Subscribe our newsletter

Please Subscribe our news letter and get update.

[newsletter]

DESCRIPTION

Key driving factors of lupus nephritis market include rising prevalence of lupus nephritis, advancements in biologics therapies and growing awareness and diagnosis rates.

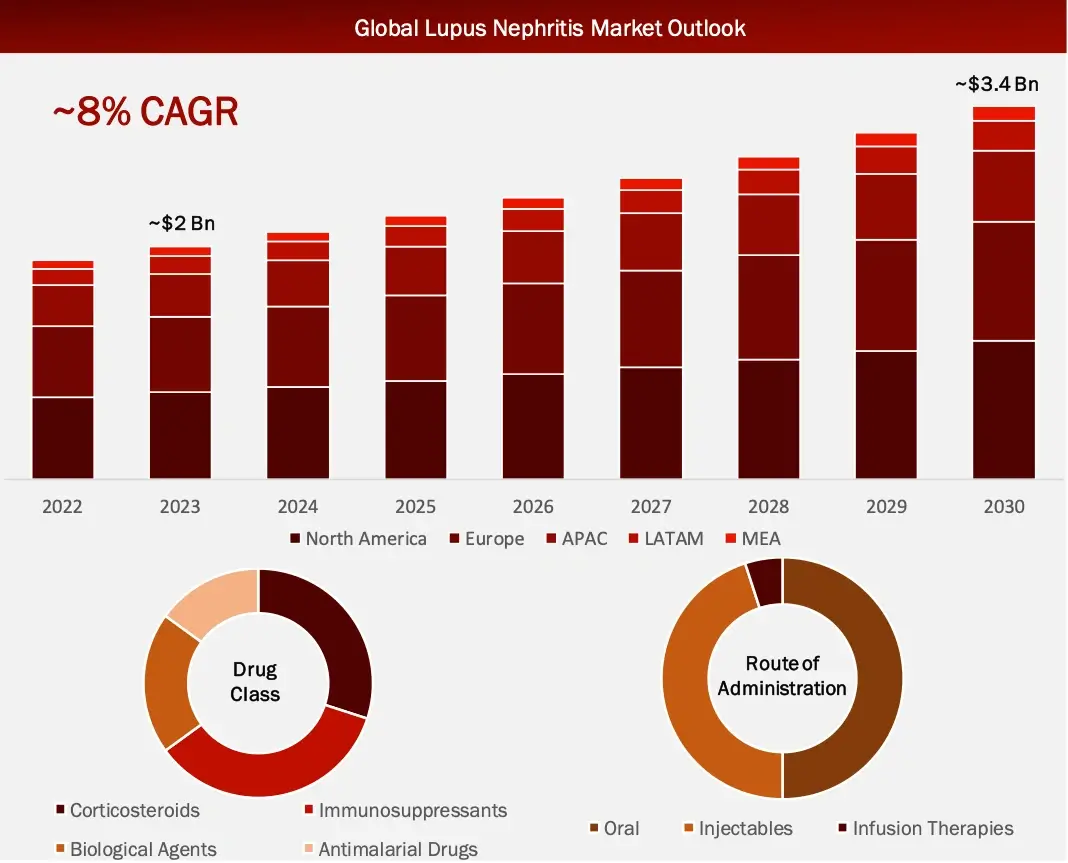

Challenges in the lupus nephritis domain include high treatment costs and limited insurance coverage and lack of curative treatments. The global lupus nephritis market is estimated to be valued at ~ $2 Billion in 2023, and is expected to grow at a CAGR of ~8%. immunosuppressant has held the most significant share in the market since 2022, with North America dominating the regional market share.

Key players functioning in lupus nephritis sector are Eli Lilly and Company, Johnsons & Johnsons, Merck, GlaxoSmithKline, Sanofi and Bayer AG.

