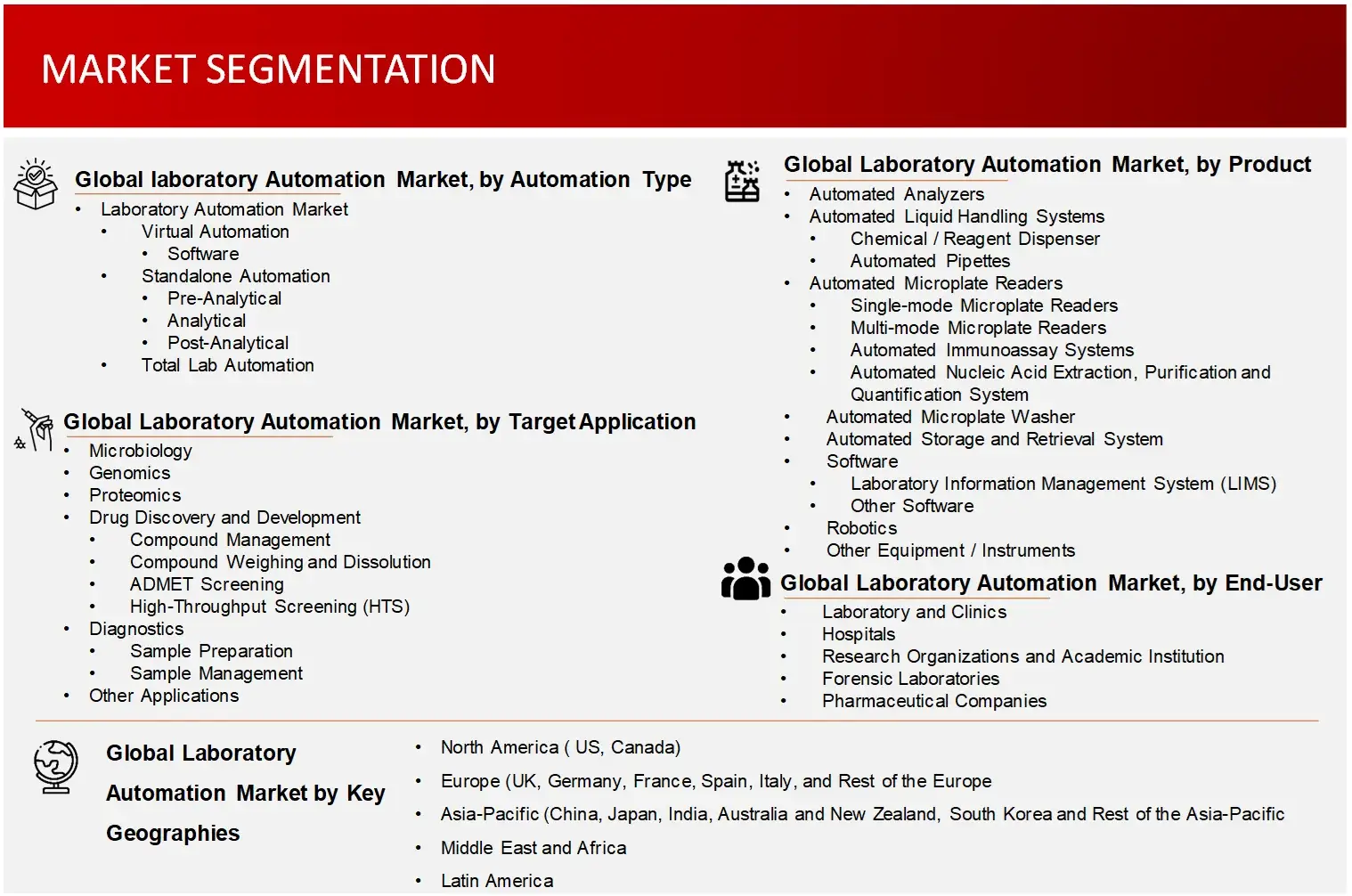

Laboratory Automation Market by Product (Analyzers, Liquid Handling Equipment, Software, Robotics) Automation Type (Virtual, Standalone, and Total Laboratory) Application (Genomics, Proteomics, Drug Discovery, Diagnostics) End-User, Regions, Companies – Global Forecast to 2030

Sources: Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentation, Paid Database, and Wissen Research Analysis.

