Subscribe our newsletter

Please Subscribe our news letter and get update.

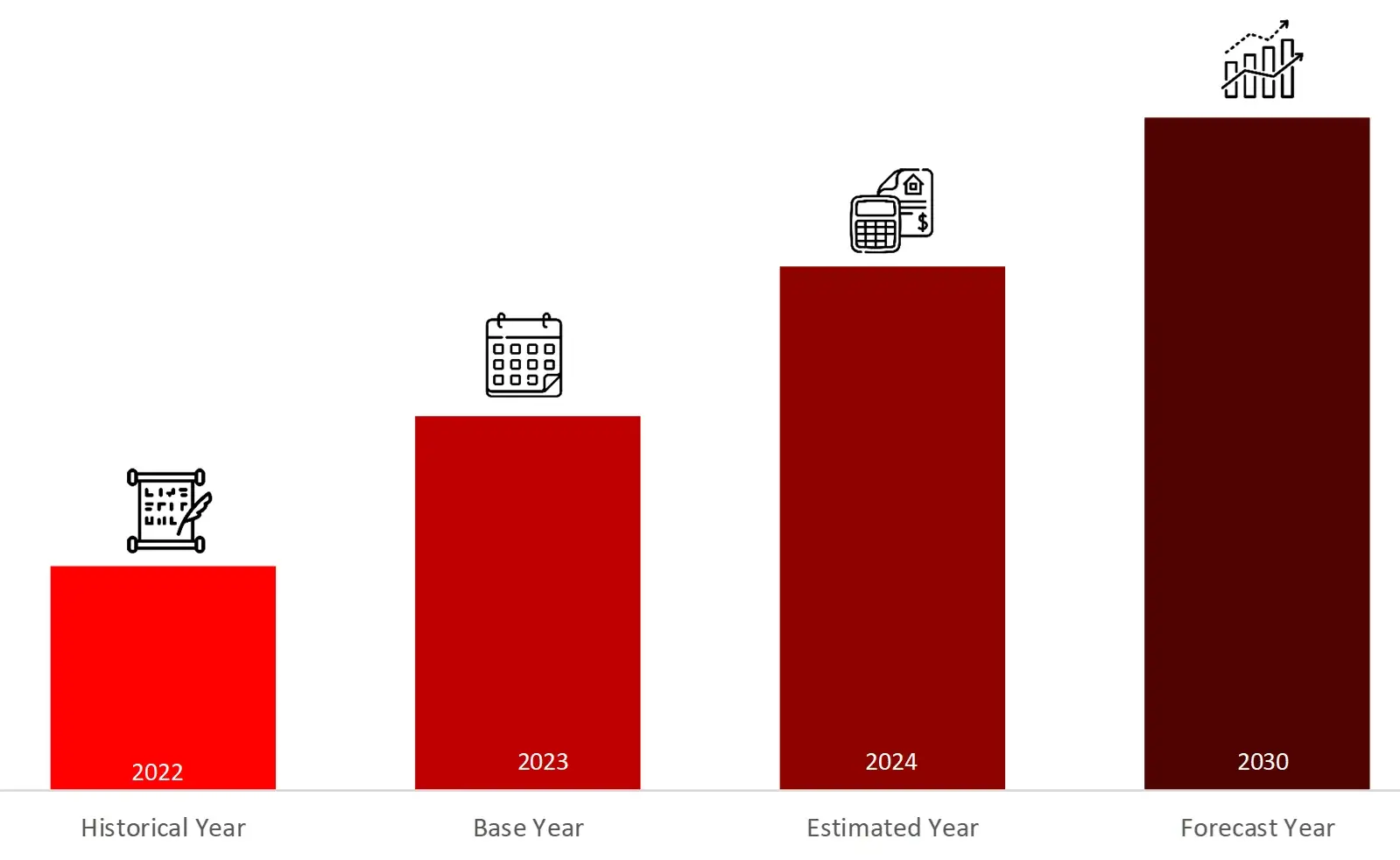

The global diagnostic imaging market is estimated at USD 31.5 billion in 2023 and is projected to reach USD 42.2 billion by 2030, expected to grow at a CAGR of 5% during the forecast period, 2024-2030.

Over the past decade, diagnostic imaging has become a cornerstone of modern healthcare, driving advancements in disease detection, management, and treatment outcomes. The field spans a wide range of technologies, including X-ray, MRI, CT, ultrasound, and nuclear imaging, which enable precise and non-invasive visualization of internal body structures. A 2023 survey by the Radiological Society of North America (RSNA) found that nearly 80% of healthcare providers consider advanced imaging essential for early cancer detection, with over 65% integrating AI-driven solutions to enhance diagnostic accuracy. The market’s growth is propelled by the rising prevalence of chronic diseases, increasing adoption of preventive healthcare measures, and the need for rapid, reliable diagnostic tools to support personalized treatment strategies.

Further, the US with USD 11 billion market in 2023, holds majority share in the global diagnostic imaging market and is likely to remain the leading region growing a CAGR of 5% within this market, during the forecast period.

