Bipolar Disorder: Market Size, Trend, by Treatment Type, by Disease Type, by Drug Class (Mood Stabilizer, Anticonvulsant, Antipsychotic, Antidepressant, etc.), Route of Administration, End User, Distribution Channel, Region, Major Player – Global Forecast to 2030

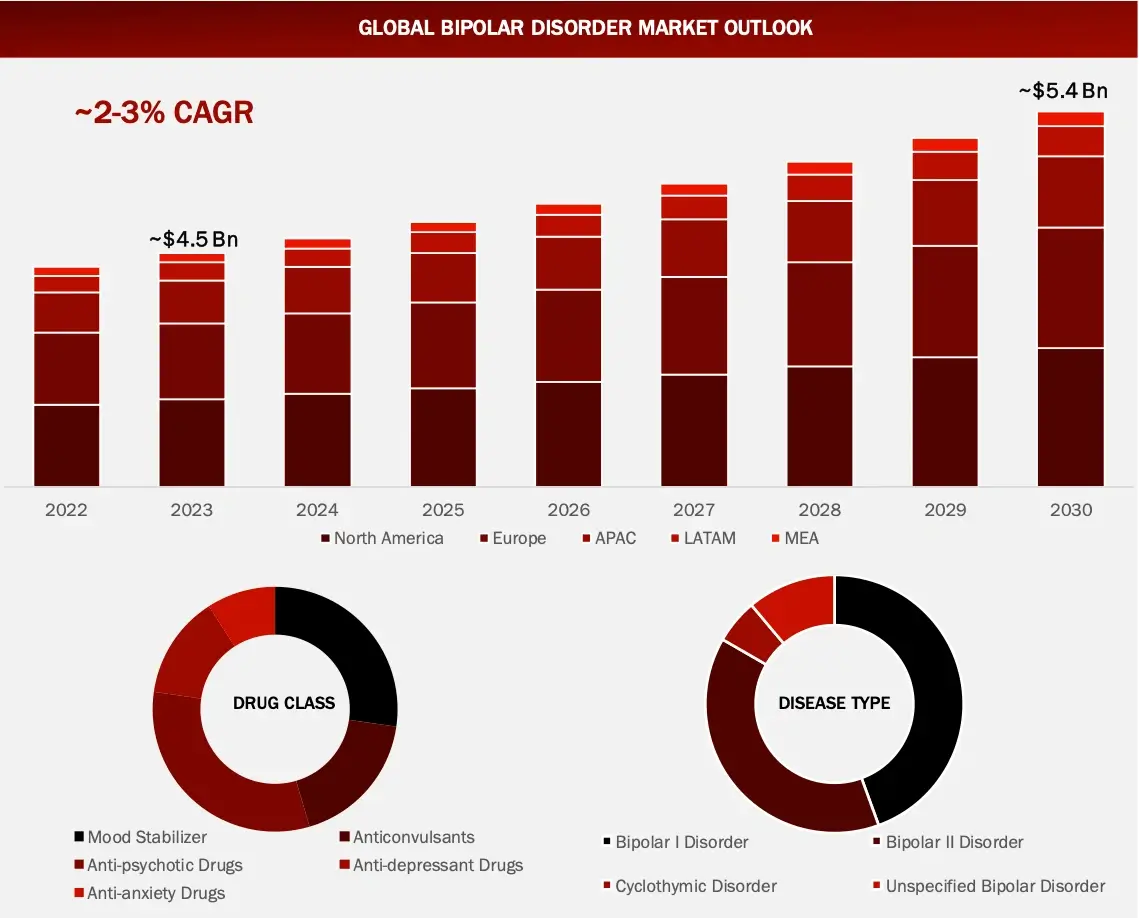

The global bipolar disorder market is estimated to be valued at ~ $4.5 Billion in 2023, and is expected to grow at a CAGR of ~2-3%. Anti-psychotic drugs have held the most significant share in the market since 2023, with North America dominating the regional market share.

Key driving factors of bipolar disorder market includes increase in the prevalence of bipolar disorders due to changing lifestyles and urbanization, which has led to high stress and substance abuse, as well as heavy investments by key medical institutes in the research and development of bipolar disorder and its treatment have contributed to the upward market growth. Challenges in the bipolar disorder domain include high treatment costs and limited approved anticonvulsants drugs and side effects caused by the available treatments.

