Endoscopy Equipment: Market Size, Trend, by Application (Gastrointestinal, Laparoscopy, Bronchoscopy, ENT) Product (Rigid endoscopes, Flexible endoscopes, Robot-assisted, Capsule endoscopes, Disposable) End User, Region, Major Players – Global Forecast to 2030

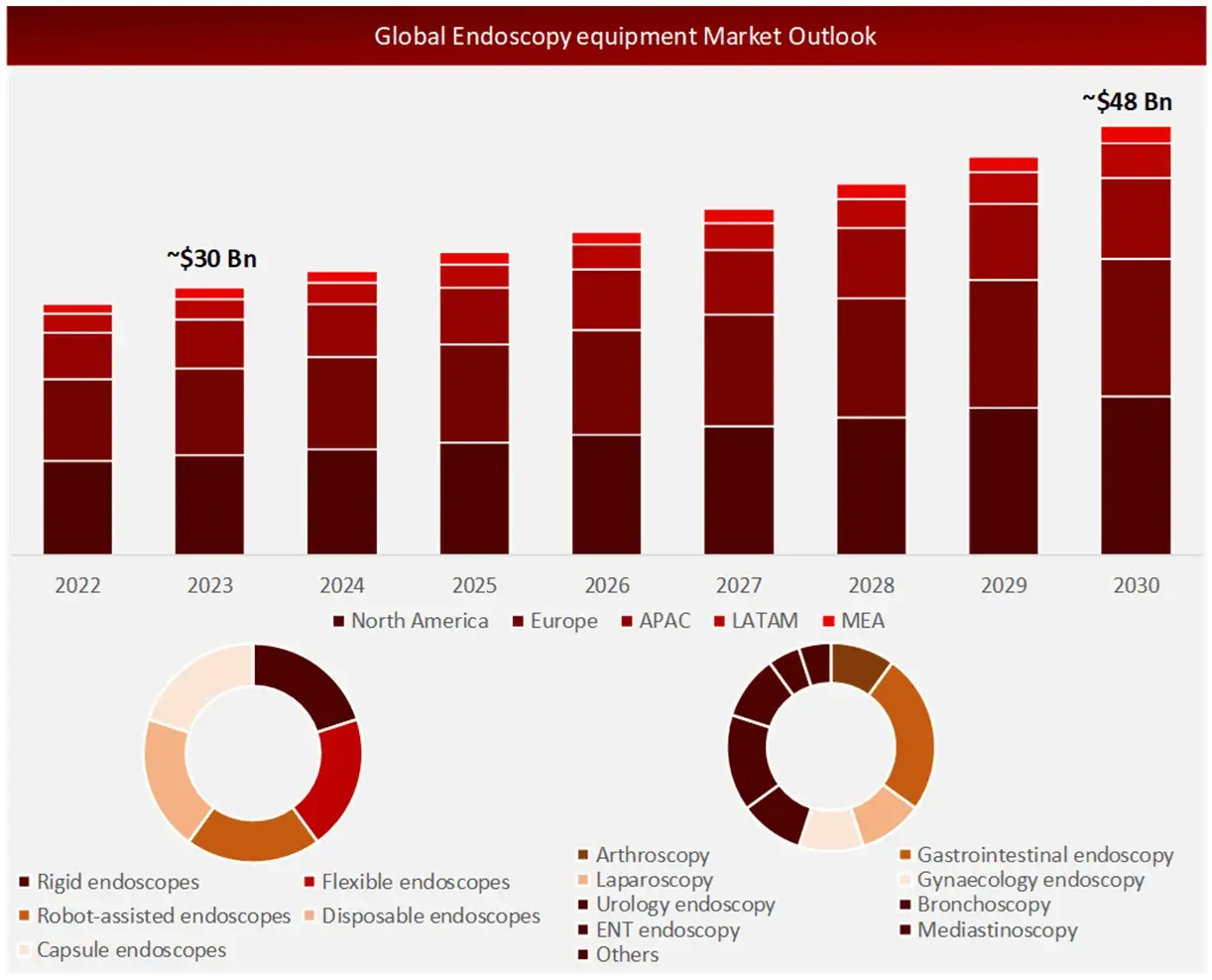

Challenges in the diagnostics domain include shortage in trained endoscopists and surging number of product recalls. The global endoscopy equipment market is estimated to be valued at ~ $30 Billion in 2023, and is expected to grow at a CAGR of ~7%. Flexible endoscopes have held the most significant share in the market since 2022, with gastrointestinal endoscopy dominating the market share by application.

