Subscribe our newsletter

Please Subscribe our news letter and get update.

Sources: Company Websites and Wissen Research Analysis.

Sources: Company Websites and Wissen Research Analysis.

DESCRIPTION

The oral care market is poised for robust growth, driven by increasing awareness of oral hygiene, technological advancements, and changing consumer preferences. As the market evolves, companies that focus on innovation, sustainability, and meeting the diverse needs of consumers will be well-positioned to capitalize on the opportunities presented in this dynamic landscape.

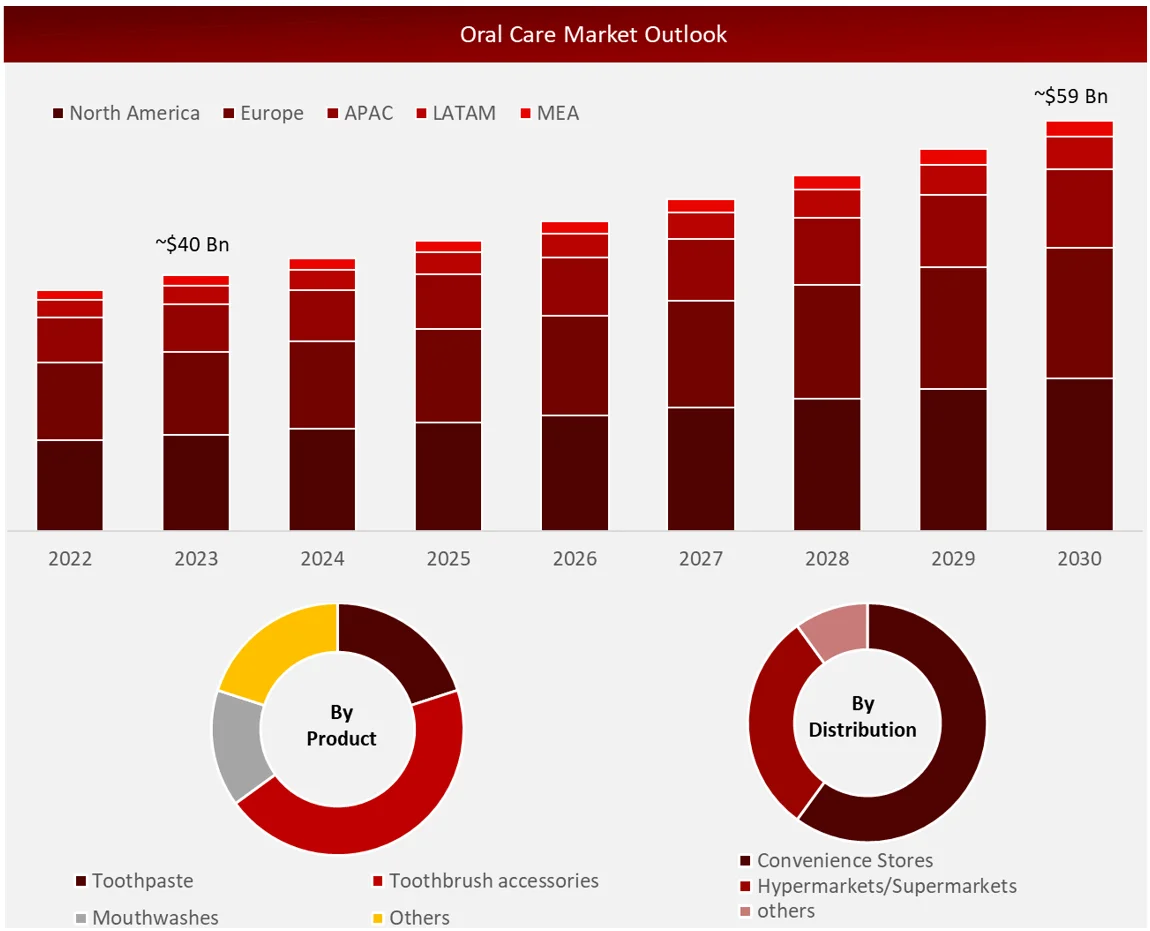

Wissen Research analyses that the oral care market is estimated at ~USD 40 billion in 2023 and is projected to reach ~USD 59 billion by 2030, expected to grow at a CAGR of ~6% during the forecast period, 2024-2030.