Key players functioning in bipolar disorder sector are AbbVie Inc., Johnsons & Johnsons, Bristol Myers Squibb, GlaxoSmithKline, Novartis AG and ELI Lilly and Company.

Company | Product/Brand Name | Status | Type of Agent | Route of Administration |

AbbVie Inc. | ABBV-932 | Phase ll | _ | Oral |

Neumora Therapeutics | NMRA-140 | Phase ll | Navacaprant | Oral |

Teva Pharmaceutical | TV-44749 | Phase lll | olanzapine | Subcutaneous |

Note: This is not an exhaustive list

*Data latest as of 13 December 2024

The increasing global prevalence of bipolar disorder is a significant driver for market growth. An estimated 40 million people globally suffer from Bipolar disorder with higher diagnostic rates due to improved awareness and access to mental health services. For example, studies show that bipolar disorder affects around 2.8% of U.S. adults annually, with similar patterns in Europe and Asia. This growing patient pool has led to heightened demand for effective pharmacological and non-pharmacological treatments, driving innovation and expansion in the market.

Advances in genetic testing and biomarker discovery are enabling more tailored treatment approaches, which can improve outcomes and reduce side effects. This shift towards individualized care is expected to drive demand for targeted therapies and diagnostic tools, fostering growth in the bipolar disorder market. For instance, genetic markers such as SLC6A4 and BDNF are being explored to help identify the most effective treatments for patients, enhancing therapeutic efficacy.

The high costs associated with long-term treatment for bipolar disorder, including medications and ongoing therapy, present a significant challenge. Many patients require lifelong management with medications like mood stabilizers, antipsychotics, and antidepressants, which can be expensive, especially in regions with limited insurance coverage. This financial burden limits access to treatment for some patients and affects market growth. Moreover, variability in treatment response and adherence rates adds complexity to managing costs effectively.

Anti-psychotic drugs dominated the bipolar disorder drug market in 2023

Bipolar disorder treatment includes various drug classes, including mood stabilizer, anticonvulsants, anti-psychotic drugs, anti-depressant drugs, anti-anxiety drugs among others. Each category serves a different mode of disease management. Among these, Anti-psychotic drugs have held the largest market share.

Anti-psychotic drugs dominate the bipolar disorder market due to their strong efficacy in managing severe manic and depressive episodes, providing significant symptom control and stabilization for patients. These medications are well-established as a first-line treatment, particularly in cases requiring immediate intervention, and have a broad application in both acute and maintenance therapy

Significant market share held by hospital pharmacies was observed in 2023

Various distribution channels are employed in global LN market such as hospitals pharmacies, retail pharmacies, online pharmacies, among others.

The traditional healthcare facilities, i.e. hospital pharmacies remained the significant holder of distribution channels market share this can be attributed to their ability to manage and dispense complex treatments and medications, such as mood stabilizers and antipsychotics, under professional medical supervision. These settings are equipped to handle patient monitoring and provide counseling, which are essential for managing side effects and ensuring treatment adherence. This infrastructure supports comprehensive care, making hospital pharmacies the preferred choice for distributing bipolar disorder medications.

North America held the largest market share in bipolar disorder in the forecast period

Bipolar disorder market research included a comprehensive analysis of five key regions:

All regions were evaluated based on these following factors- healthcare infrastructure, regulatory landscape, technological adoption, and market dynamics. The research observed that North America held the largest share in the Bipolar disorder treatment market domain during the forecast period, primarily due to its advanced healthcare systems, high adoption rates, and the presence of major market players driving innovation in this sector.

As per the historical and the base year of the report (2022 and 2023, respectively), key players in Bipolar disorder were GSK plc (UK), Eli Lilly and Company (US), AstraZeneca (UK), Pfizer Inc. (US), Sanofi (France), Johnson & Johnson (US), Novartis AG (Switzerland), Astellas Pharma Inc. (Japan), Bristol-Myers Squibb Company (US), AbbVie Inc. (US), Eli Lilly and Company (US), Otsuka Holdings Co. Ltd. (Japan), among others.