Recent Developments:

Pipeline Analysis*:

Company | Product/Brand Name | Status | Type of Agent | Route of Administration |

F. Hoffmann-La Roche Ltd | Gazyva/Gazyvaro | Phase lll | Obinutuzumab | Intravenous (IV) |

AstraZeneca | vemircopan | Phase ll | _ | Oral |

Aurinia Pharmaceuticals | LUPKYNIS® | Phase lll | Voclosporin | Oral |

Novartis Pharmaceuticals | VAY736 | Phase lll | Ianalumab | Subcutaneous |

Note: This is not an exhaustive list. *Data latest as of 12 December 2024

MARKET DYNAMICS

Drivers: Rising prevalence of Lupus Nephritis globally

The prevalence of lupus nephritis is increasing worldwide, driven by a growing number of systemic lupus erythematosus (SLE) cases. In the United States, studies report an overall prevalence of approximately 20 to 25 per 100,000 individuals. This prevalence is notably higher among females and certain ethnic groups. Studies indicate that approximately 40-60% of SLE patients develop lupus nephritis, with the condition being more severe and frequent in African American, Hispanic, and Asian populations. For example, in the United States, African American women are four times more likely to develop lupus nephritis compared to Caucasian women. Additionally, a report from the Lupus Foundation of America highlights that up to 20% of patients with lupus nephritis may progress to end-stage renal disease (ESRD) within 10 years, underscoring the critical need for timely diagnosis and effective treatment. This increasing prevalence places greater emphasis on innovative therapies and improved disease management strategies, thereby increasing the R&D activities among the key players in the market.

Opportunities: Increased investments in clinical trials and R&D

Investments in clinical trials and research and development (R&D) are significantly expanding in the lupus nephritis market, driven by the need for more effective treatments and the development of personalized medicine approaches. Pharmaceutical companies and research institutions are focusing on advancing therapies that target the underlying causes of lupus nephritis and improve patient outcomes. For instance, a study by the American Society of Nephrology reported that there has been a 34% increase in clinical trial registrations focused on lupus nephritis over the past decade with a notable rise from around 2013 to 2023, indicating a growing commitment to finding new treatment solutions. Additionally, organizations like the Lupus Research Alliance and the Lupus Foundation of America are funding innovative studies aimed at discovering novel biomarkers and targeted therapies. These efforts not only enhance the understanding of the disease but also accelerate the development of more effective treatment options.

Challenges: High treatment costs and limited insurance coverage for specialized LN therapies

High treatment costs and limited insurance coverage remain significant challenges in the lupus nephritis market. Specialized therapies, such as biologics and immunosuppressants, which are critical for managing severe lupus nephritis cases, come with high price tags that many patients find unaffordable without adequate insurance coverage. A survey conducted by the Lupus Foundation of America found that nearly 30% of lupus nephritis patients in the US reported having to choose between paying for their medications or other essential living expenses due to high drug costs. Moreover, in many regions, insurance policies either exclude coverage for certain biologic treatments or impose high co-pays and deductibles, limiting access to these therapies for many patients. This financial burden can lead to poor adherence to treatment protocols and worse long-term health outcomes, making it a critical issue that needs addressing through policy reforms and improved reimbursement strategies.

GLOBAL LUPUS NEPHRITIS MARKET, BY DRUG CLASS

Immunosuppressants dominated the lupus nephritis drug market in 2023

Lupus nephritis treatment includes various drug classes, including immunosuppressants, corticosteroids, biological agents, antimalarial drugs among others. Each category serves a different mode of disease management. Among these, immunosuppressants have held the largest market share.

Drugs such as mycophenolate mofetil, azathioprine, cyclophosphamide, and tacrolimus have been proven effective in suppressing the immune system and are considered cornerstone treatments for this condition. In 2023, these drugs accounted for the largest share of the market due to their established efficacy in preventing flares and managing severe cases. For instance, mycophenolate mofetil, a widely prescribed immunosuppressant, was reported to be used by over 60% of lupus nephritis patients in the United States, underscoring its widespread acceptance as a standard treatment. Additionally, these drugs are often used in combination with corticosteroids and, in some cases, biologics, making them an integral part of comprehensive treatment strategies.

