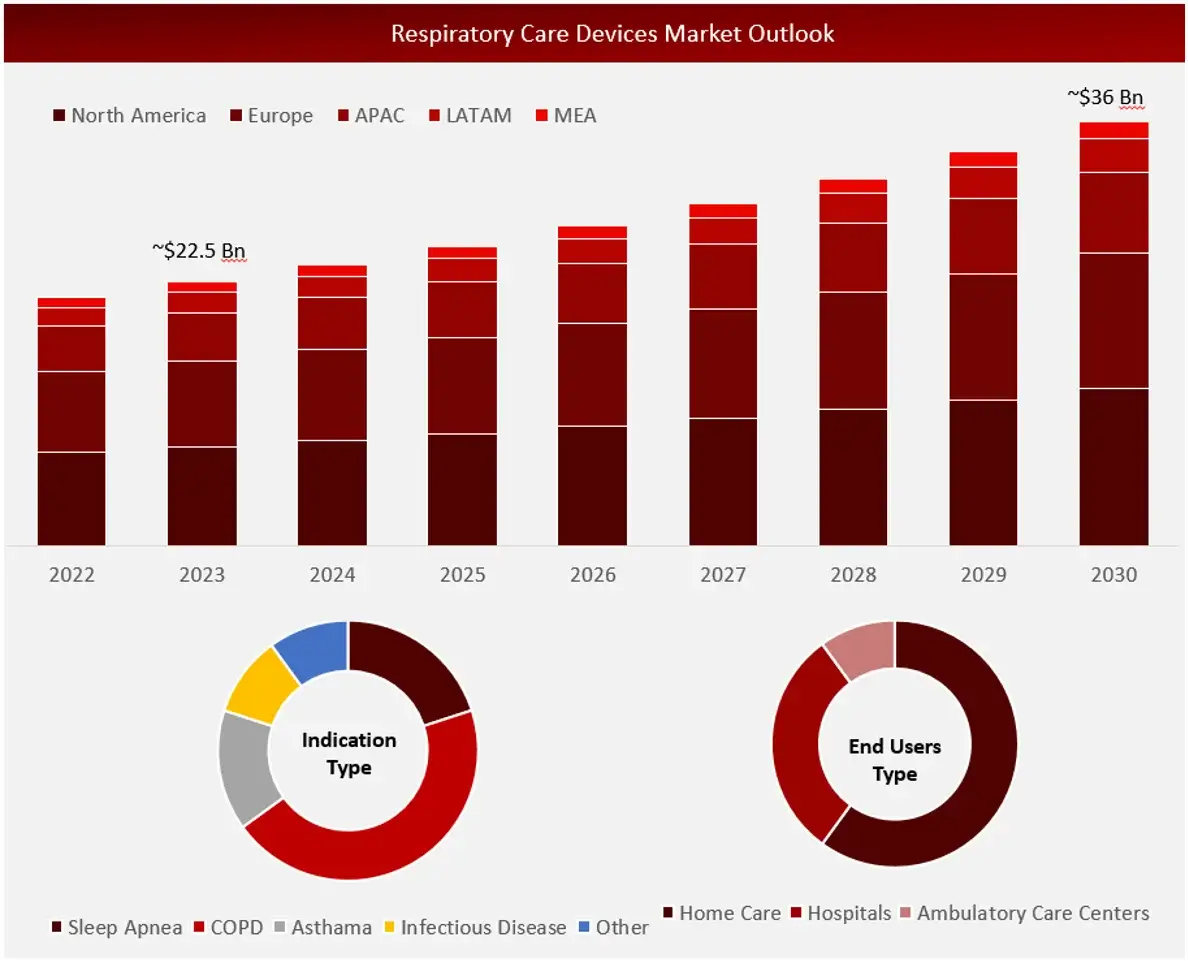

Respiratory Care Devices Market by Product (Therapeutic, Monitoring, Diagnostic, Consumable), Indication (COPD, Sleep Apnea, Asthma, Infection), End User (Hospitals, Homecare, ACC), Regions, Key Players – Global Forecast to 2030

