In the past, Alzheimer’s disease (AD) presented a significant diagnostic challenge. It could only be conclusively diagnosed post-mortem through the examination of brain tissue, revealing the presence of characteristic plaques and tangles. This approach made it impossible to diagnose the disease during a patient’s lifetime, limiting treatment options and leaving many individuals undiagnosed until late stages of the disease. The lack of effective treatments further compounded the problem.

Diagnosis during this era relied heavily on clinical observations and cognitive assessments, which often lacked the precision and reliability needed for early detection. Physicians would perform physical and neurological exams, assessing factors like reflexes, muscle strength, coordination, and sensory perception. While these exams could help identify cognitive impairment, they were not definitive in diagnosing AD.

Today, significant progress has been made in diagnosing Alzheimer’s disease during a patient’s lifetime, offering more certainty and earlier interventions. Biomarker tests have emerged as a crucial tool for early detection. These tests include specific types of PET scans and measures of amyloid and tau proteins in blood and cerebrospinal fluid. These biomarkers can detect the presence of plaques and tangles, key hallmarks of AD.

The diagnostic process now involves a combination of clinical assessments and biomarker testing. A healthcare professional will still conduct physical and neurological exams to assess cognitive function and overall health. However, the integration of biomarkers provides a more accurate and early diagnosis. This early detection allows for better planning, potential enrolment in clinical trials, and the initiation of disease-modifying treatments.

Additionally, significant advancements have been made in understanding the pathophysiology of AD, including the role of beta-amyloid and tau proteins, as well as other factors like inflammation, mitochondrial dysfunction, and glutamate toxicity. While there is no cure, several FDA-approved drugs, such as donepezil, galantamine, and memantine, can help delay disease progression and manage symptoms. Recent approvals like aducanumab and lecanemab represent promising treatments that target beta-amyloid.

The future of Alzheimer’s disease diagnosis and treatment holds great promise. It will likely involve a stepped or personalized approach, tailored to individual patient needs and preferences. Some individuals may opt for comprehensive genetic testing and extensive biomarker analysis to prepare for the future, participate in clinical trials, or assess eligibility for disease-modifying treatments. Others may require less extensive evaluation if they exhibit intact cognitive function and daily living skills.

In terms of treatment, researchers are exploring various avenues beyond current drugs. Novel therapies are focusing on anti-Aβ and anti-tau strategies, mitochondria-targeting, multi-target approaches, and neuroprotective agents. These innovations may offer new concepts and methods for managing AD in the future, potentially leading to more effective treatments and improved patient outcomes.

Overall, the landscape of Alzheimer’s disease has evolved significantly, moving from a past where diagnosis was only possible post-mortem to a present where early detection is achievable through biomarkers and clinical assessments. The future holds the promise of more personalized diagnostic approaches and innovative treatments to address this challenging neurodegenerative disease.

Our comprehensive report offers valuable insights into the market forecast for treatments in Alzheimer’s disease, serving as a crucial resource for stakeholders and industry experts. By meticulously analysing current trends, research advancements, and emerging therapies, our report provides a forward-looking perspective on the evolving landscape of Alzheimer’s treatments. We delve into factors such as demographic shifts, regulatory developments, and the competitive landscape, enabling informed decision-making for pharmaceutical companies, healthcare providers, and investors.

Our comprehensive report delves into the realm of Alzheimer’s disease, offering a meticulous opportunity analysis within this critical field of healthcare. Alzheimer’s disease poses a significant challenge globally, and our report aims to shed light on the potential avenues for improvement and innovation in treatments. Through extensive research and data-driven insights, we explore the current landscape of Alzheimer’s treatments, assessing their effectiveness and limitations. By identifying gaps, emerging trends, and promising breakthroughs, our report equips stakeholders with a valuable resource to make informed decisions in the pursuit of more effective and compassionate care for individuals grappling with Alzheimer’s disease.

