Subscribe our newsletter

Please Subscribe our news letter and get update.

DESCRIPTION

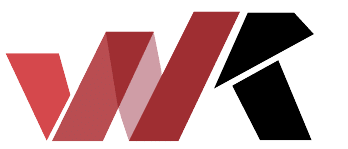

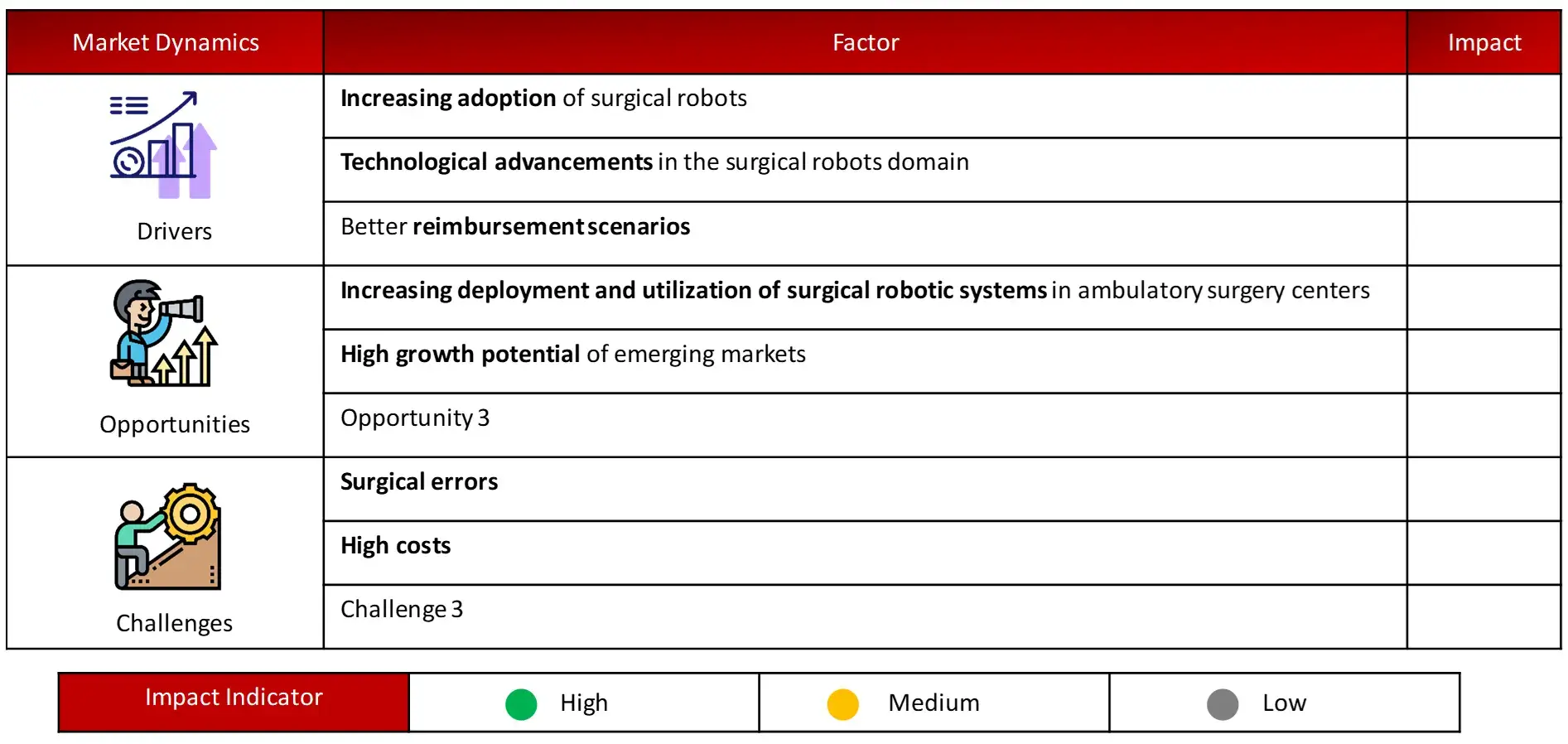

Key driving factors of surgical robots’ market include rising adoption of surgical robots, technological advancements in surgical robot’s domain and better reimbursements scenarios.

Challenges in the surgical robots’ domain include high cost of development and surgical errors. The global surgical robots market is estimated to be valued at ~ $9 Billion in 2023, and is expected to grow at a CAGR of ~16%. Instruments and accessories have held the most significant share in the market since 2022, with North America dominating the regional market share.

