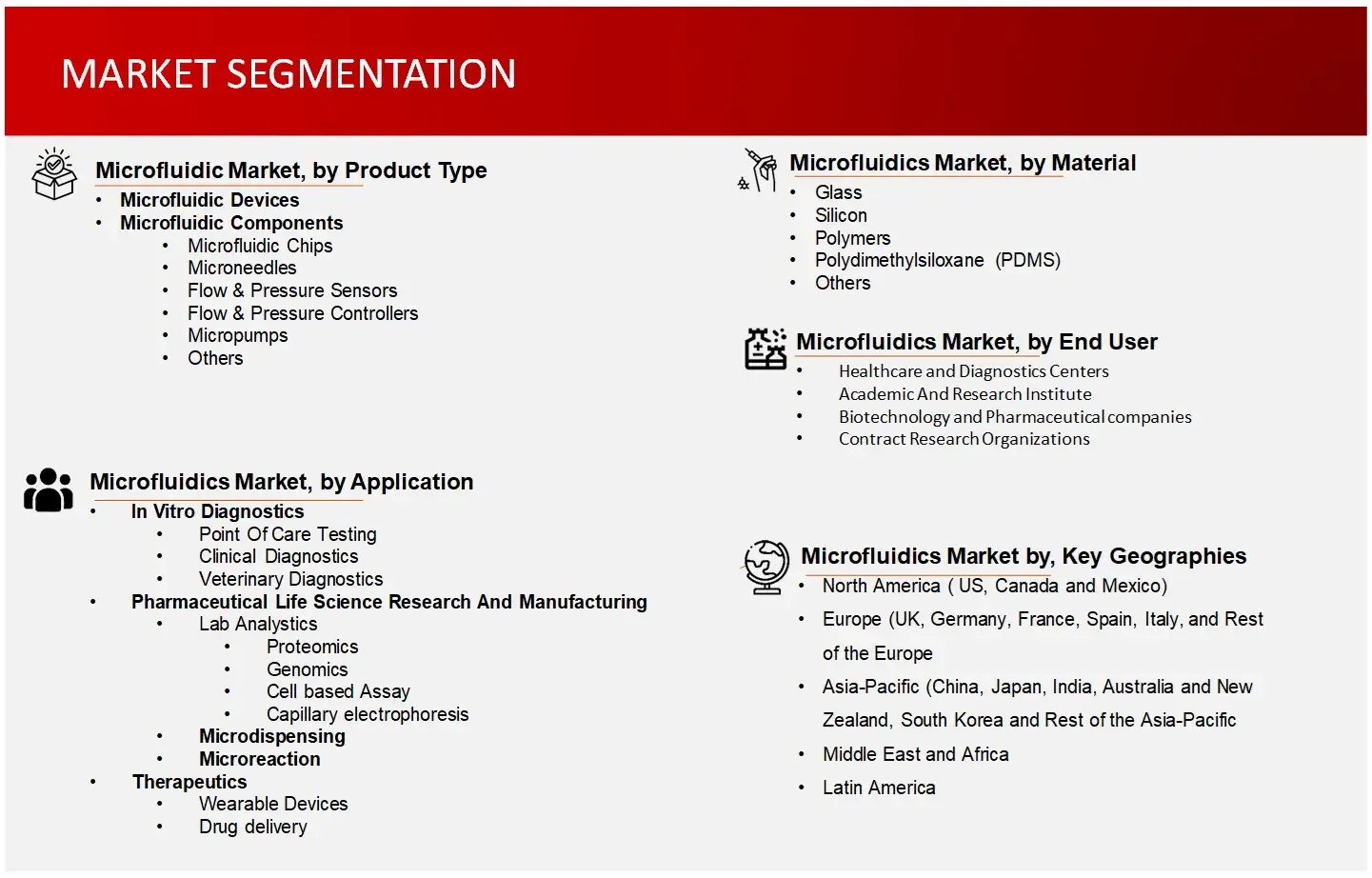

Microfluidics Market by Product (Microfluidic devices, Microfluidic Chips, Microneedles), Application (In Vitro Diagnostics, Proteomics, Genomics), Material (Glass, Silicon, Polymers) End User, Regions, Key Players – Global Forecast to 2030

Sources: Company Websites and Wissen Research Analysis.

Sources: Company Websites and Wissen Research Analysis.

