Minimally Invasive Surgery Market by Product (Surgical, Robotics, Imaging,), Application (Cardio-Thoracic, Vascular, Neuro), Technology (Laparoscopy, Transcatheter) End User, Regions, Key Players – Global Forecast to 2030

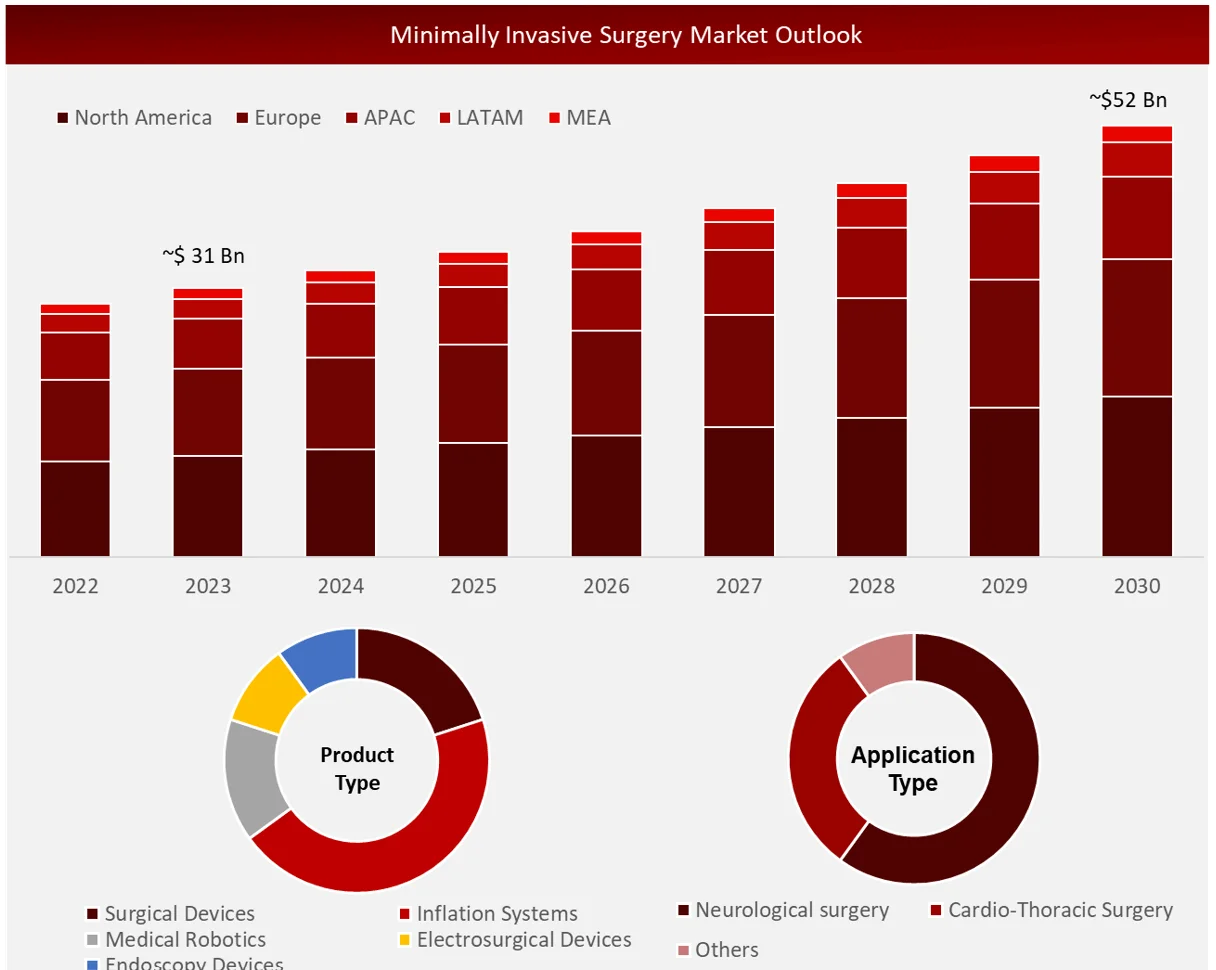

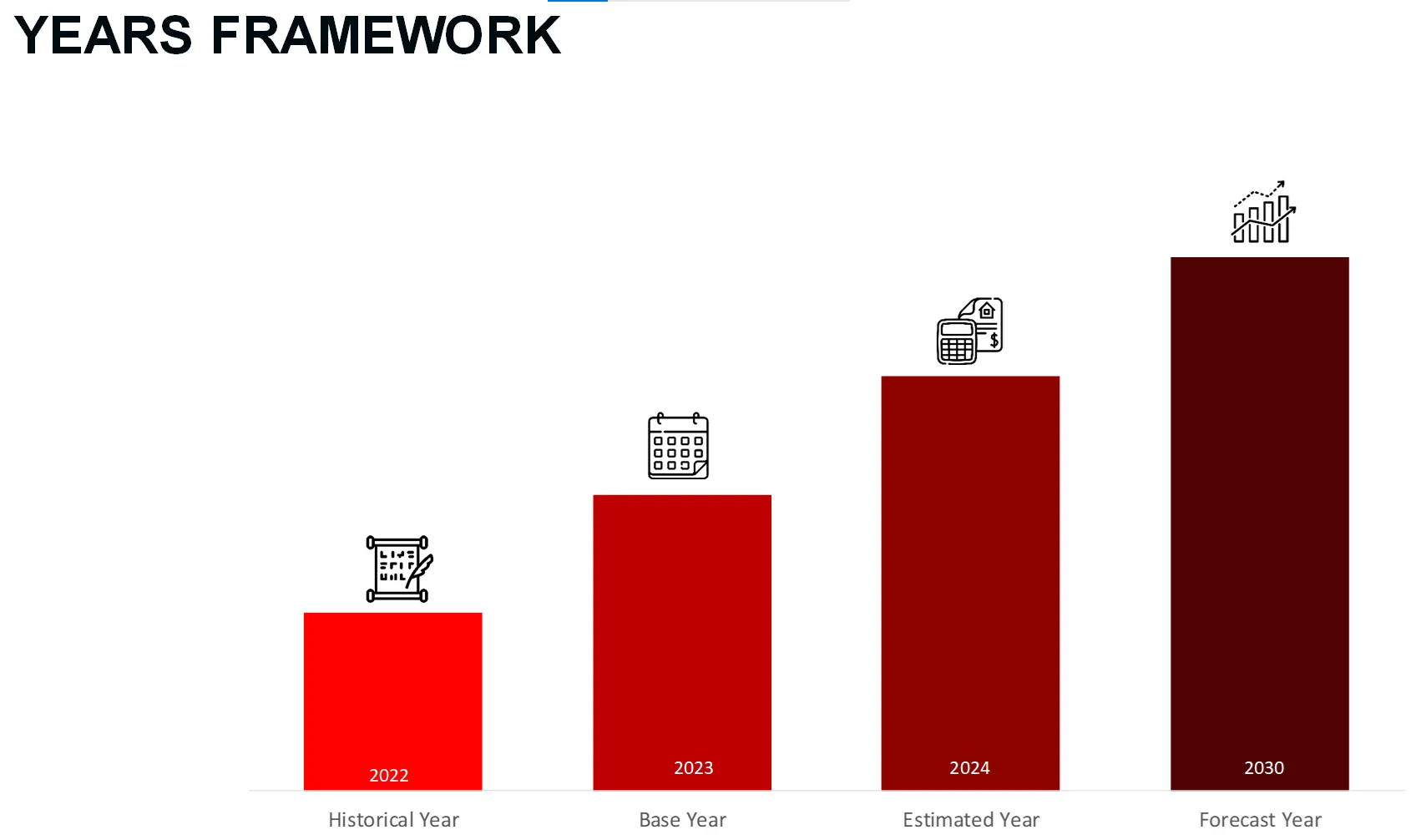

Wissen Research analyses that the minimally invasive surgery market is estimated at ~USD 31 billion in 2023 and is projected to reach ~USD 52 billion by 2030, expected to grow at a CAGR of ~7% during the forecast period, 2024-2030.

Minimally invasive surgery is a surgical procedure that utilizes smaller incisions in comparison to traditional open surgery. It