LUCRATIVE OPPORTUNITIES IN THE DIAGNOSTIC IMAGING MARKET

Strategic Activities Within The Diagnostic Imaging Market

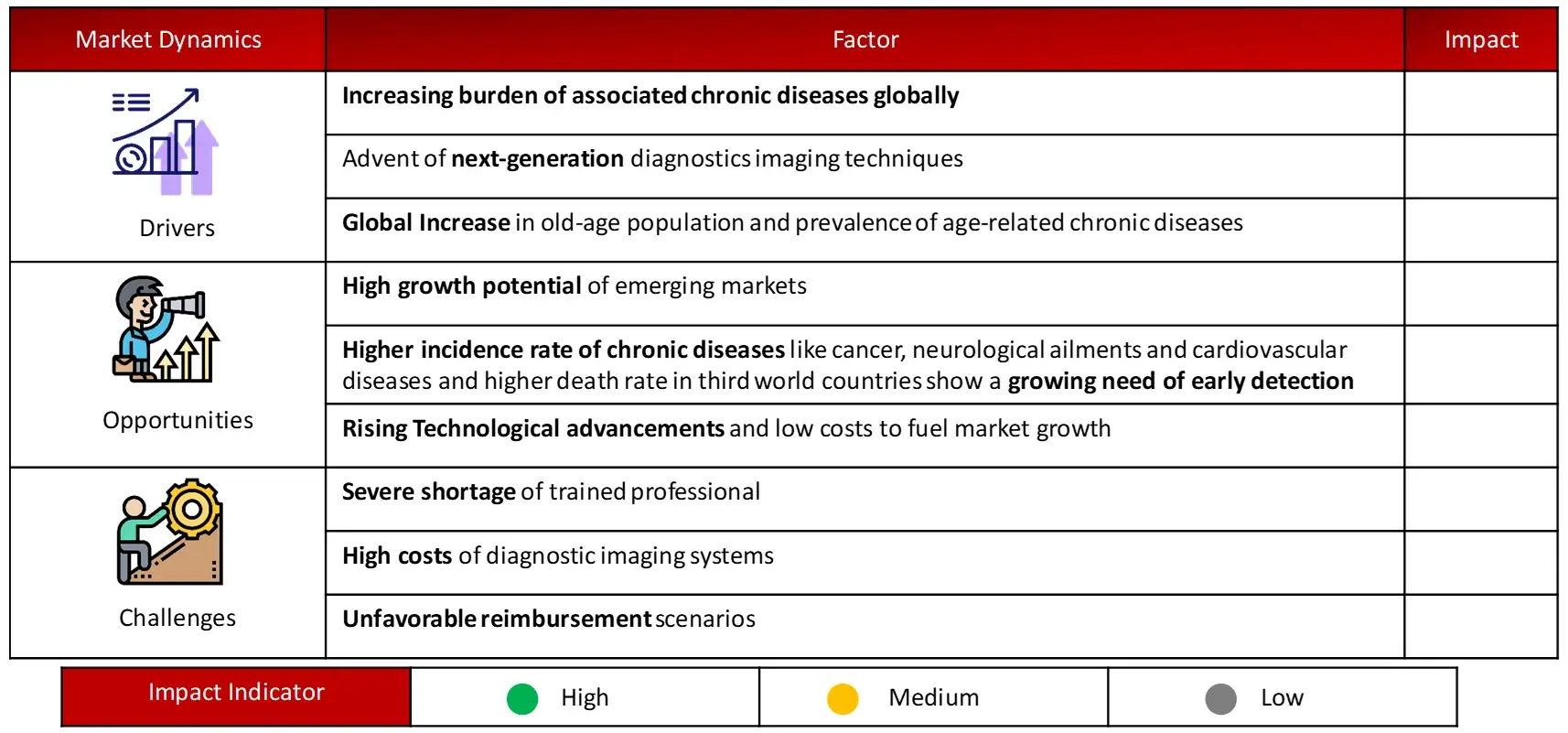

Drivers: Increasing Funding Investments By Public-Private Organizations To Drive The Diagnostic Imaging Market

Increasing funding investments by public-private organizations are significantly driving the diagnostic imaging market. Governments and private entities are recognizing the critical role that advanced imaging technologies play in early disease detection, monitoring, and improving patient outcomes. For instance, the U.S. National Institutes of Health (NIH) has been actively funding research in imaging techniques such as AI-based radiology solutions to enhance diagnostic accuracy. Similarly, private companies like Siemens Healthineers and GE Healthcare are investing in cutting-edge technologies like 3D imaging and portable ultrasound devices, aimed at improving accessibility and efficiency in diagnosis.

The growing collaboration between the public and private sectors is also leading to the development of new diagnostic tools that are more cost-effective and accessible, especially in underserved regions. For example, in India, public-private partnerships have led to the deployment of portable diagnostic imaging units in rural areas, providing high-quality imaging where traditional infrastructure is limited. Additionally, funding from organizations like the Bill & Melinda Gates Foundation has supported diagnostic imaging innovations to combat global health challenges, such as tuberculosis and cancer, in low-resource settings. These investments are accelerating the adoption of advanced imaging solutions, propelling market growth globally.

Opportunities: Contract-Based Radiology Solutions and Mobile Solutions in Diagnostic Imaging Market

Contract-based radiology solutions and mobile diagnostic imaging solutions are emerging as significant opportunities in the market. Contract-based models allow healthcare providers to access advanced imaging services without the high upfront costs of purchasing equipment. For instance, many hospitals are entering long-term partnerships with imaging service providers, such as those offered by companies like RadNet, to provide radiology services on demand. This approach helps healthcare facilities manage costs while still offering high-quality imaging to patients, especially in rural or smaller clinics that may not afford expensive imaging devices.

Mobile diagnostic imaging solutions are also gaining traction, particularly in underserved or remote regions. These portable devices, including mobile CT scanners, ultrasound units, and X-ray machines, offer flexible and cost-effective alternatives to traditional imaging. For example, the use of mobile MRI and CT units in rural parts of Africa and Asia has expanded access to diagnostic services, providing early detection of diseases like tuberculosis and cancer. Additionally, mobile imaging services have proven crucial in disaster-stricken areas, where temporary infrastructure is needed to support medical care. As healthcare continues to shift towards more flexible and accessible solutions, contract-based and mobile diagnostic imaging services present promising avenues for growth in the market.

Challenges: Rising adoption of refurbished diagnostic imaging systems in Diagnostic Imaging Market

Rising adoption of refurbished diagnostic imaging systems presents both a challenge and an opportunity in the diagnostic imaging market. While refurbished equipment provides a cost-effective solution for healthcare providers, especially in emerging economies and smaller clinics, it can compromise the quality of patient care and diagnostic accuracy. Refurbished systems, though more affordable, may not incorporate the latest technological advancements, such as AI-enhanced imaging or improved image resolution, limiting their effectiveness in detecting complex conditions like cancer or cardiovascular diseases.

Moreover, there are concerns about the reliability and longevity of refurbished equipment, which may result in higher maintenance costs and potential downtime. For example, the growing use of refurbished MRI and CT scanners in developing countries may help increase access to imaging services, but the potential for frequent breakdowns and outdated technology can affect patient outcomes and increase healthcare costs in the long term.

Additionally, regulatory concerns around the quality and safety standards of refurbished equipment can create challenges for healthcare providers in maintaining compliance with international standards. This makes it crucial for the industry to balance affordability with the need for high-quality, cutting-edge diagnostic tools to ensure the best patient care outcomes.

The diagnostic imaging market report offers information on the latest advancements in the industry, as well as product portfolio analysis, supply chain/value chain analysis, market share, and the effects of localized and domestic players. It also analyses potential revenue opportunities and changes in market regulations, as well as market size, category market growth, application dominance, product approvals, product launches, geographic expansions, and technological innovations. For an analyst brief and other information on the diagnostic imaging market, get in touch with Wissen Research. Our staff can assist you in making well-informed decisions that will lead to market expansion.

Magnetic Resonance Imaging (MRI) Segment Dominated the Diagnostic Imaging Market by Product Type in 2023

In 2023, Magnetic Resonance Imaging (MRI) emerged as the leading segment in the diagnostic imaging market by product type, driven by its superior imaging capabilities and increasing applications in neurology, oncology, and musculoskeletal diagnostics. The segment’s growth was fueled by advancements in MRI technology, such as 3T and open MRI systems, which offer higher image resolution and improved patient comfort. For instance, Siemens Healthineers reported a significant increase in demand for its MAGNETOM Free.Max, a low-field MRI system designed to enhance accessibility and reduce costs, particularly in emerging markets. Additionally, the growing prevalence of neurological disorders and cancer has accelerated the adoption of MRI systems globally, solidifying its dominance in the market.

