Sources: Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentation, Paid Database, and Wissen Research Analysis.

Sources: Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentation, Paid Database, and Wissen Research Analysis.The comprehensive research includes an in-depth analysis of industry trends, detailed pricing evaluations, patent assessments, insights from conferences and webinars, identification of key stakeholders, and a sophisticated understanding of market purchasing behaviors. Government programs focused on improving dental health and funding dental equipment within public healthcare systems are instrumental in driving the growth of the dental equipment market. These initiatives aim to reduce disparities in access to dental care, especially among underserved populations, by allocating resources for purchasing advanced dental equipment. By offering financial support and incentives, governments encourage dental practices and clinics to upgrade their facilities with modern diagnostic tools, treatment technologies, and infection control systems. This not only enhances the quality of care but also boosts the efficiency and capacity of dental services to meet increasing demand. However, disruptions in the global supply chain pose a significant challenge, leading to delays and higher costs for raw materials and components

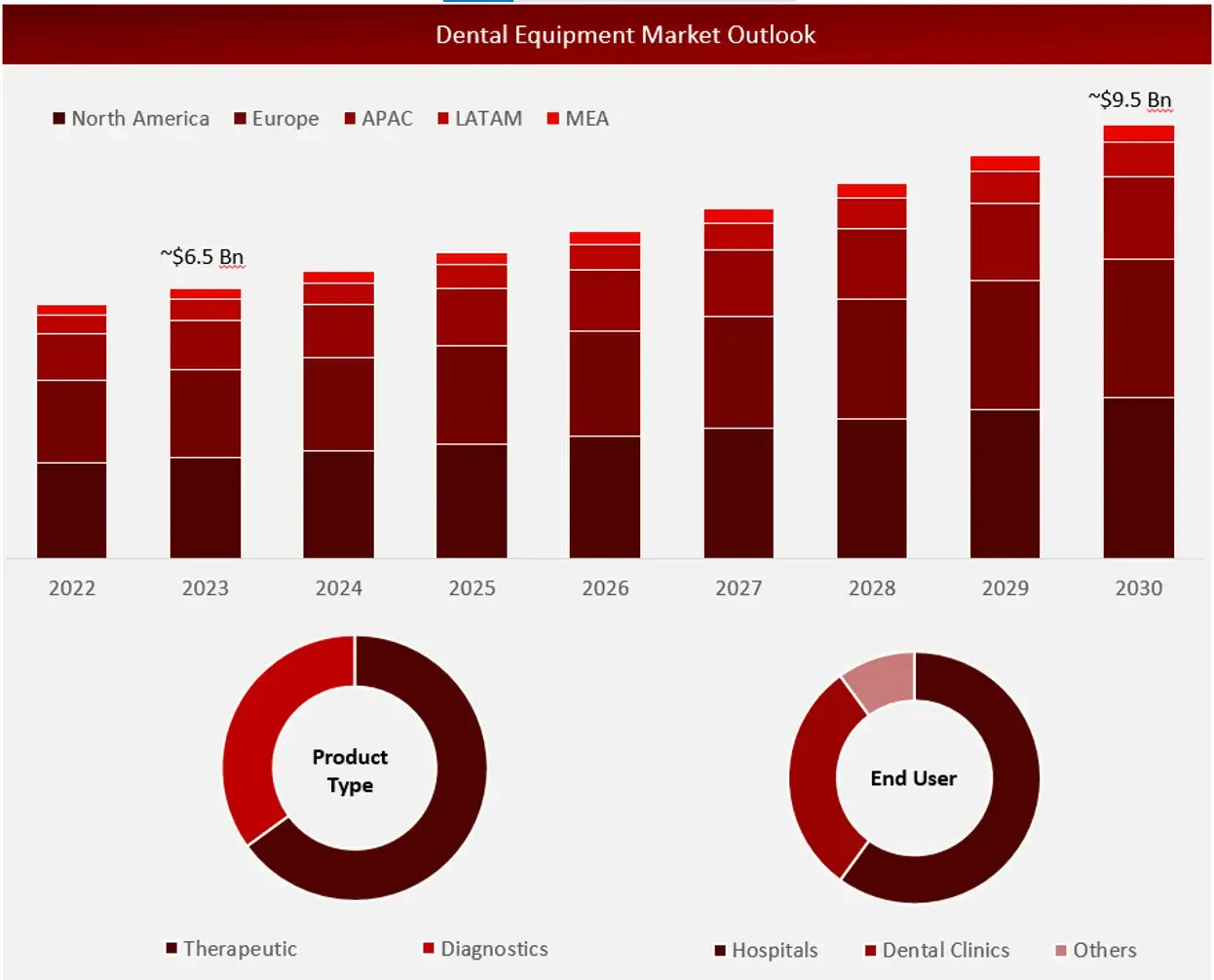

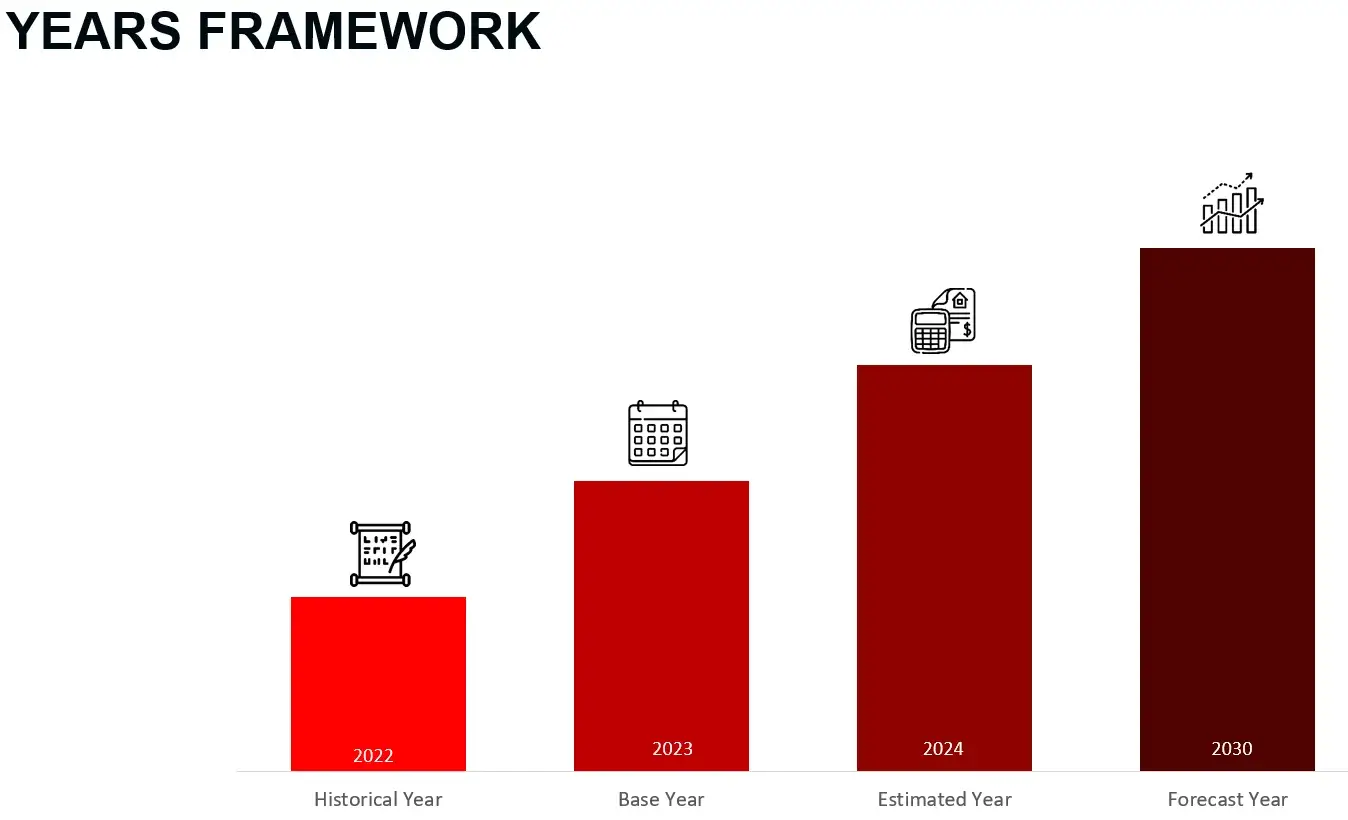

Wissen Research analyses that the global dental equipment market is estimated at ~USD 6.5 billion in 2023 and is projected to reach ~USD 9.5 billion by 2030, expected to grow at a CAGR of ~5.5% during the forecast period, 2023-2030.