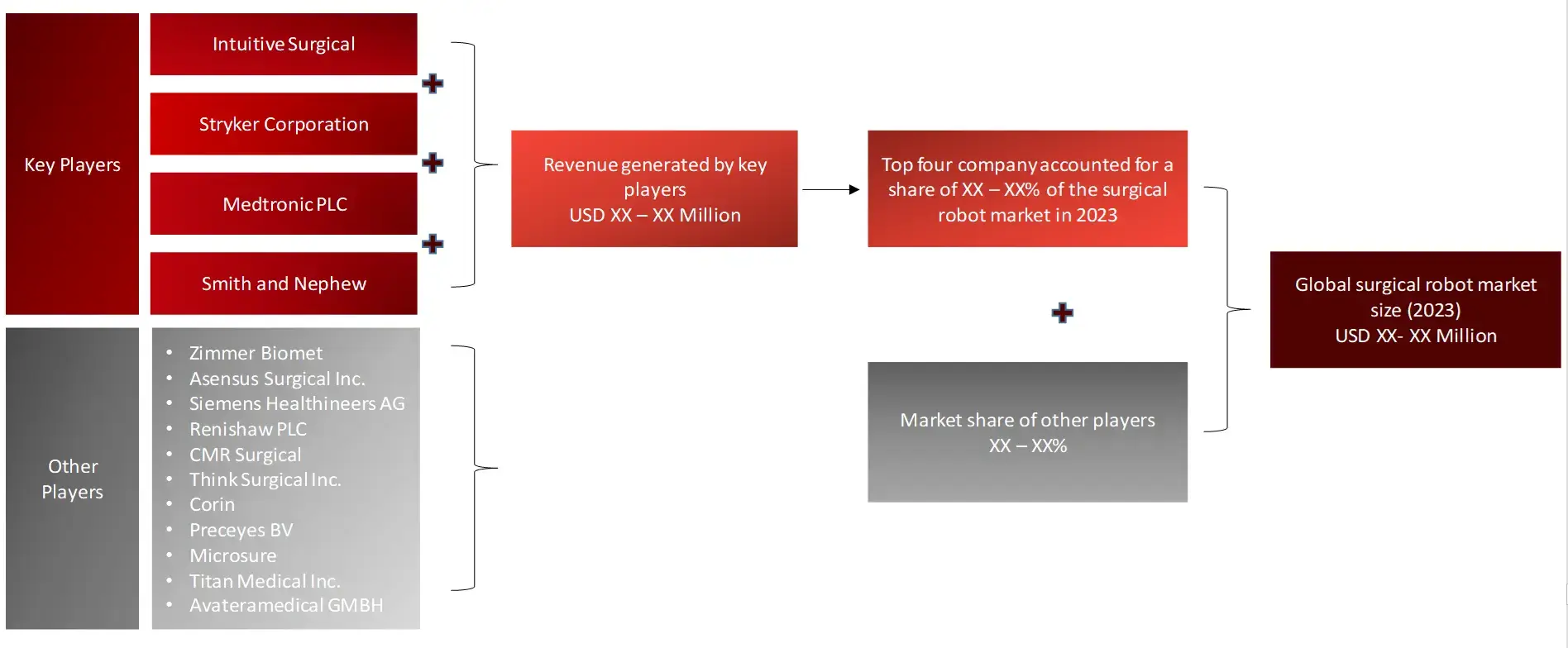

Key players functioning in surgical robot sector are Intuitive Surgical, Stryker Corporation, Medtronic Plc, Smith & Nephew, Zimmer Biomet and Asensus Surgical.

In recent strategic activities, Asensus Surgical announced that it entered into a collaboration with Nvidia to accelerate the development of its Intelligent surgical units (Sept, 2023) and Sony Group Corporation (Sony) announced the development of a microsurgery assistance robot capable of automatic surgical instrument exchange and precision control. The prototype was unveiled at the Sony booth during the 2024 Institute of Electrical and Electronics Engineers (IEEE) International Conference on Robotics and Automation (ICRA2024). (May, 2024)

MARKET DYNAMICS

Drivers: Increasing adoption of surgical robots

The increasing adoption of surgical robots is driving market growth, as evidenced by rising procedure numbers and expanding installations. Intuitive Surgical reported 1.2 million da Vinci procedures worldwide in 2020, an 11% year-over-year increase. Their installed base grew to 5,989 units, up 7% from 2019. This trend extends beyond a single manufacturer, with new players like Medtronic entering the market. Over 67% of large U.S. hospitals (500+ beds) now have at least one surgical robot, reflecting widespread recognition of the technology’s benefits in precision and minimally invasive techniques.

Opportunities: High growth potential of emerging markets

Emerging markets present significant growth opportunities for surgical robotics. Countries like China, India, Brazil, and Mexico are experiencing rapid healthcare infrastructure development and increasing investment in advanced medical technologies. For instance, China’s surgical robot market is projected to grow at a faster rate than established markets, with domestic companies like MicroPort and Tinavi gaining traction. Similarly, a high surge in surgical robotic operations were observed on India and Brazil

Challenges: High cost of development

The high cost of development poses a significant challenge in the surgical robotics market. Research, engineering, and regulatory approval processes for these complex systems require substantial investment. For example, Intuitive Surgical, a market leader, reported R&D expenses of $595 million in 2020, representing about 12% of their total revenue. New entrants face even steeper costs; Medtronic reportedly invested over $1.5 billion in developing its Hugo RAS system before bringing it to market. These high development costs often translate to expensive systems, with a typical surgical robot costing between $1 million to $2.5 million, plus annual maintenance fees of $100,000 to $200,000. This financial barrier limits adoption, particularly in smaller hospitals and emerging markets, potentially slowing market growth and innovation in the field.