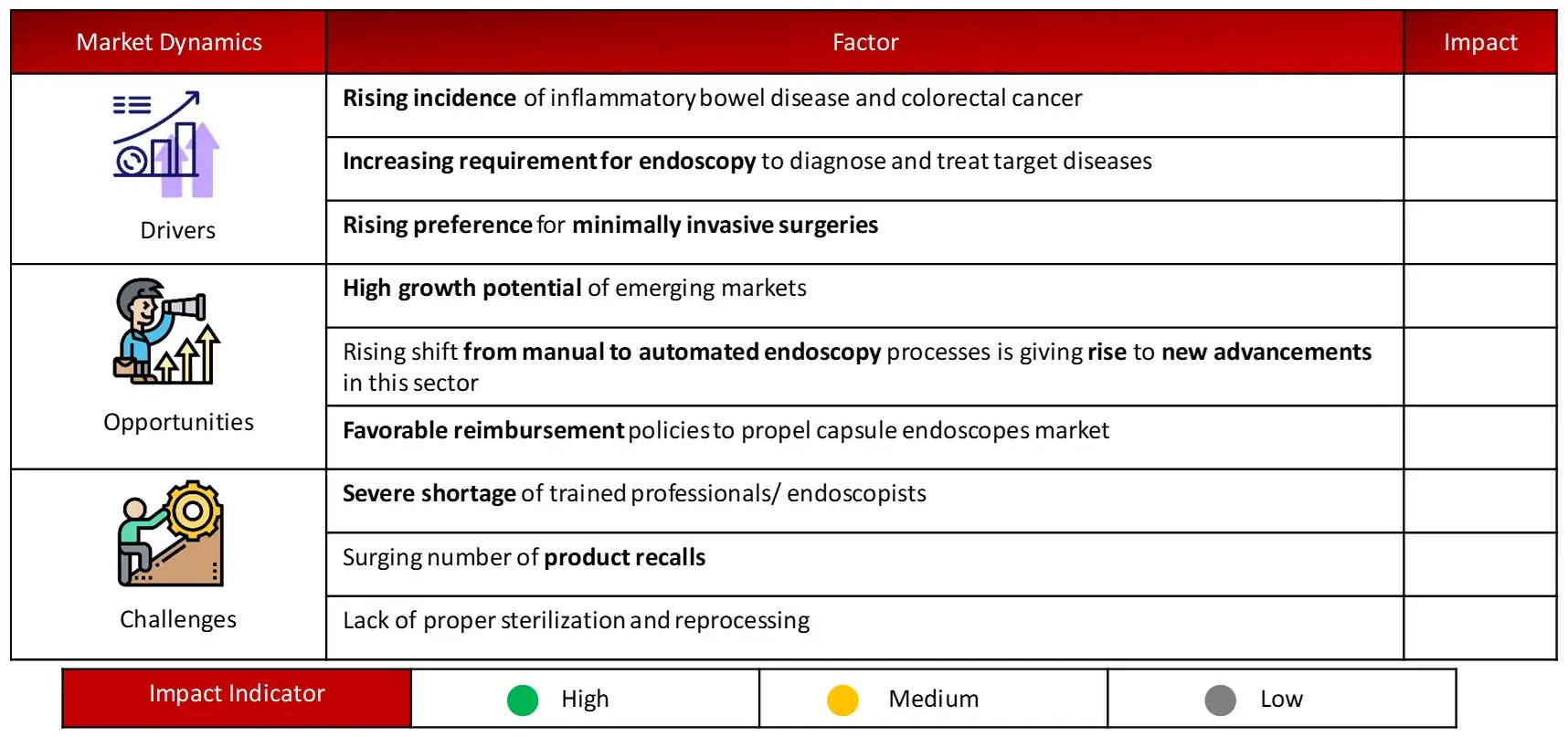

Key driving factors of endoscopy include rising incidence of inflammatory bowel disease and colorectal cancer, etc., increasing requirement for endoscopy to diagnose and treat target diseases and rising preference for minimally invasive surgeries

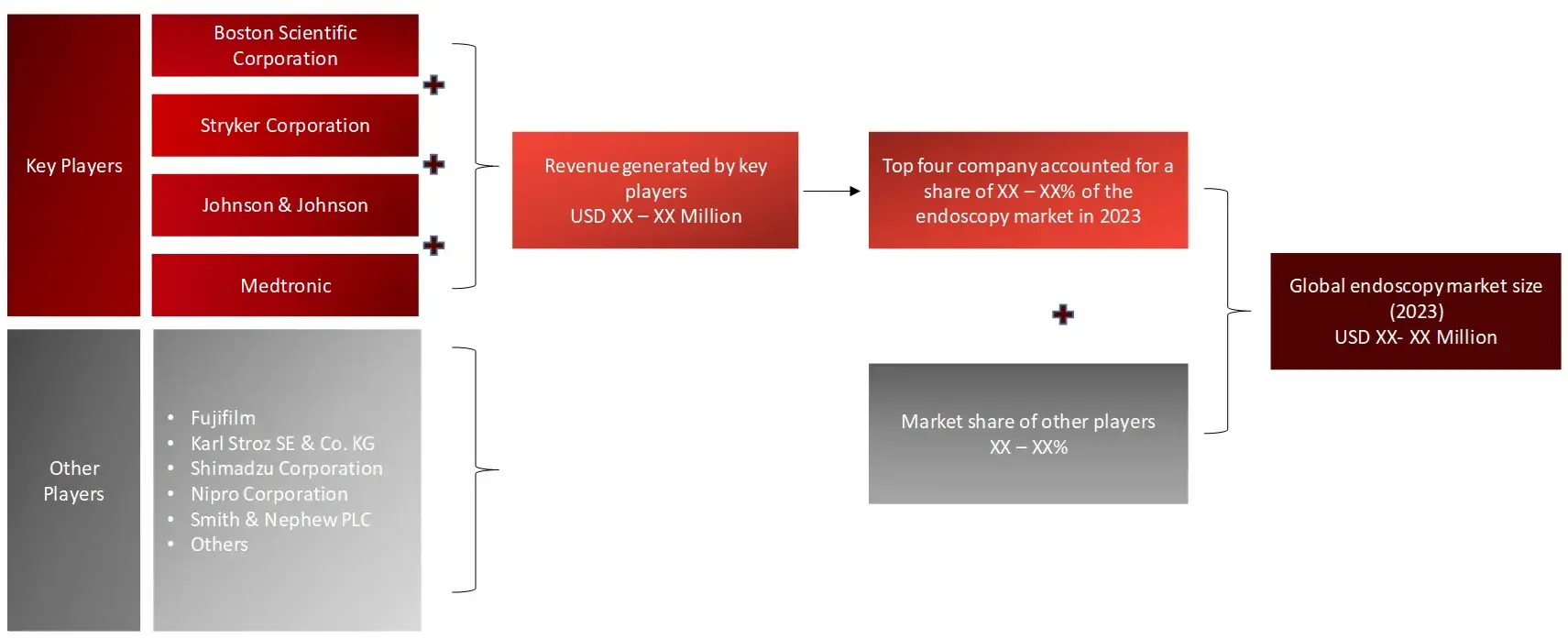

Key players functioning in endoscopy sector are Boston Scientific Corporation, Stryker Corporation, Fujifilm, Johnson & Johnson, Medtronic and Karl Storz SE & Co. KG. Recent strategic activities feature the Medtronic signing a USD 200 Million deal with Cosmo Pharmaceuticals for development of AI-powered diagnostic endoscopy platform. (Dec, 2023) and Partnership between Scivita Medical Technology and Boston Scientific, this expanded strategic cooperation arrangement will bring single-use endoscope and imaging devices to more hospitals and patients throughout China and other countries. (March, 2024)

Drivers: Rising preference for minimally invasive surgeries

The significant growth in endoscopy equipment market is driven by the increasing preference for minimally invasive surgeries. This trend is fueled by the numerous benefits these procedures offer, such as

According to Wissen Research’s analysis, the global minimally invasive surgical procedures market is expected to reach ~$45 billion by 2030, growing at a CAGR of ~9% from 2022 to 2030. This surge in demand directly impacts the endoscopy equipment market, as these devices are essential tools in minimally invasive techniques.

Furthermore, advancements in endoscopic technologies, such as high-definition imaging and 3D visualization, are enhancing surgical precision and outcomes, further accelerating market growth.