Orthopaedics Segment Accounted for The Majority Share in The Diagnostic Imaging Market by Application in 2023

Orthopaedics segment accounted for the largest share of the diagnostic imaging market by application in 2023, driven by the growing prevalence of musculoskeletal disorders and sports-related injuries. According to the World Health Organization (WHO), musculoskeletal conditions, including osteoarthritis and fractures, are among the leading contributors to disability worldwide, fueling the demand for advanced imaging solutions like X-rays, MRI, and CT scans. The adoption of high-resolution imaging systems, such as GE Healthcare’s OEC 3D surgical imaging systems, has been particularly impactful in supporting complex orthopedic surgeries and pre-surgical planning. Additionally, the rise in the aging population, prone to conditions such as osteoporosis, has further solidified the segment’s dominance in the diagnostic imaging market.

North America Held the Largest Market Share in Diagnostic Imaging Market in 2023

Diagnostic imaging market analysis encompassed a detailed evaluation of five key regions: North America, Europe, Asia-Pacific, Middle East & Africa, and Latin America. These regions were assessed based on healthcare infrastructure, regulatory frameworks, technological advancements, and market trends. North America retained the largest market share in diagnostic imaging in 2023, owing to its advanced healthcare infrastructure, early adoption of innovative imaging technologies, and the strong presence of leading market players like GE Healthcare, Siemens Healthineers, and Philips.

The region’s dominance was further supported by high investments in research and development and a growing focus on AI-enhanced imaging solutions, which are being integrated into clinical workflows for improved diagnostic accuracy. Additionally, the rising prevalence of chronic diseases such as cancer and cardiovascular conditions in the U.S. and Canada continues to drive demand for high-quality imaging modalities.

Meanwhile, the Asia-Pacific region is projected to witness the fastest growth in the diagnostic imaging market during the forecast period, propelled by increasing investments in healthcare infrastructure, a rising geriatric population, and supportive government initiatives to expand access to advanced diagnostic technologies.

Prominant Players Within Diagnostic Imaging Market

Major players operating in diagnostic imaging market are:

Other major players in diagnostic imaging market include(s):

Sternmed GMBH (Germany),Konica Minolta, Inc. (Japan),Allengers Medical Systems Ltd. (India),NP JSC Amico (Russia),Neusoft Medical Systems Co., Ltd. (China),Trivitron Healthcare (India),Analogic Corporation (US),Cmr Naviscan (US),Clarius (Canada),Time Medical Systems (China),Aspect Imaging Ltd. (US)

Sources: Secondary Research

Note: Above mention is non-exhaustive list of products offered by leading players

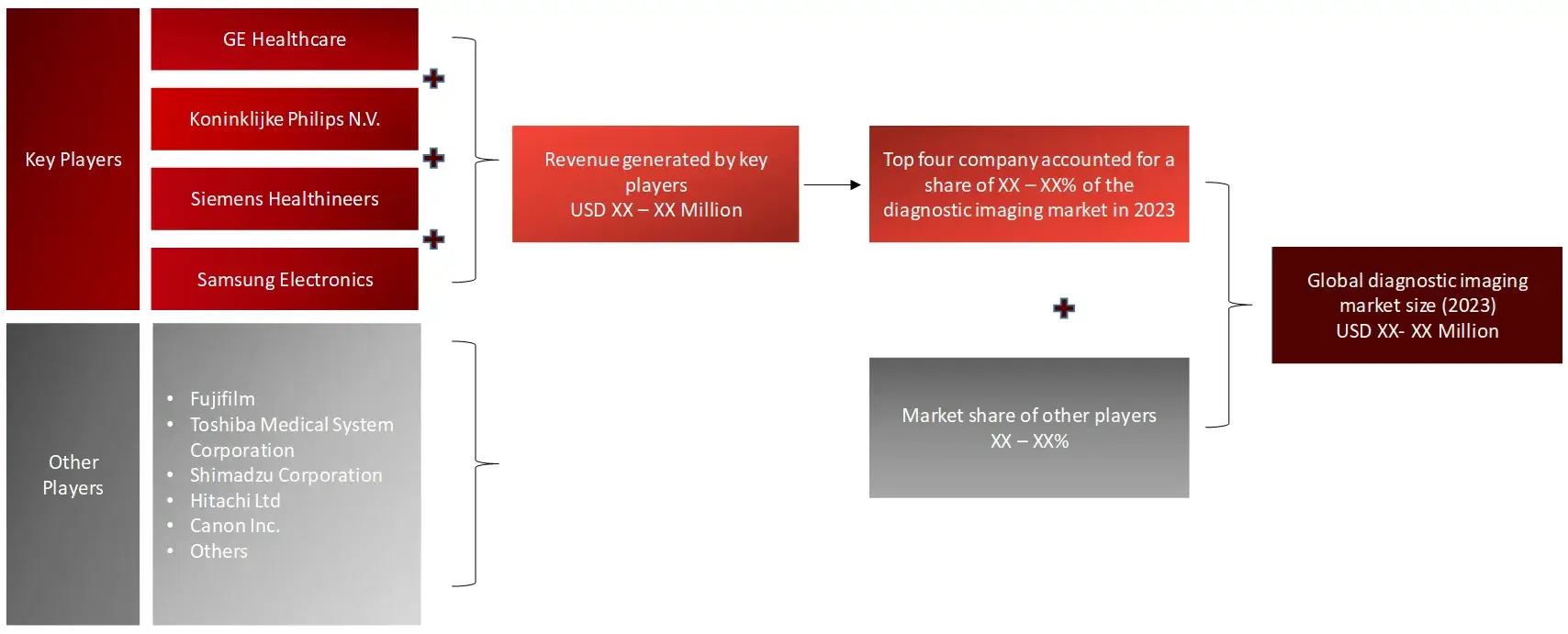

The overall diagnostic imaging market is consolidated with five-six key players holding majority share of the total diagnostic imaging market.

Sources: Secondary Research

Note: 1. 3D APT (Amide Proton Transfer), it uses the presence of endogenous cellular proteins to produce an MR signal that directly correlates with cell proliferation, a marker of tumoral activity

Primary Insights From Key Opinion Leaders

Sources: Primary Research and Wissen Research Analysis.

Note: Above mention is non-exhaustive samples of the primary insights.