includes utilizing specific tools and methods to reach the surgical area with minimal damage to the nearby tissues.

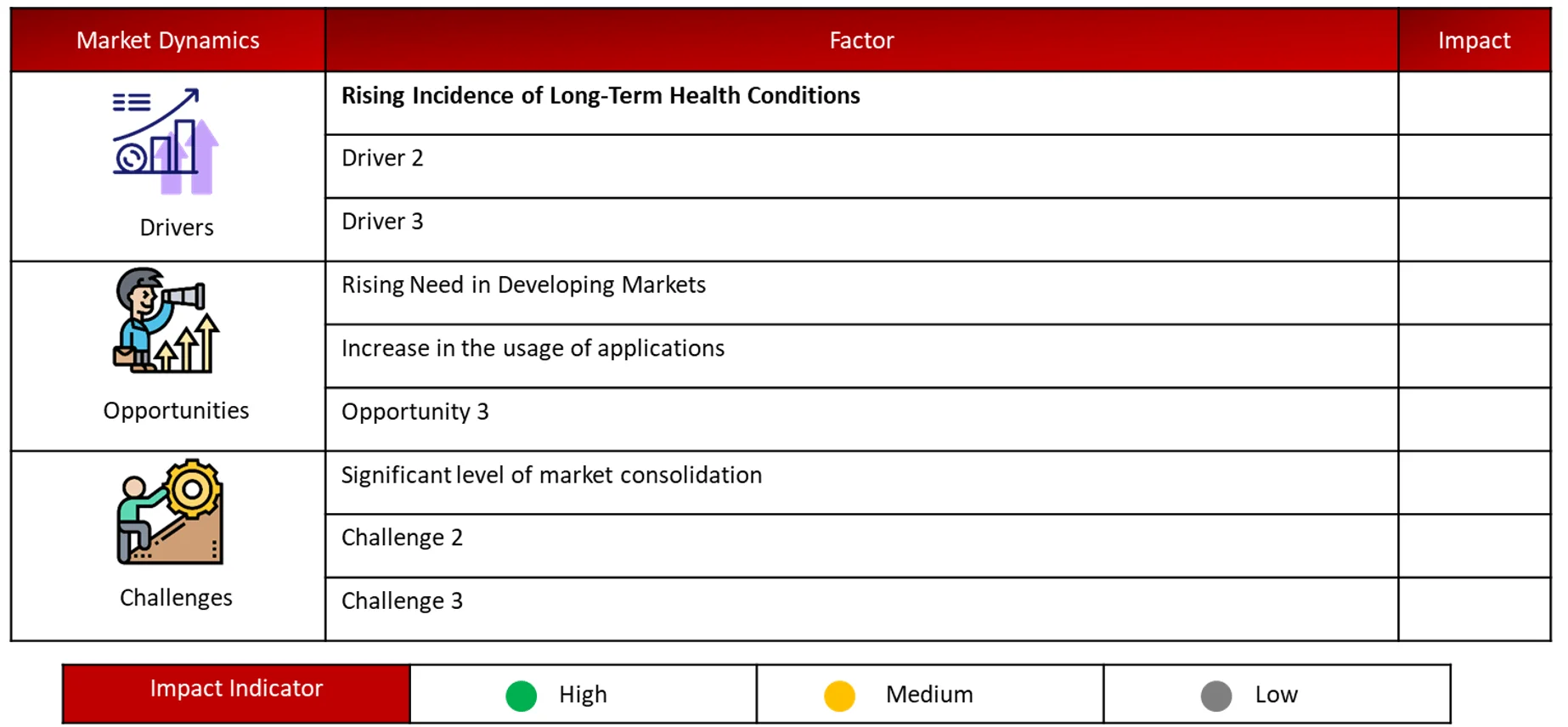

Increasing prevalence of chronic diseases and aging populations, coupled with expanding research and funding initiatives, along with international advancements in surgical methodologies, are significant drivers of the expansion of the minimally invasive surgery market. The future is expected to see a rise in demand for minimally invasive procedures due to continued advancements in healthcare technology. However, the growth of the market could be limited due to the expensive expenses and regulatory obstacles.

