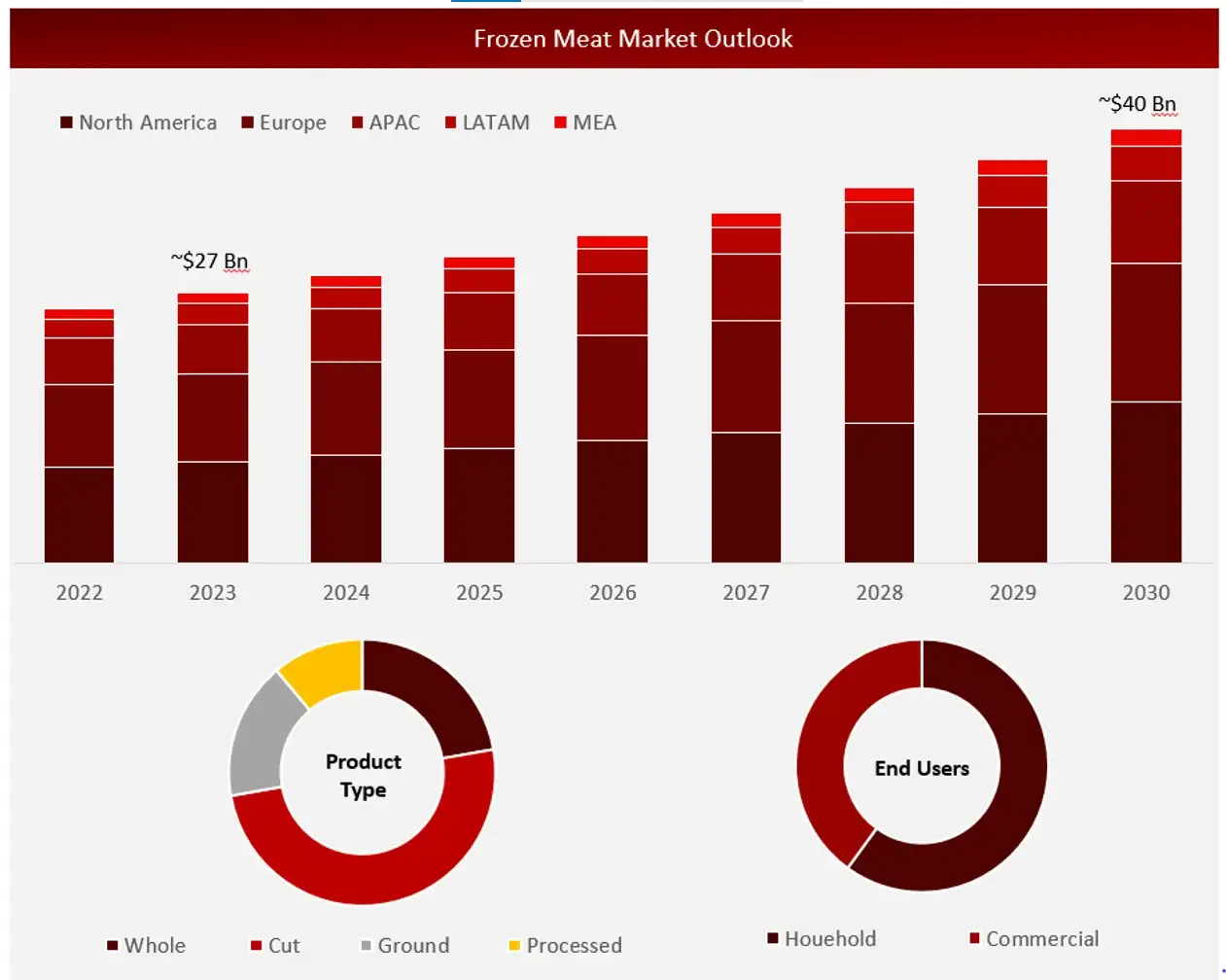

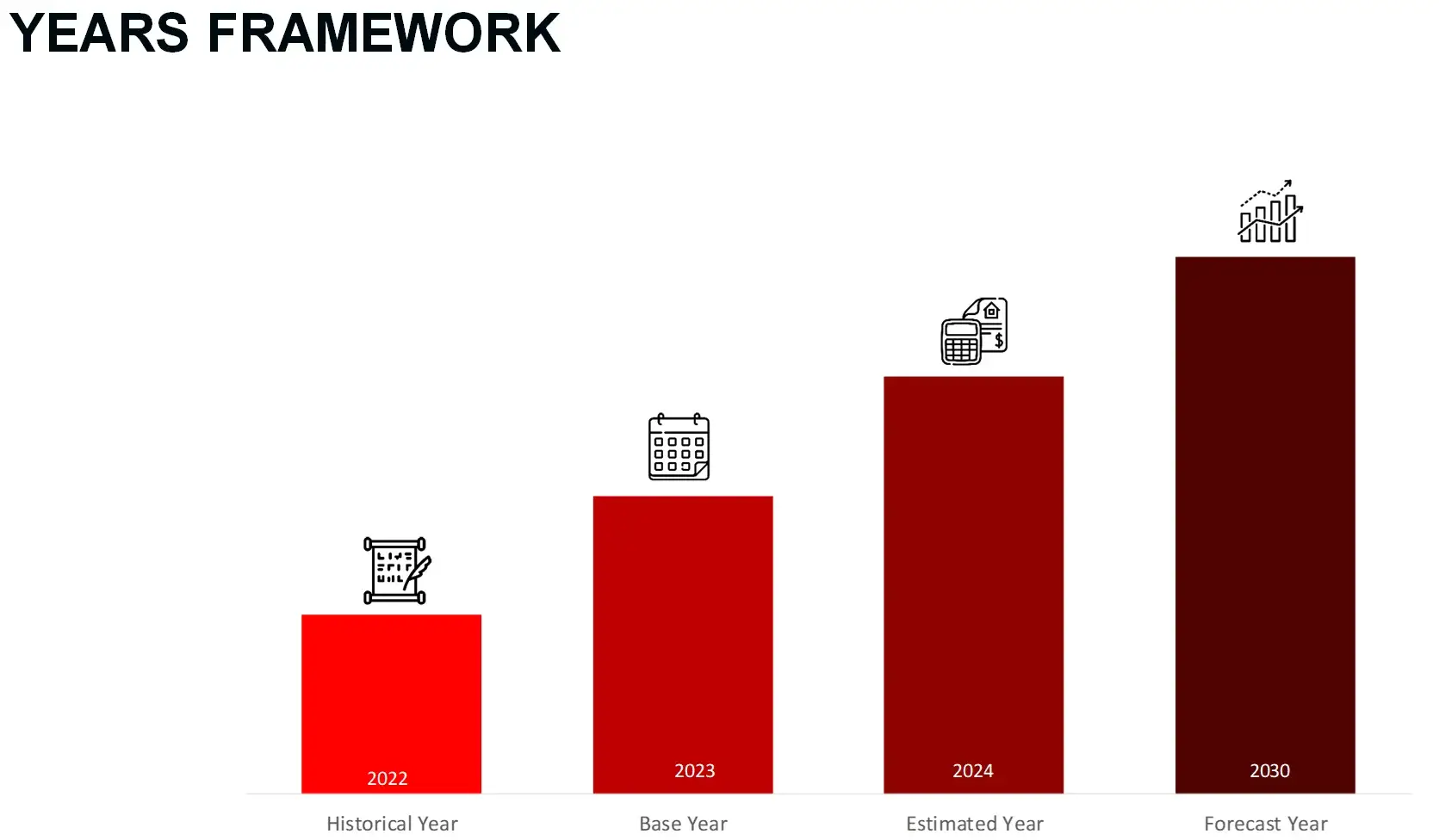

Wissen Research analyses that the global frozen meat market is estimated at ~USD 27 billion in 2023 and is projected to reach ~USD 40 billion by 2030, expected to grow at a CAGR of ~5% during the forecast period, 2023-2030.

Frozen meat is a widely used preservation method that slows enzyme activity, inhibits microbial growth, and extends shelf life. When properly packaged and stored at 0°C, frozen meat remains safe to eat, making it suitable for international transportation. Since some meats are seasonal or region-specific, freezer technology allows for year-round storage and global distribution. The growth of the frozen meat market is driven by the rising meat-eating population and the increasing demand for ready-to-eat foods.