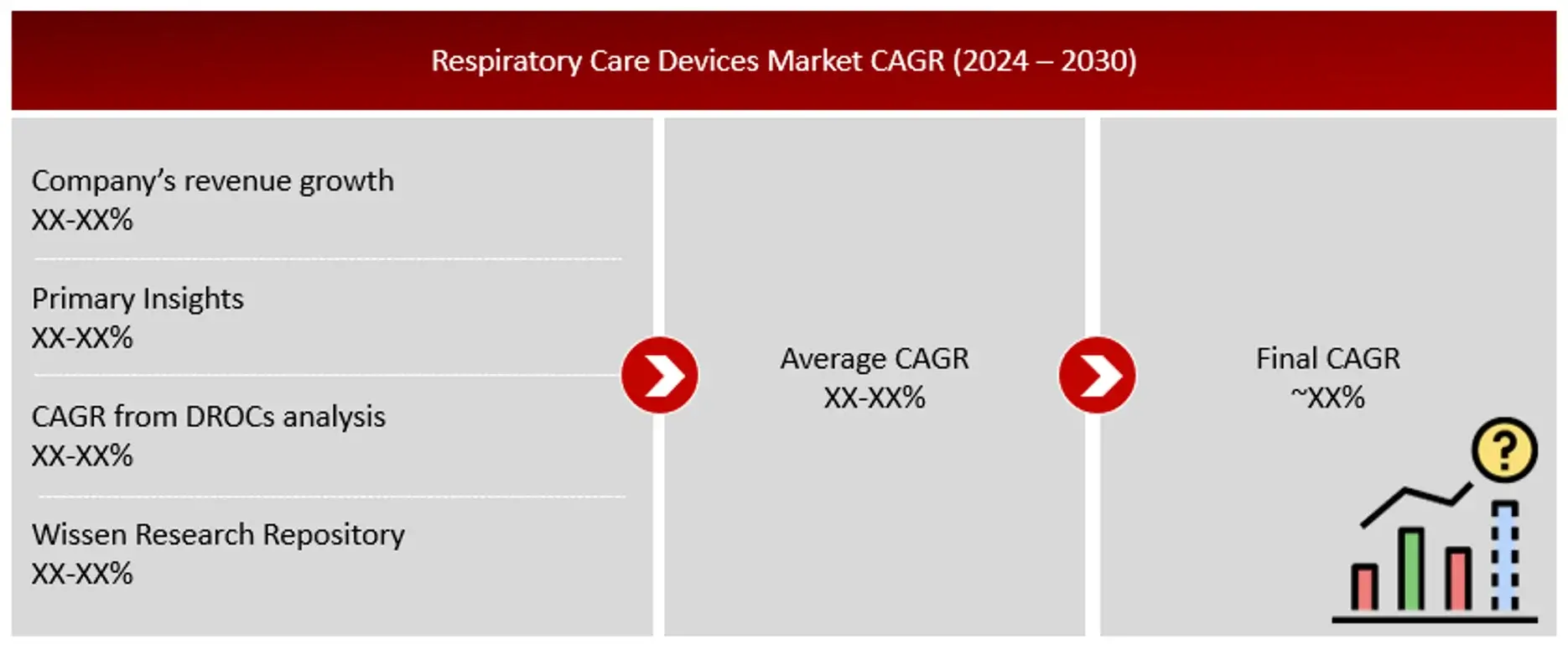

Wissen Research analyses that the respiratory care devices market is estimated at ~USD 22.5 billion in 2023 and is projected to reach ~USD 36 billion by 2030, expected to grow at a CAGR of ~7% during the forecast period, 2023-2030.

The increase in respiratory care devices market is mostly due to the rise in patients with respiratory conditions like COPD and asthma, the growth in the number of overweight and obese individuals, and the increase in preterm births. Around the world, there has been a rise in the amount of preterm births in the last two decades. Pregnancy occurring at an unsuitable age, typically above 40 years old or below 20 years old, raises the likelihood of premature birth. Causes of preterm deliveries involve maternal health issues such as diabetes, hypertension, and extensive use of infertility treatments. Additionally, females from certain ethnicities have a genetic predisposition to giving birth prematurely. For example, African-American and Hispanic communities in the US are at a heightened danger of experiencing preterm deliveries. Smoking and being overweight while pregnant can also heighten the risk of premature deliveries.

Driving Factor: Increasing Incidence of Respiratory Disorders

Long-term asthma, prolonged exposure to tobacco smoke, indoor and outdoor air pollution, as well as occupational fumes and dust are among the main factors leading to COPD. COPD is associated with additional chronic conditions like heart disease, muscle issues, and diabetes mellitus. These factors can also affect the patients’ health conditions and disrupt the treatment of COPD. The WHO reported that in 2019, approximately 262 million individuals were affected by asthma, and 0.5 million individuals lost their lives due to the condition. In asthma, morbidity and mortality continue to be significant concerns, and no treatment has successfully achieved disease normalization. The global population of asthmatic patients is expected to increase by 100 million by 2025. In the United States, 1 out of every 12 people are impacted by the condition, while in Europe, there are almost 10 million individuals aged over 45 who have asthma. Approximately 1,000 individuals are believed to lose their lives daily due to asthma.

Opportunity: Diagnosing patients at the point of care

The growth of the POC respiratory disease diagnostics market is primarily fueled by the rise in patients conducting self-testing. In the upcoming years, advancements in technology that enable miniaturization and microfabrication processes are anticipated to promote the use of POC testing and aid in managing respiratory diseases. Government agencies in both advanced and emerging nations have acknowledged that point-of-care technology offers a great opportunity to improve public health systems and meet the medical needs of underserved patients. Furthermore, the declining availability of qualified technicians in the central system is contributing to the growing favor of Point Of Care testing.

