Surface Disinfectants Market by Composition (Alcohols, Chlorine Compound, Hydrogen Peroxide, Quaternary Ammonium Compounds), Type (Liquids, Wipes, Spray, Aerosols), Application (Surface, Instruments), End User, Regions, Key Players – Global Forecast to 2030

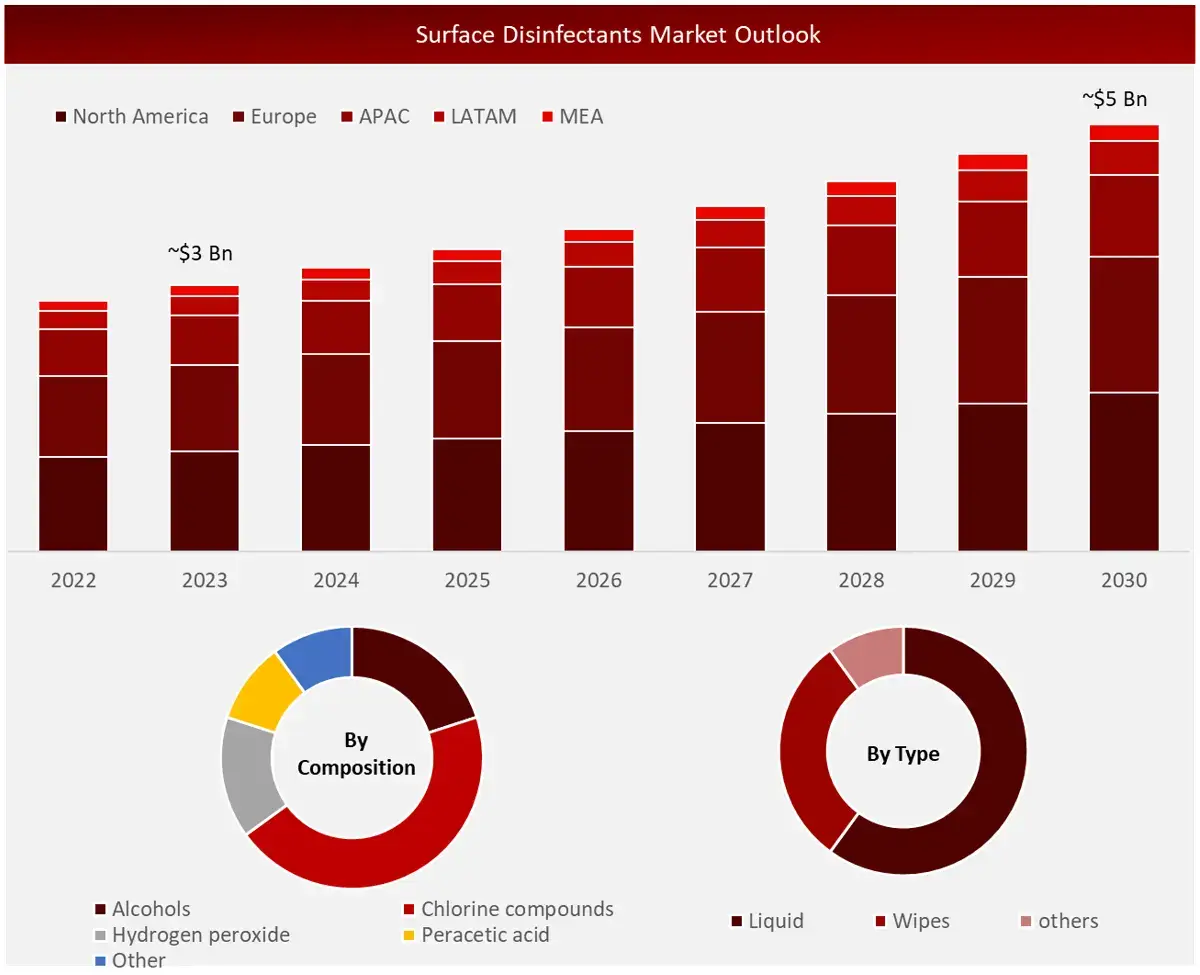

Wissen Research analyses that the surface disinfectants market is estimated at ~USD 3 billion in 2023 and is projected to reach ~USD 5 billion by 2030, expected to grow at a CAGR of ~8% during the forecast period, 2024-2030.

Surface disinfectant is a chemical compound used to kill microbes on surfaces to stop the spread of infections. They work by disturbing the metabolism of the microbes. They are frequently used in laboratories, medical facilities, kitchens, and bathrooms to prevent the transmission of contagious illnesses. They are also used to clean floors, walls, tabletops, and medical equipment and instruments.

There is a significant rise in demand for cleaning products, sanitizers, and disinfectants in the global surface disinfectant market as a result of increased attention to hygiene and sanitation post-pandemic. The increase in demand for products that combat germs and viruses on surfaces has positively impacted market growth.