Opportunities: Rising shift from manual to automated endoscopy processes is giving rise to new advancements in this sector

This transition presents a significant opportunity for manufacturers to develop and introduce advanced automated endoscopy systems. Recent innovations include

A 2023 study by the American Society for Gastrointestinal Endoscopy found that AI-assisted colonoscopies improved adenoma detection rates by 14% compared to standard procedures. Additionally, automated endoscope reprocessors have been shown to reduce the risk of contamination by up to 50% over manual cleaning methods. These advancements not only enhance procedural efficiency and accuracy but also address the growing demand for improved patient safety and reduced human error in endoscopic procedures, making them increasingly attractive to healthcare providers worldwide.

Challenges: Surging number of product recalls

The endoscopy equipment market is struggling with a rise in product recalls, posing significant challenges to growth and consumer trust. In 2022, a major recall affected over 4,800 endoscopes due to contamination risks. The ECRI Institute has consistently ranked endoscope-related infections among the top 10 health technology hazards. A recent survey of 500 U.S. hospitals found that 60% experienced procedure delays due to endoscope recalls in the past year.

These incidents not only result in financial losses for manufacturers but also disrupt healthcare services, highlighting the urgent need for enhanced quality control and product design in the industry.

Flexible endoscopes dominated the endoscopy equipment market share in 2023

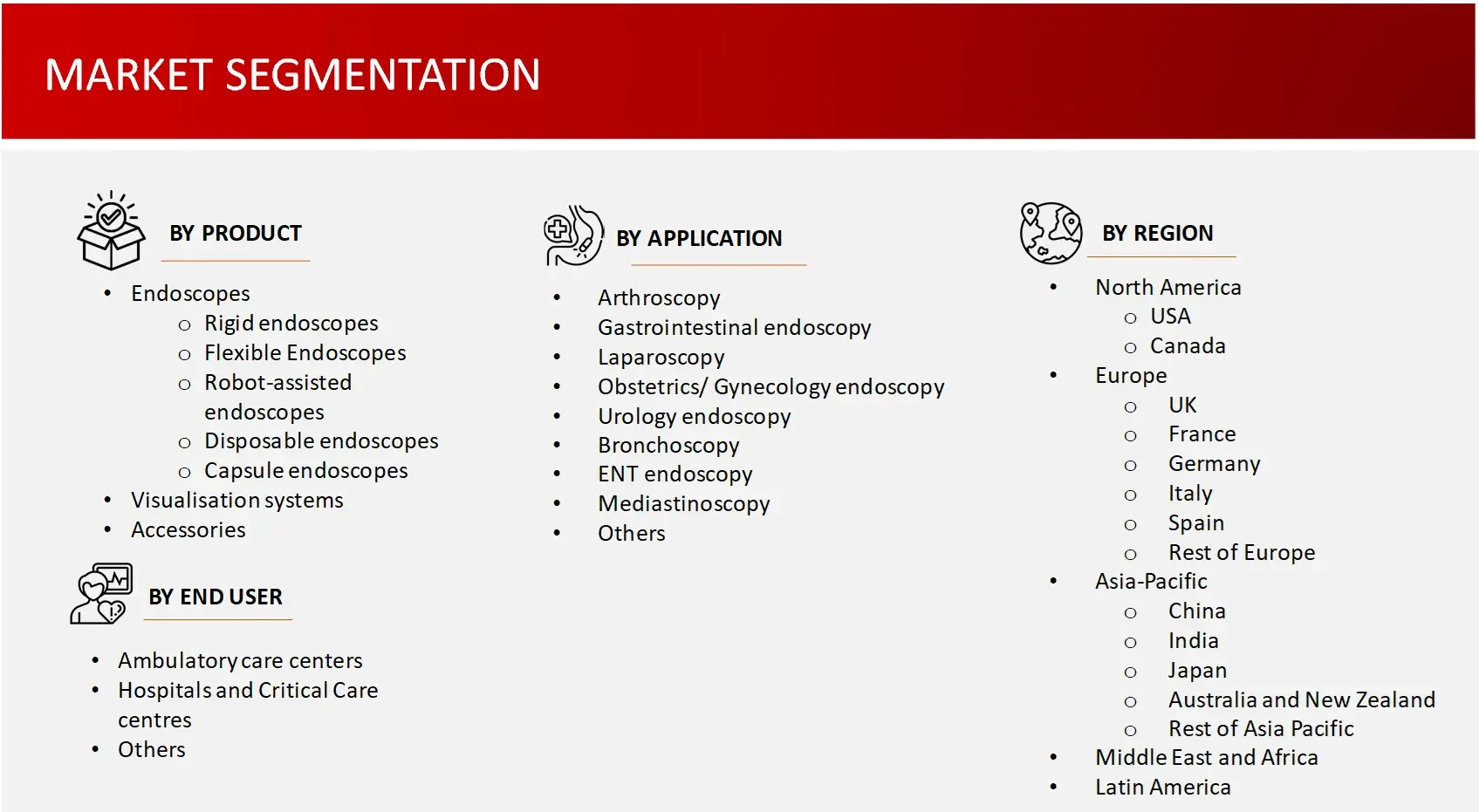

Endoscopy equipment encompasses various product types, including rigid endoscopes (laparoscopes, urology endoscopes, gynaecology endoscopes, arthroscopes and others), flexible endoscopes (upper gastrointestinal endoscopes, colonoscopes, broncoscopes and others), robot-assisted, capsules and disposable. Each category serves specific diagnostic and or treatment needs across different medical applications. Among these, flexible endoscopes have held the largest market share, primarily due to the high global prevalence of Inflammatory bowel disease (IBD), stomach cancer etc.

Gastrointestinal endoscopy accounted for the largest share in 2023

Global endoscopy market by application is segmented into- arthroscopy, gastrointestinal endoscopy, laparoscopy, obstetrics/gynaecology endoscopy, urology endoscopy, bronchoscopy, ENT endoscopy, mediastinoscopy, others.

Among the aforementioned applications gastrointestinal endoscopy segment dominated the market due to high prevalence of gastrointestinal ailments and advancements in this sector leading to better image quality and procedure efficiency.

Significant market share held by hospitals was observed in 2022

Endoscopy equipment serve a number of end-users such as diagnostic centers, ambulatory facilities for outpatient care, hospitals and critical care centers for various visceral disease diagnosis and treatment. The traditional healthcare facilities, i.e. hospitals remained the significant holder of user market share due to increase in the automated system utilization, such as robot-assisted endoscopes. Giving rise to better diagnosis and treatment efficiency.

