.1.3 OPPORTUNITIES

4.1.3.1 HIGH GROWTH POTENTIAL OF EMERGING MARKETS

4.1.3.2 INCREASING SHIFT TOWARDS TRADITIONAL NUTRITONAL PRODUCTS

4.1.3.3 INCREASING ADOPTION OF CONTRACT MANUFACTURING

4.1.4 CHALLENGES

4.1.4.1 GROWING INFLUX OF COUNTERFEIT / FAKE SUPPLEMENTS IN THE MARKET

4.1.4.2 MARKET SATURATION IN DEVELOPED REGIONS

4.2 TOP-LEVEL END USER PERCEPTION ANALYSIS

4.3 NEED-GAP ANALYSIS

4.4 VALUE CHAIN ANALYSIS

4.5 DIETARY SUPPLEMENTS ECOSYSTEM

4.6 INDUSTRY TRENDS

4.6.1 INCREASING FOCUS ON PERSONALIZATION AND CUSTOMIZATION

4.6.2 EXPANSION OF BOTANICAL SUPPLEMENTS: A TREND SHIFTING THE DYNAMICS OF DIETARY SUPPLEMENTS MARKET

4.6.3 INCREASING IMPROTANCE OF MENTAL WELLBEING AND COGNITIVE HEALTH

4.7 PORTER’S FIVE FORCES MODEL

5. PATENT ANALYSIS

5.1 INTRODUCTION

5.2 DIETARY SUPPLEMENTS MARKET: APPLICATION AND ISSUED TREND (2005 – 2024)

5.3 DIETARY SUPPLEMENTS MARKET: PATENT ANALYSIS BY TYPE

5.4 DIETARY SUPPLEMENTS MARKET: PATENT ANALYSIS BY COUNTRY OF ORIGIN

5.5 DIETARY SUPPLEMENTS MARKET: TOP ASSIGNEES

5.6 DIETARY SUPPLEMENTS MARKET: MOST CITED PATENTS

6. DIETARY SUPPLEMENTS MARKET, BY PRODUCT TYPE

6.1 INTRODUCTION

6.2 VITAMINS

6.3 MINERALS

6.4 BOTANICAL

6.5 PROBIOTICS

6.6 AMINO ACIDS

6.7 FATTY ACIDS

7. DIETARY SUPPLEMENTS MARKET, BY DOSAGE FORM

7.1 INTRODUCTION

7.2 TABLETS

7.3 CAPSULES

7.4 LIQUIDS

7.5 GELS

7.6 POWDER

7.7 GUMMIES

7.8 OTHERS

8. DIETARY SUPPLEMENTS MARKET, BY TARGET POPULATION

8.1 INTRODUCTION

8.2 INFANTS

8.3 CHILDREN

8.4 ADULTS

8.5 PREGNANT WOMEN

8.6 SENIORS

9. DIETARY SUPPLEMENTS MARKET, BY TARGET APPLICATION

9.1 INTRODUCTION

9.2 IMMUNITY

9.3 STRESS MANAGEMENT

9.4 ENERGY

9.5 SKIN HEALTH

9.6 SLEEP MANAGEMENT

9.7 SPORTS

9.8 WEIGHT MANAGEMENT

9.9 OTHERS

10. DIETARY SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL

10.1 INTRODUCTION

10.2 PHARMACIES

10.3 SUPERMARKETS / HYPERMARKETS

10.4 E-COMMERCE

10.5 OTHERS

11. DIETARY SUPPLEMENTS MARKET, BY GEOGRAPHY

11.1 INTRODUCTION

11.2 NORTH AMERICA

11.2.1 US

11.2.2 CANADA

11.3 EUROPE

11.3.1 GERMANY

11.3.2 UK

11.3.3 FRANCE

11.3.4 ITALY

11.3.5 SPAIN

11.3.6 REST OF THE EUROPE

11.4 ASIA-PACIFIC

11.4.1 CHINA

11.4.2 JAPAN

11.4.3 INDIA

11.4.4 SOUTH KOREA

11.4.5 AUSTRALIA AND NEW ZEALAND

11.4.6 REST OF THE ASIA-PACIFIC

11.5 LATIN AMERICA

11.6 MIDDLE EAST AND AFRICA

12. COMPETITIVE LANDSCAPE

12.1 INTRODUCTION

12.2 MARKET SHARE ANALYSIS

12.3 COMPETITIVE SITUATION AND TRENDS

12.3.1 PRODUCT LAUNCHES

12.3.2 INORGANIC GROWTH STRATEGIES

12.3.3 OTHER DEVELOPMENTS

12.4 KEY PLAYERS FOOTPRINT ANALYSIS

12.5 GEOGRAPHICAL REVENUE SNAPSHOT OF KEY PLAYERS

12.6 R&D EXPENDITURE BY KEY PLAYERS