GLOBAL SURGICAL ROBOTS MARKET, BY TECHNOLOGY TYPE

Instruments and accessories dominated the surgical robots market share in 2023

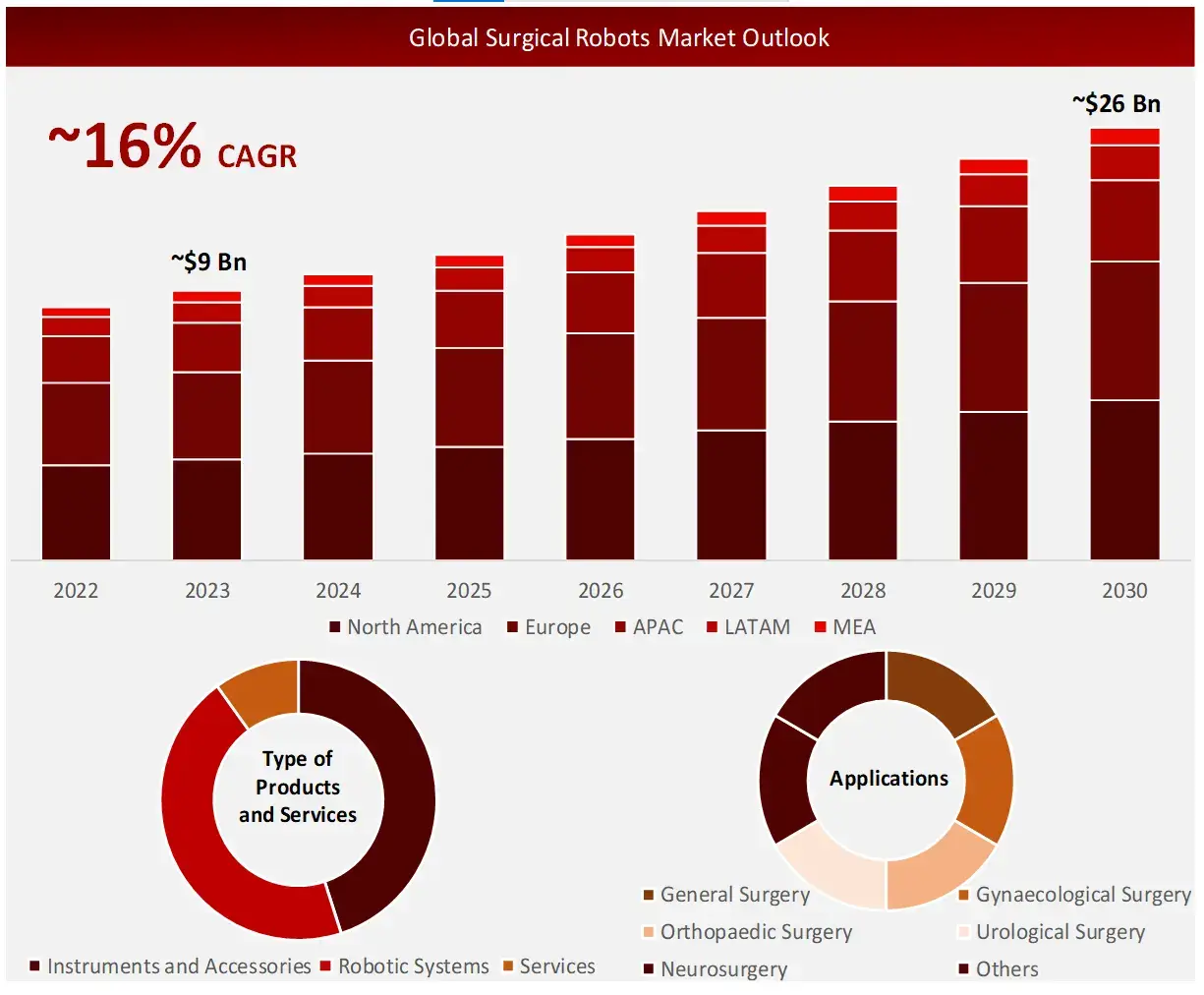

Surgical robots include various technology types, including instruments and accessories, robotic systems (laparoscopic robotic systems, orthopaedic robotic systems, neurosurgical robotic systems and other robotic systems), services. Each category serves specific surgical needs across different procedures. Among these, instruments and accessories have held the largest market share, primarily due to the recurrent purchase of them.

GLOBAL SURGICAL ROBOTS MARKET, BY APPLICATION

Urological surgery accounted for the largest share in 2023

Global surgical robots market by application is segmented into a diverse indication spectrum, such as- general surgery, gynaecological surgery, orthopaedic surgery, urological surgery, neurosurgery and others.

Among the aforementioned applications urological surgery dominated the market, while orthopedic surgery accounted for the second largest.

GLOBAL SURGICAL ROBOTS MARKET, BY END USER

Significant market share was held by hospitals in 2022

Surgical robots serve a number of end-users such as hospitals, ambulatory surgery centers and others

The traditional healthcare facilities, i.e. hospitals remained the significant holder of user market share due to increase in the adoption rates of surgical robots globally.

GLOBAL SURGICAL ROBOTS MARKET, BY REGION

North America held the largest market share in surgical robots in the forecast period

Surgical robots market research included a comprehensive analysis of five key regions:

All regions were evaluated based on these following factors- healthcare infrastructure, regulatory landscape, technological adoption, and market dynamics.

The research observed that North America held the largest share in the surgical robots’ domain during the forecast period, primarily due to its advanced healthcare systems, high adoption rates, and the presence of major market players driving innovation in this sector.

Introduction

Market Definition

Surgical robots are advanced mechatronic systems designed to augment surgical capabilities. These programmable devices operate under surgeon control, facilitating complex procedures through enhanced precision and dexterity. Primarily developed to enable minimally invasive techniques, surgical robots allow for smaller incisions and finer manipulations. The technology has evolved from early telerobotic systems to increasingly sophisticated platforms, expanding potential applications in various surgical specialties and contributing to the ongoing advancement of medical interventions.