Driving Factor: Boost the acceptance of MIS compared to open surgeries

Laparoscopic surgeries require less invasion, leading to reduced expenses for both pre- and post-operative care as well as shorter hospital stays, resulting in cost savings. These surgical procedures lead to reduced blood loss, decreased postoperative complications, and shorter recovery periods for patients. Moreover, some health insurance providers in certain countries are starting to include coverage for minimally invasive surgeries. Doctors favor minimally invasive surgeries over traditional open surgeries because they see it as a way for hospitals to save costs.

Opportunity: Growth opportunities in emerging markets

Developing markets are transforming into promising sectors for minimally invasive surgery. Numerous factors play a part in the expansion possibilities in these markets, including low regulatory barriers, advancements in healthcare infrastructure, a growing patient base, increasing healthcare spending, rising disposable incomes, and a growing elderly population. Countries in the Asia Pacific region are better at adapting and are more conducive to doing business compared to those in developed countries. This has caused top players in the minimally invasive surgery market to shift their focus to emerging countries, in addition to facing more competition in mature markets.

Challenge: Significant level of market consolidation

The minimally invasive surgery industry is extremely consolidated. Only major corporations have the financial means to cover expensive investments in capital, as well as the costly expenses associated with research and development and production. It will block potential new competitors from entering the minimally invasive surgery market. The top player also appreciates the strong brand loyalty. Newcomers must battle established industry leaders to stand out and establish themselves by creating unique product offerings.

The surgical devices segment is anticipated to lead the market in terms of revenue in the minimally invasive surgery market, based on product type.

In 2023, the surgical devices sector dominated the market with a significant portion of revenue. Different types of surgical tools, such as handheld instruments, laparoscopy devices, guiding tools, and inflation systems, are essential in minimally invasive surgery (MIS) and improve surgical results through ongoing advancements and creativity. Technological progress plays a crucial role in the growth of MIS with surgical tools, with the goal of enhancing the accuracy, adaptability, and security of these devices, ultimately leading to advantages for patients. An example is the development of sophisticated laparoscopic tools, which has allowed surgeons to perform complex procedures with greater precision and decreased invasiveness. Additionally, the expansion of the minimally invasive surgery sector is being supported by the innovation of advanced surgical technologies from leading companies in the industry. These technologies frequently combine robotics, artificial intelligence, and advanced imaging, enabling surgeons to conduct procedures with greater efficiency and effectiveness.

Neurological surgery sector sees the highest growth rate in minimally invasive surgery market by Application

The field of neurological surgery is projected to experience the most rapid growth rate compared to the forecasted market growth for minimally invasive surgery. Multiple factors are leading to the rising utilization of minimally invasive surgery (MIS) in neurological procedures. Technological progress has enhanced the accuracy of minimally invasive procedures, especially in the fields of imaging techniques and surgical tools. Reducing post-operative complications, decreasing patient morbidity, and speeding up recovery times are also important reasons to use minimally invasive surgery in neurological procedures. Furthermore, the shift towards patient-focused results and value-driven healthcare models is also playing a role in the adoption of MIS in neurosurgery.

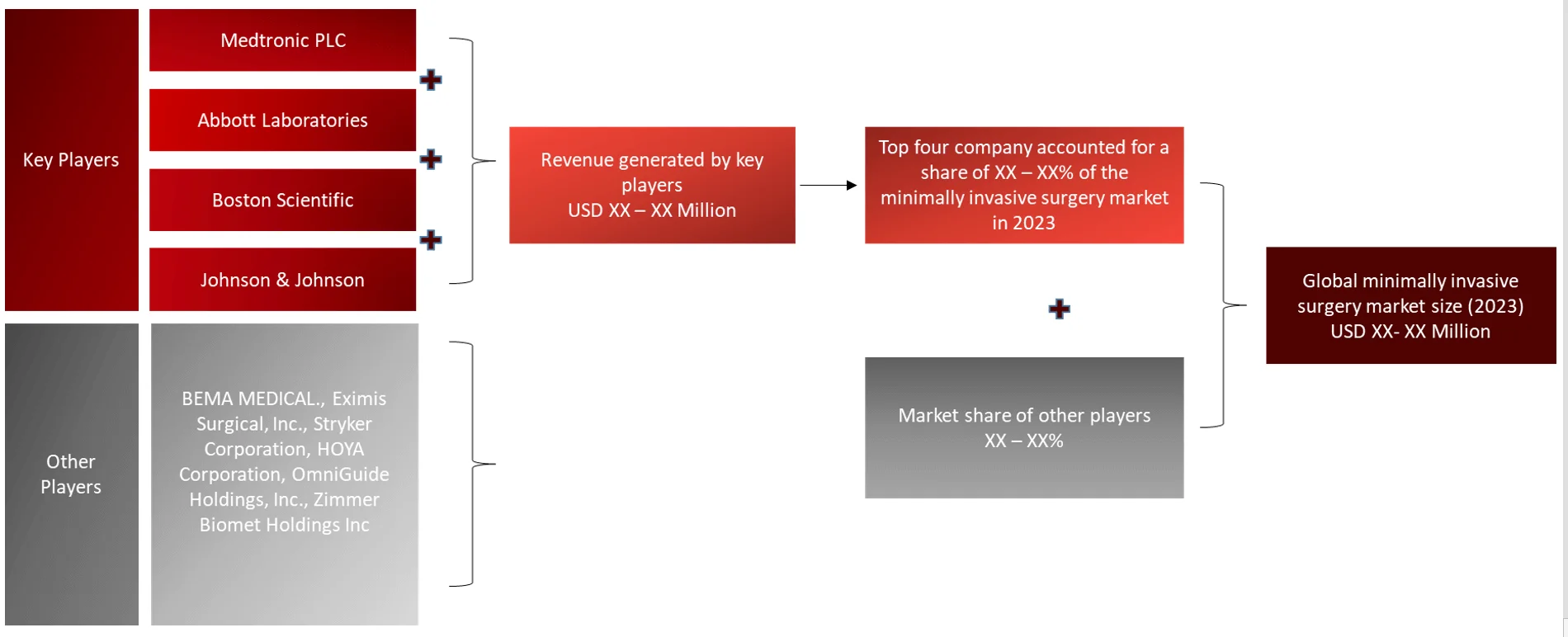

Major Companies and Market Share Insights in Minimally Invasive Surgery Market

Major players operating in minimally invasive surgery market are Medtronic PLC, Abbott Laboratories., Johnson & Johnson., Boston Scientific, Stryker Corporation., and NuVasive among others.