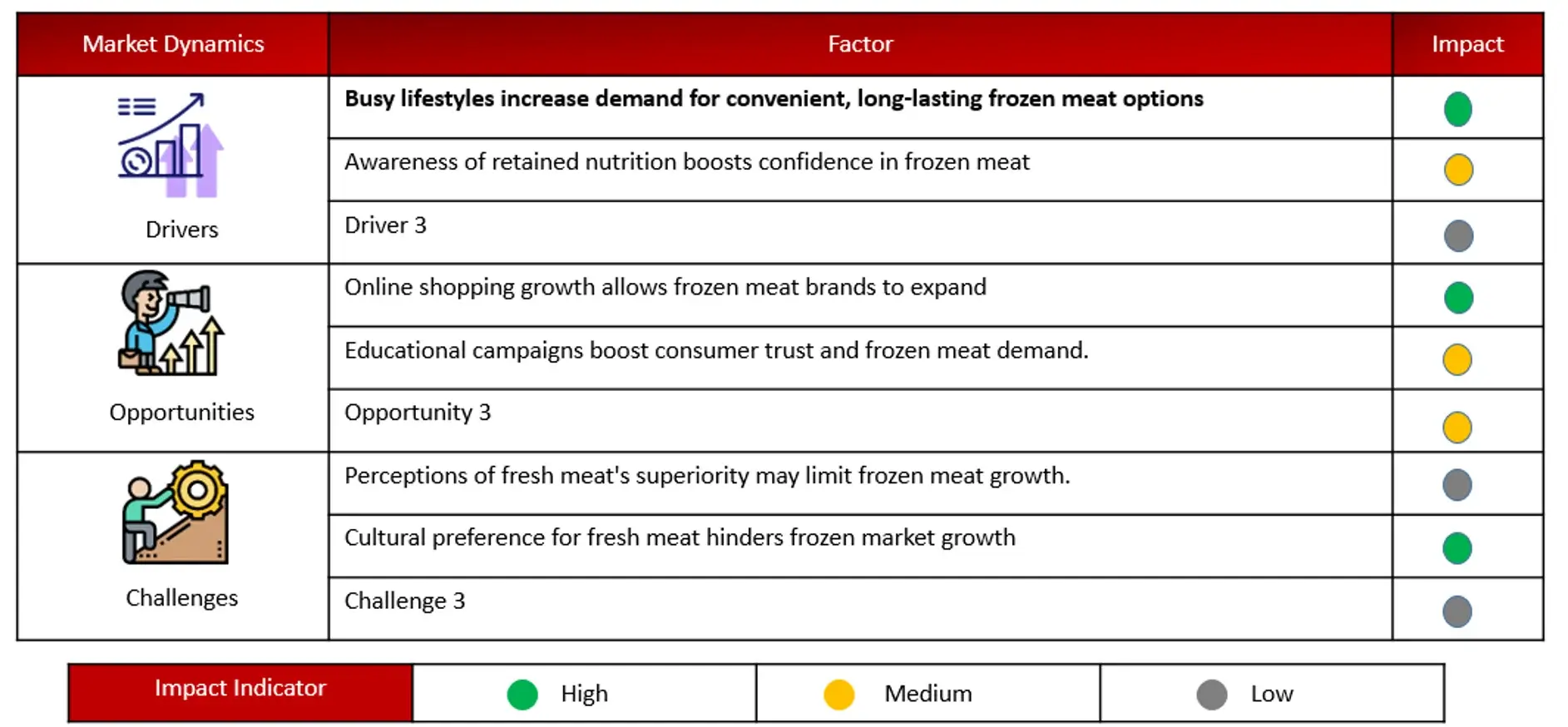

Driving Factor: Increasing preference for exploring diverse food options

The increasing consumer preference for frozen products reflects a broader trend of convenience and interest in long-lasting, easy-to-prepare foods. Alongside this, there is a rising curiosity among consumers to explore and experience diverse nutritional profiles, leading them to seek out different types of frozen foods that offer various health benefits. This combination of convenience and a desire for nutritional variety is a significant factor driving the growth and innovation within the frozen food industry. As consumers become more knowledgeable about nutritional values, their purchasing decisions increasingly support market expansion.

Opportunity: Growing Demand Boosts Global Frozen Meat Trade

To address the growing demand, numerous frozen meat product manufacturers are entering the market, with new players expanding into different regions. Consequently, the frozen meat industry is seeing an increase in international food trade, leading to more extensive and complex supply chains. This expansion has heightened the need for meat to stay fresh over longer durations, which in turn is boosting the sales of frozen meat products.

Challenge: High costs of acquiring freezing equipment could threaten growth

High costs for freezing equipment and the impact of preservatives on health are major concerns for the global frozen meat market. These factors could hinder market growth in the coming years. The frozen poultry and meat market report offers insights into recent developments, trade regulations, production analysis, and market opportunities. For more details, contact Data Bridge Market Research for an Analyst Brief to make informed decisions and drive market growth.

Poultry segment is expected to hold largest rate within the frozen meat market

Poultry is projected to holds the highest frozen meat market share in 2024, driven by consumer preference for its health benefits, versatility, and affordability compared to red meat. Chicken and turkey are popular for their low fat and calorie content and are easily substituted for red meat in various recipes.

North America holds the highest share in the Frozen Meat Market

The North American market holds the largest share and is projected to lead growth over the forecast period, driven by high disposable incomes, busy lifestyles, evolving eating habits, and a preference for ready-to-eat products. Meanwhile, the Asia Pacific market is expected to experience the fastest growth, fueled by changing eating habits, a growing working-class population, the influence of Western food trends, increasing disposable incomes, busy lifestyles, and a booming modern retail sector.

