Digital Diabetes Management Market by Product & Services (Devices, Application, Data Management Software & Platforms, Services), Devices Type (Handheld, Wearable), End User (Self/Homecare, Diagnostic Centers, Hospitals & Specialty Diabetes Clinics, Academic & Research Institutes), Regions, Key Players – Global Forecast to 2030

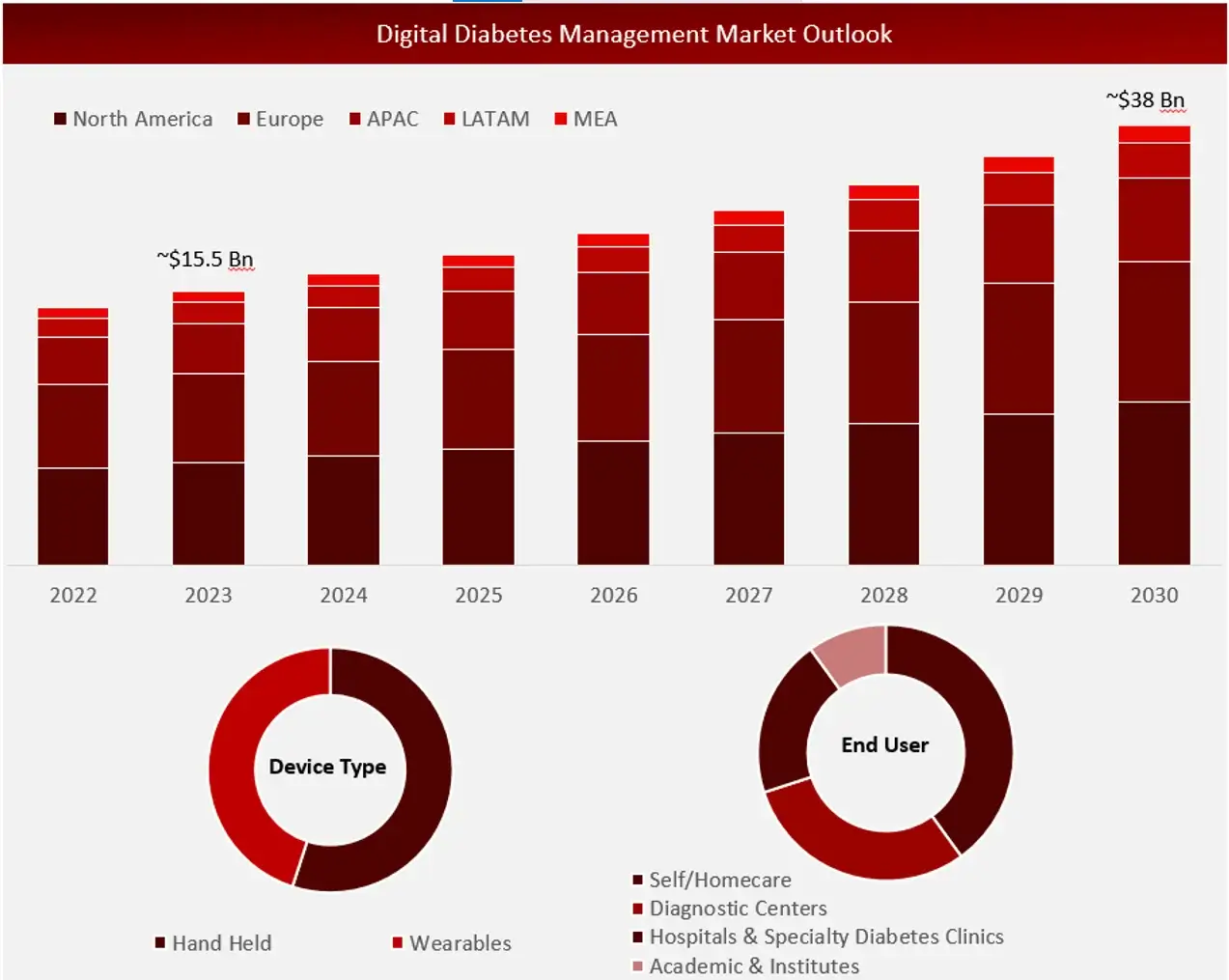

Wissen Research analyzes that the digital diabetes management market is estimated at ~USD 15.5 billion in 2023 and is projected to reach ~USD 38 billion by 2030, expected to grow at a CAGR of ~14% during the forecast period, 2023-2030.

