Ophthalmic Equipment Market by Product Type (Diagnostic And Monitoring Devices, Surgical Devices, Vision Care), Application Type (Vision Care, Ophthalmic, Wound care, Cataract Surgery, Oculoplastic, Others), End User (Hospitals, Consumers, Speciality Clinics And Ambulatory Surgery Centers), Regions, Key Players – Global Forecast to 2030

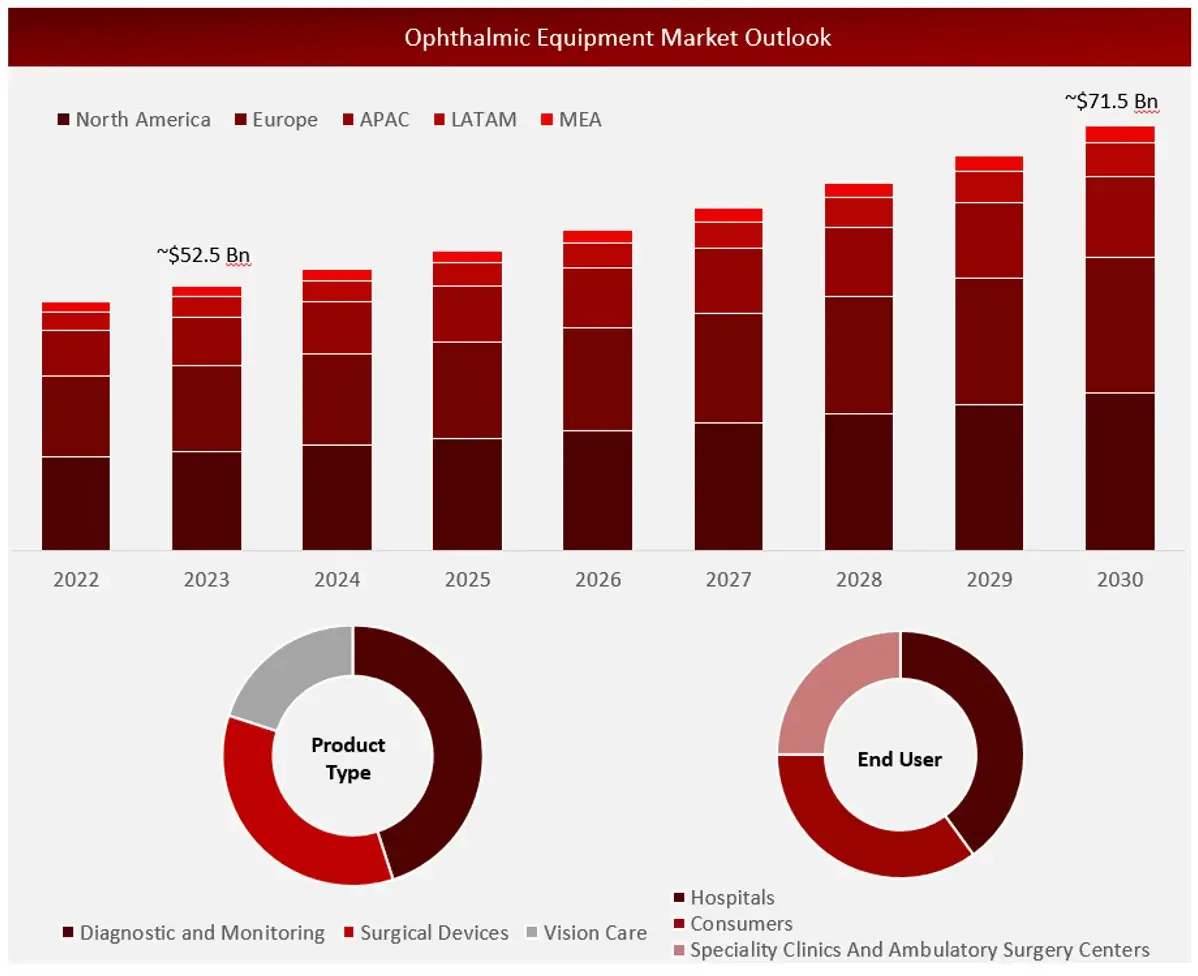

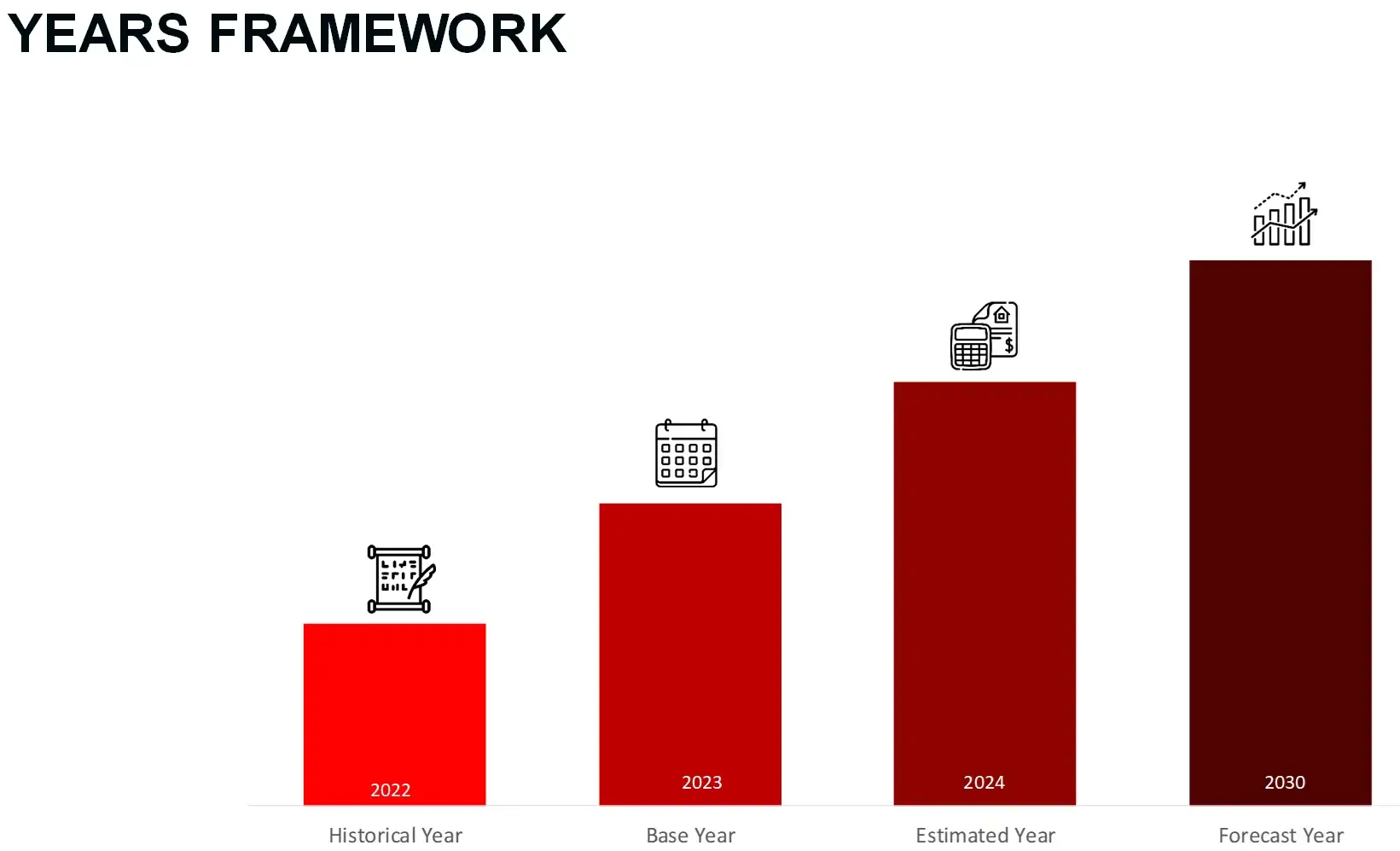

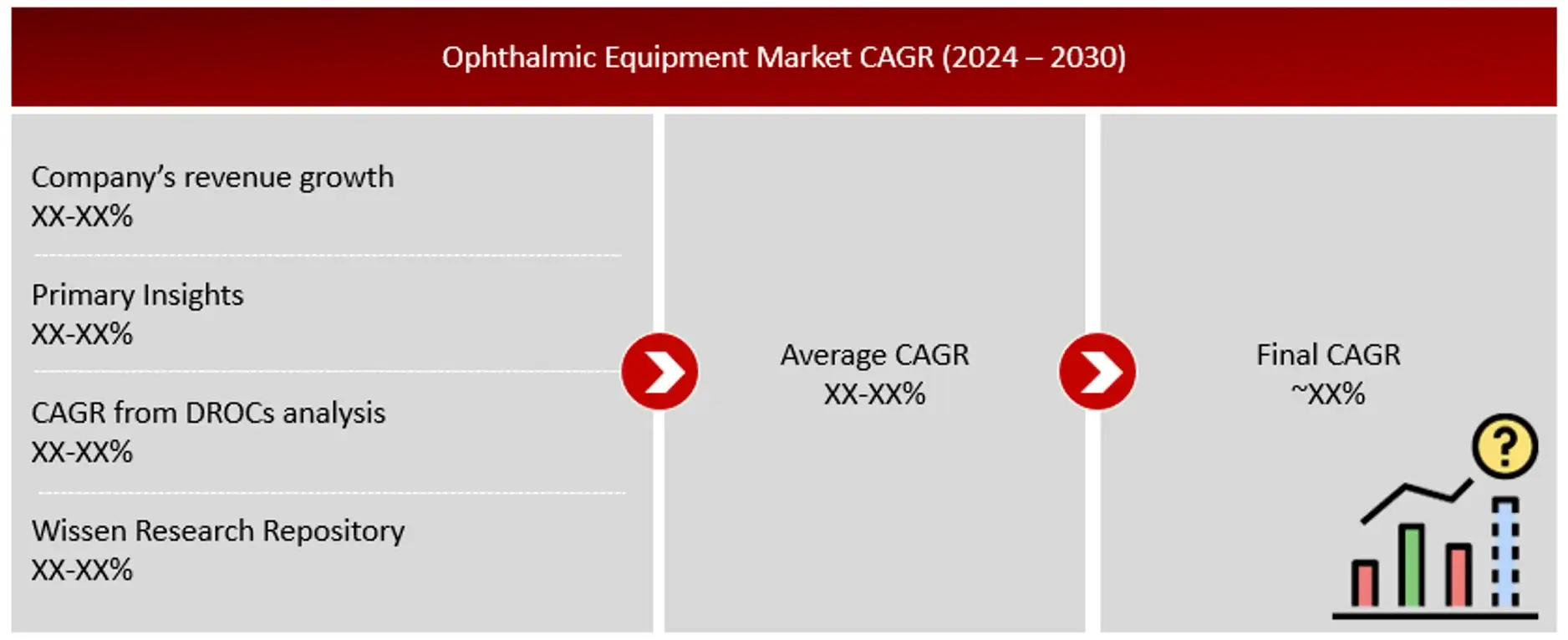

Wissen Research analyses that the global ophthalmic equipment market is estimated at ~USD 52.5 billion in 2023 and is projected to reach ~USD 71.5 billion by 2030, expected to grow at a CAGR of ~4.5% during the forecast period, 2023-2030.

The new research study offers a comprehensive analysis of the ophthalmic equipment market, focusing on industry trends, pricing strategies, patent developments, and materials from conferences and webinars. It examines the role of key stakeholders and consumer buying behavior within the market. The study underscores the high prevalence of eye conditions like cataracts, glaucoma, and other vision-related disorders, which drives demand for advanced ophthalmic equipment. This equipment, used in procedures such as LASIK, cataract surgery, refractive surgery, and treatments for glaucoma, retinal, and corneal conditions, is gaining traction due to its precision, accuracy, and significant return on investment for ophthalmologists. These factors collectively contribute to the market’s growth.