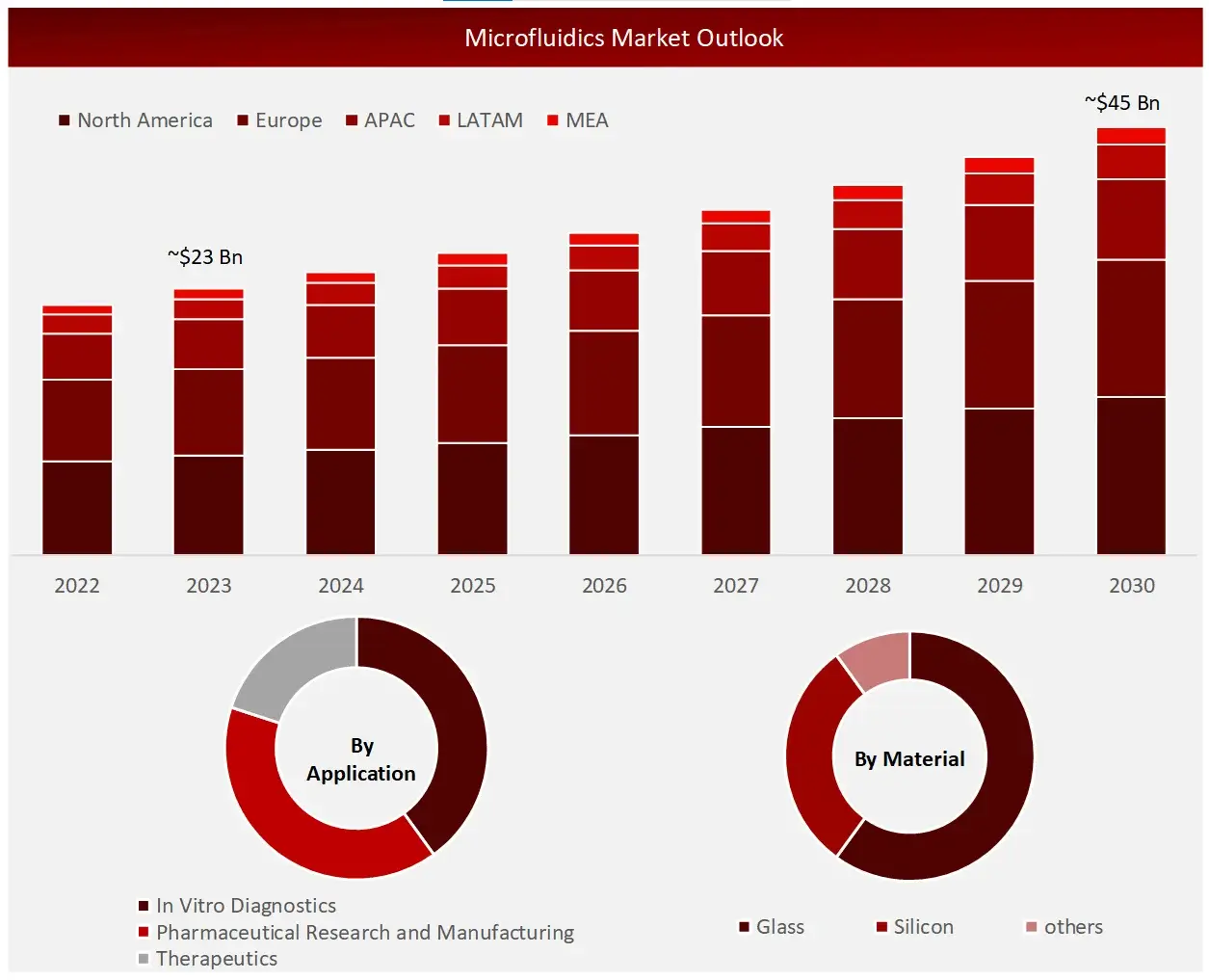

Wissen Research analyses that the microfluidics market is estimated at ~USD 23 billion in 2023 and is projected to reach ~USD 45 billion by 2030, expected to grow at a CAGR of ~12% during the forecast period, 2024-2030.

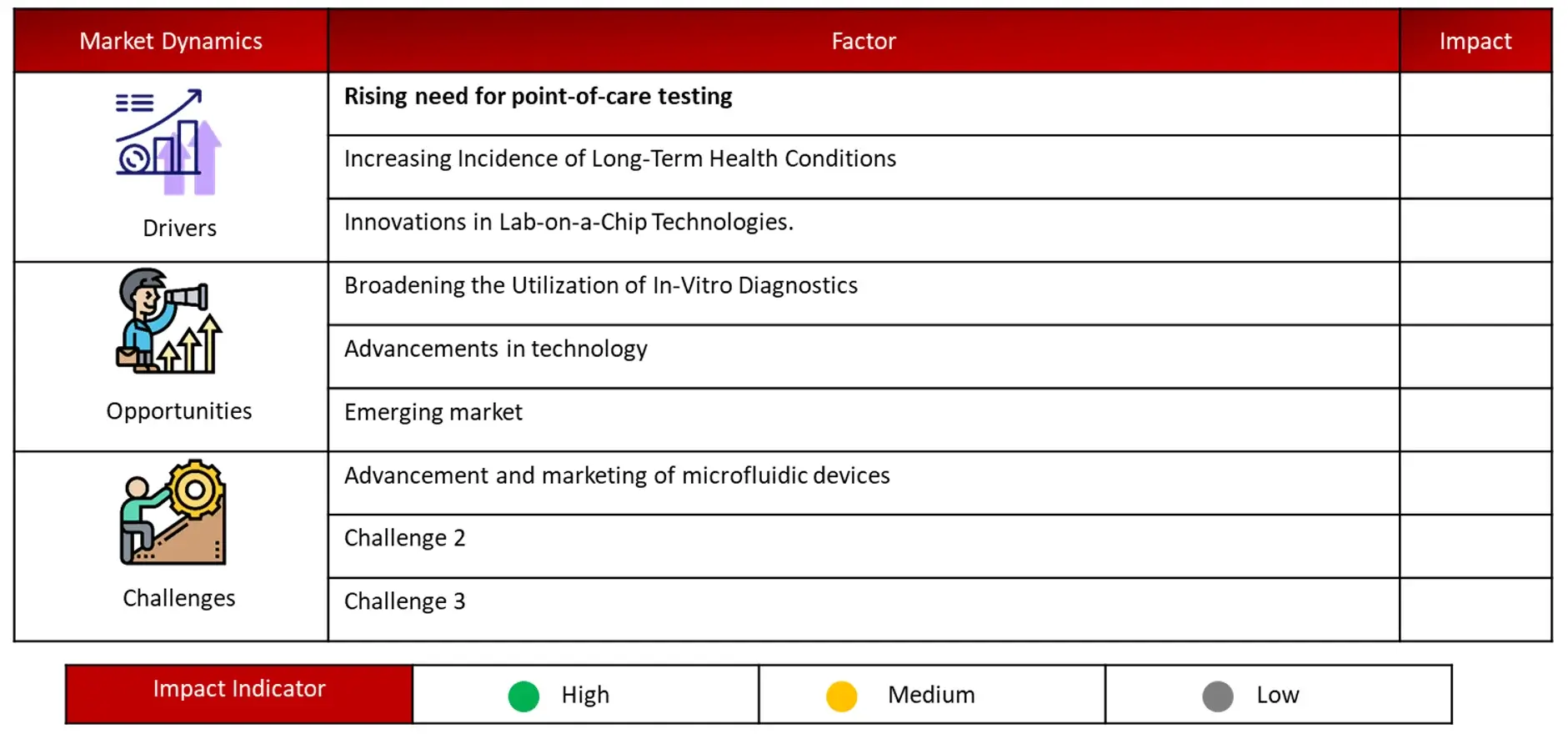

The microfluidics industry is experiencing growth due to the rising need for integrated point-of-care testing devices and portable field-testing devices, as well as the growing demand for quick testing through miniaturization of microfluidic chips and substantial investments in research and development activities. Furthermore, the progress in microfluidics systems has resulted in their widespread application in Lab-on-a-chip and organs-on-a-chip devices, offering significant potential due to their user-friendly nature, minimal sample needs, and cost efficiency. The market is experiencing numerous growth opportunities due to the broad application of microfluidics in sectors such as medical science, biomedical, bio-sensing, pharmaceuticals, drug discovery, chemical synthesis, and more. These factors mentioned above will have a positive impact on the outlook of the microfluidics Industry in the forecast period.

Driving Factor: Technology advancements to boost growth in overall microfluidics market

The aim of advancements in microfluidic components is to enhance and streamline processes in the healthcare industry. Integrated microfluidic components have been utilized in research laboratories for over two decades. Over the last decade, the use of soft lithography and large-scale microfluidic integration has been significantly improved, leading to greater utilization in life sciences and medical research. Due to technological advancements, researchers have increased the intricacy of experiments possible on microfluidic chips, resulting in accelerated development endeavors. Microfluidic elements are quickly becoming essential technology in a growing range of sectors such as pharmaceuticals, sensing biological substances, activating biological processes, and creating chemicals. This shows how microfluidics has evolved from a possible R&D technology to being utilized in clinical research for data collection with the help of artificial intelligence. Microfluidics, especially in the field of lab-on-a-chip technology, is a powerful tool for advancing and using AI in a cost-effective, automated, diverse, and high-throughput manner.

