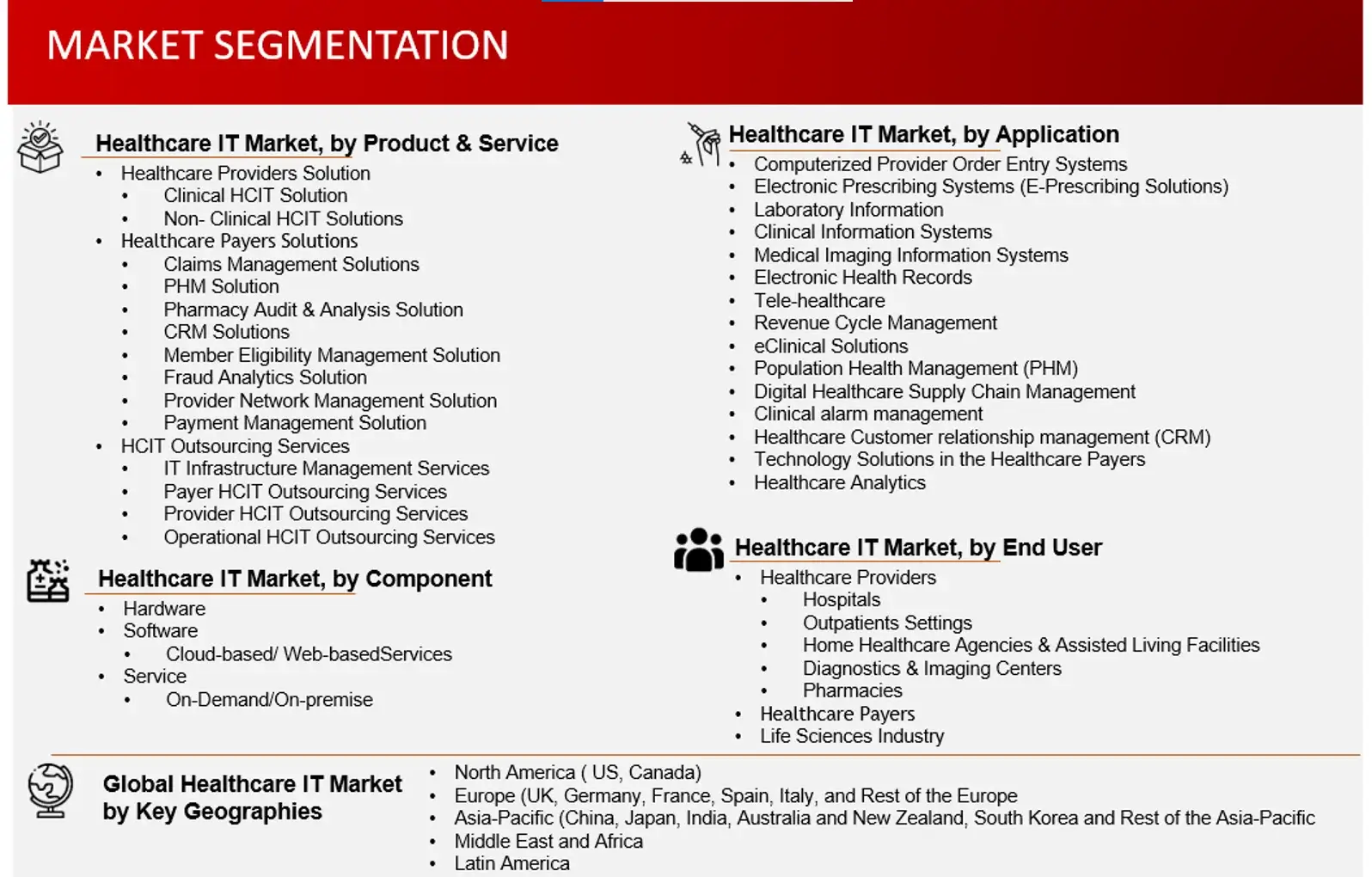

Healthcare IT Market by Product & Service Type (Healthcare Provider, Healthcare Payer, HCIT Outsourcing) Application (Laboratory Information, Tele-healthcare) Components (Hardware, Software, Services) End User (Hospital, Pharmacies Payers), Regions, Key Players-Global Forecast to 2030

Sources: Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentation, Paid Database, and Wissen Research Analysis.

Sources: Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentation, Paid Database, and Wissen Research Analysis.Healthcare IT, also known as healthcare information technology, involves the development, design, creation, and maintenance of information systems in hospitals, clinics, and other healthcare sectors. Healthcare IT provides many benefits and opportunities for enhancing healthcare, including improving clinical results, decreasing errors, increasing efficiency, aiding in care coordination, and monitoring data throughout time. The increase in global healthcare IT market is mainly due to the rise in telehealth and mHealth solutions demand from smartphone users, adoption of cloud technology in HCIT services, healthcare reforms like PPACA, and the growing aging population leading to more chronic diseases.