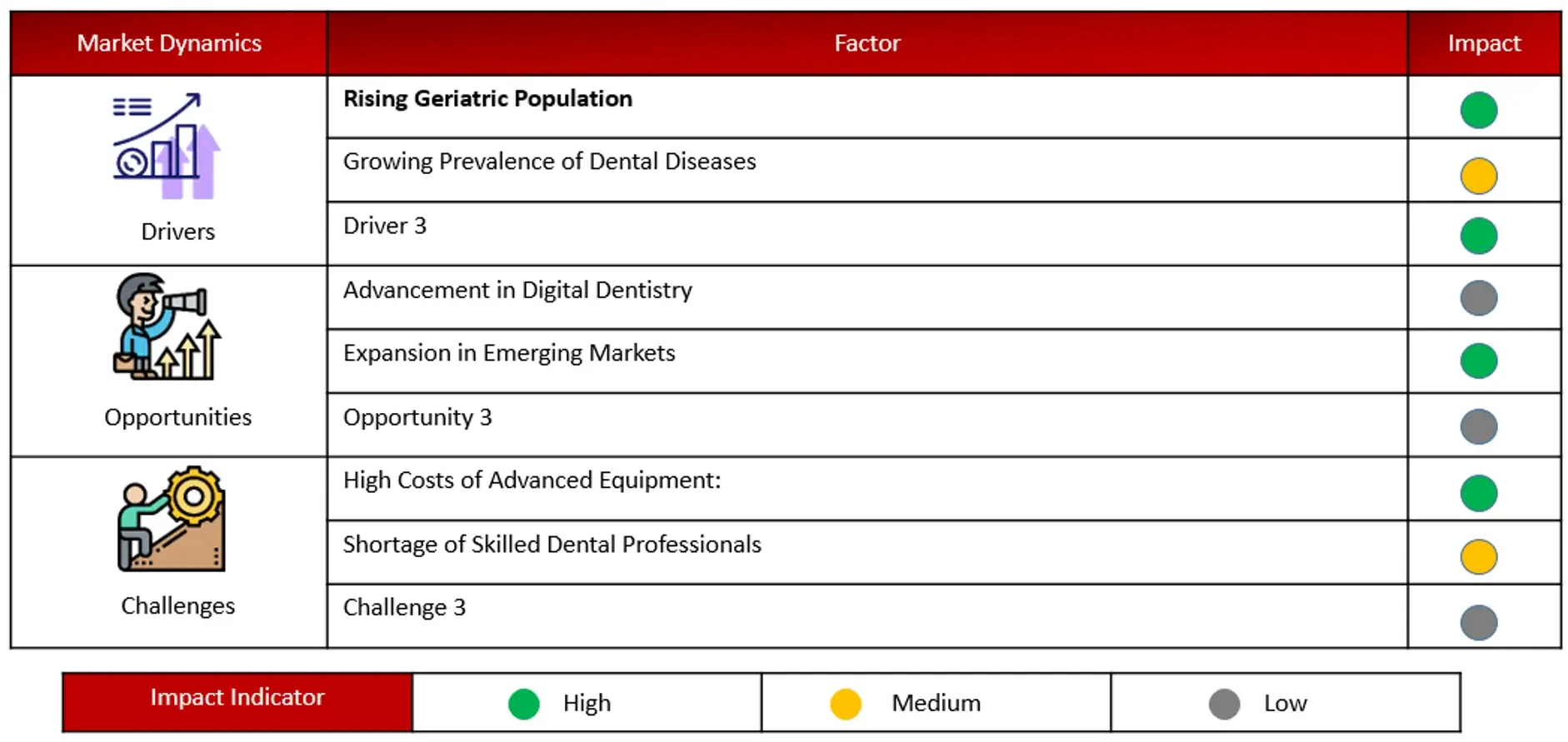

Driving Factor: Development of technologically advanced solutions

The dental industry has undergone significant evolution through the development of advanced dental materials and technologies. Concurrently, patient compliance has risen alongside a growing preference for minimally invasive procedures. Dental lasers, for instance, are increasingly utilized in surgical treatments such as gum lifting and teeth whitening to minimize blood loss and enhance patient comfort. Adhesive dentistry has also gained prominence, employing composite materials that improve both aesthetic appeal and tooth strength with minimal damage to tooth structures, thereby attracting a rising number of patients seeking such procedures.

Opportunity: Increasing emphasis on emerging markets.

Rapidly advancing countries in Asia and Latin America, such as India, China, and Brazil, exhibit strong demand for restorative dental products and equipment. This demand is driven by rising incidences of dental diseases, ongoing development of oral healthcare infrastructure, increased willingness to invest in dental restoration due to growing disposable incomes, and heightened awareness of oral hygiene. These factors are expected to stimulate the market for dental prosthetics, restoration materials, and equipment in these regions.

Challenge: Shortage of skilled dental practitioners

Globally, the demand for dental care services is expected to rise due to changing demographics, increased awareness of dental health, sedentary lifestyles, and a growing prevalence of dental diseases. However, many countries are facing significant challenges due to a shortage of dental professionals. Regions such as Africa, Asia, and Latin America also face shortages of oral health professionals. In Africa, for example, the dentist-to-population ratio is roughly 1:150,000, which contrasts sharply with developed countries where the ratio is around 1:2,000. This shortage of dentists in these regions poses a significant challenge, likely to impede the broader adoption of dental equipment and technologies, despite the substantial patient population in need of dental care.

Sources: Company Websites and Wissen Research Analysis.

Sources: Company Websites and Wissen Research Analysis.

The therapeutic dental equipment segment captured the largest share of the dental equipment industry

The therapeutic dental equipment segment dominated the global dental equipment market in 2023, driven largely by the growing demand for cosmetic dental procedures. With the rising popularity of treatments like teeth whitening, orthodontics, and dental implants, spurred by increased consumer awareness and the emphasis on dental aesthetics, there has been a notable surge in this segment. Social media’s influence, where a perfect smile is highly prized, has further fueled this trend. In response, dental practices globally are investing in advanced therapeutic technologies, such as laser systems, CAD/CAM devices, and specialized instruments, to efficiently meet the rising demand for cosmetic procedures. These technologies not only enhance treatment accuracy and outcomes but also improve patient comfort and recovery times, making them increasingly attractive to both patients and practitioners.