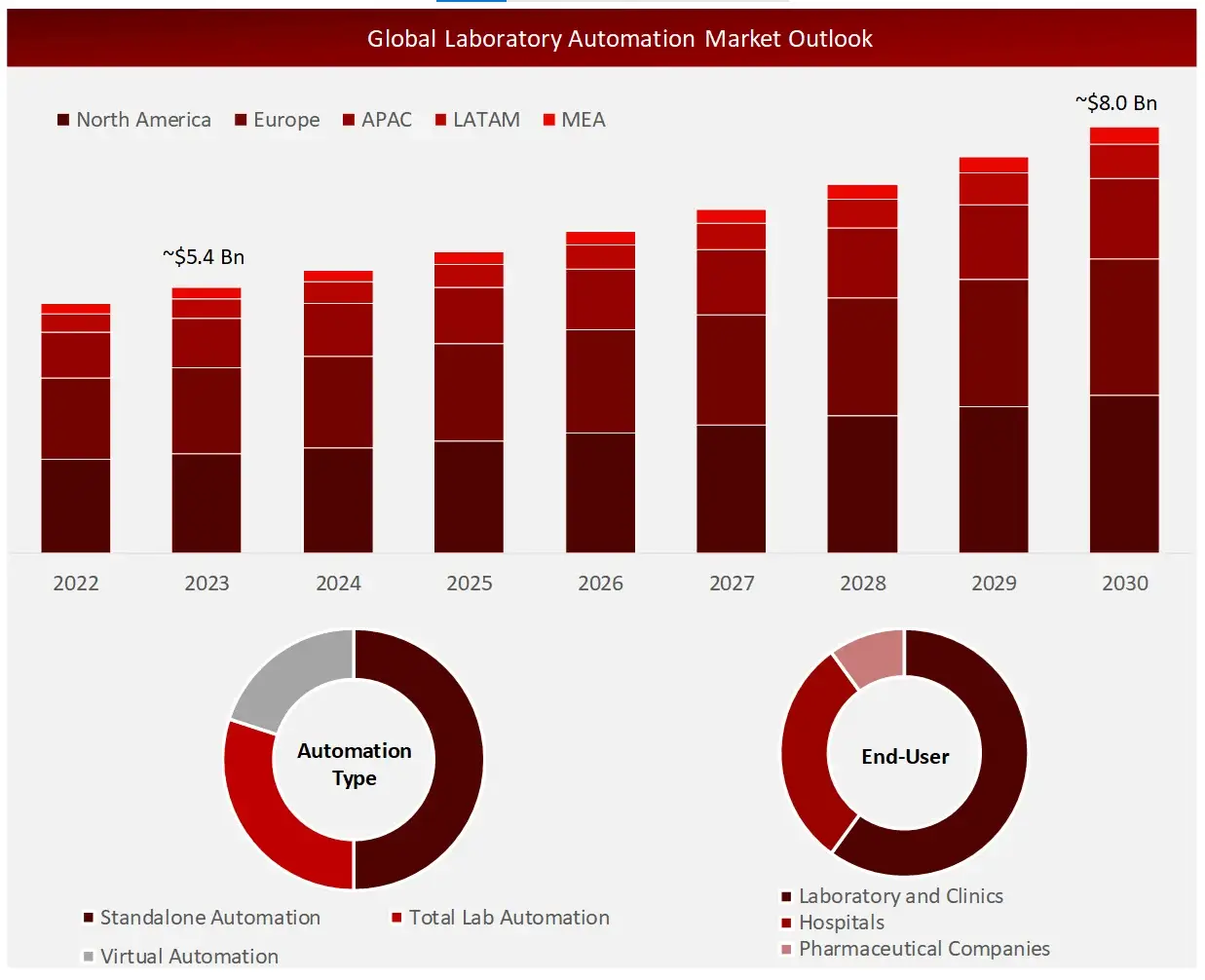

Sources: Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentation, Paid Database, and Wissen Research Analysis.Wissen Research analyses that the global laboratory automation market is estimated at ~USD 5.4 billion in 2023 and is projected to reach ~USD 8.0 billion by 2030, expected to grow at a CAGR of ~6.0% during the forecast period, 2023-2030.

With the increasing complexity of research and stringent regulatory requirements, traditional manual methods of managing lab operations present considerable obstacles. The rise of laboratory automation has provided a solution to these challenges. Laboratory automations significantly enhances the consistency and quality control of laboratory research. It is worth mentioning that the advancements in genetics has led to a growing need for automating state-of-the-art genetic analysis tools. Moreover, pharmaceutical and biotechnology companies are recognizing the importance of research and development, which is further driving the demand for laboratory automation. Presently, there is a lot of research being conducted within the laboratory automation domain, therefore it is anticipated that a significant progress will take place in this area in the coming years.

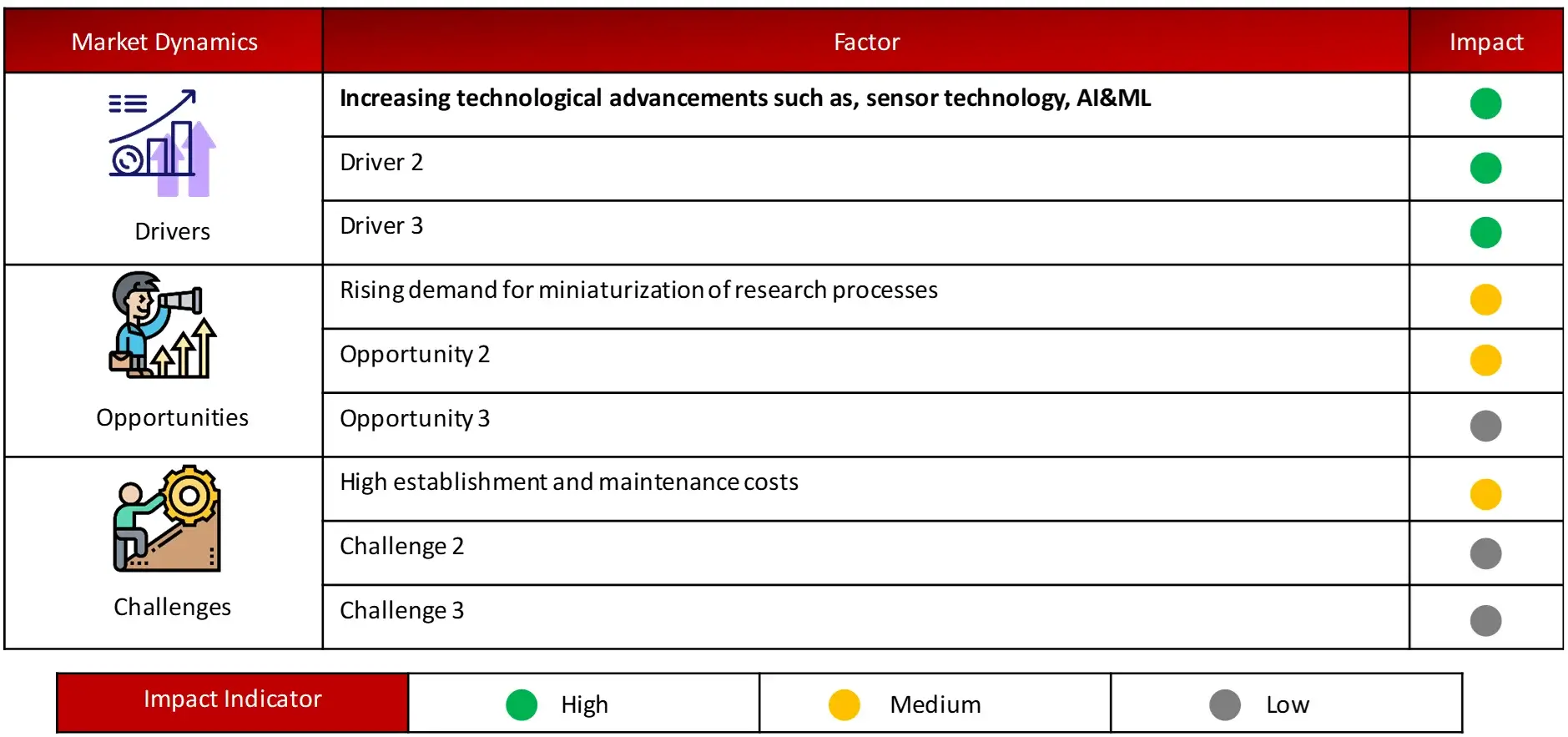

Given the increasing adoption of advanced technologies such as, sensor technology, robotics, artificial intelligence and machine learning and others in the past few years, the laboratories have been able to automate repetitive and time consuming activities in the lab, thus, enabling high-throughput processing and more accurate results. By early utilization and investments in high-tech innovations, pharmaceutical companies and laboratories are anticipated to have competitive edge.