North America held the largest market share in endoscopy equipment in the forecast period

Endoscopy equipment market research encompassed a comprehensive analysis of five key regions:

All regions were evaluated based on these following factors- healthcare infrastructure, regulatory landscape, technological adoption, and market dynamics.

The research observed that North America held the largest share in the endoscopy equipment domain during the forecast period, primarily due to its advanced healthcare systems, high adoption rates of new technologies, favorable reimbursement policies, and the presence of major market players driving innovation in this sector.

As per the historical and the base year of the report (2022 and 2023, respectively), key players in endoscopy were Boston Scientific Corporation (US), Stryker Corporation (US), Fujifilm (Japan), Johnson & Johnson (US), Medtronic (Ireland), Karl Storz SE & Co. KG (Germany), Nipro Corporation (Japan), Hoya Corporation (Japan), Smith & Nephew PLC (UK), Olympus Corporation (Japan), Steris PLC (Ireland), Cook Medical (US) and Intuitive Surgical (US).

Introduction

Market Definition

Endoscopy is a non-surgical procedure used to the examine digestive tract. It is done by lowering a thin and a flexible tube with a light and camera attached to it down an open body cavity (mostly mouth). It is used diagnose and treat functional gastrointestinal disorders.

FIGURE: ENDOSCOPY EQUIPMENT MARKET SEGMENT