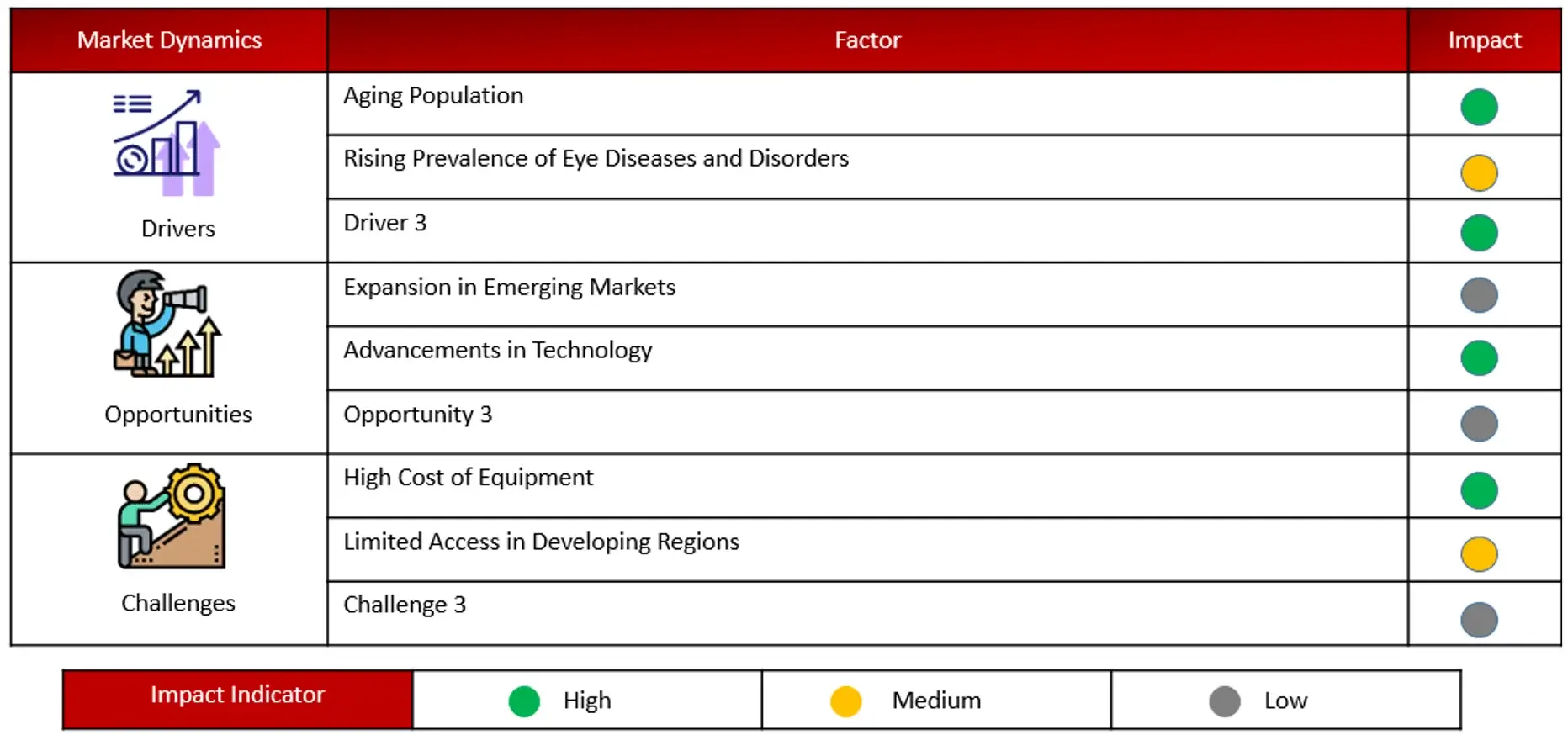

Driving Factor: Age and UV Exposure Drive Eye Disorder Rise

A significant factor in the development of eye-related disorders is age. The increasing global population and prolonged exposure to UV screens are contributing to a rise in these conditions. Common eye disorders include diabetic retinopathy, glaucoma, cataracts, corneal opacities, trachoma, and refractive errors. The growing prevalence of diabetic retinopathy, a major concern for individuals with diabetes, has spurred demand for advanced imaging and laser treatments. Innovations such as femtosecond lasers and phacoemulsification systems for cataract treatment offer promising solutions in the global effort to combat vision loss.

Opportunity: Limited use of phacoemulsification devices and premium IOLs in developing regions

Phacoemulsification is a key method for cataract surgery, widely used worldwide but less so in emerging regions like Asia, due to high costs and limited reimbursement for premium lenses. In India, this technique is used in 17% of cataract surgeries, with only 8% involving premium lenses. Affordable premium lenses could drive market growth in Asia Pacific and Latin America, despite the higher costs of equipment and advanced intraocular lenses compared to traditional methods.