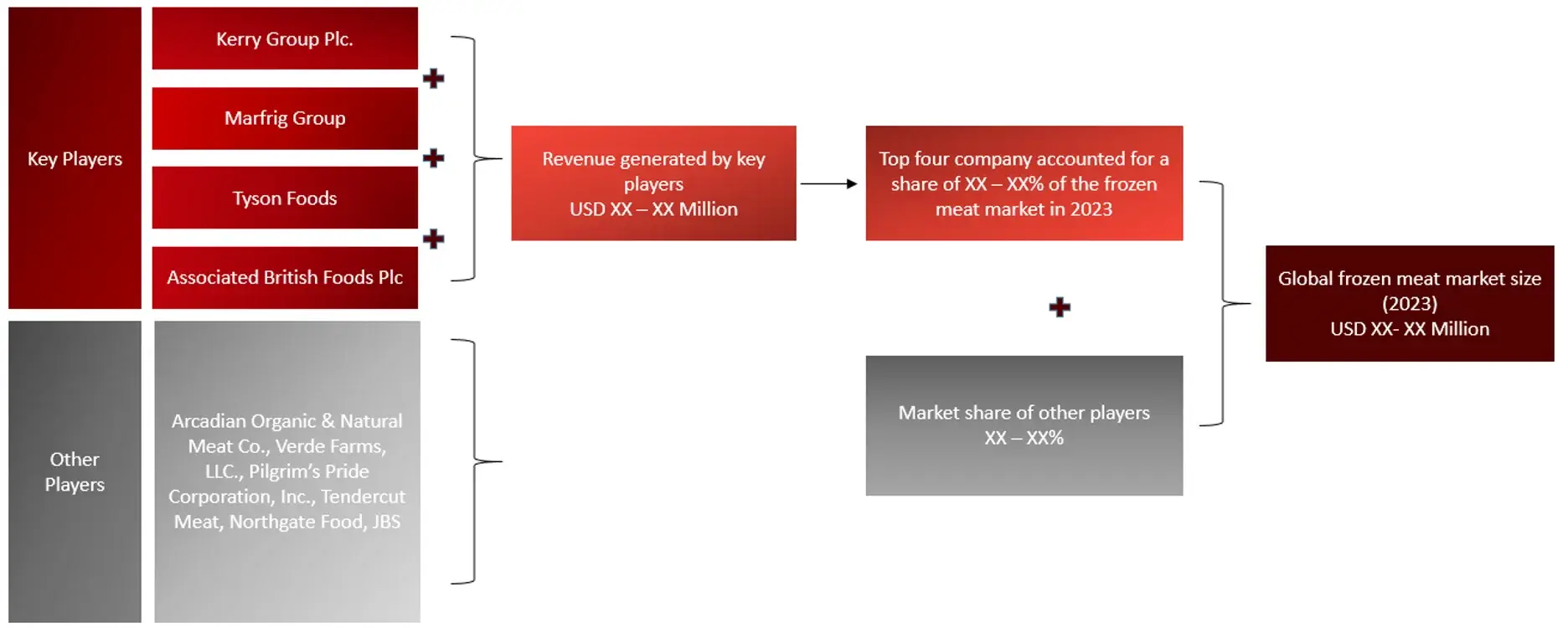

Major Companies and Market Share Insights in Frozen Meat Market

Major players operating in frozen meat market are Tyson Foods, SMC Ltd., BRF S.A, Marfrig Global Foods S.A., Pilgrim’s Pride Corporation, Associated British Foods Plc., V H Group., Tyson Foods, Inc., Verde Farms LLC, JBS S.A., Kerry Group Plc., Cargill Inc. among others.

Recent Developments in Global Frozen Meat Market:

Introduction

Market Definition

The frozen meat market refers to the sector of the food industry focused on the production, distribution, and sale of meat products that have been preserved through freezing. This process involves lowering the temperature of meat to below its freezing point to inhibit the growth of microorganisms, reduce enzyme activity, and extend the product’s shelf life.