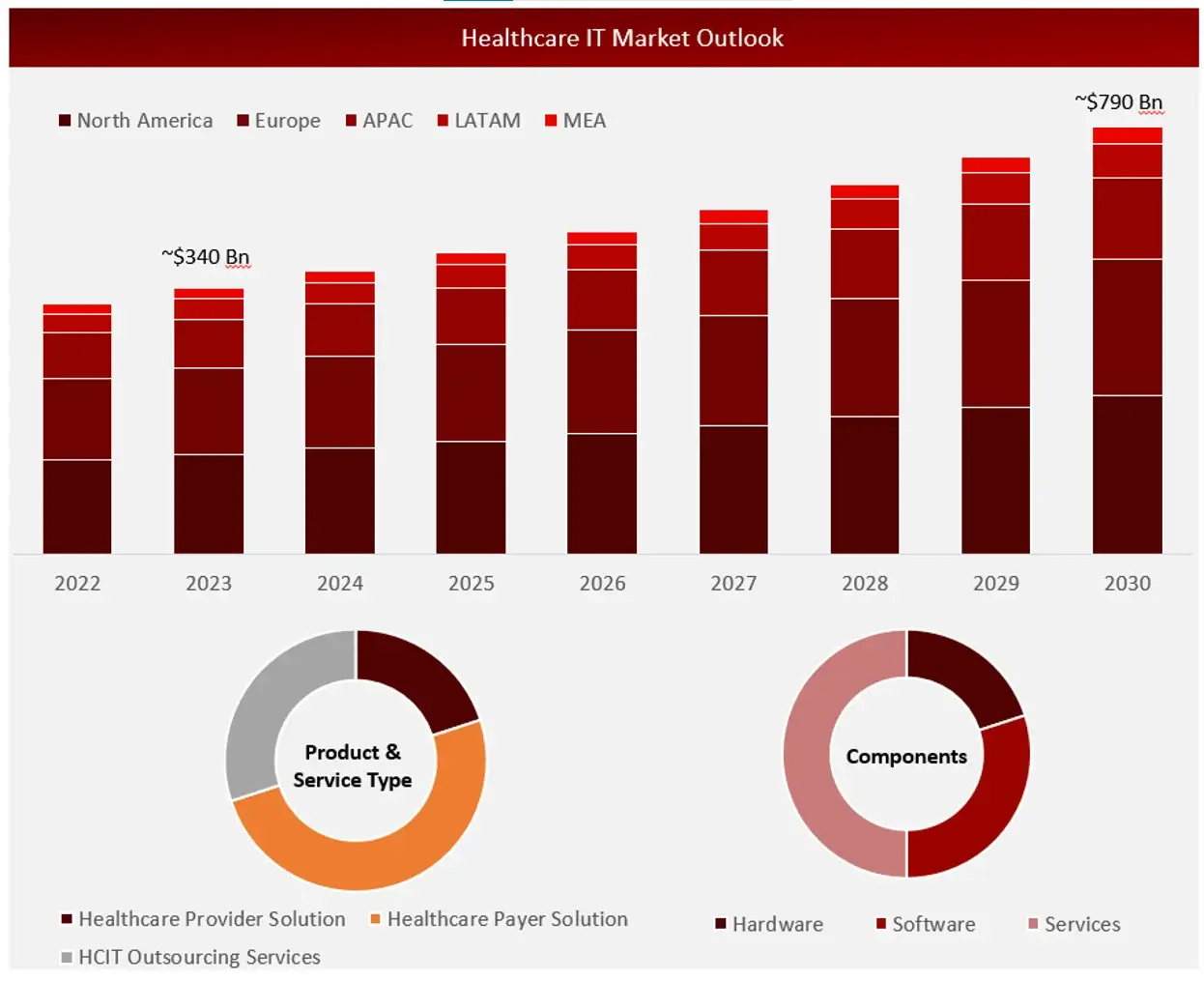

Wissen Research analyses that the global healthcare IT market is estimated at ~USD 340 billion in 2023 and is projected to reach ~USD 790 billion by 2030, expected to grow at a CAGR of ~13% during the forecast period, 2023-2030.

The global health crisis has led to a notable rise in the strain on healthcare institutions worldwide. Healthcare institutions are under significant pressure to establish a cohesive environment in which all medical equipment is linked internally and the facility works together with other healthcare entities. Worldometer reported about 650 million confirmed COVID-19 cases and 66 million deaths worldwide by December 5, 2022. With the increasing number of cases, many countries’ healthcare systems are experiencing a significant lack of hospital beds, healthcare workers, and essential medical supplies. Hospitals and other care facilities are being pressured to implement capacity management solutions in order to monitor COVID-19 patients and oversee disease progression.

In light of increasing demands on healthcare systems to cut care expenses, the sector is moving towards outpatient facilities to decrease costs of care. The cost of a procedure at an outpatient surgery center is approximated to be 30% to 60% lower than at a hospital for inpatients. Furthermore, ease of access is another crucial element fueling the increase of ambulatory healthcare. As outpatient settings and patient numbers grow, the need for HCIT solutions in outpatient settings will also rise.

Despite advancements in coordinated value-based care by healthcare providers, the challenge of achieving interoperability among information systems still hinders the implementation of HCIT solutions. The healthcare sector is very reliant on information, with patient data being produced in every department during care within a healthcare facility. Yet, the value of this data diminishes greatly when not seamlessly integrated to form a comprehensive and precise patient profile. As numerous HCIT tools are implemented in healthcare systems, it is crucial to enhance integration of IT systems to support accurate decision-making by healthcare providers across various care settings. Additionally, the absence of compatibility between health organizations using a regional or national health IT system for sharing information limits the complete utilization of HCIT solutions.

The rise in new medical apps and health information exchange solutions from consumer tech companies makes it hard to incorporate older solutions. Many healthcare organizations have already put money into different information management systems and medical devices from various vendors, each with their own brands and types. With the rising use of HCIT systems in healthcare organizations, there is a growing requirement to incorporate various IT systems into an organization’s IT structure for maximum efficiency. Consequently, the efficient blending of HCIT systems with other systems is a key priority for IT infrastructure development projects.

Based on product and service offerings, the healthcare provider solutions sector of the healthcare IT market is expected to experience the most significant growth. Government efforts to enhance patient care quality and healthcare services efficiency have resulted in the significant expansion of this sector. The healthcare provider solutions segment is also separated into clinical and non-clinical HCIT solutions. The clinical solutions sector is experiencing growth due to increased demand for better patient safety and care, strict regulations on healthcare provider solutions, and the necessity for integrated healthcare systems.

The healthcare providers segment held the biggest portion in the global healthcare IT market during the forecast period, according to end users. This share can be attributed to factors like strict government regulations and the necessity to enhance patient care while boosting operational efficiency. The growth of this end-user segment is being driven by the growing number of patients, hospitals, and ambulatory care centres, as well as the hospitals’ strong purchasing power.

In the healthcare IT market in 2023, North America had the highest proportion, with Europe, Asia Pacific, Latin America, and the Middle East and Africa following. The significant portion of North America’s market dominance can be credited to the widespread implementation of healthcare IT solutions, strict healthcare quality regulations, and the growing necessity to control rising healthcare expenses with the help of healthcare IT solutions.

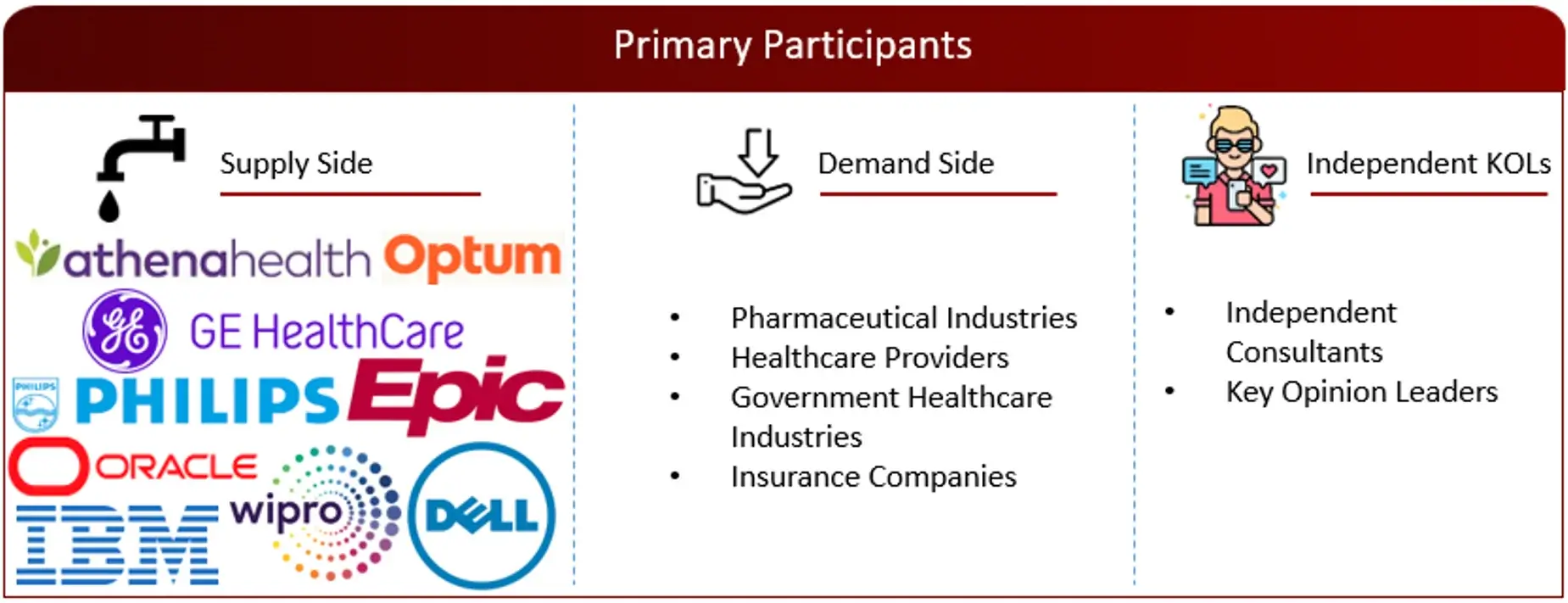

Major players operating in healthcare IT market are Athena Health, BoomerangFX., Epic System Corporation, Dell Technologies, GE Healthcare., Optum, Inc., Change Healthcare, Wipro Limited, IBM., and Oracle Corporation among others.

