Age-related macular degeneration (ARMD) is an acquired retinal degeneration that significantly impairs central vision as a result of a mix of non-neovascular (abnormalities in the drusen and retinal pigment epithelium) and neovascular (development of choroidal neovascular membrane) derangements. Advanced disease may include subretinal fibrosis, sub-RPE hemorrhage, serous fluid, and focal areas of retinal pigment epithelium (RPE) loss. Franciscus Cornelis Donders and Dr. Albrecht Nagel created the theory of macular degeneration in the early 1980s based on their observations of drusen that resulted in degeneration of the choriocapillaris, the RPE, and thinning of the neuroretina with vision loss. The earliest descriptions of AMD date back to around 300 BC. Thus, several treatment modalities like macular photocoagulation and laser photocoagulation were investigated to reduce the disease’s symptoms. Later, the development of anti-VEGF drugs like Pegaptanib, Ranibizumab, etc. completely changed how AMD was treated. These anti-VEGF agents were applied topically or through intravitreal injections, but there were problems with low patient adherence to the treatment regimen and insufficient frequency of delivery. Intraocular implants were developed to address these problems.

Cut to the present, various therapeutic regimens other than anti-VEGF’s are being developed to manage AMD, including cell-based therapies, gene therapy, visual cycle modulators, neuroprotectors, etc. In addition, various drug delivery methods other than implants are being investigated to increase the bioavailability and penetrability of these therapeutic regimens. Microspheres, hydrogels, polymeric nanoparticles, solid lipid nanoparticles, and liposomes are the major components of these methods.

Early ARMD is characterised by an abundance of tiny (63 microns, “hard”) or intermediate (63 microns but 125 microns, “soft”) drusen. As intermediate drusen are more specific for ARMD; small drusen are regularly observed in people over the age of 50 and may be an epiphenomenon of ageing.

Intermediate ARMD is characterised by extensive drusen of small or intermediate size or by any drusen that is large (>125 microns); the average diameter of the retinal vein at the edge of the optic disc is 124 microns.

Geographic atrophy or the appearance of choroidal neovascular membrane, as well as any associated complications such subretinal or sub-RPE haemorrhage or serous fluid, and subretinal fibrosis, are indicators of advanced ARMD.