Challenge: Noncompliance from patients

The market’s growth is hindered by the crucial challenge of patients not complying with CPAP therapy. Adherence to treatment is consistently a challenge for patients with respiratory and sleep disorders, often because of factors like cost and convenience. Patients in regions such as Asia (India and China) and RoW are reluctant to cover treatment expenses because of the minimal reimbursements available. Non-adherence is discovered to be more widespread among CPAP users. Research indicates that approximately 30% to 50% of individuals encounter challenges in staying with CPAP therapy because of its confined feeling. A different study revealed that approximately half of CPAP users discontinued using their machine within 1 to 3 weeks due to discomfort caused by the masks or airflow, leading to non-adherence to the treatment.

ICU ventilators segment represented the largest portion of the respiratory care devices market, by product

In 2022, the ICU ventilators segment held the largest share of the respiratory care devices market. This segment’s growth is driven by factors such as the increasing number of intensive care beds equipped with ventilators, rising ICU admissions and re-admissions in developed countries, and a favorable reimbursement environment. Additionally, the growing prevalence of severe health issues among elderly individuals is leading to more patients being treated in critical care units, further boosting the demand for intensive care beds.

The COPD segment is projected to grow at a higher CAGR during the forecast period

The global respiratory care devices market is categorized by disease indication into chronic obstructive pulmonary disease (COPD), asthma, sleep apnea, infectious diseases, and other conditions. The COPD segment is projected to grow at a higher CAGR during the forecast period. Tobacco smoking is a primary cause of COPD, with the US Centers for Disease Control and Prevention (CDC) reporting that up to 80% of COPD-related deaths are linked to smoking. Additionally, increasing indoor and outdoor air pollution, as well as exposure to dust and chemicals, are contributing to the rising prevalence of COPD.

The home care settings segment is expected to see the highest CAGR during the forecast period

The home care is the fastest-growing segment, largely due to the convenience it offers patients. Sleep apnea treatments represent a significant portion of the home care market for respiratory devices. The increasing adoption of positive airway pressure devices for managing sleep apnea is a major factor driving the growth of this segment.

Major players operating in respiratory care devices market are Philips, Getinge, GE Healthcare, Masimo, Fisher & Paykel Healthcare Limited, Medtronic, ResMed, Adapt Health, Baxter, Vyaire Medical, Inc, Invacare Corporation., Hamilton among others.

Recent Developments:

Introduction

Market Definition

Respiratory care is a specialized field in healthcare that involves assessing, treating, controlling, managing, and monitoring diseases and disorders of the cardiopulmonary system. Respiratory support devices are widely utilized in general and surgical wards as well as ICUs for life-saving purposes. Respiratory support devices are designed to aid patients who require assistance with breathing, elimination of carbon dioxide, and treatments to prevent weakening of abdominal muscles due to lack of use.

Sources: Company Websites and Wissen Research Analysis.

Sources: Wissen Research Analysis.