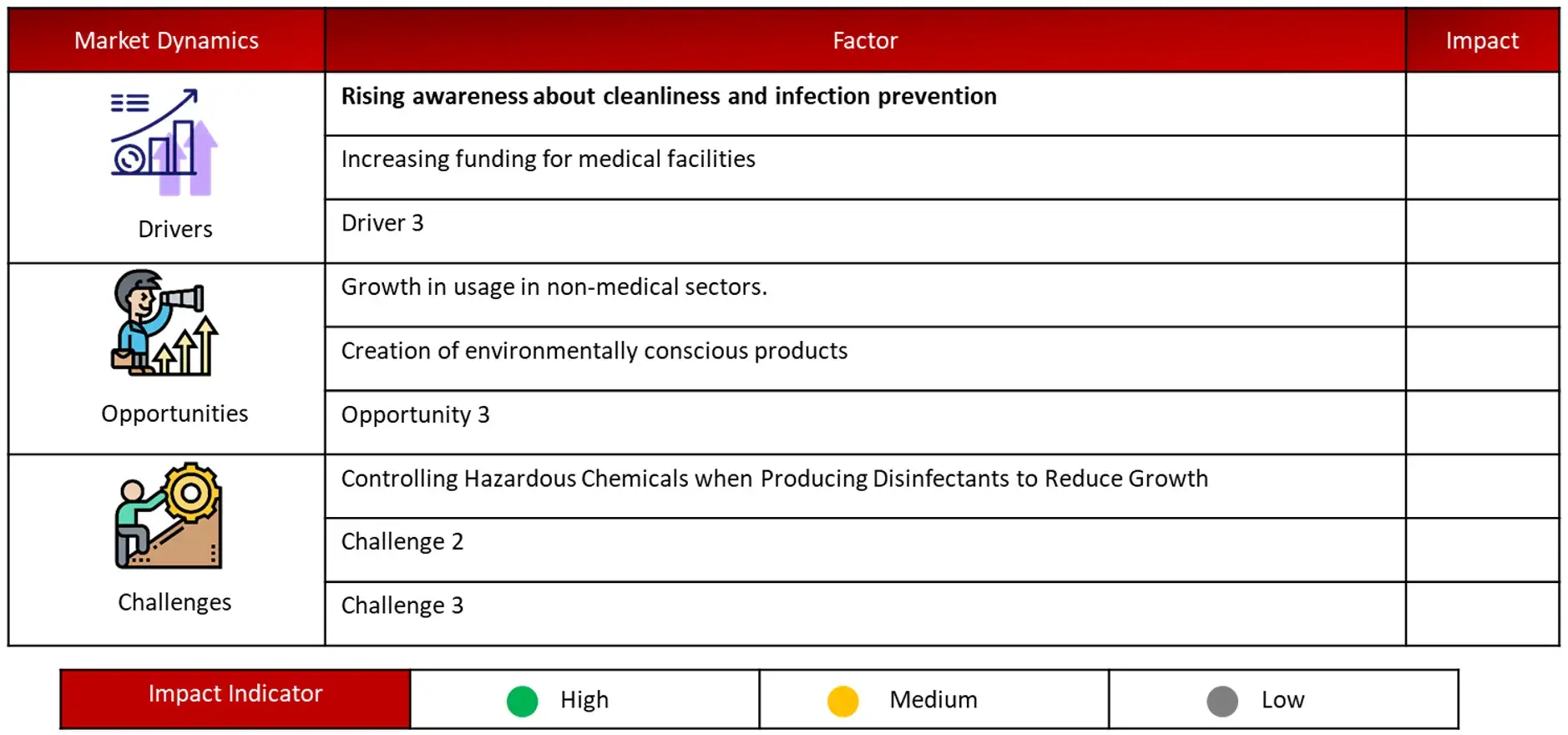

Driving Factor: Increasing need for infection prevention measures to reduce cases of hospital-acquired infections

difficile, Staphylococcus aureus, Klebsiella, and Escherichia coli are among the main pathogens responsible for healthcare-associated infections (HAIs). Pathogens can be spread either by coming into direct contact with healthcare workers or by being exposed to a contaminated environment. A growing number of elderly people and rising chronic disease rates lead to more hospitalizations, thereby raising the prevalence of HAIs. This is predicted to increase the need for sterilization and disinfectant items.

Opportunity: Rising healthcare spending and emphasis in developing countries

Opportunities are abundant for players in the sterilization and disinfection industries in emerging markets such as South Africa, Brazil, and India. The need for improved healthcare services is driven by the aging populations, increasing patient volumes, higher average incomes, and greater awareness in these economies. Multinational companies specializing in infection control can discover lucrative chances to relocate their business activities to developing economies in the Asia-Pacific area.