Opportunity: Broadening the utilizations of microfluidics in drug delivery technologies

Implantable drug delivery systems are a highly advanced system that provide significant growth opportunities for market participants. This is due to the fact that microfluidics technology enables the production of portable and wearable items that ensure precise and dependable medication administration. Currently in development are various micro-pumping techniques closely related to insulin pumps, which are the most commonly used drug delivery devices based on microfluidics. In the next two to three years, it is anticipated that more of these devices will become available.

Challenge: Development and commercialization of microfluidic devices

Customer acceptance affects the commercialization of any equipment. Various studies validate the use of microfluidics technology devices and offer multiple guarantees on the results they produce. Yet, the adoption of this technology by consumers is hindered by its integration into the commercial sector and its uncertain scalability. Despite showing promising research results, it will still take several years for this technology to be fully implemented across all sectors of the industries. Investors are inclined to put their money into technologies that show more potential. Therefore, there is a probable shift in researcher’s attention from microfluidics technologies towards other sectors like the environment or food industry.

Sources: Company Websites and Wissen Research Analysis.

Sources: Company Websites and Wissen Research Analysis.

The largest portion of the microfluidics industry was attributed to the microfluidic devices sector, based on product type.

Incorporating microfluidics into point-of-care testing devices is a significant use of microfluidics technology. Microfluidic technology enhances the detection and control of fluids within a single component, improving the ability to identify specific analytes at low volumes, addressing various obstacles seen in traditional point-of-care diagnostics. Microfluidic POCT devices are commonly utilized for conducting molecular biology as well as chemical and biochemical analysis. Examples of microfluidic POCT devices include Revogene, a real-time PCR device using microfluidics cartridges to test for C. difficile, Strep B., and Streptococcus A, with results available in approximately 2 minutes.

The largest portion in the microfluidics industry was held by the in vitro diagnostic sector by Application

In-Vitro Diagnostic integrated with microfluidic technologies like PoC diagnostics, PCR systems, analyzers, and electrophoretic systems is being more commonly utilized in diagnostic, pharmaceutical, biotechnology companies, and forensic applications. These gadgets offer multiple benefits like being easy to carry (thanks to their small size), more frequent testing, lower usage of reagents and samples, and precise and rapid analysis. Other important factors that support the increased use of microfluidics-based PoC technologies include the availability of affordable supplies and the ability of PoC devices to lower costs and deliver quicker test results through compact integrated systems.

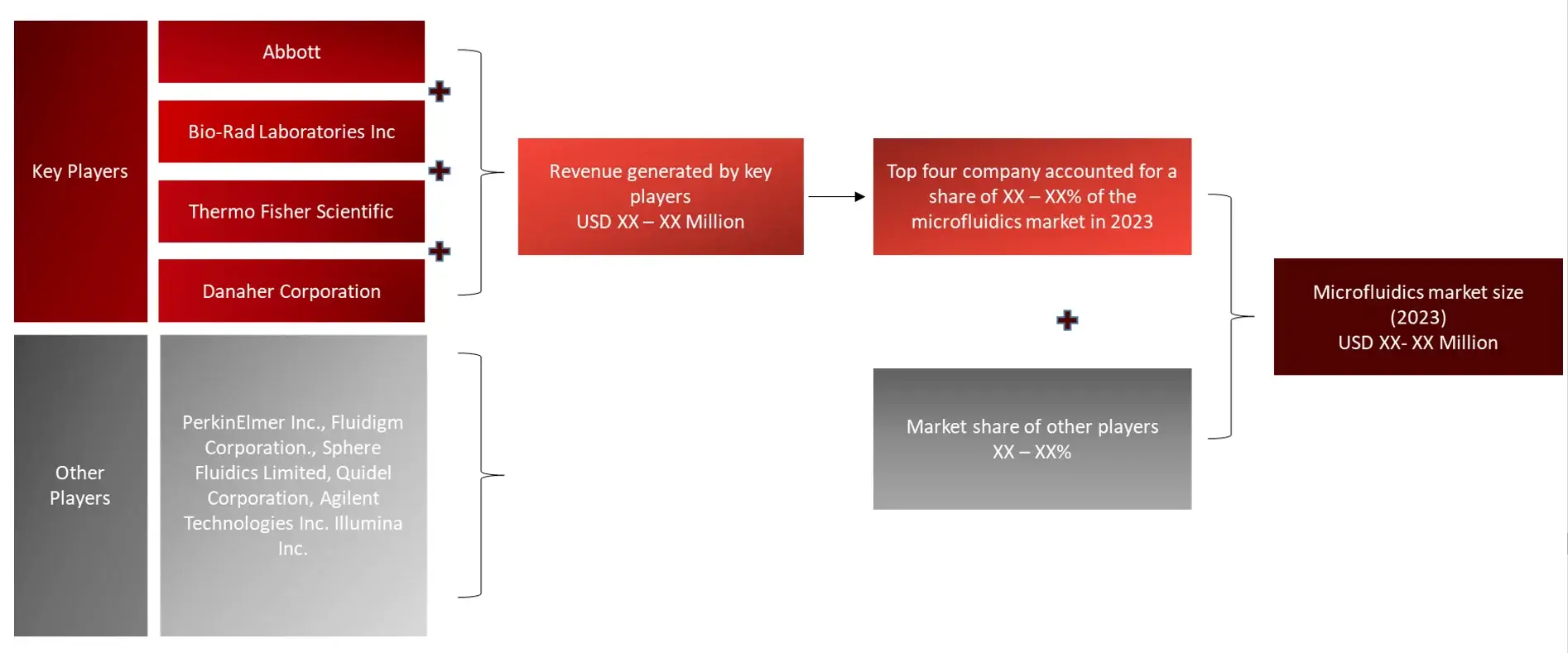

Major Companies and Market Share Insights in Microfluidics Market

Major players operating in microfluidics surgery market are Bio-Rad Laboratories Inc., Illumina Inc., PerkinElmer, Inc., Agilent Technologies Inc, Danaher Corporation, Qiagen NV and Abbott Laboratories among others.