Particulars | Details |

Report | Diagnostic Imaging Market |

Forecast Period | 2024-2030 |

Base Year | 2023 |

Format | |

Estimated Market Size (2023) | USD 31.5 Billion |

CAGR (2024-2030) | 5% |

Number of Pages | 170 |

Number of Tables | 161 |

Number of Figures | 33 |

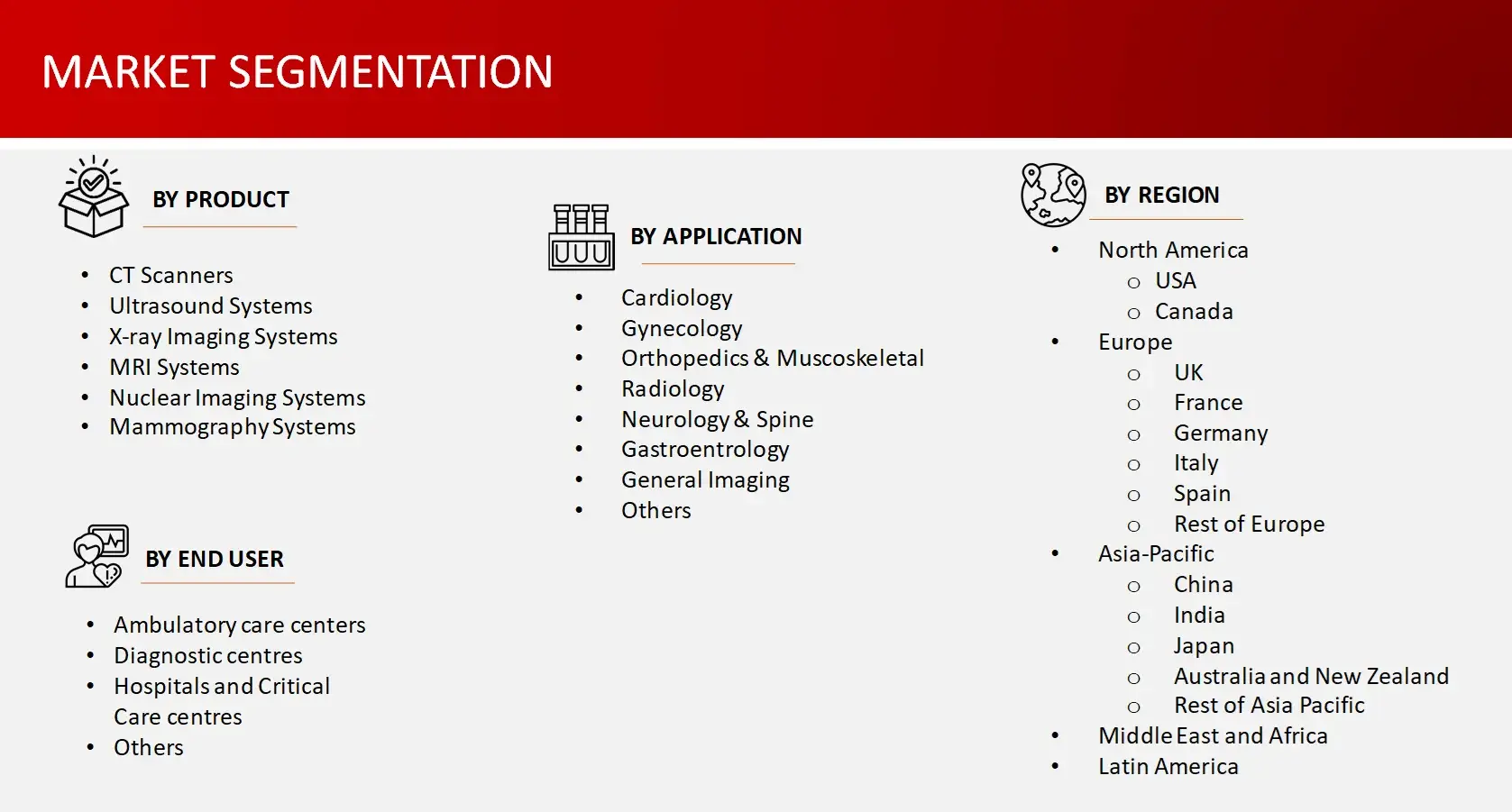

Key Segments | Diagnostic Imaging Market Product Outlook (CT Scanners, Ultrasound Systems, POC Ultrasound systems, X-Ray Imaging Systems, MRI Systems, Nuclear Imaging Systems and Mammography Systems)

Diagnostic Imaging Market Application Outlook (Cardiology, Oncology, Neurology, Orthopaedics, Gastroenterology, Gynaecology, Other Applications) Note: Other Applications include Breast screening, etc.) Diagnostic Imaging Market End User Outlook (Hospitals and Clinics, Diagnostic Imaging Centres, Ambulatory Care Centres) |

Regions Covered |

|

Key Players Covered (Majority Share Holders) | Koninklijke Philips N.V. (Netherlands), Mindray Medical International Limited (China), Fujifilm Corporation (Japan), GE Healthcare (US), Samsung Medison Co., Ltd (Korea), Hologic, Inc. (US), Canon Inc. (Japan), Siemens Healthineers AG (Germany), Shimadzu Corporation (China), Revvity, Inc. (US). |

Other Players Covered | Sternmed GMBH (Germany), Konica Minolta, Inc. (Japan), Allengers Medical Systems Ltd. (India), NP JSC Amico (Russia), Neusoft Medical Systems Co., Ltd. (China), Trivitron Healthcare (India), Analogic Corporation (US), Cmr Naviscan (US), Clarius (Canada), Time Medical Systems (China), Aspect Imaging Ltd. (US). |

Introduction

Market Definition

Diagnostic imaging, a cornerstone of modern medicine, includes various techniques that provides crucial insights into the body’s internal structures to help figure out the causes of an illness or injury and hence, give a diagnosis.