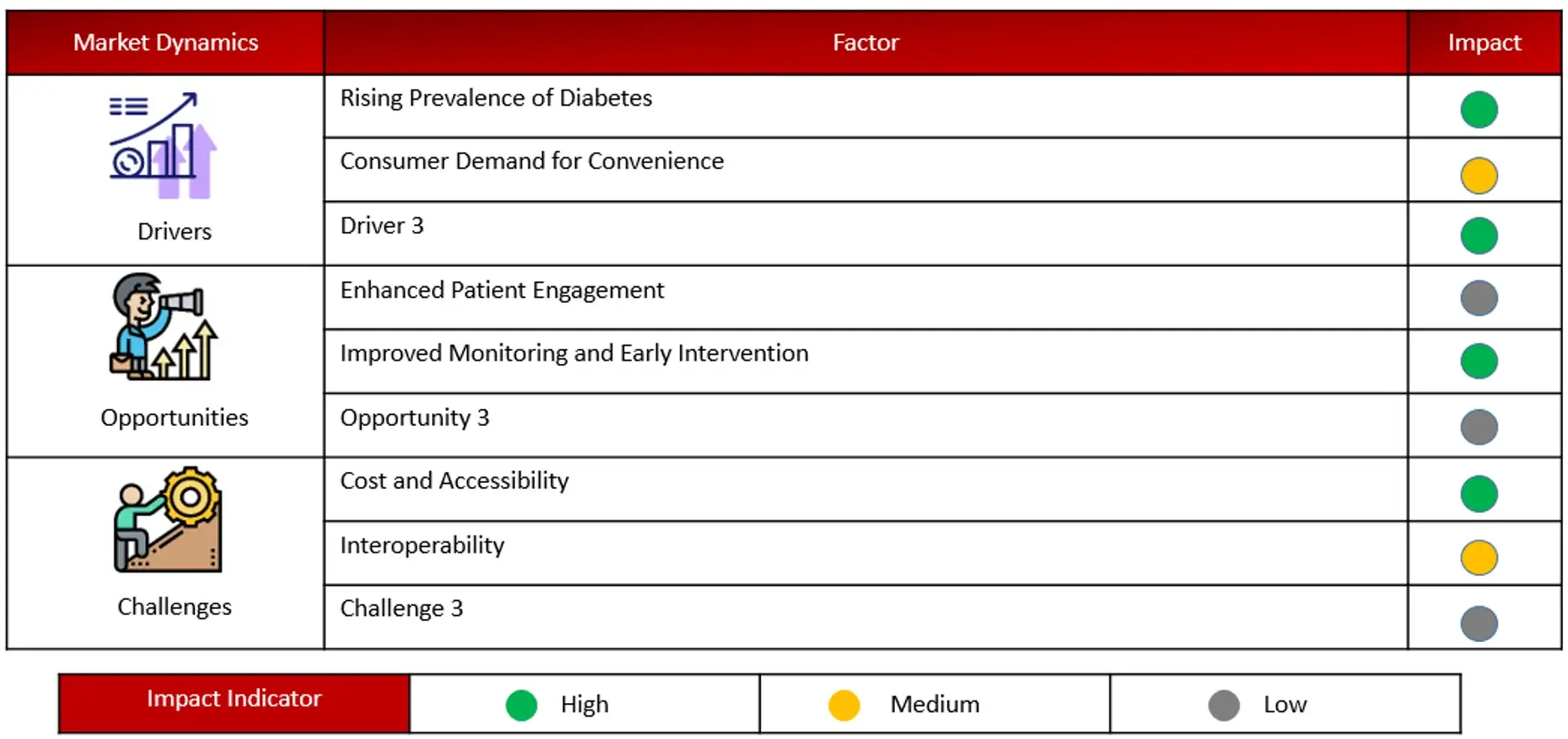

The new research study provides a comprehensive analysis of the market, covering industry trends, pricing strategies, patent developments, conference and webinar materials, key stakeholders, and buying behavior. The rising prevalence of diabetes has led to an increased demand for more effective diabetes care solutions. Technological advancements have enabled the introduction of highly adaptable solutions, further boosting market growth. Additionally, the growing use of connected devices and apps, along with the adoption of cloud-based enterprise solutions, are significant factors driving the market. However, growth during the forecast period may be limited by challenges such as high device costs, lack of reimbursement in developing countries, and continued preference for traditional diabetes management devices.

Driving Factor: Emergence of Artificial Intelligence in Diabetes Care Devices

A rapidly expanding field is Artificial intelligence (AI) and its applications in diabetes care have transformed how this chronic condition is diagnosed and managed. Machine learning principles have been employed to develop algorithms that support predictive models for assessing the risk of developing diabetes or its related complications. Technological advancements have also improved the efficient use of resources in diabetes management. These intelligent innovations have led to better glycemic control by reducing fasting and postprandial glucose levels, glucose fluctuations, and glycosylated hemoglobin. AI is poised to shift diabetes care from traditional management strategies to more targeted, data-driven precision care. Many individuals are utilizing the company’s innovative products, such as blood glucose meters, blood pressure cuffs, and scales, which collect data and transmit it to a centralized database. This data is then used by the company to generate comprehensive insights for patients’ benefit.

Opportunity: Expanding diabetes market presents growth opportunities

Global health expenditure related to diabetes has seen a significant increase over the past 15 years. This rise is partly due to improved data quality, and the direct costs associated with diabetes are expected to continue growing. The International Diabetes Federation projects that diabetes-related health expenses will keep rising in the coming decades. The North America and Caribbean region has the highest spending per adult with diabetes, followed by Europe, South and Central America, and the Western Pacific. In contrast, expenditure is lower in the Middle East and North Africa, Africa, and Southeast Asia regions. Diabetes-related costs have a substantial impact on overall global health spending. As diabetes-related expenses increase in emerging markets, many digital diabetes management device manufacturers are focusing on expanding their businesses in these areas to seize new opportunities.

Challenge: Shortage of qualified practitioners

The adoption of technologically advanced digital diabetes management platforms is lower in developing countries compared to developed ones. This is due to insufficient infrastructure, unclear national e-health policies, public concerns about data privacy and security, challenges in achieving system interoperability, a shortage of trained health informatics professionals, and limited strategies for regional integration. Additionally, low investment in healthcare by both private and public sectors in developing countries affects access to and the quality of health services. According to a WHO and World Bank report, a significant number of people still lack access to essential health services, particularly in Africa and South Asia, and this situation is expected to persist into 2030. Limited access to healthcare, poor service quality, and low levels of digital integration negatively impact health outcomes and poverty levels, resulting in hesitation and inability to fully adopt advanced digital solutions, including those for diabetes management

Sources: Company Websites and Wissen Research Analysis.

Sources: Company Websites and Wissen Research Analysis.

Insulin pens segment dominate the market due to rise in demand and cost-effectiveness and convenience

The demand for insulin pens has significantly risen in recent years, driven by the growing incidence of diabetes, their cost-effectiveness, and their ability to provide less painful and more efficient insulin delivery. Other major factors contributing to the growth of this segment in the digital diabetes management market include the increasing preference for personalized, patient-centric devices and the need to minimize needle-stick injuries. However, the limited applicability of smart insulin pens for patients who require a combination of two different types of insulin is constraining the expansion of this market segment.

Wearable devices dominate digital diabetes management

The digital diabetes management market is categorized into handheld and wearable devices based on device type. Wearable devices hold a substantial portion of this market, largely due to several advancements in the field. These include the development of closed-loop pump systems, smart insulin patches, and other innovative devices in the pipeline. Additionally, the growing adoption of smart insulin pumps and patches for self-administered insulin delivery has further propelled the dominance of wearable devices in managing diabetes.

North America is projected to be the fastest-growing market

North America is expected to experience the highest CAGR in the digital diabetes management market, surpassing Europe, Asia Pacific, Latin America, and the Middle East & Africa. This growth is driven by several factors, including the widespread adoption of connected diabetes management devices, increased use of diabetes and obesity management apps, high demand for technologically advanced solutions, greater acceptance of digital diabetes solutions by payers, government initiatives promoting digital health, and rising awareness of self-diabetes management in the region.