Particulars | Details |

Report Title | Bipolar Disorder Market |

Forecast Period | 2024 – 2030 |

Base Year | 2023 |

Format | |

Estimated Market Size (2024) | ~USD 4.6 Billion |

CAGR (2024-2030) | 2-3% |

Number of Pages | ~170 |

Number of Tables | ~120 |

Number of Figures | ~35 |

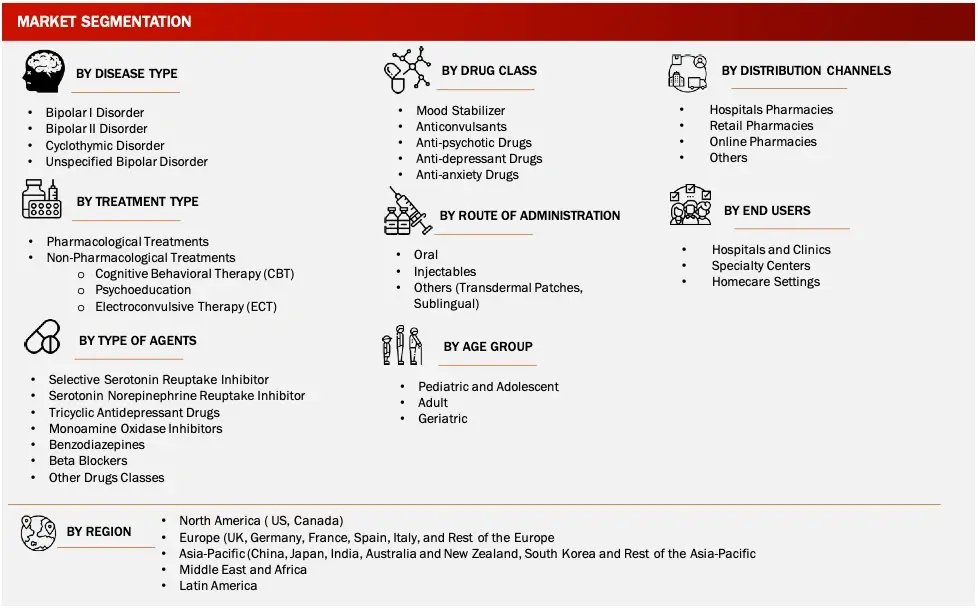

Key Segments | · By Disease Type (Bipolar I Disorder, Bipolar II Disorder, Cyclothymic Disorder, Unspecified Bipolar Disorder) · By Drug Class (Mood Stabilizer, Anticonvulsants, Anti-psychotic Drugs, Anti-depressant Drugs, Anti-anxiety Drugs) · By Type of Agent (Selective Serotonin Reuptake Inhibitor, Serotonin Norepinephrine Reuptake Inhibitor, Tricyclic Antidepressant Drugs, Monoamine Oxidase Inhibitors, Benzodiazepines, Beta Blockers, Other Drugs Classes) · By Treatment Type (Pharmacological Treatments, Non-Pharmacological Treatments) · By Age Group (Pediatric and Adolescent, Adult, Geriatric) · By Route of Administration (Oral, Injectable, Others*) *(Others include Transdermal Patches, Sublingual) · By End User (Hospitals and Clinics, Specialty Centers, Homecare Settings) · By Distribution Channels (Hospitals Pharmacies, Retail Pharmacies, Online Pharmacies, Others*) *Others include Mental Health Organizations, Specialty Clinics, etc. |

Regions Covered | · North America: US and Canada · Europe: Germany, UK, France, Italy, Spain, and Rest of the Europe · Asia-Pacific: China, Japan, India, South Korea, Australia and New Zealand, and Rest of the Asia-Pacific · Latin America · Middle East and Africa |

Key Players Covered | GSK plc (UK), Eli Lilly and Company (US), AstraZeneca (UK), Pfizer Inc. (US), Sanofi (France), Johnson & Johnson (US), Novartis AG (Switzerland), Astellas Pharma Inc. (Japan), Bristol-Myers Squibb Company (US), AbbVie Inc. (US), Otsuka Holdings Co. Ltd. (Japan) |

Introduction

Market Definition

Bipolar disorder is a chronic mental health condition characterized by extreme mood swings that include emotional highs (mania or hypomania) and lows (depression). These mood episodes can interfere with daily functioning and relationships. Treatment typically involves a combination of medications, such as mood stabilizers and antipsychotics, along with therapy to help manage symptoms and improve quality of life.