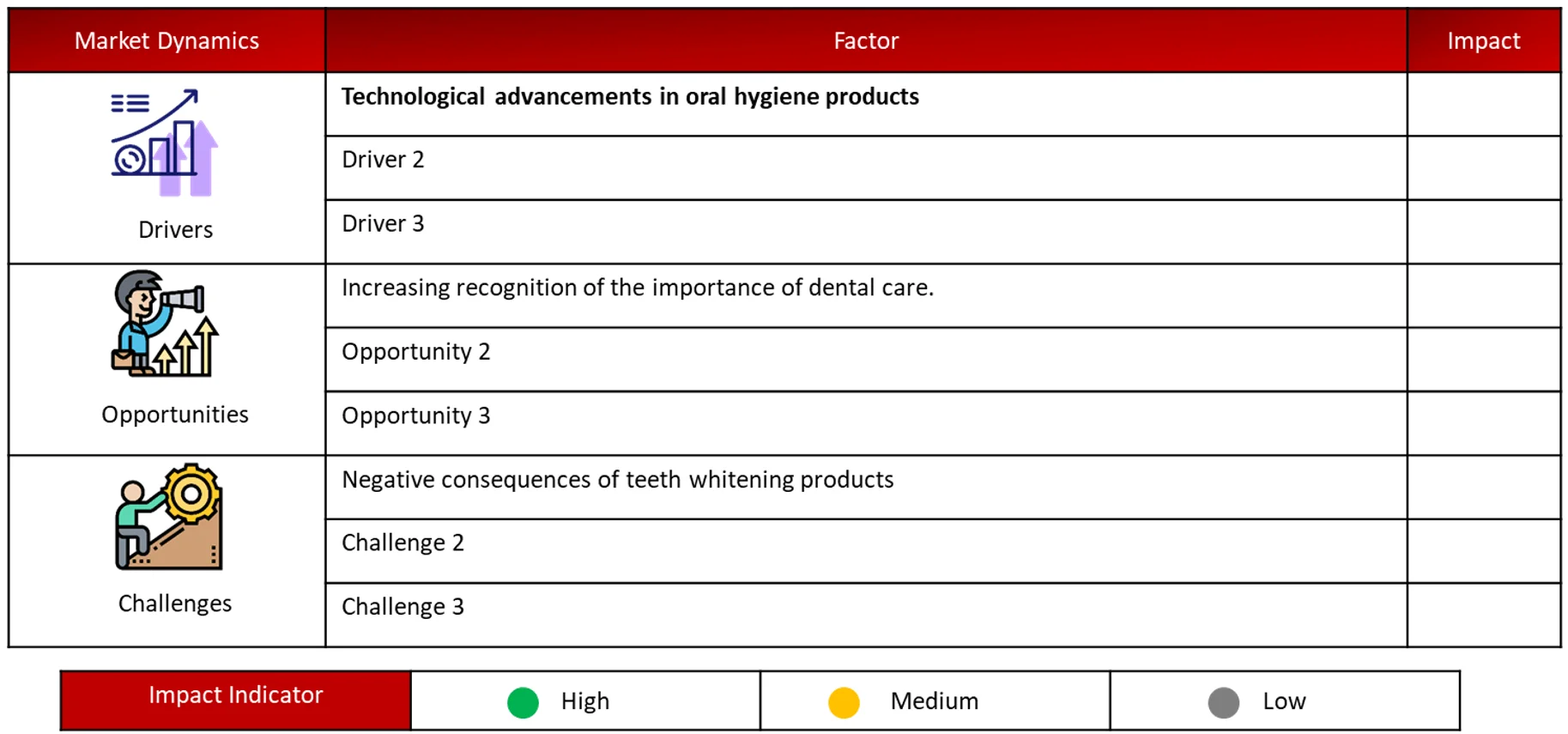

Oral Care Market Dynamics:

Driving Factor: Technological advancements in oral hygiene products

Innovations in products have allowed for the creation of high-tech and user-friendly oral hygiene products like electric toothbrushes, AI toothbrushes, and vibrating toothbrushes. Innovative technology in toothbrushes is a major driving force behind the market’s expansion. Key market participants have introduced interactive toothbrushes incorporated with position detection and motion sensor technologies. These toothbrushes analyze the mouth to give instant advice on how to brush and take care of oral health.

The creation of these new products helps users monitor oral care routines and enhance oral health. There have been significant advancements in at-home teeth-whitening products in the past few years. In May 2021, GLO Science (US) introduced the GLO to Go Teeth Whitening Pen, a convenient teeth whitening pen for at-home use, enriched with natural antimicrobials.

Players in the oral care industry are utilizing technological advancements to enhance oral health awareness through strategic partnerships. The growth of the market is driven by increased consumer engagement and compliance with oral hygiene practices through technological advances in oral care devices and care delivery in dental practice.

Opportunity: Increasing recognition of the importance of dental care.

Dentists’ hard work and influential market figures have led to an increased focus on oral health. These stakeholders organize different workshops and events to raise awareness about dental hygiene and showcase recently released, advanced technological products. This assists players in showcasing their product portfolios and fulfilling their corporate social responsibility (CSR) obligations. For example, Oral-B (Procter & Gamble) revealed a $1 million effort to give oral care items and dental services to high-risk individuals in collaboration with Dental LifeLine Network (US) to enhance oral hygiene habits and promote improved oral health results.

Challenge: Negative consequences of teeth whitening products

Continued application of whitening products like teeth whitening pens can lead to permanent damage to the tooth enamel. Due to the continual wearing away of the enamel layer, tooth sensitivity may develop. Additionally, the whitening solution may come into contact with the gums when being used, potentially leading to irritation and discomfort in that area. Whitening products can lead to inconsistent whitening of teeth, particularly when some or many of the teeth are artificial.

Furthermore, it is not advisable to use these products on open cavities as it may lead to the product leaking into the roots and resulting in additional tooth harm. The negative impacts may discourage the utilization of these items and consequently limit the expansion of the cosmetic dental whitening products sector in the market. Nevertheless, some peroxide-free teeth whitening alternatives that are currently on the market or in the works could help the industry overcome this obstacle.

Sources: Company Websites and Wissen Research Analysis.

Sources: Company Websites and Wissen Research Analysis.

The toothbrushes and accessories category will experience the most rapid growth in the oral care industry, based on product type.

In the oral care market, the toothbrushes category dominated, but the toothbrushes and accessories segment is projected to have the highest CAGR in the future. The significant growth of this sector is largely due to the rising popularity of electric toothbrushes and replacement heads, particularly in developed regions.

The Convenience stores sector was the leading force in the oral care market by Distribution

The convenience stores segment was the largest segment of the oral care distribution channel by providing quick access to essential products, although their selection is typically more limited compared to larger retail formats.

During the forecast period, the highest CAGR growth in the oral care industry is anticipated in Asia Pacific.

The oral care market was mostly dominated by Asia Pacific in terms of share. Furthermore, it is anticipated that the region will experience the highest compound annual growth rate (CAGR) during the forecast period. The growth of this region is fueled by factors including prominent players shifting their focus to emerging Asian countries, the rise of the dental tourism industry in major Asian markets, a boost in healthcare expenditure, and an increase in disposable income.