APAC is projected to be the fastest-growing regional market in the dental equipment industry

The rising middle class in the Asia Pacific region is a key factor driving the increased demand for advanced healthcare services, especially in dental care, which is fueling growth in the dental equipment market. Rapid economic development in countries such as China, India, and various Southeast Asian nations is elevating disposable incomes and living standards among the middle class. This demographic change is also leading to heightened health awareness, resulting in greater expenditure on both preventive and corrective dental treatments.

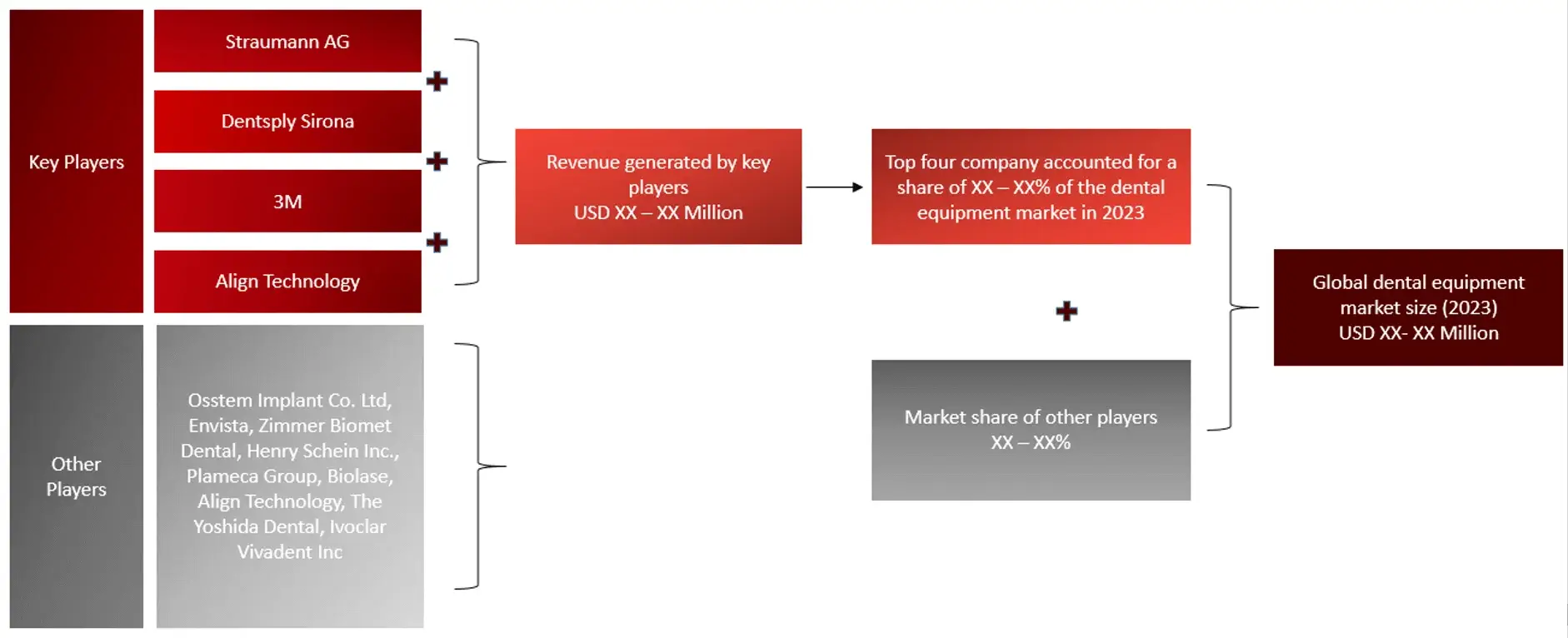

Major Companies and Market Share Insights

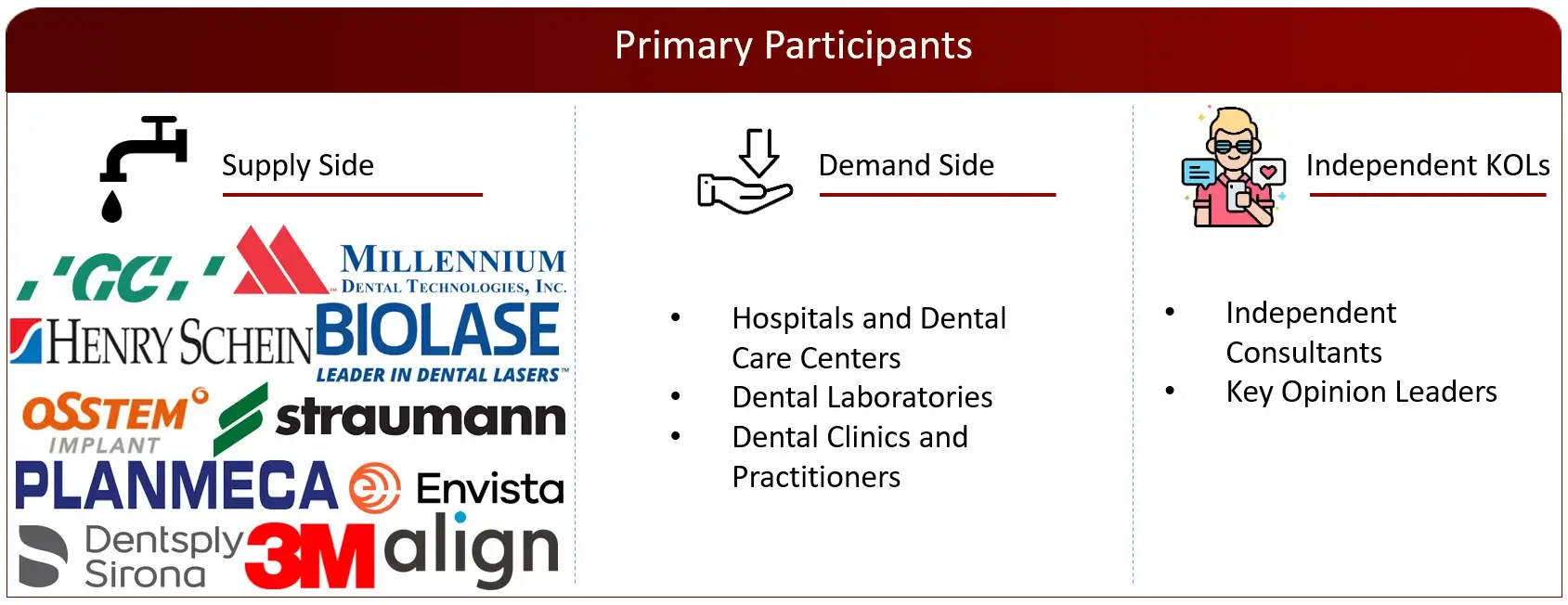

Major players operating in dental equipment market are Danaher, Dentsply Sirona, 3M Biolase, Align Technology, GC Corporation, Osstem Implant Co. Ltd, Envista, Zimmer Biomet Dental, Henry Schein Inc., Plameca Group, Instutit Straumann AG among others.

Introduction

Market Definition

Dental equipment refers to the comprehensive array of tools and instruments that are crucial for diagnosing, treating, and preventing various dental diseases and disorders. These tools are essential in the daily practice of dental professionals, including dentists, dental hygienists, and technicians working in dental laboratories. Therapeutic instruments include items like dental lasers, drills, and scalers, used in procedures ranging from routine cleanings to complex surgeries. Each piece of equipment plays a vital role in ensuring accurate diagnosis, effective treatment, and overall patient care, making them indispensable in modern dental practices.

Sources: Company Websites and Wissen Research Analysis.