13. COMPANY PROFILES

13.1 NESTLE S.A.

13.1.1 BUSINESS OVERVIEW

13.1.2 FINANCIAL SNAPSHOT: NESTLE S.A. (2023)

13.1.3 PRODUCT OFFERINGS

13.1.4 RECENT DEVELOPMENTS

13.2 ABBOTT LABORATORIES

13.2.1 BUSINESS OVERVIEW

13.2.2 FINANCIAL SNAPSHOT: ABBOTT LABORATORIES (2023)

13.2.3 PRODUCT OFFERINGS

13.2.4 RECENT DEVELOPMENTS

13.3 AMWAY CORPORATION

13.3.1 BUSINESS OVERVIEW

13.3.2 FINANCIAL SNAPSHOT: AMWAY CORPORATION (2023)

13.3.3 PRODUCT OFFERINGS

13.3.4 RECENT DEVELOPMENTS

13.4 GLANBIA PLC

13.4.1 BUSINESS OVERVIEW

13.4.2 FINANCIAL SNAPSHOT: GLANBIA PLC (2023)

13.4.3 PRODUCT OFFERINGS

13.4.4 RECENT DEVELOPMENTS

13.5 OTSUKA HOLDINGS CO., LTD.

13.5.1 BUSINESS OVERVIEW

13.5.2 FINANCIAL SNAPSHOT: OTSUKA HOLDINGS CO., LTD. (2023)

13.5.3 PRODUCT OFFERINGS

13.5.4 RECENT DEVELOPMENTS

13.6 ARCHER-DANIELS-MIDLAND COMPANY (ADM)

13.6.1 BUSINESS OVERVIEW

13.6.2 FINANCIAL SNAPSHOT: ARCHER-DANIELS-MIDLAND COMPANY (2023)

13.6.3 PRODUCT OFFERINGS

13.6.4 RECENT DEVELOPMENTS

13.7 HALEON PLC

13.7.1 BUSINESS OVERVIEW

13.7.2 FINANCIAL SNAPSHOT: HALEON PLC (2023)

13.7.3 PRODUCT OFFERINGS

13.7.4 RECENT DEVELOPMENTS

13.8 HERBALIFE LTD.

13.8.1 BUSINESS OVERVIEW

13.8.2 FINANCIAL SNAPSHOT: HERBALIFE LTD. (2023)

13.8.3 PRODUCT OFFERINGS

13.8.4 RECENT DEVELOPMENTS

13.9 BAYER AG

13.9.1 BUSINESS OVERVIEW

13.9.2 FINANCIAL SNAPSHOT: BAYER AG (2023)

13.9.3 PRODUCT OFFERINGS

13.9.4 RECENT DEVELOPMENTS

13.10 H&H GROUP

13.10.1 BUSINESS OVERVIEW

13.10.2 FINANCIAL SNAPSHOT: H&H GROUP (2023)

13.10.3 PRODUCT OFFERINGS

13.10.4 RECENT DEVELOPMENTS

13.11 NU SKIN ENTERPRISES, INC.

13.11.1 BUSINESS OVERVIEW

13.11.2 FINANCIAL SNAPSHOT: NU SKIN ENTERPRISES INC. (2023)

13.11.3 PRODUCT OFFERINGS

13.11.4 RECENT DEVELOPMENTS

13.12 USANA HEALTH SCIENCES, INC.

13.12.1 BUSINESS OVERVIEW

13.12.2 FINANCIAL SNAPSHOT: USANA HEALTH SCIENCES, INC. (2023)

13.12.3 PRODUCT OFFERINGS

13.12.4 RECENT DEVELOPMENTS

13.13 NATURE’S SUNSHINE PRODUCTS, INC.

13.13.1 BUSINESS OVERVIEW

13.13.2 FINANCIAL SNAPSHOT: NATURE’S SUNSHINE PRODUCTS, INC. (2023)

13.13.3 PRODUCT OFFERINGS

13.13.4 RECENT DEVELOPMENTS

14. APPENDIX

14.1 INDUSTRY SPEAK: KEY INSIGHTS FROM PRIMARY INTERVIEWS

14.2 DISCUSSION GUIDE

14.2.1 MARKET OVERVIEW

14.2.2 MARKET SIZING AND SPLIT SHARES

14.2.3 COMPETITIVE LANDSCAPE

14.3 AVAILABLE CUSTOMIZATION OPTION

14.4 ADJACENT MARKET STUDIES

14.5 AUTHORS OF THE STUDY

LIST OF FIGURES

FIGURE 1: DIETARY SUPPLEMENTS MARKET SEGMENTATION

FIGURE 2: RESEARCH DESIGN

FIGURE 3: PRIMARY SOURCES

FIGURE 4: PRIMARY PARTICIPANTS FROM DEMAND AND SUPPLY SIDE

FIGURE 5: BREAKDOWN OF PRIMARY PARTICIPANTS (SUPPLY SIDE)