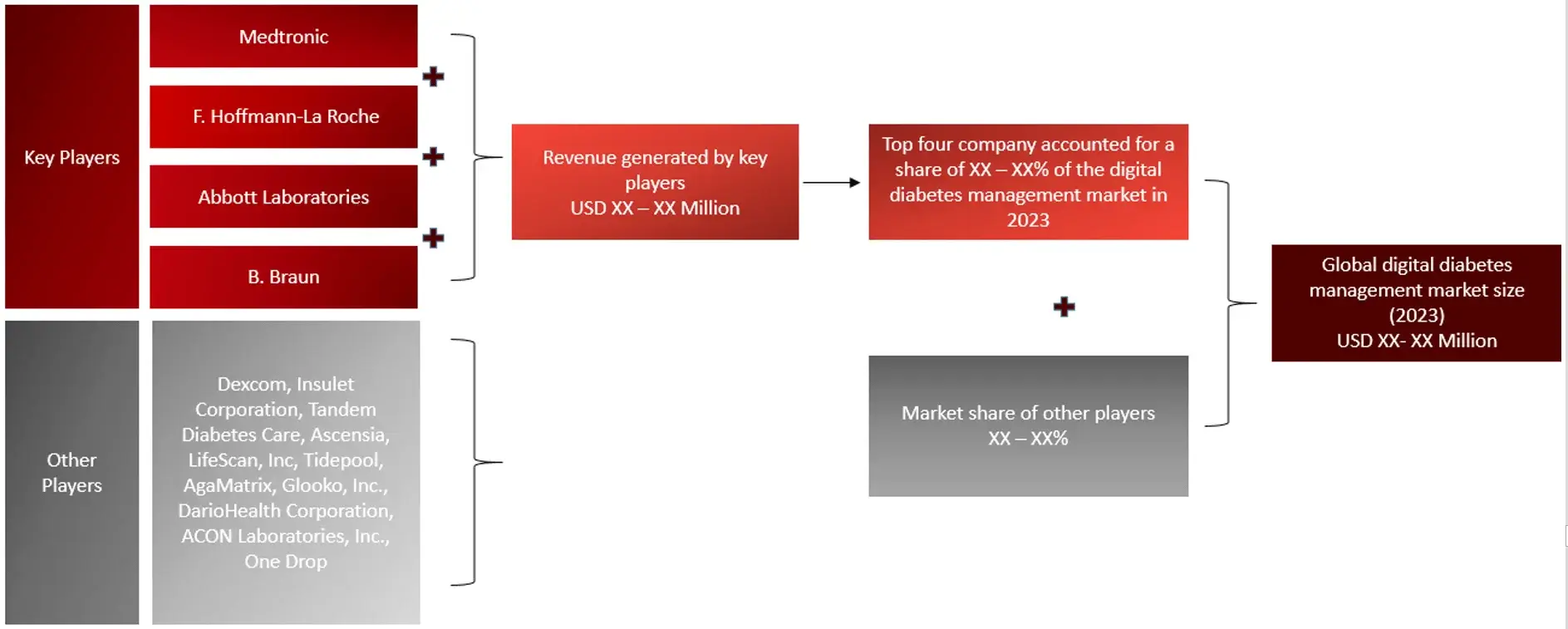

Major Companies and Market Share Insights in Digital Diabetes Management Market

Major players operating in digital diabetes management market are Medtronic (Ireland), F. Hoffmann-La Roche (Switzerland), Abbott Laboratories (US), B. Braun Melsungen AG (Germany), Dexcom, Inc. (US), Insulet Corporation (US), Tandem Diabetes Care (US), Ascensia, LifeScan, Inc. (US), Tidepool (US), AgaMatrix (US), Glooko, Inc. (US), DarioHealth Corporation (Israel), ACON Laboratories, Inc. (US), One Drop (US), Dottli (Finland), Diabetes Care Holdings AG (Switzerland), Ypsomed Holding AG (Switzerland), Care Innovations, LLC (US), ARKRAY (Japan), Health2Sync (Taiwan), among others.

Introduction

Market Definition

The digital diabetes management market includes technologies such as glucose meters, insulin pumps, mobile apps, and telehealth platforms designed to help monitor, manage, and treat diabetes. This market is driven by the increasing prevalence of diabetes, technological advancements, and a growing demand for convenient, personalized healthcare solutions. It faces challenges like data privacy concerns and integration with traditional healthcare systems but continues to evolve with trends in personalized medicine and interoperability.

Sources: Company Websites and Wissen Research Analysis.

Sources: Company Websites and Wissen Research Analysis. Sources: Wissen Research Analysis.