Sources: Company Websites and Wissen Research Analysis.

Sources: Wissen Research Analysis.

Sources: Wissen Research Analysis.

Key Stakeholders

Key objectives of the Study

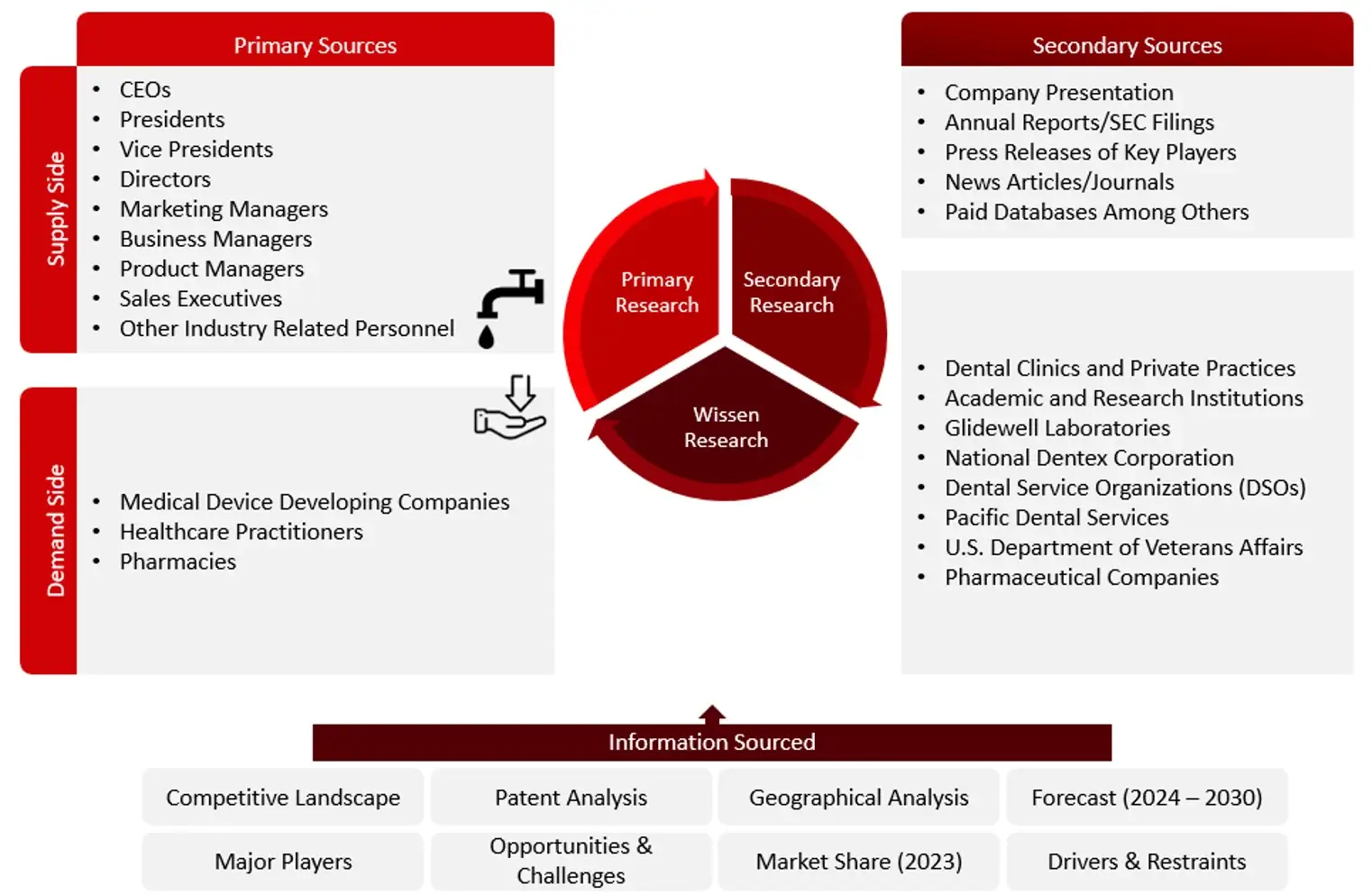

Research Methodology

The aim of the study is to examine the key market forces such as drivers, opportunities, restraints, challenges, and strategies of key leaders. To monitor company advancements such as patents granted, product launches, expansions, and collaborations of key players, analyzing their competitive landscape based on various parameters of business and product strategy. Markey sizing will be estimated using top-down and bottom-up approaches. Using market breakdown and data triangulation techniques, market sizing of segments and sub-segments will be estimated.

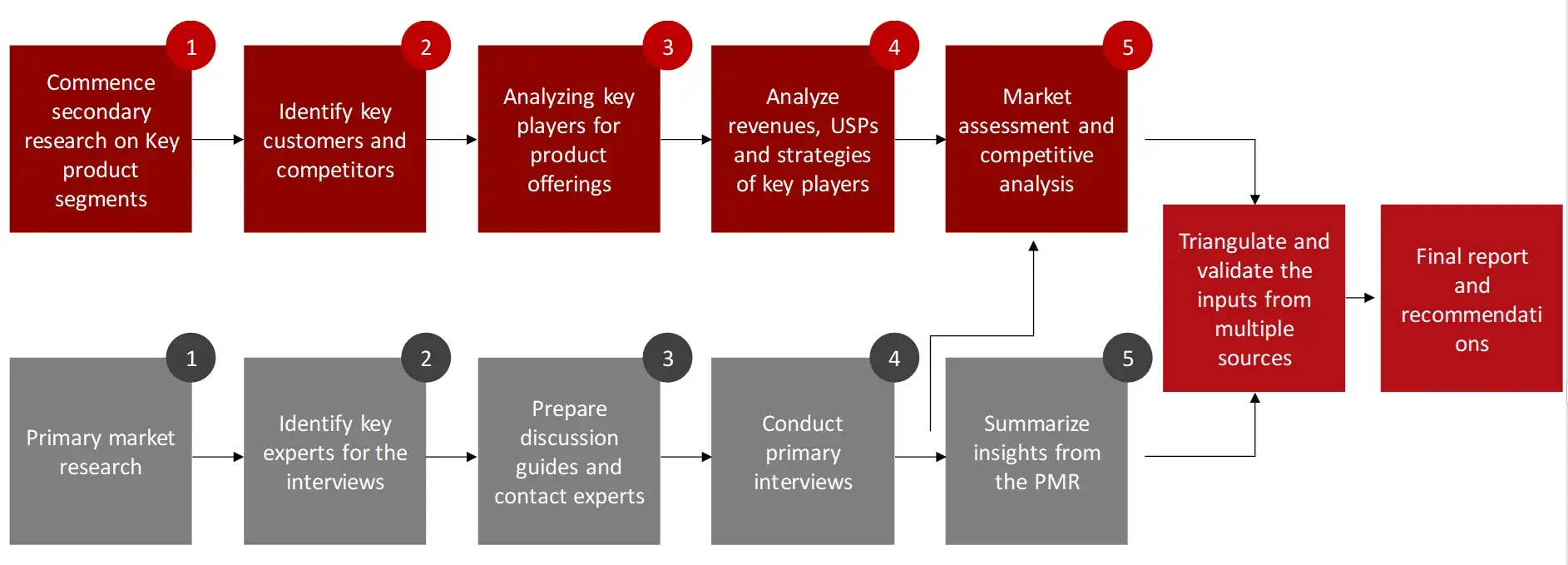

FIGURE: RESEARCH DESIGN

Sources: Wissen Research Analysis.

