Sources: Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentation, Paid Database, and Wissen Research Analysis.

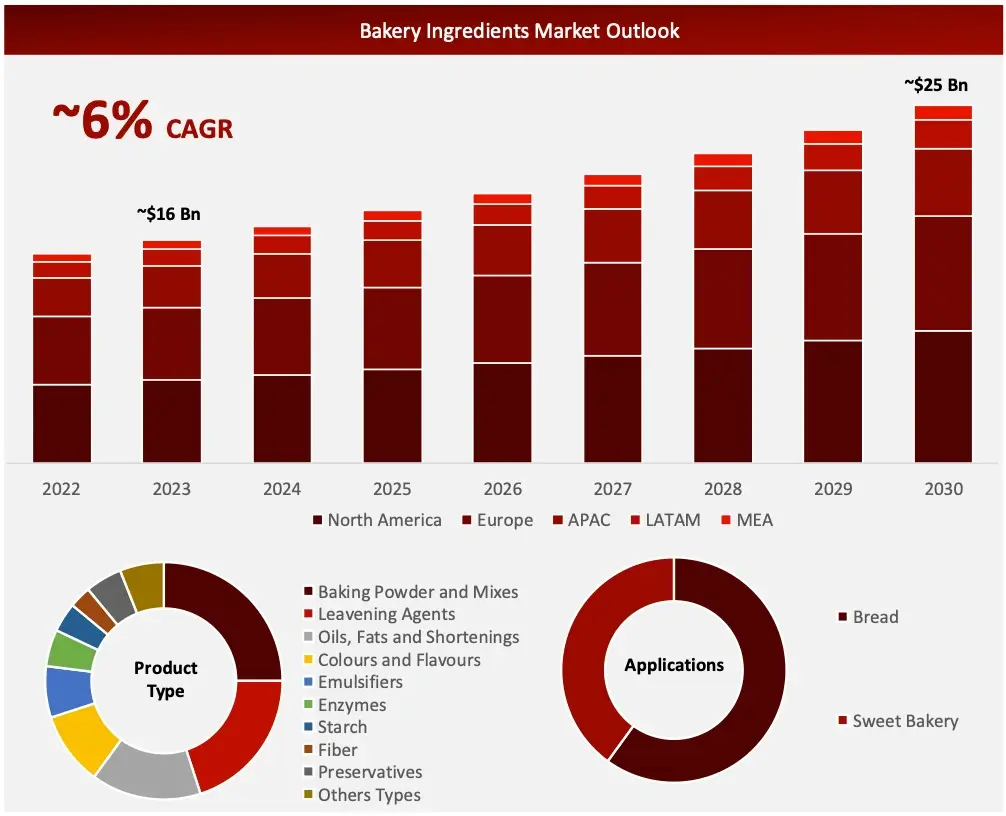

Wissen Research analyses that the global bakery ingredients market is estimated at ~USD 16 billion in 2023 and is projected to reach ~USD 25 billion by 2030, expected to grow at a CAGR of ~6% during the forecast period, 2023-2030.

Bakery ingredients are essential components used in the production of baked goods, ranging from basic items like flour, sugar, and yeast to specialized additives such as emulsifiers, preservatives, and flavoring agents. These ingredients play crucial roles in determining texture, taste, appearance, and shelf life of various bakery products. The market includes both natural and synthetic ingredients, catering to diverse needs from artisanal baking to large-scale industrial production.

The global bakery ingredients market is experiencing steady growth, driven by evolving consumer preferences and the expansion of the bakery industry worldwide. Rising demand for convenience foods, healthier baked goods, and specialty products is shaping market trends. Clean label ingredients and natural additives are gaining traction as consumers seek healthier options. The market is also seeing increased innovation in gluten-free, organic, and functional ingredients to meet diverse dietary requirements. Major players are focusing on product development and strategic partnerships to maintain their competitive edge in this dynamic sector. As urbanization and changing lifestyles continue to influence food consumption patterns, the bakery ingredients market is poised for continued expansion across both developed and emerging economies.

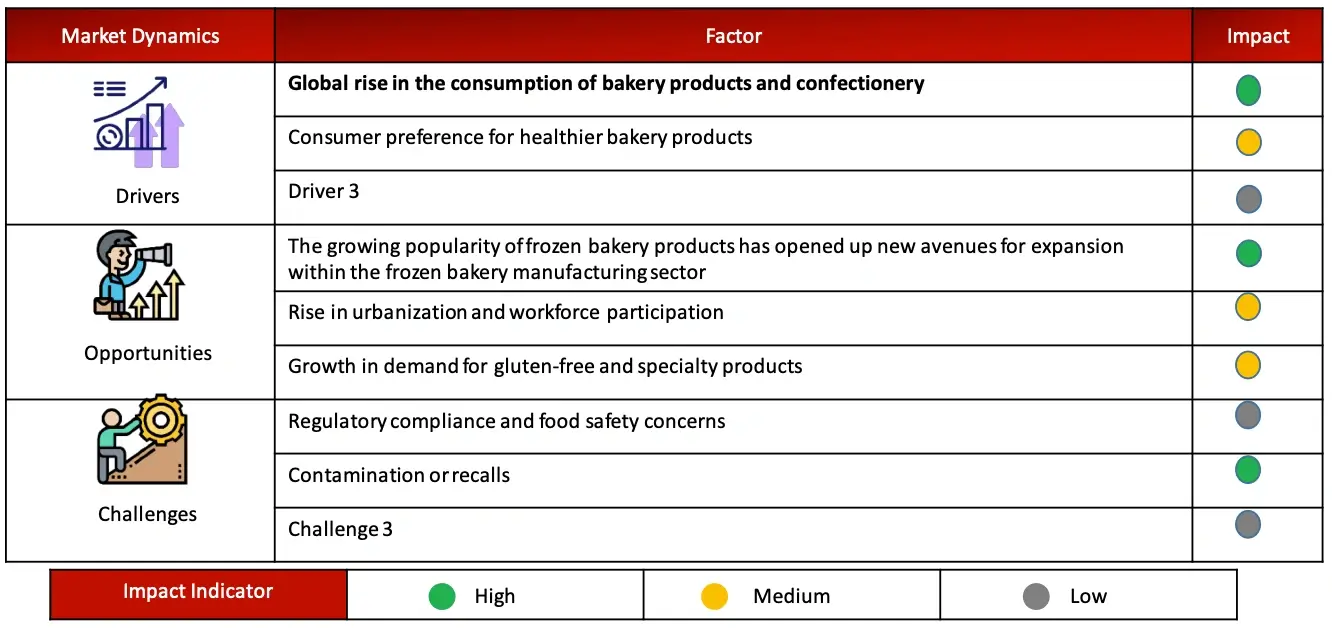

Driving Factor: Global rise in the consumption of bakery products and confectionery

Consumers are increasingly incorporating breads, pastries, and confectioneries into their daily diets, both as staple foods and indulgent treats. The rise of café culture and the demand for convenient, on-the-go food options further fuel this growth. Additionally, the expansion of retail bakeries and the proliferation of artisanal baking are contributing to increased ingredient demand. This sustained growth in bakery product consumption directly translates to a heightened demand for diverse, high-quality bakery ingredients, propelling market expansion across various regions.