Introduction

Market Definition

Microfluidics is the study of how fluids move through tiny advanced devices with chambers and tunnels. Microfluidics technology has advanced from MEMS devices and is able to imitate all the capabilities of its counterparts in different healthcare uses, such as drug delivery, point-of-care diagnostics, and clinical diagnostics.

Key Stakeholders

Key objectives of the Study

Research Methodology

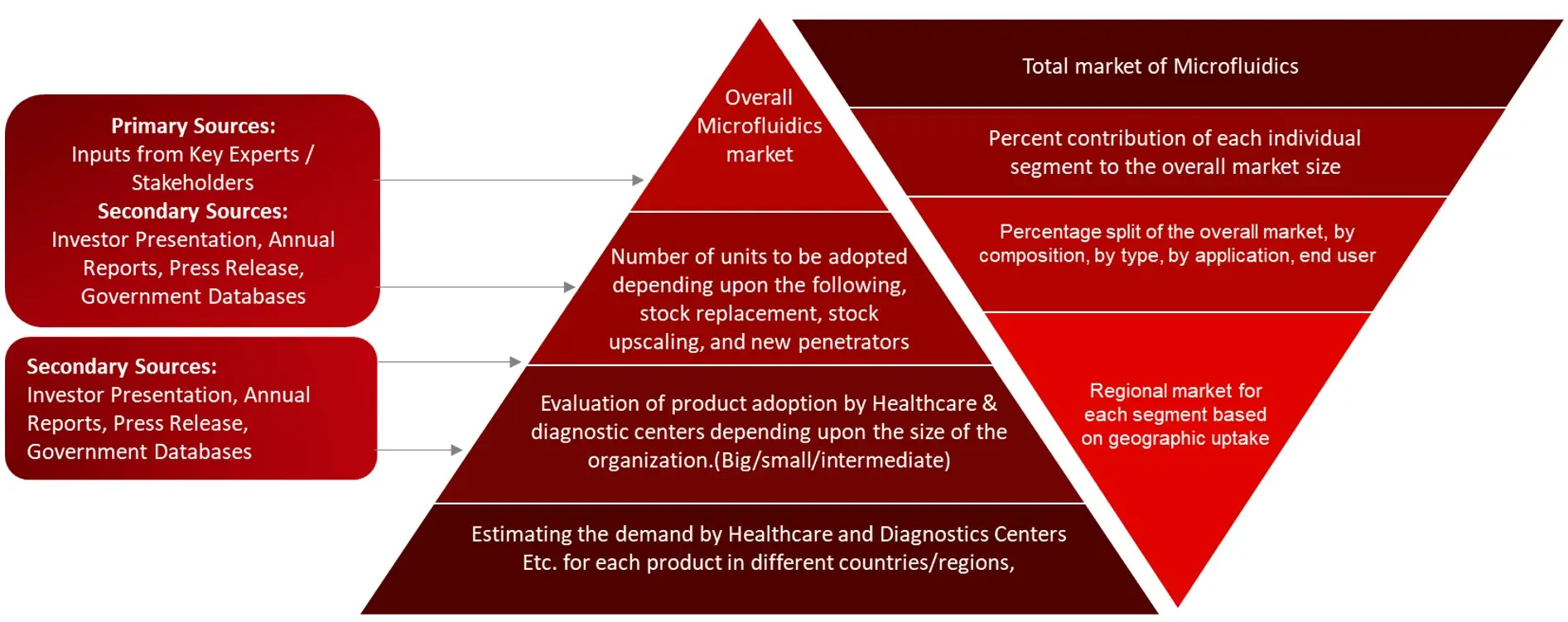

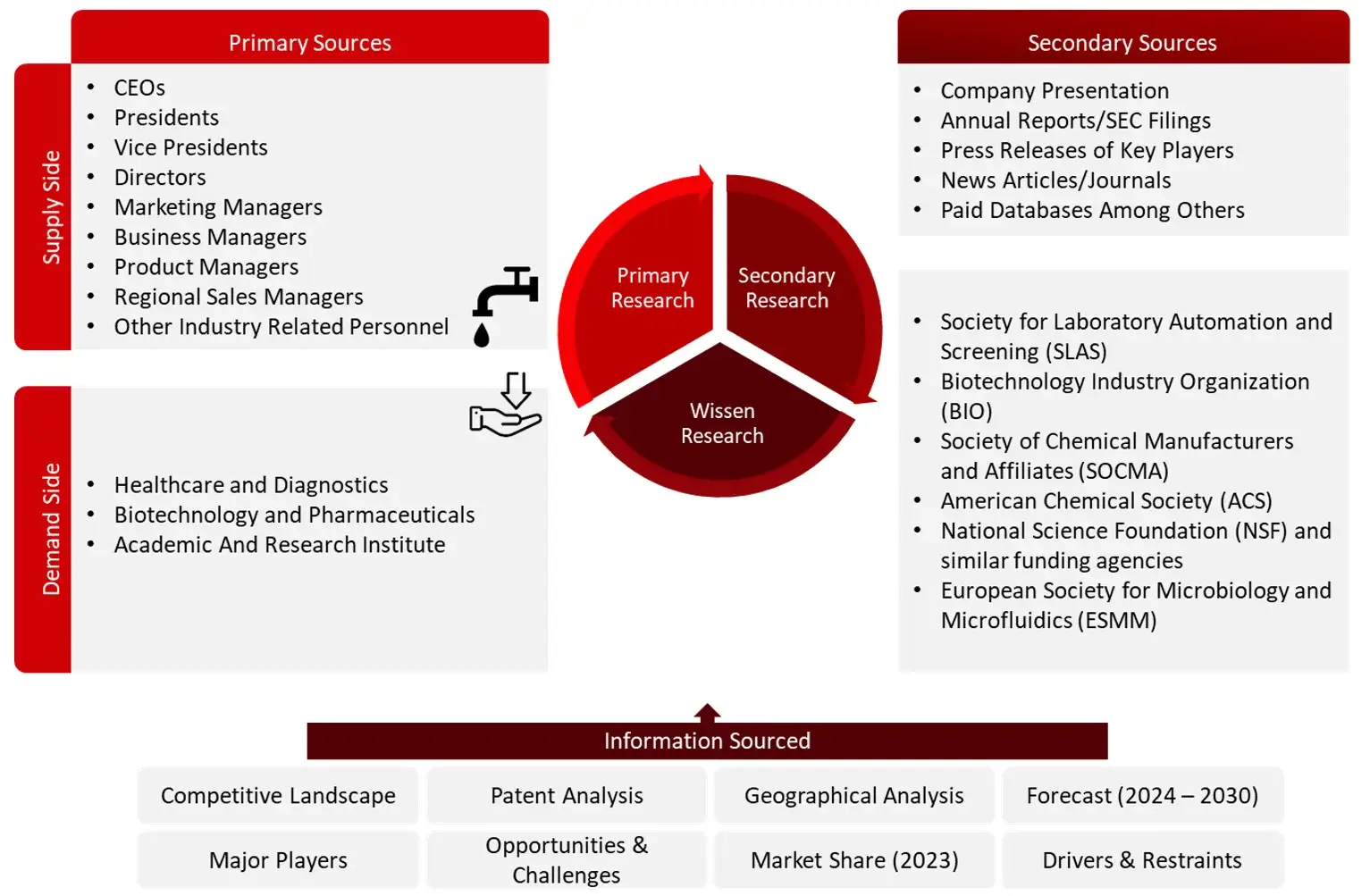

The aim of the study is to examine the key market forces such as drivers, opportunities, restraints, challenges, and strategies of key leaders. To monitor company advancements such as patents granted, product launches, expansions, and collaborations of key players, analyzing their competitive landscape based on various parameters of business and product strategy. Markey sizing will be estimated using top-down and bottom-up approaches. Using market breakdown and data triangulation techniques, market sizing of segments and sub-segments will be estimated.

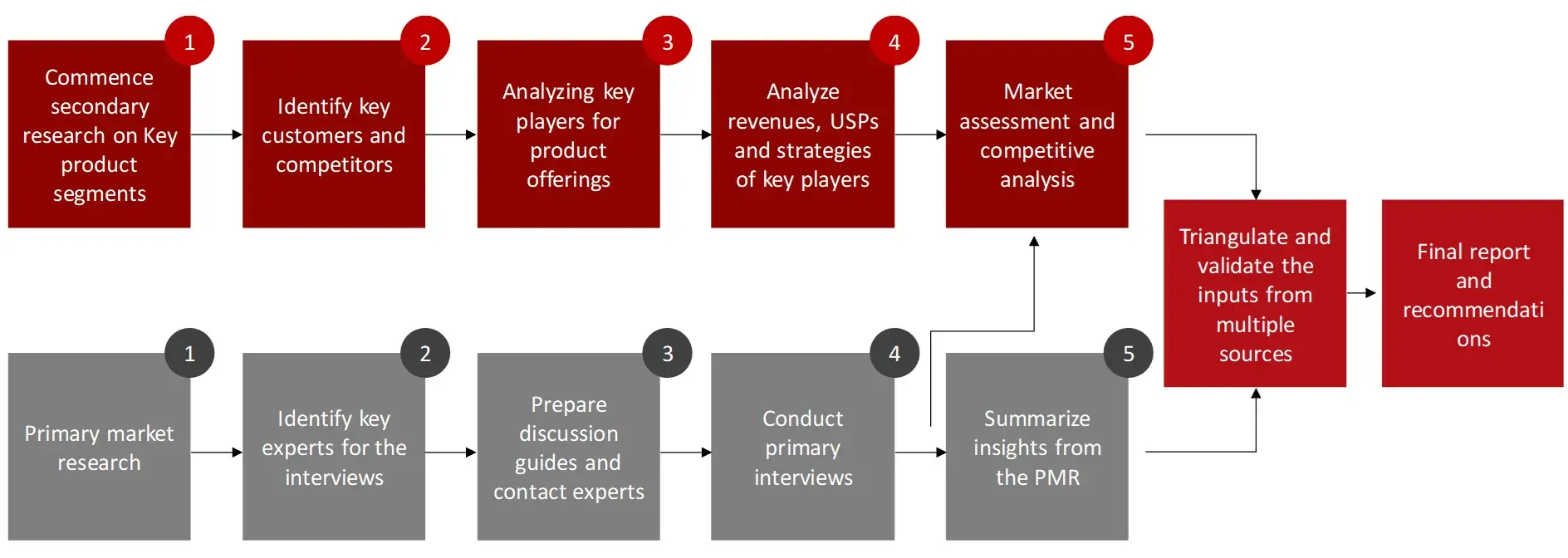

FIGURE: RESEARCH DESIGN

Sources: Wissen Research Analysis.

Research Approach

Collecting Secondary Data

The process of collating secondary research data involves the utilization of databases, secondary sources, annual reports, investor presentations, directories, and SEC filings of companies. Secondary research will be utilized to identify and gather information beneficial for the in-depth, technical, market-oriented, and commercial analysis of the minimally invasive surgery market. A database of the key industry leaders will also be compiled using secondary research.

Collecting Primary Data

The primary research data will be conducted after acquiring knowledge about the Minimally invasive surgery market scenario through secondary research. A significant number of primary interviews will be conducted with stakeholders from both the demand and supply side (including various industry experts, such as Vice Presidents (VPs), Chief X Officers (CXOs), Directors from business development, marketing and product development teams, product manufacturers) across major countries of Europe, Asia Pacific, North America, Latin America, and Middle East and Africa. Primary data for this report will be collected through questionnaires, emails, and telephonic interviews.