Technology covered: Worldwide

Market covered: Specifically, for USA

Time Period

For technology coverage: 2018 till present

For market analysis: 2023 till 2033

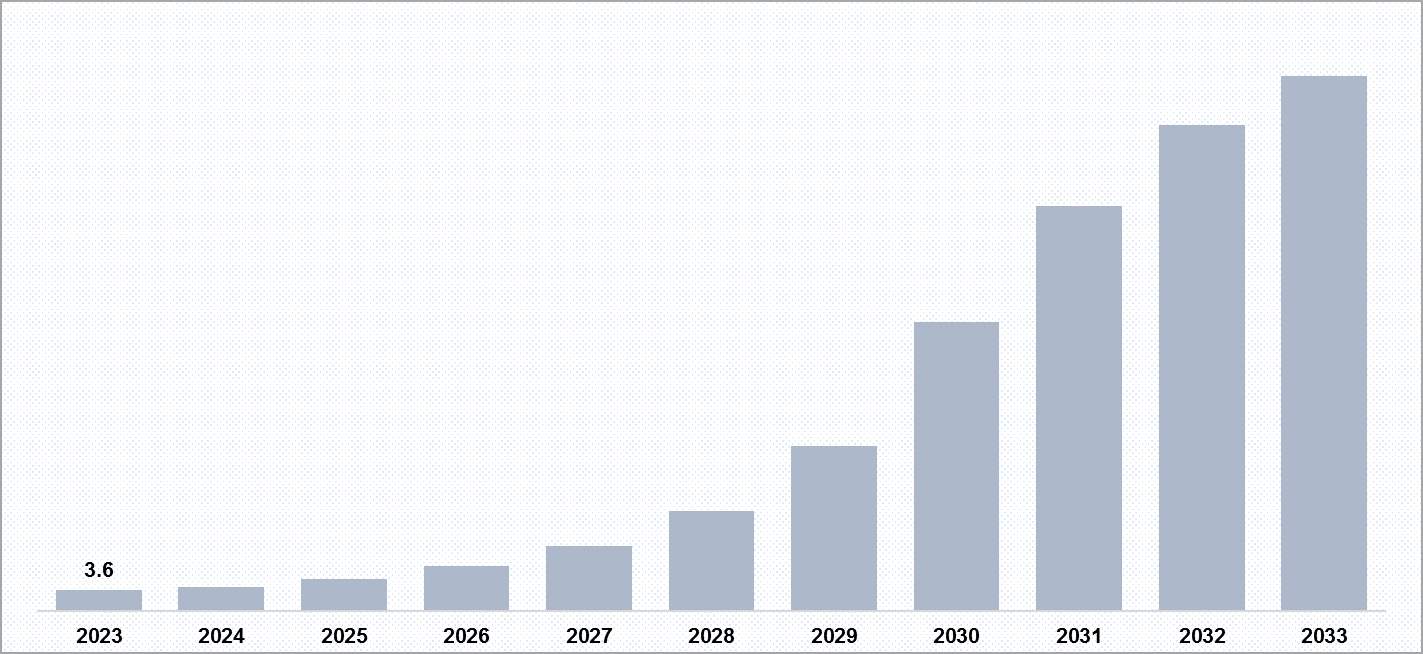

The report provides assessment and forecast about different drug delivery method like implants/hydrogels/nanoparticles/micro particles. Along with this it also provides assumptions, adoption and insights. The Age-related Macular Degeneration market size in different markets is segregated into two part, Dry-AMD, and Wet-AMD. As per our analysis and estimation, in 2023, the market size of implant used as drug delivery method for AMD was approximately USD 3.6 million which is further expected to increase by 2033

The report provides identification of problems associated with implants/hydrogels/

The report provides identification of patent filing on different drug delivery method like implants/hydrogels/nanoparticles/micro particles in time period of 2018-2023. Our report provides bibliographic (including Top Assignees, Assignee segmentation, Geographical distribution of top assignees, Filling Trends, Litigations, Legal Status) as well as technology (By disease type, By drug delivery approach, By drug class type, By drug formulation type) analysis

The report includes comprehensive information on partnerships, acquisitions, and mergers, as well as licencing and patent information for a drug delivery technique for age-related macular degeneration.

We perform competitively and market Intelligence analysis of the Age-related Macular Degeneration drug delivery method including identification of most likely competitors, emerging competitors, SWOT analysis etc. The inclusion of the analysis entirely depends upon the data availability.

The report provides insights into different therapeutic candidates in phase I, phase II, and phase III stages also analyse key players involved in developing drug delivery methods.

The report provides insights about different products for these drug delivery method through company segmentation, type of drug delivery method as well as their pipeline.

In order to give the most precise estimations and forecasts, Wissen Research uses an extensive and iterative research approach that is focused on reducing deviation. The company blends top-down and bottom-up methodologies for market segmentation and quantitative estimation. In addition, data triangulation, which examines the market from three separate angles, is a recurrent topic present in all of our research studies. Important components of the approach used for all of our studies include the following.:

Preliminary data mining

On a wide scale, unprocessed market data is collected. Continuous data filtering makes sure that only verified and authenticated sources are taken into account. Additionally, data is extracted from a wide range of reports in our repository and from a number of reputable premium databases. We gather information from raw material suppliers, distributors, and purchasers to help with this since understanding the entire value chain is crucial for a thorough understanding of the market.

Surveys, technical symposia, and trade magazines are used to gather information on technical concerns and trends. Technical information focusing on white space and freedom of movement is also obtained from an intellectual property standpoint. Additionally, information on the industry’s drivers, constraints, and pricing patterns is obtained. As a result, a variety of original data are included in the material that is then cross-validated and certified with published sources.

Statistical model

We use simulation models to generate our market projections and estimates. Every study receives a special model that is tailored to it. Data for market dynamics, the technology environment, application development, and pricing patterns are gathered and supplied into the model all at once for analysis. The relative relevance of these factors is investigated, and their impact on the forecast period is assessed, using correlation, regression, and time series analysis. The process of market forecasting combines technological analysis with economic strategies, practical business acumen, and subject expertise.