Opportunity: Growing popularity of frozen bakery products

his trend is driven by consumers’ increasing preference for convenience foods that offer freshness and quality comparable to freshly baked items. Frozen bakery products allow for longer shelf life, reduced waste, and consistent quality, appealing to both retail consumers and food service providers. As a result, bakery ingredient manufacturers are investing in research and development to create products that cater to the unique needs of the frozen bakery segment, opening up new revenue streams and market expansion opportunities.

Challenge: Regulatory compliance and food safety concerns

Regulatory compliance and food safety concerns present significant challenges for the bakery ingredients market. Manufacturers must navigate a complex and evolving landscape of food safety regulations, labeling requirements, and quality standards that vary by region, leading to costly and time-consuming compliance efforts. Increasing scrutiny on ingredient sourcing, processing methods, and allergens necessitates rigorous quality control measures. Additionally, rising consumer demand for clean label and natural ingredients compels companies to reformulate products while preserving functionality and shelf life. To address these challenges, ongoing investment in compliance systems, employee training, and product innovation is essential to meet regulatory standards and consumer expectations for safe, high-quality bakery products.

Sources: Company Websites and Wissen Research Analysis.

Baking powders & mixes segment led market share within the Bakery Ingredients market

This segment serves as a significant source of proteins, vitamins, and carbohydrates and is widely utilized as a primary ingredient in bakery products worldwide. Wheat-based baking powder, known for its lower saturated fat and cholesterol levels, is becoming increasingly popular due to growing consumer awareness of organic products.

North America held the largest share in 2023, Asia-Pacific to grow the fastest during the forecast period in the Bakery Ingredients Market

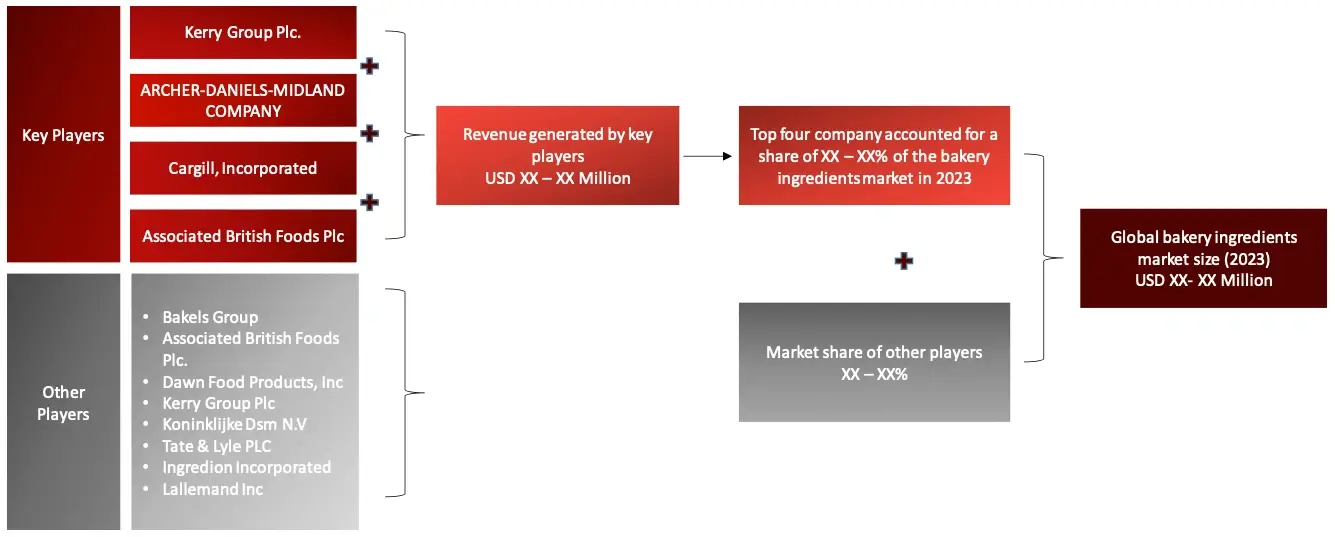

Major Companies and Market Share Insights in Bakery Ingredients Market

Major players operating in bakery ingredients market are Archer-Daniels-Midland Company, Bakels Group, Dawn Food Products, Inc, Koninklijke Dsm N.V., Tate & Lyle PLC, Ingredion Incorporated, Associated British Foods Plc., Kerry Group Plc., Cargill Inc., Lallemand Inc among others.

Introduction

Market Definition

The global bakery ingredients market is experiencing steady growth, driven by evolving consumer preferences and the expansion of the bakery industry worldwide. Key components include baking powder & mixers, leavening agents, enzymes, baking powder & mixers, oils, fats, and shortenings, colors & flavors, starch and fiber, catering to both artisanal and industrial baking needs. Rising demand for convenience foods, healthier baked goods, and specialty products is shaping market trends. Clean label ingredients and natural additives are gaining traction as consumers seek healthier options. The market is also seeing increased innovation in gluten-free, organic, and functional ingredients to meet diverse dietary requirements. Major players are focusing on product development and strategic partnerships to maintain their competitive edge in this dynamic sector. As urbanization and changing lifestyles continue to influence food consumption patterns, the bakery ingredients market is poised for continued expansion across both developed and emerging economies.

Sources: Company Websites and Wissen Research Analysis.

Sources: Company Websites and Wissen Research Analysis.

Sources: Wissen Research Analysis.

