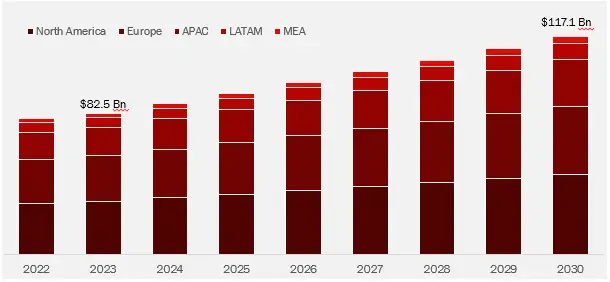

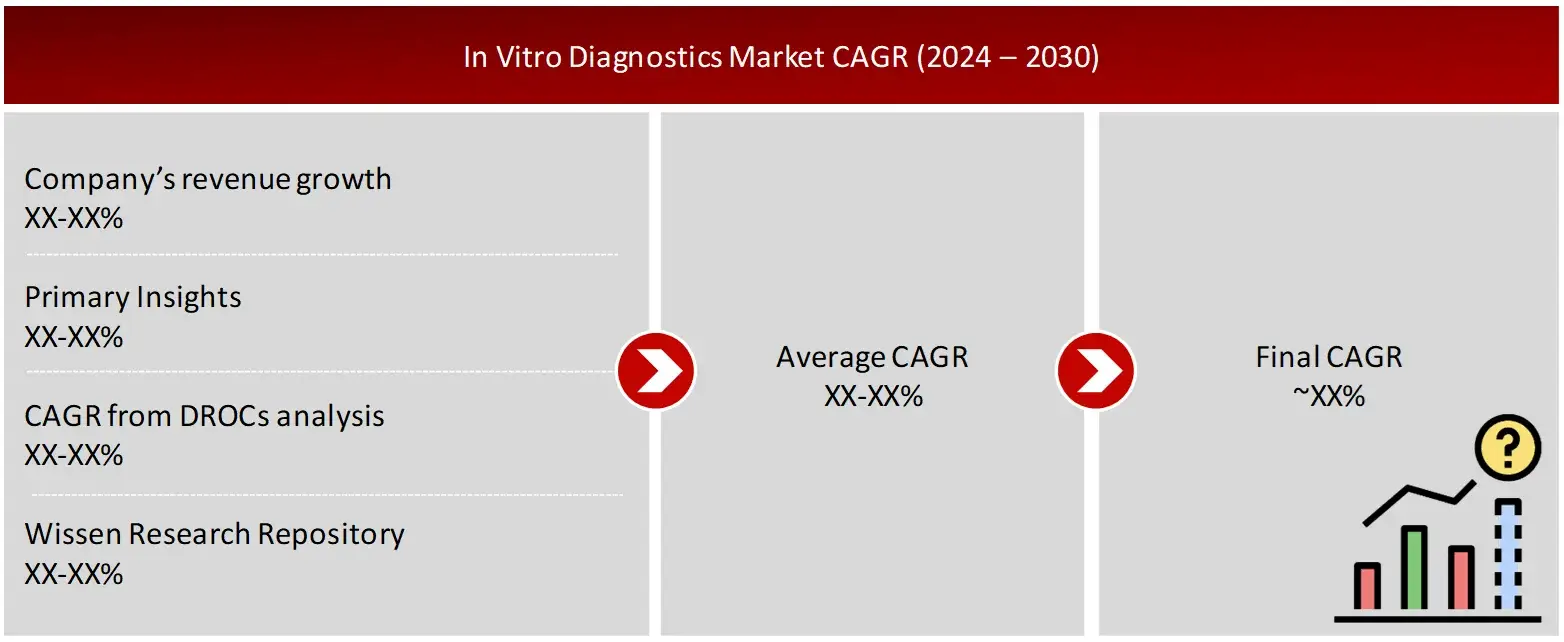

Wissen Research analyses that the global In vitro Diagnostics market is estimated at approximately USD 82.5 billion in 2023 and is projected to reach USD 117.1 billion by 2030, expected to grow at a CAGR of 5.1% during the forecast period, 2024-2030.

In vitro diagnostics (IVDs) play a crucial role in modern healthcare. IVDs are employed for diagnosing, screening, monitoring and evaluating predispositions to illnesses. According to WHO, more than 40,000 IVDs products are globally available which are being utilized across diverse health issues. Moreover, it is estimated that around 70% of clinical decisions are impacted by the findings of IVDs. The market is rapidly expanding driven by the rising occurrence of chronic diseases for instance cardiac disease, diabetes and infectious illnesses. It should be noted that CDC data from 2021 indicates that 38.4 million Americans suffer from diabetes, highlighting the significant opportunities in this field. Furthermore, as the ageing population continues to grow, blood and tissue tests demand is expected to propel at an annualized rate of 10%, over the coming years.

Further, the US with USD 41.8 billion market in 2023, holds majority share in the global In-vitro Diagnostics market and is likely to remain the leading region growing a CAGR of 5.0% within this market, during the forecast period.

Driving Factor: Increasing Incidence and Prevalence of Chronic and Infectious Disease

With the growing burden of chronic and infectious diseases worldwide, the demand for early diagnosis and monitoring of the treatment will increase, therefore, will drive the growth of overall IVD market. Rapid growth in ageing population is likely to increase the prevalence of age associated disease for instance, hypertension and diabetes which will drive the demand for IVD solutions.

Opportunity: Increasing Demand for Personalized Treatments

Personalized medicine helps in making customized decisions with regards to disease diagnosis and treatment. Through technologies such as, molecular diagnostics and genetic sequencing of test samples, IVDs will support the natural evolution of medicine and more personalized treatment.

Challenge: Expensive Raw Materials and Their Shortage

Rising prices of raw materials will pose threats in the value chain. Further, the shortage of raw materials will greatly inhibit the testing capabilities, globally.