FIGURE: BIPOLAR DISORDER MARKET SEGMENTS

Sources: Company Websites and Wissen Research Analysis

Key Stakeholders

Key objectives of the Study

Research Methodology

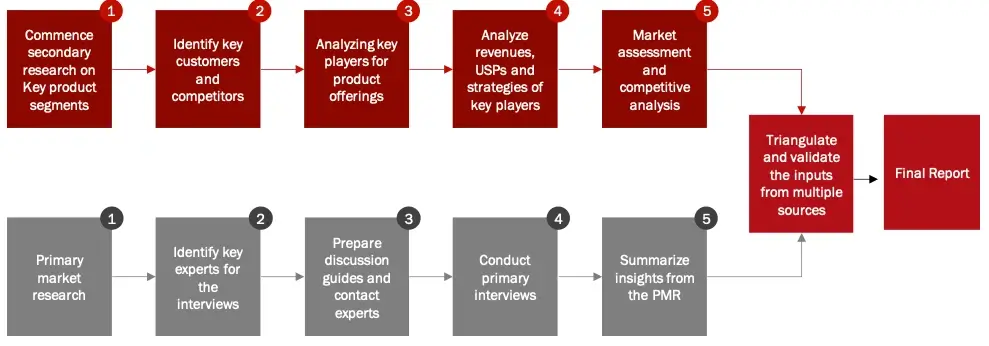

The objective of the study is to analyze the key market dynamics such as drivers, opportunities, challenges, restraints, and key player strategies. To track company developments such as product launches and approvals, expansions, and collaborations of the leading players, the competitive landscape of the bipolar disorder market to analyze market players on various parameters within the broad categories of business and product strategy. Top-down and bottom-up approaches will be used to estimate the market size. To estimate the market size of segments and sub segments the market breakdown and data triangulation will be used.

FIGURE: RESEARCH DESIGN

Sources: Wissen Research Analysis

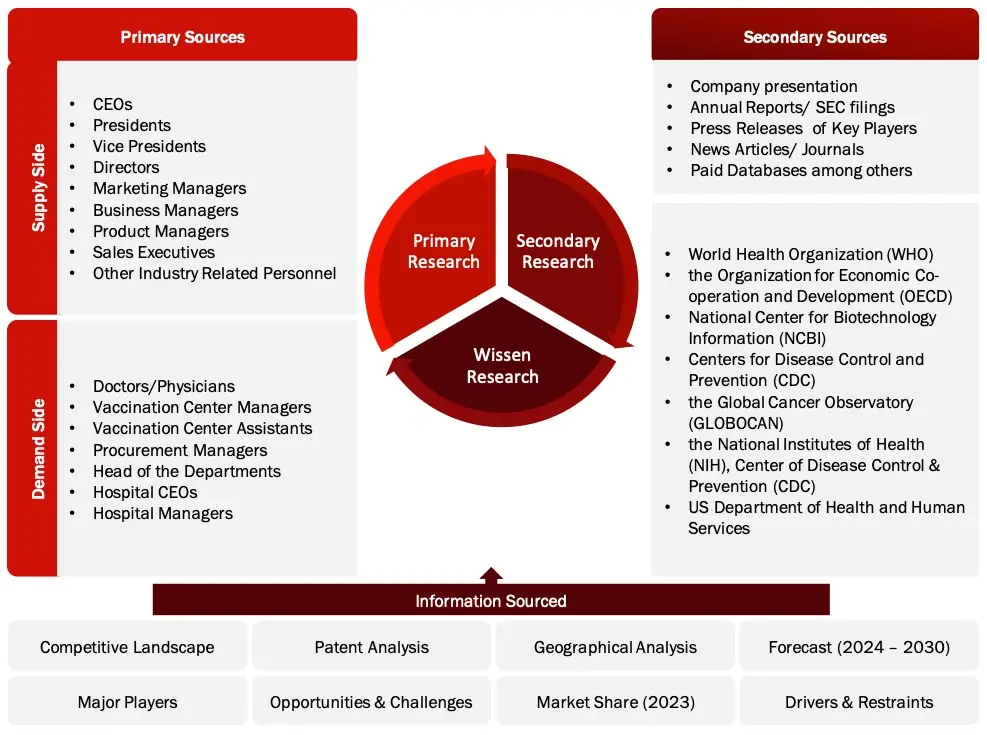

Research Approach

Collecting Secondary Data

The secondary research data collection process involves the usage of secondary sources, directories, databases, annual reports, investor presentations, and SEC filings of companies. Secondary research will be used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the bipolar disorder market. A database of the key industry leaders will also be prepared using secondary research.