FIGURE 6: BREAKDOWN OF PRIMARY PARTICIPANTS (DEMAND SIDE)

FIGURE 7: SUPPLY SIDE MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

FIGURE 8: REVENUE SHARE ANALYSIS ILLUSTRATION

FIGURE 9: SUPPLY SIDE MARKET SIZE ESTIMATION: COMPANY SHARE ANALYSIS

FIGURE 10: BOTTOM-UP APPROACH (DEMAND SIDE) AND TOP-DOWN APPROACH (SUPPLY SIDE)

FIGURE 11: CAGR PROJECTIONS FROM MARKET DYNAMICS ANALYSIS (2024-2030)

FIGURE 12: CAGR PROJECTIONS PARAMETERS (2024 – 2030)

FIGURE 13: DATA TRIANGULATION METHODOLOGY

FIGURE 14: DIETARY SUPPLEMENTS MARKET, BY PRODUCT TYPE (2024 VS 2030, USD MILLION)

FIGURE 15: DIETARY SUPPLEMENTS MARKET, BY DOSAGE FORM (2024 VS 2030, USD MILLION)

FIGURE 16: DIETARY SUPPLEMENTS MARKET, BY TARGET POPULATION (2024 VS 2030, USD MILLION)

FIGURE 17: DIETARY SUPPLEMENTS MARKET, BY TARGET APPLICATION (2024 VS 2030, USD MILLION)

FIGURE 18: DIETARY SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL (2024 VS 2030, USD MILLION)

FIGURE 19: GEOGRAPHIC SNAPSHOT OF DIETARY SUPPLEMENTS MARKET

FIGURE 20: RISING AWARENESS OF IMPRTANCE OF HEALTH AND WELLNESS

FIGURE 21: CHINA ACCOUTED FOR THE LARGEST SHARE IN ASIA PACIFIC

FIGURE 22: CHINA AND INDIA TO REGISTER HIGHEST GROWTH DURING THE FORECAST PERIOD

FIGURE 23: NORTH AMERICA TO DOMINATE THE MARKET THROUGH FORECAST PERIOD

FIGURE 24: EMERGING MARKETS TO REGISTER HIGHER GROWTH

FIGURE 25: PHYSICAL INACTIVITY AMONG ADULTS IN DIFFERENT REGIONS (2024)

FIGURE 26: VALUE CHAIN ANALYSIS: KEY STAKEHOLDERS INVOLVED AT EACH STEP

FIGURE 27: INDUSTRY TRENDS EXPECTED TO DRIVE THE GROWTH OF DIETARY SUPPLEMENTS MARKET

FIGURE 28: GEOGRAPHICAL SNAPSHOT OF GLOBAL DIETARY SUPPLEMENTS MARKET

FIGURE 29: NORTH AMERICA: REGIONAL SNAPSHOT – DIETARY SUPPLEMENTS MARKET

FIGURE 30: EUROPE: REGIONAL SNAPSHOT – DIETARY SUPPLEMENTS MARKET

FIGURE 31: ASIA-PACIFIC: REGIONAL SNAPSHOT – DIETARY SUPPLEMENTS MARKET

FIGURE 32: KEY STRATEGIES ADOPTED BY MAJOR PLAYERS IN DIETARY SUPPLEMENTS MARKET (JANUARY 2023 – JULY 2024)

FIGURE 33: DIETARY SUPPLEMENTS MARKET SHARE, BY KEY PLAYERS, 2023

LIST OF TABLES

TABLE 1: STANDARD CURRENCY COVERSION RATE

TABLE 2: ASSUMPTIONS OF THE STUDY

TABLE 3:RISK ASSESSMENT: DIETARY SUPPLEMENTS MARKET

TABLE 4: RISING GERIATRIC POPULATION (% OF TOTAL POPULATION)

TABLE 5: INCREASING DISPOSABLE INCOME (2020 -2023)

TABLE 6: DIETARY SUPPLEMENTS MARKET, BY PRODUCT TYPE (2022 – 2030, USD MILLION)

TABLE 7: EXAMPLES OF VITAMIN DIETARY SUPPLEMENTS

TABLE 8: VITAMINS MARKET, BY GEOGRAPHY (2022 – 2030, USD MILLION)