Introduction

Market Definition

Minimally invasive surgery involves performing a surgical procedure through a tiny incision instead of a large opening. Minimally invasive surgery is recognized for its lower complication rates, shorter hospital stays, and reduced pain. Various surgeries, including cardiothoracic surgery, gastroenterology, heart surgery, and gastroesophageal reflux disease, utilize minimally invasive surgical procedures.

Key Stakeholders

Key objectives of the Study

Research Methodology

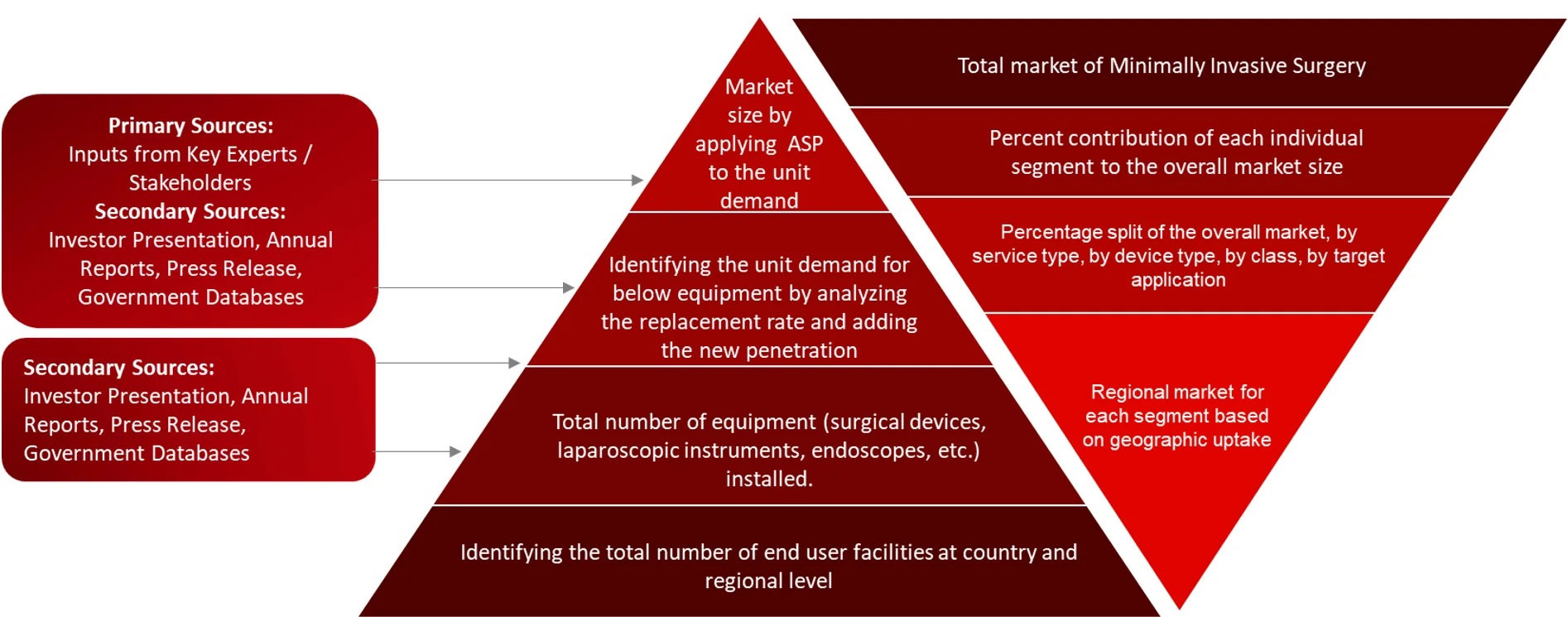

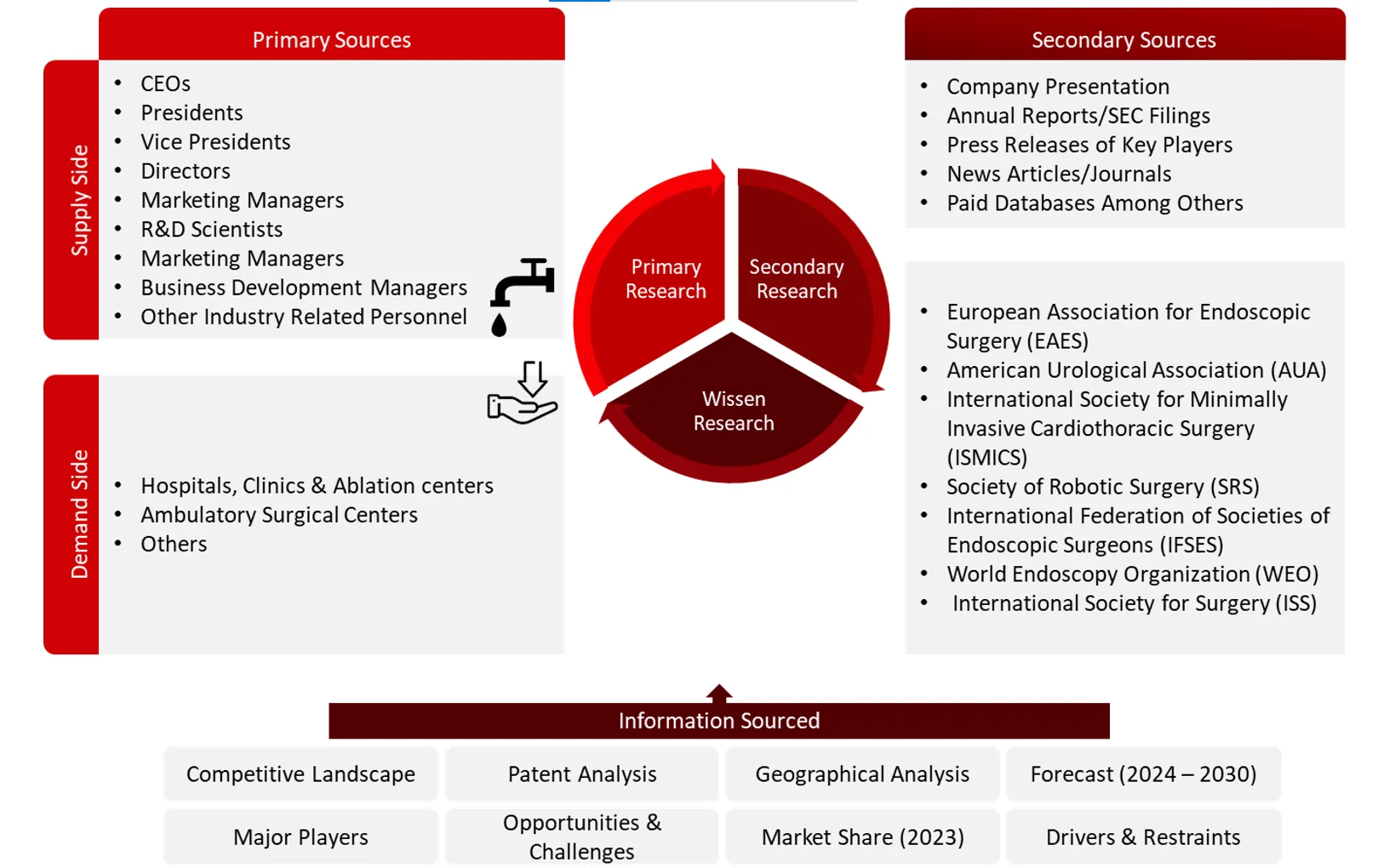

The aim of the study is to examine the key market forces such as drivers, opportunities, restraints, challenges, and strategies of key leaders. To monitor company advancements such as patents granted, product launches, expansions, and collaborations of key players, analyzing