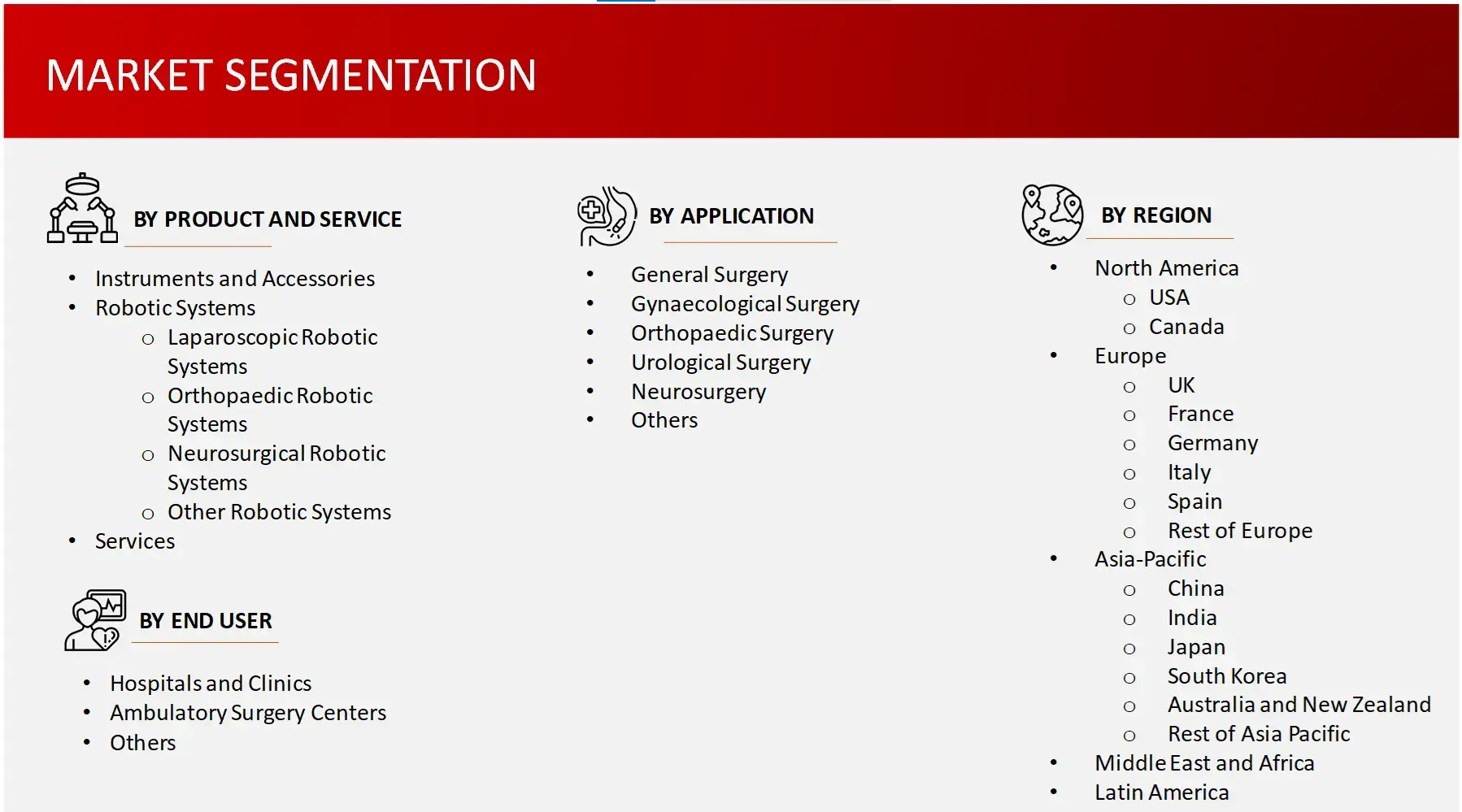

FIGURE: SURGICAL ROBOTS MARKET SEGMENT

FIGURE: YEARS FRAMEWORK CONSIDERED IN THE STUDY

Key Stakeholders

Key objectives of the Study

Research Methodology

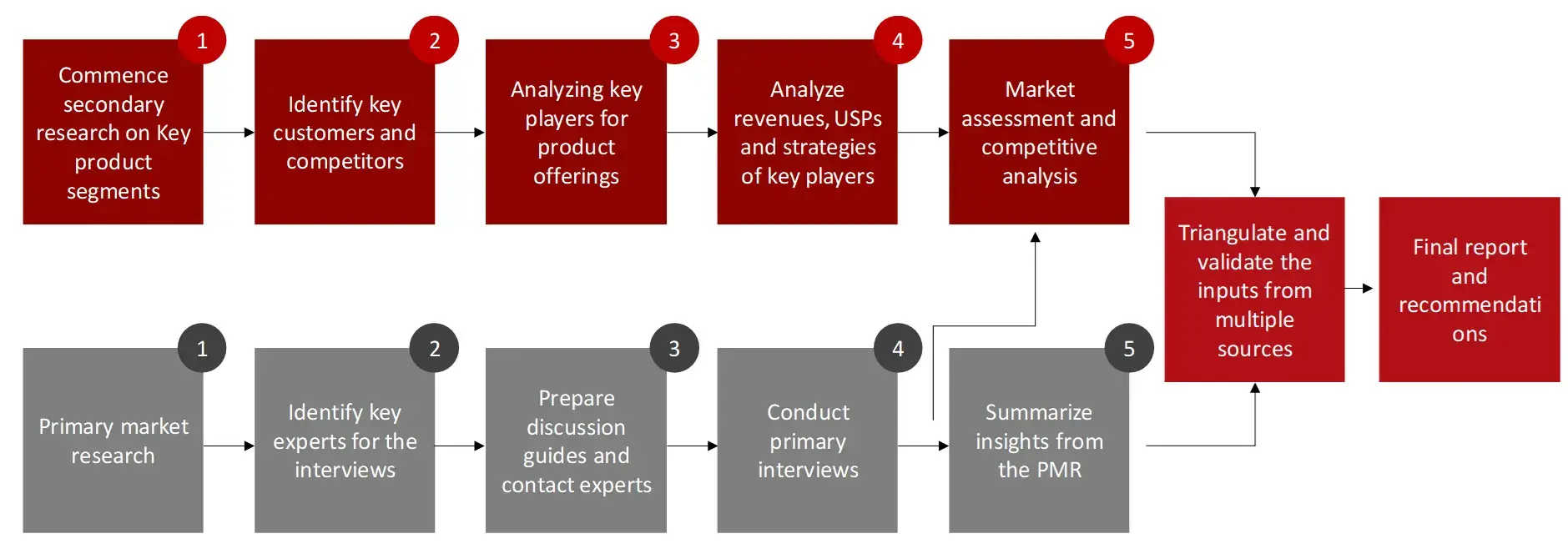

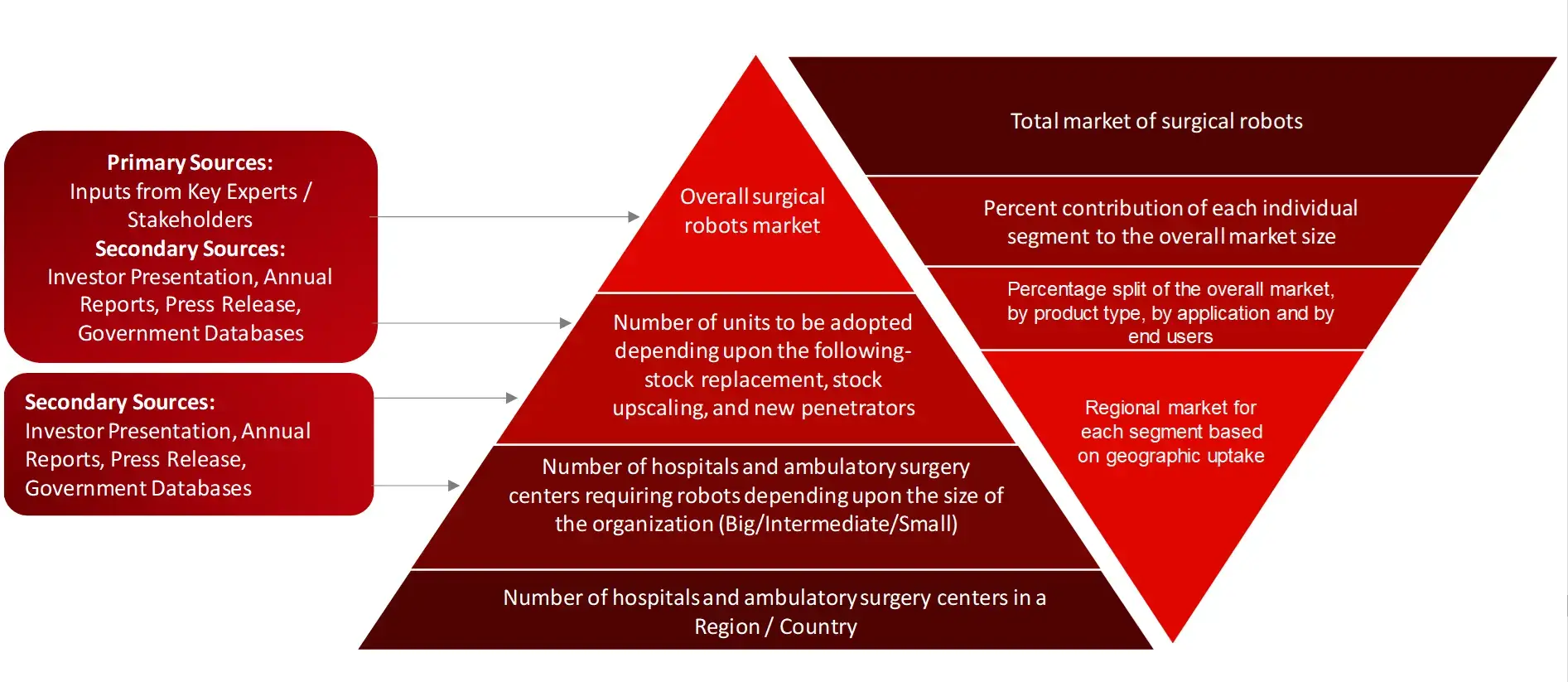

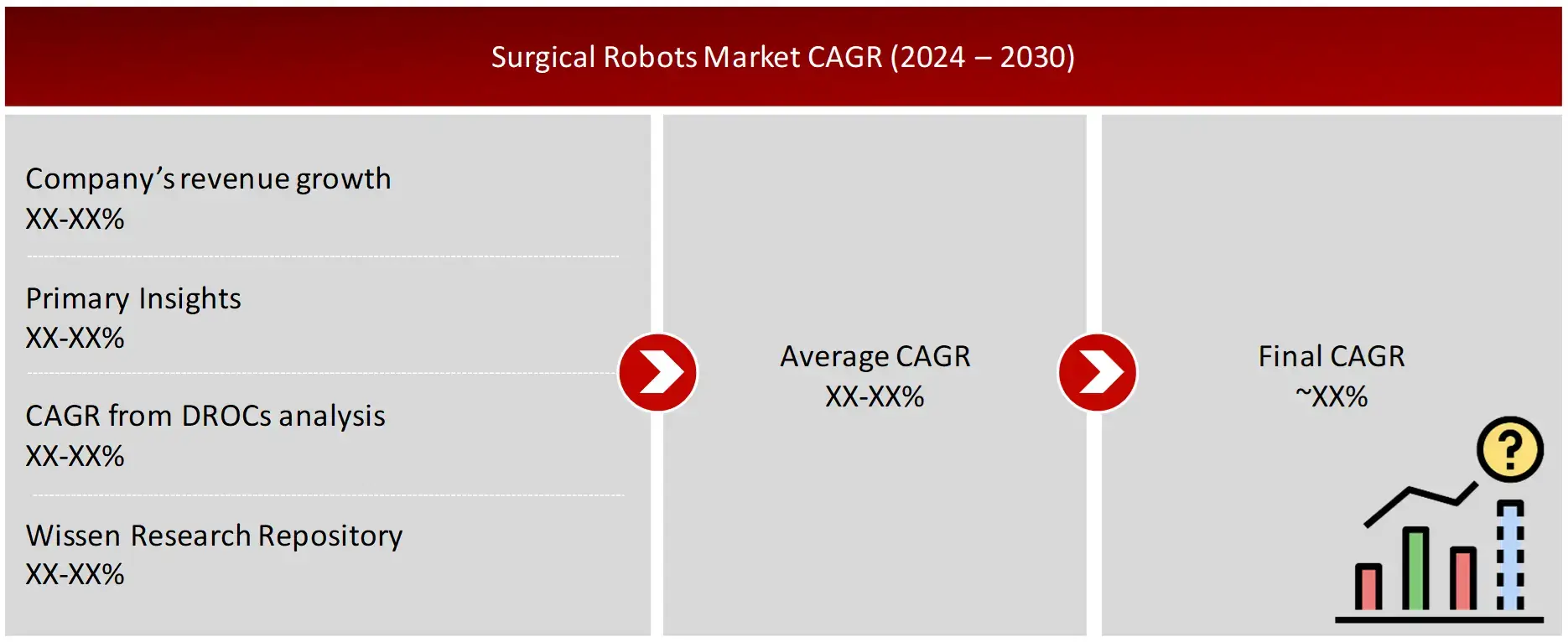

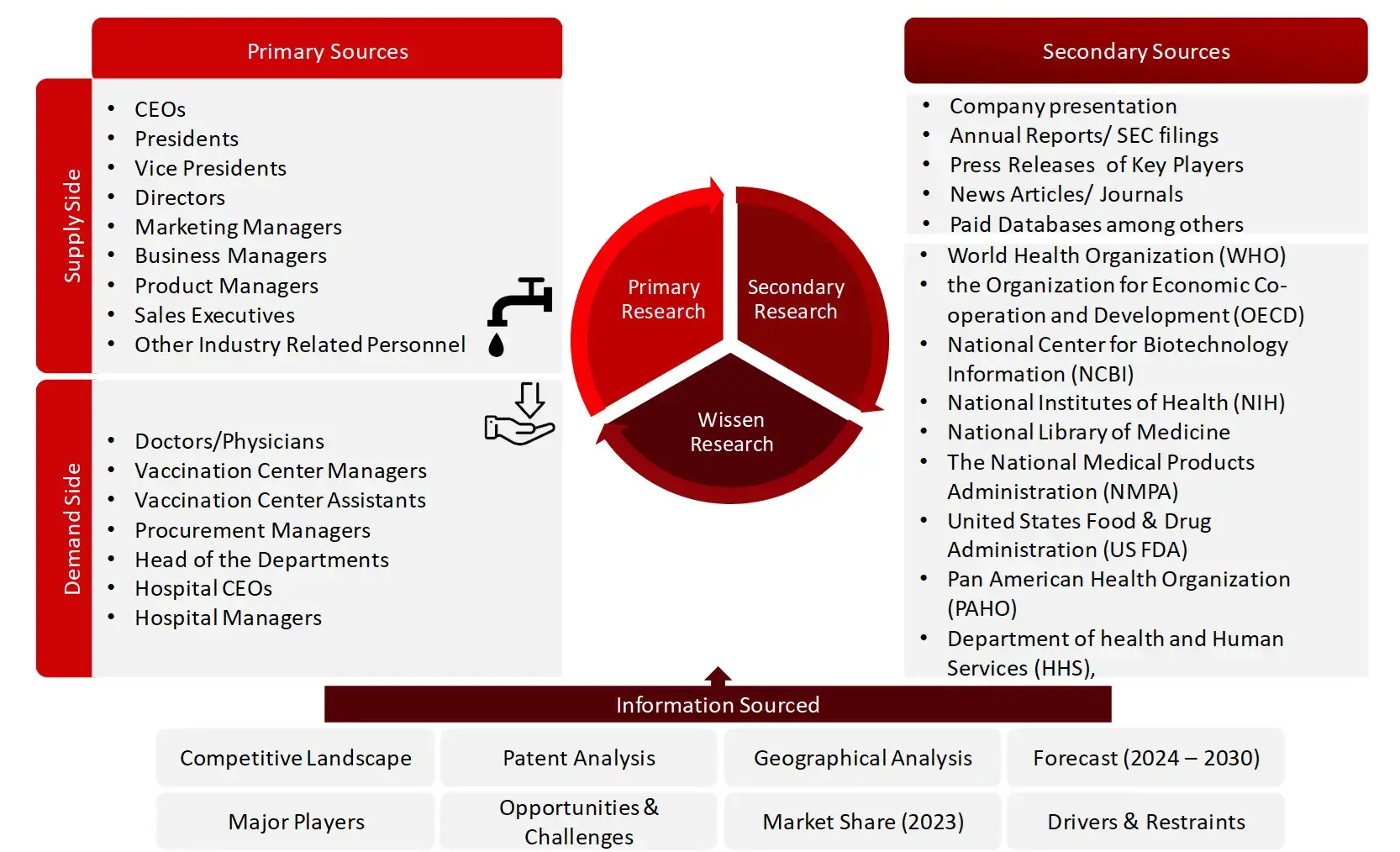

The objective of the study is to analyze the key market dynamics such as drivers, opportunities, challenges, restraints, and key player strategies. To track company developments such as product launches and approvals, expansions, and collaborations of the leading players, the competitive landscape of the surgical robots market to analyze market players on various parameters within the broad categories of business and product strategy. Top-down and bottom-up approaches will be used to estimate the market size. To estimate the market size of segments and sub segments the market breakdown and data triangulation will be used.

FIGURE: RESEARCH DESIGN

Research Approach

Collecting Secondary Data

The secondary research data collection process involves the usage of secondary sources, directories, databases, annual reports, investor presentations, and SEC filings of companies. Secondary research will be used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the surgical robots market. A database of the key industry leaders will also be prepared using secondary research.