Sources: Wissen Research Analysis.Key Stakeholders

Key objectives of the Study

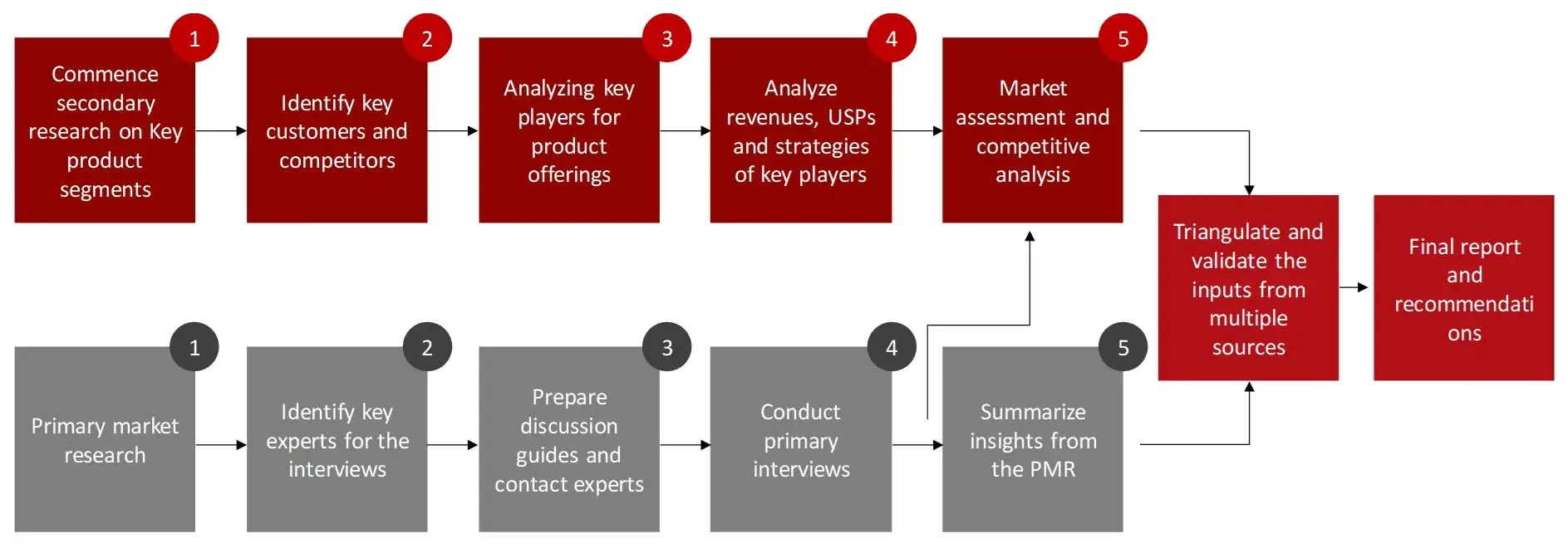

Research Methodology

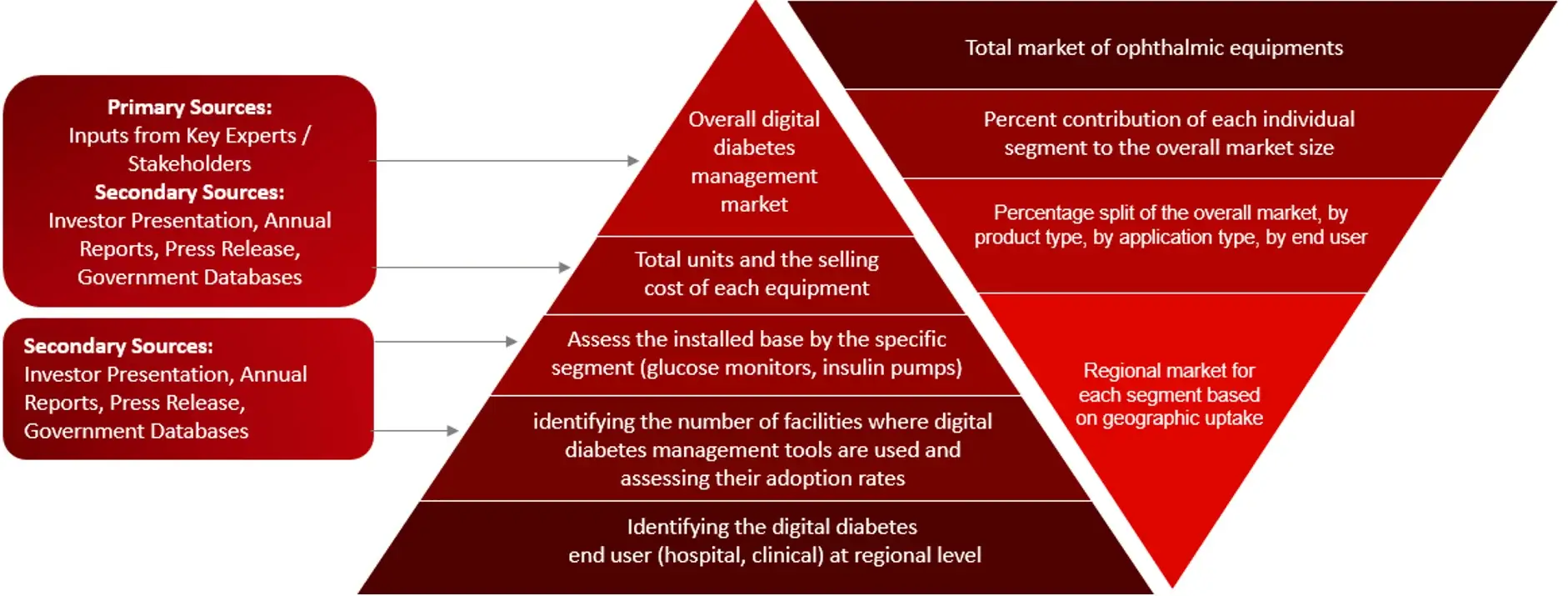

The aim of the study is to examine the key market forces such as drivers, opportunities, restraints, challenges, and strategies of key leaders. To monitor company advancements such as patents granted, product launches, expansions, and collaborations of key players, analyzing their competitive landscape based on various parameters of business and product strategy. Market sizing will be estimated using top-down and bottom-up approaches. Using market breakdown and data triangulation techniques, market sizing of segments and sub-segments will be estimated.

FIGURE: RESEARCH DESIGN

Sources: Wissen Research Analysis.