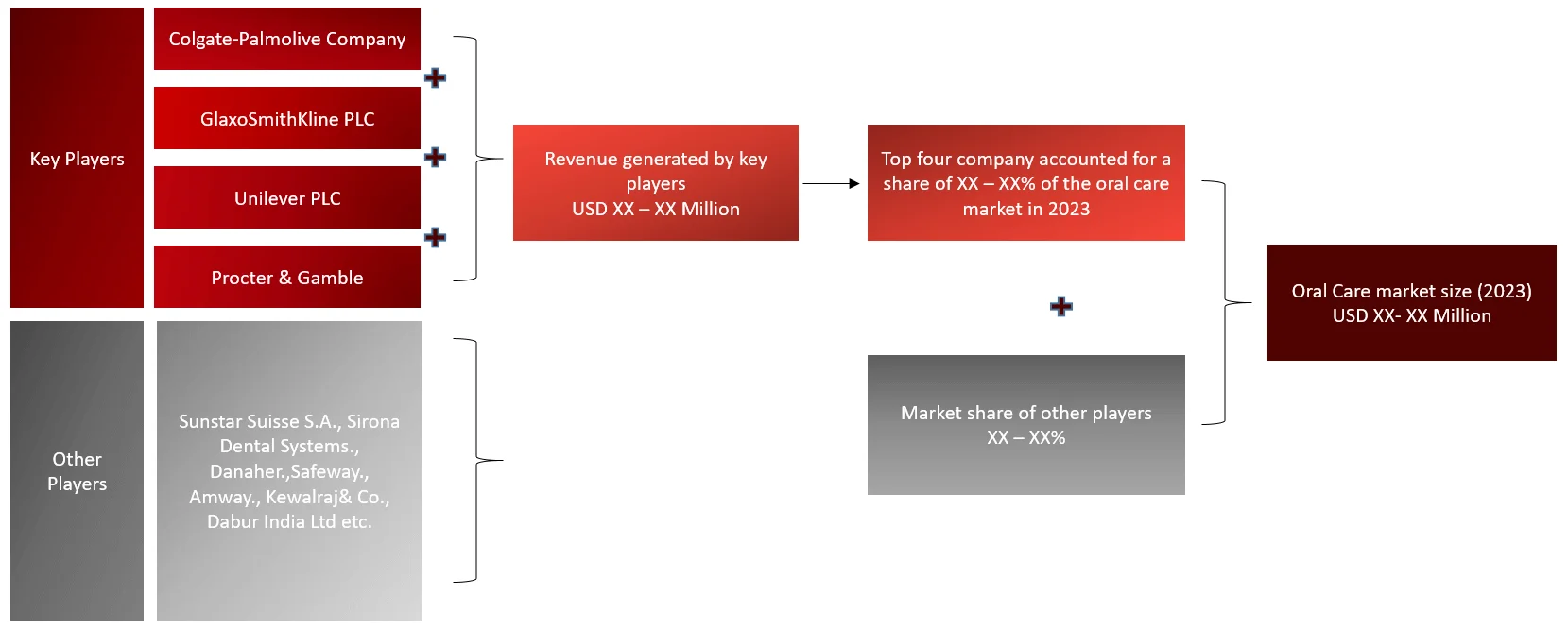

Major Companies and Market Share Insights

Major players operating in oral care market are Colgate-Palmolive Company., GlaxoSmithKline PLC., Church & Dwight Co., Inc., Unilever PLC and Procter & Gamble Company among others.

Recent Developments:

Introduction

Market Definition

Oral care is a fundamental aspect of personal health that focuses on maintaining and improving the health of the mouth, teeth, gums, and overall oral environment. Good oral hygiene practices are essential for preventing dental issues such as cavities, gum disease, and bad breath, as well as for contributing to general health and well-being.

Sources: Company Websites and Wissen Research Analysis.

Sources: Company Websites and Wissen Research Analysis. Sources: Wissen Research Analysis.