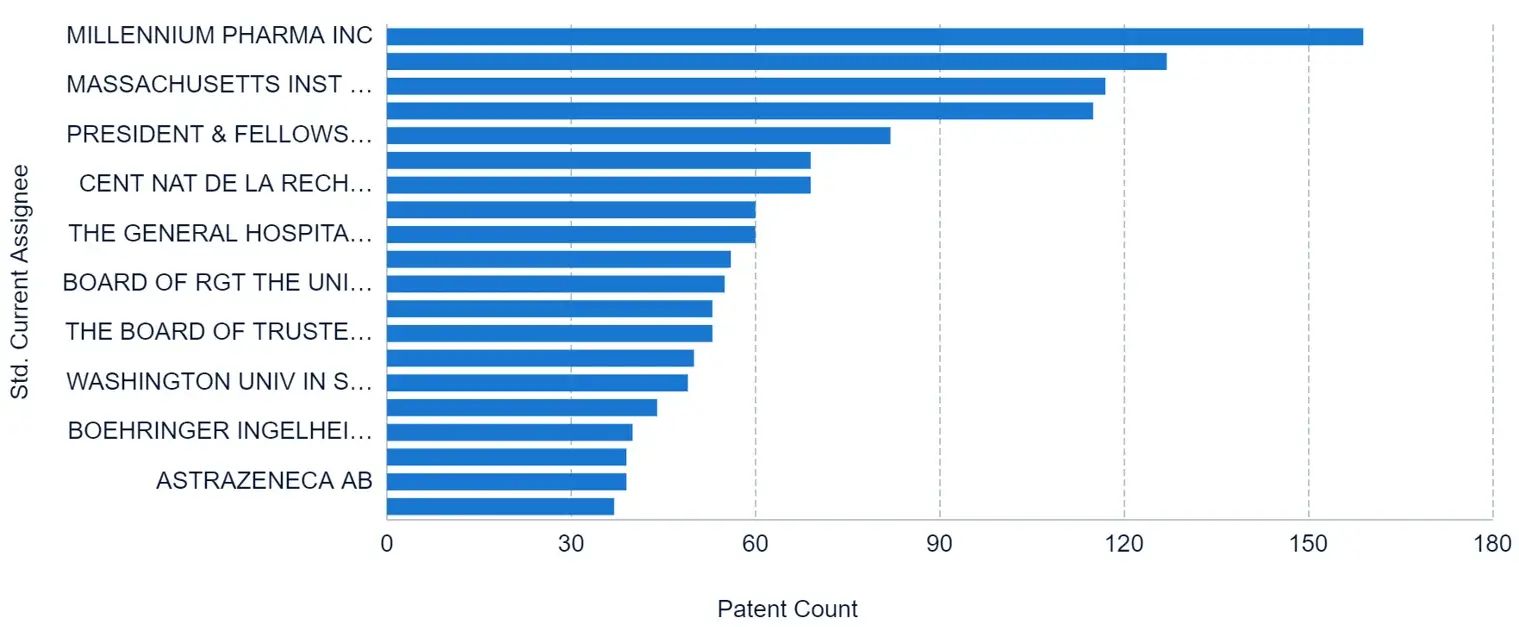

The report provides identification of patent filing on different treatment method like in time period of 2019-2023. Our report provides bibliographic (including Top Assignees, Assignee segmentation, Geographical distribution of top assignees, Filling Trends, Litigations, Legal Status) as well as technology analysis.

The report includes comprehensive information on partnerships, acquisitions, and mergers, as well as licensing and patent information for treatment in Alzheimer’s disease.