The in vitro diagnostics market report offers information on the latest advancements in the industry, as well as product portfolio analysis, supply chain/value chain analysis, market share, and the effects of localized and domestic players. It also analyzes potential revenue opportunities and changes in market regulations, as well as market size, category market growth, application dominance, product approvals, product launches, geographic expansions, and technological innovations. For an Analyst Brief and other information on the in vitro diagnostics market, get in touch with Wissen Research. Our staff can assist you in making well-informed decisions that will lead to market expansion.

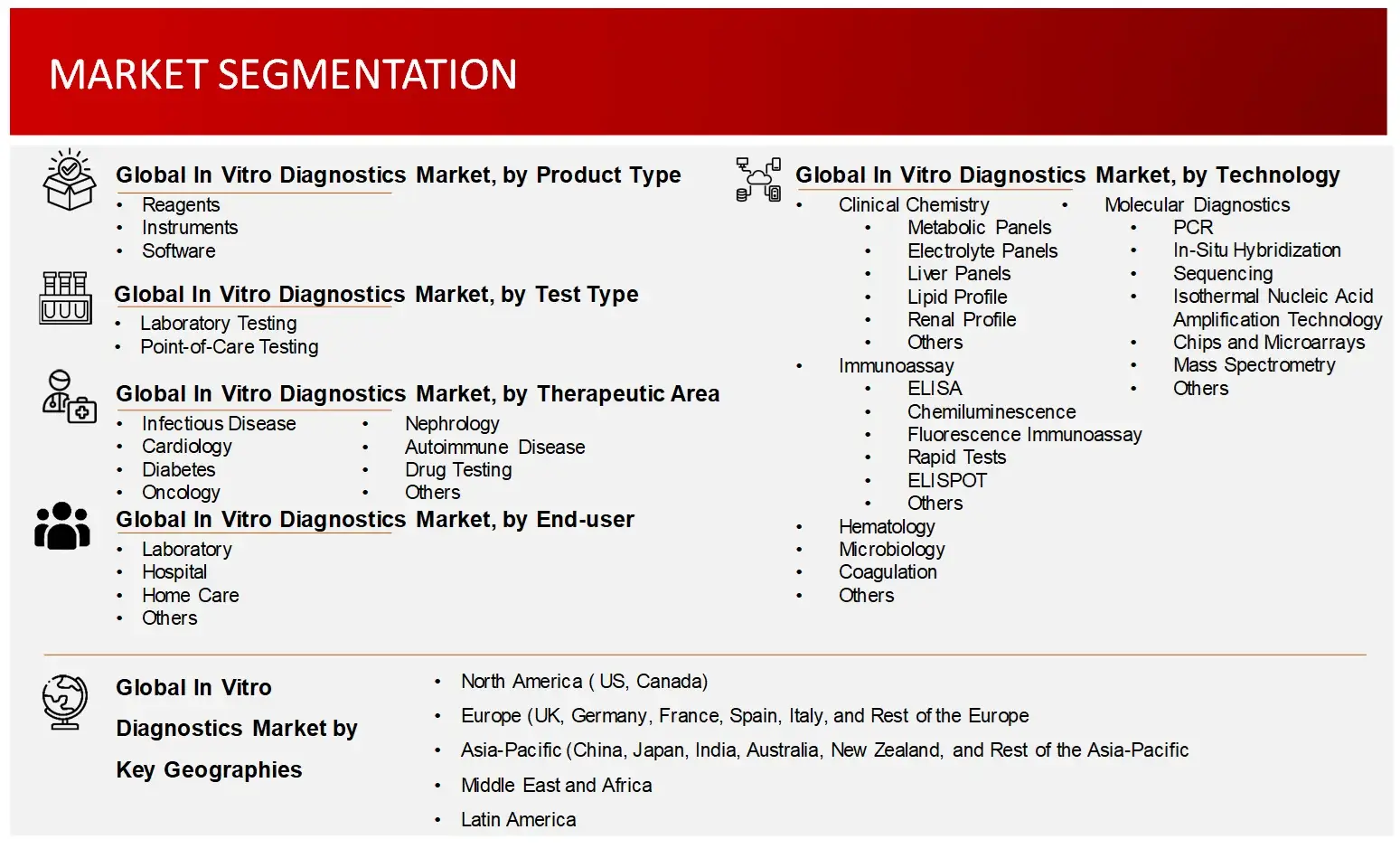

Laboratory Testing holds the largest share of in vitro diagnostics market by test type

Categorized by test type, the in vitro diagnostics market is segmented into laboratory testing and point-of-care testing. The laboratory testing segment held the largest share in 2024. Nevertheless, point-of-care testing is expected to experience higher compound annual growth rate (CAGR) in the forecasted timeframe.

Reagents captured majority share of in vitro diagnostics market by product type

Reagents, instruments and software are the key segments based on type of products offered within in vitro diagnostics market. In 2024, the reagents segment captures the largest share out of all these product types. This can be attributed to the increasing R&D efforts and costs by leading players for developing new reagents. Also, the push to invest in the field of faster detection / diagnosis of deadly diseases such as, cancer, is driving developers forward.

Immunoassay accounted for the largest share of in vitro diagnostics market by technology type

Within in vitro diagnostics market, immunoassay based testing holds the highest share in 2024 followed by clinical chemistry and molecular diagnostics. It is worth mentioning that IVD developers are investing heavily on their R&D to develop advanced immunological instruments and testing services.

North America to dominate the in vitro diagnostics market and Asia Pacific to witness the highest growth.

In 2024, North America is expected to hold the largest portion of total in vitro diagnostics market and this trend is likely to remain the same in the coming decade. Key elements supporting this trend in the region include rising senior population with a high rate of chronic and infectious illnesses and a growing public interest for individualized healthcare, all of which are anticipated to fuel growth in North America.

Asia Pacific is expected to experience the highest growth among all region included in the study in the forecast period owing to increasing economic stability and disposable income. These countries are well known for their affordable healthcare options, making them a preferred market for medical tourism.