TABLE 9: EXAMPLES OF MINERAL DIETARY SUPPLEMENTS

TABLE 10: MINERALS MARKET, BY GEOGRAPHY (2022 – 2030, USD MILLION)

TABLE 11: EXAMPLES OF BOTANICAL DIETARY SUPPLEMENTS

TABLE 12: BOTANICAL MARKET, BY GEOGRAPHY (2022 – 2030, USD MILLION)

TABLE 13: EXAMPLES OF PROBIOTIC DIETARY SUPPLEMENTS

TABLE 14: PROBIOTICS MARKET, BY GEOGRAPHY (2022 – 2030, USD MILLION)

TABLE 15: EXAMPLES OF AMINO ACIDS DIETARY SUPPLEMENTS

TABLE 16: AMINO ACIDS MARKET, BY GEOGRAPHY (2022 – 2030, USD MILLION)

TABLE 17: EXAMPLES OF FATTY ACIDS DIETARY SUPPLEMENTS

TABLE 18: FATTY ACIDS MARKET, BY GEOGRAPHY (2022 – 2030, USD MILLION)

TABLE 19: DIETARY SUPPLEMENTS MARKET, BY DOSAGE FORM (2022 – 2030, USD MILLION)

TABLE 20: TABLETS MARKET, BY GEOGRAPHY (2022 – 2030, USD MILLION)

TABLE 21: CAPSULES MARKET, BY GEOGRAPHY (2022 – 2030, USD MILLION)

TABLE 22: LIQUID MARKET, BY GEOGRAPHY (2022 – 2030, USD MILLION)

TABLE 23: GELS MARKET, BY GEOGRAPHY (2022 – 2030, USD MILLION)

TABLE 24: POWDER MARKET, BY GEOGRAPHY (2022 – 2030, USD MILLION)

TABLE 25: GUMMIES MARKET, BY GEOGRAPHY (2022 – 2030, USD MILLION)

TABLE 26: OTHER DOSAGE FORM MARKET, BY GEOGRAPHY (2022 – 2030, USD MILLION)

TABLE 27: DIETARY SUPPLEMENTS MARKET, BY TARGET POPULATION (2022 – 2030, USD MILLION)

TABLE 28: INFANTS MARKET, BY GEOGRAPHY (2022 – 2030, USD MILLION)

TABLE 29: CHILDREN MARKET, BY GEOGRAPHY (2022 – 2030, USD MILLION)

TABLE 30: ADULTS MARKET, BY GEOGRAPHY (2022 – 2030, USD MILLION)

TABLE 31: PREGNANT WOMEN MARKET, BY GEOGRAPHY (2022 – 2030, USD MILLION)

TABLE 32: SENIORS MARKET, BY GEOGRAPHY (2022 – 2030, USD MILLION)

TABLE 33: DIETARY SUPPLEMENTS MARKET, BY TARGET APPLICATION (2022 – 2030, USD MILLION)

TABLE 34: IMMUNITY MARKET, BY GEOGRAPHY (2022 – 2030, USD MILLION)

TABLE 35: STRESS MANAGEMENT MARKET, BY GEOGRAPHY (2022 – 2030, USD MILLION)

TABLE 36: ENERGY MARKET, BY GEOGRAPHY (2022 – 2030, USD MILLION)

TABLE 37:SKIN HEALTH MARKET, BY GEOGRAPHY (2022 – 2030, USD MILLION)

TABLE 38: SLEEP MANAGEMENT MARKET, BY GEOGRAPHY (2022 – 2030, USD MILLION)

TABLE 39: SPORTS MARKET, BY GEOGRAPHY (2022 – 2030, USD MILLION)

TABLE 40: WEIGHT MANAGEMENT MARKET, BY GEOGRAPHY (2022 – 2030, USD MILLION)

TABLE 41: OTHER TARGET APPLICATIONS MARKET, BY GEOGRAPHY (2022 – 2030, USD MILLION)

TABLE 42: DIETARY SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL (2022 – 2030, USD MILLION)

TABLE 43: PHARMACIES MARKET, BY GEOGRAPHY (2022 – 2030, USD MILLION)

TABLE 44: SUPERMARKETS / HYPERMARKETS MARKET, BY GEOGRAPHY (2022 – 2030, USD MILLION)

TABLE 45: TOP VITAMINS, MINERALS & SUPPLEMENTS BASED-ON SALES ON AMAZON (SEPTEMBER 2024)

TABLE 46:E-COMMERCE MARKET, BY GEOGRAPHY (2022 – 2030, USD MILLION)