Key Stakeholders

Key objectives of the Study

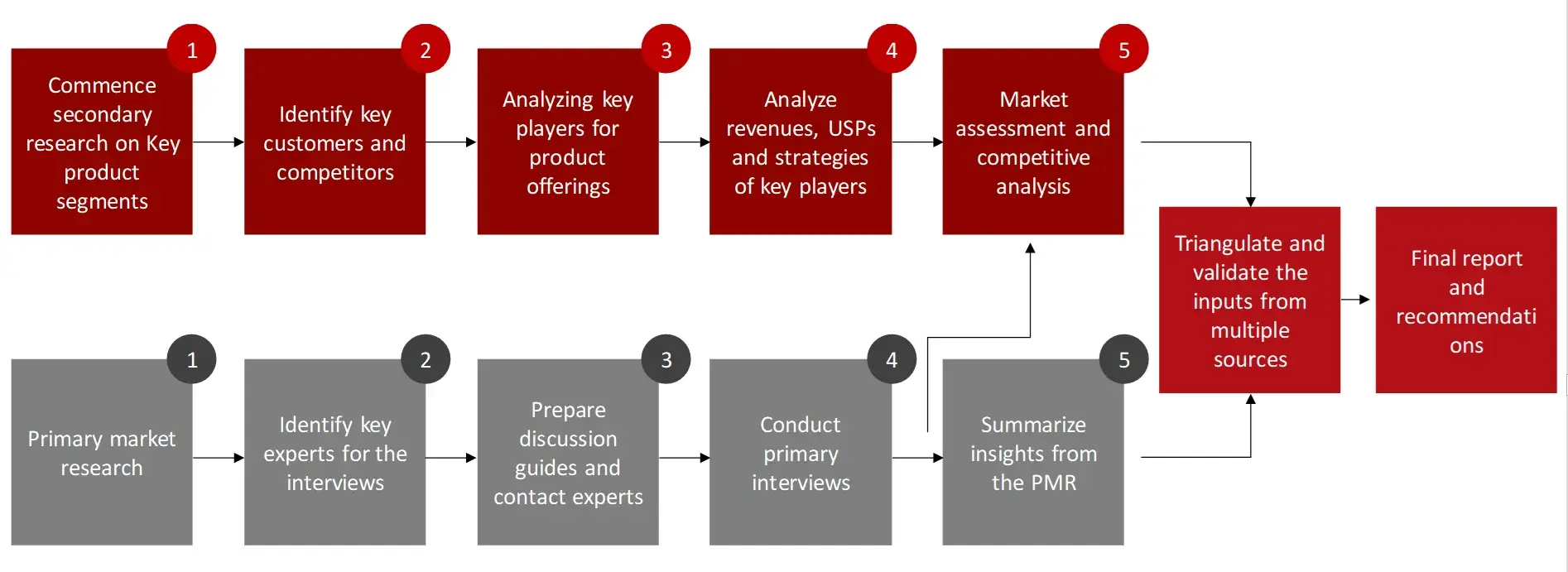

Research Methodology

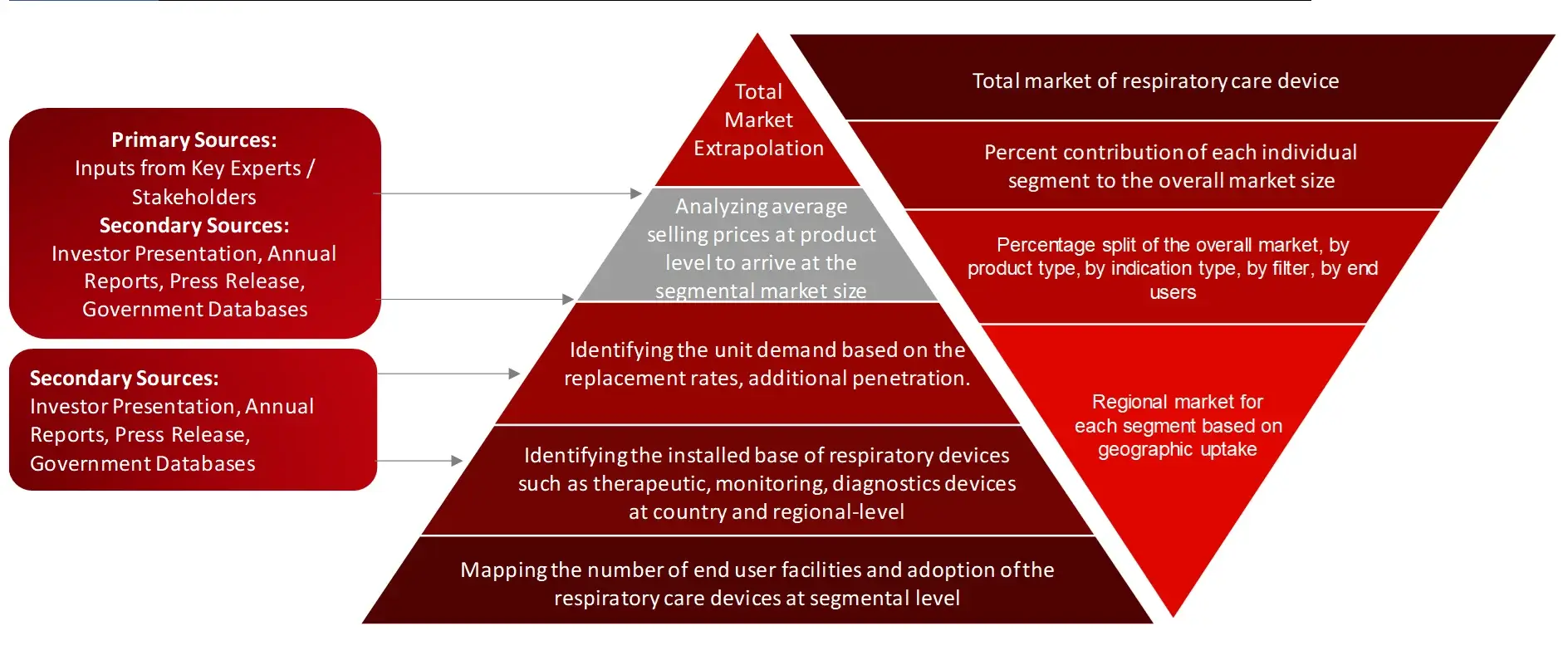

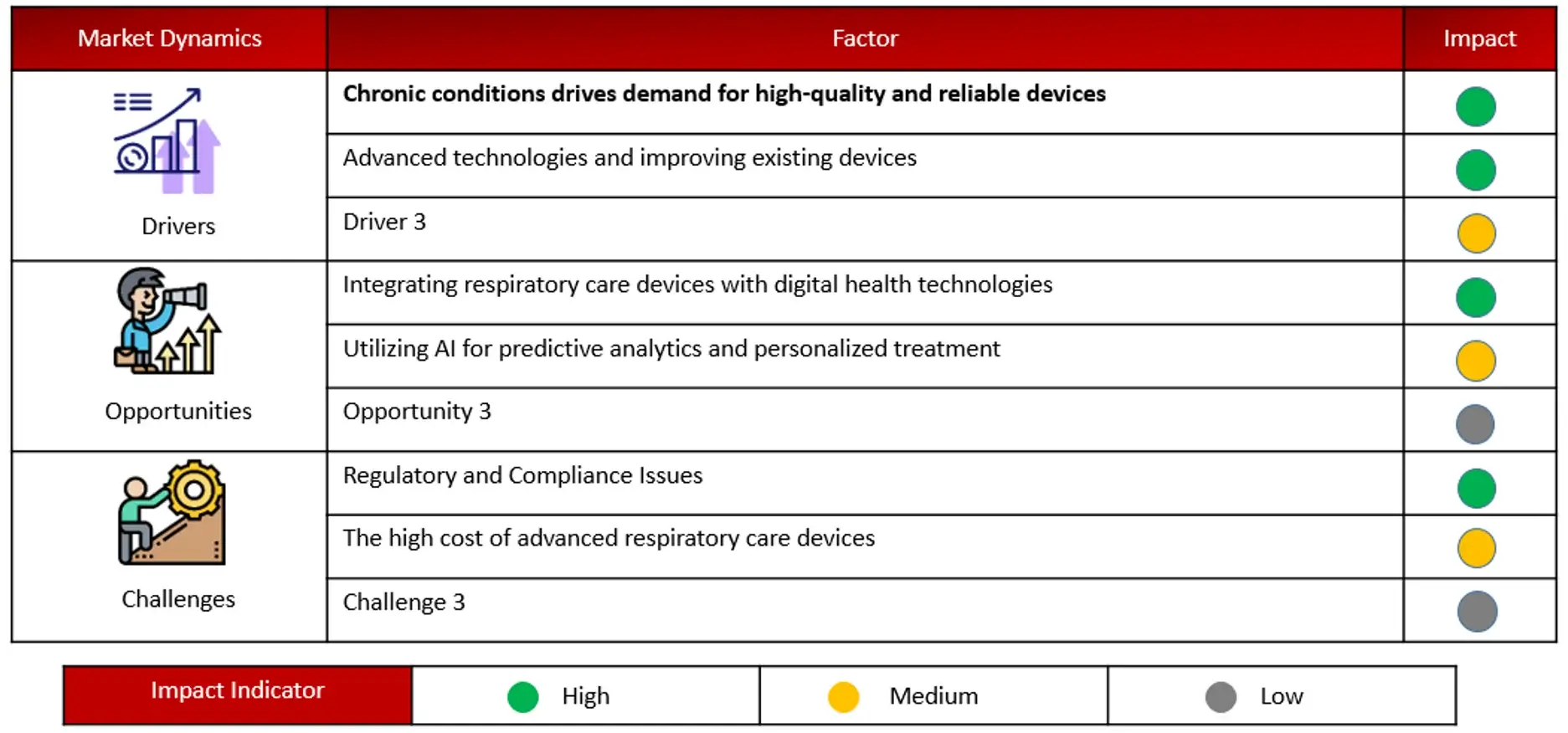

The aim of the study is to examine the key market forces such as drivers, opportunities, restraints, challenges, and strategies of key leaders. To monitor company advancements such as patents granted, product launches, expansions, and collaborations of key players, analyzing their competitive landscape based on various parameters of business and product strategy. Markey sizing will be estimated using top-down and bottom-up approaches. Using market breakdown and data triangulation techniques, market sizing of segments and sub-segments will be estimated.