FIGURE: DIAGNOSTIC IMAGING MARKET SEGMENT

FIGURE: YEARS FRAMEWORK CONSIDERED IN THE STUDY

Key Stakeholders

Key objectives of the Study

Research Methodology

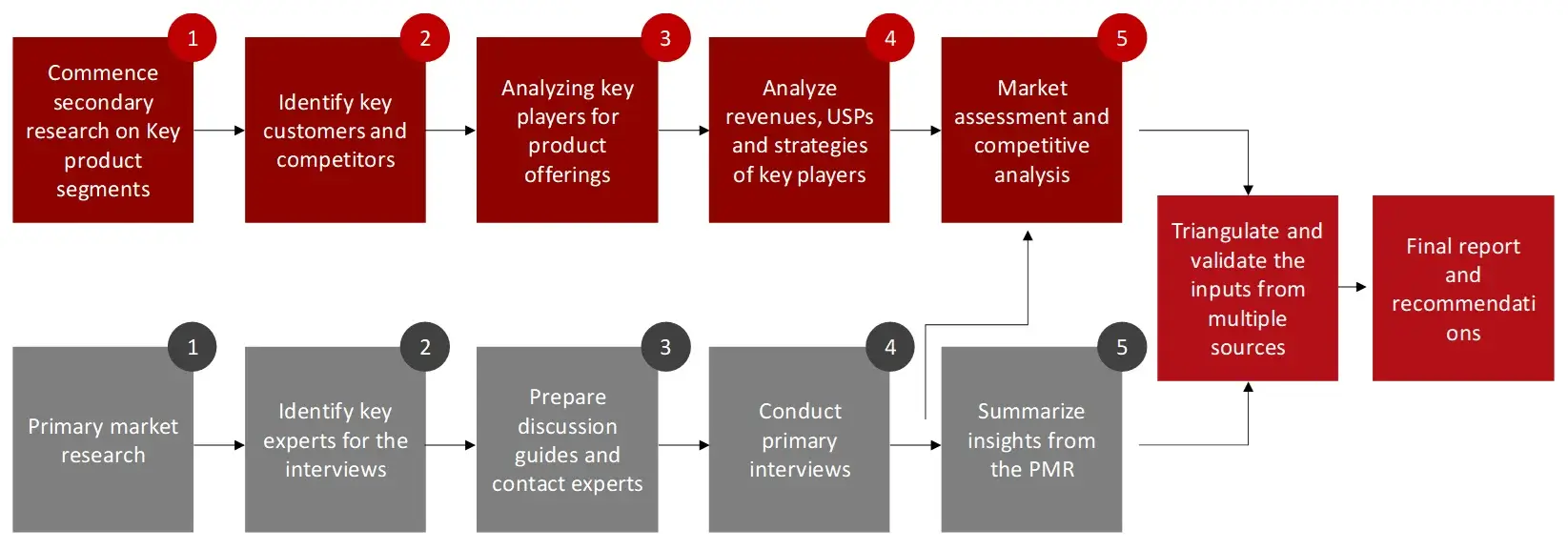

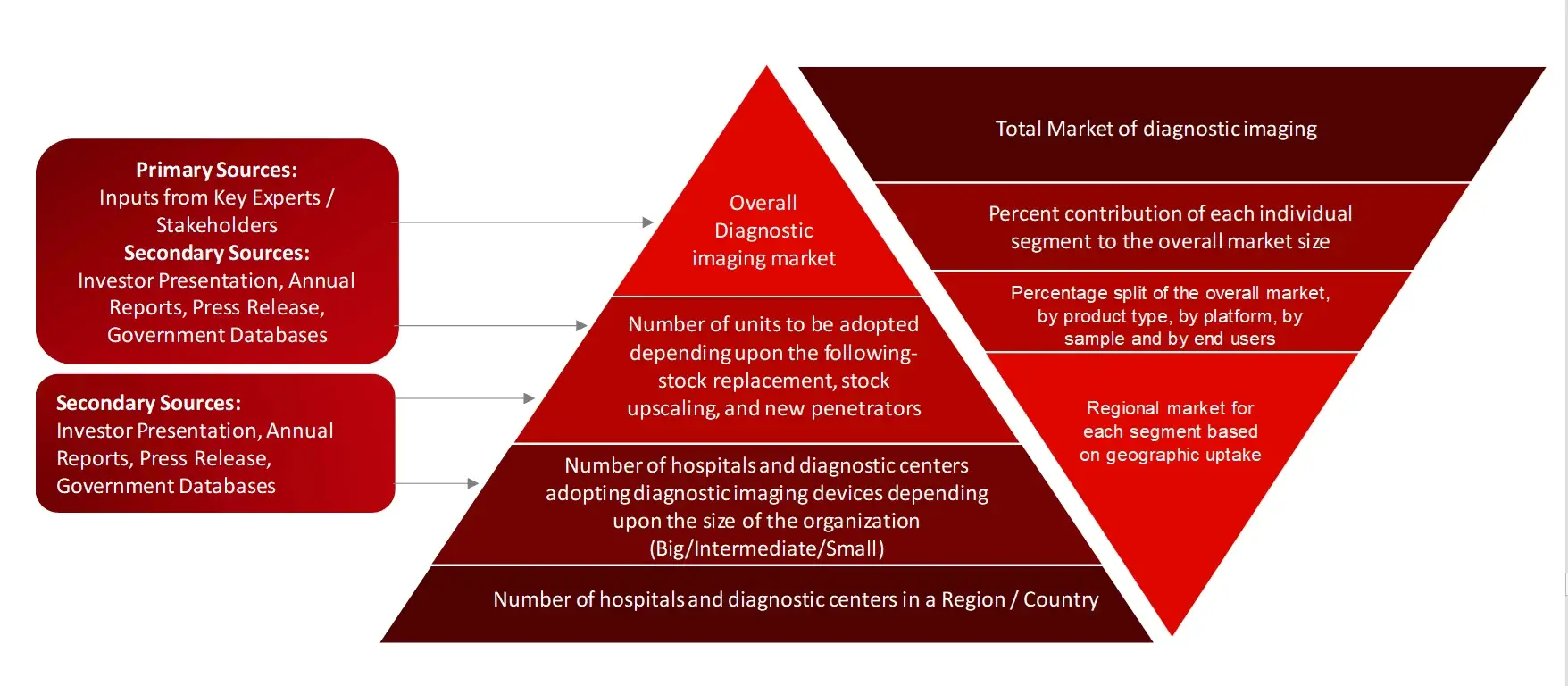

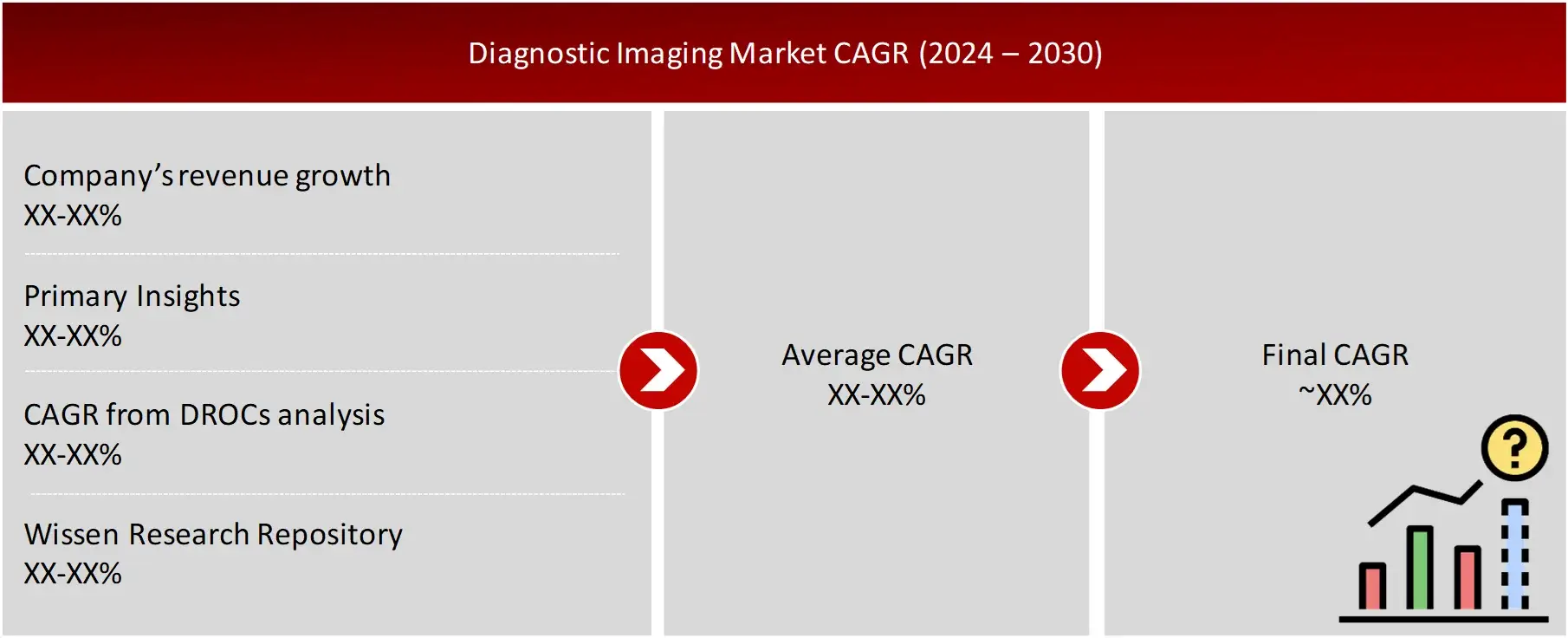

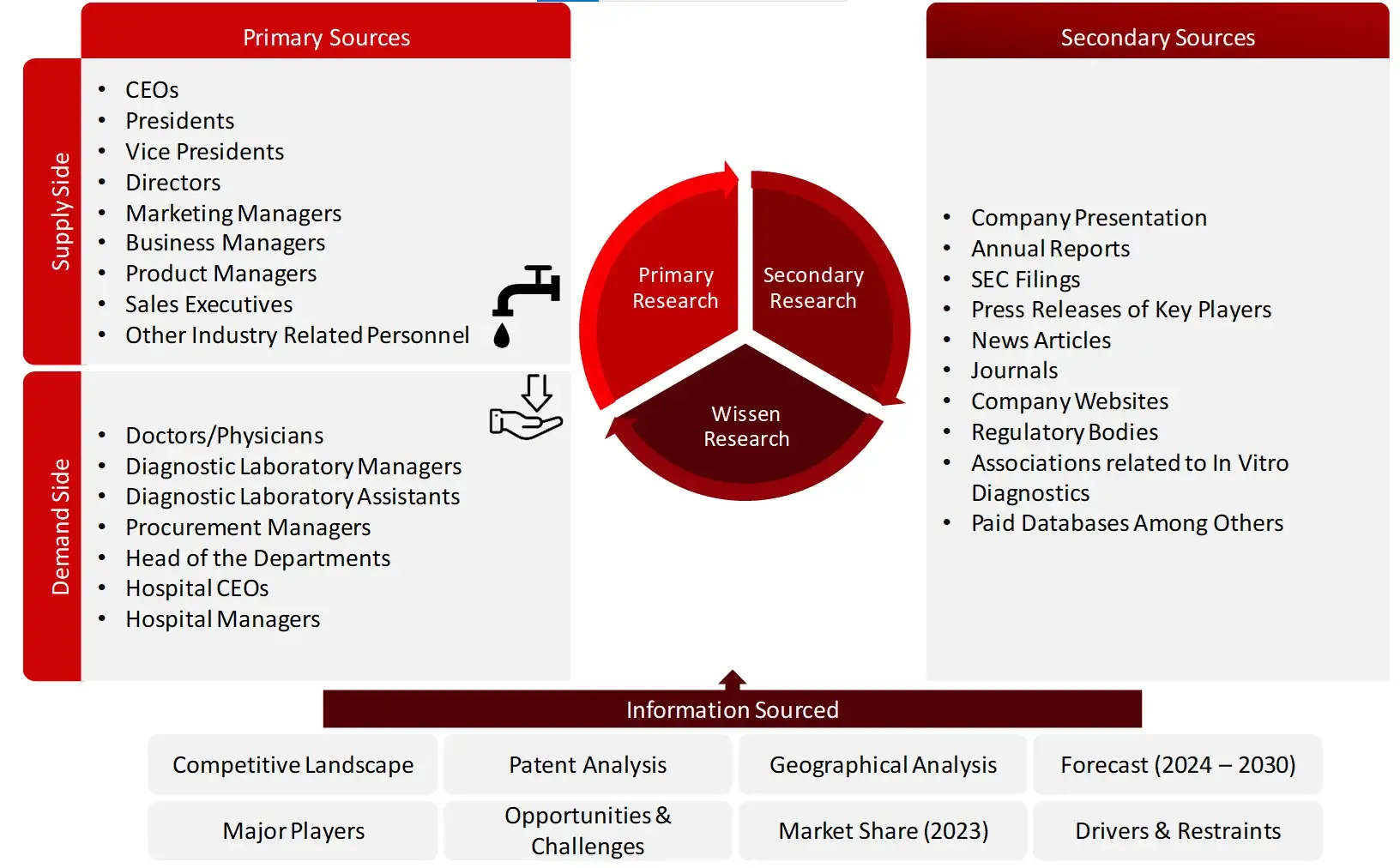

The objective of the study is to analyze the key market dynamics such as drivers, opportunities, challenges, restraints, and key player strategies. To track company developments such as product launches and approvals, expansions, and collaborations of the leading players, the competitive landscape of the diagnostic imaging market to analyze market players on various parameters within the broad categories of business and product strategy. Top-down and bottom-up approaches will be used to estimate the market size. To estimate the market size of segments and sub segments the market breakdown and data triangulation will be used.

FIGURE: RESEARCH DESIGN

Research Approach

Collecting Secondary Data

The secondary research data collection process involves the usage of secondary sources, directories, databases, annual reports, investor presentations, and SEC filings of companies. Secondary research will be used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the diagnostic imaging market. A database of the key industry leaders will also be prepared using secondary research.