Recent Developments:

In September 2022, Sharecare introduced Smart Omix, a digital clinical research tool that allows for gathering real-world data and creating digital biomarkers through mobile research studies. The capabilities of Smart Omix are crucial in progressing relevance, equity, and data integrity in clinical research throughout the healthcare industry.

Introduction

Market Definition

Healthcare information technology (HIT) refers to the use of information technology in the health and healthcare field. It facilitates the management of health information among electronic systems and ensures the safe sharing of health data among individuals, healthcare professionals, insurance companies, and regulatory agencies.

Key Stakeholders

Key objectives of the Study

Research Methodology

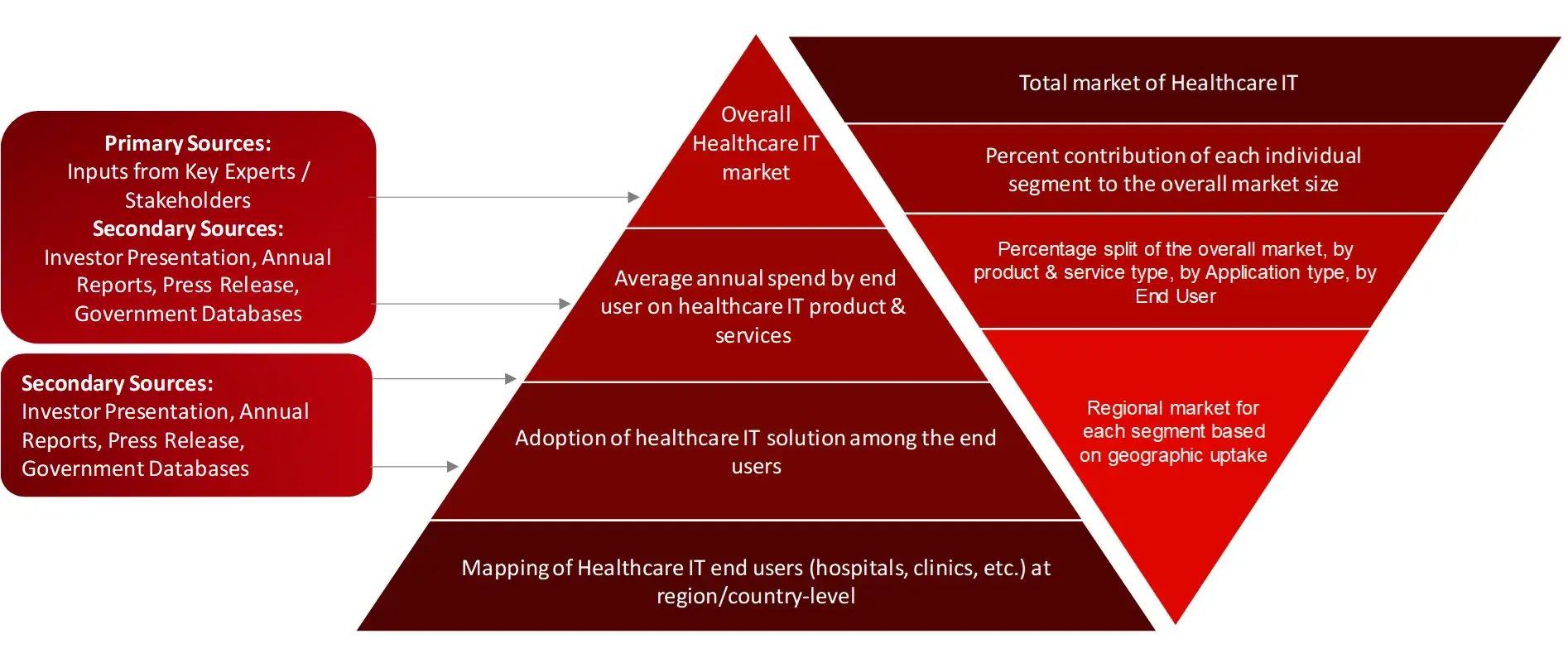

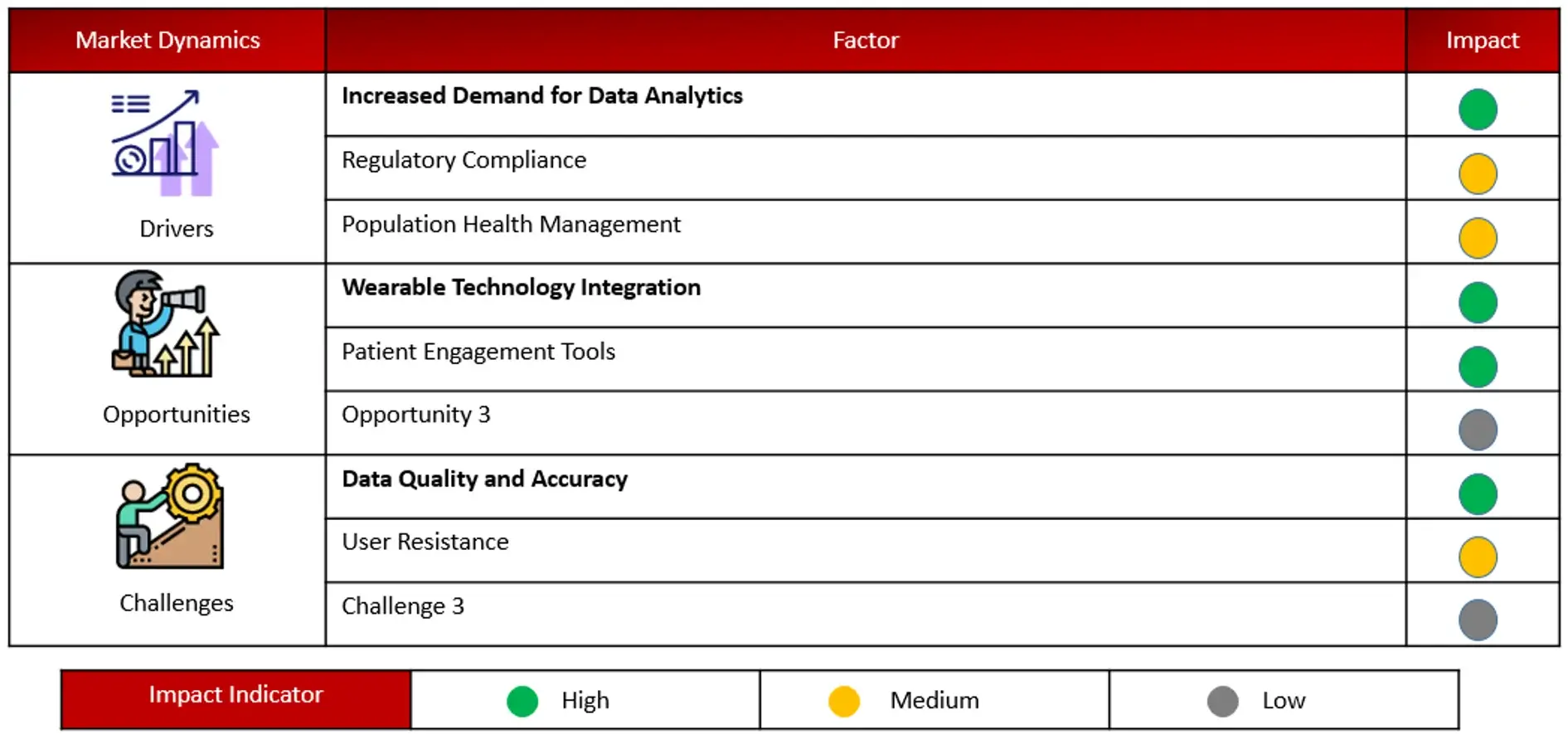

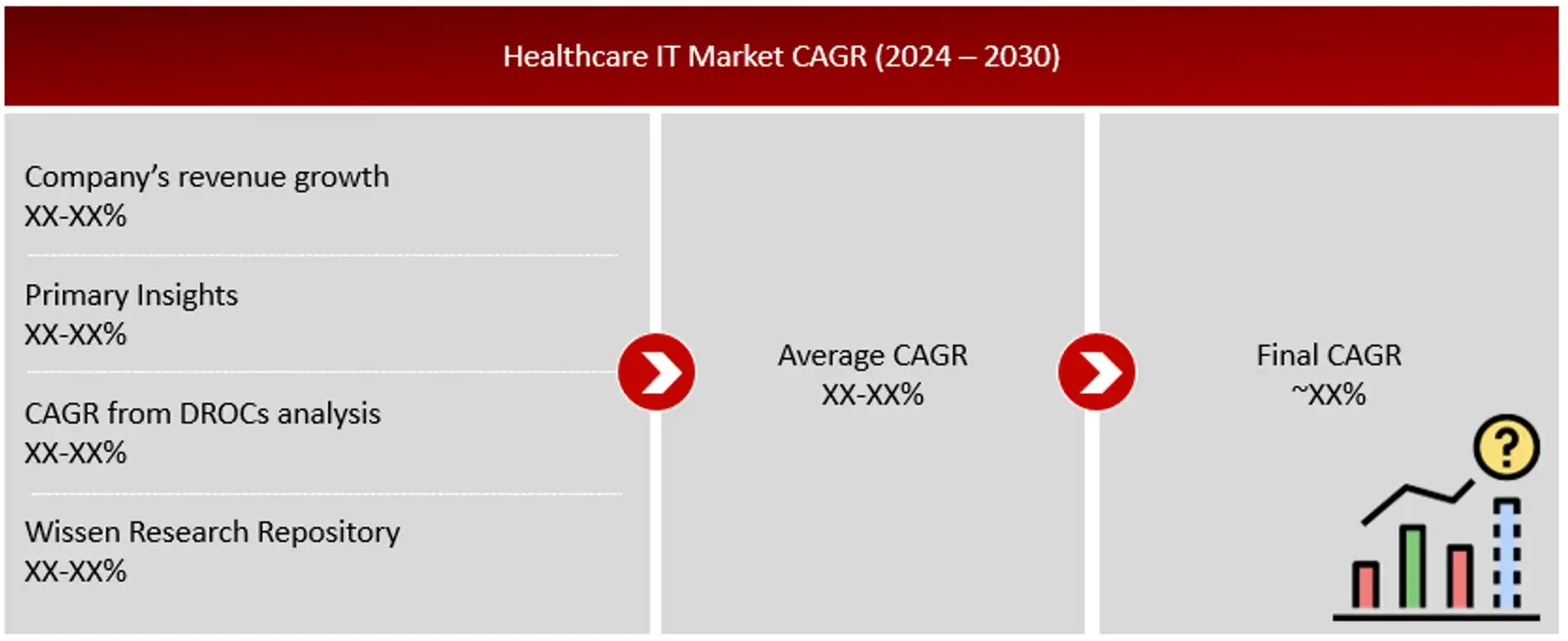