Challenge: Shortage of qualified practitioners

The demand for skilled professionals in ophthalmology has been growing steadily, driven by the increasing prevalence of eye-related conditions and the need for advanced diagnostic and surgical procedures. However, the number of qualified practitioners has not kept pace with this demand. Initially, this shortage was more pronounced in emerging regions, where healthcare infrastructure and training opportunities are often limited. However, even mature markets, which typically have more developed healthcare systems, are now experiencing similar challenges due to an aging population and a surge in the need for specialized eye care. This shortage of skilled professionals creates significant barriers to the adoption of advanced ophthalmic technologies. While innovations in diagnostic imaging and surgical equipment have the potential to greatly enhance patient outcomes, the lack of adequately trained practitioners means these tools are underutilized. Without enough skilled users to operate sophisticated technology effectively, healthcare providers are unable to fully implement or benefit from these advancements, ultimately hindering the growth and progress of the ophthalmology field.

Sources: Company Websites and Wissen Research Analysis.

Sources: Company Websites and Wissen Research Analysis.

The vision care segment represented the largest portion of the ophthalmic equipment market

The ophthalmic equipment market is experiencing significant growth due to an aging population and increasing awareness of eye health, with the Asia Pacific region leading this expansion. Factors such as government initiatives, technological advancements, and changing demographics are driving market development in countries like China, India, and Japan. The industry includes a broad range of products, from eyeglasses and contact lenses to advanced surgical instruments and diagnostic devices. Ensuring fair access to high-quality eye care is essential, which involves addressing infrastructure, affordability, and workforce challenges. Collaboration and innovation are key to achieving accessible eye care for all.

North America is projected to be the fastest-growing market in the ophthalmic equipment industry

The North American region of the ophthalmic equipment market, with some of the highest healthcare spending rates globally, invests heavily in cutting-edge ophthalmic technology. This fosters the development and adoption of advanced technology for preventive care and vision restoration. The region hosts leading research facilities and medical centers specializing in ocular research and development, creating a dynamic environment that drives innovation and leads to a continuous influx of new and improved equipment. Additionally, the aging population in North America, with an increase in age-related eye conditions such as cataracts and macular degeneration, further boosts the demand for diagnostic and therapeutic equipment.