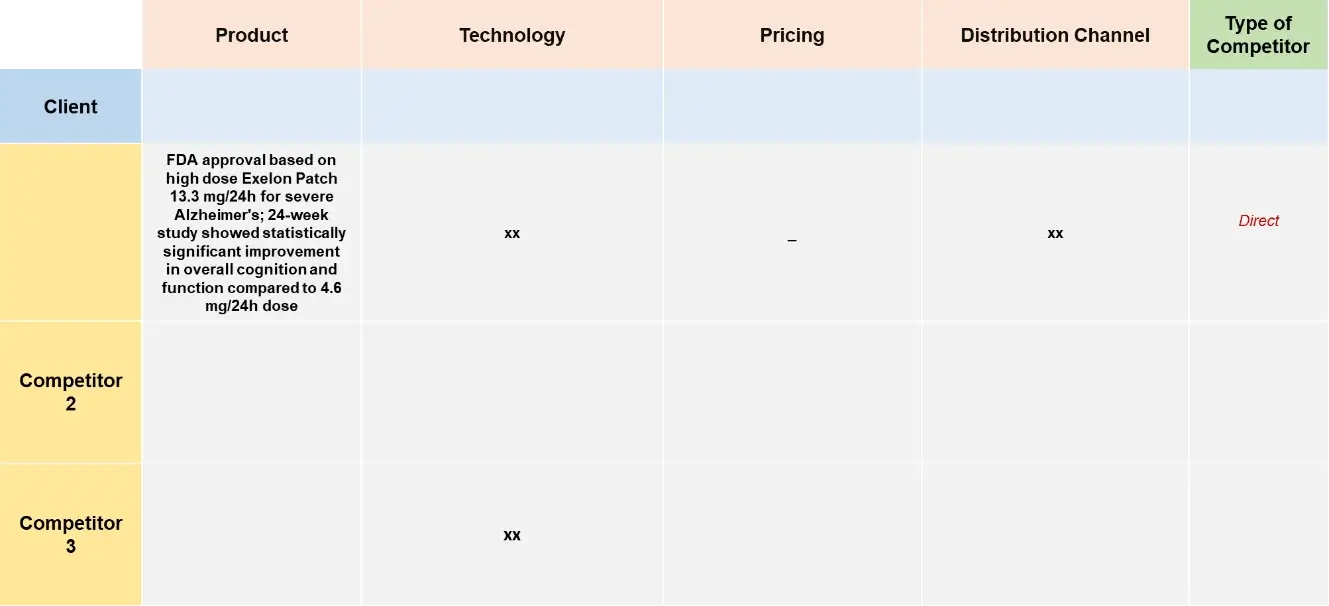

We perform competitive and market Intelligence analysis of the Alzheimer’s Disease treatment method including identification of most likely competitors, emerging competitors, SWOT analysis etc.

The report provides insights into different therapeutic candidates in phase I, phase II, and phase III stages also analyse key players involved in developing treatments.

In order to give the most precise estimations and forecasts, Wissen Research uses an extensive and iterative research approach that is focused on reducing deviation. The company blends top-down and bottom-up methodologies for market segmentation and quantitative estimation. In addition, data triangulation, which examines the market from three separate angles, is a recurrent topic present in all of our research studies. Important components of the approach used for all of our studies include the following.:

Preliminary data mining

On a wide scale, unprocessed market data is collected. Continuous data filtering makes sure that only verified and authenticated sources are taken into account. Additionally, data is extracted from a wide range of reports in our repository and from a number of reputable premium databases. We gather information from raw material suppliers, distributors, and purchasers to help with this since understanding the entire value chain is crucial for a thorough understanding of the market.

Surveys, technical symposia, and trade magazines are used to gather information on technical concerns and trends. Technical information focusing on white space and freedom of movement is also obtained from an intellectual property standpoint. Additionally, information on the industry’s drivers, constraints, and pricing patterns is obtained. As a result, a variety of original data are included in the material that is then cross-validated and certified with published sources.

Statistical model

We use simulation models to generate our market projections and estimates. Every study receives a special model that is tailored to it. Data for market dynamics, the technology environment, application development, and pricing patterns are gathered and supplied into the model all at once for analysis. The relative relevance of these factors is investigated, and their impact on the forecast period is assessed, using correlation, regression, and time series analysis. The process of market forecasting combines technological analysis with economic strategies, practical business acumen, and subject expertise.

Econometric models are frequently used for short-term forecasting, but technology market models are typically employed for long-term forecasting. These are based on a confluence of the business environment, regulatory environment, economic projection, and technical landscape. In order to develop global estimates, it is preferable to estimate markets from the bottom up by integrating data from key regional markets. This is required to ensure accuracy and a complete comprehension of the subject. Among the variables taken into account for forecasting are:

scenario for raw materials and supply versus pricing patterns

Regulations and anticipated developments

We give these criteria weights and use weighted average analysis to assess their market influence in order to calculate the anticipated market growth rate.