GLOBAL LUPUS NEPHRITIS MARKET, BY ROUTE OF ADMINISTRATION

Oral drugs accounted for the largest share in 2023

Global lupus nephritis market by application is segmented into multiple RoA types, these are oral and injectable, infusion therapies

In 2023, oral drugs accounted for the largest share in the lupus nephritis drug market, reflecting their convenience, ease of administration, and strong efficacy in managing the condition. Oral medications such as Mycophenolate mofetil, azathioprine, and cyclophosphamide are commonly prescribed for lupus nephritis due to their effectiveness in controlling inflammation and immune system activity.

GLOBAL LUPUS NEPHRITIS MARKET, BY DISTRIBUTION CHANNELS

Significant market share held by hospitals was observed in 2023

Various distribution channels are employed in global LN market such as hospitals, retail pharmacies, online pharmacies, among others.

The traditional healthcare facilities, i.e. hospitals remained the significant holder of distribution channels market share this can be attributed to their role as primary treatment centers. Additionally, they have the infrastructure needed for handling complex treatments like biologics and infusion therapies, ensuring proper administration and patient monitoring.

GLOBAL LUPUS NEPHRITIS MARKET, BY REGION

North America held the largest market share in Lupus Nephritis in the forecast period

Lupus nephritis market research included a comprehensive analysis of five key regions:

All regions were evaluated based on these following factors- healthcare infrastructure, regulatory landscape, technological adoption, and market dynamics. The research observed that North America held the largest share in the lupus nephritis treatment market domain during the forecast period, primarily due to its advanced healthcare systems, high adoption rates, and the presence of major market players driving innovation in this sector.

As per the historical and the base year of the report (2022 and 2023, respectively), key players in lupus nephritis were GSK plc (UK), Merck & Co (Germany), AstraZeneca (UK), Bayer AG (Germany), Sanofi (France), Johnson & Johnson (US), Sun Pharmaceutical Industries Ltd (India), Abbott Laboratories (US), Bristol-Myers Squibb Company (US), F. Hoffmann-La Roche AG (Switzerland), Eli Lilly and Company (US), Aurinia Pharmaceuticals Inc. (Canada), among others

Introduction

Market Definition

Lupus nephritis is a serious kidney inflammation caused by systemic lupus erythematosus (SLE), an autoimmune disease where the immune system attacks healthy tissues. It affects the kidneys’ ability to filter waste effectively and can lead to complications like proteinuria, hematuria, hypertension, and renal failure if untreated. Lupus nephritis is most common in women of childbearing age, particularly among African American, Hispanic, and Asian populations. Early diagnosis and targeted treatments, including immunosuppressants, corticosteroids, and biologics, are critical to managing the disease and preventing long-term kidney damage.

FIGURE: LUPUS NEPHRITIS MARKET SEGMENTS

Sources: Company Websites and Wissen Research Analysis

Sources: Company Websites and Wissen Research Analysis

Key Stakeholders

Key objectives of the Study

Research Methodology

The objective of the study is to analyze the key market dynamics such as drivers, opportunities, challenges, restraints, and key player strategies. To track company developments such as product launches and approvals, expansions, and collaborations of the leading players, the competitive landscape of the lupus nephritis market to analyze market players on various parameters within the broad categories of business and product strategy. Top-down and bottom-up approaches will be used to estimate the market size. To estimate the market size of segments and sub segments the market breakdown and data triangulation will be used.

FIGURE: RESEARCH DESIGN

Sources: Wissen Research Analysis

Sources: Wissen Research Analysis

Research Approach

Collecting Secondary Data

The secondary research data collection process involves the usage of secondary sources, directories, databases, annual reports, investor presentations, and SEC filings of companies. Secondary research will be used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the lupus nephritis market. A database of the key industry leaders will also be prepared using secondary research.

Collecting Primary Data

The primary research data will be conducted after acquiring knowledge about the lupus nephritis market scenario through secondary research. A significant number of primary interviews will be conducted with stakeholders from both the demand side and supply side (including various industry experts, such as Directors, Chief X Officers (CXOs), Vice Presidents (VPs) from business development, marketing and product development teams, product manufacturers) across major countries of North America, Europe, Asia Pacific, and Rest of the World. Primary data for this report was collected through questionnaires, emails, and telephonic interviews.