Econometric models are frequently used for short-term forecasting, but technology market models are typically employed for long-term forecasting. These are based on a confluence of the business environment, regulatory environment, economic projection, and technical landscape. In order to develop global estimates, it is preferable to estimate markets from the bottom up by integrating data from key regional markets. This is required to ensure accuracy and a complete comprehension of the subject. Among the variables taken into account for forecasting are:

scenario for raw materials and supply versus pricing patterns

Regulations and anticipated developments

We give these criteria weights and use weighted average analysis to assess their market influence in order to calculate the anticipated market growth rate.

Data Collection Matrix

Primary research | Secondary research |

|

|

1.1. Historic Period

1.2. Epidemiology

1.3. Objective of the study

2.1. Market Scope / Definition

2.2. Technology Categorization

2.3. Inclusion & Exclusion

3.1. To Provide Opportunity Analysis / Gap Analysis

3.1.1. Problem Solution

3.1.2.Technology Trends

3.1.3. Technology Evolution

3.2. Patent Bibliographic Analysis

3.2.1. Top Assignees

3.2.1.1 Top Assignee of Implant

3.2.1.2. Top Assignee of Hydrogel

3.2.1.3.Top Assignee of Nanoparticles

3.2.2. Technology Focus of Top Assignees

3.2.3. Geographical Distribution of Patents of Top Assignees

3.2.4. Top Countries of Origin

3.2.5. New Entrants

3.2.6. Assignee Segmentation

3.2.7. Legal Status

3.2.8. Key Patents

3.2.8.1. Most Cited Patents

3.2.8.2. Largest Invention Families

3.2.8.3. Most Claim-Heavy Patents

3.2.8.4. Highest Market-Valued Patents

3.2.9. Patents Filing Trends

3.2.9.1. By Disease Type

3.2.9.2. By Drug Delivery Approach

3.2.10. Technology Trends

3.2.10.1. Delivery Approach

3.2.10.1.1. By Disease Type

3.2.10.1.2. By Drugs Delivered

3.2.10.1.3. By Drug Form

3.2.10.2. Key Insights

3.2.10.2.1. Implant

3.2.10.2.2. Hydrogel

3.2.10.2.3. Nanoparticles

3.3. Scientific Literature Analysis

3.3.1. Literature Filing Trend

3.3.2. Geographic Analysis

3.3.3. Key Summary

3.4. Product Analysis

3.4.1. Graphical Representation

3.4.1.1. Product Type (Segmented by Implants, Hydrogels, Nanoparticles/Micro particles)

3.4.1.2. Product Pipeline Analysis

3.4.2. Portfolio for Approved Products

3.5. Clinical Trials

3.5.1. Clinical Trial Filing Timeline

3.5.2. Clinical Trial Status Versus Companies / Sponsors

3.5.3. Clinical Trial Phases with Respect to Specific Drug Delivery Approach

3.5.4. Illustration of Different Clinical Trial Phases

3.5.5. Key Insights

4.1. Identification of Most Likely Competitors

4.2. Identification of Emerging Competitors in This Area

4.3. SWOT Analysis of Top Players

5.1. To provide drivers and restraints

5.2. Company Benchmarking

5.3. Provide top players in the market

5.4. Overview of start-ups

5.5. Strategic Activities

5.6. Distribution channel

6.1. By Drug Delivery Method type