The rising need for miniaturization has led to numerous research endeavors focused on developing innovative automation systems and workstations. The biotechnology and clinical chemistry domains are fueling the need for downsizing, research processes to be smaller and complex ones to be automated. This desire for miniaturization is probably expected to the innovation of new automation technologies in the near future.

Due to financial restrictions, many small and mid-sized pharmaceutical companies and laboratories find it challenging to install expensive laboratory automation equipment / instruments. Further, the high maintenance cost has become a constant challenge and thus pressurize end-users in managing operational costs while maintaining quality and compliance.

The laboratory automation market report offers information on the latest advancements in the industry, as well as service portfolio analysis, supply chain/value chain analysis, market share, and the effects of localized and domestic players. It also analyzes potential revenue opportunities and changes in market regulations, as well as market size, category market growth, application dominance, product approvals, service launches, geographic expansions, and technological innovations. For an Analyst Brief and other information on the laboratory automation market, get in touch with Wissen Research. Our staff can assist you in making well-informed decisions that will lead to market expansion.

Sources: Company Websites and Wissen Research Analysis.

Sources: Company Websites and Wissen Research Analysis.

The laboratory automation market is segmented into automated analyzers, automated liquid handling equipment, automated pipettes, automated storage and retrieval systems, automated chemical / reagent dispenser, microplate readers, automated immunoassay systems, automated nucleic acid extraction, purification and quantification systems, and other equipment / instruments. Currently, liquid handling equipment segment is anticipated to hold majority share. This can be ascribed to the quick and simple sample preparation, reduction in human error and high accuracy in the research processes.

Microbiology, genomics, proteomics, drug discovery and development, diagnostics, and other applications are the key applications where the laboratory automation solutions are being utilized. In 2024, drug discovery and development segment captures the largest share out of all these applications. This can be attributed to the faster determination of drug level and drug screening of large number of compounds.

Currently, North America hold the maximum share owing to the its well established healthcare infrastructure and high pharmaceutical research and development expenditure. However, Asia-Pacific region is anticipated to grow at highest annualized growth rate during the forecast period. Key factors supporting this trend includes growing healthcare expenditure, favorable government schemes supporting the faster and accurate laboratory processes, high demand for advanced and reliable technologies, and comparatively less stringent regulatory framework, all are anticipated to fuel growth in emerging Asia-Pacific region.

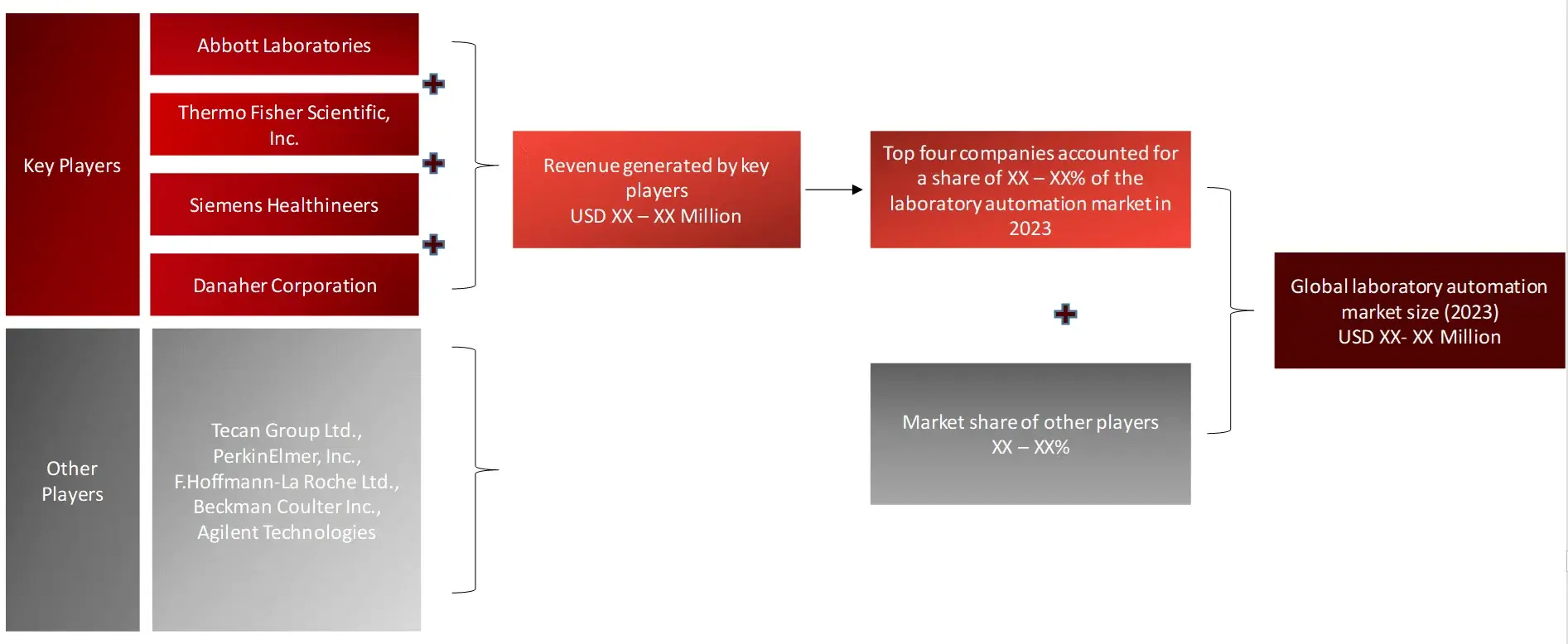

Major players operating in laboratory automation market are Abbott Laboratories, Thermo Fisher Scientific, Inc., Siemens Healthineers, F.Hoffmann-La Roche Ltd., Beckton, Dickinson and Company, Danaher Corporation, Hudson Robotics Inc., Tecan Group Ltd., among others.