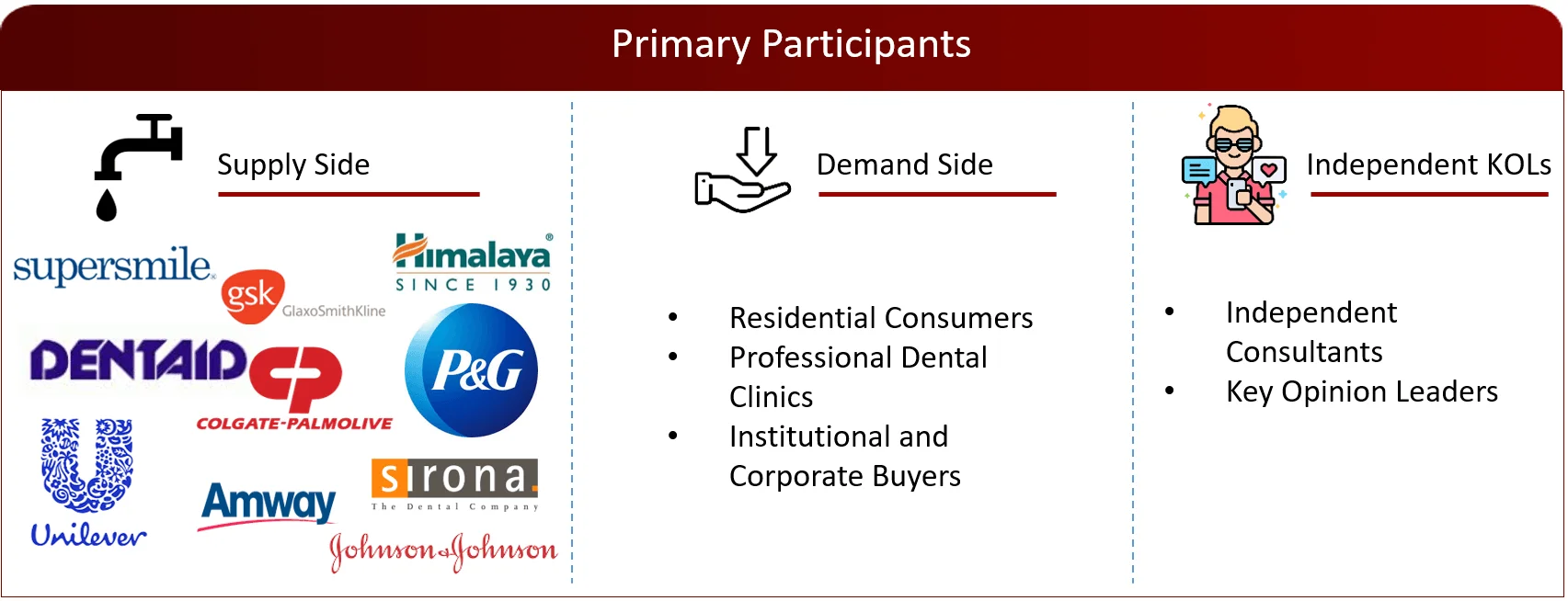

Sources: Wissen Research Analysis.Key Stakeholders

Key objectives of the Study

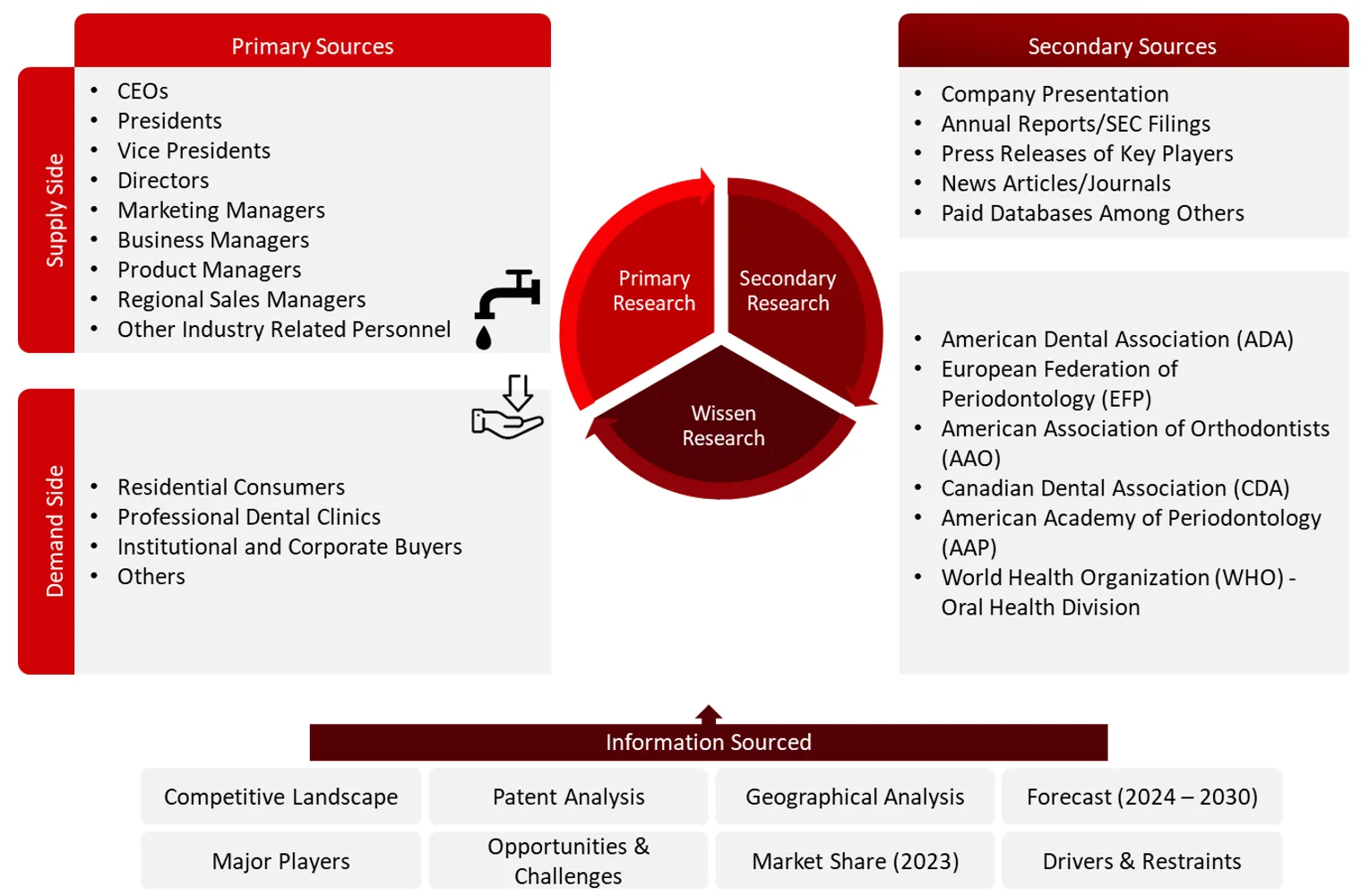

Research Methodology

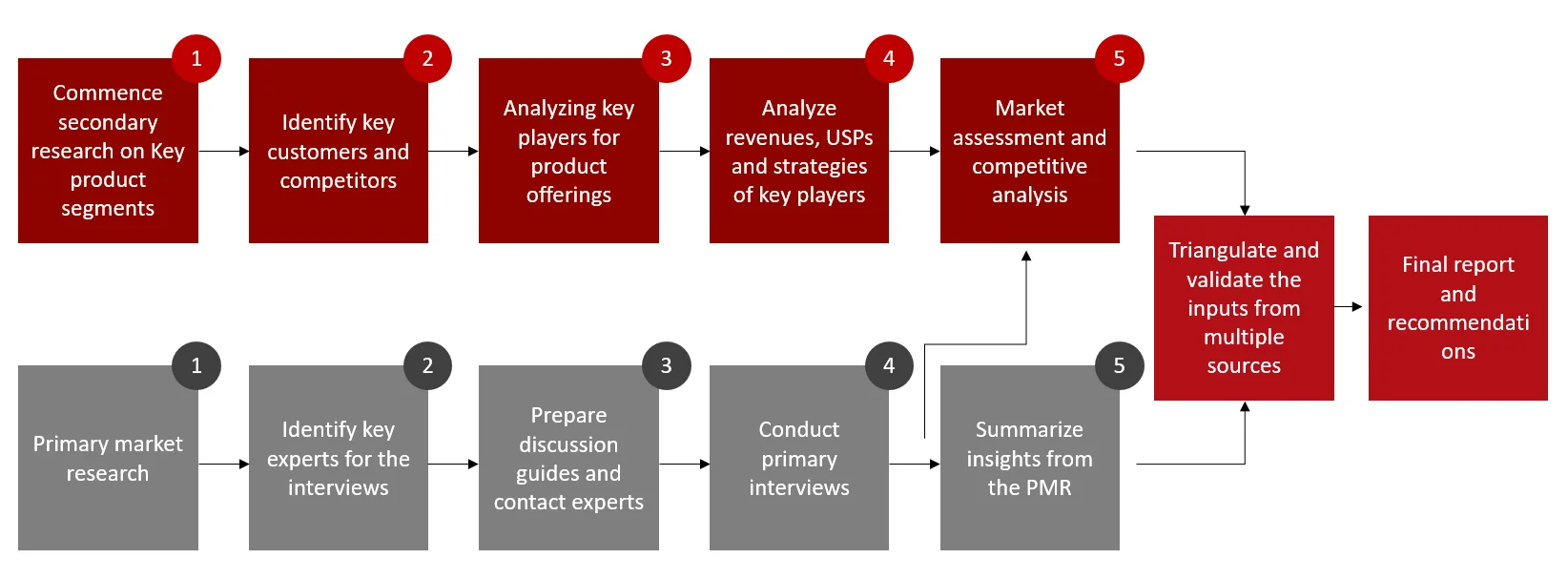

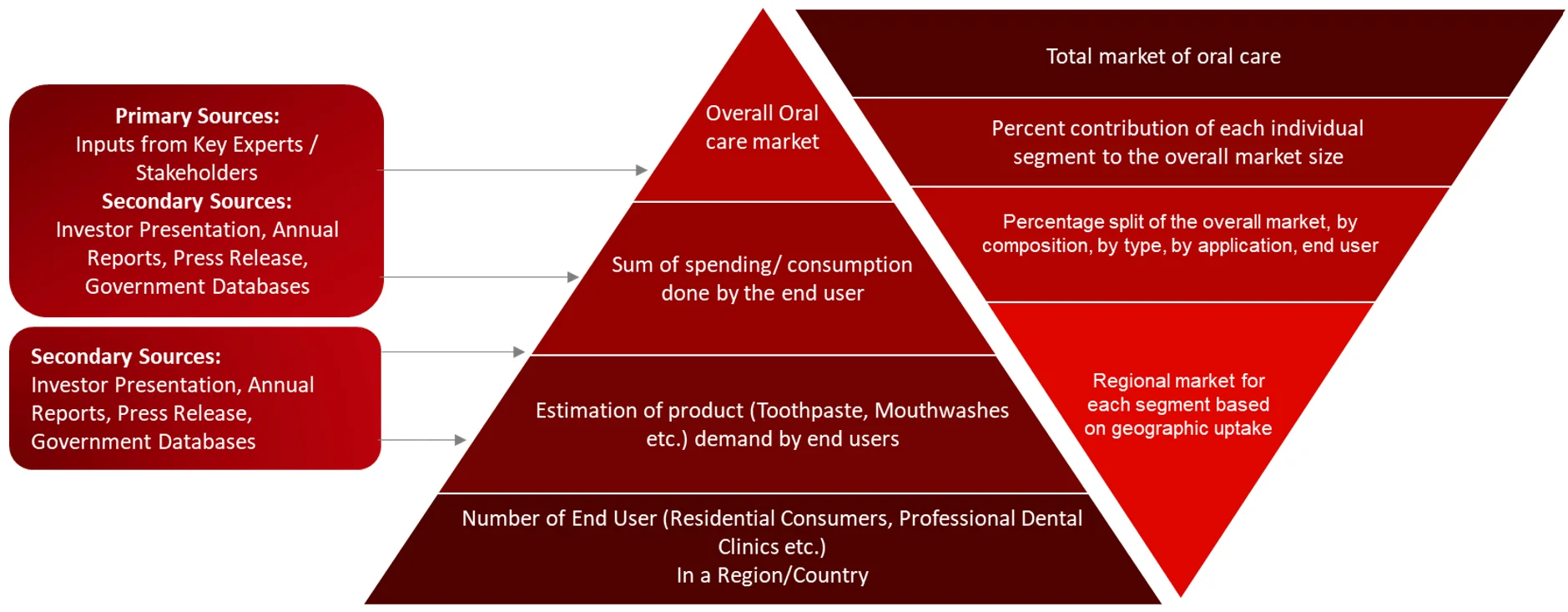

The aim of the study is to examine the key market forces such as drivers, opportunities, restraints, challenges, and strategies of key leaders. To monitor company advancements such as patents granted, product launches, expansions, and collaborations of key players, analyzing their competitive landscape based on various parameters of business and product strategy. Markey sizing will be estimated using top-down and bottom-up approaches. Using market breakdown and data triangulation techniques, market sizing of segments and sub-segments will be estimated.

FIGURE: RESEARCH DESIGN

Sources: Wissen Research Analysis.

Sources: Wissen Research Analysis.Research Approach

Collecting Secondary Data

The process of collating secondary research data involves the utilization of databases, secondary sources, annual reports, investor presentations, directories, and SEC filings of companies. Secondary research will be utilized to identify and gather information beneficial for the in-depth, technical, market-oriented, and commercial analysis of the minimally invasive surgery market. A database of the key industry leaders will also be compiled using secondary research.

Collecting Primary Data

The primary research data will be conducted after acquiring knowledge about the oral care market scenario through secondary research. A significant number of primary interviews will be conducted with stakeholders from both the demand and supply side (including various industry experts, such as Vice Presidents (VPs), Chief X Officers (CXOs), Directors from business development, marketing and product development teams, product manufacturers) across major countries of Europe, Asia Pacific, North America, Latin America, and Middle East and Africa. Primary data for this report will be collected through questionnaires, emails, and telephonic interviews.