Key Stakeholders

Key objectives of the Study

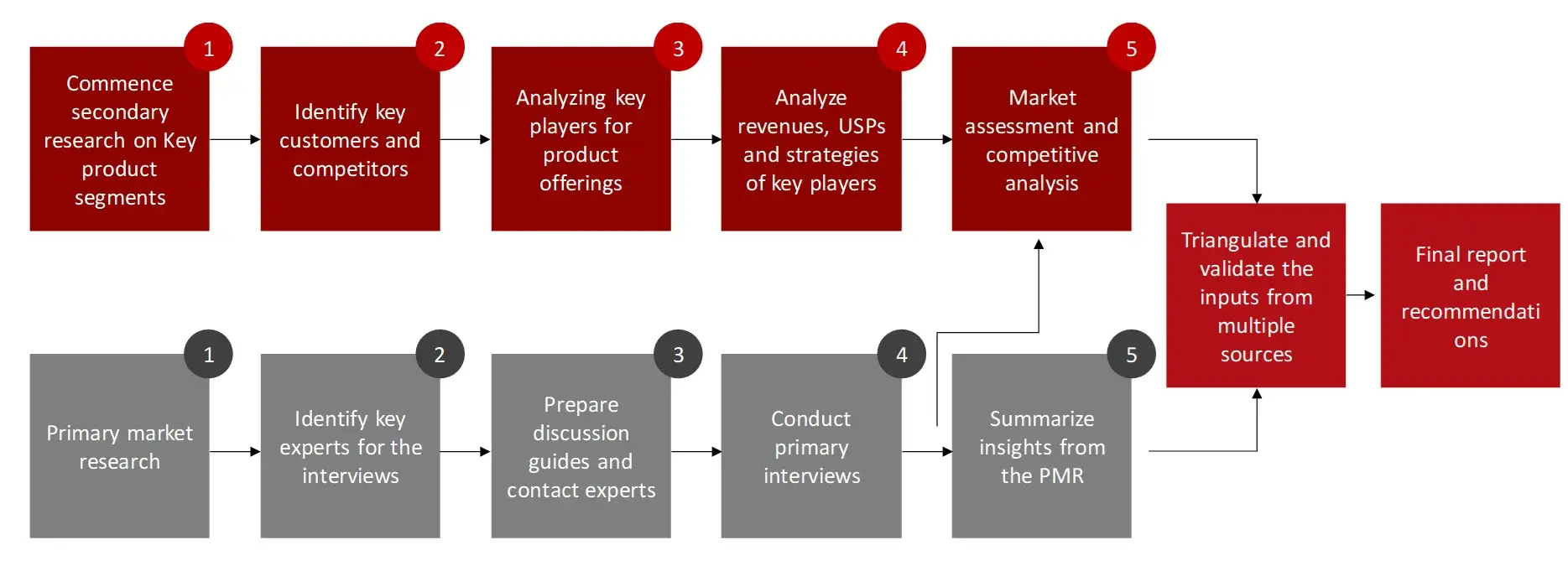

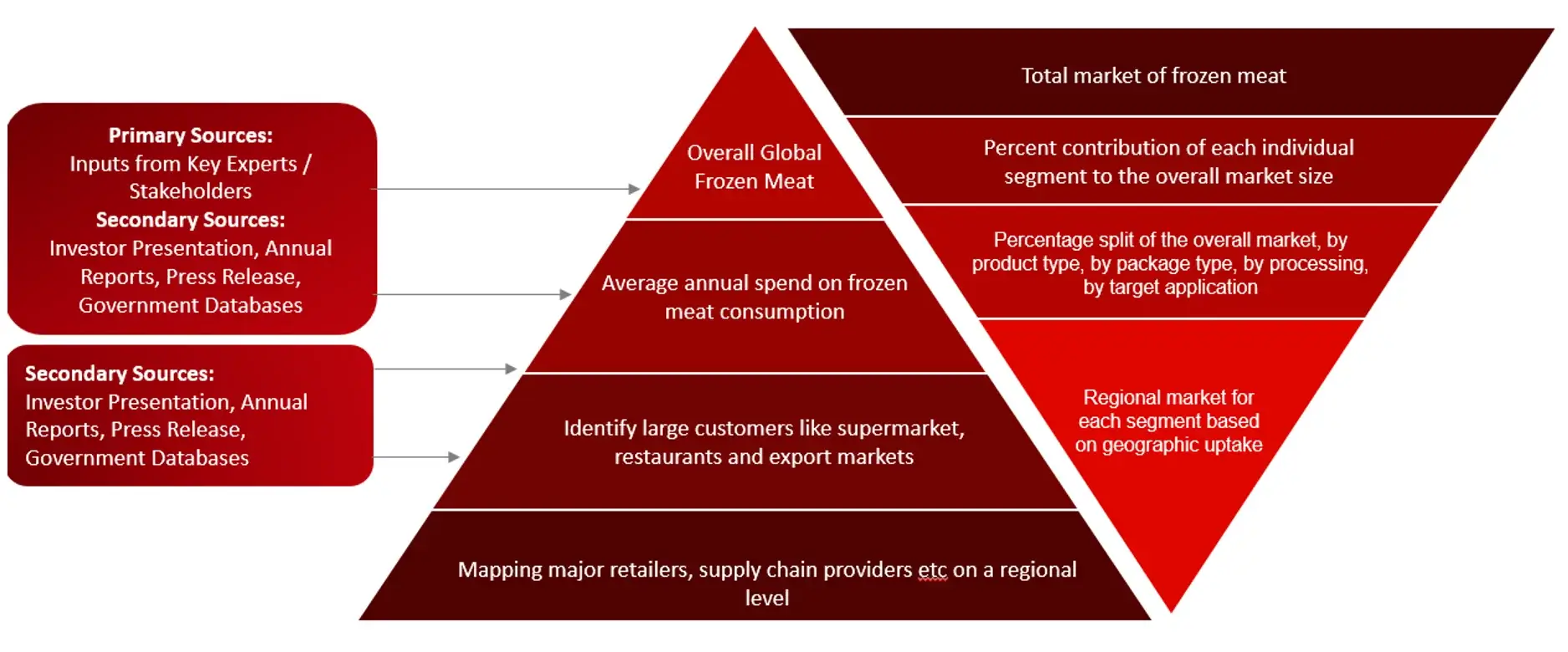

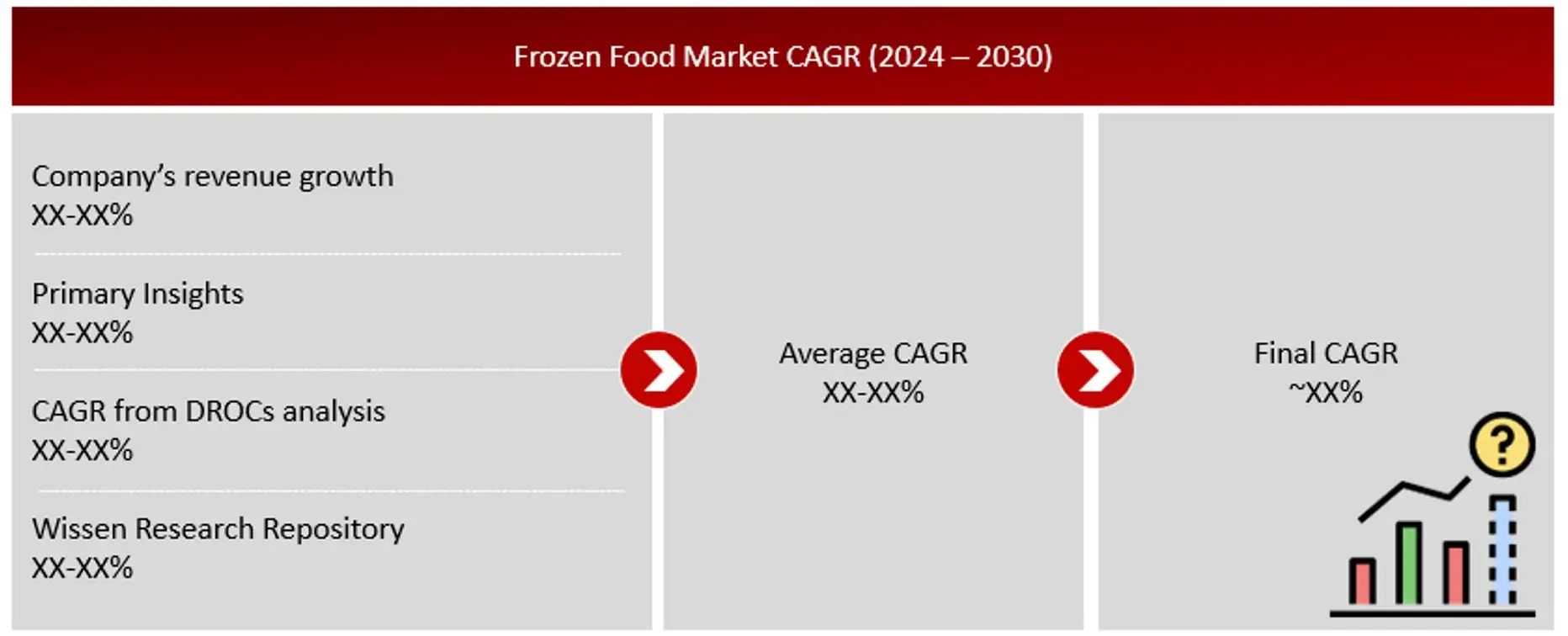

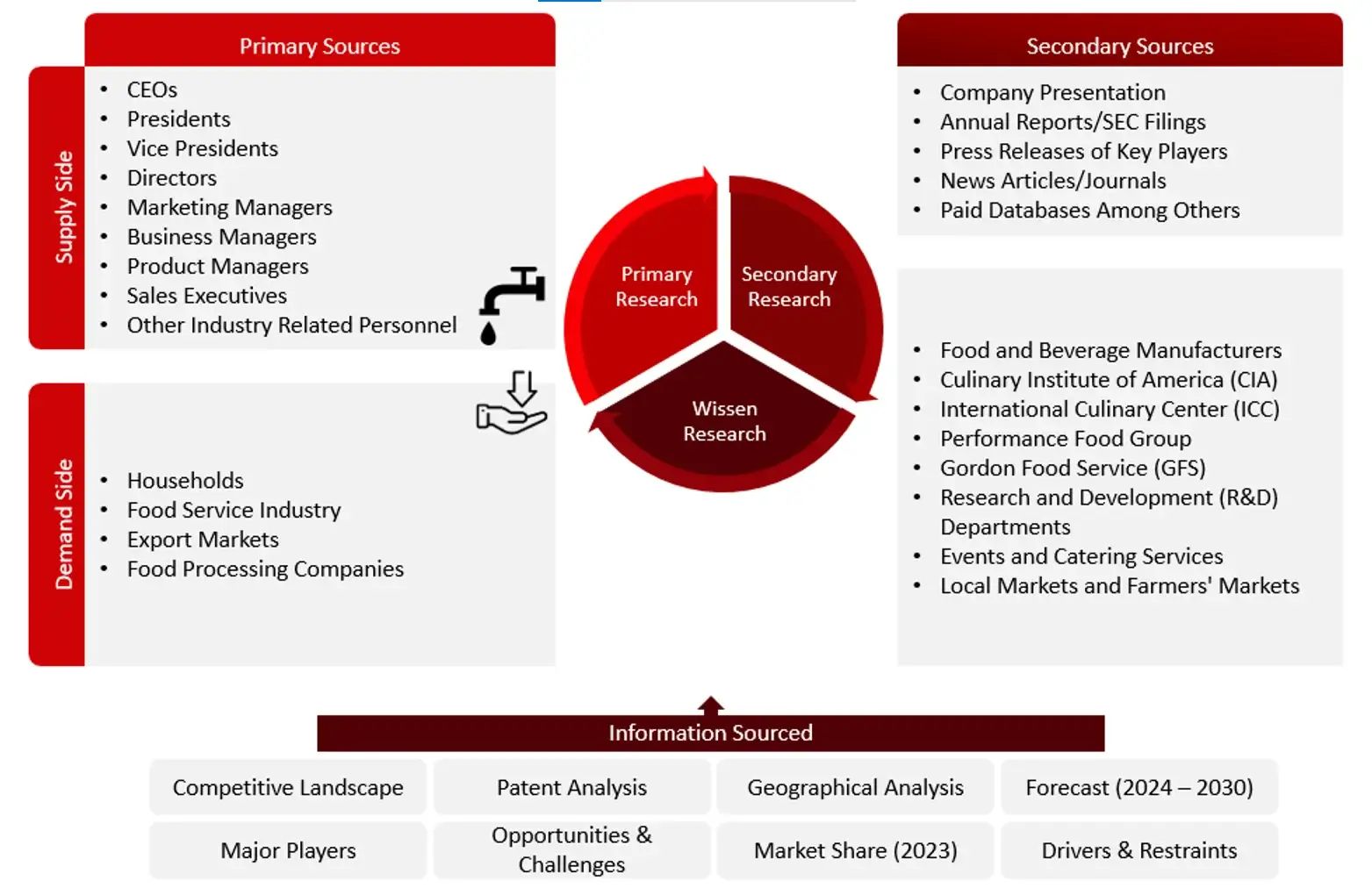

Research Methodology

The aim of the study is to examine the key market forces such as drivers, opportunities, restraints, challenges, and strategies of key leaders. To monitor company advancements such as patents granted, product launches, expansions, and collaborations of key players, analyzing their competitive landscape based on various parameters of business and product strategy. Markey sizing will be estimated using top-down and bottom-up approaches. Using market breakdown and data triangulation techniques, market sizing of segments and sub-segments will be estimated.

FIGURE: RESEARCH DESIGN

Sources: Wissen Research Analysis.