their competitive landscape based on various parameters of business and product strategy. Markey sizing will be estimated using top-down and bottom-up approaches. Using market breakdown and data triangulation techniques, market sizing of segments and sub-segments will be estimated.

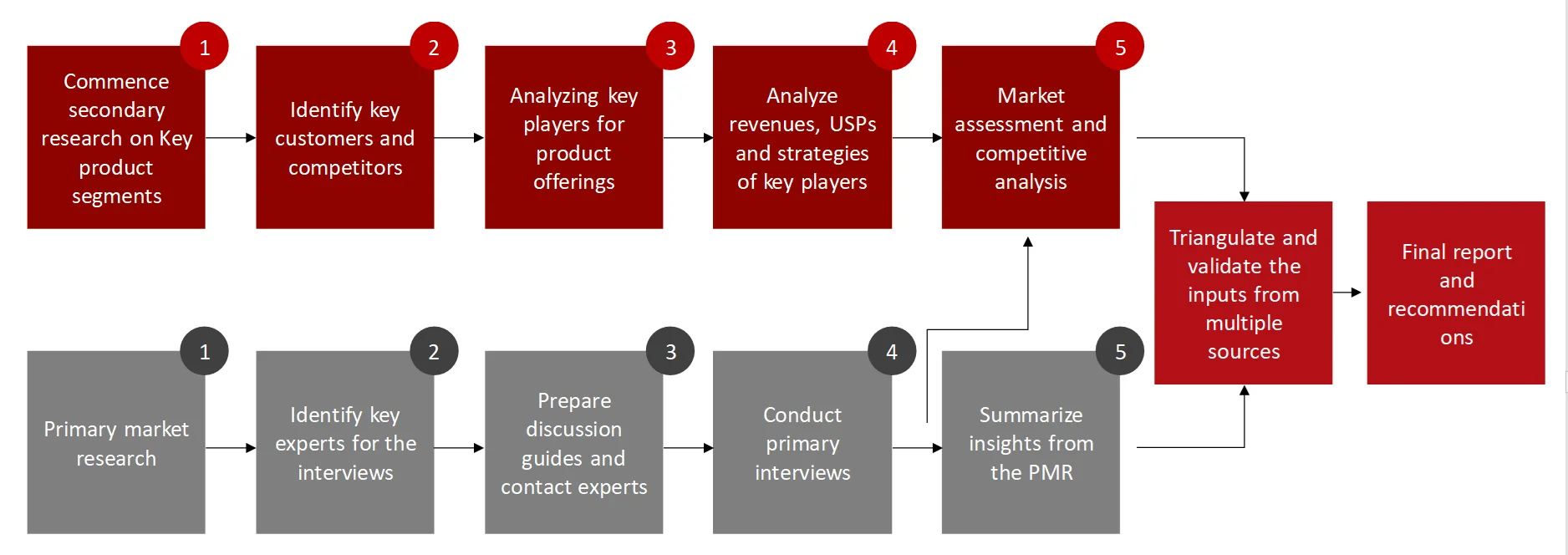

FIGURE: RESEARCH DESIGN

Research Approach

Collecting Secondary Data

The process of collating secondary research data involves the utilization of databases, secondary sources, annual reports, investor presentations, directories, and SEC filings of companies. Secondary research will be utilized to identify and gather information beneficial for the in-depth, technical, market-oriented, and commercial analysis of the minimally invasive surgery market. A database of the key industry leaders will also be compiled using secondary research.