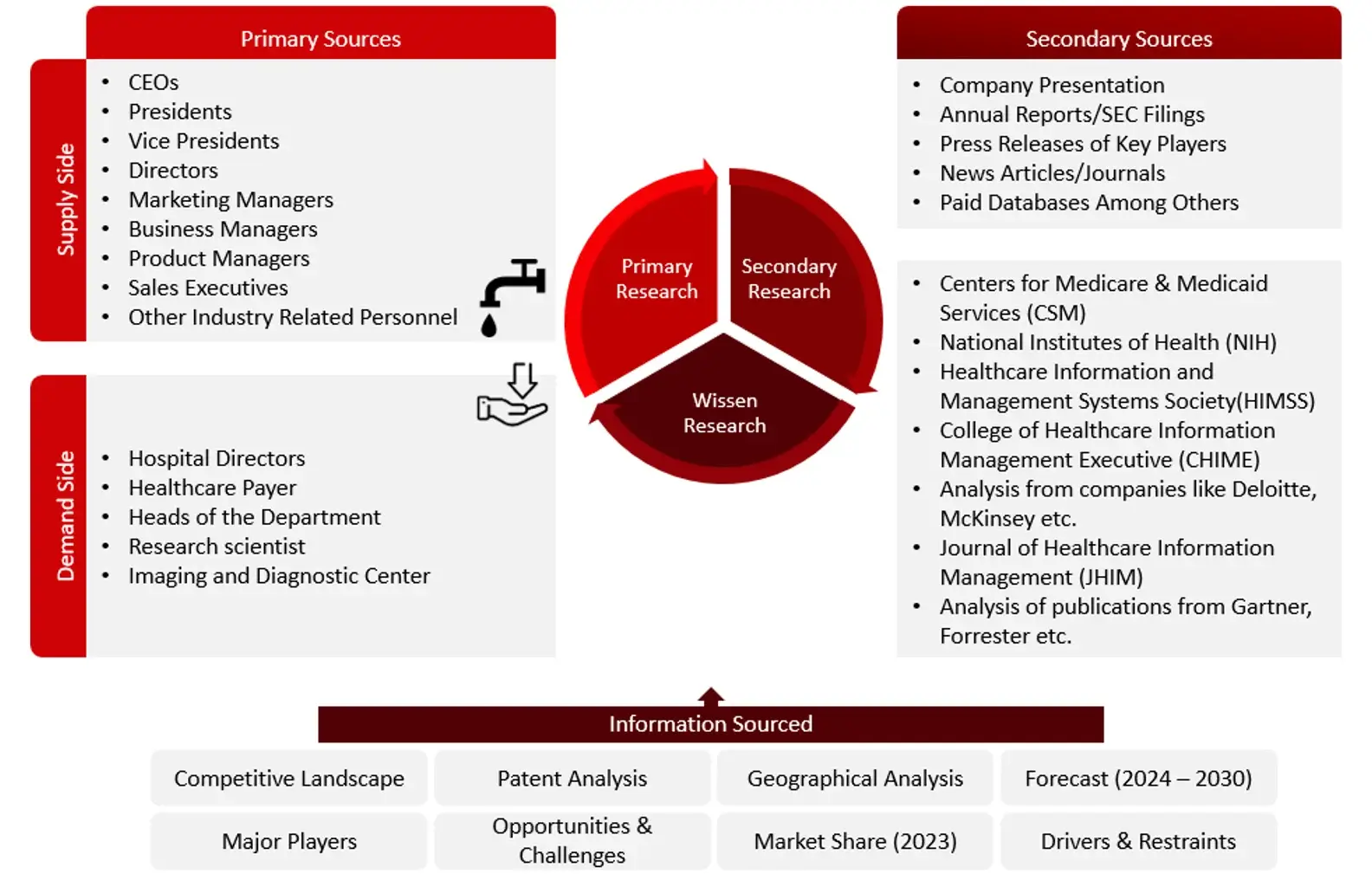

The aim of the study is to examine the key market forces such as drivers, opportunities, restraints, challenges, and strategies of key leaders. To monitor company advancements such as patents granted, product launches, expansions, and collaborations of key players, analyzing their competitive landscape based on various parameters of business and product strategy. Markey sizing will be estimated using top-down and bottom-up approaches. Using market breakdown and data triangulation techniques, market sizing of segments and sub-segments will be estimated.

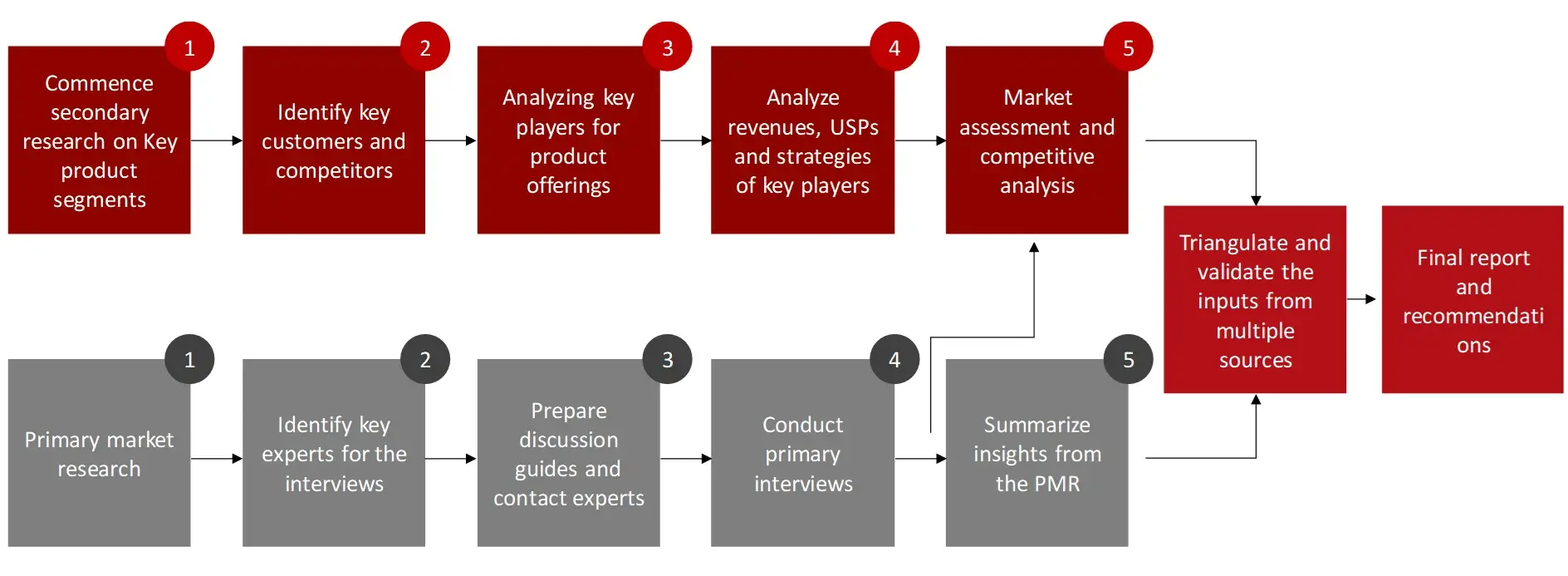

FIGURE: RESEARCH DESIGN

Research Approach

Collecting Secondary Data

The process of collating secondary research data involves the utilization of databases, secondary sources, annual reports, investor presentations, directories, and SEC filings of companies. Secondary research will be utilized to identify and gather information beneficial for the in-depth, technical, market-oriented, and commercial analysis of the Healthcare IT market. A database of the key industry leaders will also be compiled using secondary research.

Collecting Primary Data

The primary research data will be conducted after acquiring knowledge about the Healthcare IT market scenario through secondary research. A significant number of primary interviews will be conducted with stakeholders from both the demand and supply side (including various industry experts, such as Vice Presidents (VPs), Chief X Officers (CXOs), Directors from business development, marketing and product development teams, product manufacturers) across major countries of Europe, Asia Pacific, North America, Latin America, and Middle East and Africa. Primary data for this report will be collected through questionnaires, emails, and telephonic interviews.