Market Size Estimation

All major manufacturers offering various lupus nephritis will be identified at the global/regional level. Revenue mapping will be done for the major players, which will further be extrapolated to arrive at the global market value of each type of segment. The market value of lupus nephritis market will also split into various segments and sub segments at the region level based on:

Research Design

After arriving at the overall market size-using the market size estimation processes-the market will be split into several segments and sub segment. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub segment, the data triangulation, and market breakdown procedures will be employed, wherever applicable. The data will be triangulated by studying various factors and trends from both the demand and supply sides in the lupus nephritis market industry.

Sources: Company Website, Press Releases, Annual Reports, Paid Data Sources, and Wissen Research Analysis and the above mentioned sources

Sources: Company Website, Press Releases, Annual Reports, Paid Data Sources, and Wissen Research Analysis and the above mentioned sources

1. Introduction

1.1 Key Objectives

1.2 Definitions

1.2.1 In Scope

1.2.2 Out of Scope

1.3 Scope of The Report

1.4 Scope Related Limitations

1.5 Key Stakeholders

2. Research Methodology

2.1 Research Approach

2.2 Research Methodology / Design

2.3 Market Sizing Approach

2.3.1 Secondary Research

2.3.2 Primary Research

3. Executive Summary & Premium Content

3.1 Global Market Outlook

3.2 Key Market Findings

4. Market Overview

4.1 Market Dynamics

4.1.1 Drivers/Opportunities

4.1.2 Restraints/Challenges

4.2 End User Perception

4.3 Need Gap

4.4 Supply Chain / Value Chain Analysis

4.5 Industry Trends

4.6 Regulatory Landscape Analysis

4.7 Porter’s Five Forces Analysis

4.8 Reimbursement Scenario

5. Patent Analysis

5.1 Top Assignees in Lupus Nephritis Market

5.2 Geography Focus of Top Assignees

5.3 Legal Status of Lupus Nephritis Patents

5.4 Assignee Segmentation

5.5 Network Analysis of Top Collaborating Entities in Lupus Nephritis Patent Applications

5.6 Technology Evolution in Lupus Nephritis

5.7 Key Patents in Lupus Nephritis

5.8 Patent Trends and Innovations

5.9 Key Players and Patent Portfolio Analysis

6. Clinical Trial Analysis

6.1 Overview of Lupus Nephritis Clinical Trials

6.2 Analysis by Trial Registration Year

6.3 Analysis by Phase of Development

6.4 Analysis by Number of Patients Enrolled

6.5 Analysis by Status of Trial

6.6 Analysis by Study Design

6.7 Analysis by Intervention Type

6.8 Analysis by Geography

6.9 Analysis by Key Sponsors/Collaborators

7. Lupus Nephritis Market, by Drug Class (2023-2030, USD Million)

7.1 Immunosuppressants

7.1.1 Mycophenolate mofetil

7.1.2 Azathioprine

7.1.3 Cyclophosphamide

7.1.4 Tacrolimus

7.2 Corticosteroids

7.2.1 Prednisone

7.2.2 Methylprednisolone

7.3 Biological Agents

7.3.1 Belimumab

7.3.2 Rituximab

7.3.3 Epratuzumab

7.4 Antimalarial Drugs

7.4.1 Hydroxychloroquine

7.4.2 Chloroquine

8. Lupus Nephritis Market, by Treatment Type (2023-2030, USD Million)

8.1 Pharmacological Treatments

8.2 Non-Pharmacological Treatments

8.2.1 Dialysis:

8.2.2 Kidney Transplantation

8.3 Symptomatic Treatments

9. Lupus Nephritis Market, by Disease Type (2023-2030, USD Million)

9.1 Mild Lupus Nephritis

9.2 Moderate Lupus Nephritis

9.3 Severe Lupus Nephritis

10. Lupus Nephritis Market, by Route of Administration (2023-2030, USD Million)

10.1 Oral