6.1.1. Through Implant / Inserts

6.1.1.1. Market size, By Country (North America)

6.1.1.2. Market share, By Region

6.1.2. Through Hydrogels

6.1.2.1. Market size, By Country (North America)

6.1.2.2. Market share, By Region

6.1.3. Through Nanoparticles / Micro particles

6.1.3.1. Market size, By country (North America)

6.1.3.2. Market share, By Region

6.2. Research Methodology and Assumptions for Market Forecasting

S.No | Key highlight of Report | |

1. | Patent Analysis |

|

2. | Product Analysis |

|

3. | Epidemiology |

|

4. | Clinical Trials |

|

5. | Forecast |

|

6. | Drivers and Barrier |

|

7. | Key Players |

|

8. | KOLs |

|

9. | SWOT |

|

10. | Opportunity Analysis |

|

11. | Benchmarking |

|

12. | Competitive analysis |

|

13. | Distribution channel(only for companies with approved products) |

|

14. | Strategic activities of companies |

|

15. | Insights |

|

LIST OF FIGURES

Figure number | Description |

Figure 1 | Terminology of Ageing Macula Disorder (AMD) Over The Years |

Figure 2 | Ophthalmic Drug Delivery – History and Present |

Figure 3 | Projection of AMD till 2040 in different geographies |

Figure 4 | Technology Categorization Of Ocular Drug Delivery Methods For AMD |

Figure 5 | Recent Technology Trends in Ocular Drug Delivery Market |

Figure 6 | Technology Evolution in Ocular Drug Delivery Market |

Figure 7 | Geographical Distribution of Patents of Top Assignees |

Figure 8 | Assignee Segmentation (Companies) |

Figure 9 | Assignee Segmentation (Educational Establishment) |

Figure 10 | Patent Based Key Insights Of Implants |

Figure 11 | Patent Based Key insights of Hydrogel |

Figure 12 | Patent Based Key insights of Nanoparticles |

Figure 13 | Geographic Distribution of the Universities/Research Organizations Filling Scientific Literature On Various Drug Delivery Approaches |

Figure 14 | Key Summary Regarding the Literature Filing On Drug Delivery Approaches |

Figure 15 | Product Pipeline of Different Ocular Drug Delivery Approaches with Companies Name |

Figure 16 | Portfolio for Approved Product |

Figure 17 | Clinical Trials Conducted till Date by Different Companies and Universities w.r.t Drug Delivery Approaches (i.e. Implants, Hydrogels and Nanoparticles). |

Figure 18 | Clinical Trials based Key Insights |

Figure 19 | Key Growth Drivers for AMD Ocular Drug Delivery Market (Particularly Implant |

Figure 20 | Restraints for AMD Ocular Drug Delivery Market (Particularly Implant) |

Figure 21 | Allergan’s Portfolio (Top Player) |

Figure 22 | Genentech’s Portfolio (Top Player) |

Figure 23 | Ocular Therapeutics Portfolio (Top Player) |

Figure 24 | Graybug’s Portfolio (Top Player) |

Figure 25 | Novartis Portfolio (Top Player) |

Figure 26 | Aviceda Opthalmics Portfolio (Start-up) |

Figure 27 | Ripple Therapeutics Portfolio (Start-up) |

Figure 28 | Re-Vana Therapeutics Portfolio (Start-up) |

Figure 29 | Strategic Activities Including Collaboration, Partnerships and Acquisitions |