Sources: Wissen Research Analysis.

Research Approach

Collecting Secondary Data

The process of collating secondary research data involves the utilization of databases, secondary sources, annual reports, investor presentations, directories, and SEC filings of companies. Secondary research will be utilized to identify and gather information beneficial for the in-depth, technical, market-oriented, and commercial analysis of the dental equipment market. A database of the key industry leaders will also be compiled using secondary research.

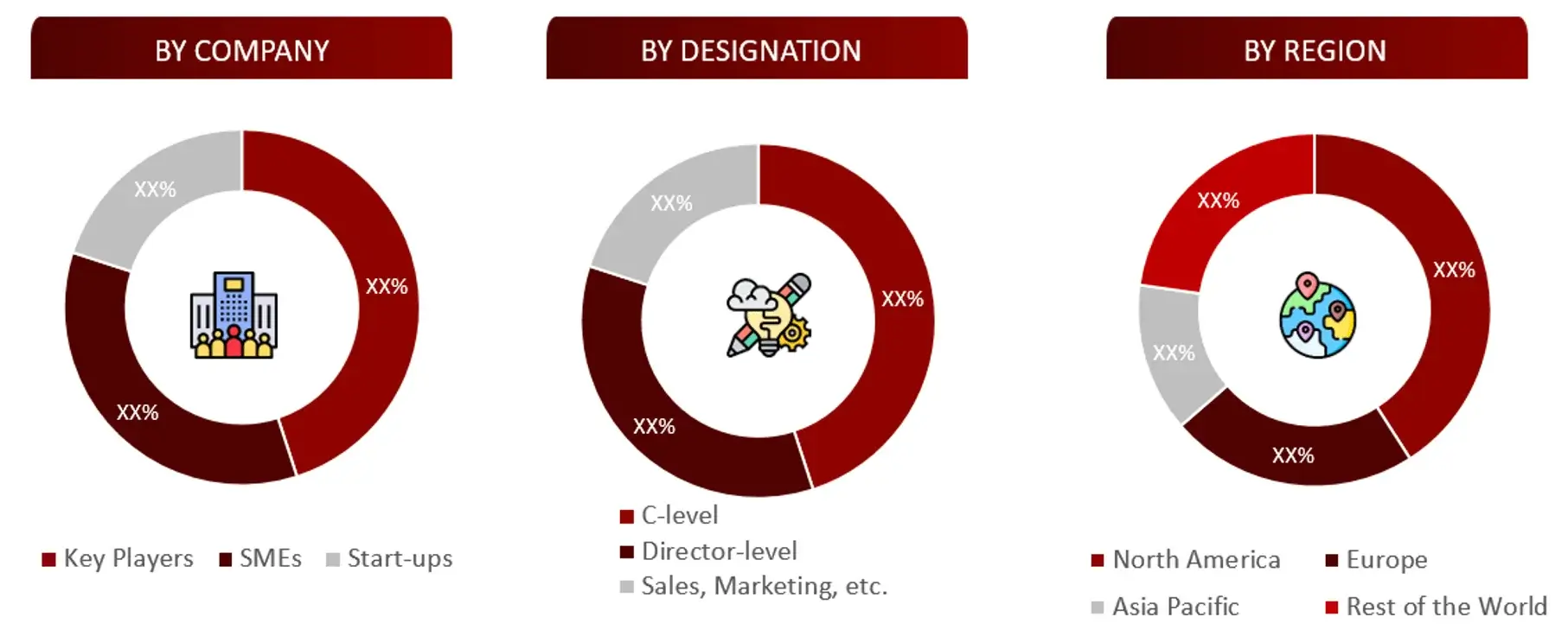

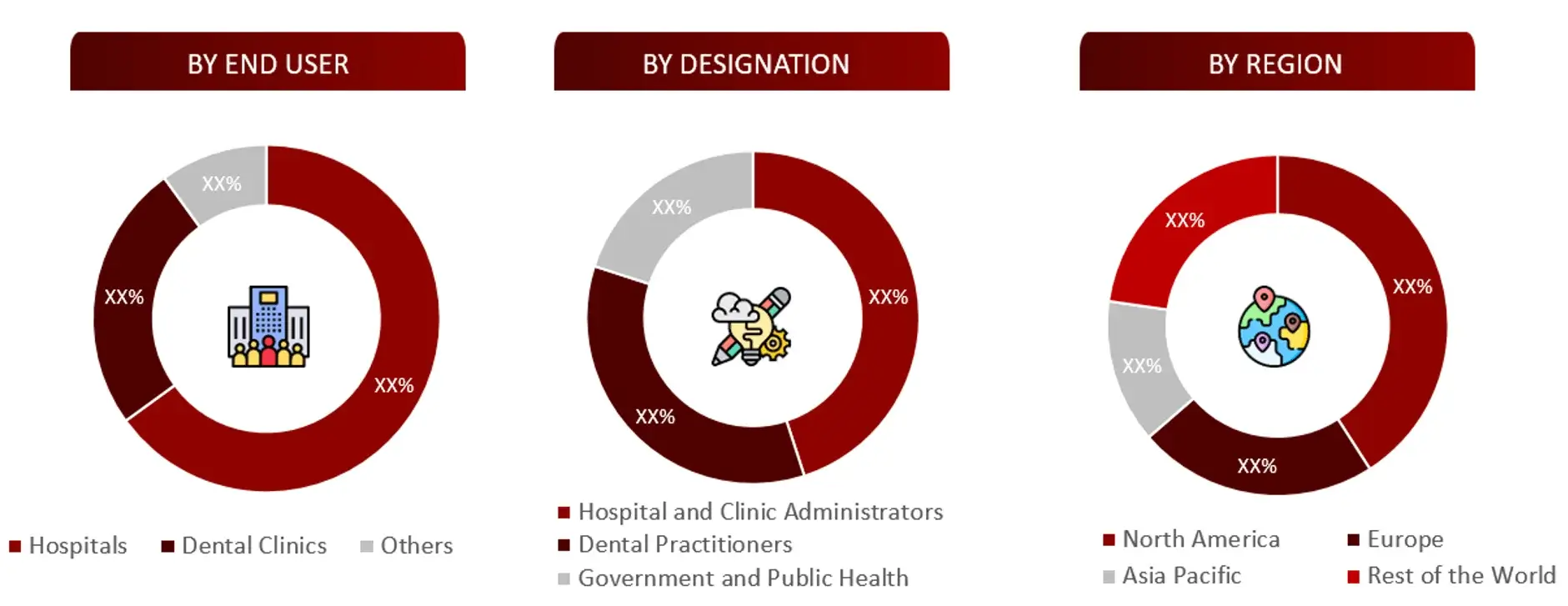

Collecting Primary Data

The primary research data will be conducted after acquiring knowledge about the dental equipment market scenario through secondary research. A significant number of primary interviews will be conducted with stakeholders from both the demand and supply side (including various industry experts, such as Vice Presidents (VPs), Chief X Officers (CXOs), Directors from business development, marketing and product development teams, product manufacturers) across major countries of Europe, Asia Pacific, North America, Latin America, and Middle East and Africa. Primary data for this report will be collected through questionnaires, emails, and telephonic interviews.

FIGURE: BREAKDOWN OF PRIMARY INTERVIEWS FROM SUPPLY SIDE

FIGURE: BREAKDOWN OF PRIMARY INTERVIEWS FROM DEMAND SIDE

FIGURE: PROPOSED PRIMARY PARTICIPANTS FROM DEMAND AND SUPPLY SIDE

Note: Above mention companies are non-exhaustive.