10.2 Injectable

10.2.1 Intravenous (IV)

10.2.2 Subcutaneous (SC)

10.3 Infusion Therapies

11. Lupus Nephritis Market, by End Users (2023-2030, USD Million)

11.1 Hospitals and Clinics

11.2 Outpatient Care Centers

11.3 Others (Homecare, Research institutes, etc.)

12. Lupus Nephritis Market, by Distribution Channels (2023-2030, USD Million)

12.1 Hospitals Pharmacies

12.2 Retail Pharmacies

12.3 Online Pharmacies

12.4 Others

13. Lupus Nephritis Market, by Region (2023-2030, USD Million)

13.1 North America

13.1.1 US

13.1.2 Canada

13.2 Europe

13.2.1 UK

13.2.2 France

13.2.3 Germany

13.2.4 Italy

13.2.5 Spain

13.2.6 Rest of Europe

13.3 Asia Pacific

13.3.1 China

13.3.2 India

13.3.3 Japan

13.3.4 South Korea

13.3.5 Australia and New Zealand

13.3.6 Rest of Asia Pacific

13.4 Middle East and Africa

13.5 Latin America

14. Competitive Analysis

14.1 Key Player’s Footprint Analysis

14.2 Pipeline Analysis of Key Players in the Market

14.3 Market Share Analysis

14.4 Key Brand Analysis

14.5 Regional Snapshot of Key Players

14.6 R&D Expenditure of Key Players

15. Company Profiles2

15.1 Merck & Co

15.1.1 Business Overview

15.1.2 Product Portfolio

15.1.3 Financial Snapshot3

15.1.4 Recent Developments

15.1.5 SWOT Analysis

15.2 Roche

15.3 Bristol-Myers Squibb

15.4 Eli Lilly and Company

15.5 GlaxoSmithKline

15.6 AstraZeneca

15.7 Aurinia Pharmaceuticals Inc.

15.8 Johnson & Johnson Private Limited

15.9 Bayer AG

15.10 Sanofi

15.11 Sun Pharmaceutical Industries Ltd

15.12 Abbott

16. Appendix

16.1 Industry speak

16.2 Questionnaire

16.3 Available custom work

16.4 Adjacent studies

Authors

17. References

Key Notes:

Note 1 – Contents in the ToC / market segments are tentative and might change as the research proceeds.

Note 2 – List of companies is not exhaustive and might change during the course of study.

Note 3 – Details on key financials might not be captured in case of unlisted companies.

Note 4 – SWOT analysis will be provided for top 3-5 companies.

S.no | Key Highlights of Report | |

1. | Patent Analysis | · Top Assignee · Geography focus of top Assignees · Assignee Segmentation · Network analysis of the top collaborating entities in Lupus Nephritis treatments patent applications · Technology Evolution · Key Patents · Application and Issued Trend · Key technology |

2. | Market analysis | · Current Treatment Options · Emerging Therapies and Research Developments (by product analysis and scientific analysis) · Therapeutic activity of drugs · Company portfolio |

3. | Clinical Trials | · Analysis of clinical trial through graphical representation · Coverage of treatments from pre-clinical phases till commercialization (also including terminated and completed studies) |

4. | Forecast | · Detailed comprehension of the historic, current and forecasted trend of market by analysis of impact of these treatments on the market |

5. | Key Players | · Detailed profiles of the key players that are engaged in the development of approved drugs |

6. | Strategic activities of companies | · Collaboration/Mergers/Agreements/Partnerships/Acquisitions taken place by analyzed companies |

7. | Opportunity Analysis | · Technology evolution based on problem solution · Potential licensees · Geography of suppliers · Treatment trends · Unmet needs · SWOT Analysis · Drivers and barriers · Opportunity for new treatment |

8. | KOLs | · A detailed analysis and identification of the key opinion leaders (KOLs), shortlisted based on their contributions |