TABLE 47: OTHER DISTRIBUTION CHANNELS MARKET, BY GEOGRAPHY (2022 – 2030, USD MILLION)

TABLE 48: DIETARY SUPPLEMENTS MARKET, BY REGIONS (2022 – 2030, USD MILLION)

TABLE 49: NORTH AMERICA: DIETARY SUPPLEMENTS MARKET, BY COUNTRY (2022 – 2030, USD MILLION)

TABLE 50: NORTH AMERICA: DIETARY SUPPLEMENTS MARKET, BY PRODUCT TYPE (2022 – 2030, USD MILLION)

TABLE 51: NORTH AMERICA: DIETARY SUPPLEMENTS MARKET, BY DOSAGE FORM (2022 – 2030, USD MILLION)

TABLE 52: NORTH AMERICA: DIETARY SUPPLEMENTS MARKET, BY TARGET POPULATION (2022 – 2030, USD MILLION)

TABLE 53: NORTH AMERICA: DIETARY SUPPLEMENTS MARKET, BY TARGET APPLICATION (2022 – 2030, USD MILLION)

TABLE 54: NORTH AMERICA: DIETARY SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL (2022 – 2030, USD MILLION)

TABLE 55: KEY INDICATORS INFLUENCING THE US DIETARY SUPPLEMENTS MARKET

TABLE 56: US: DIETARY SUPPLEMENTS MARKET, BY PRODUCT TYPE (2022 – 2030, USD MILLION)

TABLE 57: US: DIETARY SUPPLEMENTS MARKET, BY DOSAGE FORM (2022 – 2030, USD MILLION)

TABLE 58: US: DIETARY SUPPLEMENTS MARKET, BY TARGET POPULATION (2022 – 2030, USD MILLION)

TABLE 59: US: DIETARY SUPPLEMENTS MARKET, BY TARGET APPLICATION (2022 – 2030, USD MILLION)

TABLE 60: US: DIETARY SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL (2022 – 2030, USD MILLION)

TABLE 61: KEY INDICATORS INFLUENCING THE CANADA DIETARY SUPPLEMENTS MARKET

TABLE 62: CANADA: DIETARY SUPPLEMENTS MARKET, BY PRODUCT TYPE (2022 – 2030, USD MILLION)

TABLE 63: CANADA: DIETARY SUPPLEMENTS MARKET, BY DOSAGE FORM (2022 – 2030, USD MILLION)

TABLE 64: CANADA: DIETARY SUPPLEMENTS MARKET, BY TARGET POPULATION (2022 – 2030, USD MILLION)

TABLE 65: CANADA: DIETARY SUPPLEMENTS MARKET, BY TARGET APPLICATION (2022 – 2030, USD MILLION)

TABLE 66: CANADA: DIETARY SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL (2022 – 2030, USD MILLION)

TABLE 67:

EUROPE: DIETARY SUPPLEMENTS MARKET, BY COUNTRY (2022 – 2030, USD MILLION)

TABLE 68: EUROPE: DIETARY SUPPLEMENTS MARKET, BY PRODUCT TYPE (2022 – 2030, USD MILLION)

TABLE 69: EUROPE: DIETARY SUPPLEMENTS MARKET, BY DOSAGE FORM (2022 – 2030, USD MILLION)

TABLE 70: EUROPE: DIETARY SUPPLEMENTS MARKET, BY TARGET POPULATION (2022 – 2030, USD MILLION)

TABLE 71: EUROPE: DIETARY SUPPLEMENTS MARKET, BY TARGET APPLICATION (2022 – 2030, USD MILLION)

TABLE 72: EUROPE: DIETARY SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL (2022 – 2030, USD MILLION)

TABLE 73:KEY INDICATORS INFLUENCING THE GERMANY DIETARY SUPPLEMENTS MARKET

TABLE 74: GERMANY: DIETARY SUPPLEMENTS MARKET, BY PRODUCT TYPE (2022 – 2030, USD MILLION)

TABLE 75: GERMANY: DIETARY SUPPLEMENTS MARKET, BY DOSAGE FORM (2022 – 2030, USD MILLION)

TABLE 76: GERMANY: DIETARY SUPPLEMENTS MARKET, BY TARGET POPULATION (2022 – 2030, USD MILLION)

TABLE 77: GERMANY: DIETARY SUPPLEMENTS MARKET, BY TARGET APPLICATION (2022 – 2030, USD MILLION)

TABLE 78: GERMANY: DIETARY SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL (2022 – 2030, USD MILLION)

TABLE 79: KEY INDICATORS INFLUENCING THE UK DIETARY SUPPLEMENTS MARKET

TABLE 80: UK: DIETARY SUPPLEMENTS MARKET, BY PRODUCT TYPE (2022 – 2030, USD MILLION)