Research Approach

Collecting Secondary Data

The process of collating secondary research data involves the utilization of databases, secondary sources, annual reports, investor presentations, directories, and SEC filings of companies. Secondary research will be utilized to identify and gather information beneficial for the in-depth, technical, market-oriented, and commercial analysis of the frozen meat market. A database of the key industry leaders will also be compiled using secondary research.

Collecting Primary Data

The primary research data will be conducted after acquiring knowledge about the frozen meat market scenario through secondary research. A significant number of primary interviews will be conducted with stakeholders from both the demand and supply side (including various industry experts, such as Vice Presidents (VPs), Chief X Officers (CXOs), Directors from business development, marketing and product development teams, product manufacturers) across major countries of Europe, Asia Pacific, North America, Latin America, and Middle East and Africa. Primary data for this report will be collected through questionnaires, emails, and telephonic interviews.

FIGURE: BREAKDOWN OF PRIMARY INTERVIEWS FROM SUPPLY SIDE

FIGURE: BREAKDOWN OF PRIMARY INTERVIEWS FROM DEMAND SIDE

FIGURE: PROPOSED PRIMARY PARTICIPANTS FROM DEMAND AND SUPPLY SIDE

Note: Above mention companies are non-exhaustive.

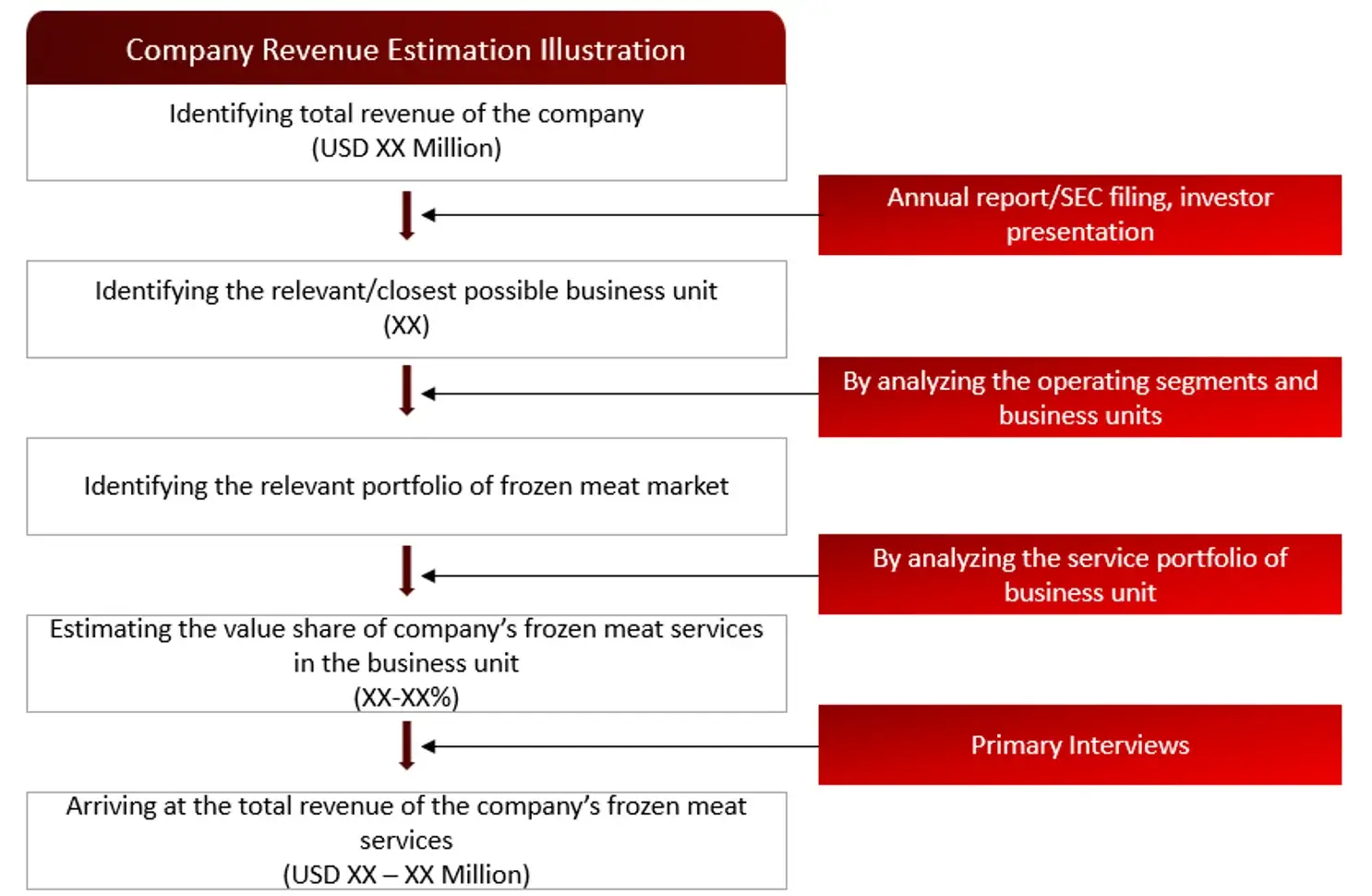

Market Size Estimation

All major manufacturers offering various frozen meat services will be identified at the global / regional level. Revenue mapping will be done for the major players, which will further be extrapolated to arrive at the global market value of each type of segment. The market value of frozen meat market will also split into various segments and sub segments at the region level based on:

FIGURE: REVENUE MAPPING BY COMPANY (ILLUSTRATION)

Sources: Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentation, Paid Database, and Wissen Research Analysis.