Data Collection Matrix

Primary research | Secondary research |

|

|

1. Executive Summary

1.1 Key Findings

1.2 Market Overview

1.3 Market Outlook

2. Introduction

2.1 Alzheimer’s Disease: An Overview

2.2 Scope of the Report

2.3 Research Methodology

2.4 Data Sources

3. Market Insight

3.1 Disease Prevalence and Epidemiology

3.2 Risk Factors and Etiology

3.3 Market Drivers

3.4 Market Challenges

3.5 Market Opportunities

3.6 Regulatory Landscape

4. Clinical Trial Analysis

4.1 Current Treatment Landscape

4.2 Emerging Therapies and Pipeline Analysis

4.3 Clinical Trial Design and Phases

4.4 Key Clinical Trials and Results

4.5 Future Prospects in Alzheimer’s Disease Research

5. Product Analysis

5.1 Approved Alzheimer’s Disease Drugs

5.2 Drug Classes and Mechanisms of Action

5.3 Emerging Therapies and Drug Candidates

5.4 Treatment Guidelines and Best Practices

5.5 Market Share Analysis of Leading Products

5.6 Product analysis through graphical representation

5.7 Product Pipeline analysis

5.8 Company Segmentation

5.9 Key Insights

6. Patent Analysis

6.1 Key Patents and Patent Holders

6.2 Patent Trends in Alzheimer’s Disease Research

6.3 Patent Analysis by Geographical Regions

6.4 Top Assignees

6.5 Assignee segmentation

6.6 Geographical distribution of top assignees

6.7 Filling trends

6.8 Litigations

6.9 Legal status

7. Competitive Analysis

7.1 Market Players Overview

7.2 Benchmarking for top players

7.3 Company Profiles for top 5 players

7.4 SWOT Analysis for top 5 players

7.5 Competitive Strategies

7.6 Market Consolidation Trends

7.7 Emerging Market Trends

7.8 Future Outlook and Opportunities

7.9 Investment and Market Entry Strategies

8. KOLs:

8.1 A detailed analysis identifying the key opinion leaders (KOLs)

8.2 Shortlisting based on their contributions

9. Global Alzheimer’s disease diagnostics market, by end user

9.1 Overview

9.2 Hospitals

9.3 Diagnostic Centres

9.4 Pharmaceutical Companies

9.5 Clinics

10. Global Alzheimer’s Disease diagnostics market, By Diagnostic Test