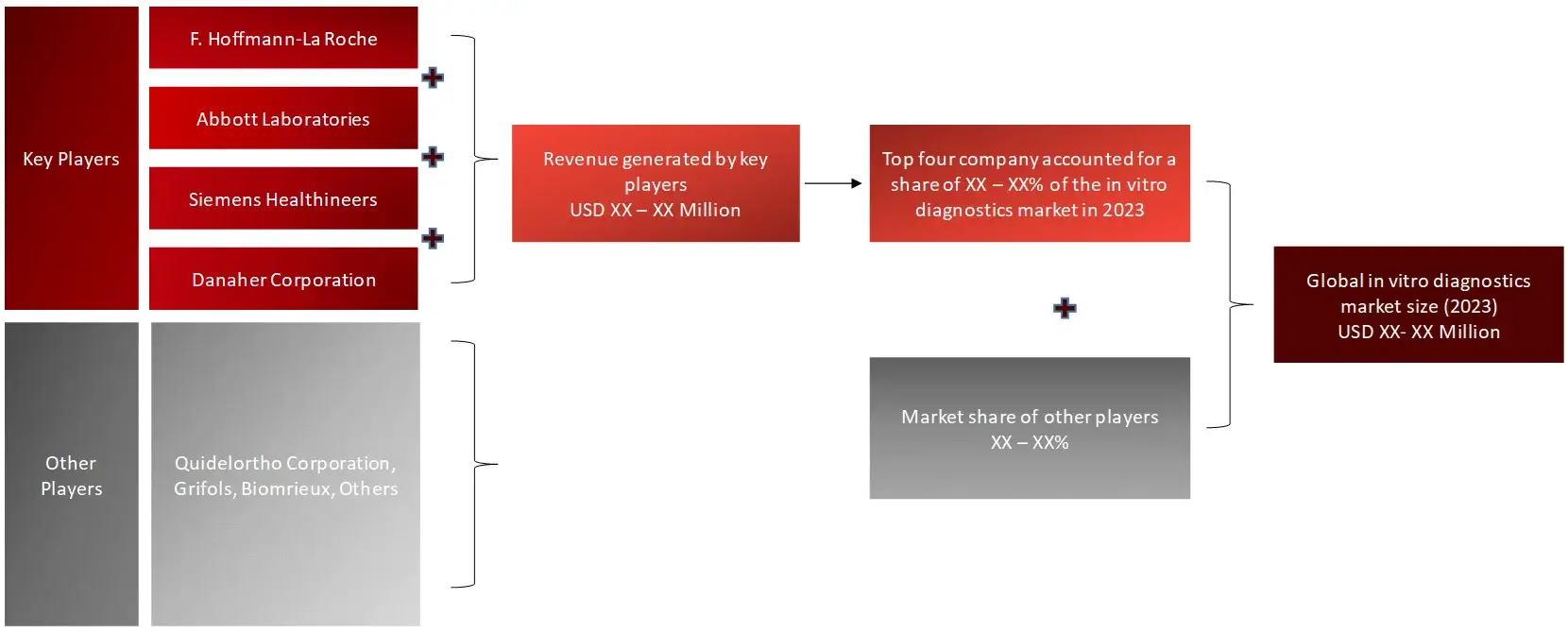

Major players operating in IVD market are Abbott, Agilent, Becton, Dickinson and Company, bioMérieux, BioRad, Danaher Corporation, DiaSorin, Grifols S.A., Hologic Inc., Illumina Inc., Siemens Healthineers, Qiagen N.V., QuideOrtho Corporation, Thermo Fisher Scientific Inc., and Werfen S.A. among others. The overall IVD market is consolidated with five key players holding majority share of the total in vitro diagnostics market.

The in vitro diagnostics market size is experiencing significant growth, driven by advancements in technology and increasing demand for early disease detection. Key in vitro diagnostics market trends include the rise of personalized medicine, the adoption of point-of-care testing, and the integration of artificial intelligence for enhanced diagnostic accuracy.