LIST OF FIGURES

Figure number | Description |

Figure 1 | Terminology of Lupus Nephritis Over The Years |

Figure 2 | Lupus Nephritis Treatment– History and Present |

Figure 3 | Projection of Lupus Nephritis till 2033 in different geographies |

Figure 4 | Technology Categorization Of Drug Delivery Methods For Lupus Nephritis |

Figure 5 | Recent Technology Trends in Lupus Nephritis |

Figure 6 | Technology Evolution in Drug Delivery Market of Lupus Nephritis |

Figure 7 | Geographical Distribution of Patents of Top Assignees |

Figure 8 | Assignee Segmentation (Companies) |

Figure 9 | Assignee Segmentation (Educational Establishment) |

Figure 10 | Patent Based Key Insights Of xx |

Figure 11 | Patent Based Key insights of xx |

Figure 12 | Patent Based Key insights of xx |

Figure 13 | Geographic Distribution of the Universities/Research Organizations Filling Patents On Various Drug Delivery Approaches |

Figure 14 | Key Summary Regarding the Patent Filing On Lupus Nephritis |

Figure 15 | Product Pipeline of Different Approaches with Companies Name |

Figure 16 | Portfolio for Approved Product |

Figure 17 | Clinical Trials Conducted till Date by Different Companies and Universities |

Figure 18 | Clinical Trials based Key Insights |

Figure 19 | Key Growth Drivers for Lupus Nephritis Market |

Figure 20 | Restraints for Lupus Nephritis Market |

Figure 21 | xx Portfolio (Top Player) |

Figure 22 | xx Portfolio (Top Player) |

Figure 23 | xx Portfolio (Top Player) |

Figure 24 | xx Portfolio (Top Player) |

Figure 25 | xx Portfolio (Top Player) |

Figure 26 | xx Portfolio (Start-up) |

Figure 27 | xx Portfolio (Start-up) |

Figure 28 | xx Portfolio (Start-up) |

Figure 29 | Strategic Activities Including Collaboration, Partnerships and Acquisitions |

Figure 30 | Research Methodology for Patent, Selection and Analysis |

Figure 31 | Research Methodology for Scientific Literature, Selection and Analysis |

Figure 32 | Research Methodology for Clinical Trials, Selection and Analysis |

LIST OF GRAPHS

Graph number |

Description |

Graph 1 | Number of people worldwide with Lupus Nephritis |

Graph 2 | Problem Solution Analysis |

Graph 3 | Top Assignees in Lupus Nephritis |

Graph 4 | Technology Focus of Top Assignees (IPC-CPC Classes) |

Graph 5 | Top Countries of Origin of Patents |

Graph 6 | New entrants in drug delivery field |

Graph 7 | Legal Status |

Graph 8 | Most Cited Patents |

Graph 9 | Patents with Largest Invention Families |

Graph 10 | Most Claim-Heavy Patents |

Graph 11 | Filing Trends |

Graph 12 | Literature Filling Trend During Time Period (2018 – 2023) |

Graph 13 | Clinical Trial Filing Timeline |

Graph 14 | Recruitment Status of the Clinical Trials Related to the Different Drug Delivery Approaches |

Graph 15 | Clinical Trials Phases with Respect to Specific Drug Delivery Approach |

Graph 16 | Weighted Scores for Top 64 Players According to Benchmarking Criteria |

Graph 17 | Lupus Nephritis (CAGR: 2023-2033) |

Graph 18 | Lupus Nephritis Market Share: Distribution by Key Geographical Area, 2023-2033 |

LIST OF TABLES

Table number | Description |

Table 1 | Parameters included and excluded for conducting the analysis |

Table 2 | Technology Classes with Definitions |

Table 3 | Patent Litigation |

Table 4 | Highest Market Valued Patents |

Table 5 | SWOT Analysis of Top 3 Players |

Table 6 | Parameters and their score for Benchmarking |

Table 7 | Weighted scores for top 5 players according to benchmarking criteria |

Please Subscribe our news letter and get update.

© Copyright 2024 – Wissen Research All Rights Reserved.