Research Approach

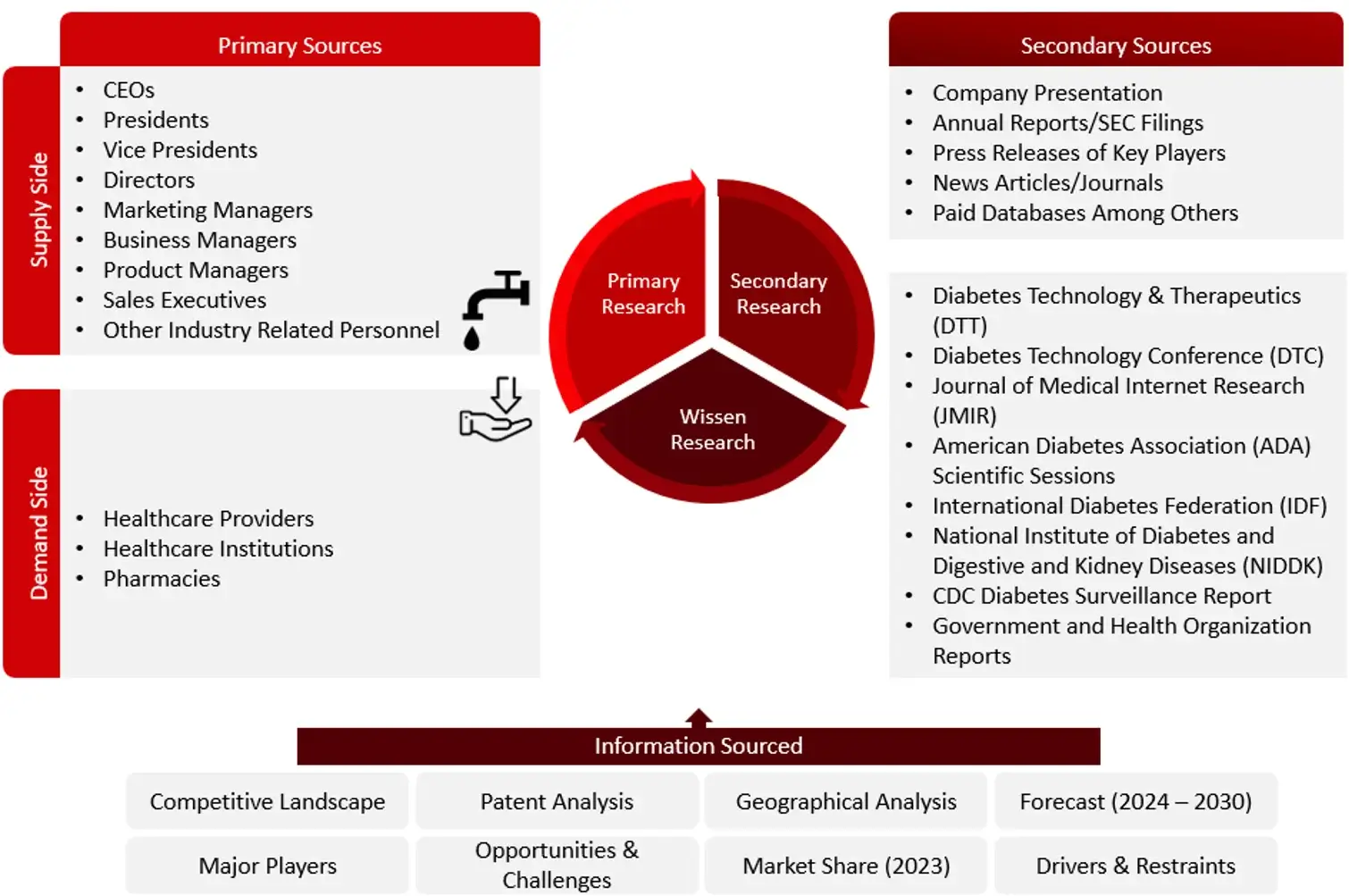

Collecting Secondary Data

The process of collating secondary research data involves the utilization of databases, secondary sources, annual reports, investor presentations, directories, and SEC filings of companies. Secondary research will be utilized to identify and gather information beneficial for the in-depth, technical, market-oriented, and commercial analysis of the digital diabetes management market. A database of the key industry leaders will also be compiled using secondary research.

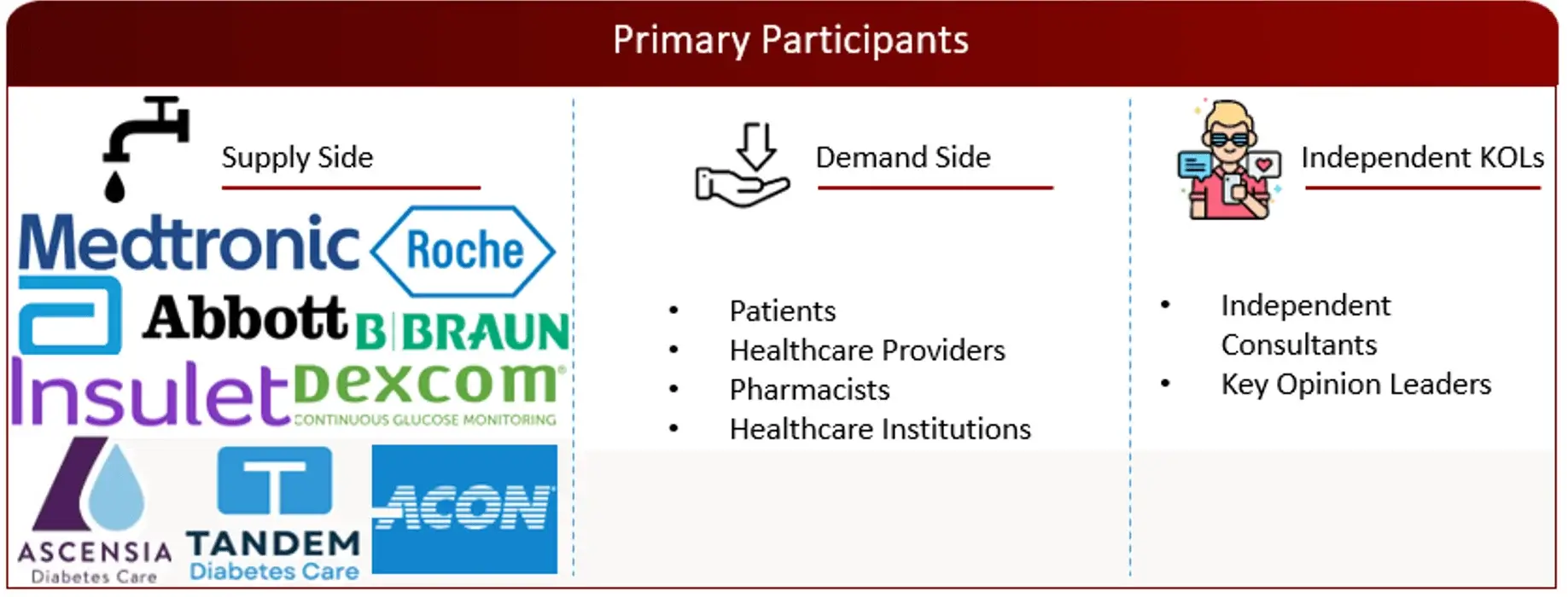

Collecting Primary Data

The primary research data will be conducted after acquiring knowledge about the digital diabetes management market scenario through secondary research. A significant number of primary interviews will be conducted with stakeholders from both the demand and supply side (including various industry experts, such as Vice Presidents (VPs), Chief X Officers (CXOs), Directors from business development, marketing and product development teams, product manufacturers) across major countries of Europe, Asia Pacific, North America, Latin America, and Middle East and Africa. Primary data for this report will be collected through questionnaires, emails, and telephonic interviews.

FIGURE: BREAKDOWN OF PRIMARY INTERVIEWS FROM SUPPLY SIDE

FIGURE: BREAKDOWN OF PRIMARY INTERVIEWS FROM DEMAND SIDE

FIGURE: PROPOSED PRIMARY PARTICIPANTS FROM DEMAND AND SUPPLY SIDE

Note: Above mention companies are non-exhaustive.

Note: Above mention companies are non-exhaustive.