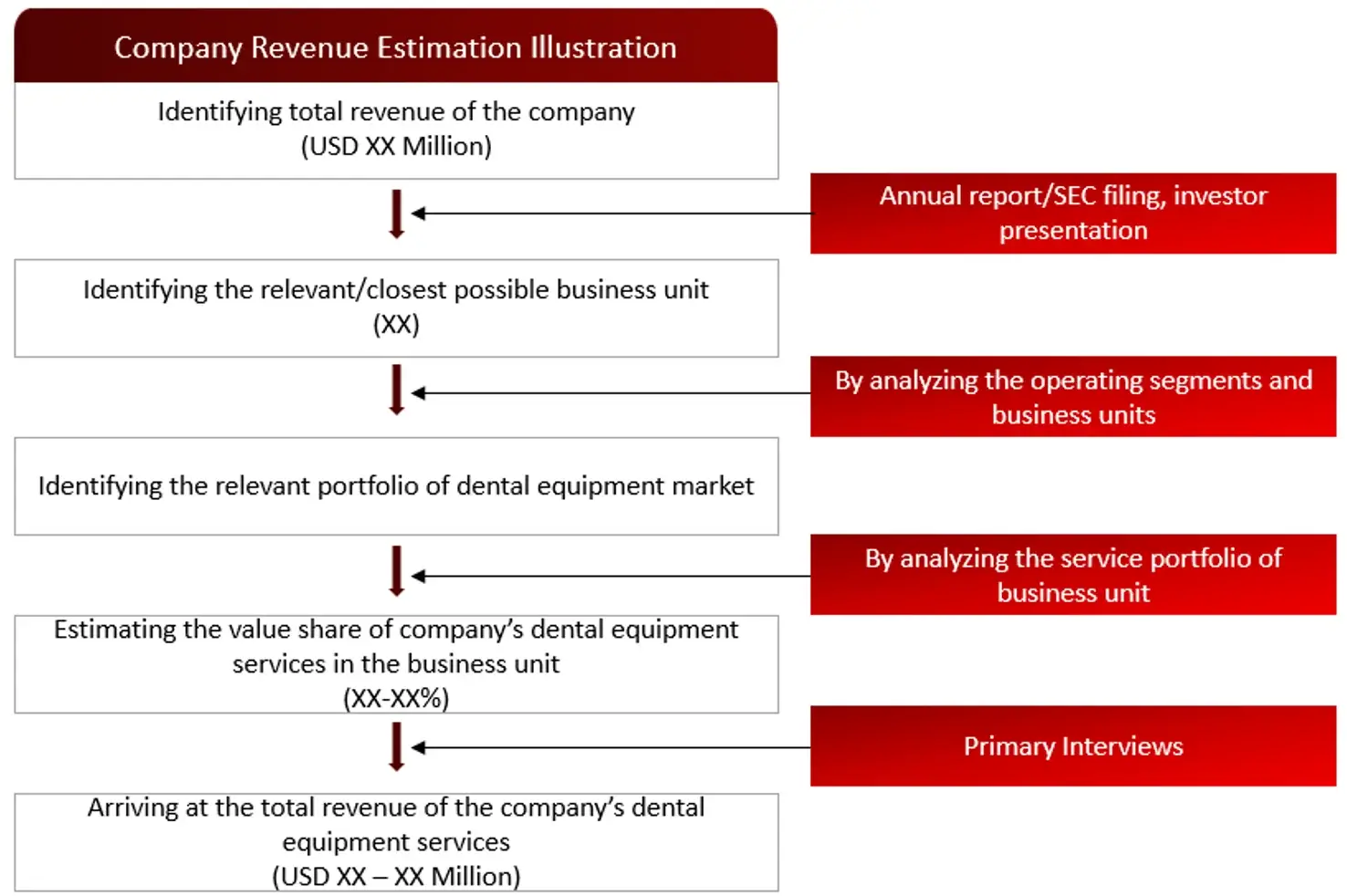

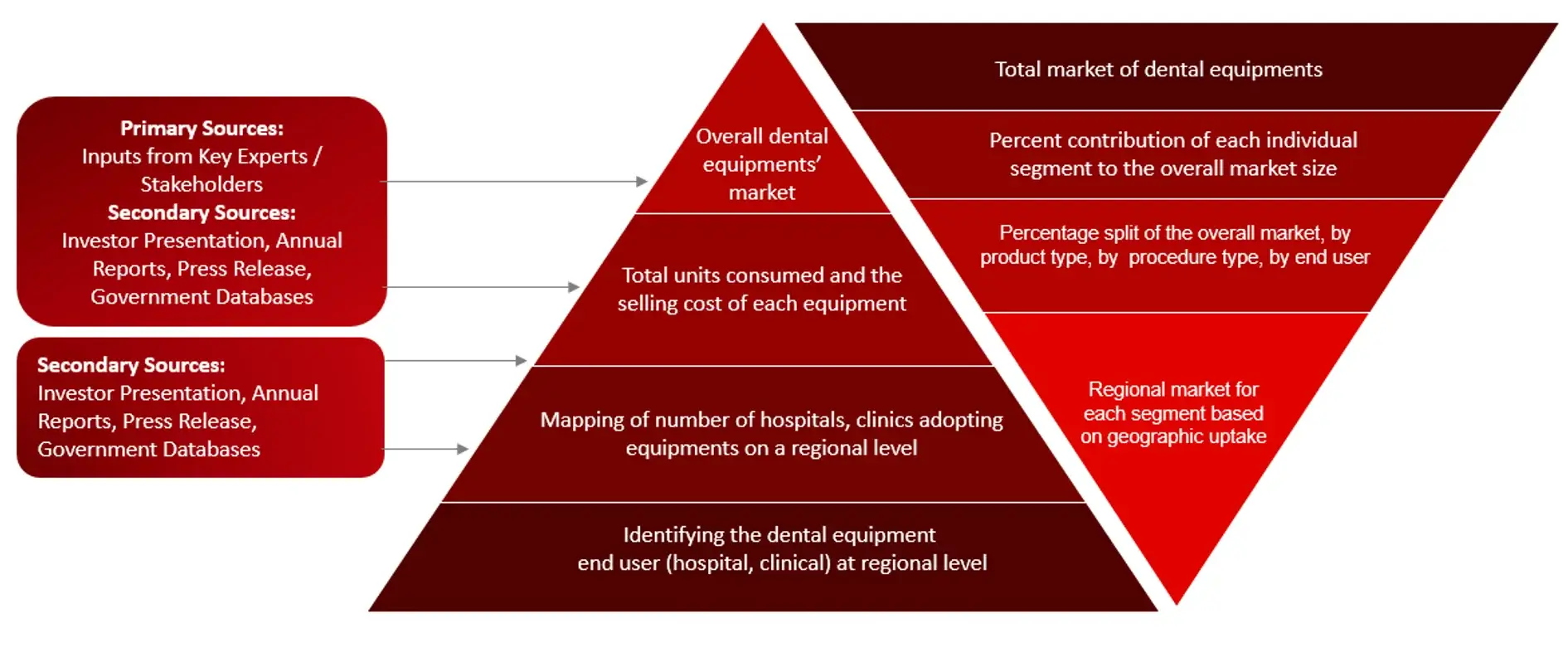

Market Size Estimation

All major manufacturers offering various dental equipment services will be identified at the global / regional level. Revenue mapping will be done for the major players, which will further be extrapolated to arrive at the global market value of each type of segment. The market value of dental equipment market will also split into various segments and sub segments at the region level based on:

FIGURE: REVENUE MAPPING BY COMPANY (ILLUSTRATION)

Sources: Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentation, Paid Database, and Wissen Research Analysis.