Recent Developments:

Introduction

Market Definition

Laboratory automation focuses on enhancing and perfecting technologies for automating traditional laboratories. It involves the intricate corporation of computers, liquid handling instruments, reagent dispensers, robotics, and various other technologies. Laboratory automation solutions are being utilized across numerous domains such as, pharmaceutical testing, bioscreening, drug discovery and development, and others.

Key Stakeholders

Key objectives of the Study

Research Methodology

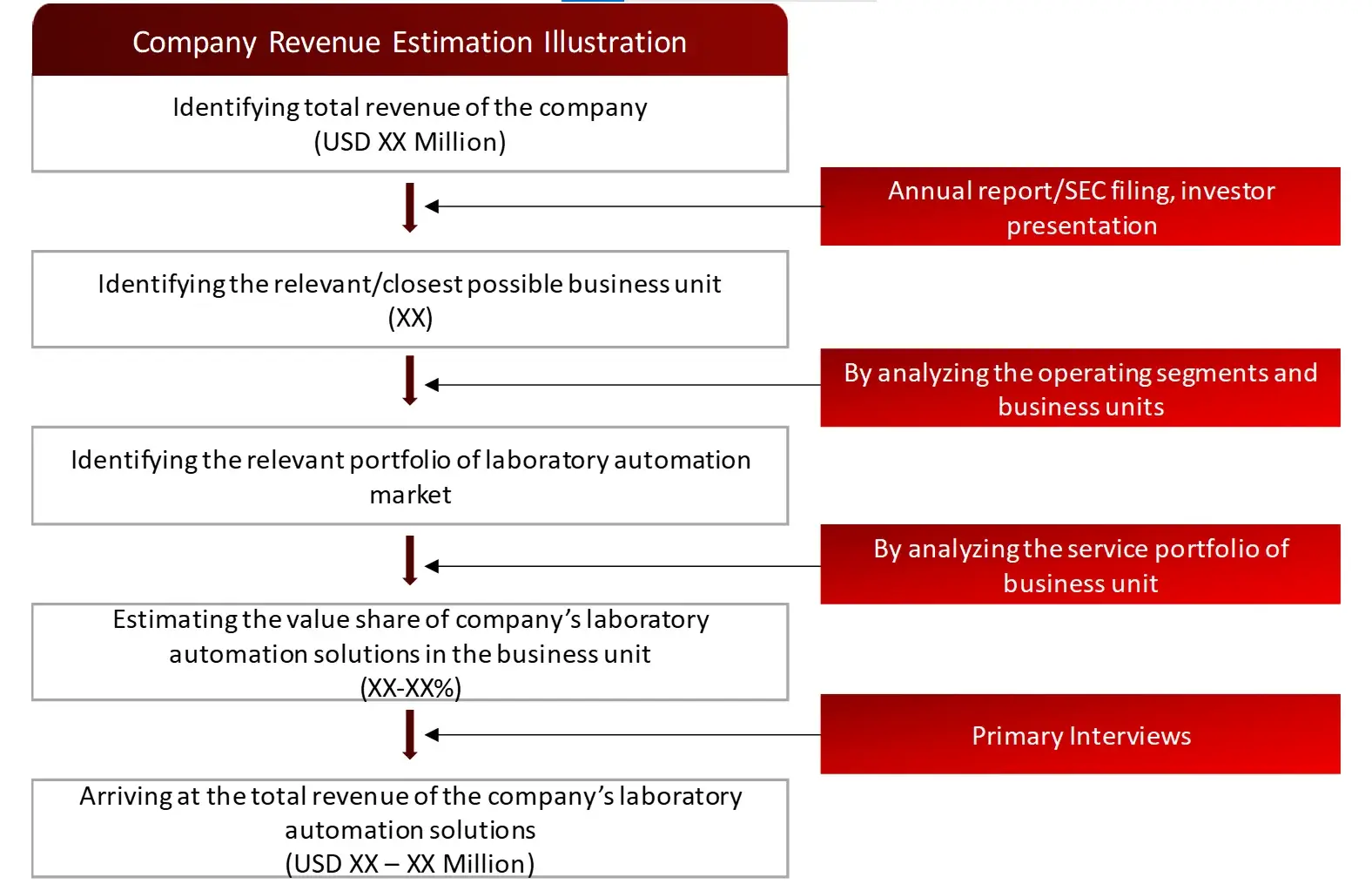

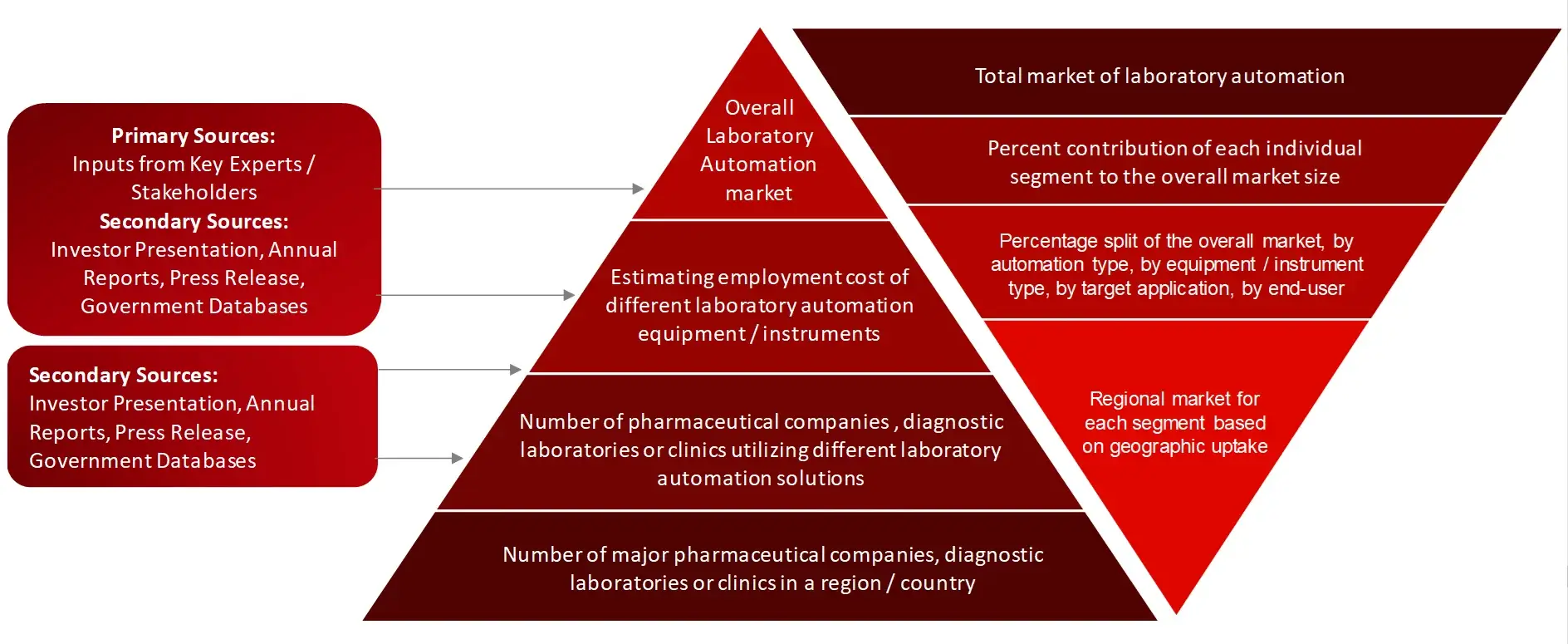