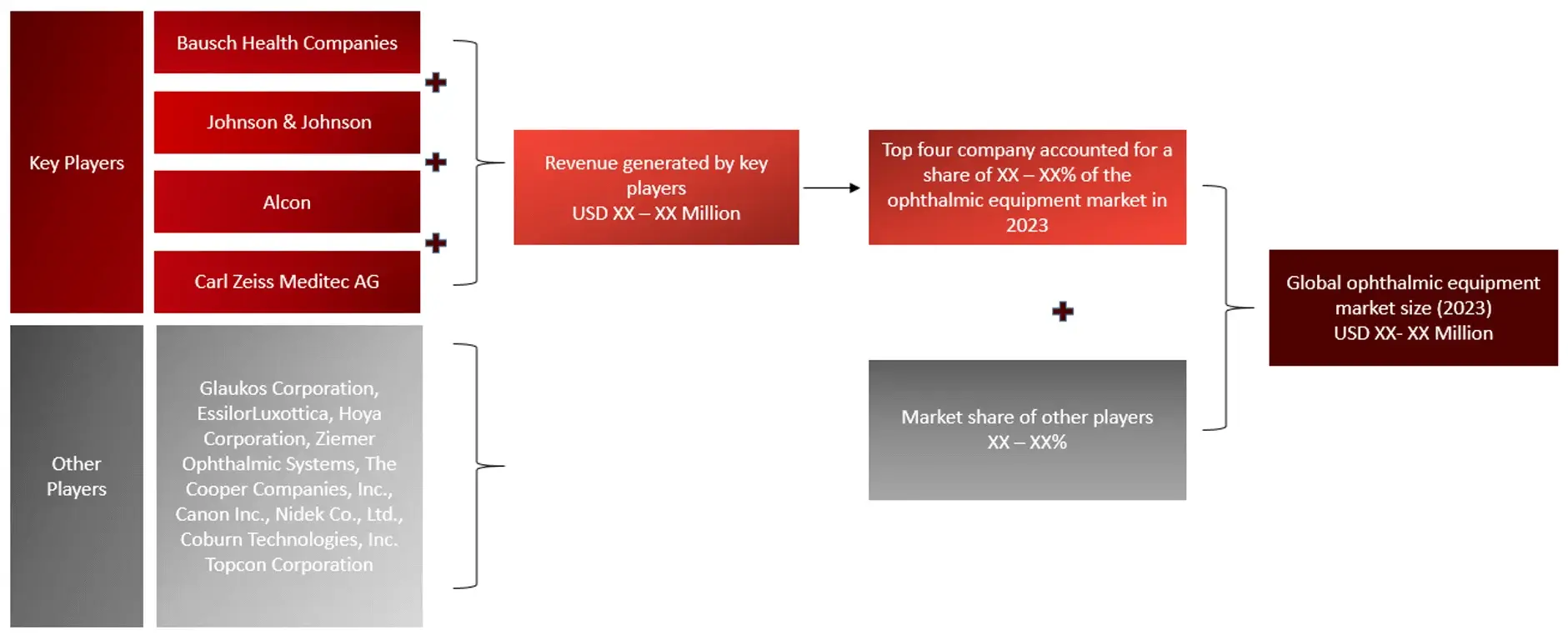

Major Companies and Market Share Insights in Ophthalmic Equipment Market

Major players operating in ophthalmic equipment market are Bausch + Lomb Corporation , Johnson & Johnson (US), Alcon (Switzerland), Carl Zeiss Meditec AG (Germany), Glaukos Corporation (US), EssilorLuxottica (France), Hoya Corporation (Japan), Ziemer Ophthalmic Systems (Switzerland), The Cooper Companies, Inc.(US), Canon Inc. (Japan), Nidek Co., Ltd. (Japan), Coburn Technologies, Inc. (US), Topcon Corporation (Japan), Staar Surgical (US), Haag-Streit (Switzerland), Quantel Medical (US), FCI Ophthalmics (US), among others.

Introduction

Market Definition

The ophthalmic equipment market includes devices and instruments used for diagnosing, treating, and managing eye conditions and vision disorders. It encompasses diagnostic tools like auto-refractors and OCT systems, surgical instruments for eye surgeries, therapeutic devices such as laser systems, and vision correction products like eyeglasses and contact lenses. The market serves hospitals, eye clinics, optometrists, and retail optical stores. Growth in this sector is driven by technological advancements, increasing eye disorder prevalence, and heightened awareness of eye health.

Sources: Company Websites and Wissen Research Analysis.

Sources: Company Websites and Wissen Research Analysis.

Sources: Wissen Research Analysis.