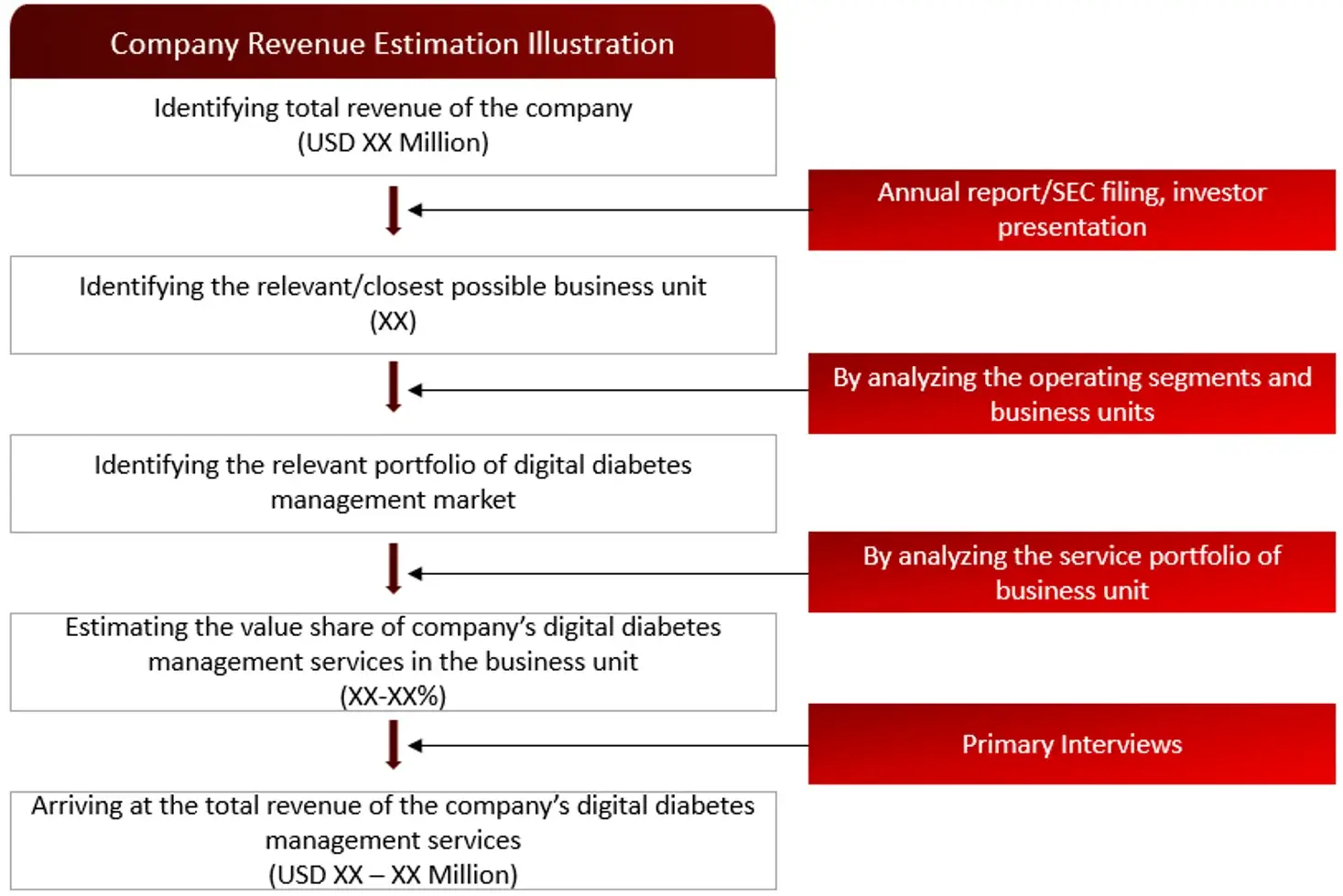

Market Size Estimation

All major manufacturers offering various digital diabetes management services will be identified at the global / regional level. Revenue mapping will be done for the major players, which will further be extrapolated to arrive at the global market value of each type of segment. The market value of digital diabetes management market will also split into various segments and sub segments at the region level based on:

FIGURE: REVENUE MAPPING BY COMPANY (ILLUSTRATION)

Sources: Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentation, Paid Database, and Wissen Research Analysis.

Sources: Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentation, Paid Database, and Wissen Research Analysis.FIGURE: REVENUE SHARE ANALYSIS OF KEY PLAYERS (SUPPLY SIDE)

Sources: Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentation, Paid Database, and Wissen Research Analysis.

Sources: Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentation, Paid Database, and Wissen Research Analysis.FIGURE: MARKET SIZE ESTIMATION TOP-DOWN AND BOTTOM-UP APPROACH

Sources: Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentation, Paid Database, and Wissen Research Analysis.

Sources: Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentation, Paid Database, and Wissen Research Analysis.FIGURE: ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES FOR GROWTH FORECAST

Sources: Diabetes Technology & Therapeutics (DTT), Diabetes Technology Conference (DTC), Journal of Medical Internet Research (JMIR), American Diabetes Association (ADA) Scientific Sessions, International Diabetes Federation (IDF), National Institute of Diabetes and Digestive and Kidney Diseases (NIDDK), CDC Diabetes Surveillance Report, Government and Health Organization Reports, Pharmaceutical Companies Company Website, Press Releases, Annual Reports, Paid Data Sources, and Wissen Research Analysis.