Sources: Wissen Research Analysis.

Key Stakeholders

Key objectives of the Study

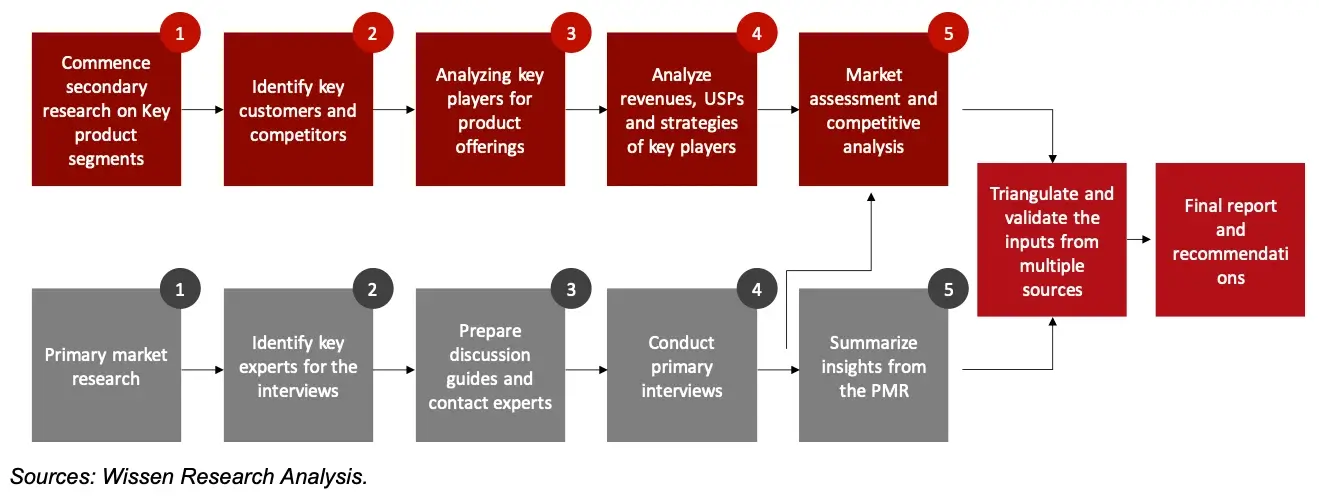

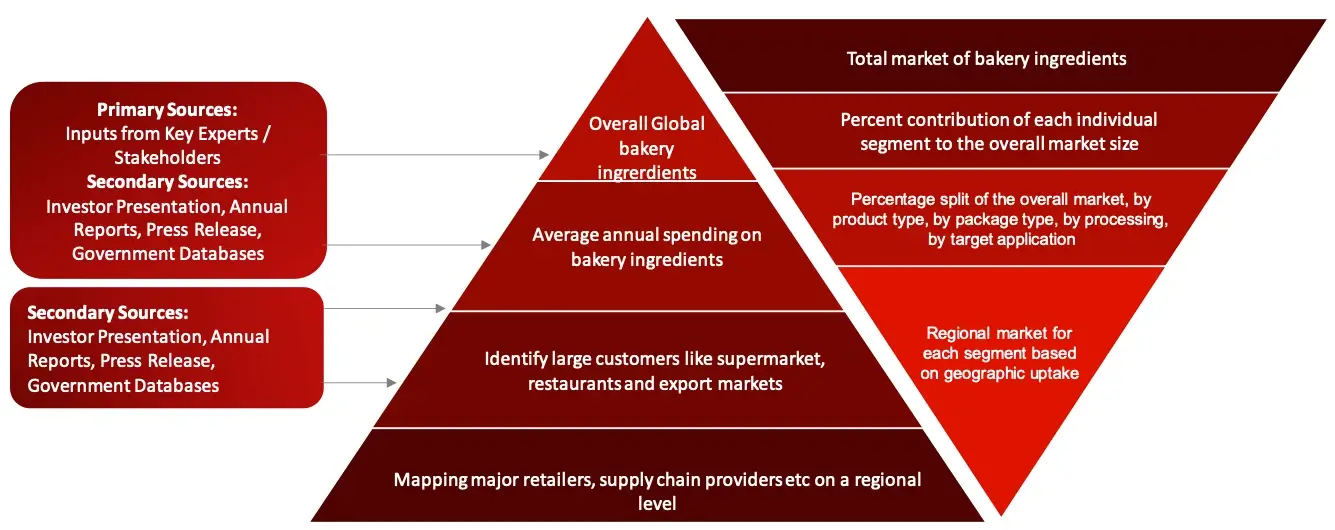

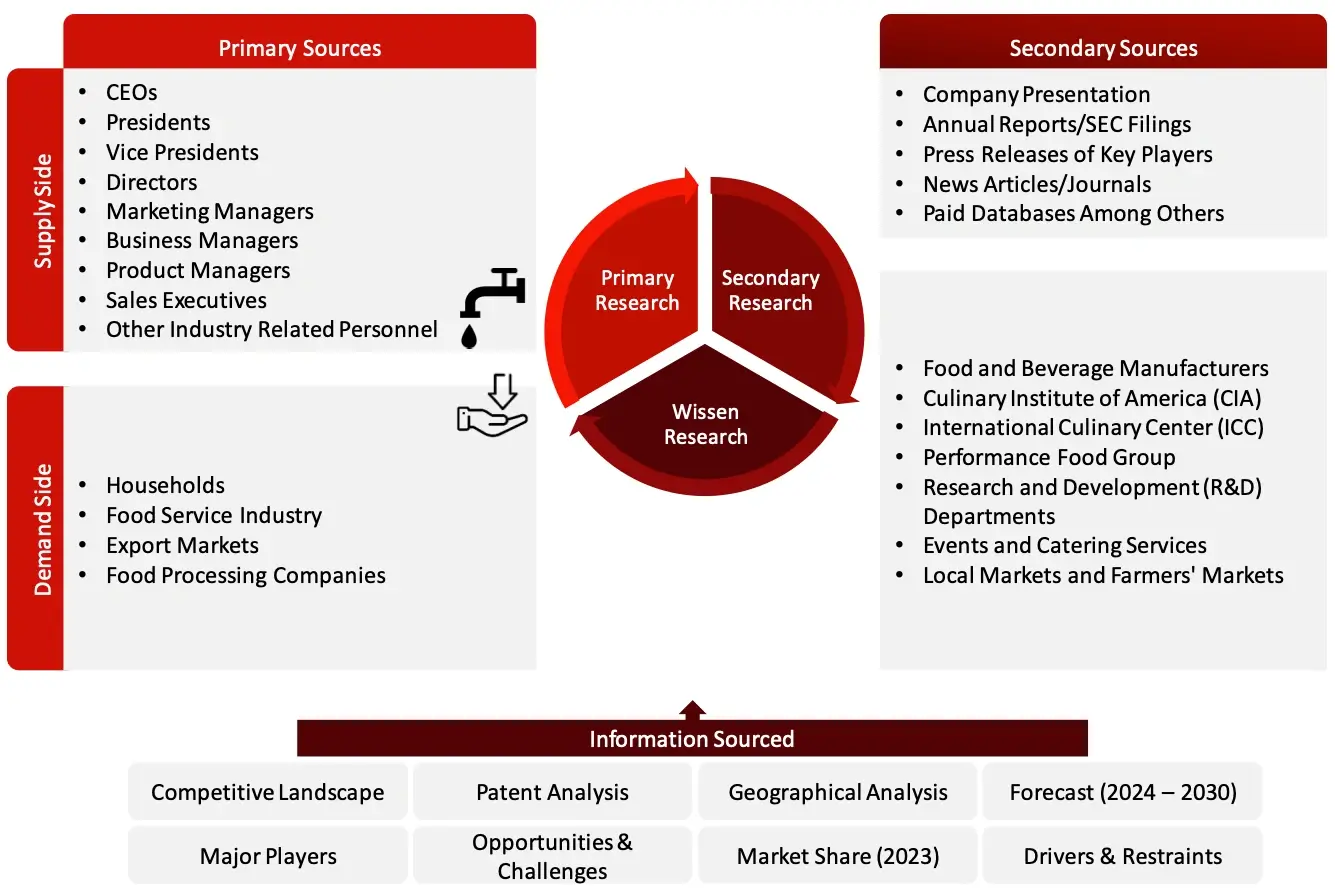

Research Methodology

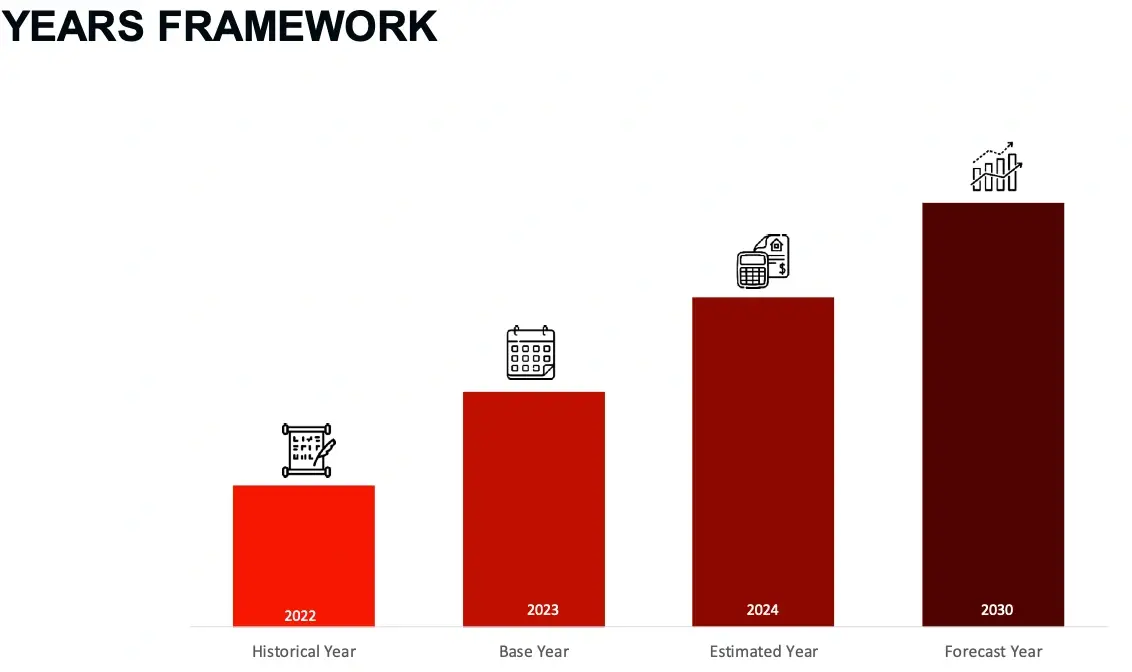

The aim of the study is to examine the key market forces such as drivers, opportunities, restraints, challenges, and strategies of key leaders. To monitor company advancements such as patents granted, product launches, expansions, and collaborations of key players, analyzing their competitive landscape based on various parameters of business and product strategy. Markey sizing will be estimated using top-down and bottom-up approaches. Using market breakdown and data triangulation techniques, market sizing of segments and sub-segments will be estimated.

FIGURE: RESEARCH DESIGN

Sources: Wissen Research Analysis.

Sources: Wissen Research Analysis.

Research Approach

Collecting Secondary Data

The process of collating secondary research data involves the utilization of databases, secondary sources, annual reports, investor presentations, directories, and SEC filings of companies. Secondary research will be utilized to identify and gather information beneficial for the in-depth, technical, market-oriented, and commercial analysis of the bakery ingredients market. A database of the key industry leaders will also be compiled using secondary research.

Collecting Primary Data

The primary research data will be conducted after acquiring knowledge about the bakery ingredients market scenario through secondary research. A significant number of primary interviews will be conducted with stakeholders from both the demand and supply side (including various industry experts, such as Vice Presidents (VPs), Chief X Officers (CXOs), Directors from business development, marketing and product development teams, product manufacturers) across major countries of Europe, Asia Pacific, North America, Latin America, and Middle East and Africa. Primary data for this report will be collected through questionnaires, emails, and telephonic interviews.