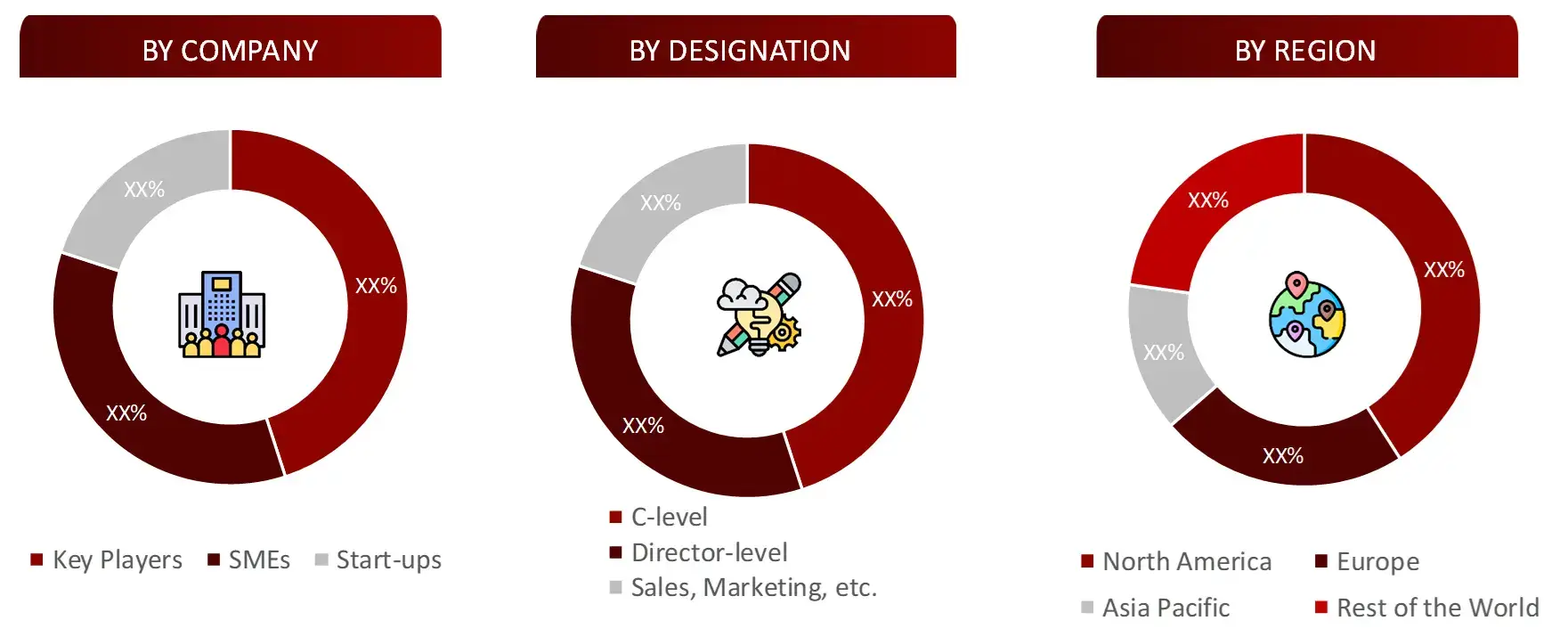

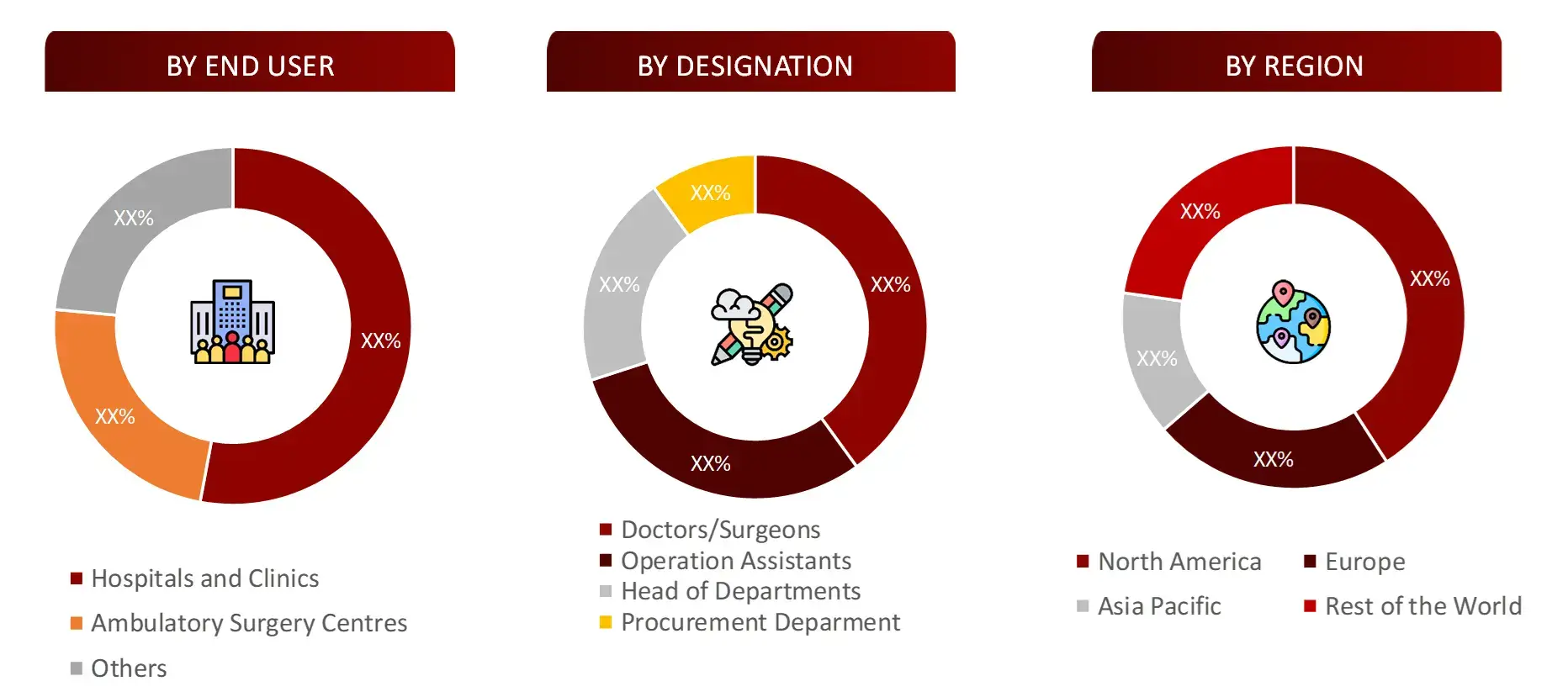

Collecting Primary Data

The primary research data will be conducted after acquiring knowledge about the surgical robots market scenario through secondary research. A significant number of primary interviews will be conducted with stakeholders from both the demand side and supply side (including various industry experts, such as Directors, Chief X Officers (CXOs), Vice Presidents (VPs) from business development, marketing and product development teams, product manufacturers) across major countries of North America, Europe, Asia Pacific, and Rest of the World. Primary data for this report was collected through questionnaires, emails, and telephonic interviews.

FIGURE: BREAKDOWN OF PRIMARY INTERVIEWS FROM SUPPLY SIDE