Challenge: Managing Dangerous Chemicals in the Manufacture of Disinfectants to Limit Expansion

Substances like hypochlorite, peroxides, and acetic acid are utilized in making these disinfectants and pose risks to both the environment and human health. Handling, storing, and transporting sodium hypochlorite can be challenging and expensive due to its corrosive and flammable nature, as well as its ability to cause burns. The NCBI’s study revealed a significant number of users suffering from chronic diseases with serious health consequences. Hence, the reasons mentioned above will serve as constraints for this market

Alcohol-based disinfectant is expected to hold largest share within surface disinfectants market by composition type

The surface disinfectant market by composition is divided into categories such as alcohols, chlorine compounds, quaternary ammonium compounds, hydrogen peroxide, and other compositions depending on their composition. Alcohol-based disinfectants accounted for the largest share in 2023. The large share of this segment is attributed to quick evaporation and effectiveness in killing germs, easy availability, and higher adoption among the end users.

Liquid segment captured majority share of surface disinfectants market by type

The market for surface disinfectant is divided into liquids, wipes, and sprays according to type. The liquid segment is projected to dominate the market share in the forecast period, which are more cost-effective than sprays and wipes, are commonly utilized for preventing hospital-acquired infections and make up a significant portion of the market for infection control.

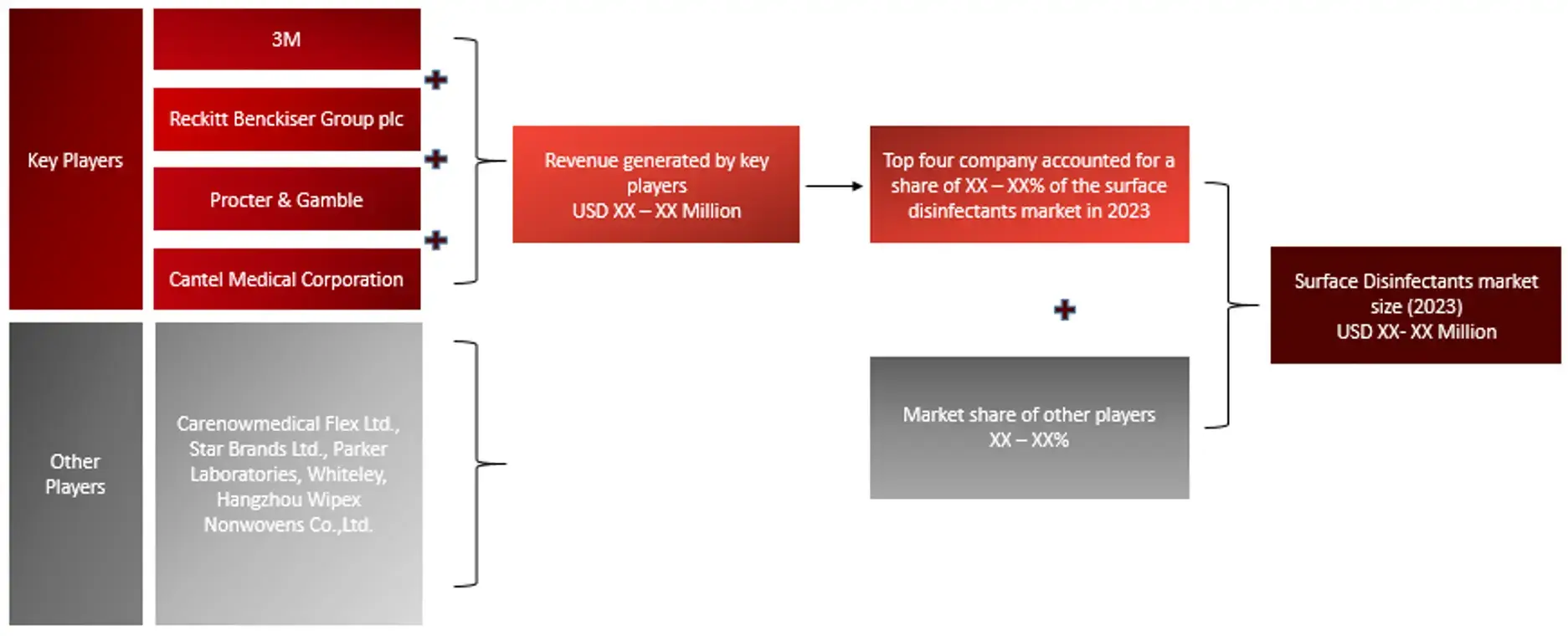

Major Companies and Market Share Insights in Surface Disinfectants Market

Major players operating in surface disinfectant market are 3M., Dreumex., Reckitt Benckiser Group plc, Procter & Gamble., and Cantel Medical Corporation among others.

Recent Developments in Surface Disinfectants Market:

Introduction

Market Definition

Surface disinfectants, known as chemicals, are applied to solid surfaces and water sources, such as drinking water and wastewater, to eliminate, deactivate, or greatly reduce pathogens such as bacteria, viruses, and fungi. Surface disinfectants are used in pathology labs, hospitals, and other settings involving patients to stop the spread of microbial diseases and cross-contamination via surfaces. They are used in labs and companies in the pharmaceutical and biotechnology industries to handle and care for human cells for research and development. Surface disinfectants are mainly used to clean walls, floors, and other surfaces in hospitals, as well as to disinfect medical instruments and devices.