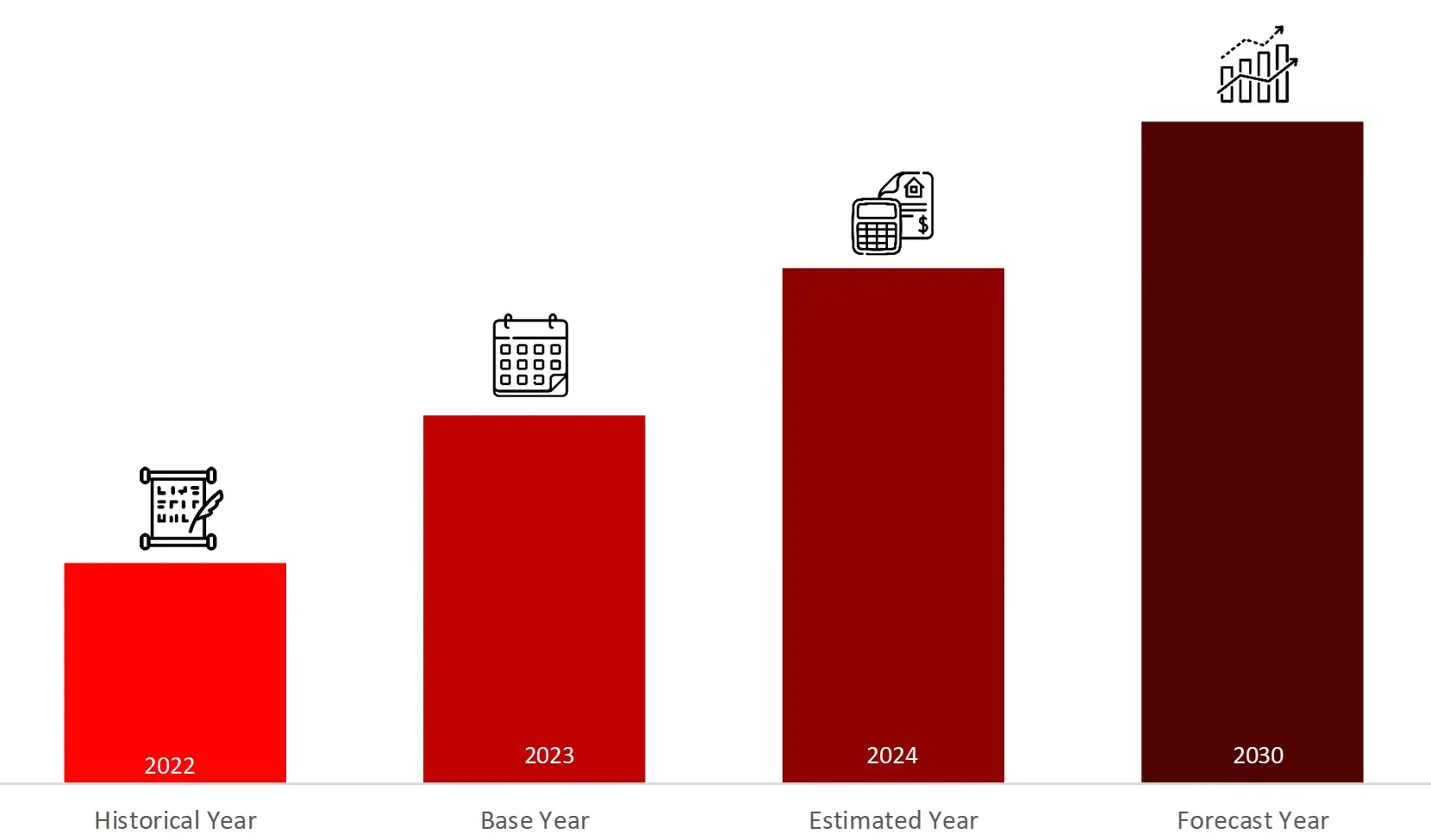

FIGURE: YEARS FRAMEWORK CONSIDERED IN THE STUDY

Sources: Wissen Research Analysis

Sources: Wissen Research AnalysisKey Stakeholders

Key objectives of the Study

Research Methodology

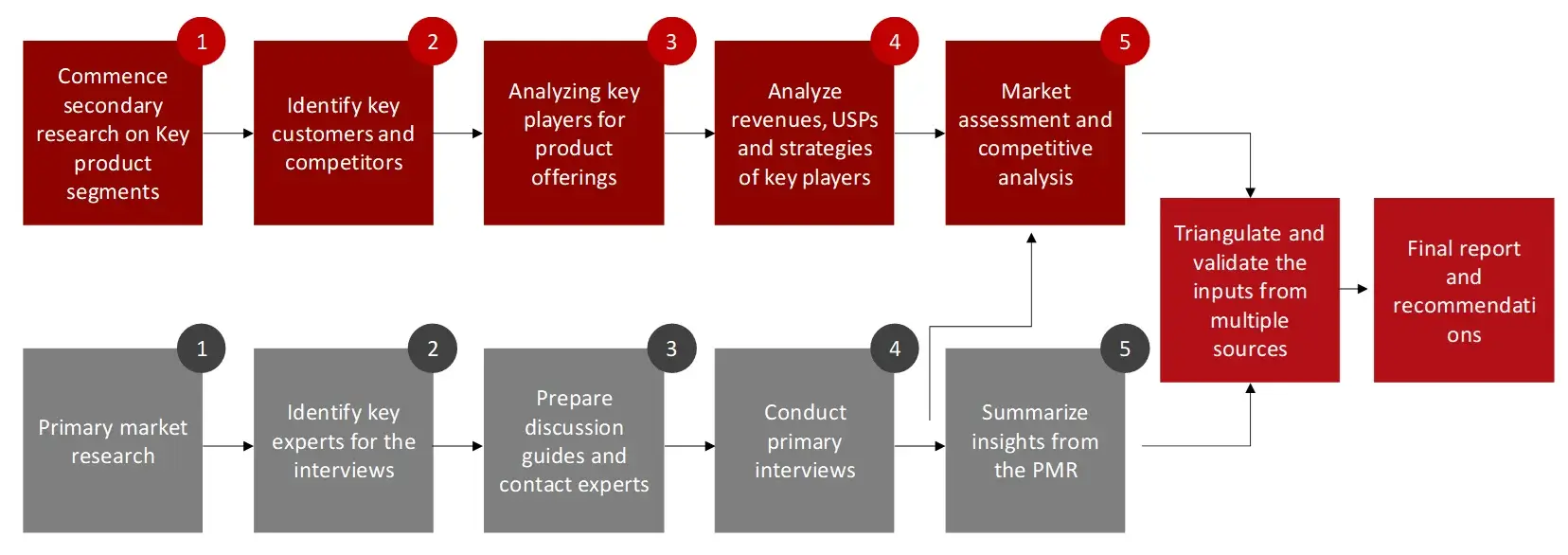

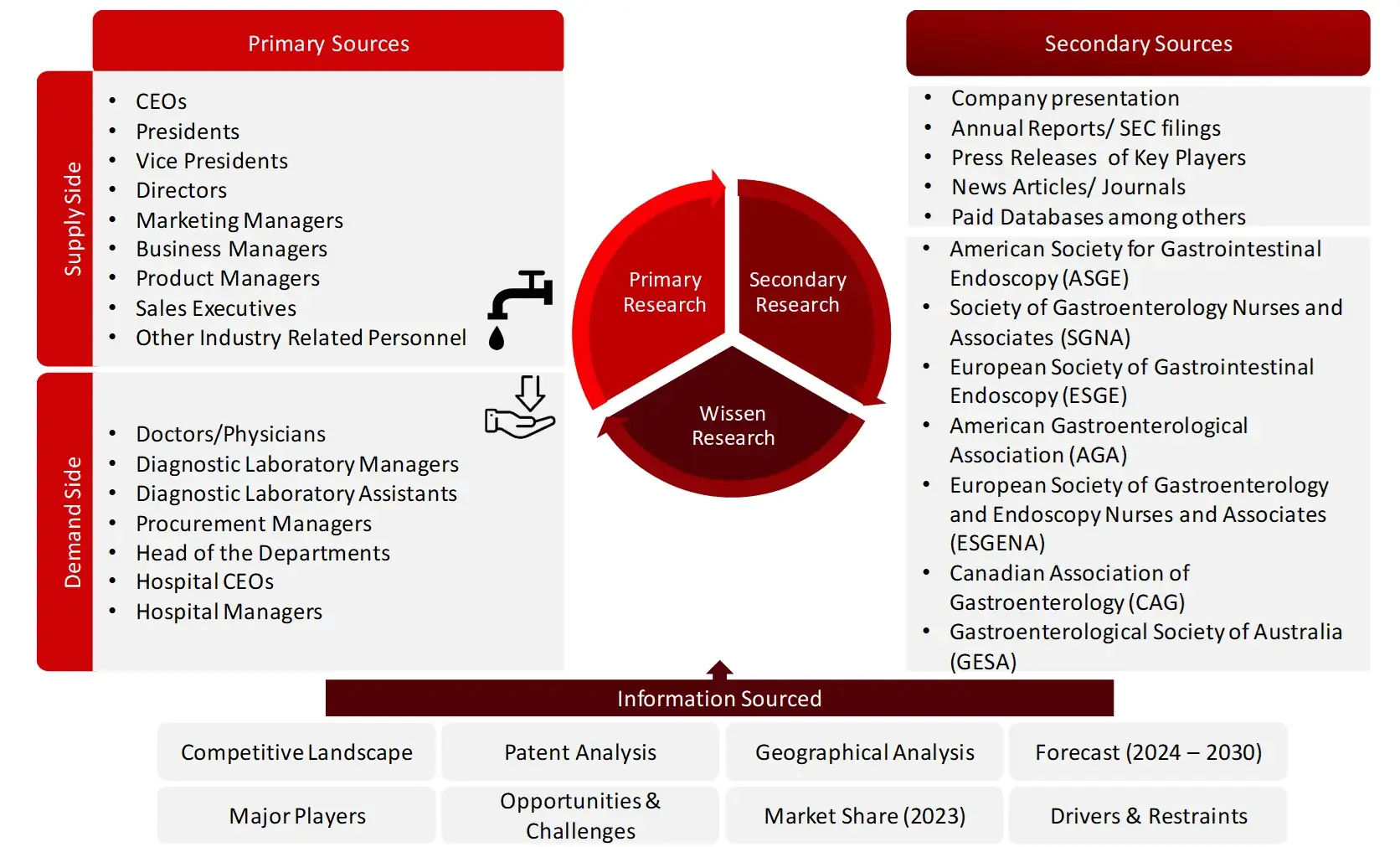

The objective of the study is to analyze the key market dynamics such as drivers, opportunities, challenges, restraints, and key player strategies. To track company developments such as product launches and approvals, expansions, and collaborations of the leading players, the competitive landscape of the endoscopy equipment market to analyze market players on various parameters within the broad categories of business and product strategy. Top-down and bottom-up approaches will be used to estimate the market size. To estimate the market size of segments and sub segments the market breakdown and data triangulation will be used.

FIGURE: RESEARCH DESIGN

Sources: Wissen Research Analysis

Sources: Wissen Research AnalysisResearch Approach

Collecting Secondary Data

The secondary research data collection process involves the usage of secondary sources, directories, databases, annual reports, investor presentations, and SEC filings of companies. Secondary research will be used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the endoscopy equipment market. A database of the key industry leaders will also be prepared using secondary research.