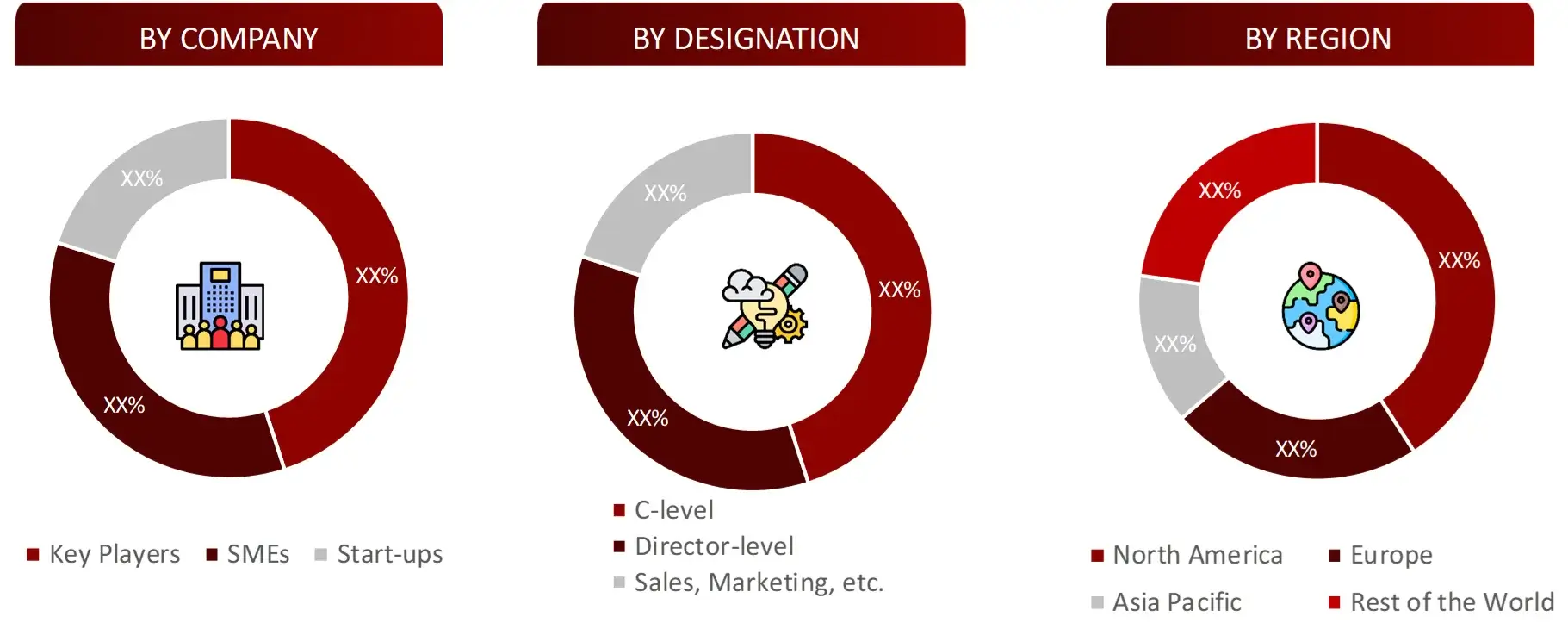

FIGURE: BREAKDOWN OF PRIMARY INTERVIEWS FROM SUPPLY SIDE

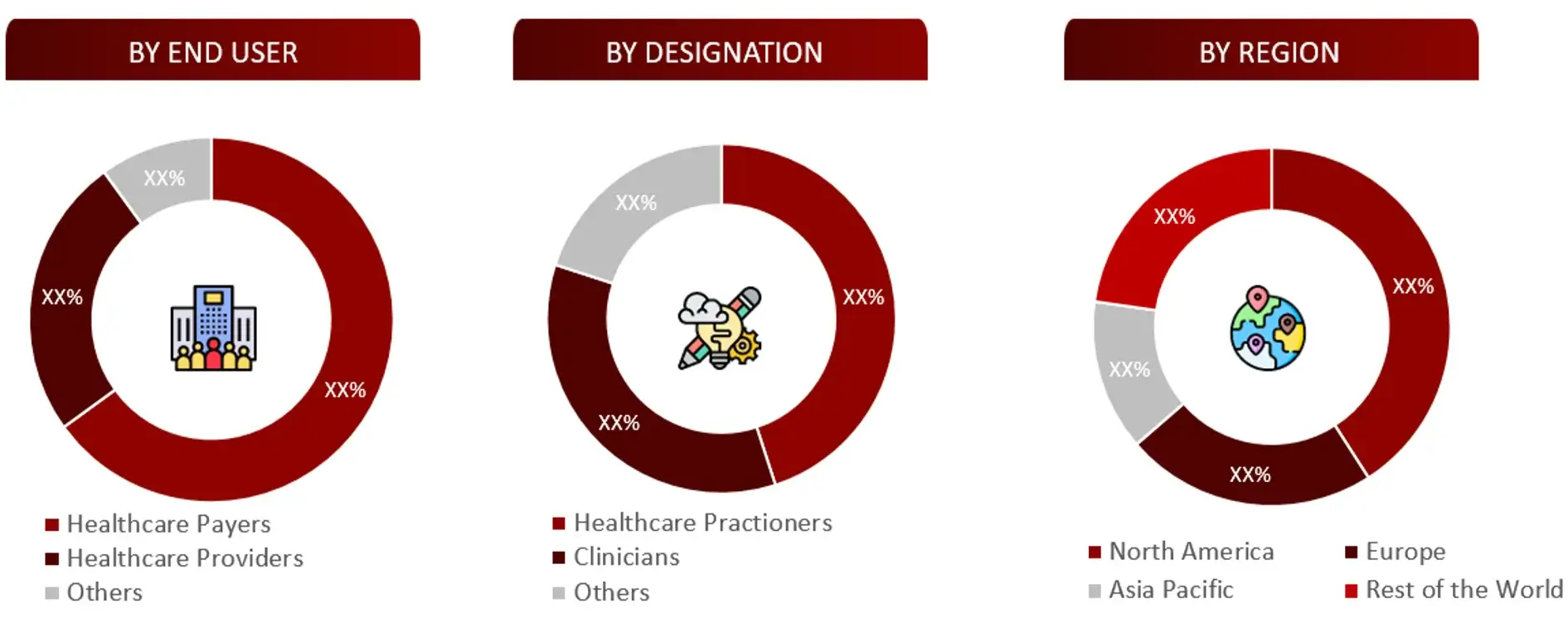

FIGURE: BREAKDOWN OF PRIMARY INTERVIEWS FROM DEMAND SIDE

FIGURE: PROPOSED PRIMARY PARTICIPANTS FROM DEMAND AND SUPPLY SIDE

Note: Above mention companies are non-exhaustive.