FIGURE: BREAKDOWN OF PRIMARY INTERVIEWS FROM DEMAND SIDE

FIGURE: PROPOSED PRIMARY PARTICIPANTS FROM DEMAND AND SUPPLY SIDE

Note: Above mentioned companies are non- exhaustive

Note: Above mentioned companies are non- exhaustive

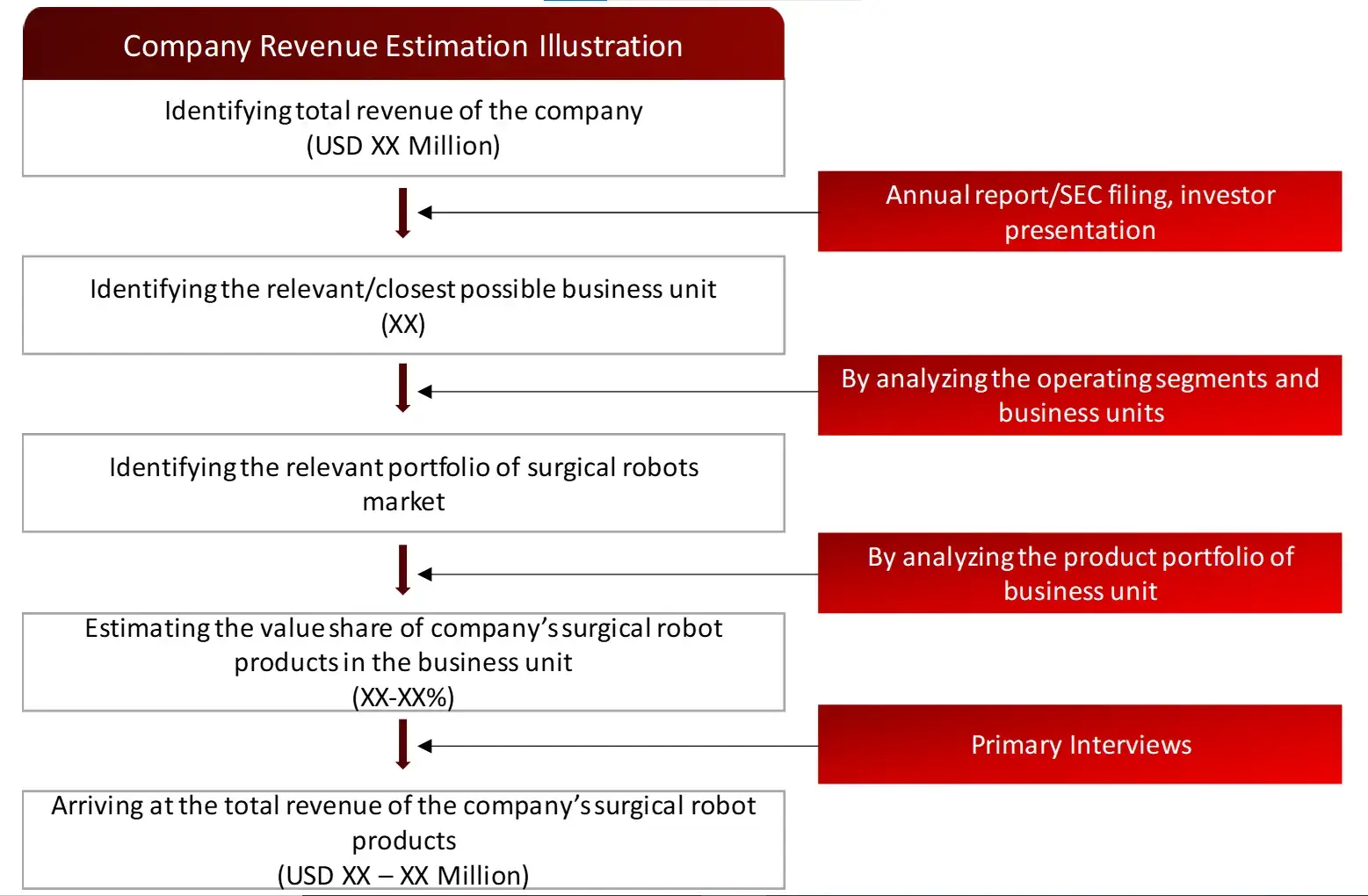

Market Size Estimation

All major manufacturers offering various surgical robots will be identified at the global/regional level. Revenue mapping will be done for the major players, which will further be extrapolated to arrive at the global market value of each type of segment. The market value of surgical robots market will also split into various segments and sub segments at the region level based on:

FIGURE: REVENUE MAPPING BY COMPANY (ILLUSTRATION)

Sources: Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentation, Paid Database, and Wissen Research Analysis.