10.1 Overview

10.2 PET

10.3 SPECT

10.4 Blood based ELISA test

10.5 CSF Assays

10.6 Others

11. Global Alzheimer’s Disease diagnostics market, By Geography

11.1 USA

11.2 Canada

11.3 Germany

11.4 K.

11.5 France

11.6 Italy

11.7 Spain

11.8 Japan

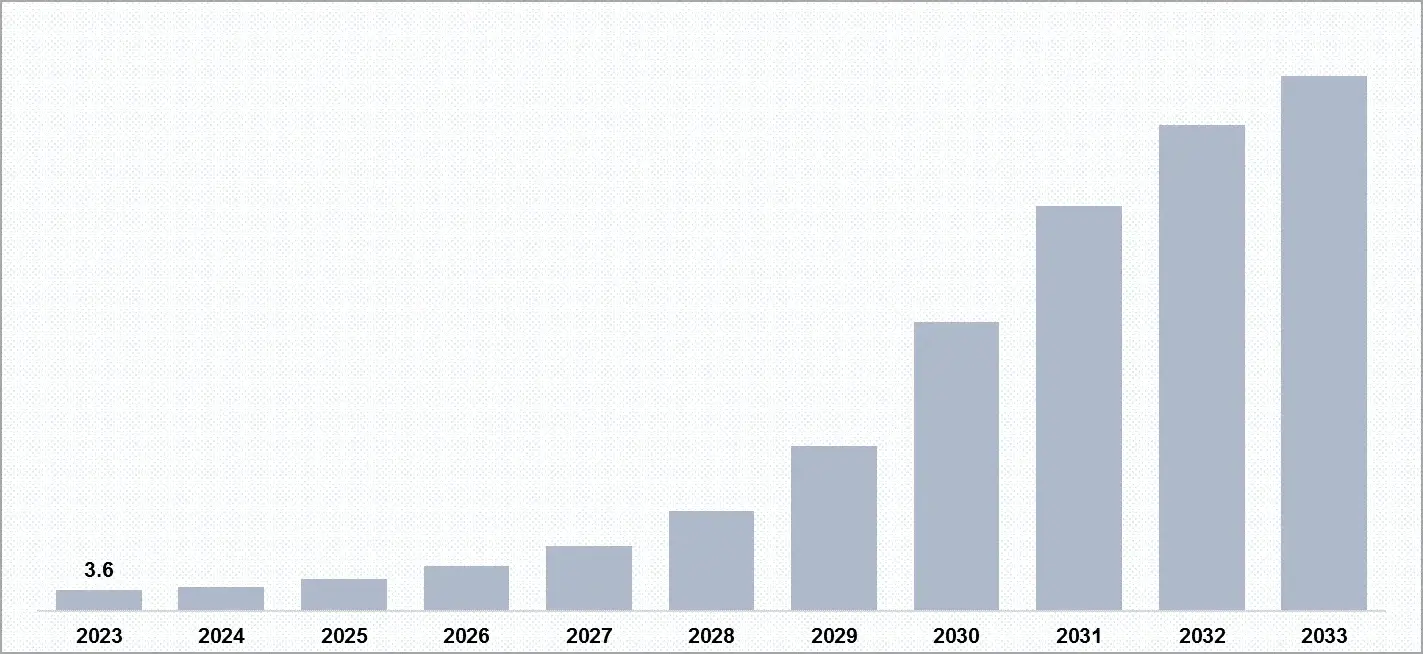

12. Market Forecast – 2023-2033

12.1 Market Size and Growth Projections

12.2 Market Segmentation

12.3 By Treatment Type

12.4 By Region

12.5 By End User

13. Key Developments

13.1 Product launches/Developments

13.2 Mergers and Acquisitions

13.3 Business Expansions

13.4 Partnerships and Collaborations

14. Conclusion

15. Appendix

15.1 Glossary of Terms

15.2 List of Abbreviations

15.3 Methodology

15.4 Data Sources

S.No | Key highlight of Report | |

1. | Patent Analysis | · Top Assignees · Assignee segmentation · Geographical distribution of top assignees · Filling Trends · Litigations · Legal Status |

2. | Product Analysis | · Product analysis through graphical representation · Product Pipeline analysis · Company Segmentation · Key Insights |

3. | Epidemiology | · Epidemiology Insights into the historical and current patient pool |

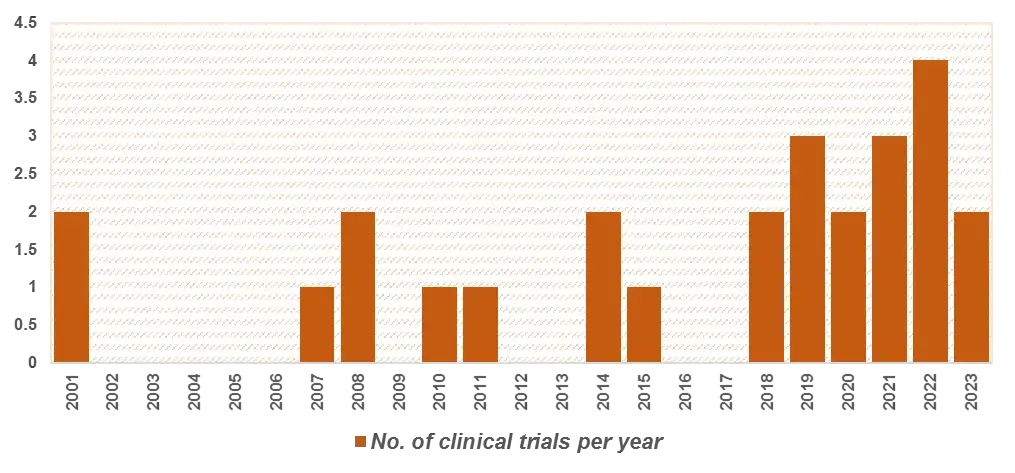

4. | Clinical Trials | · Analysis of clinical trial through graphical representation · Coverage of drug delivery methods from pre-clinical phases till commercialization (also including terminated and completed studies) |

5. | Forecast | · Detailed comprehension of the historic, current and forecasted trend of market |

6. | Drivers and Barrier | · Unmet needs · Drivers and barriers · Demand for better technology |

7. | Key Players | · Detailed profiles of the key players that are engaged in the development of drugs or treatment |

8. | KOLs | · A detailed analysis and identification of the key opinion leaders (KOLs), shortlisted based on their contributions |

9. | SWOT | · SWOT analysis for top players · Market Access · Technology development |

10. | Opportunity Analysis | · Problem solution · Technology trends · Technology evolution |