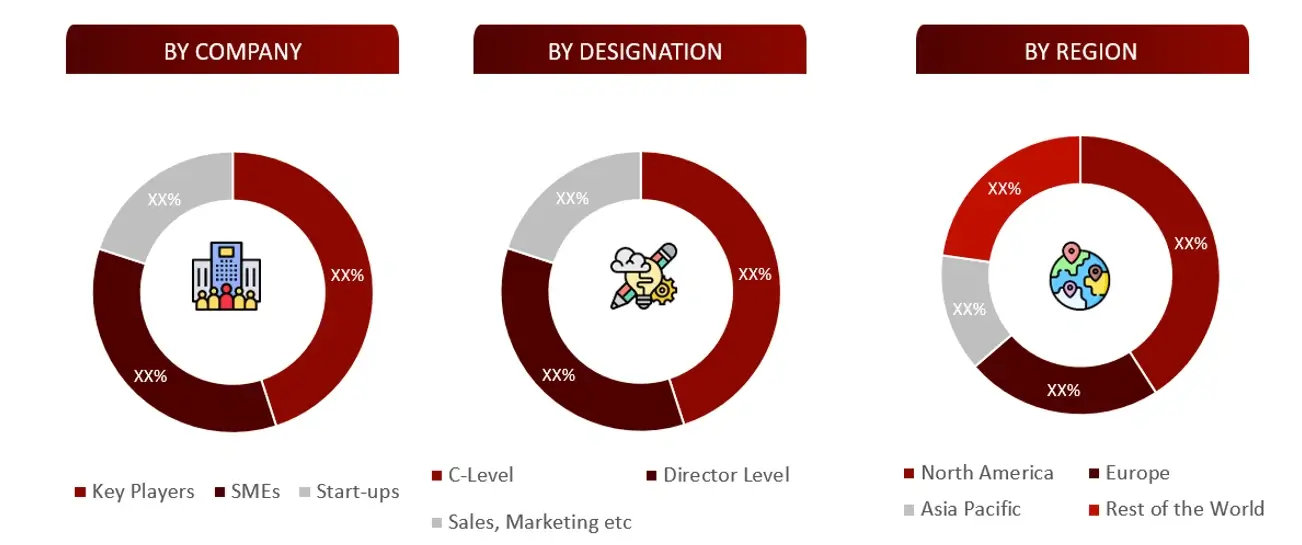

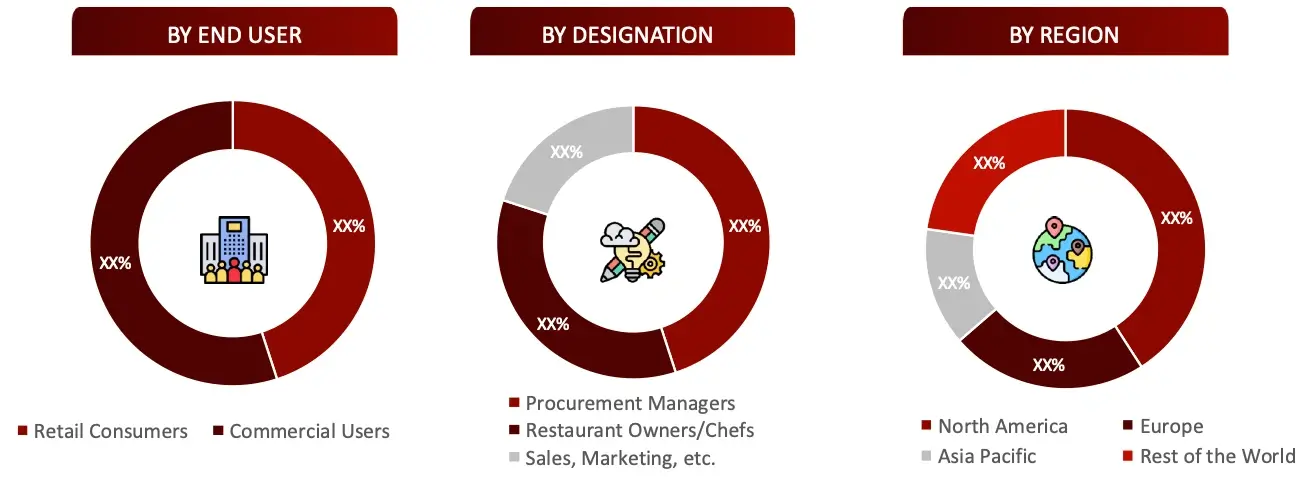

FIGURE: BREAKDOWN OF PRIMARY INTERVIEWS FROM SUPPLY SIDE

FIGURE: BREAKDOWN OF PRIMARY INTERVIEWS FROM DEMAND SIDE

FIGURE: PROPOSED PRIMARY PARTICIPANTS FROM DEMAND AND SUPPLY SIDE

Note: Above mention companies are non-exhaustive.