Collecting Primary Data

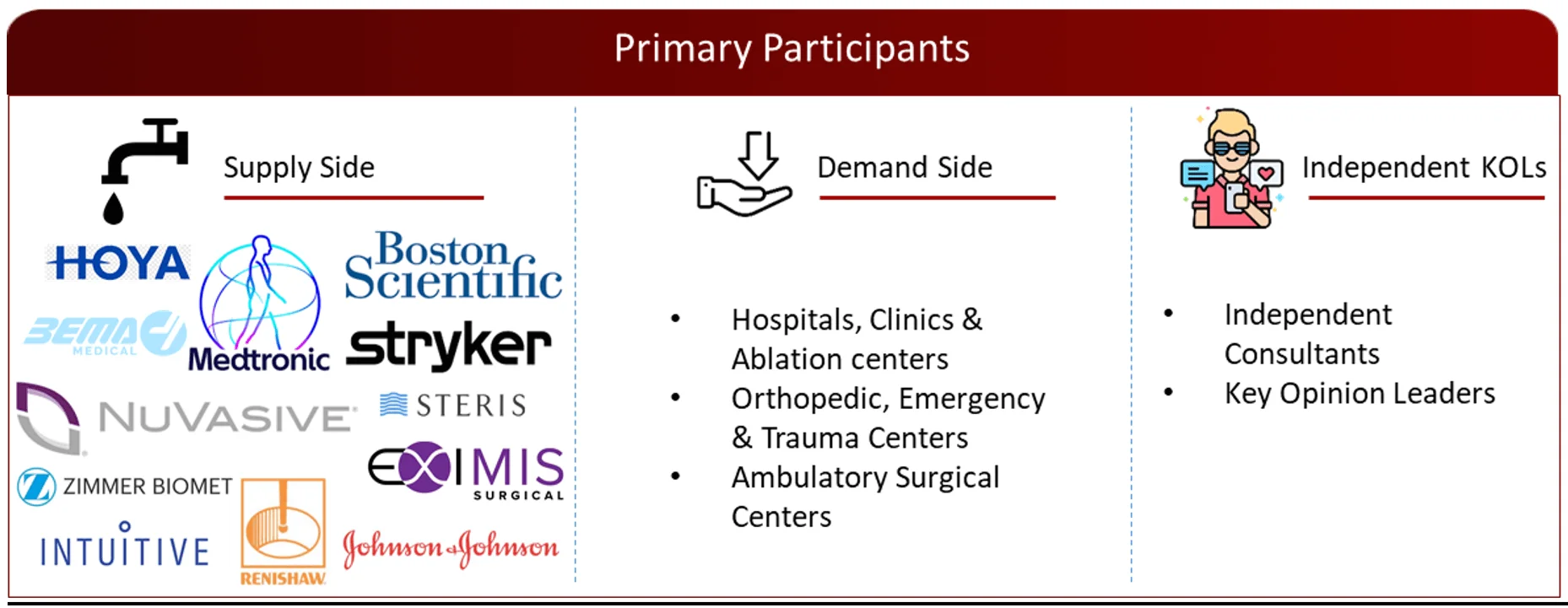

The primary research data will be conducted after acquiring knowledge about the Minimally invasive surgery market scenario through secondary research. A significant number of primary interviews will be conducted with stakeholders from both the demand and supply side (including various industry experts, such as Vice Presidents (VPs), Chief X Officers (CXOs), Directors from business development, marketing and product development teams, product manufacturers) across major countries of Europe, Asia Pacific, North America, Latin America, and Middle East and Africa. Primary data for this report will be collected through questionnaires, emails, and telephonic interviews.

FIGURE: BREAKDOWN OF PRIMARY INTERVIEWS FROM SUPPLY SIDE

FIGURE: BREAKDOWN OF PRIMARY INTERVIEWS FROM DEMAND SIDE

FIGURE: PROPOSED PRIMARY PARTICIPANTS FROM DEMAND AND SUPPLY SIDE

Note: Above mention companies are non-exhaustive.