Collecting Primary Data

The primary research data will be conducted after acquiring knowledge about the bipolar disorder market scenario through secondary research. A significant number of primary interviews will be conducted with stakeholders from both the demand side and supply side (including various industry experts, such as Directors, Chief X Officers (CXOs), Vice Presidents (VPs) from business development, marketing and product development teams, product manufacturers) across major countries of North America, Europe, Asia Pacific, and Rest of the World. Primary data for this report was collected through questionnaires, emails, and telephonic interviews.

Market Size Estimation

All major manufacturers offering various bipolar disorder will be identified at the global/regional level. Revenue mapping will be done for the major players, which will further be extrapolated to arrive at the global market value of each type of segment. The market value of bipolar disorder market will also split into various segments and sub segments at the region level based on:

Research Design

After arriving at the overall market size-using the market size estimation processes-the market will be split into several segments and sub segment. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub segment, the data triangulation, and market breakdown procedures will be employed, wherever applicable. The data will be triangulated by studying various factors and trends from both the demand and supply sides in the bipolar disorder market industry.

Sources: Company Website, Press Releases, Annual Reports, Paid Data Sources, and Wissen Research Analysis and the above mentioned sources

1. Introduction

1.1 Key Objectives

1.2 Definitions

1.2.1 In Scope

1.2.2 Out of Scope

1.3 Scope of The Report

1.4 Scope Related Limitations

1.5 Key Stakeholders

2. Research Methodology

2.1 Research Approach

2.2 Research Methodology / Design

2.3 Market Sizing Approach

2.3.1 Secondary Research

2.3.2 Primary Research

3. Executive Summary & Premium Content

3.1 Market Outlook

3.2 Key Market Findings

4. Market Overview

4.1 Market Dynamics

4.1.1 Drivers/Opportunities

4.1.2 Restraints/Challenges

4.2 End User Perception

4.3 Need Gap

4.4 Supply Chain / Value Chain Analysis

4.5 Industry Trends

4.6 Regulatory Landscape Analysis

4.7 Porter’s Five Forces Analysis

4.8 Reimbursement Scenario

5. Patent Analysis

5.1 Top Assignees in Bipolar Disorder Market

5.2 Geography Focus of Top Assignees

5.3 Legal Status of Bipolar Disorder Patents

5.4 Assignee Segmentation

5.5 Network Analysis of Top Collaborating Entities in Bipolar Disorder Patent Applications

5.6 Technology Evolution in Bipolar Disorder

5.7 Key Patents in Bipolar Disorder

5.8 Patent Trends and Innovations

5.9 Key Players and Patent Portfolio Analysis

6. Clinical Trial Analysis

6.1 Overview of Bipolar Disorder Clinical Trials

6.2 Analysis by Trial Registration Year

6.3 Analysis by Phase of Development

6.4 Analysis by Number of Patients Enrolled

6.5 Analysis by Status of Trial

6.6 Analysis by Study Design

6.7 Analysis by Intervention Type

6.8 Analysis by Geography

6.9 Analysis by Key Sponsors/Collaborators

7. Bipolar Disorder Market, by Drug Class (2023-2030, USD Million)

7.1 Mood Stabilizer

7.2 Anticonvulsants

7.3 Anti-psychotic Drugs

7.4 Anti-depressant Drugs

7.5 Anti-anxiety Drugs

8. Bipolar Disorder Market, by Type of Agent (2023-2030, USD Million)

8.1 Selective Serotonin Reuptake Inhibitor

8.2 Serotonin Norepinephrine Reuptake Inhibitor

8.3 Tricyclic Antidepressant Drugs

8.4 Monoamine Oxidase Inhibitors

8.5 Benzodiazepines

8.6 Beta Blockers

8.7 Other Drugs Classes

9. Bipolar Disorder Market, by Treatment Type (2023-2030, USD Million)