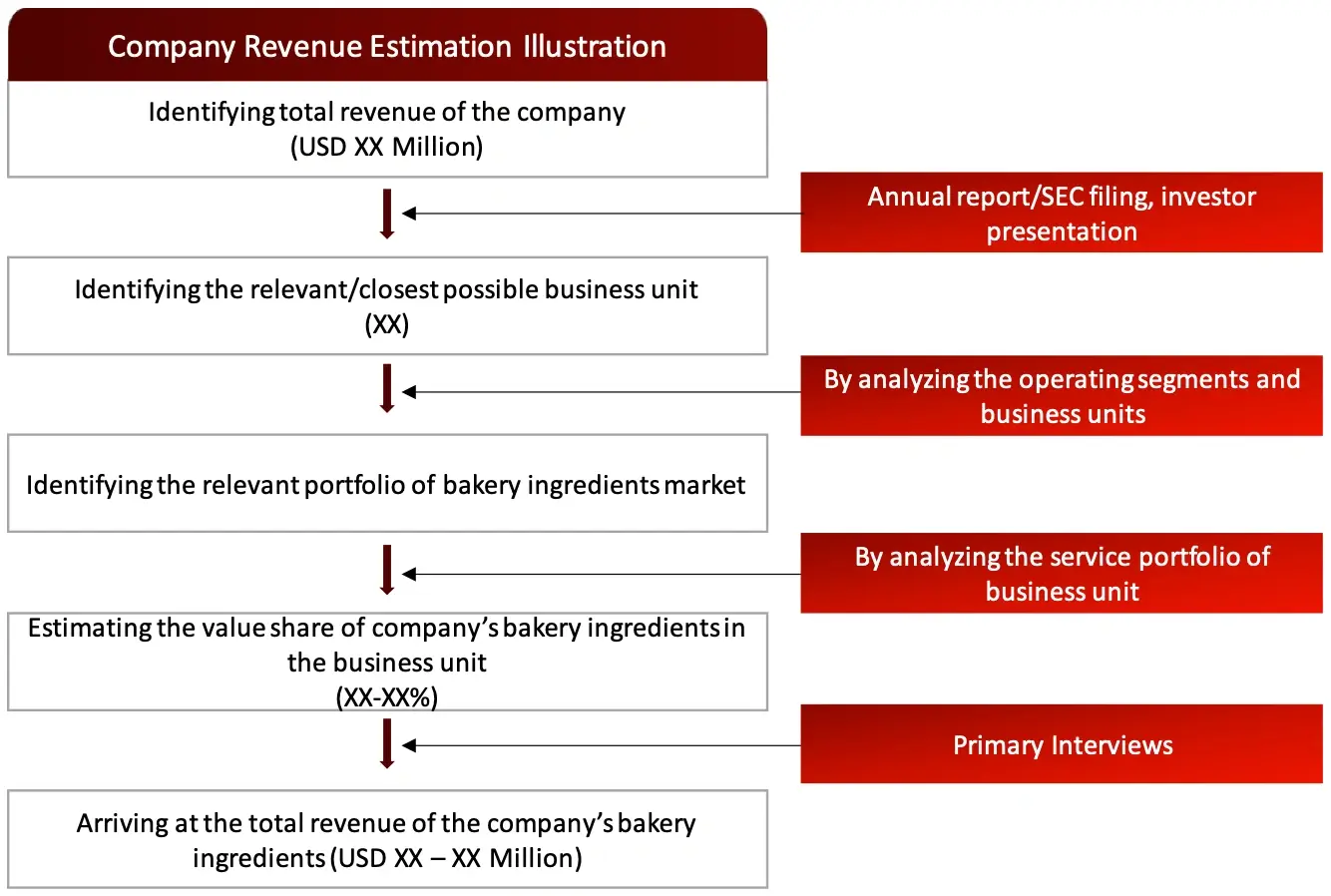

Market Size Estimation

All major manufacturers offering various bakery ingredients will be identified at the global / regional level. Revenue mapping will be done for the major players, which will further be extrapolated to arrive at the global market value of each type of segment. The market value of bakery ingredients market will also split into various segments and sub segments at the region level based on:

FIGURE: REVENUE MAPPING BY COMPANY (ILLUSTRATION)

Sources: Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentation, Paid Database, and Wissen Research Analysis.

Sources: Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentation, Paid Database, and Wissen Research Analysis.

FIGURE: REVENUE SHARE ANALYSIS OF KEY PLAYERS (SUPPLY SIDE)

Sources: Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentation, Paid Database, and Wissen Research Analysis.

Sources: Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentation, Paid Database, and Wissen Research Analysis.

FIGURE: MARKET SIZE ESTIMATION TOP-DOWN AND BOTTOM-UP APPROACH

Sources: Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentation, Paid Database, and Wissen Research Analysis.

Sources: Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentation, Paid Database, and Wissen Research Analysis.

FIGURE: ANALYSIS OF DROCS FOR GROWTH FORECAST

Sources: Food and Beverage Manufacturers, Culinary Institute of America (CIA), International Culinary Center (ICC), Performance Food Group,, Research and Development (R&D) Departments, Events and Catering Services Local Markets and Farmers’ Markets, Company Website, Press Releases, Annual Reports, Paid Data Sources, and Wissen Research Analysis.

Sources: Food and Beverage Manufacturers, Culinary Institute of America (CIA), International Culinary Center (ICC), Performance Food Group,, Research and Development (R&D) Departments, Events and Catering Services Local Markets and Farmers’ Markets, Company Website, Press Releases, Annual Reports, Paid Data Sources, and Wissen Research Analysis.

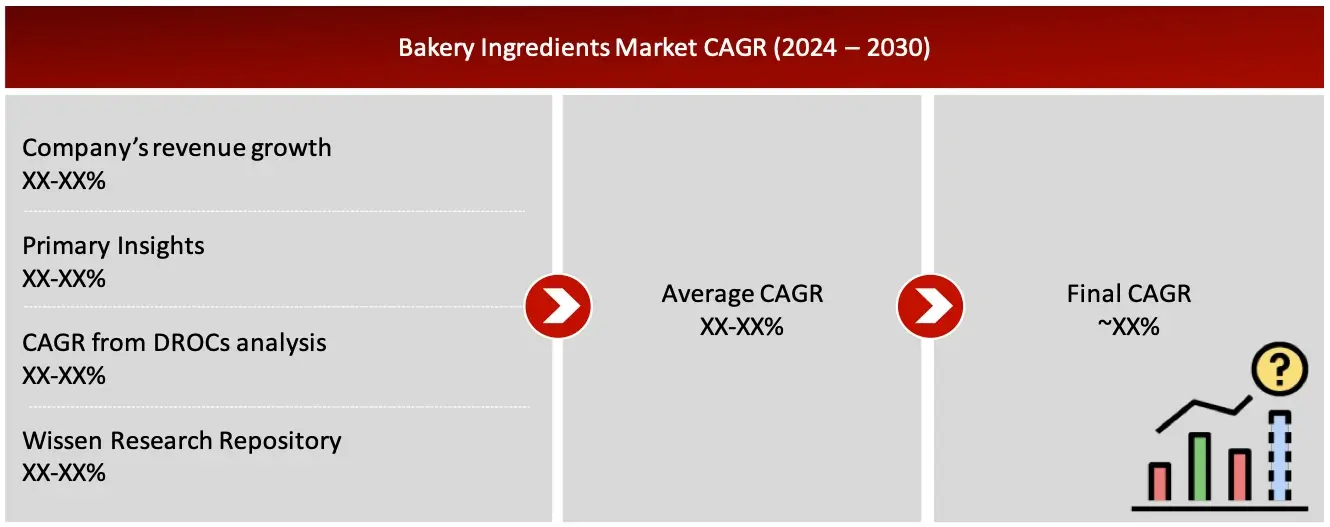

FIGURE: GROWTH FORECAST ANALYSIS UTILIZING MULTIPLE PARAMETERS

Sources: Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentation, Paid Database, and Wissen Research Analysis.