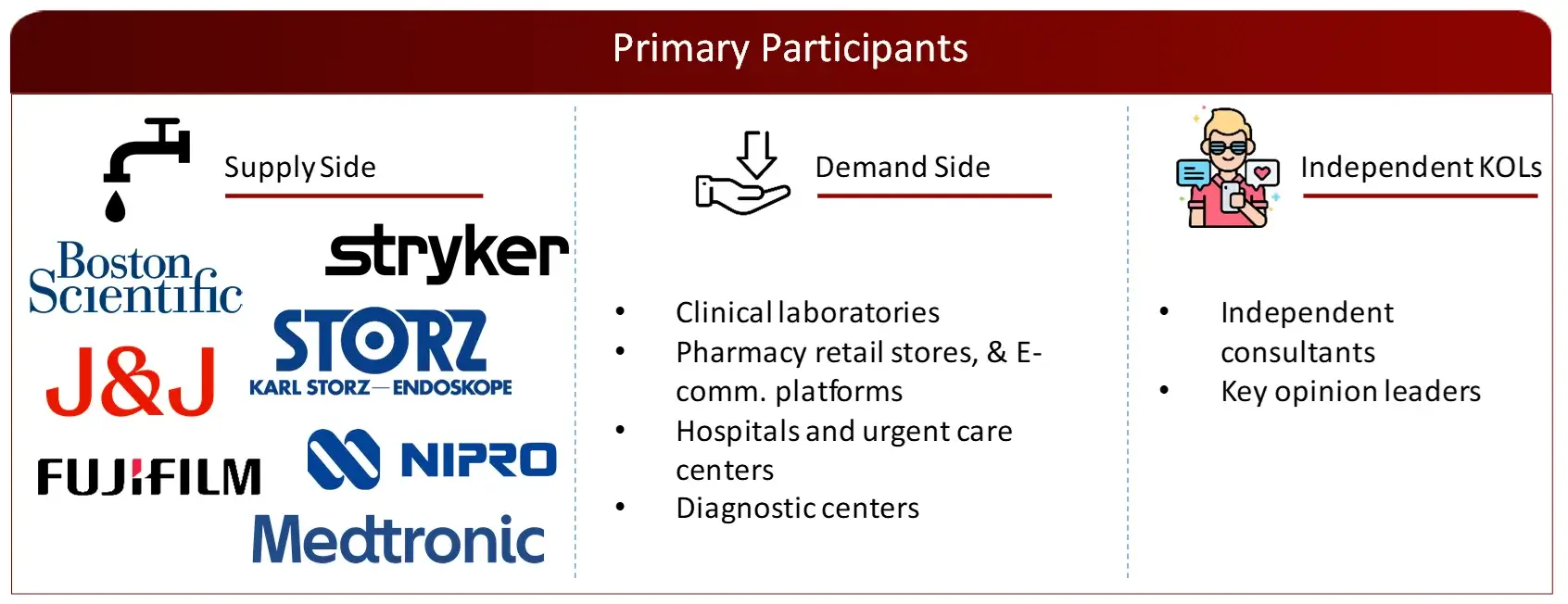

Collecting Primary Data

The primary research data will be conducted after acquiring knowledge about the endoscopy equipment market scenario through secondary research. A significant number of primary interviews will be conducted with stakeholders from both the demand side and supply side (including various industry experts, such as Directors, Chief X Officers (CXOs), Vice Presidents (VPs) from business development, marketing and product development teams, product manufacturers) across major countries of North America, Europe, Asia Pacific, and Rest of the World. Primary data for this report was collected through questionnaires, emails, and telephonic interviews.