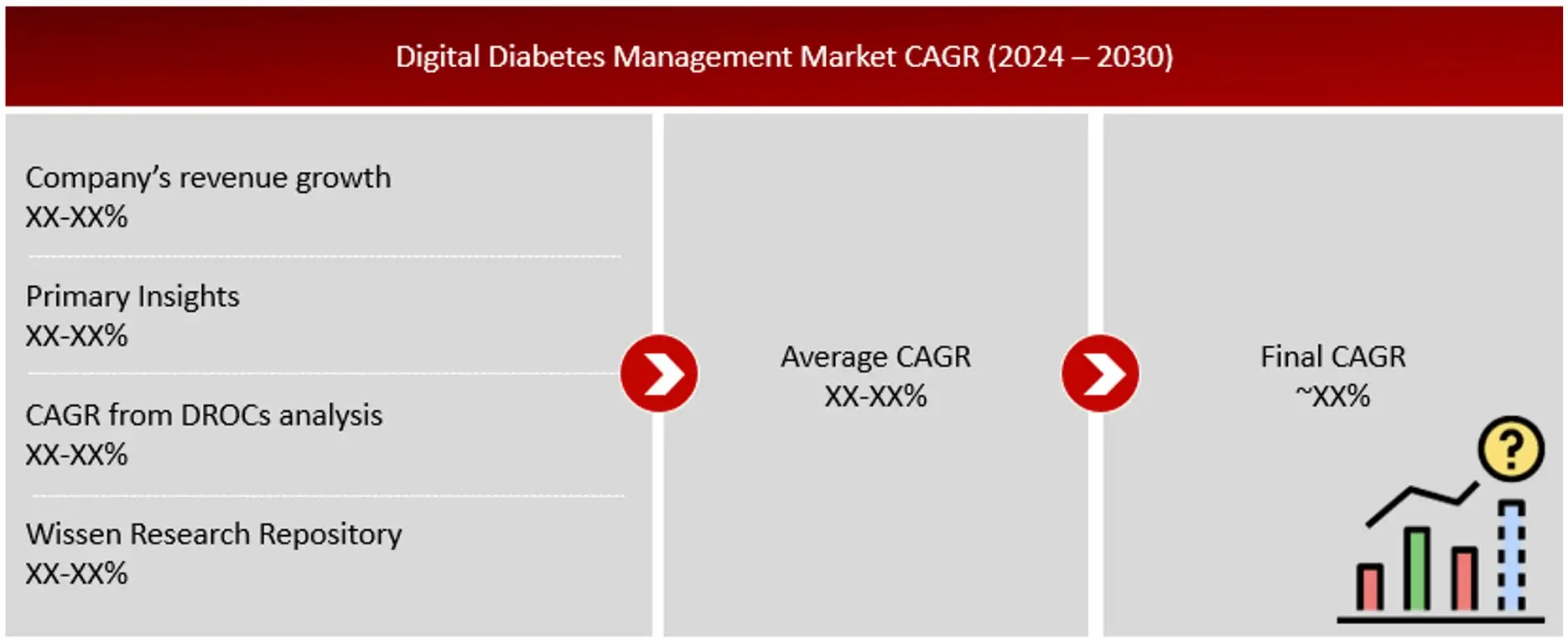

Sources: Diabetes Technology & Therapeutics (DTT), Diabetes Technology Conference (DTC), Journal of Medical Internet Research (JMIR), American Diabetes Association (ADA) Scientific Sessions, International Diabetes Federation (IDF), National Institute of Diabetes and Digestive and Kidney Diseases (NIDDK), CDC Diabetes Surveillance Report, Government and Health Organization Reports, Pharmaceutical Companies Company Website, Press Releases, Annual Reports, Paid Data Sources, and Wissen Research Analysis.FIGURE: GROWTH FORECAST ANALYSIS UTILIZING MULTIPLE PARAMETERS

Sources: Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentation, Paid Database, and Wissen Research Analysis.

Sources: Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentation, Paid Database, and Wissen Research Analysis.Research Design

After arriving at the overall market size-using the market size estimation processes-the market will be split into several segments and sub segment. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub segment, the data triangulation, and market breakdown procedures will be employed, wherever applicable. The data will be triangulated by studying various factors and trends from both the demand and supply sides in the digital diabetes management market.

Sources: Diabetes Technology & Therapeutics (DTT), Diabetes Technology Conference (DTC), Journal of Medical Internet Research (JMIR), American Diabetes Association (ADA) Scientific Sessions, International Diabetes Federation (IDF), National Institute of Diabetes and Digestive and Kidney Diseases (NIDDK), CDC Diabetes Surveillance Report, Government and Health Organization Reports, Pharmaceutical Companies Company Website, Press Releases, Annual Reports, Paid Data Sources, and Wissen Research Analysis.

Sources: Diabetes Technology & Therapeutics (DTT), Diabetes Technology Conference (DTC), Journal of Medical Internet Research (JMIR), American Diabetes Association (ADA) Scientific Sessions, International Diabetes Federation (IDF), National Institute of Diabetes and Digestive and Kidney Diseases (NIDDK), CDC Diabetes Surveillance Report, Government and Health Organization Reports, Pharmaceutical Companies Company Website, Press Releases, Annual Reports, Paid Data Sources, and Wissen Research Analysis.1. Introduction