Sources: Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentation, Paid Database, and Wissen Research Analysis.FIGURE: REVENUE SHARE ANALYSIS OF KEY PLAYERS (SUPPLY SIDE)

Sources: Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentation, Paid Database, and Wissen Research Analysis.

Sources: Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentation, Paid Database, and Wissen Research Analysis.FIGURE: MARKET SIZE ESTIMATION TOP-DOWN AND BOTTOM-UP APPROACH

Sources: Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentation, Paid Database, and Wissen Research Analysis.

Sources: Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentation, Paid Database, and Wissen Research Analysis.FIGURE: ANALYSIS OF DROCS FOR GROWTH FORECAST

FIGURE: GROWTH FORECAST ANALYSIS UTILIZING MULTIPLE PARAMETERS

Research Design

After arriving at the overall market size-using the market size estimation processes-the market will be split into several segments and sub segment. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub segment, the data triangulation, and market breakdown procedures will be employed, wherever applicable. The data will be triangulated by studying various factors and trends from both the demand and supply sides in the frozen meat market.

Sources: Food and Beverage Manufacturers, Culinary Institute of America (CIA), International Culinary Center (ICC), Performance Food Group, Gordon Food Service (GFS), Research and Development (R&D) Departments, Events and Catering Services Local Markets and Farmers’ Markets, Company Website, Press Releases, Annual Reports, Paid Data Sources, and Wissen Research Analysis.

1. Introduction

1.1 Key Objectives

1.2 Definitions

1.2.1 In Scope

1.2.2 Out of Scope

1.3 Scope of the Report

1.4 Scope Related Limitations

1.5 Key Stakeholders

2. Research Methodology

2.1 Research Approach

2.2 Research Methodology / Design

2.3 Market Sizing Approach

2.3.1 Secondary Research

2.3.2 Primary Research

3. Executive Summary & Premium Content

3.1 Global Market Outlook

3.2 Key Market Findings

4. Patent Analysis

4.1. Patents Related to Frozen Meat

4.2. Patent Landscape and Intellectual Property Trends

5. Market Overview

5.1 Market Dynamics

5.1.1 Drivers/Opportunities

5.1.2 Restraints/Challenges

5.2 End User Perception

5.3 Need Gap

5.4 Supply Chain / Value Chain Analysis

5.5 Industry Trends

5.6 Porter’s Five Forces Analysis

6. Global Frozen Meat Market, by Product Type (2023-2030, USD Million)

6.1 Beef

6.2 Pork

6.3 Poultry

6.4 Lamb

6.5 Seafood

6.6 Venison

7. Global Frozen Meat Market, by Distribution Channel (2023-2030, USD Million)

7.1 Supermarkets and Hypermarkets

7.2 Convenience Stores

7.3 Online Retailers

7.4 Specialty Stores

7.5 Direct Sales

8. Global Frozen Meat Market, by Packaging (2023-2030, USD Million)

8.1 Bulk Packaging

8.2 Retail Packaging

9. Global Frozen Meat Market, by Processing (2023-2030, USD Million)

9.1 Raw Frozen Meat

9.2 Processed Frozen Meat

10. Global Frozen Meat Market, by End User (2023-2030, USD Million)

10.1 Household Consumers

10.1.1 Retail Consumers

10.1.2 Online Consumers

10.2 Commercial Users

11. Global Frozen Meat Market, by Form (2023-2030, USD Million)

11.1 Whole

11.2 Cut

11.3 Ground

11.4 Processed (Sausages, nuggets)

12. Global Frozen Meat Market, by Region (2023-2030, USD Million)

12.1 North America

12.1.1 US

12.1.2 Canada

12.2 Europe

12.2.1 Germany

12.2.2 France

12.2.3 Spain

12.2.4 Italy

12.2.5 UK

12.2.6 Rest of the Europe

12.3 Asia Pacific

12.3.1 China

12.3.2 Japan

12.3.3 India

12.3.4 Australia and New Zealand

12.3.5 South Korea

12.3.6 Rest of the Asia Pacific

12.4 Middle East and Africa

12.5 Latin America

13. Competitive Analysis

13.1 Key Players Footprint Analysis

13.2 Market Share Analysis

13.3 Key Brand Analysis

13.4 Regional Snapshot of Key Players

13.5 R&D Expenditure of Key Players

14. Company Profiles2

14.1 Kerry Group Plc

14.1.1 Business Overview

14.1.2 Product Portfolio

14.1.3 Financial Snapshot3

14.1.4 Recent Developments

14.1.5 SWOT Analysis

14.2 Marfrig Group

14.3 BRF S.A.

14.4 Associated British Foods Plc.

14.5 Tyson Foods

14.6 Arcadian Organic & Natural Meat Co

14.7 Verde Farms, LLC.

14.8 Pilgrim’s Pride Corporation, Inc.

14.9 Tendercut Meat

14.10 Northgate Food

14.11 JBS

15. Conclusion

16. Appendix

16.1 Industry Speak

16.2 Questionnaire

16.3 Available Custom Work

16.4 Adjacent Studies

16.5 Authors

17. References

Key Notes:

© Copyright 2024 – Wissen Research All Rights Reserved.