Research Design

After arriving at the overall market size-using the market size estimation processes-the market will be split into several segments and sub segment. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub segment, the data triangulation, and market breakdown procedures will be employed, wherever applicable. The data will be triangulated by studying various factors and trends from both the demand and supply sides in the bakery ingredients market.

Sources: Food and Beverage Manufacturers, Culinary Institute of America (CIA), International Culinary Center (ICC), Performance Food Group, Research and Development (R&D) Departments, Events and Catering Services Local Markets and Farmers’ Markets, Company Website, Press Releases, Annual Reports, Paid Data Sources, and Wissen Research Analysis.

Sources: Food and Beverage Manufacturers, Culinary Institute of America (CIA), International Culinary Center (ICC), Performance Food Group, Research and Development (R&D) Departments, Events and Catering Services Local Markets and Farmers’ Markets, Company Website, Press Releases, Annual Reports, Paid Data Sources, and Wissen Research Analysis.

1. Introduction

1.1 Objectives of the Study

1.2 Market Definitions

1.3 Market Segmentations

1.3.1 In Scope

1.3.2 Out of Scope

1.4 Scope of the Report

1.5 Scope Related Limitations

1.6 Key Stakeholders in the Market

2. Research Methodology

2.1 Research Data

2.1.1 Key Data from Secondary Sources

2.2 Market Size Estimation

2.2.1 Total Market Size Estimation

2.2.2 Market Segment Assessment

2.2.3 Growth Forecast

2.3 Data Triangulation and Market Breakdown

2.4 Market Share Estimation

2.5 Assumptions

2.6 Limitations

2.6.1 Scope-Related Limitations

2.6.2 Methodology-Related Limitations

2.7 Risk Assessment

3. Executive Summary & Premium Content

3.1 Global Market Outlook

3.2 Key Market Findings

3.3 Executive Summary

3.4 Premium Content

3.4.1 Market Overview

3.4.2 Asia Pacific Market, By Product and Country (2023)

3.4.3 Market: Regional Growth Opportunity

3.4.4 Geographic Mix

3.4.5 Market: Developed Vs Emerging Markets

4. Patent Analysis

4.1 Patents Related to Bakery Ingredients

4.2. Patent Landscape and Intellectual Property Trends

5. Market Overview

5.1 Market Dynamics

5.1.1 Market Drivers

5.1.2 Restraints

5.1.3 Opportunities

5.1.4 Challenges

5.2 Top-Level End User Perception Analysis

5.3 Need-Gap Analysis

5.4 Value Chain Analysis

5.5 Industry Trends

5.6 Porter’s Five Forces Model

5.7 Patent Analysis