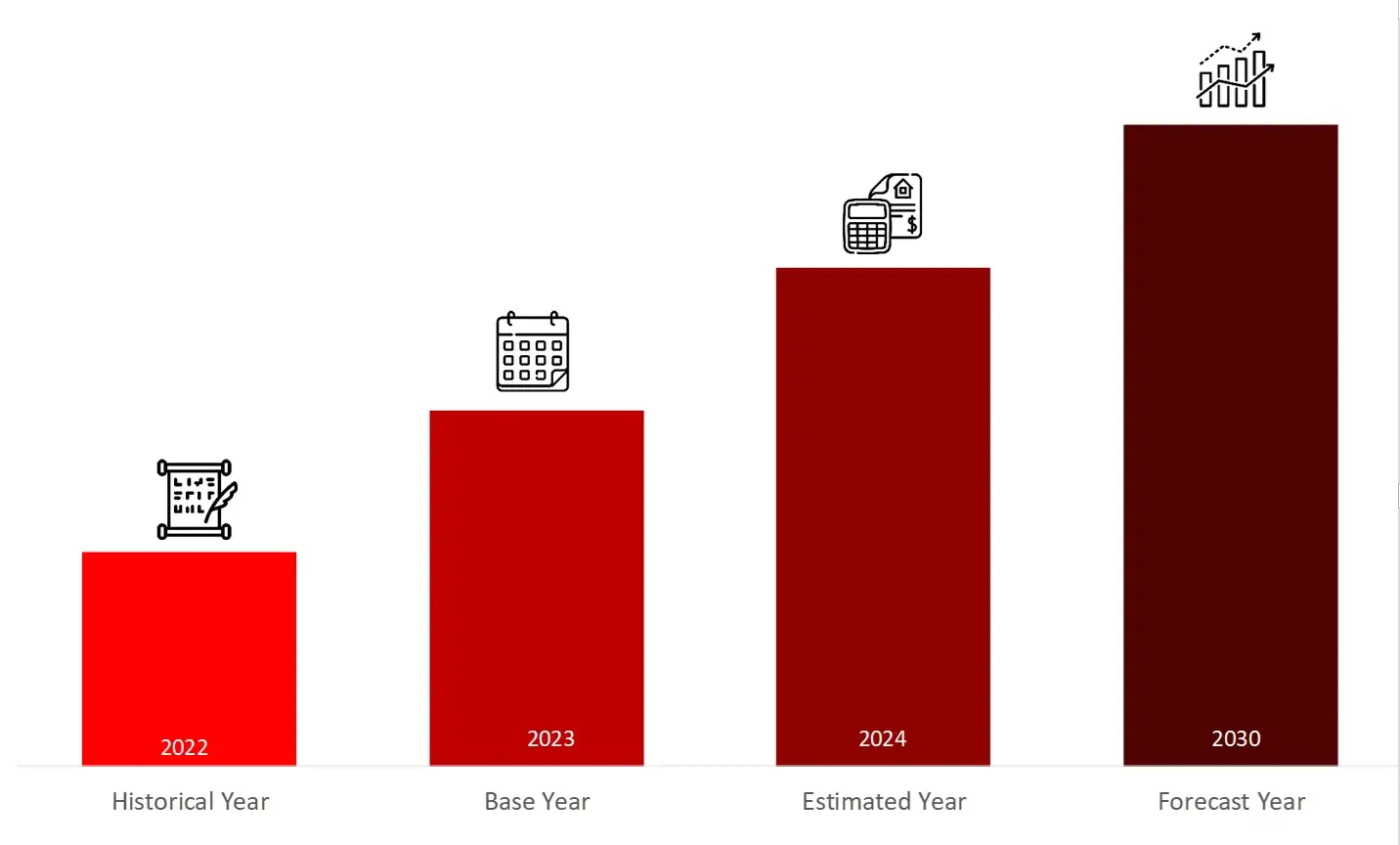

Particulars | Details |

Report | In Vitro Diagnostics Market |

Forecast Period | 2024-2030 |

Base Year | 2023 |

Format | |

Estimated Market Size (2024) | USD 86,944 Million |

CAGR (2024-2030) | 5.1% |

Number of Pages | 150+ |

Number of Tables | 170+ |

Number of Figures | 30+ |

Key Segments | In Vitro Diagnostics Market Product Outlook (Kits, Reagents, and Consumables, Instruments, Software & Services)

In Vitro Diagnostics Market Test Outlook (Laboratory Testing and Point of Care Testing)

In Vitro Diagnostics Market Technology Outlook (Clinical Chemistry, Immunoassay, Molecular Diagnostics, Hematology, Microbiology, Coagulation, Urinalysis, Others) Note: Others include mass spectrometry, among others

In Vitro Diagnostics Market Therapeutic Area Outlook (Infectious Disease, Cardiology, Endocrinology, Oncology, Nephrology, Autoimmune Diseases, Drug Testing, Genetic Testing, Allergy, Bone & Mineral Testing, Others) Note: Others include blood screening, among others

In Vitro Diagnostics Market End-User Outlook (Clinics & Hospitals, Clinical Laboratories, Home Care Settings, Blood Banks, Pharmaceutical & Biotechnology Companies, Academic Institutions, Others) |

Regions Covered |

|

Key Players Covered | F. Hoffmann-La Roche Ltd. (Switzerland), Abbott Laboratories (US), Becton, Dickinson and Company (US), Danaher Corporation (Germany), Siemens Healthineers (Germany), Thermo Fisher Scientific Inc. (US), Sysmex Corporation (Japan), QuidelOrtho Corporation (US), Werfen S.A. (Spain), Hologic, Inc. (US), Exact Sciences (US), Qiagen N.V. (The Netherlands), DiaSorin S.p.A (Italy), Bio-Rad Laboratories, Inc. (US), and bioMérieux SA (France) |

Introduction

Market Definition

In vitro diagnostics (IVDs) are the testing solutions or examinations focused on biological samples and are widely used to determine the health condition of a person. IVDs enables quick decision-making, reduces hospital visits and stays, and allows for more personalized treatment plans.

The IVDs market’s expansion is fueled by key benefits including:

Key Stakeholders

Key objectives of the Study

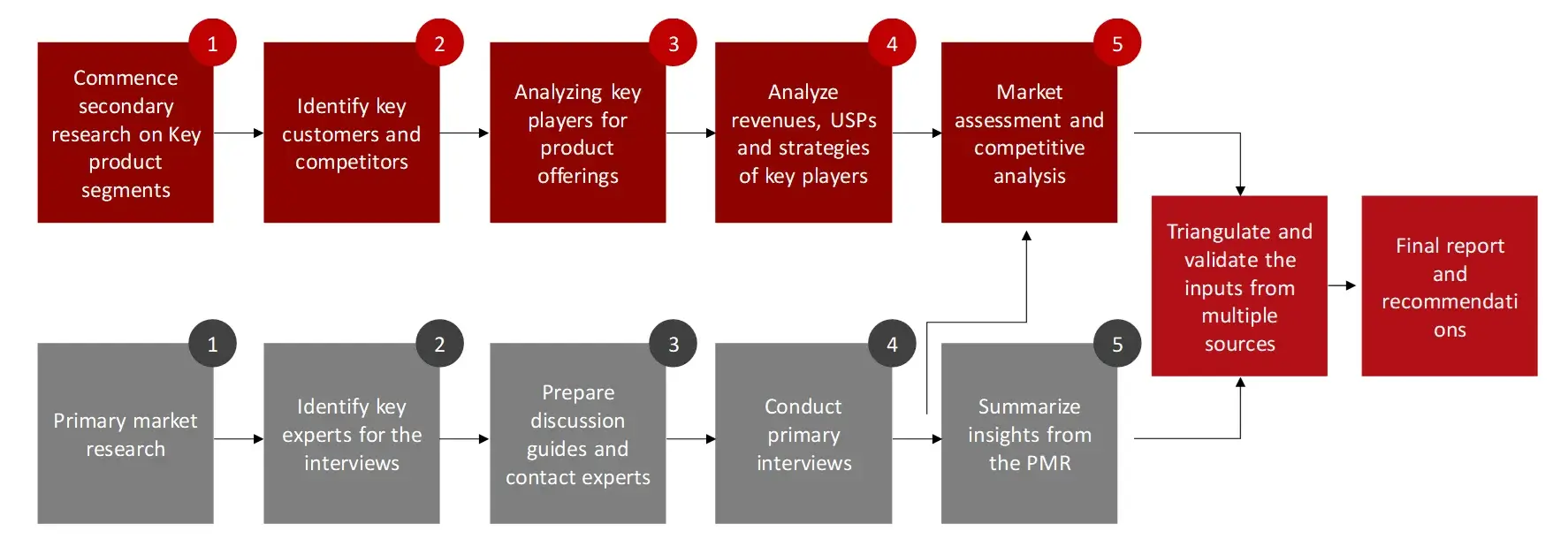

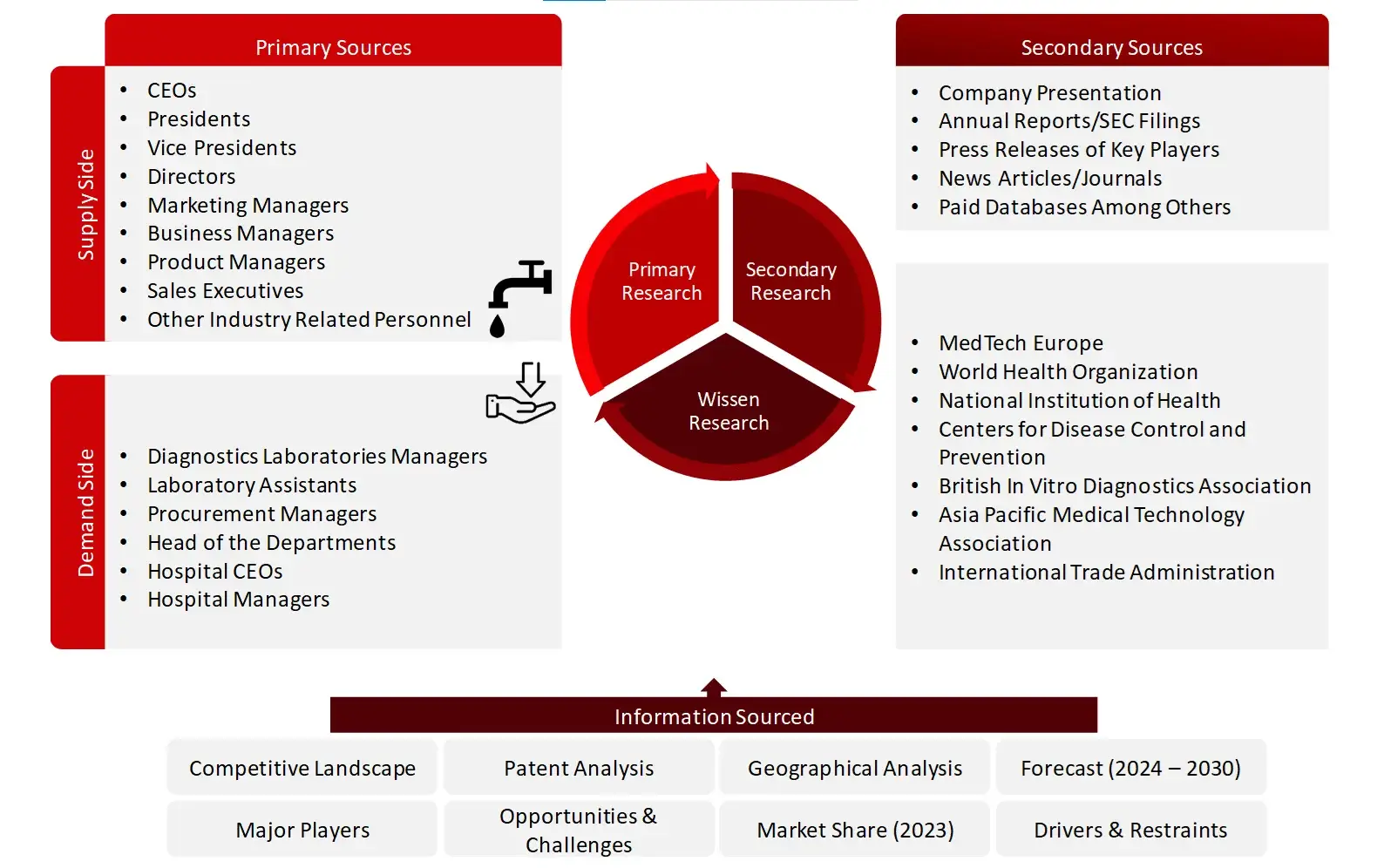

Research Methodology

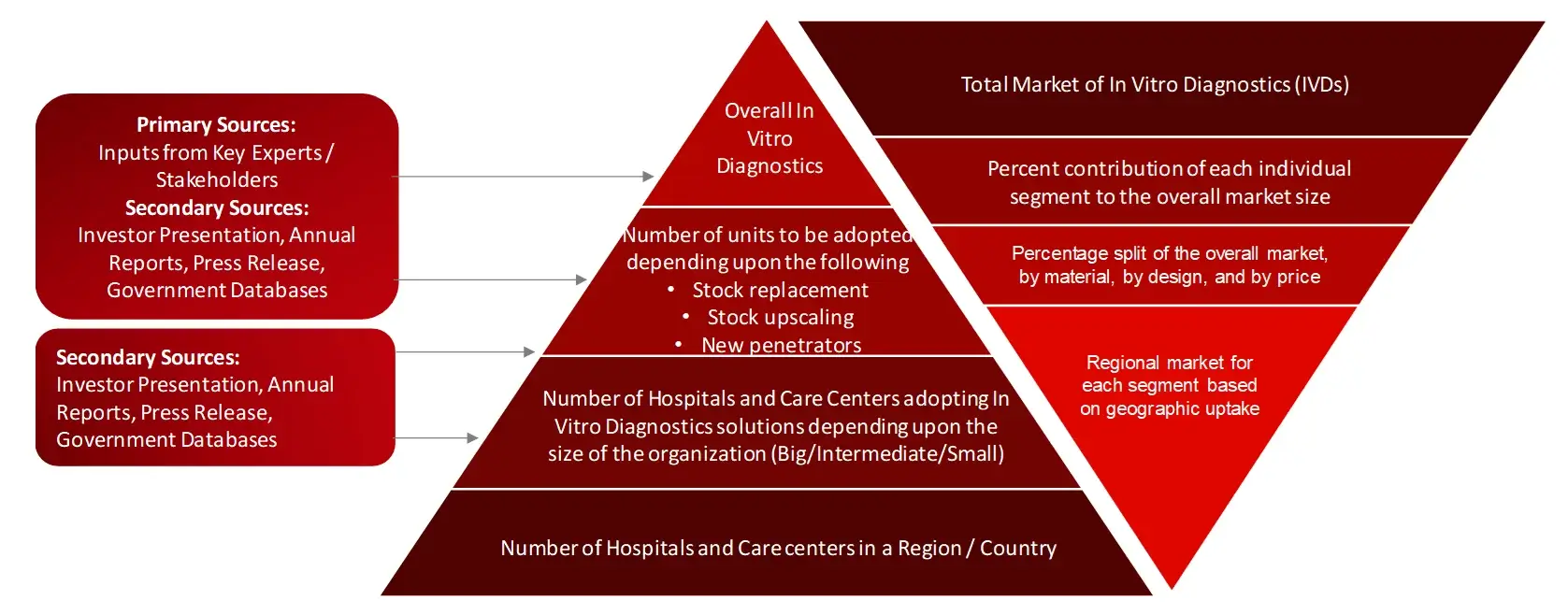

The aim of the study is to examine the key market forces such as drivers, opportunities, restraints, challenges, and strategies of key leaders. To monitor company advancements such as patents granted, product launches, expansions, and collaborations of key players, analyzing their competitive landscape based on various parameters of business and product strategy. Markey sizing will be estimated using top-down and bottom-up approaches. Using market breakdown and data triangulation techniques, market sizing of segments and sub-segments will be estimated.

FIGURE: RESEARCH DESIGN

Research Approach

Collecting Secondary Data

The process of collating secondary research data involves the utilization of secondary sources, directories, databases, annual reports, investor presentations, and SEC filings of companies. Secondary research will be utilized to identify and gather information beneficial for the in-depth, technical, market-oriented, and commercial analysis of the in vitro diagnostics market. A database of the key industry leaders will also be compiled using secondary research.