Key Stakeholders

Key objectives of the Study

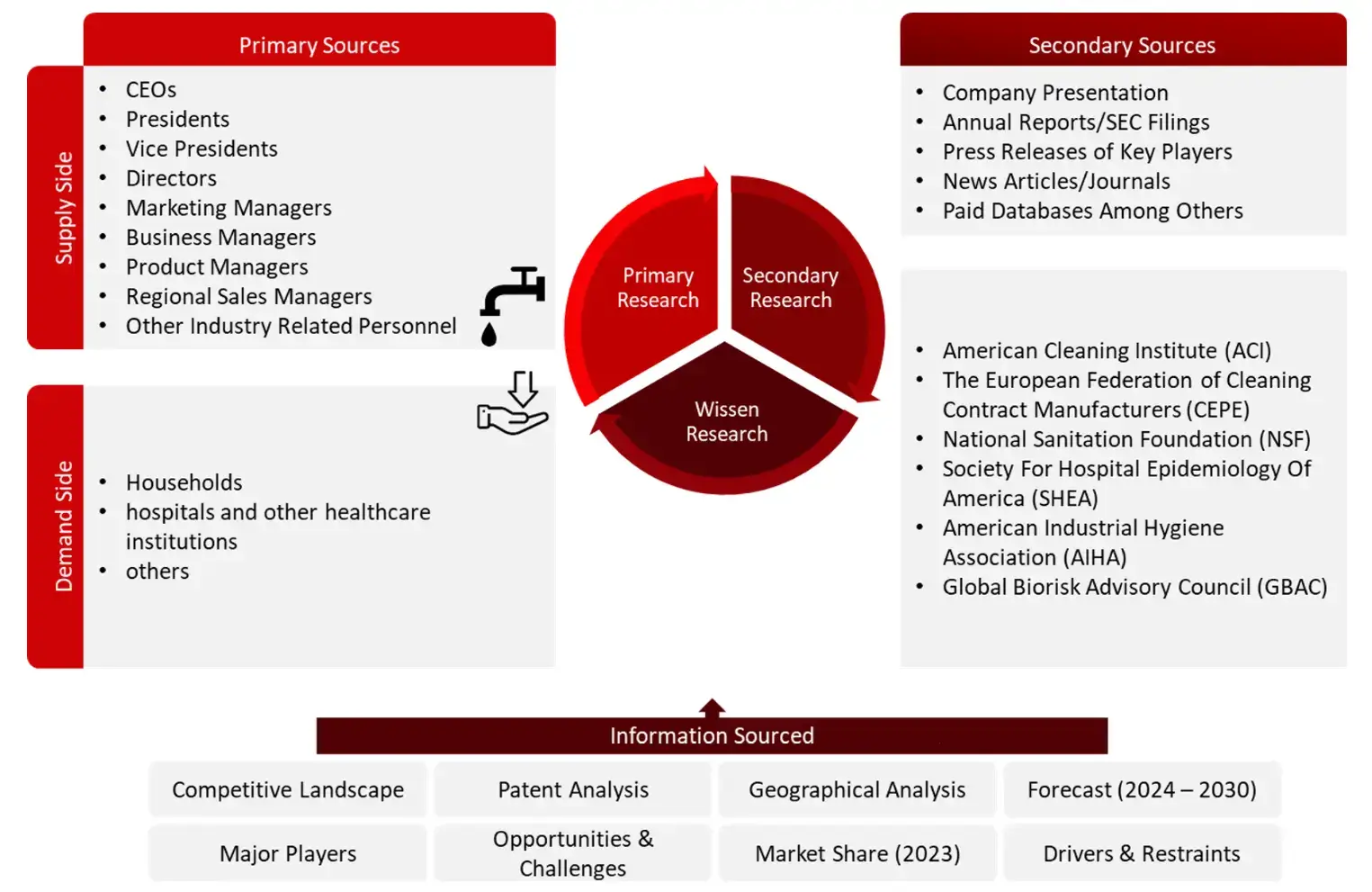

Research Methodology

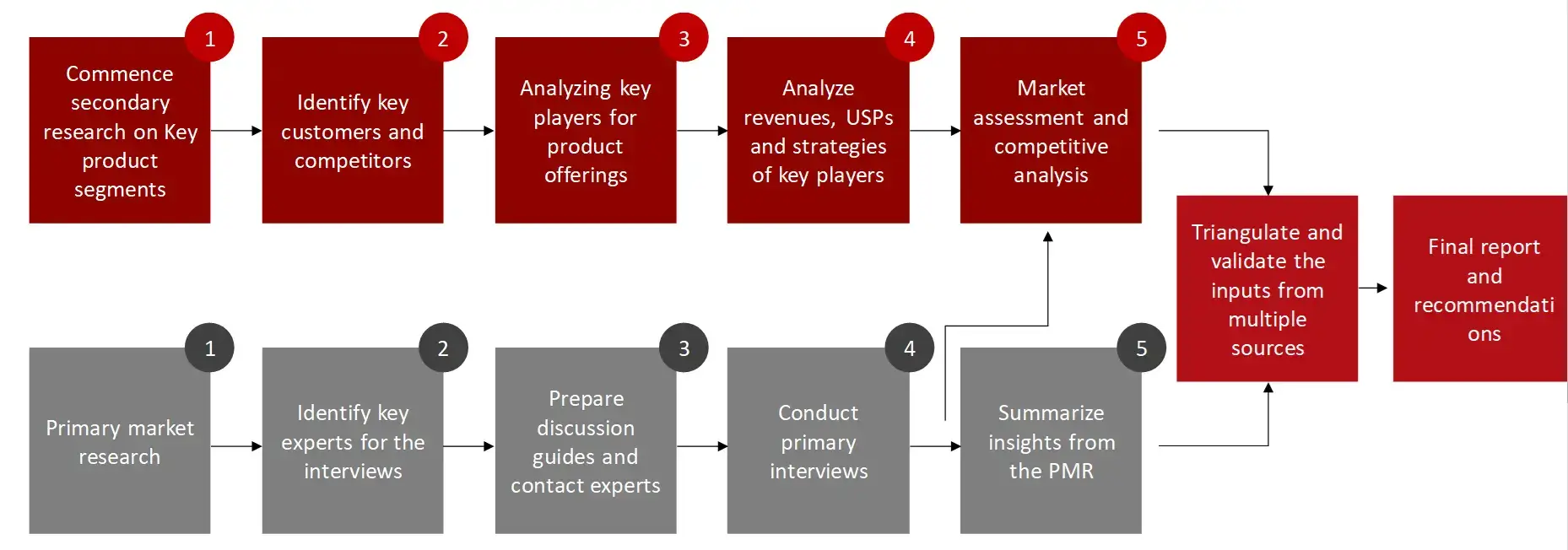

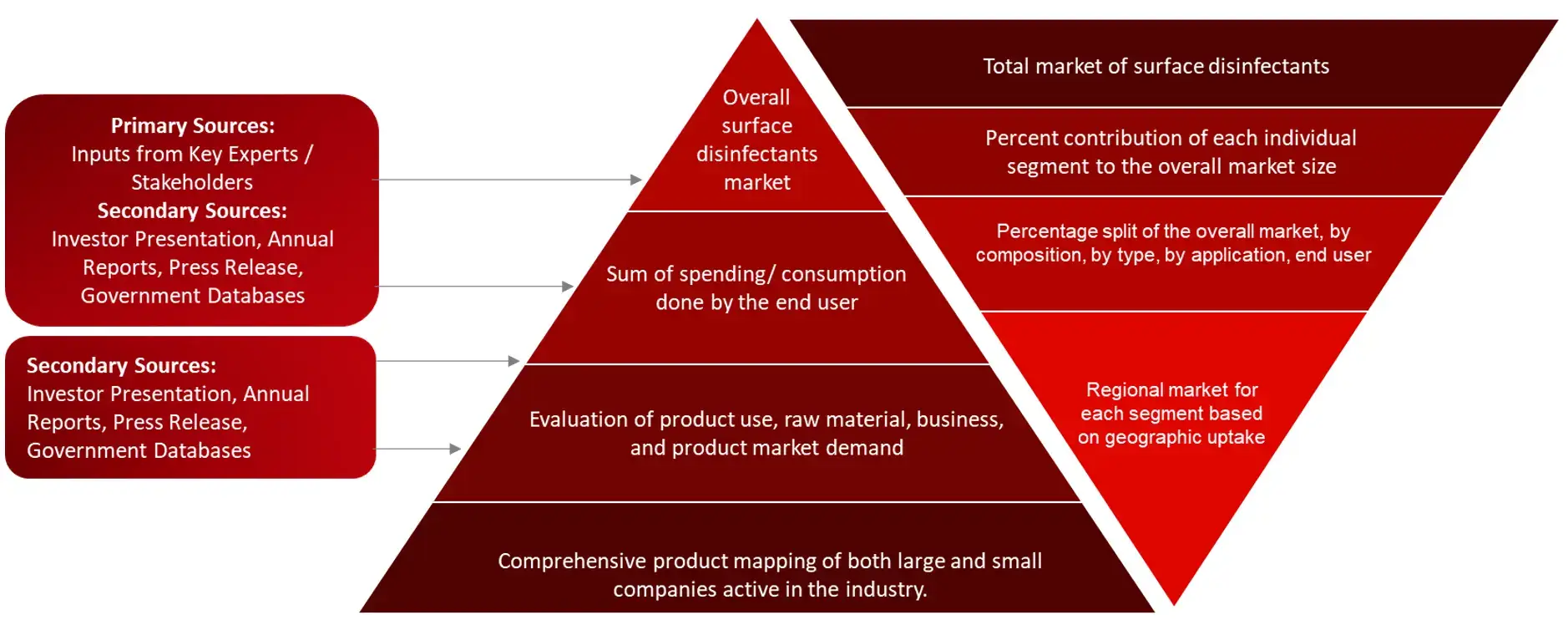

The aim of the study is to examine the key market forces such as drivers, opportunities, restraints, challenges, and strategies of key leaders. To monitor company advancements such as patents granted, product launches, expansions, and collaborations of key players, analyzing their competitive landscape based on various parameters of business and product strategy. Markey sizing will be estimated using top-down and bottom-up approaches. Using market breakdown and data triangulation techniques, market sizing of segments and sub-segments will be estimated.