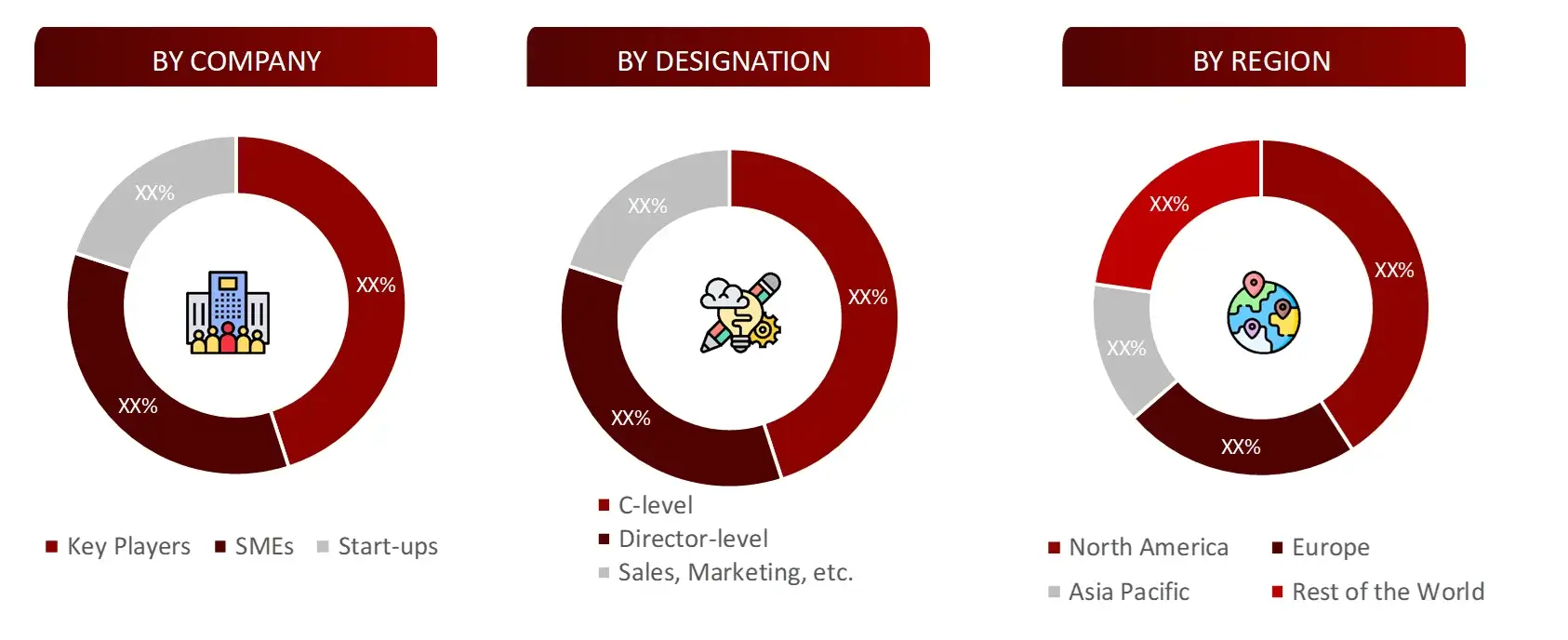

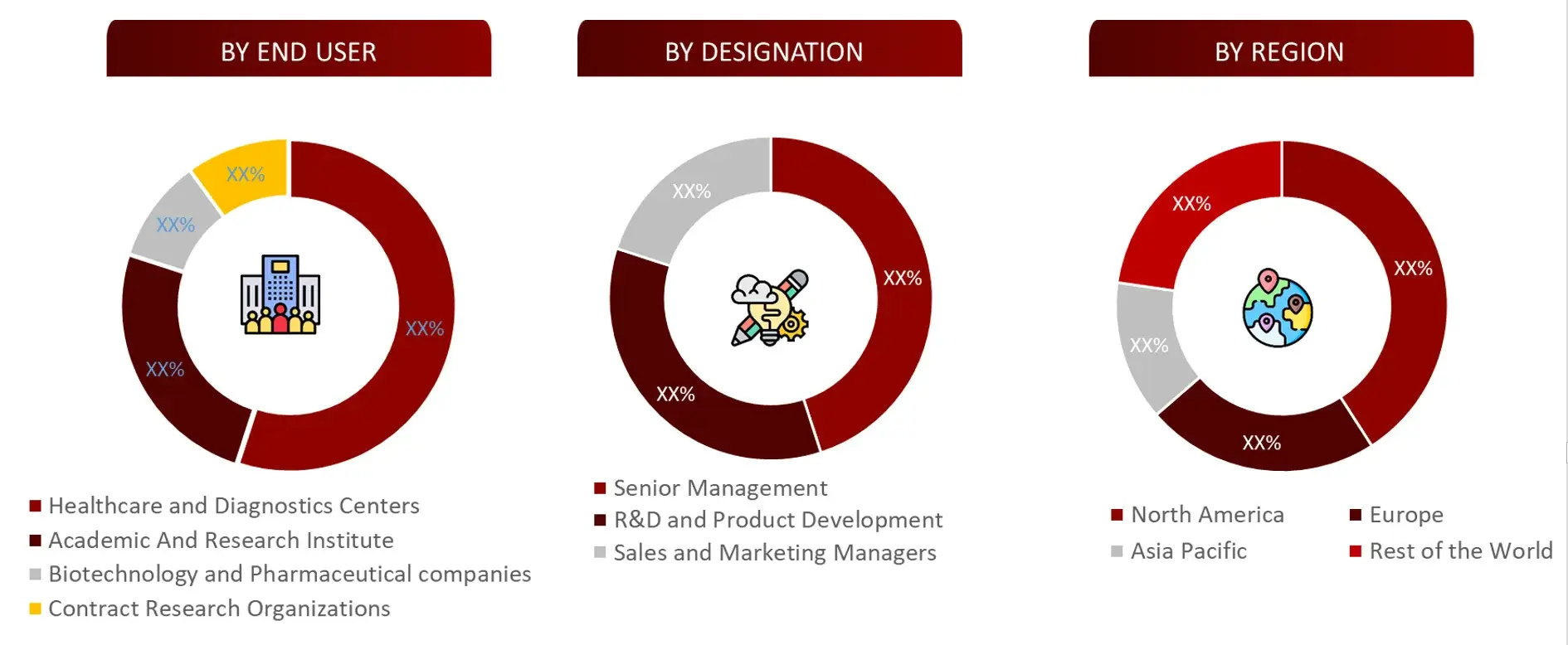

FIGURE: BREAKDOWN OF PRIMARY INTERVIEWS FROM SUPPLY SIDE

FIGURE: BREAKDOWN OF PRIMARY INTERVIEWS FROM DEMAND SIDE

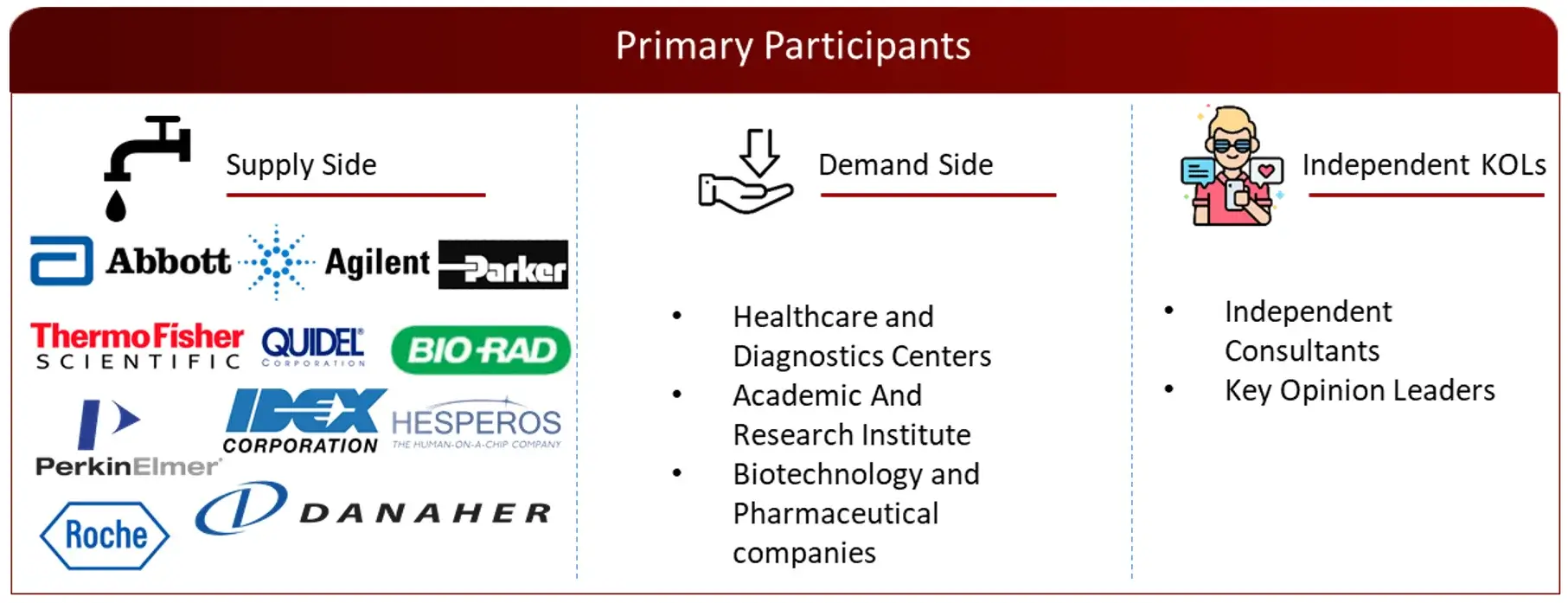

FIGURE: PROPOSED PRIMARY PARTICIPANTS FROM DEMAND AND SUPPLY SIDE

Note: Above mention companies are non-exhaustive.

Note: Above mention companies are non-exhaustive.

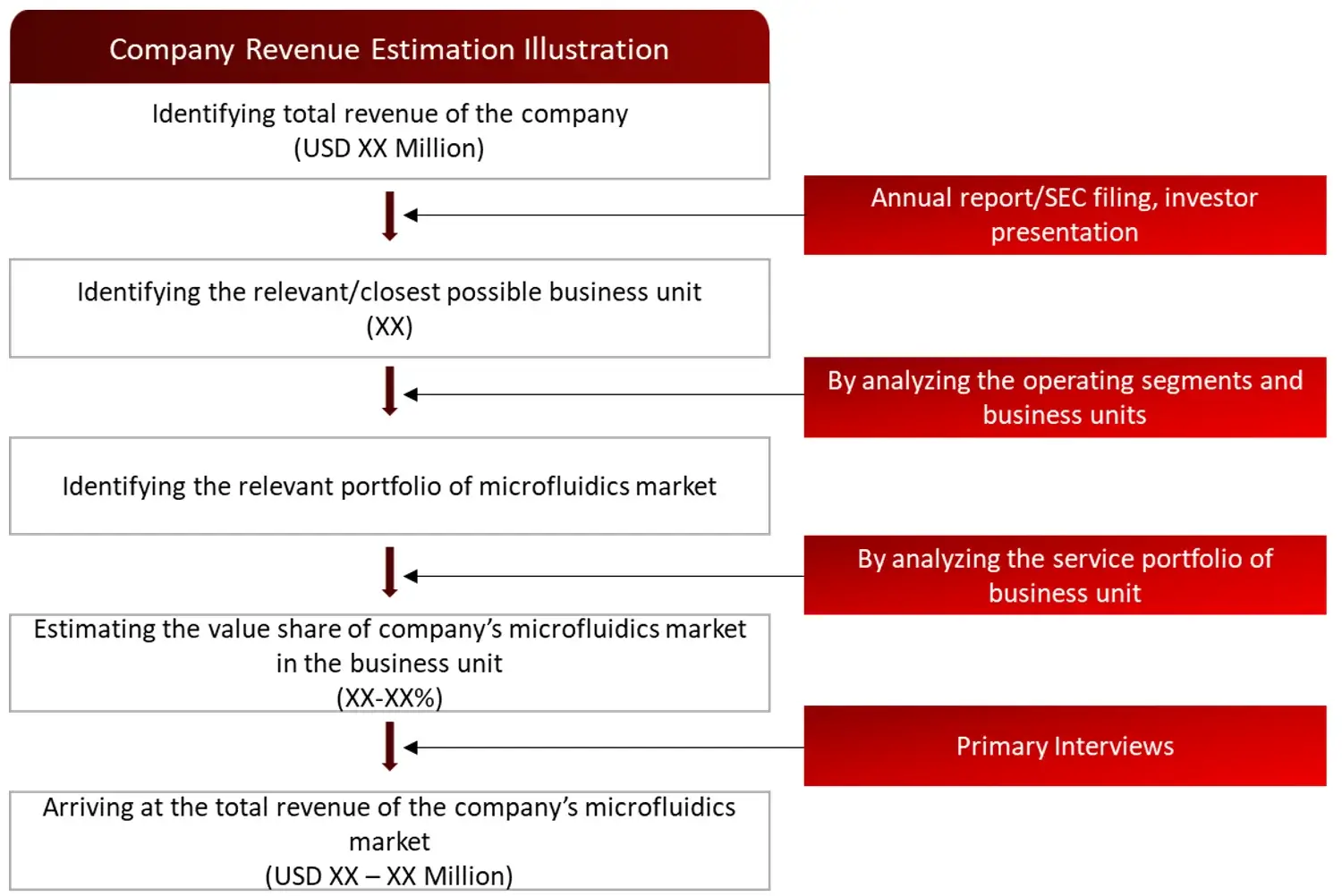

Market Size Estimation

All major industries offering various microfluidics market sizing will be identified at the global/ regional level. Revenue mapping will be done for the major players, which will further be extrapolated to arrive at the global market value of each type of segment. The market value of microfluidics market will also split into various segments and sub segments at the region level based on:

FIGURE: REVENUE MAPPING BY COMPANY (ILLUSTRATION)

Sources: Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentation, Paid Database, and Wissen Research Analysis.

Sources: Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentation, Paid Database, and Wissen Research Analysis.FIGURE: REVENUE SHARE ANALYSIS OF KEY PLAYERS (SUPPLY SIDE)

Sources: Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentation, Paid Database, and Wissen Research Analysis.

Sources: Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentation, Paid Database, and Wissen Research Analysis.FIGURE: MARKET SIZE ESTIMATION TOP-DOWN AND BOTTOM-UP APPROACH

Sources: Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentation, Paid Database, and Wissen Research Analysis.