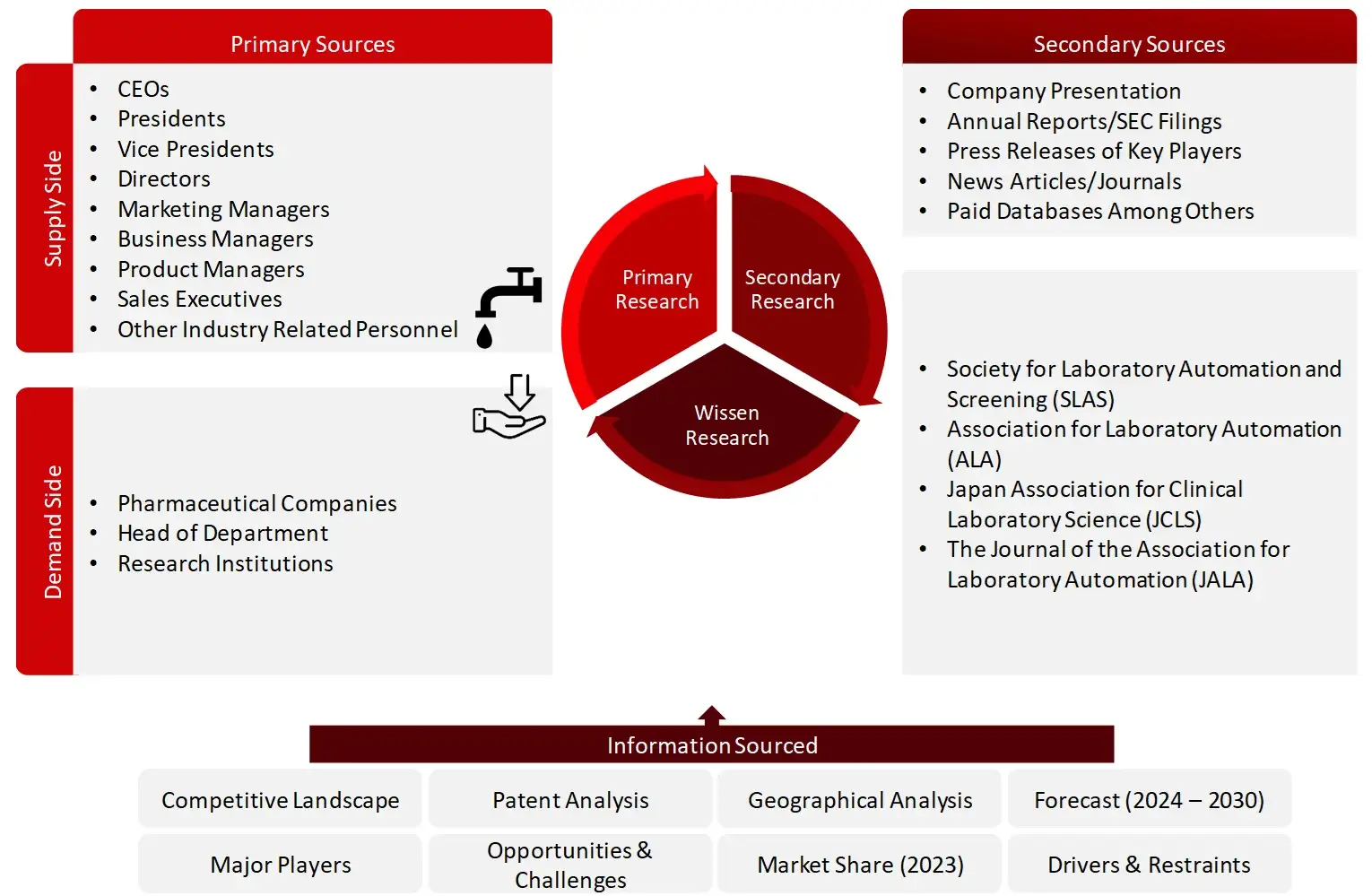

The aim of the study is to examine the key market forces such as drivers, opportunities, restraints, challenges, and strategies of key leaders. To monitor company advancements such as patents granted, product launches, expansions, and collaborations of key players, analyzing their competitive landscape based on various parameters of business and product strategy. Market sizing will be estimated using top-down and bottom-up approaches. Using market breakdown and data triangulation techniques, market sizing of segments and sub-segments will be estimated.