5.8 Market Ecosystem Analysis

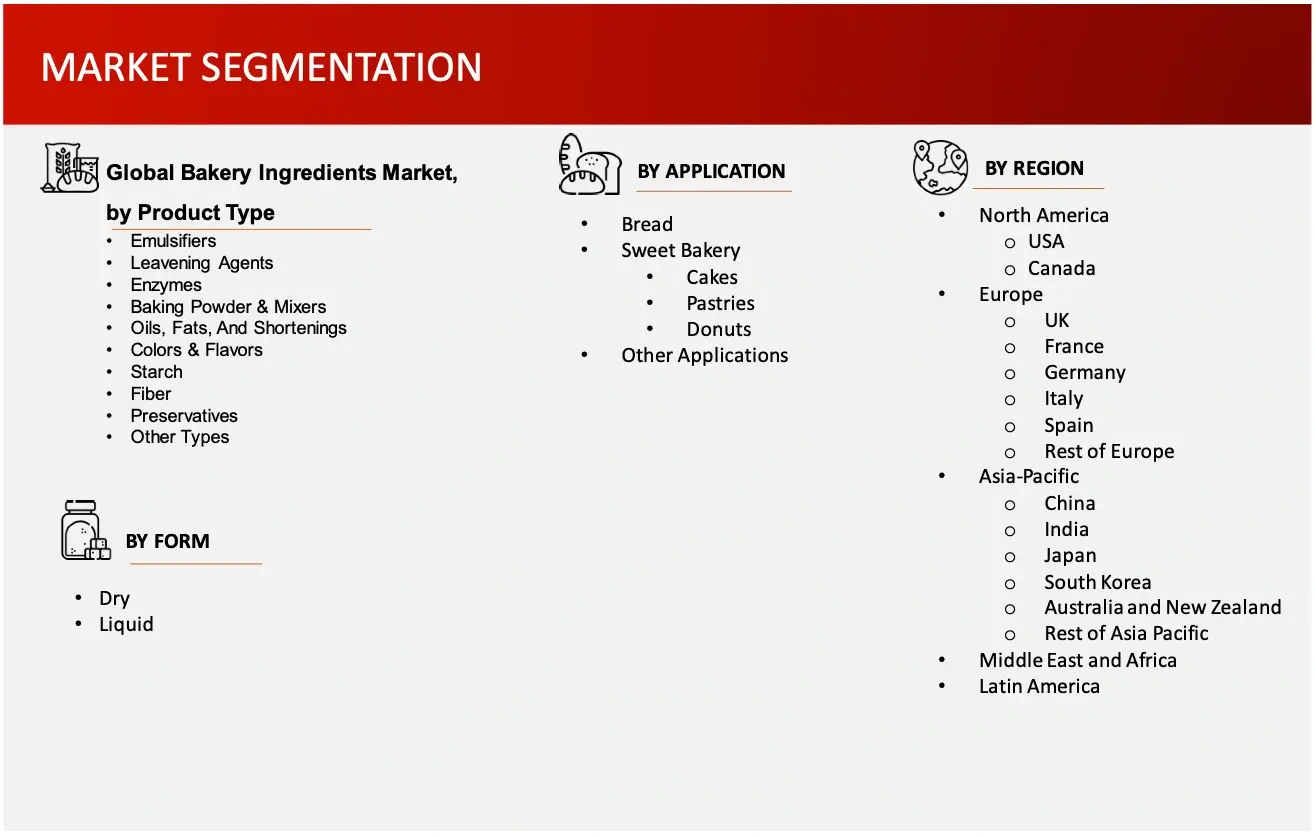

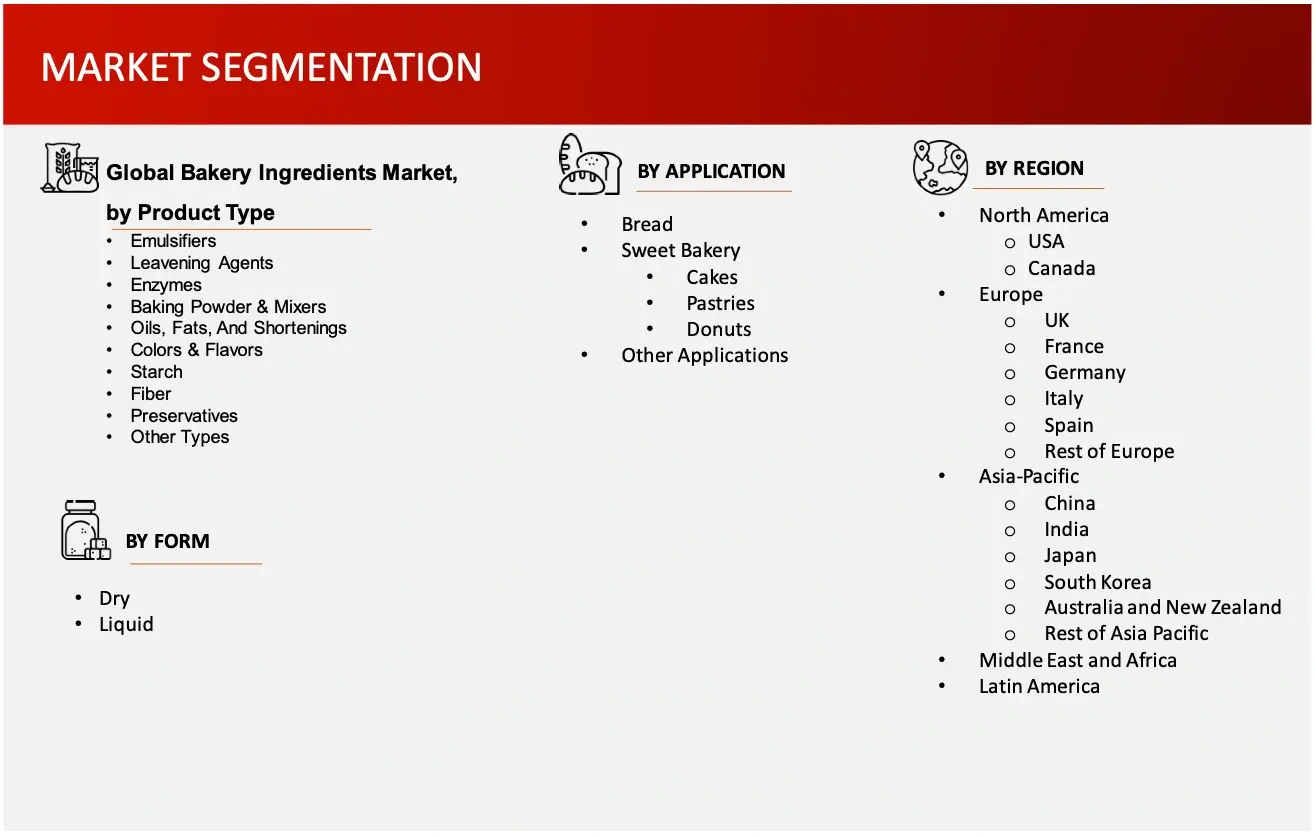

6. Global Bakery Ingredients Market, by Product Type (2023-2030, USD Million)

6.1 Emulsifiers

6.2 Leavening Agents

6.3 Enzymes

6.4 Baking Powder & Mixers

6.5 Oils, Fats, And Shortenings

6.6 Colors & Flavors

6.7 Starch

6.8 Fiber

6.9 Preservatives

6.10 Other Types

7. Global Bakery Ingredients Market, by Application (2023-2030, USD Million)

7.1 Bread

7.2 Sweet Bakery

7.2.1 Cakes

7.2.2 Pastries

7.2.3 Donuts

7.3 Other Applications

8. Global Bakery Ingredients Market, by Form (2023-2030, USD Million)

8.1 Dry

8.2 Liquid

9. Global Bakery Ingredients Market, by Region (2023-2030, USD Million)

9.1 North America

9.1.1 US

9.1.2 Canada

9.2 Europe

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 Italy

9.2.5 UK

9.2.6 Rest of the Europe

9.3 Asia Pacific

9.3.1 China

9.3.2 Japan

9.3.3 India

9.3.4 Australia and New Zealand

9.3.5 South Korea

9.3.6 Rest of the Asia Pacific

9.4 Middle East and Africa

9.5 Latin America

10. Competitive Analysis

10.1 Key Players Footprint Analysis

10.2 Market Ranking/Share Analysis

10.3 Key Brand Analysis

10.4 Regional Snapshot of Key Players

10.5 R&D Expenditure of Key Players

10.6 Revenue Analysis of Business Segments

10.7 Company Footprint Analysis

10.7.1 Product Footprint

10.7.2 Application Footprint

10.7.3 Geographic Footprint

10.8 Key Strategies Adopted by Major Players in the Market

10.9 Nature of Market

10.9.1 Consolidate/Fragmented

11. Company Profiles2

11.1 ARCHER-DANIELS-MIDLAND COMPANY

11.1.1 Business Overview

11.1.2 Product Portfolio

11.1.3 Financial Snapshot3

11.1.4 Recent Developments

11.1.5 SWOT Analysis

11.2 Cargill, Incorporated

11.3 BAKELS GROUP

11.4 Associated British Foods Plc.

11.5 DAWN FOOD PRODUCTS, INC

11.6 KERRY GROUP PLC

11.7 KONINKLIJKE DSM N.V

11.8 Tate & Lyle PLC

11.9 INGREDION INCORPORATED

11.10 LALLEMAND INC

11.11 Corbion N.V.

12. Conclusion

13. Appendix

13.1 Industry Speak

13.2 Questionnaire

13.3 Available Custom Work

13.4 Adjacent Studies

13.5 Authors

14. References

Key Notes:

Note 1 – Contents in the ToC / market segments are tentative and might change as the research proceeds.

Note 2 – List of companies is not exhaustive and might change during the course of study.

Note 3 – Details on key financials might not be captured in case of unlisted companies.

Note 4 – SWOT analysis will be provided for top 3-5 companies.

© Copyright 2024 – Wissen Research All Rights Reserved.