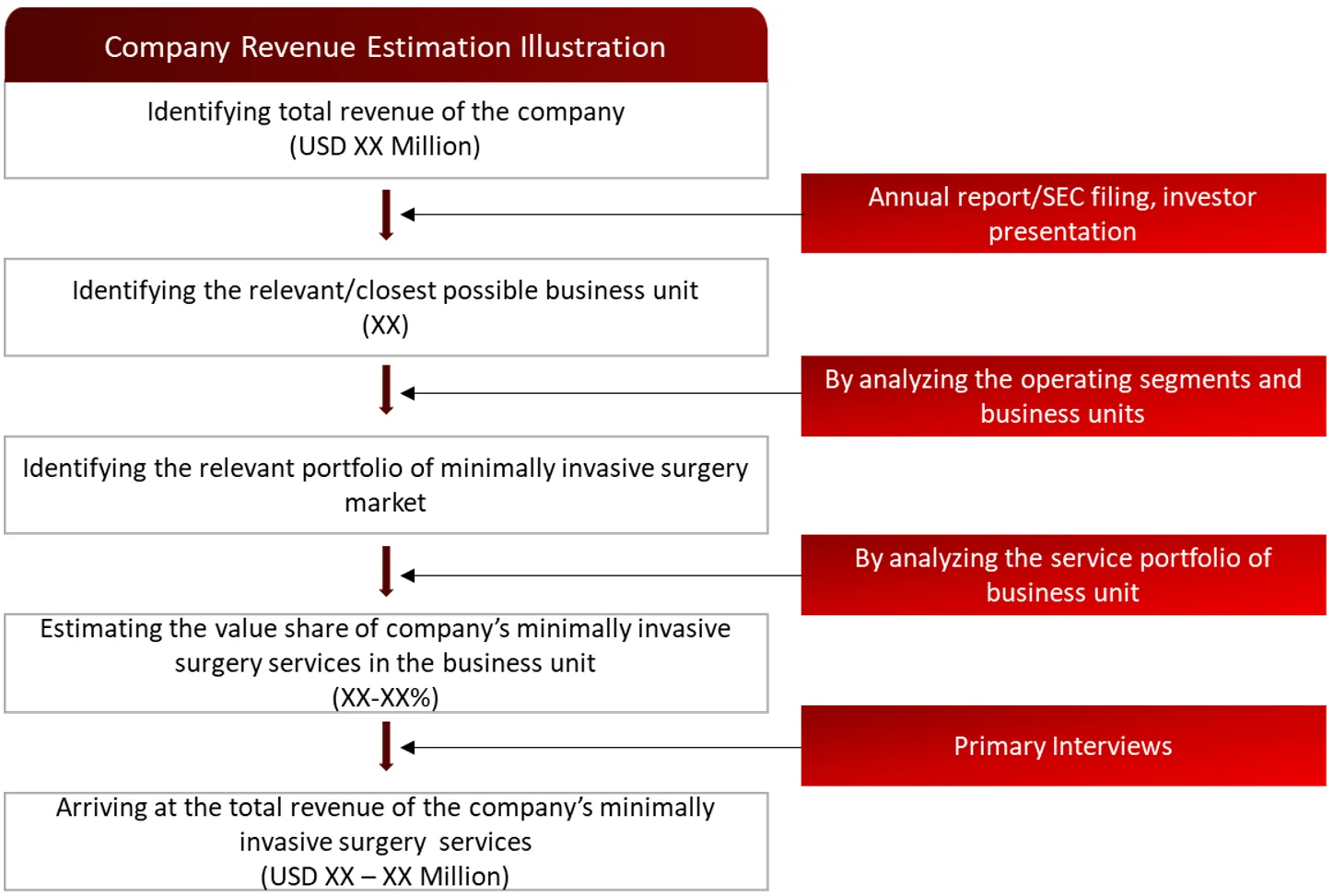

Market Size Estimation

All major industries offering various minimally invasive surgery services will be identified at the global/ regional level. Revenue mapping will be done for the major players, which will further be extrapolated to arrive at the global market value of each type of segment. The market value of minimally invasive surgery market will also split into various segments and sub segments at the region level based on:

FIGURE: REVENUE MAPPING BY COMPANY (ILLUSTRATION)

FIGURE: REVENUE SHARE ANALYSIS OF KEY PLAYERS (SUPPLY SIDE)

FIGURE: MARKET SIZE ESTIMATION TOP-DOWN AND BOTTOM-UP APPROACH

FIGURE: ANALYSIS OF DROCS FOR GROWTH FORECAST

FIGURE: GROWTH FORECAST ANALYSIS UTILIZING MULTIPLE PARAMETERS

Research Design

After arriving at the overall market size-using the market size estimation processes-the market will be split into several segments and sub segment. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub segment, the data triangulation, and market breakdown procedures will be employed, wherever applicable. The data will be triangulated by studying various factors and trends from both the demand and supply sides in the minimally invasive surgery market.