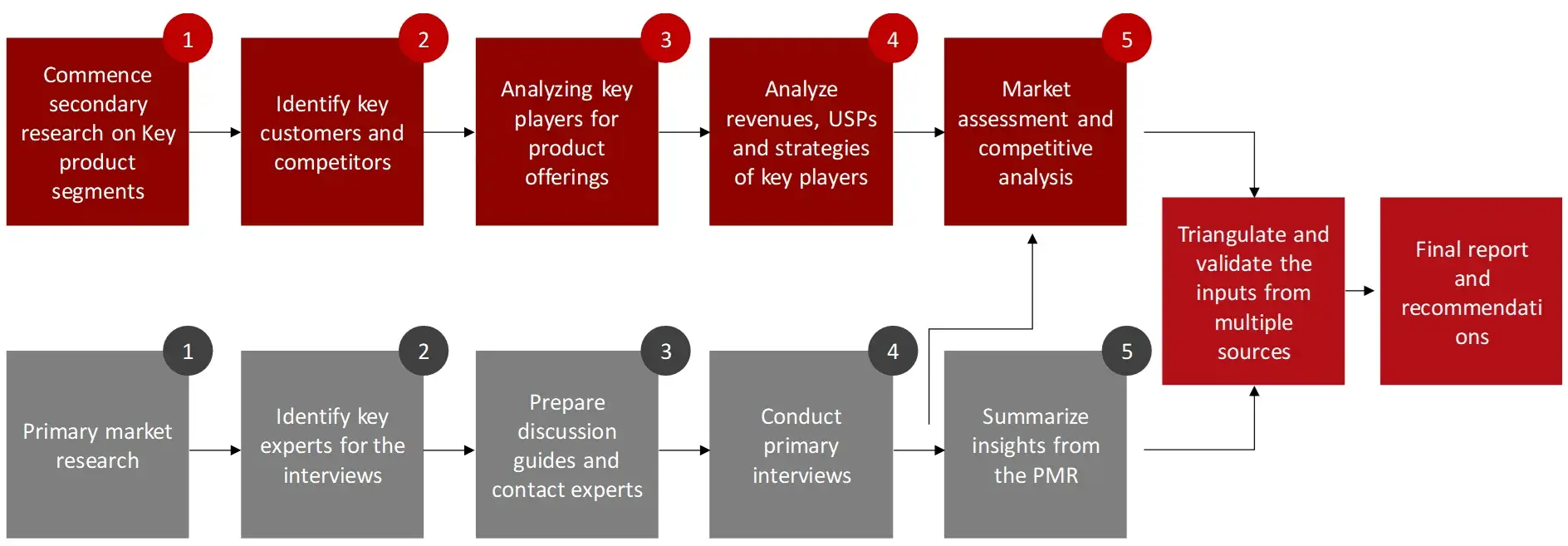

FIGURE: RESEARCH DESIGN

Research Approach

Collecting Secondary Data

The process of collating secondary research data involves the utilization of databases, secondary sources, annual reports, investor presentations, directories, and SEC filings of companies. Secondary research will be utilized to identify and gather information beneficial for the in-depth, technical, market-oriented, and commercial analysis of the laboratory automation market. A database of the key industry leaders will also be compiled using secondary research.

Collecting Primary Data

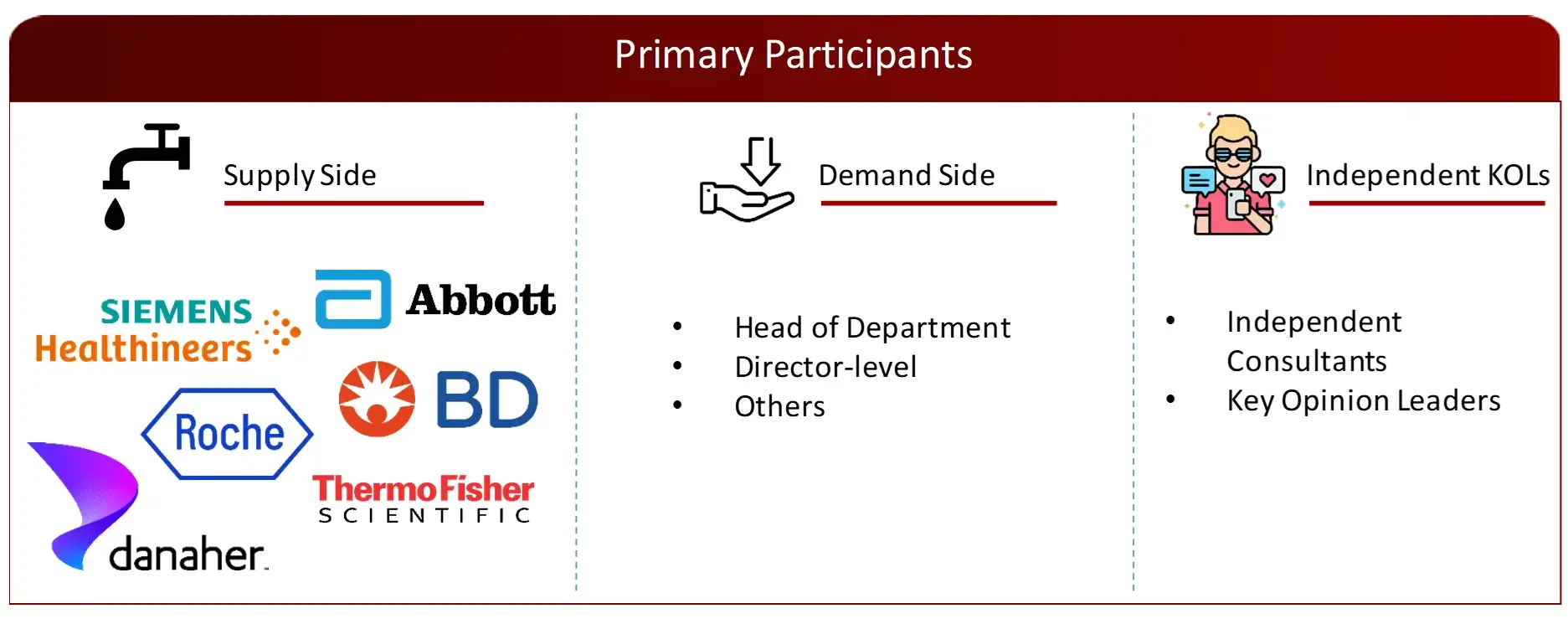

The primary research data will be conducted after acquiring knowledge about the laboratory automation market scenario through secondary research. A significant number of primary interviews will be conducted with stakeholders from both the demand and supply side (including various industry experts, such as Vice Presidents (VPs), Chief X Officers (CXOs), Directors from business development, marketing and product development teams, product manufacturers) across major countries of Asia-Pacific, Europe, North America, Middle East and Africa, and Latin America. Primary data for this report will be collected through questionnaires, emails, and telephonic interviews.