Sources: Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentation, Paid Database, and Wissen Research Analysis.FIGURE: REVENUE SHARE ANALYSIS OF KEY PLAYERS (SUPPLY SIDE)

Sources: Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentation, Paid Database, and Wissen Research Analysis.

Sources: Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentation, Paid Database, and Wissen Research Analysis.FIGURE: MARKET SIZE ESTIMATION TOP-DOWN AND BOTTOM-UP APPROACH

Sources: Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentation, Paid Database, and Wissen Research Analysis.

Sources: Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentation, Paid Database, and Wissen Research Analysis.FIGURE: ANALYSIS OF DROCS FOR GROWTH FORECAST

Sources: Dental Clinics and Private Practices, Academic and Research Institutions, Glidewell Laboratories, National Dentex Corporation, Dental Service Organizations (DSOs), Pacific Dental Services, U.S. Department of Veterans Affairs, Pharmaceutical Companies Company Website, Press Releases, Annual Reports, Paid Data Sources, and Wissen Research Analysis.

Sources: Dental Clinics and Private Practices, Academic and Research Institutions, Glidewell Laboratories, National Dentex Corporation, Dental Service Organizations (DSOs), Pacific Dental Services, U.S. Department of Veterans Affairs, Pharmaceutical Companies Company Website, Press Releases, Annual Reports, Paid Data Sources, and Wissen Research Analysis.FIGURE: GROWTH FORECAST ANALYSIS UTILIZING MULTIPLE PARAMETERS

Sources: Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentation, Paid Database, and Wissen Research Analysis.

Sources: Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentation, Paid Database, and Wissen Research Analysis.Research Design

After arriving at the overall market size-using the market size estimation processes-the market will be split into several segments and sub segment. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub segment, the data triangulation, and market breakdown procedures will be employed, wherever applicable. The data will be triangulated by studying various factors and trends from both the demand and supply sides in the dental equipment market.

Sources: Dental Clinics and Private Practices, Academic and Research Institutions, Glidewell Laboratories, National Dentex Corporation, Dental Service Organizations (DSOs), Pacific Dental Services, U.S. Department of Veterans Affairs, Pharmaceutical Companies Company Website, Press Releases, Annual Reports, Paid Data Sources, and Wissen Research Analysis.

Sources: Dental Clinics and Private Practices, Academic and Research Institutions, Glidewell Laboratories, National Dentex Corporation, Dental Service Organizations (DSOs), Pacific Dental Services, U.S. Department of Veterans Affairs, Pharmaceutical Companies Company Website, Press Releases, Annual Reports, Paid Data Sources, and Wissen Research Analysis.