FIGURE: BREAKDOWN OF PRIMARY INTERVIEWS FROM SUPPLY SIDE

FIGURE: BREAKDOWN OF PRIMARY INTERVIEWS FROM DEMAND SIDE

FIGURE: PROPOSED PRIMARY PARTICIPANTS FROM DEMAND AND SUPPLY SIDE

Note: Above mention companies are non-exhaustive.

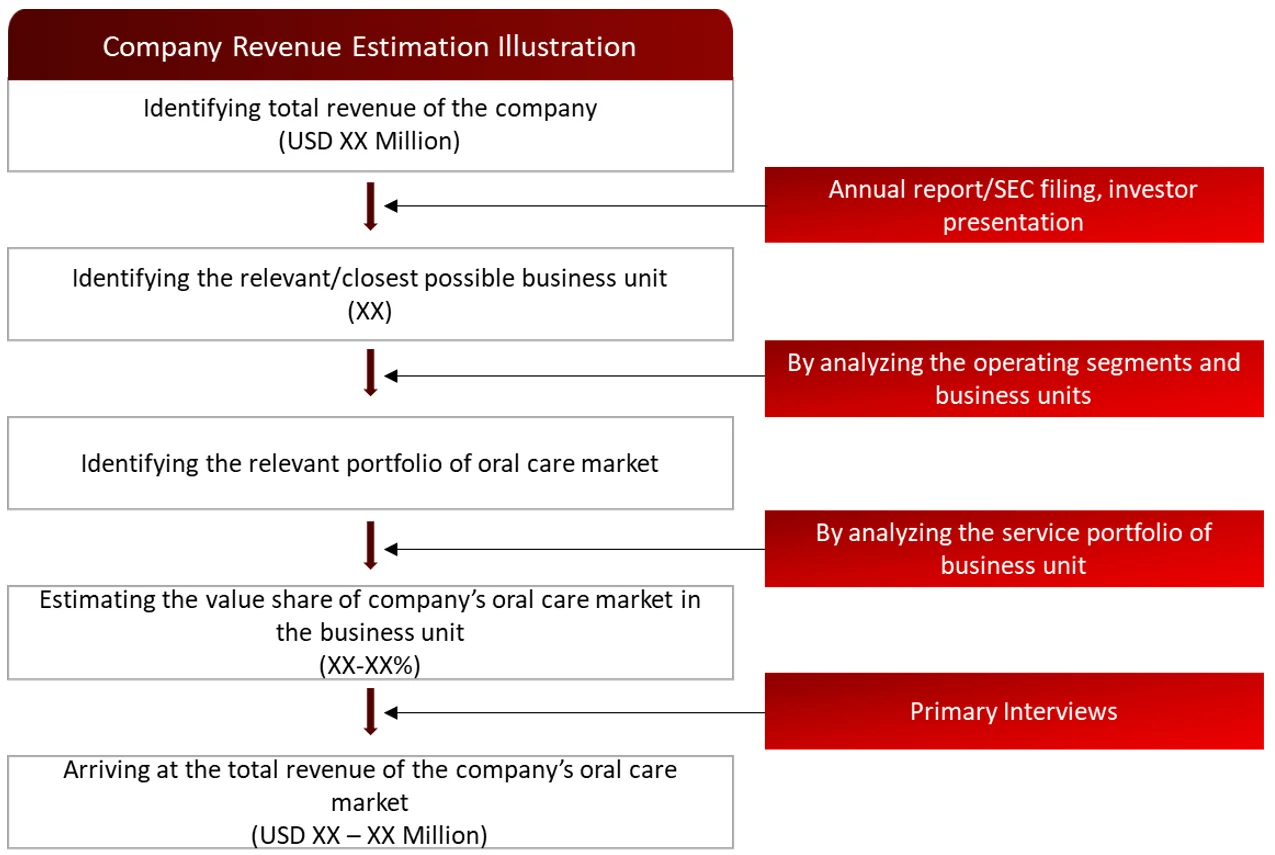

Market Size Estimation

All major industries offering various oral care market sizing will be identified at the global/ regional level. Revenue mapping will be done for the major players, which will further be extrapolated to arrive at the global market value of each type of segment. The market value of oral care market will also split into various segments and sub segments at the region level based on:

FIGURE: REVENUE MAPPING BY COMPANY (ILLUSTRATION)

Sources: Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentation, Paid Database, and Wissen Research Analysis.

Sources: Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentation, Paid Database, and Wissen Research Analysis.FIGURE: REVENUE SHARE ANALYSIS OF KEY PLAYERS (SUPPLY SIDE)

Sources: Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentation, Paid Database, and Wissen Research Analysis.

Sources: Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentation, Paid Database, and Wissen Research Analysis.FIGURE: MARKET SIZE ESTIMATION TOP-DOWN AND BOTTOM-UP APPROACH

FIGURE: ANALYSIS OF DROCS FOR GROWTH FORECAST

FIGURE: GROWTH FORECAST ANALYSIS UTILIZING MULTIPLE PARAMETERS

Sources: Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentation, Paid Database, and Wissen Research Analysis.

Sources: Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentation, Paid Database, and Wissen Research Analysis.Research Design

After arriving at the overall market size-using the market size estimation processes-the market will be split into several segments and sub segment. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub segment, the data triangulation, and market breakdown procedures will be employed, wherever applicable. The data will be triangulated by studying various factors and trends from both the demand and supply sides in the oral care market.

Sources: American Dental Association (ADA), European Federation of Periodontology (EFP), American Association of Orthodontists (AAO), Canadian Dental Association (CDA), American Academy of Periodontology (AAP) and World Health Organization (WHO) – Oral Health Division), Company Website, Press Releases, Annual Reports, Paid Data Sources, and Wissen Research Analysis.

Sources: American Dental Association (ADA), European Federation of Periodontology (EFP), American Association of Orthodontists (AAO), Canadian Dental Association (CDA), American Academy of Periodontology (AAP) and World Health Organization (WHO) – Oral Health Division), Company Website, Press Releases, Annual Reports, Paid Data Sources, and Wissen Research Analysis.