FIGURE: RESEARCH DESIGN

Research Approach

Collecting Secondary Data

The process of collating secondary research data involves the utilization of databases, secondary sources, annual reports, investor presentations, directories, and SEC filings of companies. Secondary research will be utilized to identify and gather information beneficial for the in-depth, technical, market-oriented, and commercial analysis of the surface disinfectants market. A database of the key industry leaders will also be compiled using secondary research.

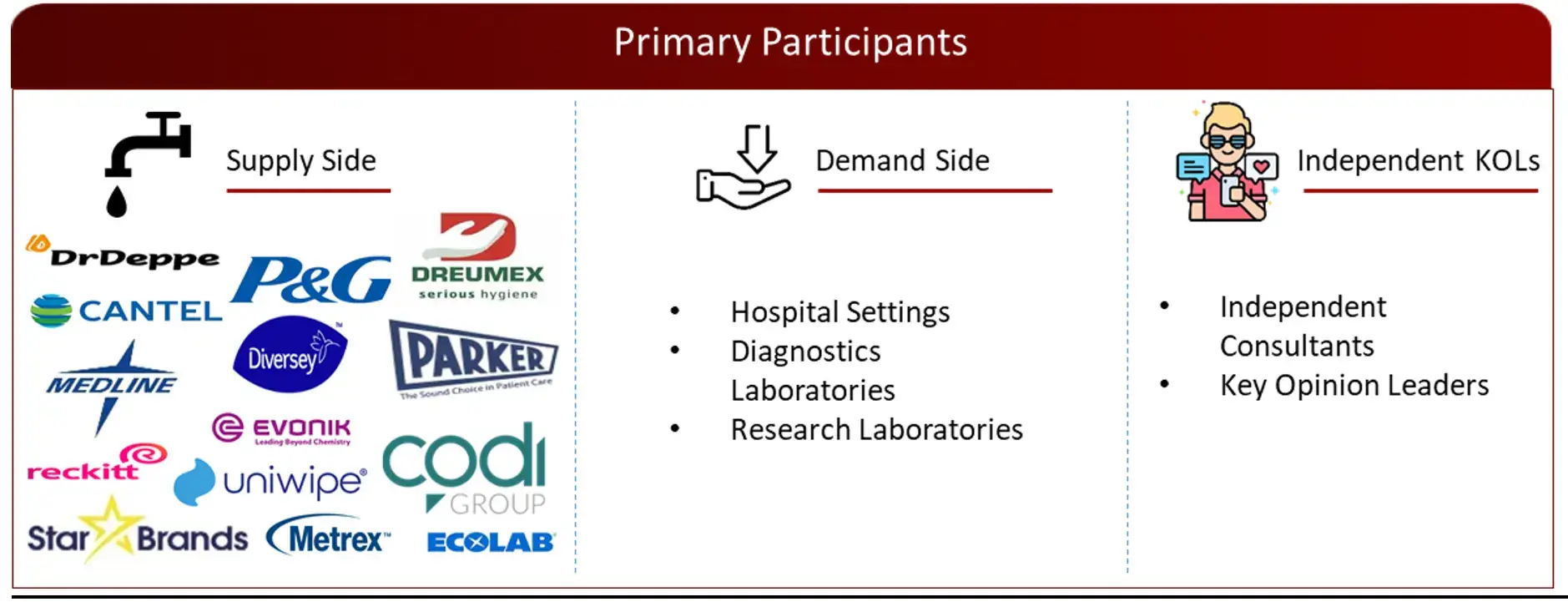

Collecting Primary Data

The primary research data will be conducted after acquiring knowledge about the surface disinfectants market scenario through secondary research. A significant number of primary interviews will be conducted with stakeholders from both the demand and supply side (including various industry experts, such as Vice Presidents (VPs), Chief X Officers (CXOs), Directors from business development, marketing and product development teams, product manufacturers) across major countries of Europe, Asia Pacific, North America, Latin America, and Middle East and Africa. Primary data for this report will be collected through questionnaires, emails, and telephonic interviews.