1. Introduction

1.1 Key Objectives

1.2 Definitions

1.2.1 In Scope

1.2.2 Out of Scope

1.3 Scope of the Report

1.4 Scope Related Limitations

1.5 Key Stakeholders

2. Research Methodology

2.1 Research Approach

2.2 Research Methodology / Design

2.3 Market Sizing Approach

2.3.1 Secondary Research

2.3.2 Primary Research

3. Executive Summary & Premium Content

3.1 Global Market Outlook

3.2 Key Market Findings

4. Market Overview

4.1 Market Dynamics

4.1.1 Drivers/Opportunities

4.1.2 Restraints/Challenges

4.2 End User Perception

4.3 Need Gap

4.4 Supply Chain / Value Chain Analysis

4.5 Industry Trends

4.6 Pricing Analysis

4.7 Porter’s Five Forces Analysis

5. Patent Analysis

5.1. Patents Related to Dental Equipment Technologies/Devices

5.2. Patent Landscape and Intellectual Property Trends

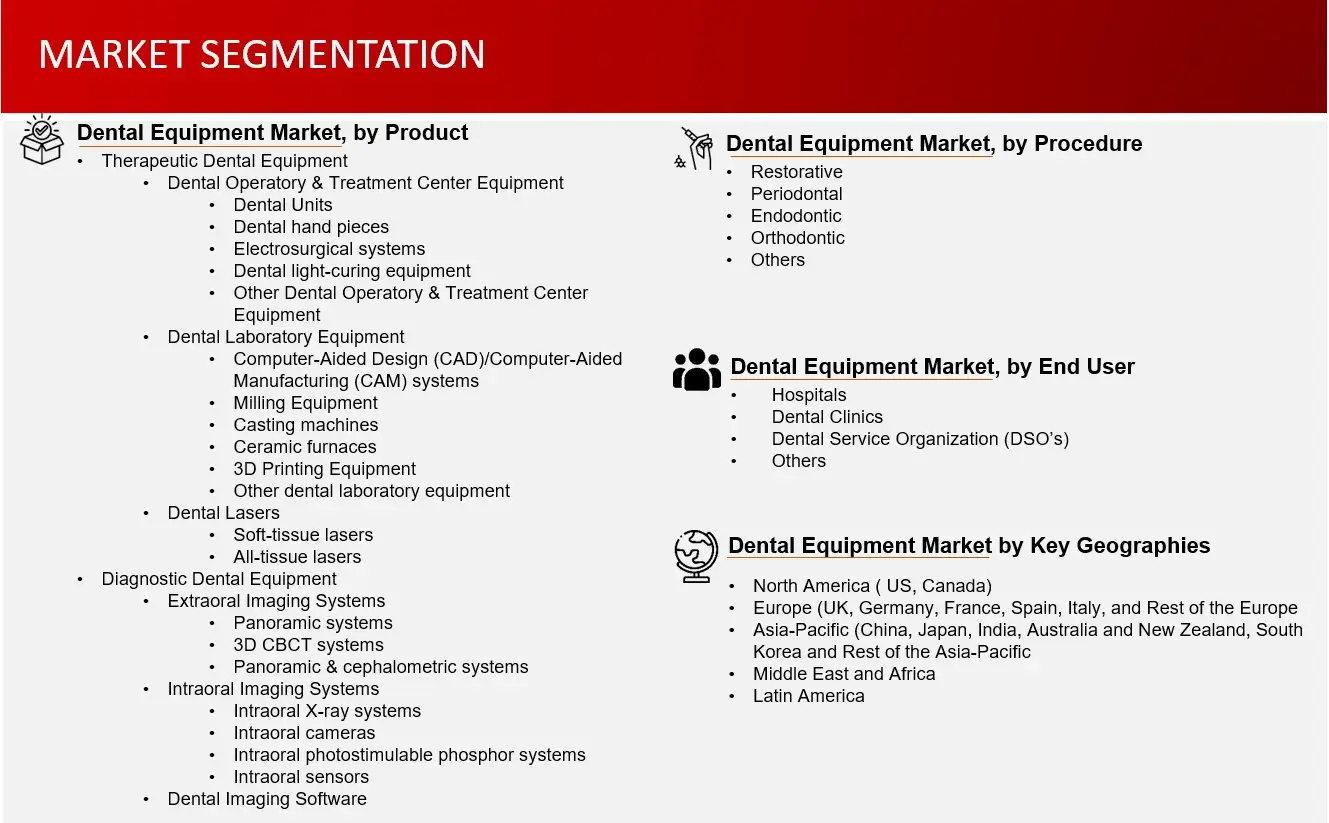

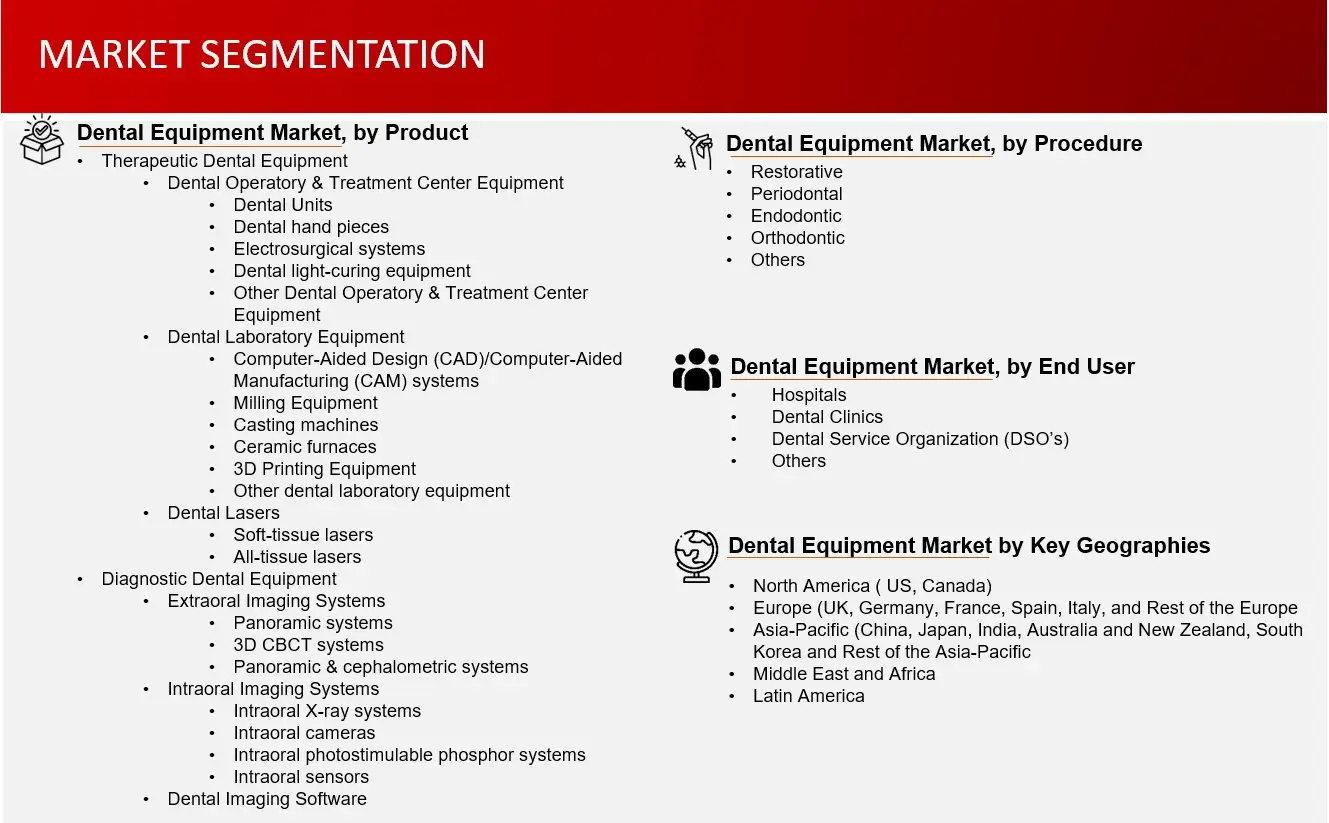

6. Global Dental Equipment Market, by Product Type (2023-2030, USD Million)

6.1 Therapeutic Dental Equipment Intra-Oral

6.1.1 Dental Operatory & Treatment Center Equipment

6.1.1.1 Dental Units

6.1.1.1.1 Instrument Delivery Systems

6.1.1.1.2 Dental Chairs

6.1.1.1.3 Dental hand pieces

6.1.1.1.4 Electrosurgical systems

6.1.1.1.5 Dental light-curing equipment

6.1.1.1.6 Other Dental Operatory & Treatment Center Equipment

6.1.2 Dental Laboratory Equipment

6.1.2.1 Computer-Aided Design (CAD)/Computer-Aided Manufacturing (CAM) systems

6.1.2.2 Milling Equipment

6.1.2.3 Casting machines

6.1.2.4 Ceramic furnaces

6.1.2.5 3D Printing Equipment

6.1.2.6 Other dental laboratory equipment

6.1.3 Dental Lasers

6.1.3.1 Soft-tissue lasers

6.1.3.1.1 Carbon-dioxide lasers

6.1.3.1.2 Diode Lasers

6.1.3.1.3 Nd:YAG lasers

6.1.3.2 All-tissue lasers

6.1.3.2.1 Er:YAG laser

6.1.3.2.2 Er,Cr:YSGG lasers

6.2 Diagnostic Dental Equipment

6.2.1 Extraoral Imaging Systems

6.2.1.1 Panoramic systems

6.2.1.2 3D CBCT systems

6.2.1.3 Panoramic & cephalometric systems

6.2.2 Intraoral Imaging Systems

6.2.2.1 Intraoral X-ray systems

6.2.2.2 Intraoral cameras

6.2.2.3 Intraoral photostimulable phosphor systems

6.2.2.4 Intraoral sensors

6.2.3 Dental Imaging Software

7. Global Dental Equipment Market, by Procedure Type (2023-2030, USD Million)

7.1 Restorative

7.2 Periodontal

7.3 Endodontic

7.4 Orthodontic

7.5 Others (Cosmetic, Preventive etc.)

8. Global Dental Equipment Market, by End User (2023-2030, USD Million)

8.1 Hospitals

8.2 Dental Service Organization (DSO’s)

8.3 Dental Clinics

8.4 Others (Ambulatory Surgery Centers, Academic & Research Institutes)

9. Global Dental Equipment Market, by Region (2023-2030, USD Million)

9.1 North America

9.1.1 US

9.1.2 Canada

9.2 Europe

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 Italy

9.2.5 UK

9.2.6 Rest of the Europe

9.3 Asia Pacific

9.3.1 China

9.3.2 Japan

9.3.3 India

9.3.4 Australia and New Zealand

9.3.5 South Korea

9.3.6 Rest of the Asia Pacific

9.4 Middle East and Africa

9.5 Latin America

10. Competitive Analysis

10.1 Key Players Footprint Analysis

10.2 Market Share Analysis

10.3 Key Brand Analysis

10.4 Regional Snapshot of Key Players

10.5 R&D Expenditure of Key Players

11. Company Profiles2

11.1 Align Technology.

11.1.1 Business Overview

11.1.2 Product Portfolio

11.1.3 Financial Snapshot3

11.1.4 Recent Developments

11.1.5 SWOT Analysis

11.2 Osstem Implant Co. Ltd,

11.3 Dentsply Sirona

11.4 3M

11.5 Envista

11.6 PreXion

11.7 Zimmer Biomet Dental

11.8 Millennium Dental Technologies, Inc.

11.9 Henry Schein Inc.

11.10 Plameca Group

11.11 Biolase

11.12 The Yoshida Dental

11.13 Align Technology

11.14 Nakanishi Inc

11.15 Ivoclar Vivadent Inc

11.16 Straumann AG

11.17 BEGO Gmbh & Co. KG

11.18 Ultradent Products, Inc.

11.19 GC Corporation

12. Conclusion

13. Appendix

13.1 Industry Speak

13.2 Questionnaire

13.3 Available Custom Work

13.4 Adjacent Studies

13.5 Authors

14. References

Key Notes:

© Copyright 2024 – Wissen Research All Rights Reserved.