TABLE 81:UK: DIETARY SUPPLEMENTS MARKET, BY DOSAGE FORM (2022 – 2030, USD MILLION)

TABLE 82: UK: DIETARY SUPPLEMENTS MARKET, BY TARGET POPULATION (2022 – 2030, USD MILLION)

TABLE 83:UK: DIETARY SUPPLEMENTS MARKET, BY TARGET APPLICATION (2022 – 2030, USD MILLION)

TABLE 84: UK: DIETARY SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL (2022 – 2030, USD MILLION)

TABLE 85: KEY INDICATORS INFLUENCING THE FRANCE DIETARY SUPPLEMENTS MARKET

TABLE 86: FRANCE: DIETARY SUPPLEMENTS MARKET, BY PRODUCT TYPE (2022 – 2030, USD MILLION)

TABLE 87: FRANCE: DIETARY SUPPLEMENTS MARKET, BY DOSAGE FORM (2022 – 2030, USD MILLION)

TABLE 88: FRANCE: DIETARY SUPPLEMENTS MARKET, BY TARGET POPULATION (2022 – 2030, USD MILLION)

TABLE 89: FRANCE: DIETARY SUPPLEMENTS MARKET, BY TARGET APPLICATION (2022 – 2030, USD MILLION)

TABLE 90: FRANCE: DIETARY SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL (2022 – 2030, USD MILLION)

TABLE 91: KEY INDICATORS INFLUENCING THE ITALY DIETARY SUPPLEMENTS MARKET

TABLE 92: ITALY: DIETARY SUPPLEMENTS MARKET, BY PRODUCT TYPE (2022 – 2030, USD MILLION)

TABLE 93: ITALY: DIETARY SUPPLEMENTS MARKET, BY DOSAGE FORM (2022 – 2030, USD MILLION)

TABLE 94: ITALY: DIETARY SUPPLEMENTS MARKET, BY TARGET POPULATION (2022 – 2030, USD MILLION)

TABLE 95: ITALY: DIETARY SUPPLEMENTS MARKET, BY TARGET APPLICATION (2022 – 2030, USD MILLION)

TABLE 96: ITALY: DIETARY SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL (2022 – 2030, USD MILLION)

TABLE 97: KEY INDICATORS INFLUENCING THE SPAIN DIETARY SUPPLEMENTS MARKET

TABLE 98: SPAIN: DIETARY SUPPLEMENTS MARKET, BY PRODUCT TYPE (2022 – 2030, USD MILLION)

TABLE 99: SPAIN: DIETARY SUPPLEMENTS MARKET, BY DOSAGE FORM (2022 – 2030, USD MILLION)

TABLE 100: SPAIN: DIETARY SUPPLEMENTS MARKET, BY TARGET POPULATION (2022 – 2030, USD MILLION)

TABLE 101:SPAIN: DIETARY SUPPLEMENTS MARKET, BY TARGET APPLICATION (2022 – 2030, USD MILLION)

TABLE 102: SPAIN: DIETARY SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL (2022 – 2030, USD MILLION)

TABLE 103: REST OF THE EUROPE: DIETARY SUPPLEMENTS MARKET, BY PRODUCT TYPE (2022 – 2030, USD MILLION)

TABLE 104: REST OF THE EUROPE: DIETARY SUPPLEMENTS MARKET, BY DOSAGE FORM (2022 – 2030, USD MILLION)

TABLE 105: REST OF THE EUROPE: DIETARY SUPPLEMENTS MARKET, BY TARGET POPULATION (2022 – 2030, USD MILLION)

TABLE 106: REST OF THE EUROPE: DIETARY SUPPLEMENTS MARKET, BY TARGET APPLICATION (2022 – 2030, USD MILLION)

TABLE 107: REST OF THE EUROPE: DIETARY SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL (2022 – 2030, USD MILLION)

TABLE 108: ASIA-PACIFIC: DIETARY SUPPLEMENTS MARKET, BY COUNTRY (2022 – 2030, USD MILLION)

TABLE 109: ASIA-PACIFIC: DIETARY SUPPLEMENTS MARKET, BY PRODUCT TYPE (2022 – 2030, USD MILLION)

TABLE 110: ASIA-PACIFIC: DIETARY SUPPLEMENTS MARKET, BY DOSAGE FORM (2022 – 2030, USD MILLION)

TABLE 111: ASIA-PACIFIC: DIETARY SUPPLEMENTS MARKET, BY TARGET POPULATION (2022 – 2030, USD MILLION)