FIGURE: BREAKDOWN OF PRIMARY INTERVIEWS FROM SUPPLY SIDE

FIGURE: BREAKDOWN OF PRIMARY INTERVIEWS FROM DEMAND SIDE

FIGURE: PROPOSED PRIMARY PARTICIPANTS FROM DEMAND AND SUPPLY SIDE

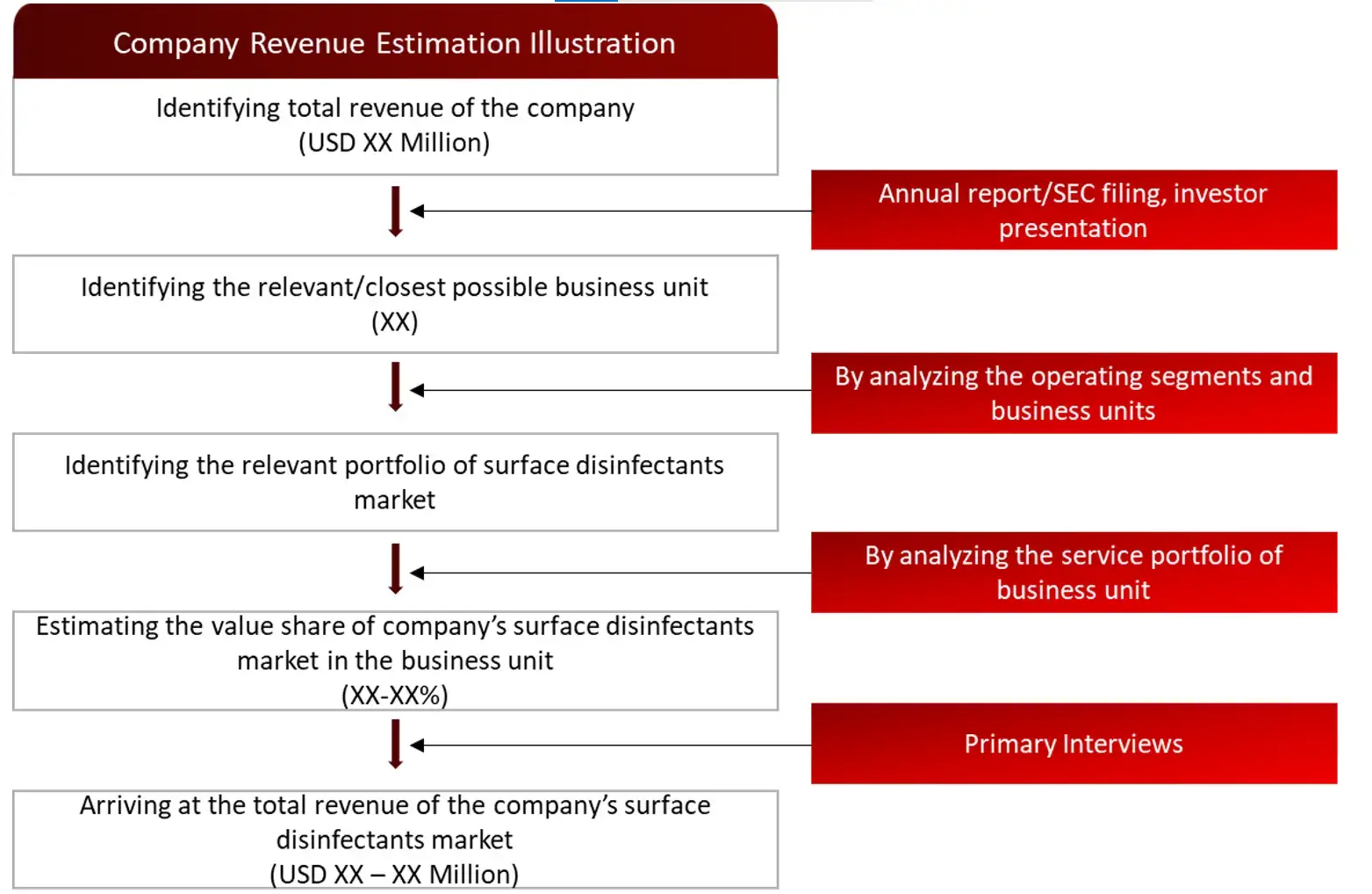

Market Size Estimation

All major industries offering various surface disinfectants services will be identified at the global/ regional level. Revenue mapping will be done for the major players, which will further be extrapolated to arrive at the global market value of each type of segment. The market value of surface disinfectants market will also split into various segments and sub segments at the region level based on:

FIGURE: REVENUE MAPPING BY COMPANY (ILLUSTRATION)

FIGURE: REVENUE SHARE ANALYSIS OF KEY PLAYERS (SUPPLY SIDE)

FIGURE: MARKET SIZE ESTIMATION TOP-DOWN AND BOTTOM-UP APPROACH

FIGURE: ANALYSIS OF DROCS FOR GROWTH FORECAST

FIGURE: GROWTH FORECAST ANALYSIS UTILIZING MULTIPLE PARAMETERS

Research Design

After arriving at the overall market size-using the market size estimation processes-the market will be split into several segments and sub segment. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub segment, the data triangulation, and market breakdown procedures will be employed, wherever applicable. The data will be triangulated by studying various factors and trends from both the demand and supply sides in the surface disinfectants market.