1. Introduction

1.1 Key Objectives

1.2 Definitions

1.2.1In Scope

1.2.2 Out of Scope

1.3 Scope of the Report

1.4 Scope Related Limitations

1.5 Key Stakeholders

2. Research Methodology

2.1 Research Approach

2.2 Research Methodology / Design

2.3 Market Sizing Approach

2.3.1 Secondary Research

2.3.2 Primary Research

3. Executive Summary & Premium Content

3.1 Global Market Outlook

3.2 Key Market Findings

4. Patent Analysis

4.1 Patents Related to oral care

4.2 Patent Landscape and Intellectual Property Trends

5. Market Overview

5.1 Market Dynamics

5.1.1 Drivers/Opportunities

5.1.2 Restraints/Challenges

5.2 End User Perception

5.3 Need Gap

5.4 Supply Chain / Value Chain Analysis

5.5 Industry Trends

5.6 Pricing Analysis

5.7 Technology Analysis

5.8 Trade Analysis

5.9 Porter’s Five Forces Analysis

5.9.1 Bargaining power of suppliers

5.9.2 Bargaining powers of customers

5.9.3 Threat of new entrants

5.9.4 Rivalry among existing players

5.9.5 Threat of substitutes

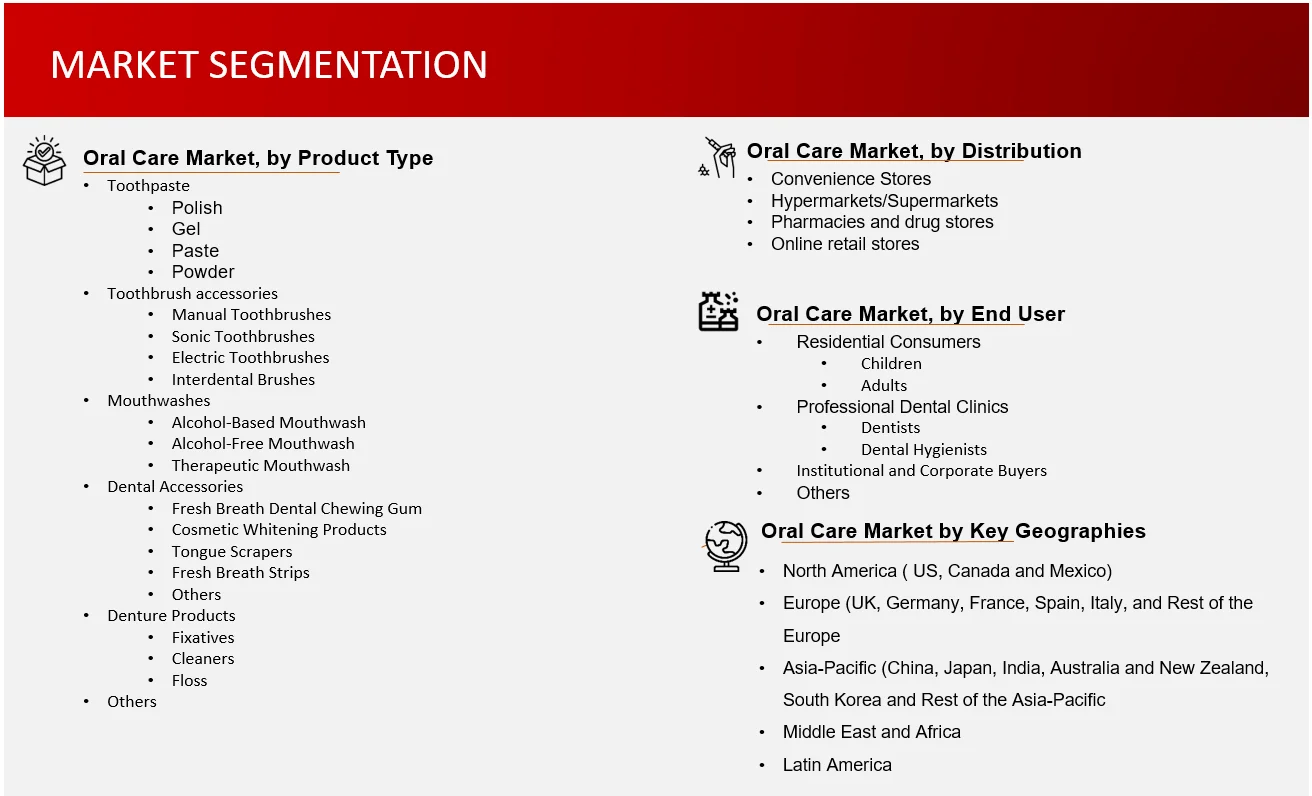

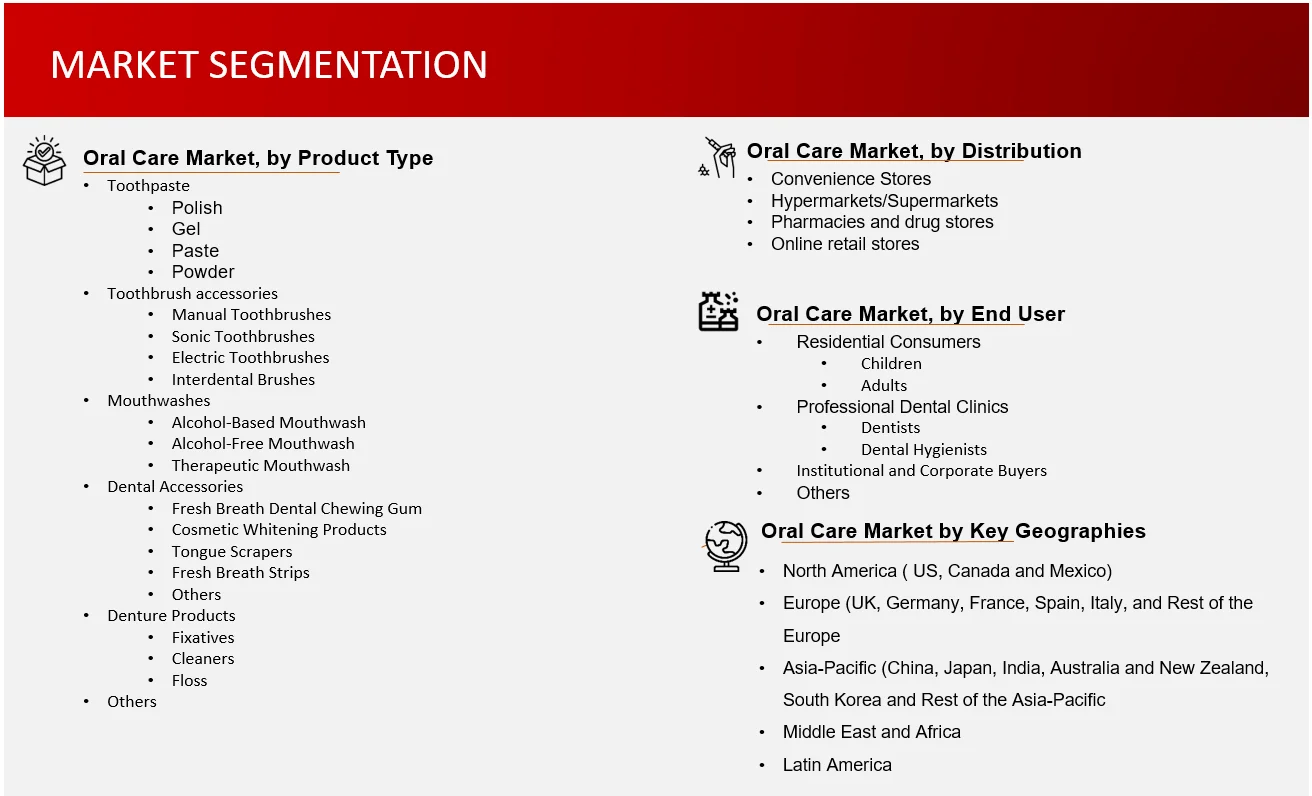

6. Oral Care Market, by Product Type (2023-2030, USD Million)

6.1 Introduction

6.2 Toothpaste

6.2.1 Polish

6.2.2 Gel

6.2.3 Paste

6.2.4 Powder

6.3 Toothbrush Accessories

6.3.1 Manual Toothbrushes

6.3.2 Sonic Toothbrushes

6.3.3 Electric Toothbrushes

6.3.4 Interdental Brushes

6.4 Mouthwashes

6.4.1 Alcohol-based Mouthwash

6.4.2 Alcohol-free Mouthwash

6.4.3 Therapeutic Mouthwash

6.5 Dental Accessories

6.5.1 Cosmetic Whitening Products

6.5.2 Tongue Scrapers

6.5.3 Fresh Breath Strips

6.5.4 Others (Dental Chews, Toothpaste Tablets, Orthodontic Wax, Dental Mirrors etc.)

6.6 Denture Products

6.6.1 Fixatives

6.6.2 Cleaners

6.6.3 Floss

6.6.3.1 Dental Floss

6.6.3.2 Floss Picks

6.7 Others (Specialty Oral Care Products, Oral Health Devices etc.)

7. Oral Care Market, by Distribution (2023-2030, USD Million)

7.1 Introduction

7.2 Convenience Stores

7.3 Hypermarkets/Supermarkets