Sources: Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentation, Paid Database, and Wissen Research Analysis.

FIGURE: REVENUE SHARE ANALYSIS OF KEY PLAYERS (SUPPLY SIDE)

Sources: Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentation, Paid Database, and Wissen Research Analysis.

Sources: Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentation, Paid Database, and Wissen Research Analysis.

FIGURE: MARKET SIZE ESTIMATION TOP-DOWN AND BOTTOM-UP APPROACH

Sources: Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentation, Paid Database, and Wissen Research Analysis.

Sources: Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentation, Paid Database, and Wissen Research Analysis.

FIGURE: ANALYSIS OF DROCS FOR GROWTH FORECAST

Sources: World Health Organization (WHO), the Organization for Economic Co-operation and Development (OECD), National Center for Biotechnology Information (NCBI), National Institutes of Health (NIH), National Library of Medicine, The National Medical Products Administration (NMPA), United States Food & Drug Administration (US FDA), Orange book, Purple book, Clinical trials.gov, Pan American Health Organization (PAHO), Department of health and Human Services (HHS), The Central Drugs Standard Control Organization (CDSCO)

Sources: World Health Organization (WHO), the Organization for Economic Co-operation and Development (OECD), National Center for Biotechnology Information (NCBI), National Institutes of Health (NIH), National Library of Medicine, The National Medical Products Administration (NMPA), United States Food & Drug Administration (US FDA), Orange book, Purple book, Clinical trials.gov, Pan American Health Organization (PAHO), Department of health and Human Services (HHS), The Central Drugs Standard Control Organization (CDSCO)

FIGURE: GROWTH FORECAST ANALYSIS UTILIZING MULTIPLE PARAMETERS

Sources: Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentation, Paid Database, and Wissen Research Analysis.

Sources: Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentation, Paid Database, and Wissen Research Analysis.Research Design

After arriving at the overall market size-using the market size estimation processes-the market will be split into several segments and sub segment. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub segment, the data triangulation, and market breakdown procedures will be employed, wherever applicable. The data will be triangulated by studying various factors and trends from both the demand and supply sides in the surgical robot market industry.

1. Introduction

1.1 Key Objectives

1.2 Definitions

1.2.1 In Scope

1.2.2 Out of Scope

1.3 Scope of the Report

1.4 Scope Related Limitations

1.5 Key Stakeholders

2. Research Methodology

2.1 Research Approach

2.2 Research Methodology / Design

2.3 Market Sizing Approach

2.3.1 Secondary Research

2.3.2 Primary Research

3. Executive Summary & Premium Content

3.1 Global Market Outlook

3.2 Key Market Findings

4. Market Overview

4.1 Market Dynamics

4.1.1 Drivers/Opportunities

4.1.2 Restraints/Challenges

4.2 End User Perception

4.3 Need Gap

4.4 Supply Chain / Value Chain Analysis

4.5 Industry Trends

4.6 Porter’s Five Forces Analysis

4.7 Pricing Analysis

4.8 Reimbursement Scenario

5. Patent Analysis

5.1 Top Assignees in Surgical Robots Market

5.2 Geography Focus of Top Assignees

5.3 Legal Status of Surgical Robots Patents

5.4 Assignee Segmentation

5.5 Network Analysis of Top Collaborating Entities in Surgical Robots Patent Applications

5.6 Technology Evolution in Surgical Robots

5.7 Key Patents in Surgical Robots

5.8 Patent Trends and Innovations

5.9 Key Players and Patent Portfolio Analysis

6. Surgical Robots Market, by Product and Service (2023-2030, USD Million)

6.1 Instruments and Accessories

6.2 Robotic Systems

6.2.1 Laparoscopic Robotic Systems

6.2.2 Orthopaedic Robotic Systems

6.2.3 Neurosurgical Robotic Systems

6.2.4 Other Robotic Systems

6.3 Services

7. Surgical Robots Market, by Application (2023-2030, USD Million)

7.1 General Surgery

7.2 Gynaecological Surgery

7.3 Orthopaedic Surgery

7.4 Urological Surgery

7.5 Neurosurgery

7.6 Others

8. Surgical Robots Market, by End Users (2023-2030, USD Million)

8.1 Hospitals and Clinics

8.2 Ambulatory Surgery Centres

8.3 Others

9. Surgical Robots Market, by Region (2023-2030, USD Million)

9.1 North America

9.1.1 US

9.1.2 Canada

9.2 Europe

9.2.1 UK

9.2.2 France

9.2.3 Germany

9.2.4 Italy

9.2.5 Spain

9.2.6 Rest of Europe

9.3 Asia Pacific

9.3.1 China

9.3.2 India

9.3.3 Japan

9.3.4 South Korea

9.3.5 Australia and New Zealand

9.3.6 Rest of Asia Pacific

9.4 Middle East and Africa

9.5 Latin America

10. Competitive Analysis

10.1 Key Player’s Footprint Analysis

10.2 Market Share Analysis

10.3 Key Brand Analysis

10.4 Regional Snapshot of Key Players

10.5 R&D Expenditure of Key Players

11. Company Profiles2

11.1 Intuitive Surgical

11.1.1 Business Overview

11.1.2 Product Portfolio

11.1.3 Financial Snapshot3

11.1.4 Recent Developments

11.1.5 SWOT Analysis

11.2 Stryker Corporation

11.3 Medtronic PLC

11.4 Smith and Nephew

11.5 Zimmer Biomet

11.6 Asensus Surgical Inc.

11.7 Siemens Healthineers AG

11.8 Renishaw PLC

11.9 CMR Surgical

11.10 Think Surgical Inc.

11.11 Corin

11.12 Preceyes BV

11.13 Microsure

11.14 Titan Medical Inc.

11.15 Avateramedical GMBH

11.16 Others Key Players

12. Appendix

12.1 Industry Speak

12.2 Questionnaire

12.3 Available Custom Work

12.4 Adjacent Studies

12.5 Authors

13. References

Key Notes:

Please Subscribe our news letter and get update.

© Copyright 2024 – Wissen Research All Rights Reserved.