1. Introduction

1.1 Key Objectives

1.2 Definitions

1.2.1 In Scope

1.2.2 Out of Scope

1.3 Scope of the Report

1.4 Scope Related Limitations

1.5 Key Stakeholders

2. Research Methodology

2.1 Research Approach

2.2 Research Methodology / Design

2.3 Market Sizing Approach

2.3.1 Secondary Research

2.3.2 Primary Research

3. Executive Summary & Premium Content

3.1 Global Market Outlook

3.2 Key Market Findings

4. Patent Analysis

4.1 Patents Related to Surface Disinfectants

4.2 Patent Landscape and Intellectual Property Trends

5. Market Overview

5.1 Market Dynamics

5.1.1 Drivers/Opportunities

5.1.2 Restraints/Challenges

5.2 End User Perception

5.3 Need Gap

5.4 Supply Chain / Value Chain Analysis

5.5 Industry Trends

5.6 Porter’s Five Forces Analysis

6. Surface Disinfectant Market, by Composition Type (2023-2030, USD Million)

6.1 Alcohols

6.2 Chlorine Compounds

6.3 Hydrogen Peroxide

6.4 Quaternary Ammonium Compounds

6.5 Peracetic Acid

6.6 Others (Iodophors, Aldehydes, etc.)

7. Surface Disinfectant Market, by Application Type (2023-2030, USD Million)

7.1 Introduction

7.2 Surface Disinfection

7.3 Instrument Disinfection

7.4 Other (Air Disinfection, Decontamination of Personal Protective Equipment (PPE) etc.)

8. Surface Disinfectant Market, by Type (2023-2030, USD Million)

8.1 Liquid

8.2 Wipes

8.3 Spray

8.4 Aerosols

9. Surface Disinfectant Market, by End User (2023-2030, USD Million)

9.1 Hospital Settings

9.2 Diagnostics Laboratories

9.3 Pharmaceutical & Biotechnology Companies

9.4 Educational institutions

10. Surface Disinfectant Market, by Region (2023-2030, USD Million)

10.1 North America

10.1.1 US

10.1.2 Canada

10.2 Europe

10.2.1 Germany

10.2.2 France

10.2.3 Spain

10.2.4 Italy

10.2.5 UK

10.2.6 Rest of the Europe

10.3 Asia Pacific

10.3.1 China

10.3.2 Japan

10.3.3 ndia

10.3.4 Australia and New Zealand

10.3.5 South Korea

10.3.6 Rest of the Asia Pacific

10.4 Middle East and Africa

10.5 Latin America

11. Competitive Analysis

11.1 Key Players Footprint Analysis

11.2 Market Share Analysis

11.3 Key Brand Analysis

11.4 Regional Snapshot of Key Players

11.5 R&D Expenditure of Key Players

12. Company Profiles2

12.1 PDI, Inc

12.1.1. Business Overview

12.1.2 Product Portfolio

12.1.3 Financial Snapshot3

12.1.4 Recent Developments

12.1.5 SWOT Analysis

12.2 Gojo Industries Inc.

12.3 M Barr

12.4 Carenowmedical Flex Ltd.

12.5 Reckitt Benckiser Group PLC

12.6 BODE Chemie GmbH

12.7 Star Brands Ltd

12.8 The 3M Company

12.9 BASF SE

12.10 Evonik Industries AG

12.11 Kimberly-Clark Corporation (KCWW)

12.12 Medline Industries, Inc.

12.13 Metrex Research LLC

12.14 Diversey Inc

12.15 STERIS plc

12.16 Whiteley Corporation

12.17 Hangzhou Wipex Nonwovens Co.,Ltd

12.18 Jainam Invamed Private Limited

12.19 Linghai Zhan Wang Biotechnology Co., Ltd.

12.20 Stepan Company

12.21 Parker Laboratories

12.22 CleanWell, LLC

12.23 Uniwipe Europe Ltd

12.24 The Hygiene Company

12.25 Codi Group

12.26 Seventh Generation Inc

12.27 Deppe GmbH

12.28 Procter & Gamble

12.29 Cantel Medical Corporation

13. Conclusion

14. Appendix

14.1 Industry Speak

14.2 Questionnaire

14.3 Available Custom Work

14.4 Adjacent Studies

14.5 Authors

15. References

Key Notes:

© Copyright 2024 – Wissen Research All Rights Reserved.