9.1 Pharmacological Treatments

9.2 Non-Pharmacological Treatments

9.2.1 Cognitive Behavioural Therapy (CBT)

9.2.2 Psychoeducation

9.2.3 Electroconvulsive Therapy (ECT)

10. Bipolar Disorder Market, by Disease Type (2023-2030, USD Million)

10.1 Bipolar I Disorder

10.2 Bipolar II Disorder

10.3 Cyclothymic Disorder

10.4 Unspecified bipolar disorder

11. Bipolar Disorder Market, by Age Group (2023-2030, USD Million)

11.1 Paediatric and Adolescent

11.2 Adult

11.3 Geriatric

12. Bipolar Disorder Market, by Route of Administration (2023-2030, USD Million)

12.1 Oral

12.2 Injectable

12.3 Others (Transdermal Patches, Sublingual)

13. Bipolar Disorder Market, by End Users (2023-2030, USD Million)

13.1 Hospitals and Clinics

13.2 Specialty Centers

13.3 Homecare Settings

14. Bipolar Disorder Market, by Distribution Channels (2023-2030, USD Million)

14.1 Hospitals Pharmacies

14.2 Retail Pharmacies

14.3 Online Pharmacies

14.4 Others

15. Bipolar Disorder Market, by Region (2023-2030, USD Million)

15.1 North America

15.1.1 US

15.1.2 Canada

15.2 Europe

15.2.1 UK

15.2.2 France

15.2.3 Germany

15.2.4 Italy

15.2.5 Spain

15.2.6 Rest of Europe

15.3 Asia Pacific

15.3.1 China

15.3.2 India

15.3.3 Japan

15.3.4 South Korea

15.3.5 Australia and New Zealand

15.3.6 Rest of Asia Pacific

15.4 Middle East and Africa

15.5 Latin America

16. Competitive Analysis

16.1 Key Player’s Footprint Analysis

16.2 Pipeline Analysis of Key Players in the Market

16.3 Market Share Analysis

16.4 Key Brand Analysis

16.5 Regional Snapshot of Key Players

16.6 R&D Expenditure of Key Players

17. Company Profiles2

17.1 AbbVie Inc.

17.1.1 Business Overview

17.1.2 Product Portfolio

17.1.3 Financial Snapshot3

17.1.4 Recent Developments

17.1.5 SWOT Analysis

17.2 Pfizer Inc.

17.3 Bristol-Myers Squibb

17.4 Eli Lilly and Company

17.5 GlaxoSmithKline

17.6 AstraZeneca

17.7 Astellas Pharma Inc.

17.8 Johnson & Johnson Private Limited

17.9 Novartis AG

17.10 Sanofi

17.11 Otsuka Holdings Co. Ltd

17.12 Teva Pharmaceutical Industries Ltd.

18. Appendix

18.1 Industry speak

18.2 Questionnaire

18.3 Available custom work

18.4 Adjacent studies

18.5 Authors

19. References

Key Notes:

Note 1 – Contents in the ToC / market segments are tentative and might change as the research proceeds.

Note 2 – List of companies is not exhaustive and might change during the course of study.

Note 3 – Details on key financials might not be captured in case of unlisted companies.

Note 4 – SWOT analysis will be provided for top 3-5 companies.

The global market for bipolar disorder was valued at approximately USD 4.5 billion in 2023, and is projected to increase to USD 4.6 billion in 2025.

The global bipolar disorder market is anticipated to grow at an annual growth rate of 3% from 2024 to 2030 to reach USD 5.4 billion, by 2030.

The major distribution channels in the bipolar disorder market include Hospitals Pharmacies, Retail Pharmacies, Online Pharmacies, Others. Hospital pharmacies remained the significant holder of distribution channels market share this can be attributed to their ability to manage and dispense complex treatments and medications, such as mood stabilizers and antipsychotics, under professional medical supervision.

Leading players within the bipolar disorder market are GSK plc (UK), Eli Lilly and Company (US), AstraZeneca (UK), Pfizer Inc. (US), Sanofi (France)

The market is moderately consolidated at top, comprising 10 key players with them holding almost 50% of the market, while it remains lightly fragmented at the lower levels, with numerous small and mid-sized companies operating at regional and national level.

© Copyright 2024 – Wissen Research All Rights Reserved.