Figure 30 | Distribution Channel of Approved Product i.e. Susvimo |

Figure 31 | Methodology and Assumptions for Implant Market Forecasting |

Figure 32 | Research Methodology |

LIST OF GRAPHS

Graph number | Description |

Graph 1 | Number of people worldwide with Age Related Macular Degeneration |

Graph 2 | Problem Solution Analysis of ocular drug delivery for AMD |

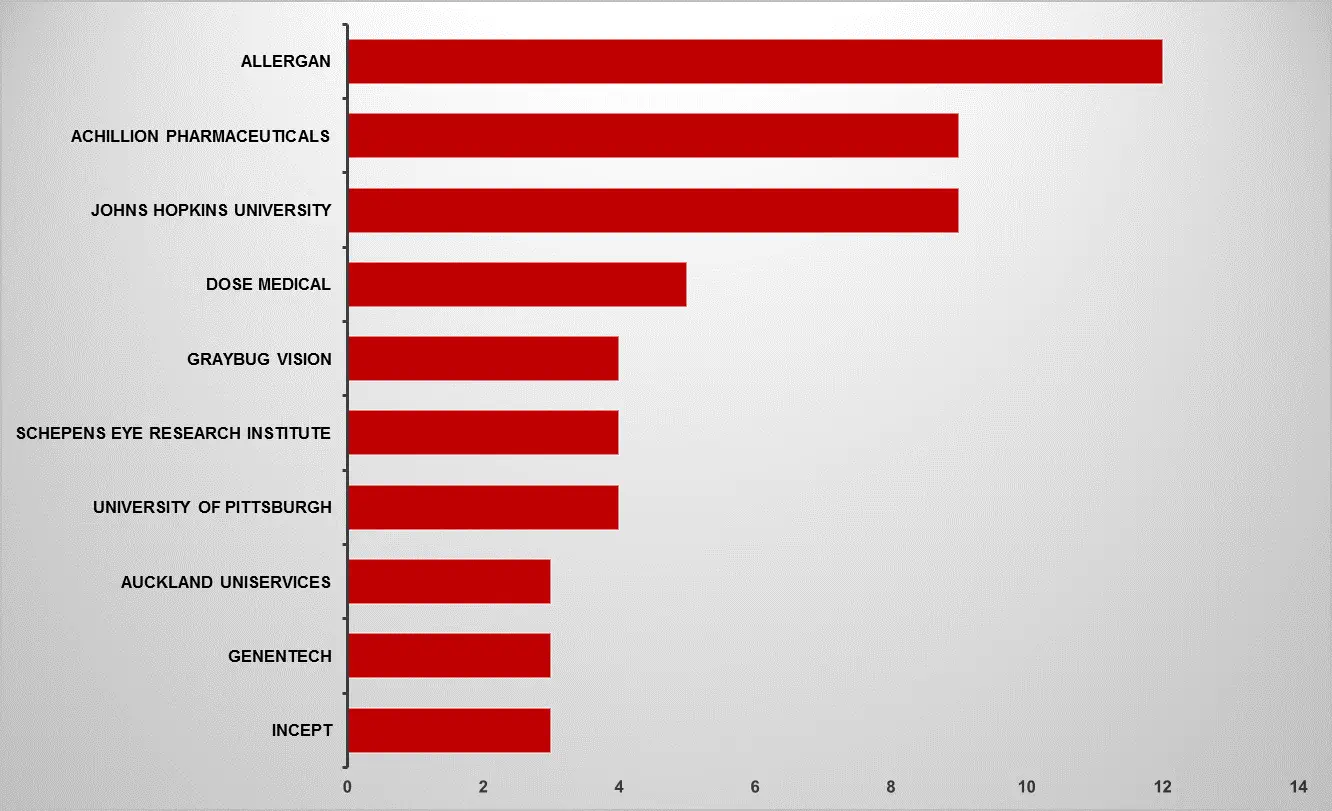

Graph 3 | Top Assignees in Ocular Drug Delivery |

Graph 4 | Top Assignees with Implant Drug Delivery |

Graph 5 | Top Assignees with Hydrogel Drug Delivery |

Graph 6 | Top Assignees with Nanoparticle Drug Delivery |

Graph 7 | Technology Focus of Top Assignees (IPC-CPC Classes) |

Graph 8 | Top Countries of Origin of Patents |

Graph 9 | New entrants in Ocular drug delivery field |

Graph 10 | Legal Status |

Graph 11 | Most Cited Patents |

Graph 12 | Patents with Largest Invention Families |

Graph 13 | Most Claim-Heavy Patents |

Graph 14 | Filing Trends by Drug Delivery Approach |

Graph 15 | Filing Trend of Ocular Drug Delivery for Dry AMD |

Graph 16 | Filing Trend of Ocular Drug Delivery for Wet AMD |

Graph 17 | Technology Trend of Ocular Drug Delivery w.r.t Disease Type Being Treated |

Graph 18 | Technology Trend of Ocular Drug Delivery w.r.t Type of Drug Being Delivered |

Graph 19 | Technology Trend of Ocular Drug Delivery w.r.t Form of Drug Being Used |

Graph 20 | Literature Filling Trend During Time Period (2018 – 2023) |

Graph 21 | Clinical Trial Filing Timeline |

Graph 22 | Recruitment Status of the Clinical Trials Related to the Different Drug Delivery Approaches |

Graph 23 | Clinical Trials Phases with Respect to Specific Drug Delivery Approach |

Graph 24 | Weighted Scores for Top 64 Players According to Benchmarking Criteria |

Graph 25 | Implant Market Size (CAGR: 2023-2033) |

Graph 26 | Implant Market Share: Distribution by Key Geographical Area, 2023-2033 |

LIST OF TABLES

Table number | Description |

Table 1 | Parameters Included and Excluded for Conducting the Analysis |

Table 2 | Technology Classes with Definitions |

Table 3 | Patent Litigation |

Table 4 | Highest Market Valued Patents |

Table 5 | SWOT Analysis of Top 3 Players |

Table 6 | Parameters and their score for Benchmarking |

Table 7 | Weighted scores for top 5 players according to benchmarking criteria |

© Copyright 2024 – Wissen Research All Rights Reserved.