FIGURE: BREAKDOWN OF PRIMARY INTERVIEWS FROM SUPPLY SIDE

FIGURE: BREAKDOWN OF PRIMARY INTERVIEWS FROM DEMAND SIDE

FIGURE: PROPOSED PRIMARY PARTICIPANTS FROM DEMAND AND SUPPLY SIDE

Note: Above mentioned companies are non- exhaustive

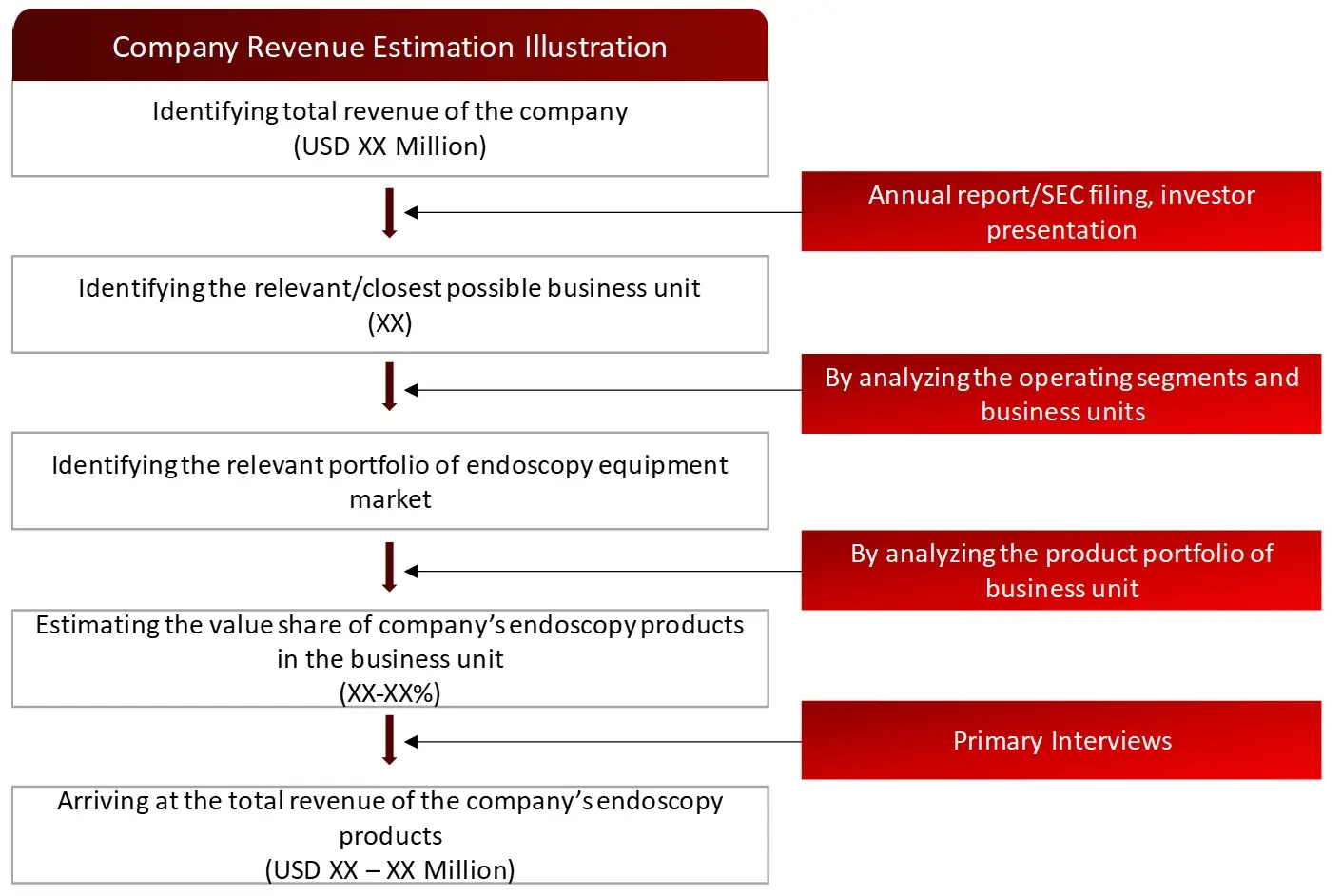

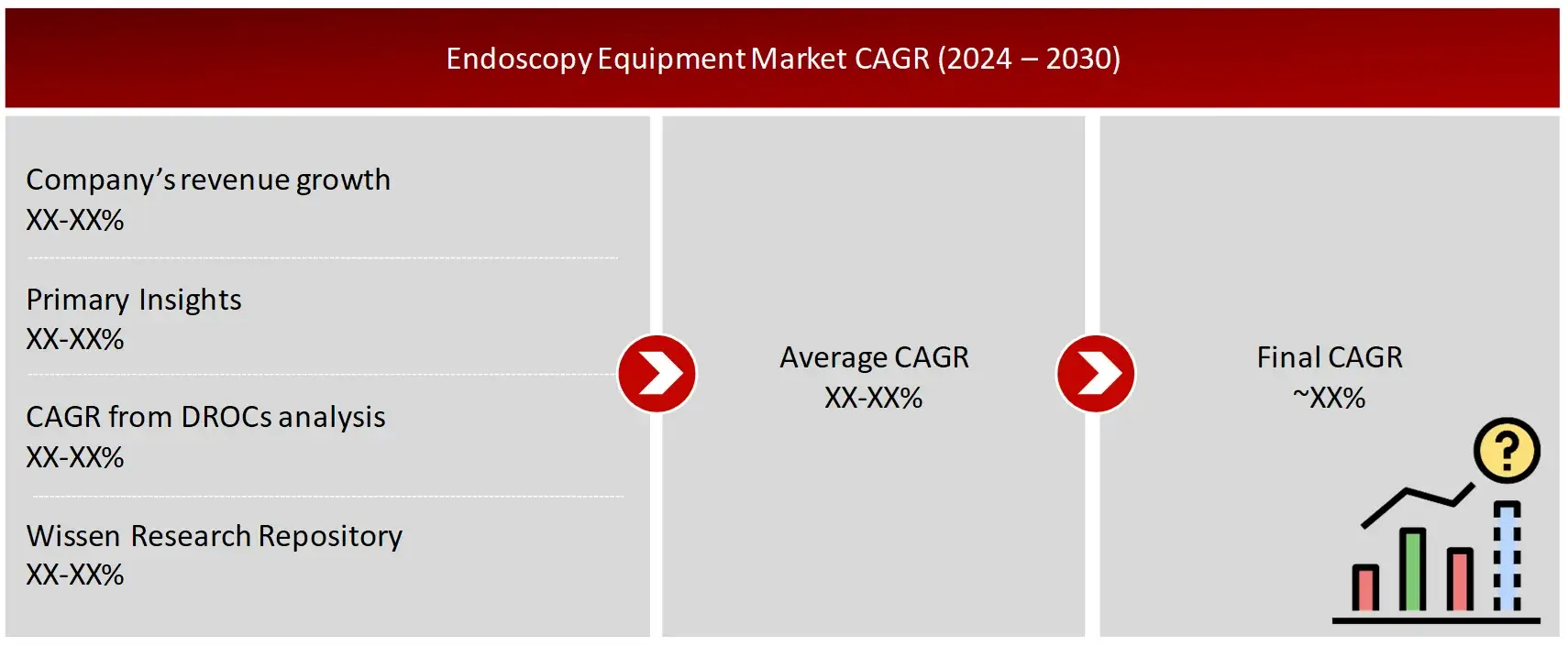

Market Size Estimation

All major manufacturers offering various endoscopy equipment will be identified at the global/regional level. Revenue mapping will be done for the major players, which will further be extrapolated to arrive at the global market value of each type of segment. The market value of endoscopy equipment market will also split into various segments and sub segments at the region level based on:

FIGURE: REVENUE MAPPING BY COMPANY (ILLUSTRATION)

Sources: Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentation, Paid Database, and Wissen Research Analysis.

Sources: Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentation, Paid Database, and Wissen Research Analysis.FIGURE: REVENUE SHARE ANALYSIS OF KEY PLAYERS (SUPPLY SIDE)

Sources: Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentation, Paid Database, and Wissen Research Analysis.

Sources: Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentation, Paid Database, and Wissen Research Analysis.FIGURE: MARKET SIZE ESTIMATION TOP-DOWN AND BOTTOM-UP APPROACH

FIGURE: ANALYSIS OF DROCS FOR GROWTH FORECAST

Sources: American Society for Gastrointestinal Endoscopy (ASGE) Society of Gastroenterology Nurses and Associates (SGNA), European Society of Gastrointestinal Endoscopy (ESGE), American Gastroenterological Association (AGA), European Society of Gastroenterology and Endoscopy Nurses and Associates (ESGENA), Canadian Association of Gastroenterology (CAG), Gastroenterological Society of Australia (GESA), Society of Gastrointestinal Endoscopy of India (SGEI), Company Website, Press Releases, Annual Reports, Paid Data Sources, and Wissen Research Analysis.