Sources: Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentation, Paid Database, and Wissen Research Analysis.FIGURE: ANALYSIS OF DROCS FOR GROWTH FORECAST

Sources: Society for Laboratory Automation and Screening (SLAS), Biotechnology Industry Organization (BIO), Society of Chemical Manufacturers and Affiliates (SOCMA), American Chemical Society (ACS), National Science Foundation (NSF) and similar funding agencies, European Society for Microbiology and Microfluidics (ESMM), Company Website, Press Releases, Annual Reports, Paid Data Sources, and Wissen Research Analysis.

Sources: Society for Laboratory Automation and Screening (SLAS), Biotechnology Industry Organization (BIO), Society of Chemical Manufacturers and Affiliates (SOCMA), American Chemical Society (ACS), National Science Foundation (NSF) and similar funding agencies, European Society for Microbiology and Microfluidics (ESMM), Company Website, Press Releases, Annual Reports, Paid Data Sources, and Wissen Research Analysis.FIGURE: GROWTH FORECAST ANALYSIS UTILIZING MULTIPLE PARAMETERS

Sources: Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentation, Paid Database, and Wissen Research Analysis.

Sources: Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentation, Paid Database, and Wissen Research Analysis.Research Design

After arriving at the overall market size-using the market size estimation processes-the market will be split into several segments and sub segment. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub segment, the data triangulation, and market breakdown procedures will be employed, wherever applicable. The data will be triangulated by studying various factors and trends from both the demand and supply sides in the microfluidics market.

1. Introduction

1.1 Key Objectives

1.2 Definitions

1.2.1 In Scope

1.2.2 Out of Scope

1.3 Scope of the Report

1.4 Scope Related Limitations

1.5 Key Stakeholders

2. Research Methodology

2.1 Research Approach

2.2 Research Methodology / Design

2.3 Market Sizing Approach

2.3.1 Secondary Research

2.3.2 Primary Research

3. Executive Summary & Premium Content

3.1 Global Market Outlook

3.2 Key Market Findings

4. Patent Analysis

4.1 Patents Related to Microfluidics devices

4.2 Patent Landscape and Intellectual Property Trends

5. Market Overview

5.1 Market Dynamics

5.1.1 Drivers/Opportunities

5.1.2 Restraints/Challenges

5.2 End User Perception

5.3 Need Gap

5.4 Supply Chain / Value Chain Analysis

5.5 Industry Trends

5.6 Pricing Analysis

5.7 Technology Analysis

5.8 Trade Analysis

5.9 Porter’s Five Forces Analysis

5.9.1 Bargaining power of suppliers

5.9.2 Bargaining powers of customers

5.9.3 Threat of new entrants

5.9.4 Rivalry among existing players

5.9.5 Threat of substitutes

6. Microfluidics Market, by Product Type (2023-2030, USD Million)

6.1 Introduction

6.2 Microfluidics Devices

6.3 Microfluidic Components

6.3.1 Microfluidic Chips

6.3.2 Microneedles

6.3.3 Flow & Pressure Sensors

6.3.4 Flow & Pressure Controllers

6.3.5 Micropumps

6.3.6 Microfluidic Valves

6.3.7 Others (Microfluidic Analyzers, Microfluidic Flow Controllers etc.)

7. Microfluidics Market, by Application Type (2023-2030, USD Million)

7.1 Introduction

7.2 In Vitro Diagnostics (IVD)

7.2.1 Point of Care Testing

7.2.2 Clinical Diagnostics

7.2.3 Veterinary Diagnostics

7.3 Pharmaceutical Life Science Research and Manufacturing

7.3.1 Lab Analystics

7.3.1.1 Proteomics

7.3.1.2 Genomics

7.3.1.3 Cell based Assay

7.3.1.4 Capillary electrophoresis

7.3.2 Microdispensing

7.3.3 Microreaction

7.4 Therapeutics

7.4.1 Wearable Devices

7.4.2 Drug delivery

8. Microfluidics Market, by Material (2023-2030, USD Million)

8.1 Glass

8.2 Silicon

8.3 Polymers

8.4 Polydimethylsiloxane (PDMS)

8.5 Others (Metal, Ceramics etc.)

9. Microfluidics Market, by End User (2023-2030, USD Million)

9.1 Healthcare and Diagnostics Centers

9.2 Academic And Research Institute

9.3 Biotechnology and Pharmaceutical companies

9.4 Contract Research Organizations

10. Microfluidics Surgery Market, by Region (2023-2030, USD Million)

10.1 North America

10.1.1 US

10.1.2 Canada

10.2 Europe

10.2.1 Germany

10.2.2 France

10.2.3 Spain

10.2.4 Italy

10.2.5 UK

10.2.6 Rest of the Europe

10.3 Asia Pacific

10.3.1 China

10.3.2 Japan

10.3.3 India

10.3.4 Australia and New Zealand

10.3.5 South Korea

10.3.6 Rest of the Asia Pacific

10.4 Middle East and Africa

10.5 Latin America

11. Competitive Analysis

11.1 Key Players Footprint Analysis

11.2 Market Share Analysis

11.3 Key Brand Analysis

11.4 Regional Snapshot of Key Players

11.5 R&D Expenditure of Key Players

12. Company Profiles2

12.1 Abbott Laboratories

12.1.1 Business Overview

12.1.2 Product Portfolio

12.1.3 Financial Snapshot3

12.1.4 Recent Developments

12.1.5 SWOT Analysis

12.2 Agilent Technologies Inc.

12.3 Bio-Rad Laboratories Inc.

12.4 Blacktrace Holdings Ltd

12.5 Elvesys Group

12.6 Fluidigm Corporation

12.7 Illumina Inc.

12.8 Micronit B.V.

12.9 Parker-Hannifin Corporation

12.10 PerkinElmer Inc

12.11 Qiagen N.V.

12.12 Thermo Fisher Scientific Inc.

12.13 Hologic

12.14 Quidel Corporation

12.15 Idex Corporation

12.16 Fortive Corporation

12.17 Dolomite Microfluids

12.18 Elveflow

12.19 Labcyte

12.20 Fluigent

12.21 SomaLogic

12.22 Cellix

12.23 Hoffmann-La Roche & Co

12.24 Micronit Microtechnologies

12.25 Danaher Corporation

12.26 Emulate Inc.

12.27 Sphere Fluidics Limited

12.28 Qiagen NV

12.29 Hesperos Inc.

12.30 Bartels-Mikrotechnik

12.31 Nanomix Inc.

12.32 Biosurfit SA

12.33 UFluidix

12.34 Sphere Fluidics

13. Conclusion

14. Appendix

14.1 Industry Speak

14.2 Questionnaire

14.3 Available Custom Work

14.4 Adjacent Studies

14.5 Authors

15. References

Key Notes:

Please select a Everest Forms.

© Copyright 2024 – Wissen Research All Rights Reserved.