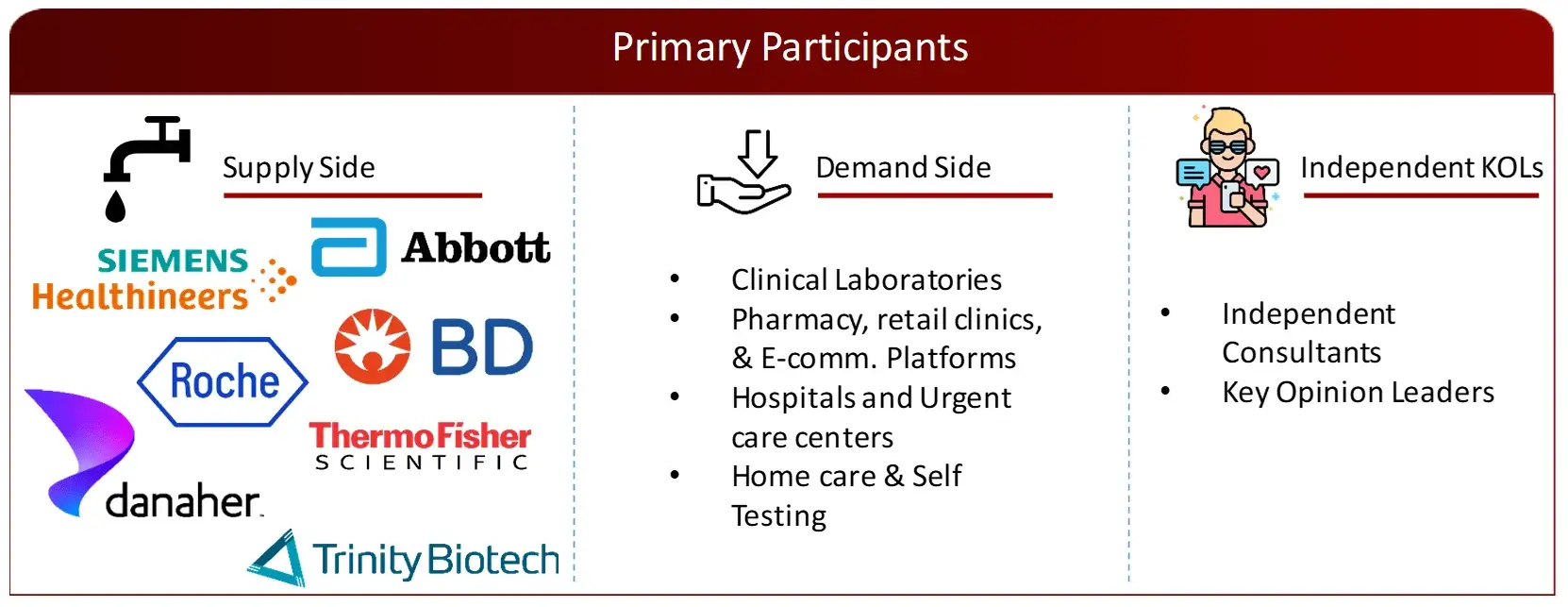

Collecting Primary Data

The primary research data will be conducted after acquiring knowledge about the IVDs market scenario through secondary research. A significant number of primary interviews will be conducted with stakeholders from both the demand side and supply side (including various industry experts, such as Directors, Chief X Officers (CXOs), Vice Presidents (VPs) from business development, marketing and product development teams, product manufacturers) across major countries of North America, Europe, Asia-Pacific, Middle East and Africa, and Latin America. Primary data for this report will be collected through questionnaires, emails, and telephonic interviews.

FIGURE: BREAKDOWN OF PRIMARY INTERVIEWS FROM SUPPLY SIDE

FIGURE: BREAKDOWN OF PRIMARY INTERVIEWS FROM DEMAND SIDE

FIGURE: PROPOSED PRIMARY PARTICIPANTS FROM DEMAND AND SUPPLY SIDE

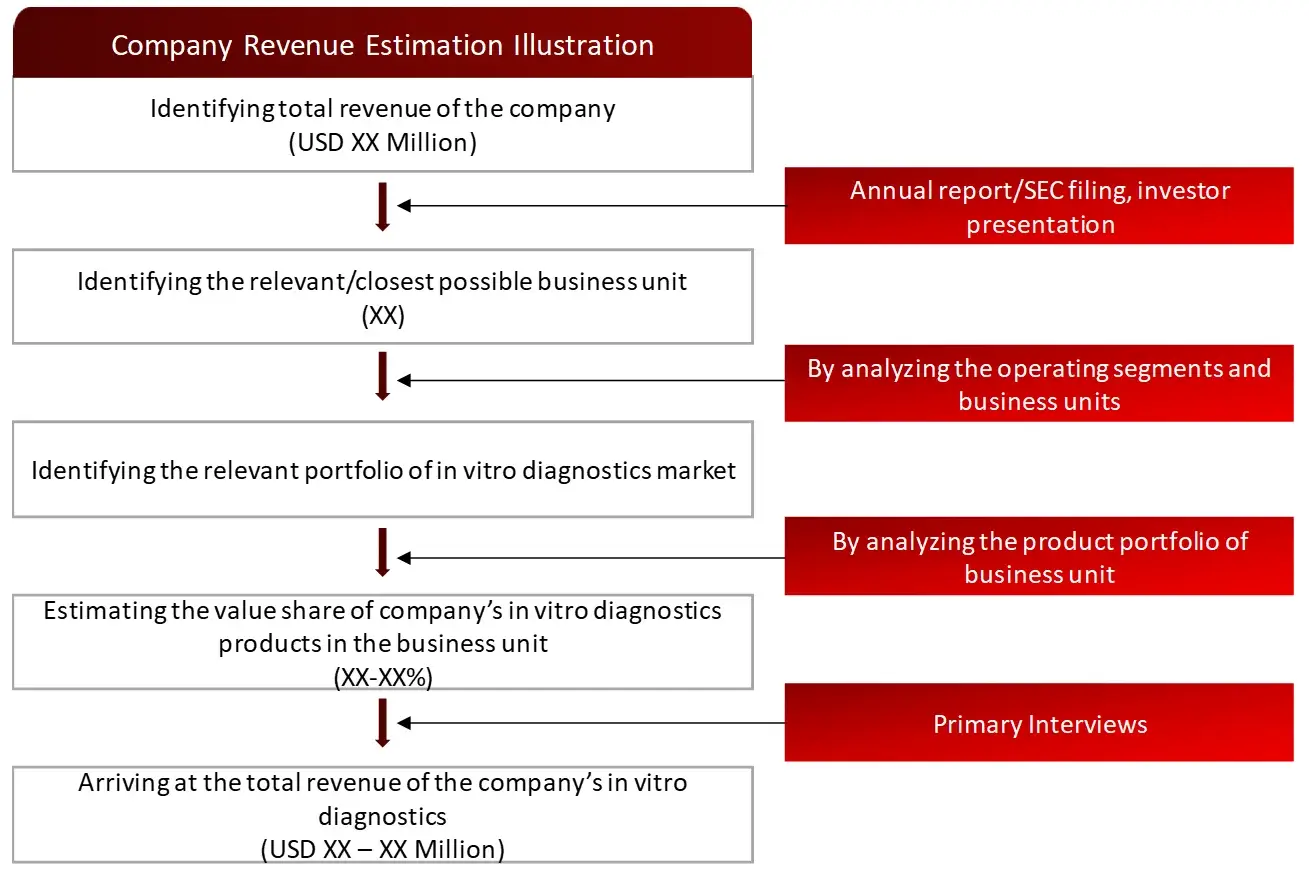

Market Size Estimation

All major manufacturers offering various IVD systems will be identified at the global / regional level. Revenue mapping will be done for the major players, which will further be extrapolated to arrive at the global market value of each type of segment. The market value of IVDs market will also split into various segments and sub segments at the region level based on:

FIGURE: REVENUE MAPPING BY COMPANY (ILLUSTRATION)

FIGURE: REVENUE SHARE ANALYSIS OF KEY PLAYERS (SUPPLY SIDE)

FIGURE: MARKET SIZE ESTIMATION TOP-DOWN AND BOTTOM-UP APPROACH

FIGURE: ANALYSIS OF DROCS FOR GROWTH FORECAST

FIGURE: GROWTH FORECAST ANALYSIS UTILIZING MULTIPLE PARAMETERS

Research Design

After arriving at the overall market size-using the market size estimation processes-the market will be split into several segments and sub segment. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub segment, the data triangulation, and market breakdown procedures will be employed, wherever applicable. The data will be triangulated by studying various factors and trends from both the demand and supply sides in the IVDs market.