TABLE 112: ASIA-PACIFIC: DIETARY SUPPLEMENTS MARKET, BY TARGET APPLICATION (2022 – 2030, USD MILLION)

TABLE 113: ASIA-PACIFIC: DIETARY SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL (2022 – 2030, USD MILLION)

TABLE 114: KEY INDICATORS INFLUENCING THE CHINA DIETARY SUPPLEMENTS MARKET

TABLE 115: CHINA: DIETARY SUPPLEMENTS MARKET, BY PRODUCT TYPE (2022 – 2030, USD MILLION)

TABLE 116: CHINA: DIETARY SUPPLEMENTS MARKET, BY DOSAGE FORM (2022 – 2030, USD MILLION)

TABLE 117: CHINA: DIETARY SUPPLEMENTS MARKET, BY TARGET POPULATION (2022 – 2030, USD MILLION)

TABLE 118: CHINA: DIETARY SUPPLEMENTS MARKET, BY TARGET APPLICATION (2022 – 2030, USD MILLION)

TABLE 119: CHINA: DIETARY SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL (2022 – 2030, USD MILLION)

TABLE 120:KEY INDICATORS INFLUENCING THE JAPAN DIETARY SUPPLEMENTS MARKET

TABLE 121: JAPAN: DIETARY SUPPLEMENTS MARKET, BY PRODUCT TYPE (2022 – 2030, USD MILLION)

TABLE 122: JAPAN: DIETARY SUPPLEMENTS MARKET, BY DOSAGE FORM (2022 – 2030, USD MILLION)

TABLE 123: JAPAN: DIETARY SUPPLEMENTS MARKET, BY TARGET POPULATION (2022 – 2030, USD MILLION)

TABLE 124: JAPAN: DIETARY SUPPLEMENTS MARKET, BY TARGET APPLICATION (2022 – 2030, USD MILLION)

TABLE 125: JAPAN: DIETARY SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL (2022 – 2030, USD MILLION)

TABLE 126: KEY INDICATORS INFLUENCING THE INDIA DIETARY SUPPLEMENTS MARKET

TABLE 127: INDIA: DIETARY SUPPLEMENTS MARKET, BY PRODUCT TYPE (2022 – 2030, USD MILLION)

TABLE 128: INDIA: DIETARY SUPPLEMENTS MARKET, BY DOSAGE FORM (2022 – 2030, USD MILLION)

TABLE 129: INDIA: DIETARY SUPPLEMENTS MARKET, BY TARGET POPULATION (2022 – 2030, USD MILLION)

TABLE 130: INDIA: DIETARY SUPPLEMENTS MARKET, BY TARGET APPLICATION (2022 – 2030, USD MILLION)

TABLE 131: INDIA: DIETARY SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL (2022 – 2030, USD MILLION)

TABLE 132: KEY INDICATORS INFLUENCING THE SOUTH KOREA DIETARY SUPPLEMENTS MARKET

TABLE 133: SOUTH KOREA: DIETARY SUPPLEMENTS MARKET, BY PRODUCT TYPE (2022 – 2030, USD MILLION)

TABLE 134: SOUTH KOREA: DIETARY SUPPLEMENTS MARKET, BY DOSAGE FORM (2022 – 2030, USD MILLION)

TABLE 135: SOUTH KOREA: DIETARY SUPPLEMENTS MARKET, BY TARGET POPULATION (2022 – 2030, USD MILLION)

TABLE 136: SOUTH KOREA: DIETARY SUPPLEMENTS MARKET, BY TARGET APPLICATION (2022 – 2030, USD MILLION)

TABLE 137: SOUTH KOREA: DIETARY SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL (2022 – 2030, USD MILLION)

TABLE 138: KEY INDICATORS INFLUENCING THE AUSTRALIA DIETARY SUPPLEMENTS MARKET

TABLE 139: KEY INDICATORS INFLUENCING THE NEW ZEALAND DIETARY SUPPLEMENTS MARKET

TABLE 140: AUSTRALIA AND NEW ZEALAND: DIETARY SUPPLEMENTS MARKET, BY PRODUCT TYPE (2022 – 2030, USD MILLION)

TABLE 141: AUSTRALIA AND NEW ZEALAND: DIETARY SUPPLEMENTS MARKET, BY DOSAGE FORM (2022 – 2030, USD MILLION)

TABLE 142: AUSTRALIA AND NEW ZEALAND: DIETARY SUPPLEMENTS MARKET, BY TARGET POPULATION (2022 – 2030, USD MILLION)

TABLE 143: AUSTRALIA AND NEW ZEALAND: DIETARY SUPPLEMENTS MARKET, BY TARGET APPLICATION (2022 – 2030, USD MILLION)