1.1 Key Objectives

1.2 Definitions

1.2.1 In Scope

1.2.2 Out of Scope

1.3 Scope of the Report

1.4 Scope Related Limitations

1.5 Key Stakeholders

2. Research Methodology

2.1 Research Approach

2.2 Research Methodology / Design

2.3 Market Sizing Approach

2.3.1 Secondary Research

2.3.2 Primary Research

3. Executive Summary & Premium Content

3.1 Global Market Outlook

3.2 Key Market Findings

4. Patent Analysis

4.1 Patents Related to Minimally Invasive Surgery devices

4.2 Key Patents and Innovations

4.3 Major Patent Holders and Licensing Agreements

4.4 Trends in Patent Filings and Technological Advancements

5. Market Overview

5.1 Market Dynamics

5.1.1 Drivers/Opportunities

5.1.2 Restraints/Challenges

5.2 End User Perception

5.3 Need Gap

5.4 Supply Chain / Value Chain Analysis

5.5 Industry Trends

5.6 Pricing Analysis

5.7 Porter’s Five Forces Analysis

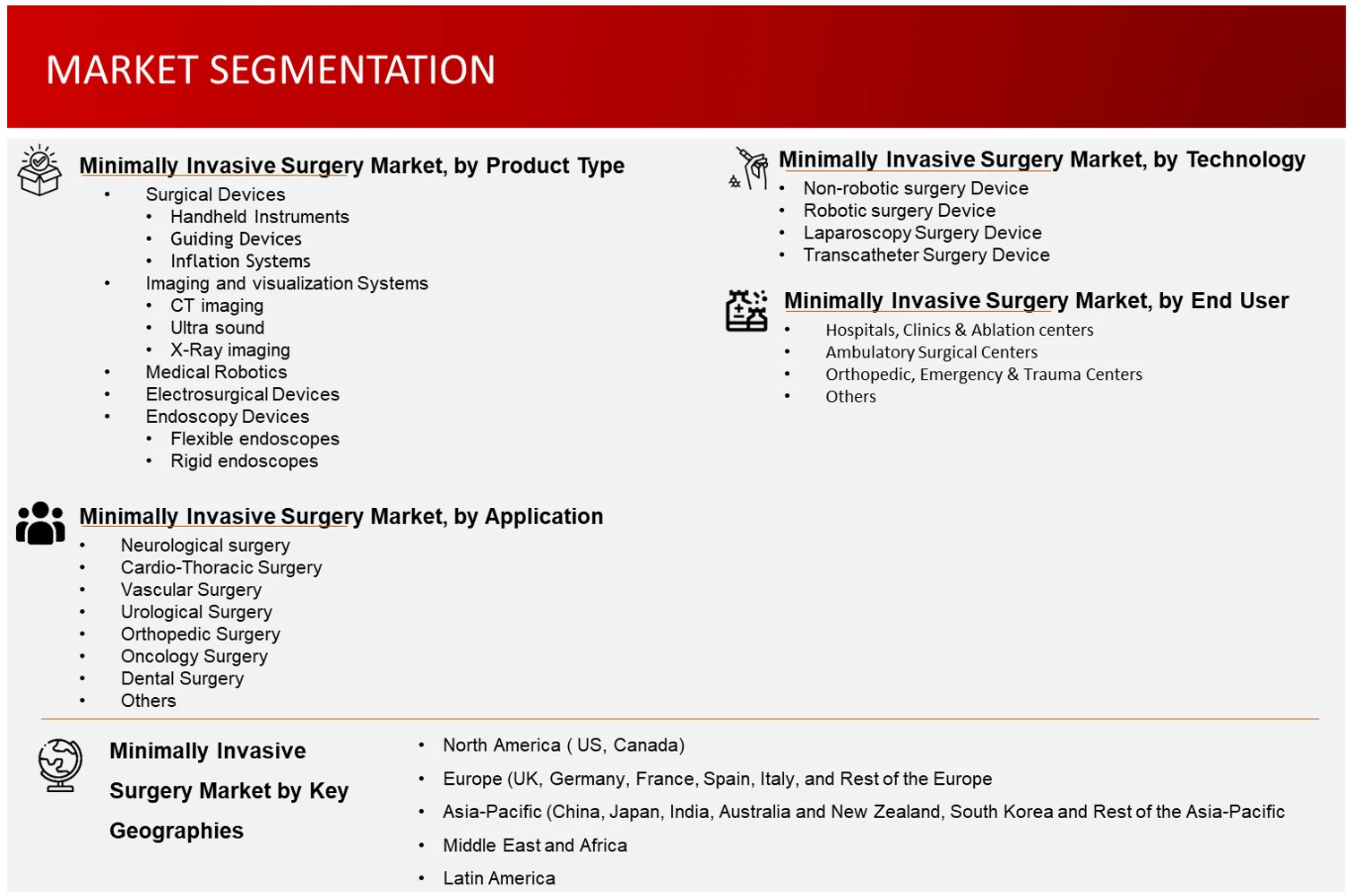

6. Minimally Invasive Surgery Market, by Product Type (2023-2030, USD Million)

6.1 Surgical Devices

6.1.1 Handheld Instruments

6.1.1.1 Tubular Retractor

6.1.1.2 Dilator

6.1.1.3 Suturing Instruments

6.1.1.4 Probes

6.1.1.5 Laser fiber devices

6.1.2 Guiding Devices

6.1.2.1 Guiding catheters

6.1.2.2 Guidewires

6.1.3 Inflation Systems

6.1.3.1 Balloon Catheters

6.1.3.2 Balloon inflation system

6.2 Laparoscopy Devices

6.2.1.1 Laparoscope

6.2.1.2 Trocar and Cannula

6.2.1.3 Graspers and Dissectors

6.3 Imaging and visualization Systems

6.3.1 CT imaging

6.3.2 Ultra sound

6.3.3 X-Ray imaging

6.3.4 MRI imaging

6.3.5 Visualization systems

6.4 Medical Robotics

6.4.1 Robotic Systems

6.4.2 Robotic Instruments

6.4.3 Robotic Software & Services

6.5 Electrosurgical Devices

6.5.1Electrocautery devices

6.5.2 Electrosurgical generators & accessories

6.6 Endoscopy Devices

6.6.1 Flexible endoscopes

6.6.2 Rigid endoscopes

6.6.3 Diagnostics endoscopes

7. Minimally Invasive Surgery Market, by Application Type (2023-2030, USD Million)

7.1 Introduction

7.2 Neurological surgery

7.3 Cardio- Thoracic Surgery

7.4 Vascular Surgery

7.5 Urological Surgery

7.6 Orthopedic Surgery

7.7 Oncology Surgery

7.8 Dental Surgery

7.9 Others (Gastrointestinal Surgery, Cosmetic Surgery etc.)

8. Minimally Invasive Surgery Market, by Technology (2023-2030, USD Million)

8.1 Non-robotic surgery Device

8.2 Robotic surgery Device

8.3 Laparoscopy Surgery Device

8.4 Transcatheter Surgery Device

9. Minimally Invasive Surgery Market, by End User (2023-2030, USD Million)

9.1 Hospitals, Clinics & Ablation Centers

9.2 Ambulatory Surgical Centers

9.3 Orthopedic, Emergency & Trauma Centers

9.4 Others (Medical Schools, Universities and Research Centers etc.)

10. Minimally Invasive Surgery Market, by Region (2023-2030, USD Million)

10.1 North America

10.1.1 US

10.1.2 Canada

10.2 Europe

10.2.1 Germany

10.2.2 France

10.2.3 Spain

10.2.4 Italy

10.2.5 UK

10.2.6 Rest of the Europe

10.3 Asia Pacific

10.3.1 China

10.3.2 Japan

10.3.3 India

10.3.4 Australia and New Zealand

10.3.5 South Korea

10.3.6 Rest of the Asia Pacific

10.4 Middle East and Africa

10.5 Latin America

11. Competitive Analysis

11.1 Key Players Footprint Analysis

11.2 Market Share Analysis

11.3 Key Brand Analysis

11.4 Regional Snapshot of Key Players

11.5 R&D Expenditure of Key Players

12. Company Profiles2

12.1 Olympus Corporation Inc.

12.1.1 Business Overview

12.1.2 Product Portfolio

12.1.3 Financial Snapshot3

12.1.4 Recent Developments

12.1.5 SWOT Analysis

12.2 Boston Scientific.

12.3 Freudenberg Medical

12.4 BEMA MEDICAL

12.5 Eximis Surgical, Inc.

12.6 OmniGuide Holdings, Inc.

12.7 Smith+Nephew

12.8 Silex Medical, LLC

12.9 Stryker Corporation

12.10 HOYA Corporation

12.11 Abbott Laboratories

12.12 Boston Scientific

12.13 Intuitive Surgical Inc.

12.14 Koninklijke Philips NV

12.15 Medtronic PLC

12.16 Steris

12.17 Zimmer Biomet Holdings Inc.

12.18 Johnson & Johnson Inc.

12.19 Renishaw PLC

12.20 CONMED Corporation

12.21 Depuy Synthes

12.22 NuVasive

12.23 Siemens Healthineer AG

12.24 GE Healthcare

12.25 PENTAX Medical

12.26 Other Players

12.26.1 Johns Hopkins University

12.26.2 Mayo Clinic

12.26.3 PENTAX Medical

12.26.4 Cleveland Clinic

12.26.5 University College London

12.26.6 Karolinska Institute

12.26.7 Kyoto University

12.26.8 National University of Singapore

13. Conclusion

14. Appendix

14.1 Industry Speak

14.2 Questionnaire

14.3 Available Custom Work

14.4 Adjacent Studies

14.5 Authors

15. References

© Copyright 2024 – Wissen Research All Rights Reserved.