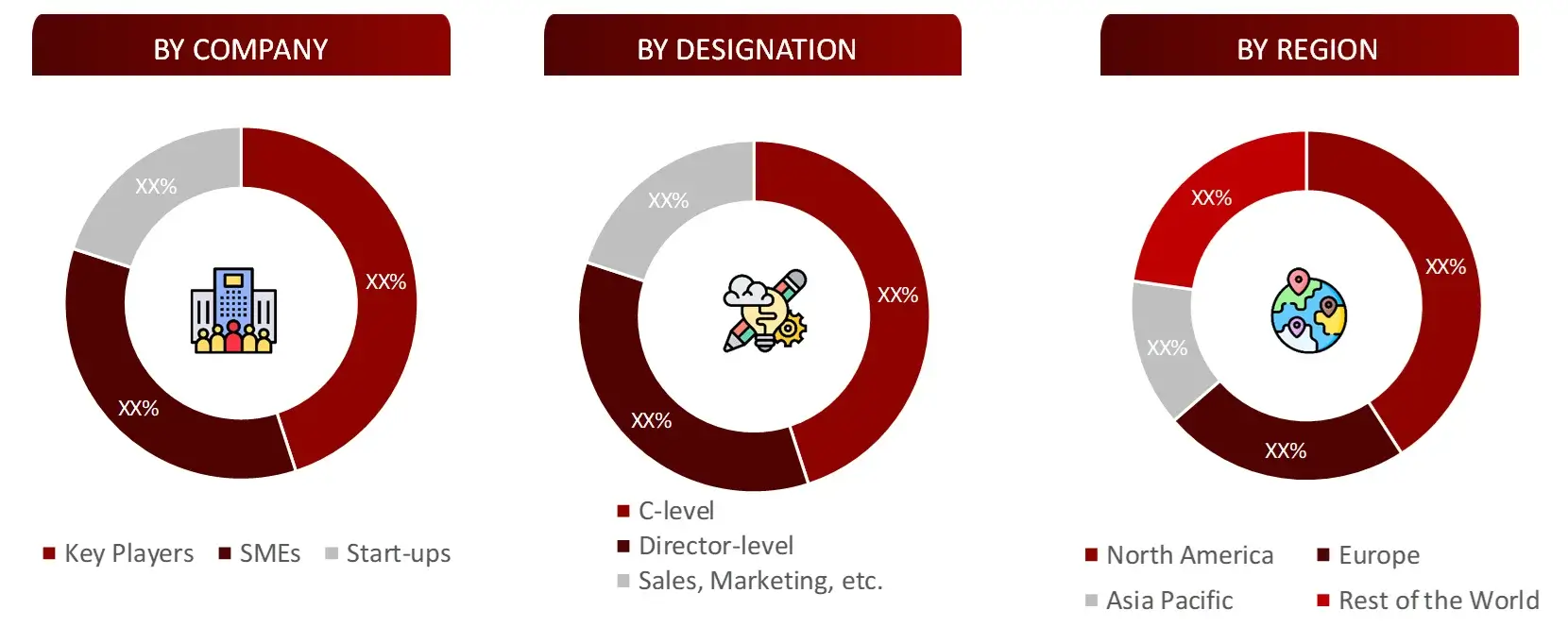

Collecting Primary Data

The primary research data will be conducted after acquiring knowledge about the diagnostic imaging market scenario through secondary research. A significant number of primary interviews will be conducted with stakeholders from both the demand side and supply side (including various industry experts, such as Directors, Chief X Officers (CXOs), Vice Presidents (VPs) from business development, marketing and product development teams, product manufacturers) across major countries of North America, Europe, Asia Pacific, and Rest of the World. Primary data for this report was collected through questionnaires, emails, and telephonic interviews.

FIGURE: BREAKDOWN OF PRIMARY INTERVIEWS FROM SUPPLY SIDE

FIGURE: BREAKDOWN OF PRIMARY INTERVIEWS FROM DEMAND SIDE

FIGURE: PROPOSED PRIMARY PARTICIPANTS FROM DEMAND AND SUPPLY SIDE

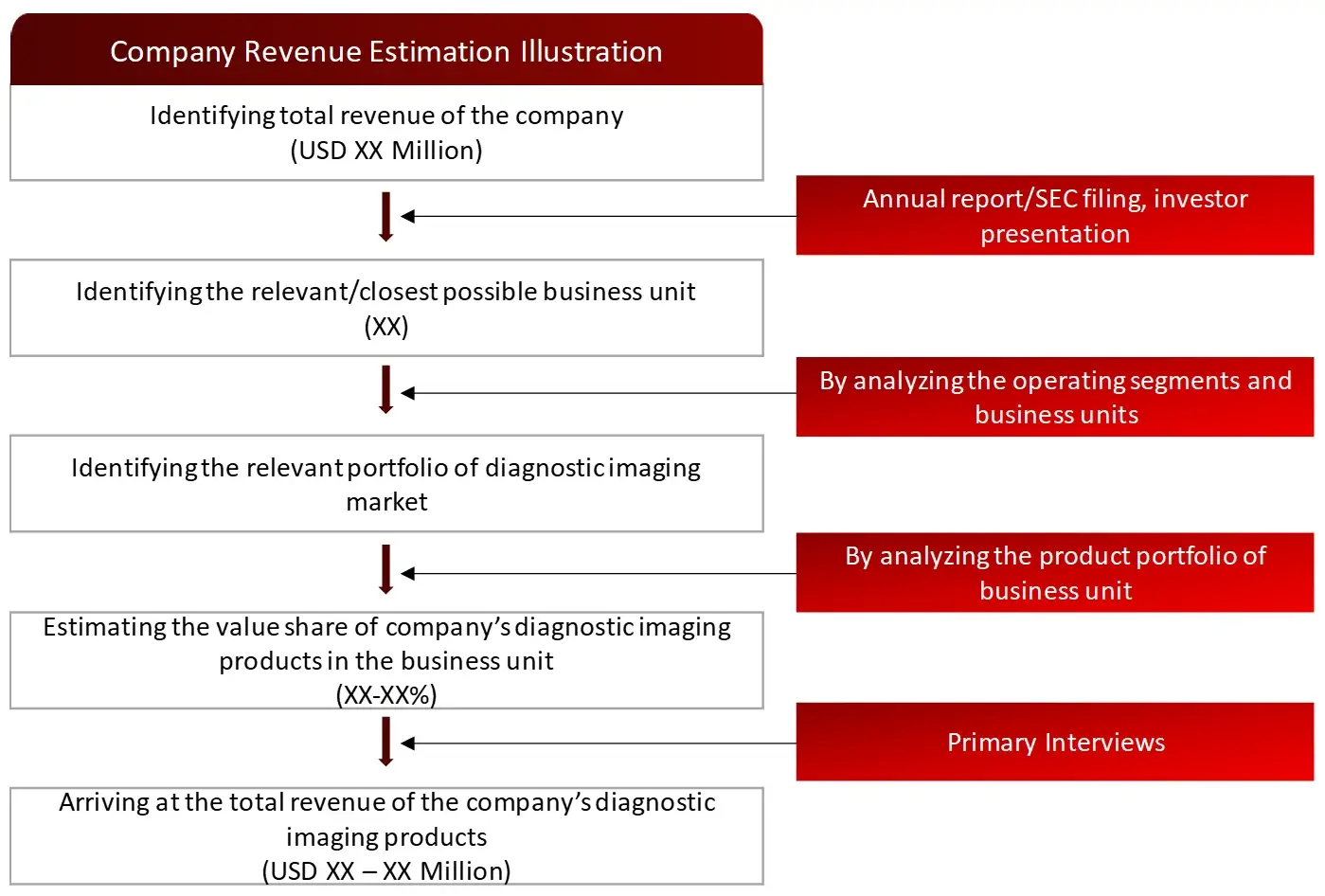

Market Size Estimation

All major manufacturers offering various diagnostic imaging systems will be identified at the global/regional level. Revenue mapping will be done for the major players, which will further be extrapolated to arrive at the global market value of each type of segment. The market value of diagnostic imaging market will also split into various segments and sub segments at the region level based on:

FIGURE: REVENUE MAPPING BY COMPANY (ILLUSTRATION)

FIGURE: REVENUE SHARE ANALYSIS OF KEY PLAYERS (SUPPLY SIDE)

FIGURE: MARKET SIZE ESTIMATION TOP-DOWN AND BOTTOM-UP APPROACH

FIGURE: ANALYSIS OF DROCS FOR GROWTH FORECAST

FIGURE: GROWTH FORECAST ANALYSIS UTILIZING MULTIPLE PARAMETERS

Research Design

After arriving at the overall market size-using the market size estimation processes-the market will be split into several segments and sub segment. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub segment, the data triangulation, and market breakdown procedures will be employed, wherever applicable. The data will be triangulated by studying various factors and trends from both the demand and supply sides in the diagnostic imaging market industry.