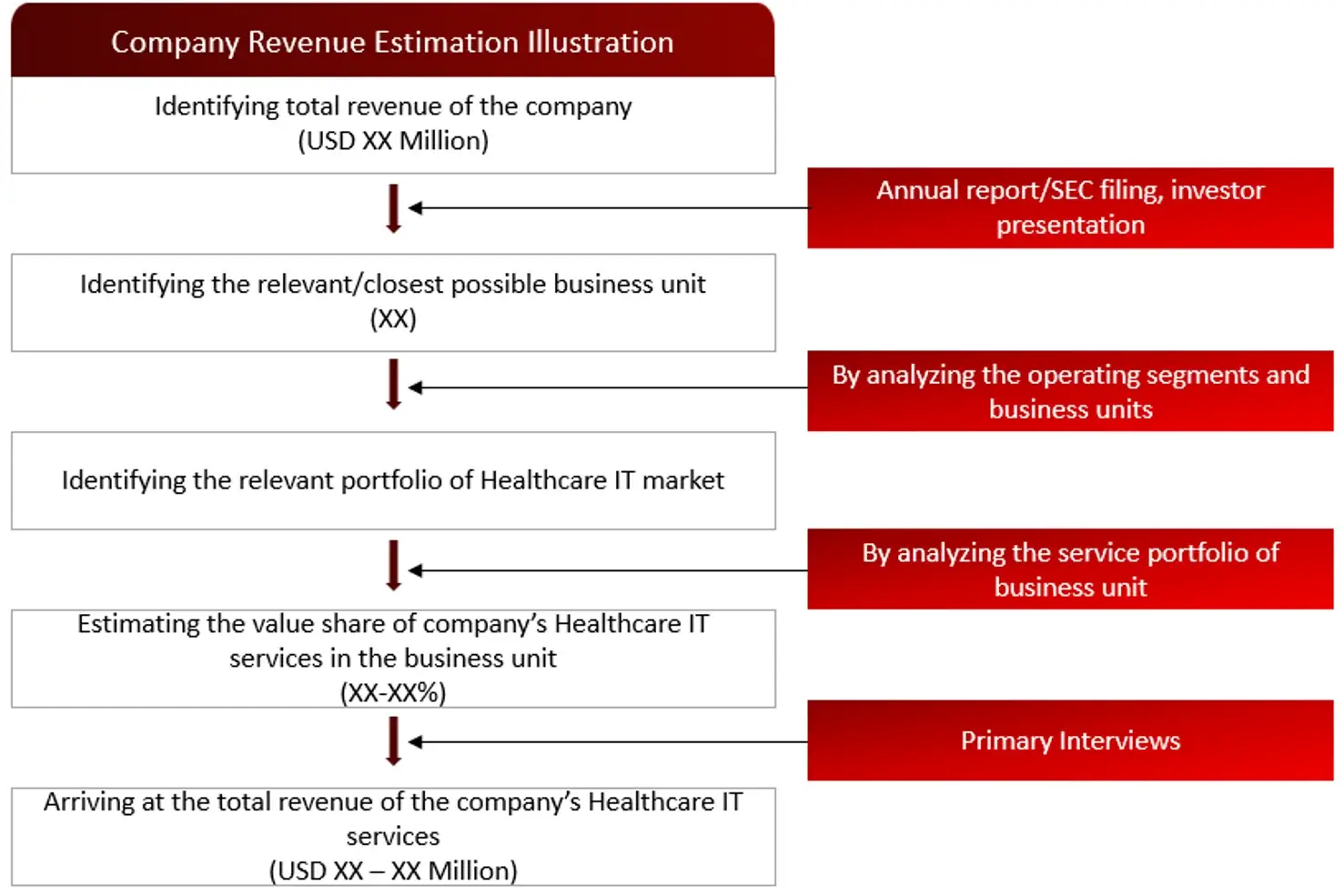

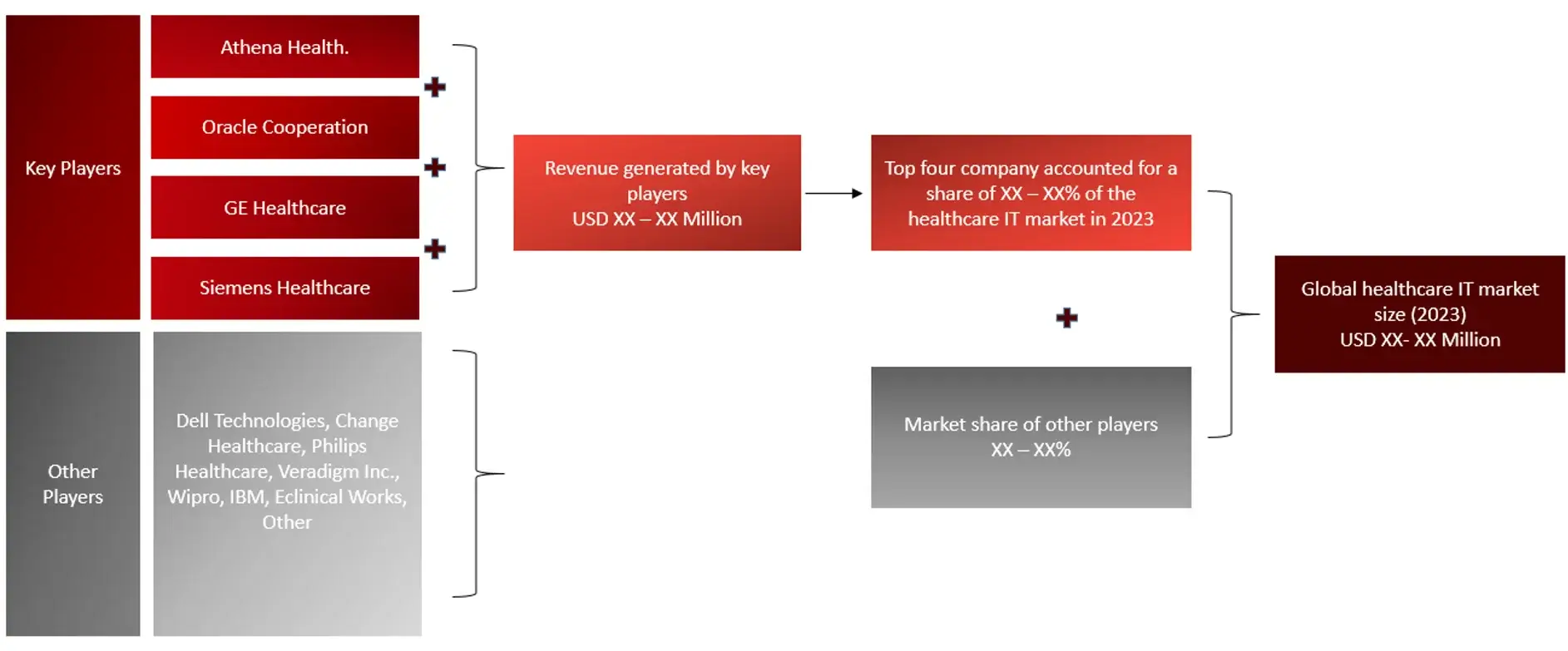

Market Size Estimation

All major manufacturers offering various Healthcare IT services will be identified at the global / regional level. Revenue mapping will be done for the major players, which will further be extrapolated to arrive at the global market value of each type of segment. The market value of Healthcare IT market will also split into various segments and sub segments at the region level based on:

FIGURE: REVENUE MAPPING BY COMPANY (ILLUSTRATION)

FIGURE: REVENUE SHARE ANALYSIS OF KEY PLAYERS (SUPPLY SIDE)

FIGURE: MARKET SIZE ESTIMATION TOP-DOWN AND BOTTOM-UP APPROACH

FIGURE: ANALYSIS OF DROCS FOR GROWTH FORECAST

FIGURE: GROWTH FORECAST ANALYSIS UTILIZING MULTIPLE PARAMETERS

Research Design

After arriving at the overall market size-using the market size estimation processes-the market will be split into several segments and sub segment. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub segment, the data triangulation, and market breakdown procedures will be employed, wherever applicable. The data will be triangulated by studying various factors and trends from both the demand and supply sides in the Healthcare IT market.