FIGURE: RESEARCH DESIGN

Research Approach

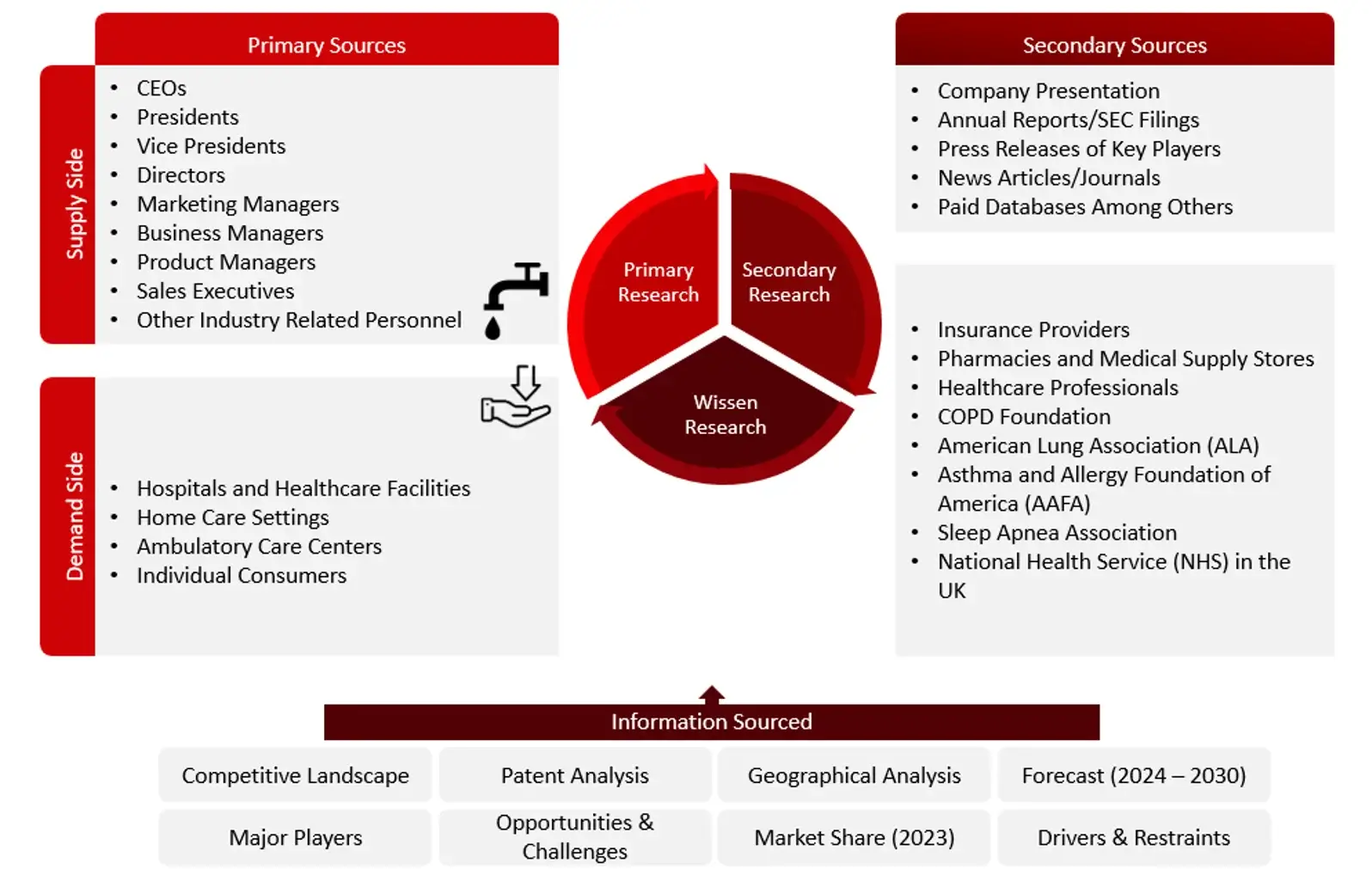

Collecting Secondary Data

The process of collating secondary research data involves the utilization of databases, secondary sources, annual reports, investor presentations, directories, and SEC filings of companies. Secondary research will be utilized to identify and gather information beneficial for the in-depth, technical, market-oriented, and commercial analysis of the respiratory care devices market. A database of the key industry leaders will also be compiled using secondary research.

Collecting Primary Data

The primary research data will be conducted after acquiring knowledge about the respiratory care devices market scenario through secondary research. A significant number of primary interviews will be conducted with stakeholders from both the demand and supply side (including various industry experts, such as Vice Presidents (VPs), Chief X Officers (CXOs), Directors from business development, marketing and product development teams, product manufacturers) across major countries of Europe, Asia Pacific, North America, Latin America, and Middle East and Africa. Primary data for this report will be collected through questionnaires, emails, and telephonic interviews.