7.4 Pharmacies and drug stores

7.5 Online retail stores

8. Oral Care Market, by End User (2023-2030, USD Million)

8.1 Residential Consumers

8.1.1 Children

8.1.2 Adults

8.2 Professional Dental Clinics

8.2.1 Dentists

8.2.2 Dental Hygienists

8.3 Institutional and Corporate Buyers

8.4 Others (Research Institutions, Product Development Companies etc.)

9. Oral Care Market, by Region (2023-2030, USD Million)

9.1North America

9.1.1 US

9.1.2 Canada

9.2 Europe

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 Italy

9.2.5 UK

9.2.6 Rest of the Europe

9.3 Asia Pacific

9.3.1 China

9.3.2 Japan

9.3.3 India

9.3.4 Australia and New Zealand

9.3.5 South Korea

9.3.6 Rest of the Asia Pacific

9.4 Middle East and Africa

9.5 Latin America

10. Competitive Analysis

10.1 Key Players Footprint Analysis

10.2 Market Share Analysis

10.3 Key Brand Analysis

10.4 Regional Snapshot of Key Players

10.5 R&D Expenditure of Key Players

11. Company Profiles2

11.1 Supersmile

11.1.1 Business Overview

11.1.2 Product Portfolio

11.1.3 Financial Snapshot3

11.1.4 Recent Developments

11.1.5 SWOT Analysis

11.2 Ultradent Products Inc.

11.3 Heraeus Dental

11.4 Haleon

11.5 Dentaid

11.6 GC Corporation

11.7 Himalaya

11.8 Y-Brush

11.9 Carestream Health

11.10 Procter & Gamble Company

11.11 Colgate-Palmolive

11.12 Lion Corporation

11.13 Fresh LLC

11.14 Sunstar Suisse S.A.

11.15 Sirona Dental Systems

11.16 Church & Dwight Co. Inc.

11.17 Johnson & Johnson Consumer Inc.

11.18 Danaher

11.19 Dentsply International

11.20 Unilever PLC

11.21 Safeway

11.22 Dabur India Ltd

11.23 Henkel AG & Co. KGaA

11.24 LG Corporation

11.25 Amway

11.26 Splat Global UK Ltd

11.27 Kewalraj& Co.

11.28 Koninklijke Philips N.V.

12. Conclusion

13. Appendix

13.1 Industry Speak

13.2 Questionnaire

13.3 Available Custom Work

13.4 Adjacent Studies

13.5 Authors

14. References

Key Notes:

Please Subscribe our news letter and get update.

© Copyright 2024 – Wissen Research All Rights Reserved.