1.1 Key Objectives

1.2 Definitions

1.2.1 In Scope

1.2.2 Out of Scope

1.3 Scope of the Report

1.4 Scope Related Limitations

1.5 Key Stakeholders

2. Research Methodology

2.1 Research Approach

2.2 Research Methodology / Design

2.3 Market Sizing Approach

2.3.1 Secondary Research

2.3.2 Primary Research

3. Executive Summary & Premium Content

3.1 Global Market Outlook

3.2 Key Market Findings

4. Market Overview

4.1 Market Dynamics

4.1.1 Drivers/Opportunities

4.1.2 Restraints/Challenges

4.2 End User Perception

4.3 Need Gap

4.4 Supply Chain / Value Chain Analysis

4.5 Industry Trends

4.6 Porter’s Five Forces Analysis

5. Patent Analysis

5.1. Patents Related to Digital Diabetes Technologies/Devices

5.2. Patent Landscape and Intellectual Property Trends

6. Global Digital Diabetes Management Market, by Product & Services (2022-2030, USD Million)

6.1 Devices

6.1.1 Smart Glucose Meters

6.1.2 Continuous Glucose Monitoring (CGM) Systems

6.1.3 Smart Insulin Pens

6.1.4 Smart Insulin Pumps/Closed-loop Pumps & Smart Insulin Patches

6.2 Application

6.2.1 Diabetes & Blood Glucose Tracking Apps

6.2.2 Obesity & Diet Management Apps

6.3 Data Management Software & Platforms

6.4 Services

7. Global Digital Diabetes Management Market, by Device (2022-2030, USD Million)

7.1 Hand Held

7.2 Wearables

8. Global Digital Diabetes Management Market, by End User (2022-2030, USD Million)

8.1 Self/Homecare

8.2 Diagnostic Centers

8.3 Hospitals & Specialty Diabetes Clinics

8.4 Academic & Research Institutes

9. Global Digital Diabetes Management Market, by Region (2022-2030, USD Million)

9.1 North America

9.1.1. US

9.1.2 Canada

9.2 Europe

9.2.1 Germany

9.2.2. France

9.2.3 Spain

9.2.4 Italy

9.2.5 UK

9.2.6 Rest of the Europe

9.3 Asia Pacific

9.3.1 China

9.3.2 Japan

9.3.3 India

9.3.4 Australia and New Zealand

9.3.5 South Korea

9.3.6 Rest of the Asia Pacific

9.4 Middle East and Africa

9.5 Latin America

10. Competitive Analysis

10.1 Key Players Footprint Analysis

10.2 Market Share Analysis

10.3 Key Brand Analysis

10.4 Regional Snapshot of Key Players

10.5 R&D Expenditure of Key Players

11. Company Profiles2

11.1 Medtronic

11.1.1 Business Overview

11.1.2 Product Portfolio

11.1.3 Financial Snapshot3

11.1.4 Recent Developments

11.1.5 SWOT Analysis

11.2 Hoffmann-La Roche

11.3 Abbott Laboratories

11.4 Braun Melsungen AG

11.5 Dexcom, Inc

11.6 Insulet Corporation

11.7 Tandem Diabetes Care

11.8 Ascensia, LifeScan, Inc.

11.9 Tidepool

11.10 AgaMatrix

11.11 Glooko, Inc.

11.12 DarioHealth Corporation

11.13 ACON Laboratories, Inc.

11.14 One Drop

11.15 Dottli

11.16 Diabetes Care Holdings AG

11.17 Ypsomed Holding AG

11.18 Care Innovations, LLC

11.19 ARKRAY

11.20 Health2Sync

12. Conclusion

13. Appendix

13.1 Industry Speak

13.2 Questionnaire

13.3 Available Custom Work

13.4 Adjacent Studies

13.5 Authors

14. References

Key Notes:

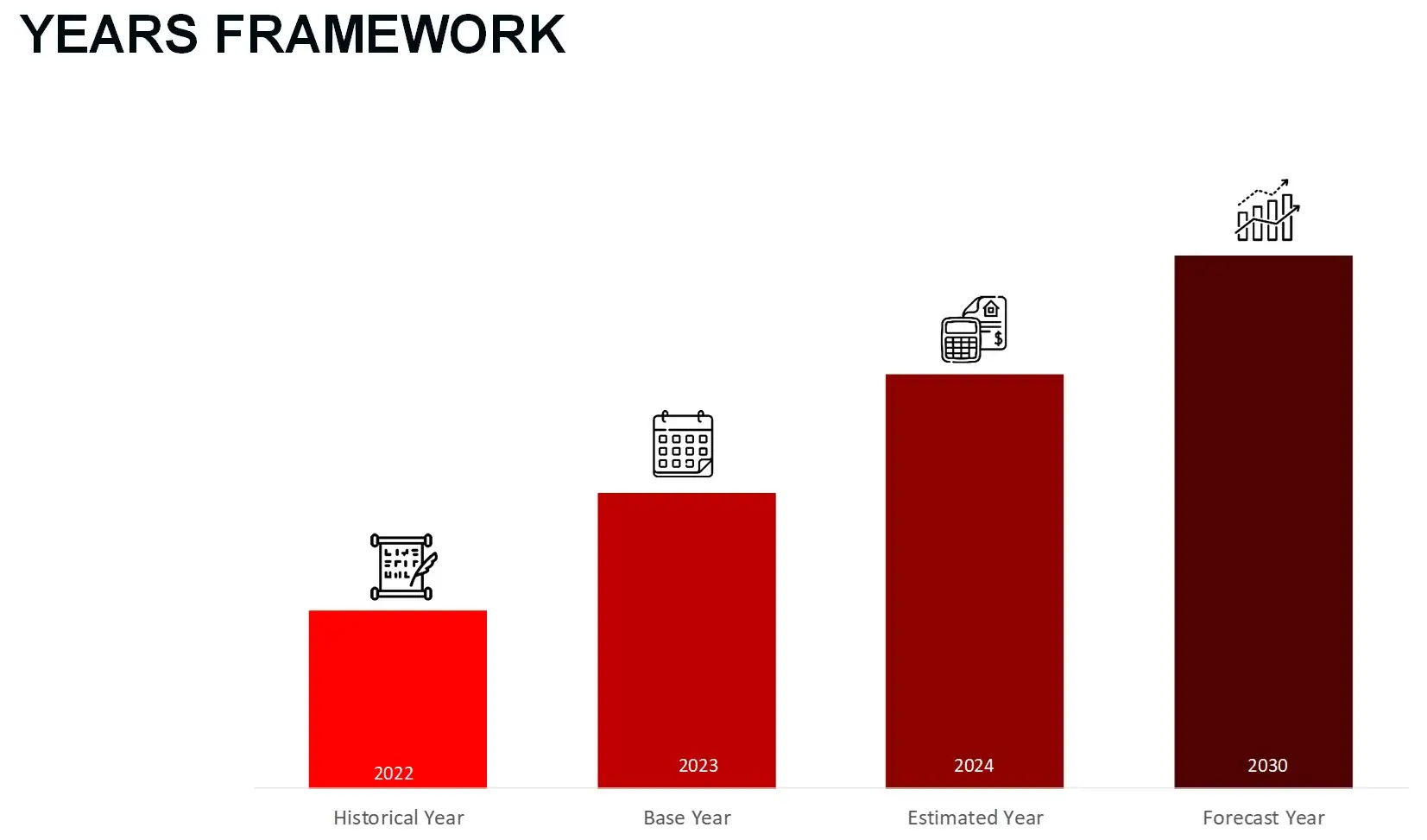

The global market for digital diabetes management was valued at approximately USD 15.5 billion in 2023, and is projected to increase to USD 17.6 billion in 2024.

The global digital diabetes management market is anticipated to grow at an annual growth rate of 14% from 2024 to 2030 to reach USD 38 billion, by 2030.

The major end-users in the digital diabetes management market include hospitals and specialty diabetes clinic, diagnostic centers, self/homecare, academics and research institutes, with hospitals and specialty diabetes clinic holding the most significant share of almost 40%, as they remain the primary source for targeted therapy and latest technological advancements.

Leading players within the digital diabetes management market are Medtronic (Ireland), F. Hoffmann-La Roche (Switzerland), Abbott Laboratories (US), B. Braun Melsungen AG (Germany), Dexcom, Inc. (US).

The market is consolidated at top, comprising 10 key players with them holding almost 50% of the market, while it remains lightly fragmented at the lower levels, with numerous small and mid-sized companies operating at regional and national level.

The primary application areas within the digital diabetes management market encompass Diabetes & Blood Glucose Tracking Apps, Obesity & Diet Management Apps. Notably, the demand in the blood glucose tracking category is anticipated to boost the growth, experiencing a CAGR of 14% between 2024 and 2030.

© Copyright 2024 – Wissen Research All Rights Reserved.