11. | Benchmarking | · Analysis of factors for benchmarking · Weightage recognition of different factors · Analysis of top players through scoring · Graphical representation of top players |

12. | Competitive analysis | · Identification of most likely competitors · Identification of emerging competitors in this area |

13. | Strategic activities of companies | · Collaboration/Mergers/Agreements/Partnerships/Acquisitions taken place by analysed companies |

14. | Insights | · New drugs or treatments now and in future · Insights related to route of administration |

LIST OF FIGURES

Figure number | Description |

Figure 1 | Terminology of Alzheimer’s disease Over The Years |

Figure 2 | Alzheimer’s disease Treatment– History and Present |

Figure 3 | Projection of Alzheimer’s disease till 2033 in different geographies |

Figure 4 | Technology Categorization Of Drug Delivery Methods For Alzheimer’s disease |

Figure 5 | Recent Technology Trends in Alzheimer’s disease |

Figure 6 | Technology Evolution in Drug Delivery Market of Alzheimer’s disease |

Figure 7 | Geographical Distribution of Patents of Top Assignees |

Figure 8 | Assignee Segmentation (Companies) |

Figure 9 | Assignee Segmentation (Educational Establishment) |

Figure 10 | Patent Based Key Insights Of xx |

Figure 11 | Patent Based Key insights of xx |

Figure 12 | Patent Based Key insights of xx |

Figure 13 | Geographic Distribution of the Universities/Research Organizations Filling Patents On Various Drug Delivery Approaches |

Figure 14 | Key Summary Regarding the Patent Filing On Alzheimer’s disease |

Figure 15 | Product Pipeline of Different Approaches with Companies Name |

Figure 16 | Portfolio for Approved Product |

Figure 17 | Clinical Trials Conducted till Date by Different Companies and Universities |

Figure 18 | Clinical Trials based Key Insights |

Figure 19 | Key Growth Drivers for Alzheimer’s disease Market |

Figure 20 | Restraints for Alzheimer’s disease Market |

Figure 21 | xx Portfolio (Top Player) |

Figure 22 | xx Portfolio (Top Player) |

Figure 23 | xx Portfolio (Top Player) |

Figure 24 | xx Portfolio (Top Player) |

Figure 25 | xx Portfolio (Top Player) |

Figure 26 | xx Portfolio (Start-up) |

Figure 27 | xx Portfolio (Start-up) |

Figure 28 | xx Portfolio (Start-up) |

Figure 29 | Strategic Activities Including Collaboration, Partnerships and Acquisitions |

Figure 30 | Research Methodology for Patent, Selection and Analysis |

Figure 31 | Research Methodology for Clinical Trials, Selection and Analysis |

LIST OF GRAPHS

Graph number |

Description |

Graph 1 | Number of people worldwide with Alzheimer’s disease |

Graph 2 | Problem Solution Analysis |

Graph 3 | Top Assignees in Alzheimer’s disease |

Graph 4 | Technology Focus of Top Assignees (IPC-CPC Classes) |

Graph 5 | Top Countries of Origin of Patents |

Graph 6 | New entrants in drug delivery field |

Graph 7 | Legal Status |

Graph 8 | Most Cited Patents |

Graph 9 | Patents with Largest Invention Families |

Graph 10 | Most Claim-Heavy Patents |

Graph 11 | Filing Trends |

Graph 12 | Clinical Trial Filing Timeline |

Graph 13 | Recruitment Status of the Clinical Trials Related to the Different Drug Delivery Approaches |

Graph 14 | Clinical Trials Phases with Respect to Specific Drug Delivery Approach |

Graph 15 | Weighted Scores for Top 5 Players According to Benchmarking Criteria |

Graph 16 | Alzheimer’s disease (CAGR: 2023-2033) |

Graph 17 | Alzheimer’s disease Market Share: Distribution by Key Geographical Area, 2023-2033 |

LIST OF TABLES

Table number | Description |

Table 1 | Parameters included and excluded for conducting the analysis |

Table 2 | Technology Classes with Definitions |

Table 3 | Patent Litigation |

Table 4 | Highest Market Valued Patents |

Table 5 | SWOT Analysis of Top 3 Players |

Table 6 | Parameters and their score for Benchmarking |

Table 7 | Weighted scores for top 5 players according to benchmarking criteria |

© Copyright 2024 – Wissen Research All Rights Reserved.