TABLE 144: AUSTRALIA AND NEW ZEALAND: DIETARY SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL (2022 – 2030, USD MILLION)

TABLE 145: REST OF THE ASIA-PACIFIC: DIETARY SUPPLEMENTS MARKET, BY PRODUCT TYPE (2022 – 2030, USD MILLION)

TABLE 146: REST OF THE ASIA-PACIFIC: DIETARY SUPPLEMENTS MARKET, BY DOSAGE FORM (2022 – 2030, USD MILLION)

TABLE 147: REST OF THE ASIA-PACIFIC: DIETARY SUPPLEMENTS MARKET, BY TARGET POPULATION (2022 – 2030, USD MILLION)

TABLE 148: REST OF THE ASIA-PACIFIC: DIETARY SUPPLEMENTS MARKET, BY TARGET APPLICATION (2022 – 2030, USD MILLION)

TABLE 149: REST OF THE ASIA-PACIFIC: DIETARY SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL (2022 – 2030, USD MILLION)

TABLE 150: KEY INDICATORS INFLUENCING THE BRAZIL DIETARY SUPPLEMENTS MARKET

TABLE 151: KEY INDICATORS INFLUENCING THE MEXICO DIETARY SUPPLEMENTS MARKET

TABLE 152: LATIN AMERICA: DIETARY SUPPLEMENTS MARKET, BY PRODUCT TYPE (2022 – 2030, USD MILLION)

TABLE 153: LATIN AMERICA: DIETARY SUPPLEMENTS MARKET, BY DOSAGE FORM (2022 – 2030, USD MILLION)

TABLE 154: LATIN AMERICA: DIETARY SUPPLEMENTS MARKET, BY TARGET POPULATION (2022 – 2030, USD MILLION)

TABLE 155: LATIN AMERICA: DIETARY SUPPLEMENTS MARKET, BY TARGET APPLICATION (2022 – 2030, USD MILLION)

TABLE 156: LATIN AMERICA: DIETARY SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL (2022 – 2030, USD MILLION)

TABLE 157: MIDDLE EAST AND AFRICA: DIETARY SUPPLEMENTS MARKET, BY PRODUCT TYPE (2022 – 2030, USD MILLION)

TABLE 158: MIDDLE EAST AND AFRICA: DIETARY SUPPLEMENTS MARKET, BY DOSAGE FORM (2022 – 2030, USD MILLION)

TABLE 159: MIDDLE EAST AND AFRICA: DIETARY SUPPLEMENTS MARKET, BY TARGET POPULATION (2022 – 2030, USD MILLION)

TABLE 160: MIDDLE EAST AND AFRICA: DIETARY SUPPLEMENTS MARKET, BY TARGET APPLICATION (2022 – 2030, USD MILLION)

TABLE 161: MIDDLE EAST AND AFRICA: DIETARY SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL (2022 – 2030, USD MILLION)

TABLE 162: DIETARY SUPPLEMENTS MARKET: PRODUCT / PLATFORM LAUNCHES (JANUARY 2022 – JULY 2024)

TABLE 163: DIETARY SUPPLEMENTS MARKET: INORGANIC GROWTH STRATEGIES (JANUARY 2022 – JULY 2024)

TABLE 164: DIETARY SUPPLEMENTS MARKET: OTHER DEVELOPMENTS (JANUARY 2022 – JULY 2024)

TABLE 165: OVERALL FOOTPRINT ANALYSIS FOR KEY PLAYERS IN DIETARY SUPPLEMENTS MARKET

TABLE 166: PRODUCT TYPE FOOTPRINT ANALYSIS FOR KEY PLAYERS IN DIETARY SUPPLEMENTS MARKET

TABLE 167: DOSAGE FORM FOOTPRINT ANALYSIS FOR KEY PLAYERS IN DIETARY SUPPLEMENTS MARKET

TABLE 168: TARGET POPULATION FOOTPRINT ANALYSIS FOR KEY PLAYERS IN DIETARY SUPPLEMENTS MARKET

TABLE 169: TARGET APPLICATION FOOTPRINT ANALYSIS FOR KEY PLAYERS IN DIETARY SUPPLEMENTS MARKET

TABLE 170: DISTRIBUTION CHANNEL FOOTPRINT ANALYSIS FOR KEY PLAYERS IN DIETARY SUPPLEMENTS MARKET

TABLE 171: REGIONAL FOOTPRINT ANALYSIS FOR KEY PLAYERS IN DIETARY SUPPLEMENTS MARKET

Please Subscribe our news letter and get update.

© Copyright 2024 – Wissen Research All Rights Reserved.