1. Introduction

1.1 Key Objectives

1.2 Definitions

1.2.1 In Scope

1.2.2 Out of Scope

1.3 Scope of the Report

1.4 Scope Related Limitations

1.5 Key Stakeholders

2. Research Methodology

2.1 Research Approach

2.2 Research Methodology / Design

2.3 Market Sizing Approach

2.3.1 Secondary Research

2.3.2 Primary Research

3.Executive Summary & Premium Content

3.1 Global Market Outlook

3.2 Key Market Findings

4. Patent Analysis

4.1 Patents Related to Point of Care Testing Technologies/Devices

4.2 Patent Landscape and Intellectual Property Trends

5. Market Overview

5.1 Market Dynamics

5.1.1 Drivers/Opportunities

5.1.2 Restraints/Challenges

5.2 End User Perception

5.3 Need Gap

5.4 Supply Chain / Value Chain Analysis

5.5 Industry Trends

5.6 Porter’s Five Forces Analysis

6. Healthcare IT Market, by Product & Service Type (2023-2030, USD Million)

6.1 Healthcare Provider solution

6.1.1 Clinical HCIT Solution

6.1.1.1 Telehealth Solution

6.1.1.2 mHealth Apps

6.1.1.3 Electronic Health Record (EHRs)

6.1.1.4 Population Health Management (PHM) Solutions

6.1.1.5 Speciality Information Management Solution

6.1.1.6 HCIT Integration solution

6.1.1.7 Picture Archiving and Communication System(PACs) & Vendor Neutral Archive (VNA)

6.1.1.8 Medical Image Analysis

6.1.1.9 Laboratory Information System (LIS)

6.1.1.10 Practice Management

6.1.1.11 Clinical Decision Support System (CDSS)

6.1.1.12 Patient Registry Software

6.1.1.13 ePrescribing Solutions

6.1.1.14 Radiology Information System (RIS)

6.1.1.15 Computerized provider order entry(CPOE)

6.1.1.16 Cardiovascular information systems (CVIS)

6.1.1.17 Infection Surveillance Solution

6.1.1.18 Radiation Dose Monitor (RDM) Solutions

6.1.2 Non Clinical HCIT Solutions

6.1.2.1 Revenue Cycle Management (RCM) Solution

6.1.2.1.1 Front –End Solution

6.1.2.1.2 Mid-RCM Solution

6.1.2.1.3 Back End RCM Solution

6.1.2.2 Healthcare Analytics Solution

6.1.2.2.1 Clinical Analytics Solution

6.1.2.2.2 Financial Analytics Solution

6.1.2.2.3 Other Healthcare Analytics Solution

6.1.2.3 Healthcare Asset Management Solution

6.1.2.4 Customer relationship management (CRM) Solution

6.1.2.5 Healthcare interoperability Solution

6.1.2.6 Pharmacy Information Solution

6.1.2.7 Healthcare Quality Management Solution

6.1.2.8 Supply Chain Management (SCM) Solution

6.1.2.8.1 Procurement management solutions

6.1.2.8.2 Inventory management solutions

6.1.2.9 Medication Management System

6.1.2.9.1 Electronic medication administration systems

6.1.2.9.2 Barcode medication administration systems

6.1.2.9.3 Medication inventory management systems

6.1.2.9.4 Medication assurance systems

6.1.2.10 Workforce management solutions

6.1.2.11 Financial management systems

6.1.2.12 Health Information Exchange (HIE) solutions

6.1.2.13 Medical document management solutions

6.2 Healthcare Payer Solution

6.2.1 Claims Management Solution

6.2.2 Population Health Management (PHM) Solution

6.2.3 Pharmacy Audit and Analysis Solution

6.2.4 Customer relationship management (CRM) Solutions

6.2.5 Member Eligibility Management Solution

6.2.6 Fraud Analytics Solution

6.2.7 Provider Network Management Solution

6.2.8 Payment Management Solution

6.3 HCIT Out Sourcing Services

6.3.1 IT Infrastructure Management Services

6.3.2 Payer HCIT Outsourcing Services

6.3.2.1 Claims Management Services

6.3.2.2 Provider Network Management Services

6.3.2.3 Billing & Accounting Management Services

6.3.2.4 Fraud Analytics Services

6.3.2.5 Other Payer HCIT Outsourcing Services

6.3.3 Provider HCIT Outsourcing Services

6.3.3.1 Revenue Cycle Management (RCM) Services

6.3.3.2 EMR/Medical document management services

6.3.3.3 Laboratory information management services

6.3.3.4 Other provider HCIT outsourcing services

6.3.4 Operational HCIT Outsourcing Services

6.3.4.1 Supply Chain Management (SCM) Services

6.3.4.2 Business Performance Management Services

6.3.4.3 Other Operational HCIT Services

7. Healthcare IT Market, by Application (2023-2030, USD Million)

7.1 Computerized Provider Order Entry Systems

7.2 Electronic Prescribing Systems (E-Prescribing Solutions)

7.3 Laboratory Information

7.4 Clinical Information Systems

7.5 Medical Imaging Information Systems

7.5.1 Radiology Information Systems

7.5.2 Monitoring Analysis Software

7.5.3 Picture Archiving and Communication Systems

7.6 Electronic Health Records

7.6.1 Licensed Software

7.6.2 Technology Resale

7.6.3 Subscriptions

7.6.4 Professional Services

7.6.5 Others

7.7 Tele-healthcare

7.7.1 Tele-care

7.7.2 Tele-Health

7.8 Revenue Cycle Management

7.8.1 Integrated

7.8.2 Standalone

7.9 eClinical Solutions

7.9.1 Electronic Clinical Outcome Assessment (eCOA)

7.9.2 Electronic Data Capture (EDC) & CDMS

7.9.3 Clinical Analytics Platforms

7.9.4 Clinical Data Integration Platforms

7.9.5 Safety Solutions

7.9.6 Clinical Trial Management System (CTMS)

7.9.7 Randomization and Trial Supply Management (RTSM)

7.9.8 Electronic Trial Master File (eTMF)

7.9.9 eConsent

7.10 Population Health Management (PHM)

7.11 Digital Healthcare Supply Chain Management

7.11.1 Software

7.11.2 Hardware

7.11.2.1 Barcodes

7.11.2.2 RFID Tags

7.11.3 Services

7.12 Clinical alarm management

7.12.1 Nurse Call Systems

7.12.2 Physiological Monitors

7.12.3 Bed Alarms

7.12.4 EMR Integration Systems

7.12.5 Ventilators

7.12.6 Others

7.13 Healthcare Customer relationship management (CRM)

7.13.1 Customer Service and Support

7.13.2 Digital Commerce

7.13.3 Marketing

7.13.4 Sales

7.13.5 Cross –CRM

7.14 Technology Solutions in the Healthcare Payers

7.14.1 Management of Enrolment and Members

7.14.2 Management of Providers

7.14.3 Management of claims

7.14.4 Payments based on the value of services

7.14.5 Management of income and invoicing

7.14.6 Analysis of data

7.14.7 Customize/ Customer Relationship Management

7.14.8 Decision support for clinical purposes

7.14.9 Management and assistance with data.

7.14.10 Others

7.15 Healthcare Analytics

7.15.1 Analysis based on descriptions

7.15.2 Analysis that predicts future outcomes

7.15.3 Analysing and providing recommendations.

8. Healthcare IT Market, by Component (2023-2030, USD Million)

8.1 Hardware

8.2 Software

8.2.1 Cloud-based/ Web-based Services

8.3 Service

8.3.1 On-Demand/On-premise

9. Healthcare IT Market, by Region (2023-2030, USD Million)

9.1 North America

9.1.1 US

9.1.2 Canada

9.2 Europe

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 Italy

9.2.5 UK

9.2.6 Rest of the Europe

9.3 Asia Pacific

9.3.1 China

9.3.2 Japan

9.3.3 India

9.3.4 Australia and New Zealand

9.3.5 South Korea

9.3.6 Rest of the Asia Pacific

9.4 Middle East and Africa

9.5 Latin America

10. Competitive Analysis

10.1 Key Players Footprint Analysis

10.2 Market Share Analysis

10.3 Key Brand Analysis

10.4 Regional Snapshot of Key Players

10.5 R&D Expenditure of Key Players

11. Company Profiles2

11.1 Athena Health

11.1.1 Business Overview

11.1.2 Product Portfolio

11.1.3 Financial Snapshot3

11.1.4 Recent Developments

11.1.5 SWOT Analysis

11.2 BoomerangFX

11.3 Epic System Corporation

11.4 GE Healthcare

11.5 Wipro

11.6 IBM

11.7 Oracle Cooperation

11.8 Dell Technologies

11.9 Change Healthcare

11.10 Philips Healthcare

11.11 Veradigm Inc. (formerly Allscripts Healthcare Solutions, Inc.)

11.12 Siemens Healthcare

11.13 Eclinical Works

12. Conclusion

13. Appendix

13.1 Industry Speak

13.2 Questionnaire

13.3 Available Custom Work

13.4 Adjacent Studies

13.5 Authors

14. References

Key Notes:

© Copyright 2024 – Wissen Research All Rights Reserved.