1. Introduction

1.1 Key Objectives

1.2 Definitions

1.2.1 In Scope

1.2.2 Out of Scope

1.3 Scope of the Report

1.4 Scope Related Limitations

1.5 Key Stakeholders

2. Research Methodology

2.1 Research Approach

2.2 Research Methodology / Design

2.3 Market Sizing Approach

2.3.1 Secondary Research

2.3.2 Primary Research

3. Executive Summary & Premium Content

3.1 Global Market Outlook

3.2 Key Market Findings

4. Market Overview

4.1 Market Dynamics

4.1.1 Drivers/Opportunities

4.1.2 Restraints/Challenges

4.2 End User Perception

4.3 Need Gap

4.4 Supply Chain / Value Chain Analysis

4.5 Industry Trends

4.6 Porter’s Five Forces Analysis

4.7 Pricing Analysis

4.8 Reimbursement Scenario

5. Patent Analysis

5.1 Top Assignees in Diagnostic Imaging Market

5.2 Geography Focus of Top Assignees

5.3 Legal Status of Diagnostic Imaging Patents

5.4 Assignee Segmentation of Diagnostic Imaging

5.5 Network Analysis of Top Collaborating Entities in Diagnostic Imaging Patent Applications

5.6 Technology Evolution in Diagnostic Imaging Market

5.7 Key Patents in Diagnostic Imaging

5.8 Patent Trends and Innovations

5.9 Key Players and Patent Portfolio Analysis

6. Diagnostic Imaging Market, by Product (2023-2030, USD Million)

6.1 CT Scanners

6.1.1 Conventional CT Scanners

6.1.2 Cone-Beam CT Scanners

6.2 Ultrasound Systems

6.2.1 Ultrasound Systems Market by Technology

6.2.1.1 2D

6.2.1.2 3D and 4D

6.2.1.3 Doppler Ultrasound Systems

6.1.2.4 Contrast-enhanced Ultrasound systems

6.2.2 Ultrasound systems by Portability

6.2.2.1 Trolley/Cart Based Ultrasound Systems

6.2.2.2 Compact/Portable Ultrasound Systems

6.3 POC Ultrasound systems

6.4 X-Ray Imaging Systems

6.4.1 X-Ray Imaging Systems Market by Type

6.4.1.1 Digital X-ray Imaging Systems

6.4.1.2 Analog X-ray Imaging Systems

6.4.2 X-Ray Imaging Systems Market by Portability

6.4.2.1 Stationary X-Ray Imaging Systems

6.4.2.2 Portable X-Ray Imaging Systems

6.5 MRI Systems

6.5.1 MRI Systems Market by Architecture

6.5.1.1 Closed MRI Systems

6.5.1.2 Open MRI Systems

6.5.2 MRI Systems Market by Field Strength

6.5.2.1 High to Very High Field MRI Systems

6.5.2.2 Low to Mid Field MRI Systems

6.5.2.3 Ultra High Field MRI Systems

6.6 Nuclear Imaging Systems

6.6.1 PET Systems

6.6.2 SPECT

6.6.3 Hybrid SPECT

6.7 Mammography Systems

7. Diagnostic Imaging Market, by Application (2023-2030, USD Million)

7.1 Cardiology

7.2 Oncology

7.3 Neurology

7.4 Orthopaedics

7.5 Gastroenterology

7.6 Gynaecology

7.7 Other Applications

8. Diagnostic Imaging Market, by End Users (2023-2030, USD Million)

8.1 Hospitals and Clinics

8.2 Diagnostic Imaging Centers

8.3 Ambulatory Care Centers

8.4 Others

9. Diagnostic Imaging Market, by Region (2023-2030, USD Million)

9.1 North America

9.1.1 US

9.1.2 Canada

9.2 Europe

9.2.1 UK

9.2.2 France

9.2.3 Germany

9.2.4 Italy

9.2.5 Spain

9.2.6 Rest of Europe

9.3 Asia-Pacific

9.3.1 China

9.3.2 India

9.3.3 Japan

9.3.4 Australia and New Zealand

9.3.5 Rest of Asia Pacific

9.3.6 South Korea

9.4 Middle East and Africa

9.5 Latin America

10. Competitive Analysis of Diagnostic Imaging Market

10.1 Key Players Footprint Analysis

10.2 Market Share Analysis

10.3 Key Brand Analysis

10.4 Regional Snapshot of Key Players

10.5 R&D Expenditure of Key Players

11. Diagnostic Imaging Market Company Profiles2 of Key Players

11.1 Koninklijke Philips N.V. (Netherlands)

11.1.1 Business Overview

11.1.2 Product Portfolio

11.1.3 Financial Snapshot3

11.1.4 Recent Developments

11.1.5 SWOT Analysis

11.2 Mindray Medical International Limited (China)

11.3 GE Healthcare (US)

11.4 Siemens Healthineers AG (Germany)

11.5 Hologic, Inc. (US)

11.6 Fujifilm Corporation (Japan)

11.7 Shimadzu Corporation (China)

11.8 Samsung Medison Co., Ltd (Korea)

11.9 Canon Inc. (Japan)

11.10 Revvity, Inc (US)

11.11 Others Key Players

11.11.1 Sternmed GMBH

11.11.2 Konica Minolta, Inc.

11.11.3 Allengers Medical Systems Ltd.

11.11.4 NP JSC Amico

11.11.5 Neusoft Medical Systems Co., Ltd.

11.11.6 Trivitron Healthcare

11.11.7 Analogic Corporation

11.11.8 Cmr Naviscan

11.11.9 Clarius

11.11.10 Time Medical Systems

11.11.11 Aspect Imaging Ltd.

12. Conclusion

12.1 Industry Speak

12.2 Questionnaire

12.3 Available Custom Work

12.4 Adjacent Studies

12.5 Authors

13. References

Key Notes:

The global market for diagnostic imaging was valued at approximately USD 31.5 billion in 2023, and is projected to increase to USD 33 billion in 2025.

The global diagnostic imaging market is anticipated to grow at an annual growth rate of 5% from 2024 to 2030 to reach USD 42.2 billion, by 2030.

The major end-users in the diagnostic imaging market include hospitals, clinics, diagnostic imaging centres, and ambulatory facilities, with hospitals still being a significant segment due advanced infrastructure, higher patient intake, and ability to invest in cutting-edge imaging technologies for comprehensive diagnosis and treatment, holding nearly 40% of the market share.

Leading players within the diagnostic imaging market are Koninklijke Philips N.V. (Netherlands), Samsung Medison Co., Ltd (Korea), GE Healthcare (US), Siemens Healthineers AG (Germany) and Fujifilm Corporation (Japan).

The market is highly consolidated at top, comprising 10 key players with them holding almost 70% of the market, while it remains lightly fragmented at the lower levels, with numerous small and mid-sized companies operating at regional and national level.

The primary application areas within the diagnostic imaging market encompass cardiology, oncology, neurology, orthopaedics, gastroenterology, gynaecology, other applications. Notably, the demand in the MRI and CT scan category is anticipated to boost the orthopaedics and cardiology segment’s growth, experiencing a CAGR of >5% between 2024 and 2030.

Please Subscribe our news letter and get update.

© Copyright 2024 – Wissen Research All Rights Reserved.