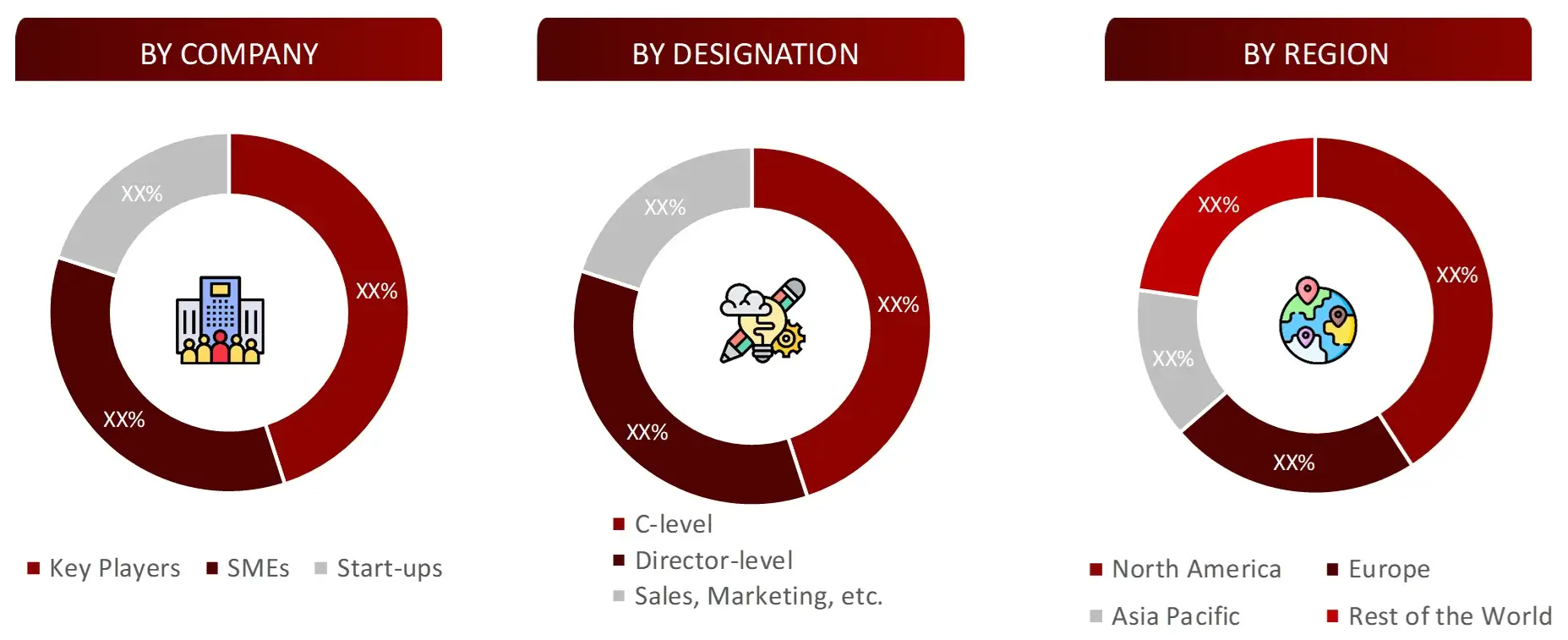

FIGURE: BREAKDOWN OF PRIMARY INTERVIEWS FROM SUPPLY SIDE

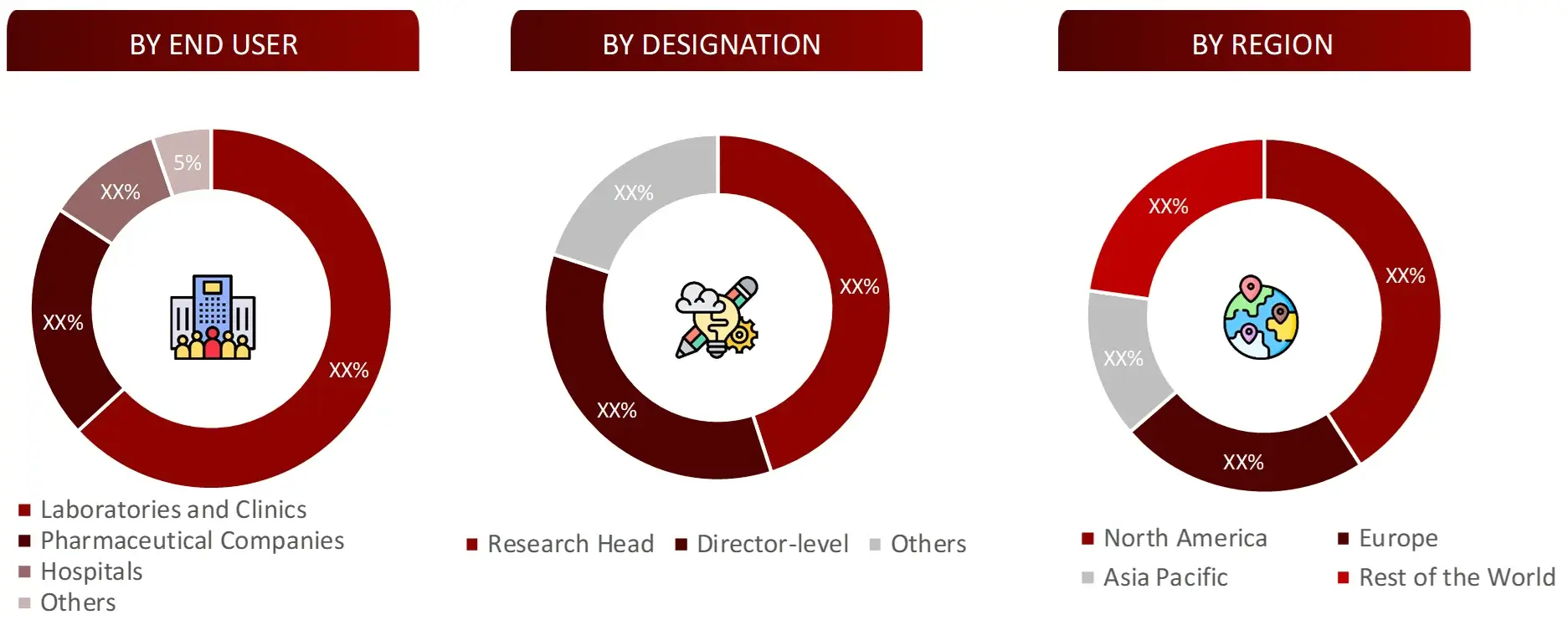

FIGURE: BREAKDOWN OF PRIMARY INTERVIEWS FROM DEMAND SIDE

FIGURE: PROPOSED PRIMARY PARTICIPANTS FROM DEMAND AND SUPPLY SIDE

Market Size Estimation

All major manufacturers offering various laboratory automation solutions will be identified at the global / regional level. Revenue mapping will be done for the major players, which will further be extrapolated to arrive at the global market value of each type of segment. The market value of laboratory automation market will also split into various segments and sub segments at the region level based on:

FIGURE: REVENUE MAPPING BY COMPANY (ILLUSTRATION)

FIGURE: REVENUE SHARE ANALYSIS OF KEY PLAYERS (SUPPLY SIDE)

FIGURE: MARKET SIZE ESTIMATION TOP-DOWN AND BOTTOM-UP APPROACH

FIGURE: ANALYSIS OF DRIVERS, OPPORTUNITIES AND CHALLANGES FOR GROWTH FORECAST

FIGURE: GROWTH FORECAST ANALYSIS UTILIZING MULTIPLE PARAMETERS

Sources: Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentation, Paid Database, and Wissen Research Analysis.

Sources: Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentation, Paid Database, and Wissen Research Analysis.Research Design

After arriving at the overall market size-using the market size estimation processes-the market will be split into several segments and sub segment. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub segment, the data triangulation, and market breakdown procedures will be employed, wherever applicable. The data will be triangulated by studying various factors and trends from both the demand and supply sides in the laboratory automation market.

1. Introduction

1.1 Key Objectives

1.2 Definitions

1.2.1 In Scope

1.2.2 Out of Scope

1.3 Scope of the Report

1.4 Scope Related Limitations

1.5 Key Stakeholders

2. Research Methodology

2.1 Research Approach

2.2 Research Methodology / Design

2.3 Market Sizing Approach

2.3.1 Secondary Research

2.3.2 Primary Research

3. Executive Summary & Premium Content

3.1 Global Market Outlook

3.2 Key Market Findings

4. Market Overview

4.1 Market Dynamics

4.1.1 Drivers/Opportunities

4.1.2 Restraints/Challenges

4.2 End User Perception

4.3 Need Gap

4.4 Supply Chain / Value Chain Analysis

4.5 Industry Trends

4.6 Porter’s Five Forces Analysis

5 Patent Analysis

5.1 Patents Related to Laboratory Automation Solutions

5.2 Patent Landscape and Intellectual Property Trends

6. Global Laboratory Automation Market, by Product (2023-2030, USD Million)

6.1 Automated Analyzers

6.2 Automated Liquid Handling Systems

6.2.1 Chemical / Reagent Dispenser

6.2.2 Automated Pipettes

6.3 Automated Microplate Readers

63.1 Single-mode Microplate Readers

6.3.2 Multi-mode Microplate Readers

6.3.3 Automated Immunoassay Systems

6.3.4 Automated Nucleic Acid Extraction, Purification and Quantification Systems

6.4 Automated Microplate Washer

6.5 Automated Storage and Retrieval System

6.6 Software

6.6.1 Laboratory Information Management System (LIMS)

6.6.2 Other Software

6.7 Robotics

6.8 Other Equipment / Instruments (filtration etc.)

7. Global Laboratory Automation Market, by Automation Type (2023-2030, USD Million)

7.1 Laboratory Automation Market

7.1.1 Virtual Automation

7.1.1.1 Software

7.1.2 Standalone Automation

7.1.2.1 Pre-Analytical

7.1.2.2 Analytical

7.1.2.3 Post-Analytical

7.1.3 Total Laboratory Automation

8. Global Laboratory Automation Market, by Target Application (2023-2030, USD Million)

8.1 Microbiology

8.2 Genomics

8.3 Proteomics

8.4 Drug Discovery and Development

8.4.1 Compound Management

8.4.2 Compound Weighing and Dissolution

8.4.3 Absorption, Distribution, Metabolism, Elimination, and Toxicity (ADMET) Screening

8.4.4 High-Throughput Screening (HTS)

8.5 Diagnostics

8.5.1 Sample Preparation

8.5.2 Sample Management

8.6 Other Applications

9. Global Laboratory Automation Market, by End-User (2023-2030, USD Million)

9.1 Diagnostic Laboratory

9.2 Hospitals & Clinics

9.3 Research Organizations and Academic Institutions

9.4 Forensic Laboratories

9.5 Pharmaceutical Companies

10. Global Laboratory Automation Market, by Region (2023-2030, USD Million)

10.1 North America

10.1.1 US

10.1.2 Canada

10.2 Europe

10.2.1 Germany

10.2.2 France

10.2.3 Spain

10.2.4 Italy

10.2.5 UK

10.2.6 Rest of the Europe

10.3 Asia-Pacific

10.3.1 China

10.3.2 Japan

10.3.3 India

10.3.4 Australia and New Zealand

10.3.5 South Korea

10.3.6 Rest of the Asia-Pacific

10.4 Middle East and Africa

10.5 Latin America

11. Competitive Analysis

11.1 Key Players Footprint Analysis

11.2 Market Share Analysis

11.3 Key Brand Analysis

11.4 Regional Snapshot of Key Players

11.5 R&D Expenditure of Key Players

12. Company Profiles2

12.1 Abbott Laboratories

12.1.1 Business Overview

12.1.2 Product Portfolio

12.1.3 Financial Snapshot3

12.1.4 Recent Developments

12.1.5 SWOT Analysis

12.2 Thermo Fisher Scientific, Inc.

12.3 Siemens Healthineers

12.4 Hoffmann-La Roche Ltd.

12.5 Becton, Dickinson and Company

12.6 Danaher Corporation

12.7 Hudson Robotics Inc.

12.8 PerkinElmer, Inc.

12.9 Tecan Group Ltd.

12.10 Agilent Technologies

12.11 Hamilton Company

12.12 Beckman Coulter Inc.

13. Conclusion

14. Appendix

14.1 Industry Speak

14.2 Questionnaire

14.3 Available Custom Work

14.4 Adjacent Studies

14.5 Authors

15. References

Key Notes:

© Copyright 2024 – Wissen Research All Rights Reserved.