1. Introduction

1.1 Key Objectives

1.2 Definitions

1.2.1 In Scope

1.2.2 Out of Scope

1.3 Scope of the Report

1.4 Scope Related Limitations

1.5 Key Stakeholders

2. Research Methodology

2.1 Research Approach

2.2 Research Methodology / Design

2.3 Market Sizing Approach

2.3.1 Secondary Research

2.3.2 Primary Research

3. Executive Summary & Premium Content

3.1 Global Market Outlook

3.2 Key Market Findings

4. Market Overview

4.1 Market Dynamics

4.1.1 Drivers/Opportunities

4.1.2 Restraints/Challenges

4.2 End User Perception

4.3 Need Gap

4.4 Supply Chain / Value Chain Analysis

4.5 Industry Trends

4.6 Porter’s Five Forces Analysis

5. Patent Analysis

5.1 Patents Related to In Vitro Diagnostics Technologies / Systems

5.2 Patent Landscape and Intellectual Property Trends

6. Global In Vitro Diagnostics Market by, Product Type (2023-2030, USD Million)

6.1 Instruments

6.2 Reagents

6.3 Software

7. Global In Vitro Diagnostics Market by, Test Type (2023-2030, USD Million)

7.1 Diagnostic Laboratory Testing

7.2 Point-of-Care Testing

8. Global In Vitro Diagnostics Market by, Technology (2023-2030, USD Million)

8.1 Clinical Chemistry

8.1.1 Metabolic Panels

8.1.2 Electrolyte Panels

8.1.3 Liver Panels

8.1.4 Lipid Profile

8.1.5 Renal Profile

8.1.6 Others

8.2 Immunoassay

8.2.1 ELISA

8.2.2 Chemiluminescence

8.2.3 Fluorescence Immunoassay

8.2.4 Rapid Tests

8.2.5 ELISPOT

8.2.6 Others

8.3 Molecular Diagnostics

8.3.1 PCR

8.3.2 In-situ Hybridization

8.3.3 Sequencing

8.3.4 Isothermal Nucleic Acid Amplification Technology

8.3.5 Chips and Microarrays

8.3.6 Mass Spectrometry

8.3.7 Others

8.4 Hematology

8.5 Microbiology

8.6 Coagulation

8.7 Others

9. Global In Vitro Diagnostics Market by, Therapeutic Area (2023-2030, USD Million)

9.1 Infectious Disease

9.2 Cardiology

9.3 Diabetes

9.4 Oncology

9.5 Nephrology

9.6 Autoimmune Disease

9.7 Drug Testing

9.8 Others

10. Global In Vitro Diagnostics Market by, End-User (2023-2030, USD Million)

10.1 Diagnostic Laboratory

10.2 Hospital

10.3 Home Care

10.4 Others

11. Global In Vitro Diagnostics Market by, Region (2023-2030, USD Million)

11.1 North America

11.1.1 US

11.1.2 Canada

11.2 Europe

11.2.1 Germany

11.2.2 France

11.2.3 Spain

11.2.4 Italy

11.2.5 UK

11.2.6 Rest of the Europe

11.3 Asia Pacific

11.3.1 China

11.3.2 Japan

11.3.3 India

11.3.4 Australia and New Zealand

11.3.5 South Korea

11.3.6 Rest of the Asia-Pacific

11.4 Middle East and Africa

11.5 Latin America

12. Competitive Analysis

12.1 Key Players Footprint Analysis

12.2 Market Share Analysis

12.3 Key Brand Analysis

12.4 Regional Snapshot of Key Players

12.5 R&D Expenditure of Key Players

13. Company Profiles2

13.1 Hoffmann-La Roche Ltd.

13.1.1 Business Overview

13.1.2 Product Portfolio

13.1.3 Financial Snapshot3

13.1.4 Recent Developments

13.1.5 SWOT Analysis

13.2 Abbott Laboratories

13.3 Agilent

13.4 Becton, Dickinson and Company

13.5 bioMérieux

13.6 BioRad

13.7 Danaher Corporation

13.8 DiaSorin

13.9 Grifols S.A.

13.10 Hologic Inc.

13.11 Illumina Inc.

13.12 Siemens Healthineers

13.13 Qiagen N.V.

13.14 Quidelortho Corporation

13.15 Thermo Fisher Scientific Inc.

13.16 Werfen S.A.

14. Conclusion

15. Appendix

15.1 Industry Speak

15.2 Questionnaire

15.3 Available Custom Work

15.4 Adjacent Studies

15.5 Authors

16. References

The global market for in vitro diagnostics was valued at approximately USD 82.5 billion in 2023, and is projected to increase to USD 87 billion in 2024.

The global in vitro diagnostics market is anticipated to grow at an annual growth rate of 5.1% from 2024 to 2030 to reach USD 117.1 billion, by 2030.

The key end-users in the in vitro diagnostics market comprise clinics & hospitals, clinical laboratories, pharmaceutical & biotechnology companies, home care settings, academic institution, and blood banks, with the home care segment anticipated to experience the highest growth rate during the forecast period.

Leading players within the in vitro diagnostics market are F. Hoffmann-La Roche Ltd., Abbott Laboratories, BECTON, DICKINSON AND COMPANY, DANAHER CORPORATION, and Siemens Healthineers.

The market is moderately consolidated at top, comprising 10 to 15 key players, while it remains highly fragmented at the lower levels, with numerous small and mid-sized companies operating at regional and national level.

The primary application areas within the in vitro diagnostics market encompass infectious diseases, cardiology, nephrology, oncology, and autoimmune diseases. Notably, the demand in the oncology category is anticipated to experience a CAGR of more than 7.0%, between 2024 and 2030.

© Copyright 2024 – Wissen Research All Rights Reserved.