FIGURE: BREAKDOWN OF PRIMARY INTERVIEWS FROM SUPPLY SIDE

FIGURE: BREAKDOWN OF PRIMARY INTERVIEWS FROM DEMAND SIDE

FIGURE: PROPOSED PRIMARY PARTICIPANTS FROM DEMAND AND SUPPLY SIDE

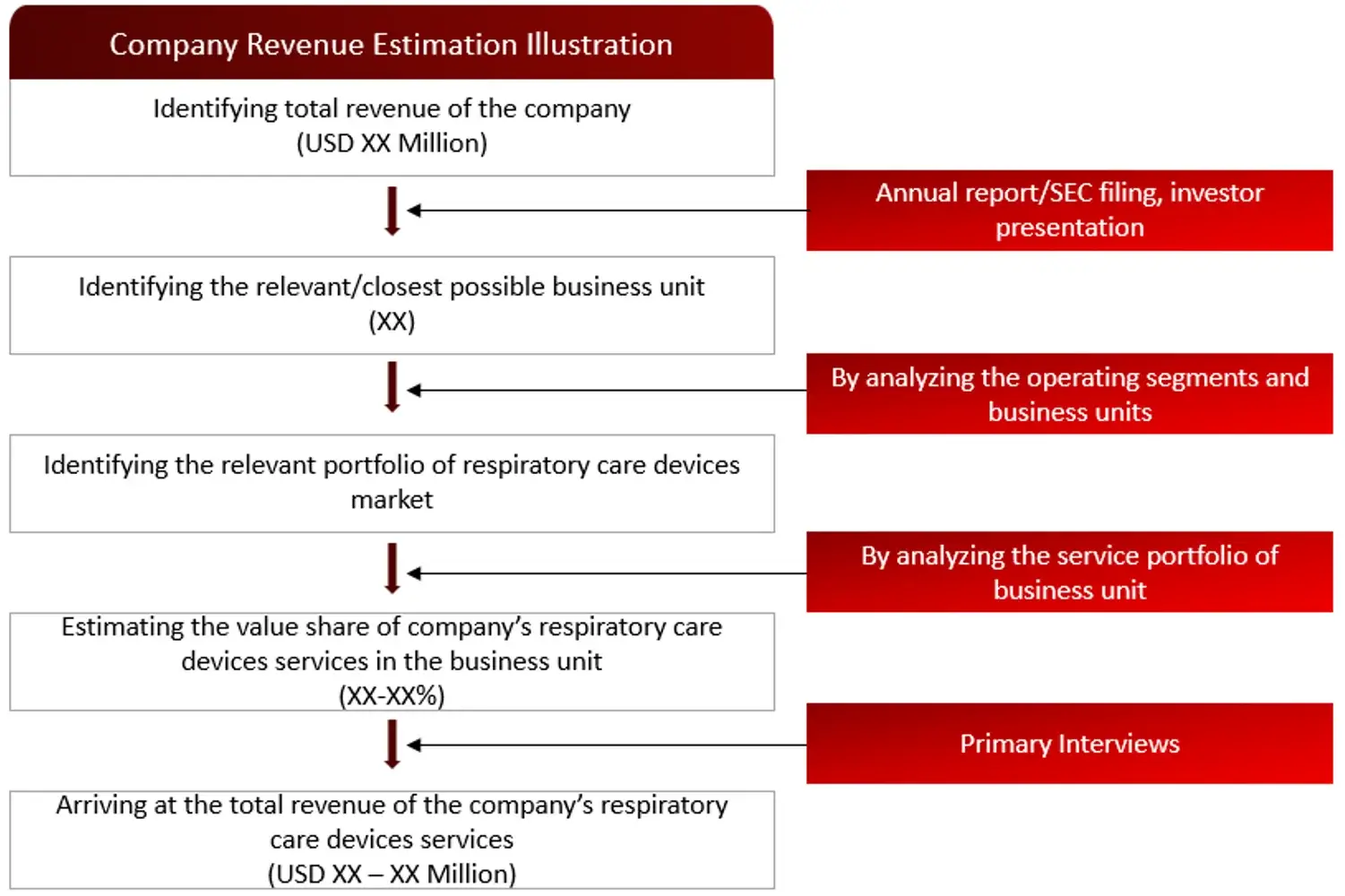

Market Size Estimation

All major manufacturers offering various respiratory services will be identified at the global / regional level. Revenue mapping will be done for the major players, which will further be extrapolated to arrive at the global market value of each type of segment. The market value of respiratory care devices market will also split into various segments and sub segments at the region level based on:

FIGURE: REVENUE MAPPING BY COMPANY (ILLUSTRATION)

FIGURE: REVENUE SHARE ANALYSIS OF KEY PLAYERS (SUPPLY SIDE)

FIGURE: MARKET SIZE ESTIMATION TOP-DOWN AND BOTTOM-UP APPROACH

FIGURE: ANALYSIS OF DROCS FOR GROWTH FORECAST

FIGURE: GROWTH FORECAST ANALYSIS UTILIZING MULTIPLE PARAMETERS

Research Design

After arriving at the overall market size-using the market size estimation processes-the market will be split into several segments and sub segment. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub segment, the data triangulation, and market breakdown procedures will be employed, wherever applicable. The data will be triangulated by studying various factors and trends from both the demand and supply sides in the respiratory care devices market.