Sources: American Society for Gastrointestinal Endoscopy (ASGE) Society of Gastroenterology Nurses and Associates (SGNA), European Society of Gastrointestinal Endoscopy (ESGE), American Gastroenterological Association (AGA), European Society of Gastroenterology and Endoscopy Nurses and Associates (ESGENA), Canadian Association of Gastroenterology (CAG), Gastroenterological Society of Australia (GESA), Society of Gastrointestinal Endoscopy of India (SGEI), Company Website, Press Releases, Annual Reports, Paid Data Sources, and Wissen Research Analysis.FIGURE: GROWTH FORECAST ANALYSIS UTILIZING MULTIPLE PARAMETERS

Sources: Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentation, Paid Database, and Wissen Research Analysis.

Sources: Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentation, Paid Database, and Wissen Research Analysis.Research Design

After arriving at the overall market size-using the market size estimation processes-the market will be split into several segments and sub segment. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub segment, the data triangulation, and market breakdown procedures will be employed, wherever applicable. The data will be triangulated by studying various factors and trends from both the demand and supply sides in the endoscopy equipment market industry.

1. Introduction

1.1 Key objectives

1.2 Definitions

1.2.1 In scope

1.2.2. Out of scope

1.3 Scope of the report

1.4 Scope related limitations

1.5 Key stakeholders

2. Research Methodology

2.1 Research approach

2.2 Research methodology / design

2.3 Market sizing approach

2.3.1 Secondary research

2.3.2 Primary research

3. Executive Summary & Premium Content

3.1 Global market outlook

3.2 Key market findings

4. Market Overview

4.1 Market dynamics

4.1.1 Drivers/Opportunities

4.1.2 Restraints/Challenges

4.2 End user perception

4.3 Need gap

4.4 Supply chain / Value chain analysis

4.5 Industry trends

4.6 Porter’s Five Forces analysis

4.7 Pricing analysis

5. Patent Analysis

5.1 Patents related to endoscopy equipment

5.2 Patent landscape and Intellectual property trends

6. Endoscopy Equipment Market, by Product (2023-2030, USD Million)

6.1 Endoscopes

6.1.1 Rigid endoscopes

6.1.1.1 Laparoscopes

6.1.1.2 Urology endoscopes

6.1.1.3 Gynaecology endoscopes

6.1.1.4 Arthroscopes

6.1.1.5 Cytoscopes

6.1.1.6 Neuroendoscopes

6.1.1.7 Others

6.1.2 Flexible Endoscopes

6.1.2.1 Upper gastrointestinal endoscopes

6.1.2.1.1 Upper gastrointestinal videoscopes

6.1.2.1.2 Upper gastrointestinal fiberscopes

6.1.2.2 Colonoscopes

6.1.2.2.1 Video colonoscopes

6.1.2.2.2 Fiber colonoscopies

6.1.2.3 Broncoscopes

6.1.2.3.1 Fiber broncoscopes

6.1.2.3.2 Video broncoscopes

6.1.2.4 Sigmoidoscopes

6.1.2.4.1. Video sigmoidoscopies

6.1.2.4.2. Fiber sigmoidoscopies

6.1.2.5 Laryngoscopes

6.1.2.5.1 Fiber laryngoscopes

6.1.2.5.2 Video laryngoscopes

6.1.2.6 Pharyngoscopes

6.1.2.6.1 Video pharyngoscopes

6.1.2.6.2 Fiber pharyngoscopes

6.1.2.7 Duodenoscopes

6.1.2.7.1 Video duodenoscopes

6.1.2.7.2 Fiber duodenoscopes

6.1.2.8 Nasophryngoscopes

6.1.2.8.1 Video nasophryngoscopes

6.1.2.8.2 Fiber nasophryngoscopes

6.1.2.9 Rhinoscopes

6.1.2.9.1 Video rhinoscopes

6.1.2.9.2 Fiber rhinoscopes

6.1.2.10 Others

6.1.3 Robot-assisted endoscopes

6.1.4 Disposable endoscopes

6.1.5 Capsule endoscopes

6.2 Visualisation systems

6.2.1 Wireless displays & monitors

6.2.2 Endoscopic light sources

6.2.3 Video convertors

6.2.4 Video recorders

6.2.5 Video processors

6.2.6 Camera heads

6.2.7 Transmitters and receivers

6.2.8 Carts

6.2.9 Others

6.3 Accessories

6.3.1. Light cables

6.3.2 Cleaning brushes

6.3.3 Surgical dissectors

6.3.4 Needle holders

6.3.5 Fluid flushing device

6.3.6 Mouthpieces

6.3.7 Biopsy valves

6.3.8 Overtubes

6.3.9 Others

7. Endoscopy equipment Market, by Application (2023-2030, USD Million)

7.1 Arthroscopy

7.2 Gastrointestinal endoscopy

7.3 Laparoscopy

7.4 Obstetrics/Gynaecology endoscopy

7.5 Urology endoscopy

7.6 Bronchoscopy

7.7 ENT endoscopy

7.8 Mediastinoscopy

7.9 Others

8. Endoscopy equipment Market, by End Users (2023-2030, USD Million)

8.1 Hospitals and critical care centres

8.2 Ambulatory care centers

8.3 Others (academic and research institutions, etc.)

9. Endoscopy equipment Market, by Region (2023-2030, USD Million)

9.1 North America

9.1.1 USA

9.1.2 Canada

9.2 Europe

9.2.1 UK

9.2.2 France

9.2.3 Germany

9.2.4 Italy

9.2.5 Spain

9.2.6 Rest of Europe

9.3 Asia-Pacific

9.3.1 China

9.3.2 India

9.3.3 Japan

9.3.4 South Korea

9.3.5 Australia and New Zealand

9.3.6 Rest of Asia-Pacific

9.4 Middle East and Africa

9.5 Latin America

10. Competitive Analysis

10.1 Key players footprint analysis

10.2 Market share analysis

10.3 Key brand analysis

10.4 Regional snapshot of key players

10.5 R&D expenditure of key players

11. Company Profiles2

11.1 Boston Scientific Corporation

11.1.1 Business overview

11.1.2 Product portfolio

11.1.3 Financial snapshot3

11.1.4 Recent developments

11.1.5 SWOT analysis

11.2 Stryker Corporation

11.3 Johnson & Johnson

11.4 Karl Storz SE & Co. KG

11.5 Fujifilm

11.6 Medtronic PLC

11.7 Nipro Corporation

11.8 Hoya Corporation

11.9 Smith & Nephew PLC

11.10 Cook Medical

11.11 Others Key Players

12. Appendix

12.1 Industry speak

12.2 Questionnaire

12.3 Available custom work

12.4 Adjacent studies

12.5 Authors

13. References

Key Notes:

© Copyright 2024 – Wissen Research All Rights Reserved.