1.Introduction

1.1 Key Objectives

1.2 Definitions

1.2.1 In Scope

1.2.2 Out of Scope

1.3 Scope of the Report

1.4 Scope Related Limitations

1.5 Key Stakeholders

2. Research Methodology

2.1 Research Approach

2.2 Research Methodology / Design

2.3 Market Sizing Approach

2.3.1 Secondary Research

2.3.2 Primary Research

3. Executive Summary & Premium Content

3.1 Global Market Outlook

3.2 Key Market Findings

4. Patent Analysis

4.1 Patents Related to Respiratory Care Devices

4.2 Patent Landscape and Intellectual Property Trends

5. Market Overview

5.1 Market Dynamics

5.1.1 Drivers/Opportunities

5.1.2 Restraints/Challenges

5.2 End User Perception

5.3 Need Gap

5.4 Supply Chain / Value Chain Analysis

5.5 Industry Trends

5.6 Porter’s Five Forces Analysis

6. Respiratory Care Devices Market, by Product Type (2023-2030, USD Million)

6.1 Therapeutic Respiratory Care Devices

6.1.1 Positive airway pressure (PAP) Devices

6.1.1.1 Continuous Positive Airway Pressure (CPAP) Devices

6.1.1.2 Automatic positive airway pressure (APAP) Devices

6.1.1.3 Bilevel Positive airway pressure (BPAP) Devices

6.1.2 Ventilators

6.1.2.1 ICU Ventilators

6.1.2.1.1 High End Ventilators

6.1.2.1.2 Mid End Ventilators

6.1.2.1.3 Basic Ventilators

6.1.2.2 Portable/transportable Ventilators

6.1.3 Nebulizers

6.1.3.1 Jet Nebulizers

6.1.3.2 Mesh Nebulizers

6.1.3.3 Ultrasonic Nebulizers

6.1.4 Humidifiers

6.1.4.1 Heated Humidifiers

6.1.4.2 Passover Humidifiers

6.1.5 Oxygen Concentrators

6.1.5.1 Fixed Oxygen Concentrators

6.1.5.2 Portable Oxygen Concentrators

6.1.6 Inhalers

6.1.6.1 Metered-dose Inhalers (MDIs)

6.1.6.2 Dry Powder Inhalers (DPIs)

6.1.7 Reusable Resuscitators

6.1.8 Nitric Oxide Delivery Units

6.1.9 Oxygen Hoods

6.2 Diagnostic Respiratory Care Devices

6.2.1 Spirometers

6.2.2 Polysomnography Devices

6.2.3 Peak Flow Meters

6.2.4 Other Diagnostic Devices

6.3 Monitoring Devices

6.3.1 Pulse Oximeters

6.3.1.1 Pulse Oximeter Sensors

6.3.1.2 Pulse Oximeter Equipment

6.3.2 Capnographs

6.3.3 Gas Analyzers

6.4. Consumables & Accessories

6.4.1. Masks

6.4.1.1 Reusable Masks

6.4.1.2 Disposable Masks

6.4.2 Disposable Resuscitators

6.4.3 Tracheostomy Tubes

6.4.4 Breathing Circuits

6.4.5 Nasal Cannula

6.4.6 Other Consumables & Accessories

7. Respiratory Care Devices Market, by Indication (2023-2030, USD Million)

7.1 Asthma

7.2 Chronic Bronchitis

7.3 Chronic Obstructive Pulmonary Disease (COPD)

7.5 Infectious Diseases

7.6 Other Disease Indications (Cystic Fibrosis, Lung Cancer etc.)

8. Respiratory Care Devices Market, by End Users (2023-2030, USD Million)

8.1 Home Care Setting

8.2 Hospitals

8.3 Ambulatory Care Centers

8.4 Other End Users

9. Respiratory Care Devices Market, by Region (2023-2030, USD Million)

9.1 North America

9.1.1 US

9.1.2 Canada

9.2 Europe

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 Italy

9.2.5 UK

9.2.6 Rest of the Europe

9.3 Asia Pacific

9.3.1 China

9.3.2 Japan

9.3.3 India

9.3.4 Australia and New Zealand

9.3.5 South Korea

9.3.6 Rest of the Asia Pacific

9.4 Middle East and Africa

9.5 Latin America

10. Competitive Analysis

10.1 Key Players Footprint Analysis

10.2 Market Share Analysis

10.3 Key Brand Analysis

10.4 Regional Snapshot of Key Players

10.5 R&D Expenditure of Key Players

11. Company Profiles2

11.1 Philips

11.1.1 Business Overview

11.1.2 Product Portfolio

11.1.3 Financial Snapshot3

11.1.4 Recent Developments

11.1.5 SWOT Analysis

11.2 Getinge

11.3 GE Healthcare.

11.4 Masimo

11.5 Fisher And Paykel Healthcare

11.6 Medtronic

11.7 ResMed

11.8 Adapt Health

11.9 Invacare Corporation

11.10 Hamilton

11.11 Nihon Kohden Corporation

11.12 Vyaire Medical, Inc.

11.13 Baxter

11.14 Rotech Healthcare

11.15 Teleflex Incorporated

11.16

Air Liquide

12. Conclusion

13. Appendix

13.1 Industry Speak

13.2 Questionnaire

13.3 Available Custom Work

13.4 Adjacent Studies

13.5 Authors

14. References

© Copyright 2024 – Wissen Research All Rights Reserved.