Sources: Wissen Research Analysis.Key Stakeholders

Key objectives of the Study

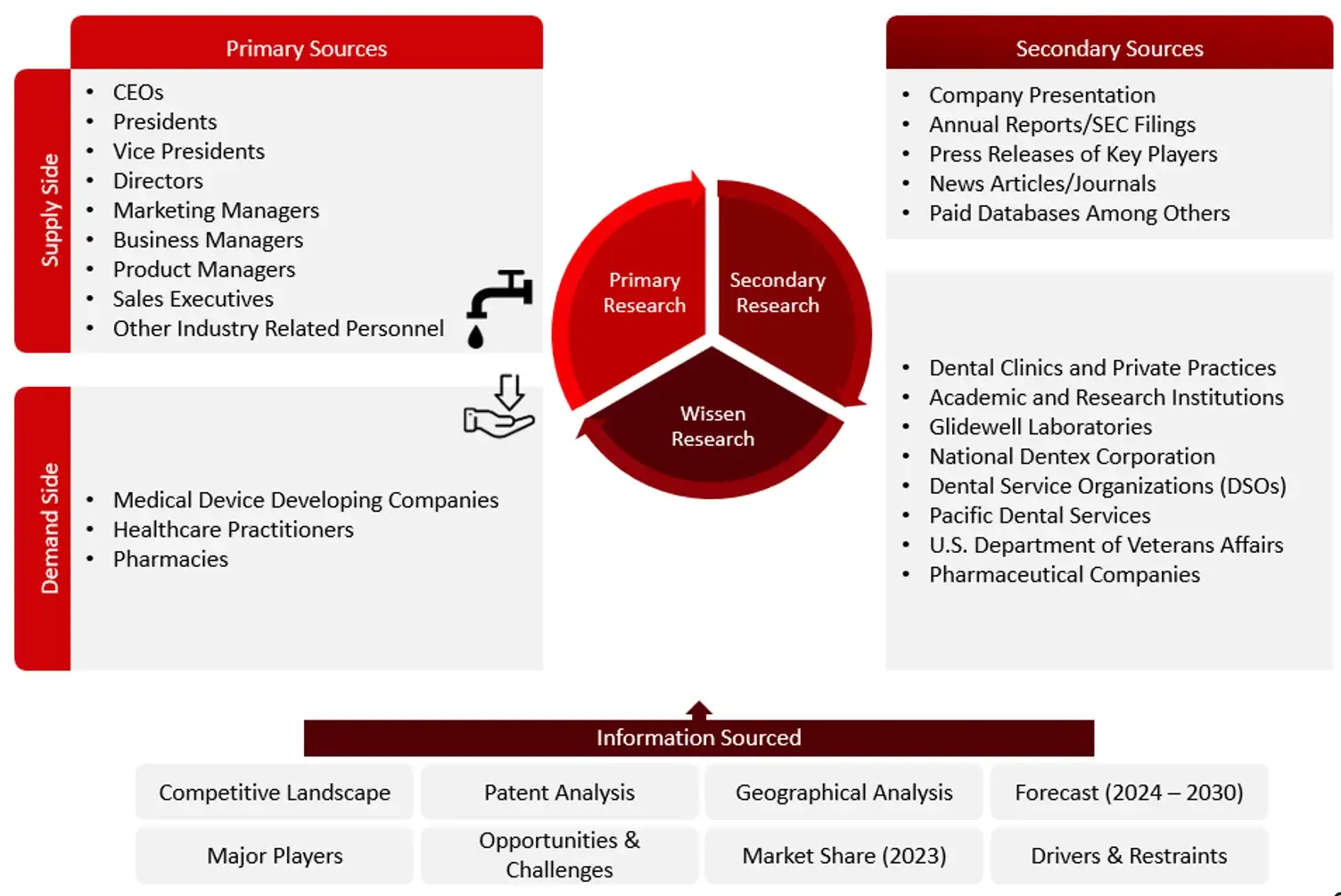

Research Methodology

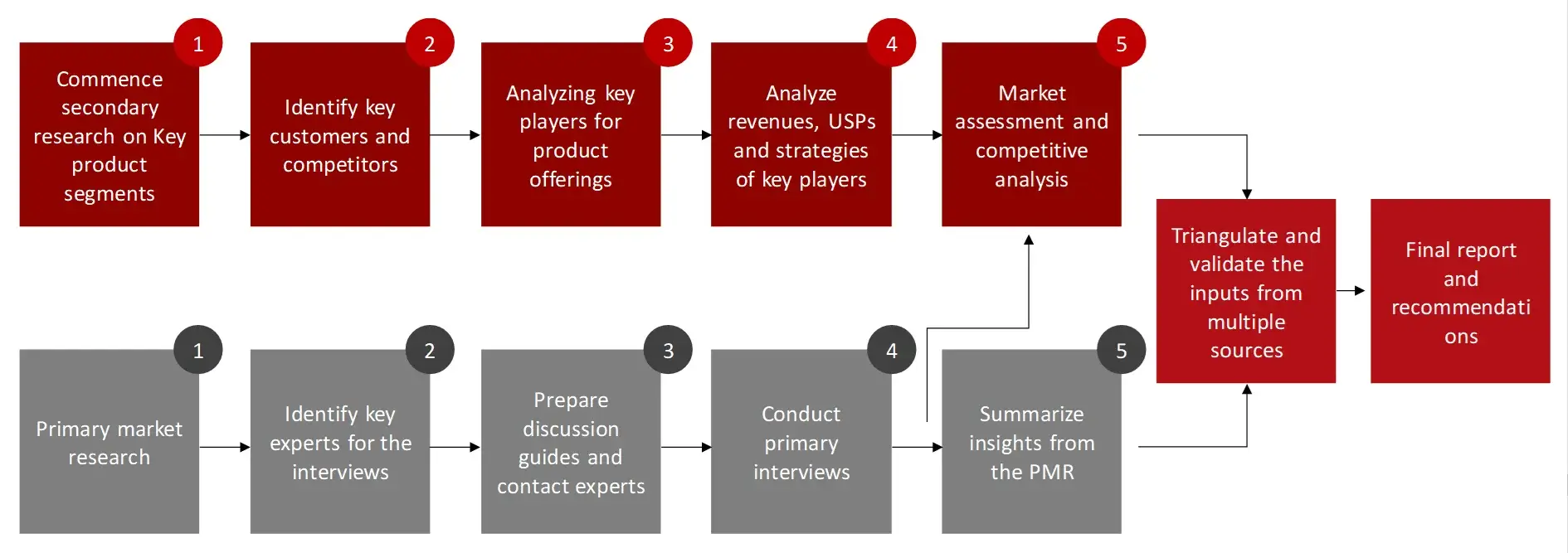

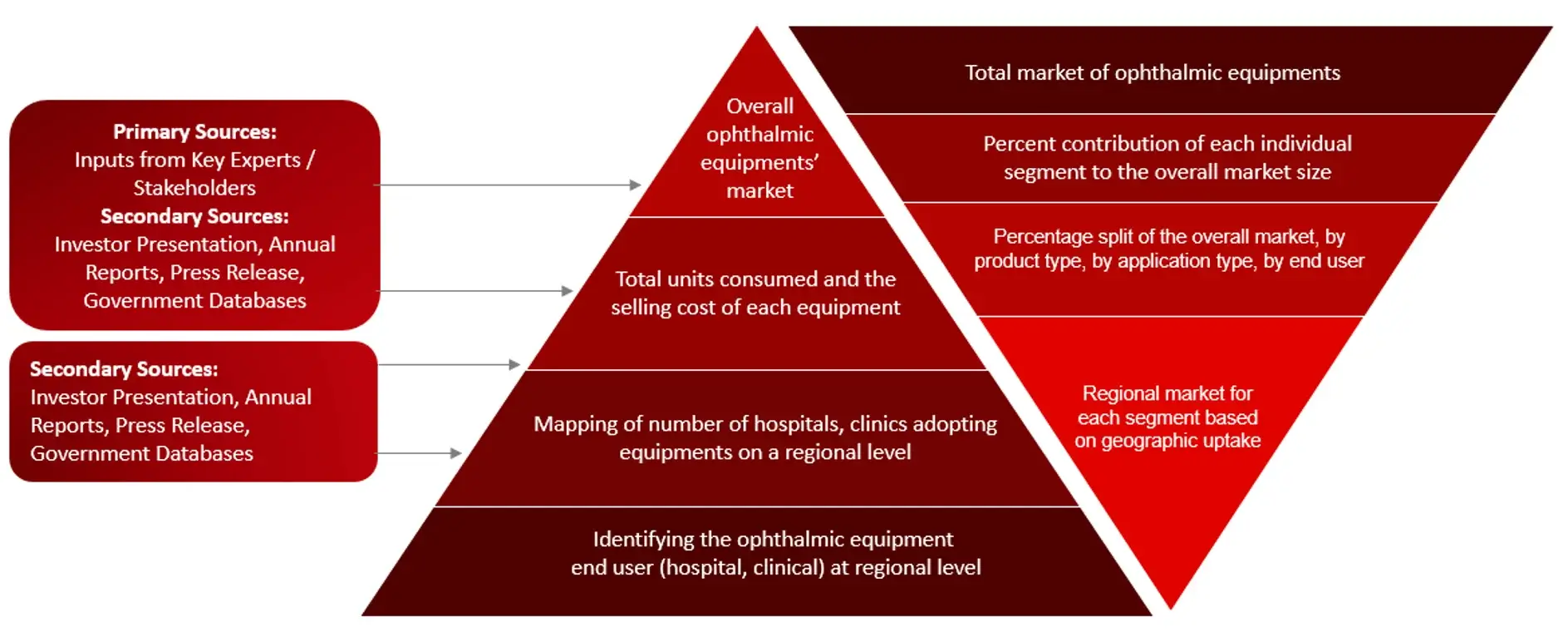

The aim of the study is to examine the key market forces such as drivers, opportunities, restraints, challenges, and strategies of key leaders. To monitor company advancements such as patents granted, product launches, expansions, and collaborations of key players, analyzing their competitive landscape based on various parameters of business and product strategy. Market sizing will be estimated using top-down and bottom-up approaches. Using market breakdown and data triangulation techniques, market sizing of segments and sub-segments will be estimated.

FIGURE: RESEARCH DESIGN

Sources: Wissen Research Analysis.

Sources: Wissen Research Analysis.Research Approach

Collecting Secondary Data

The process of collating secondary research data involves the utilization of databases, secondary sources, annual reports, investor presentations, directories, and SEC filings of companies. Secondary research will be utilized to identify and gather information beneficial for the in-depth, technical, market-oriented, and commercial analysis of the ophthalmic equipment market. A database of the key industry leaders will also be compiled using secondary research.

Collecting Primary Data

The primary research data will be conducted after acquiring knowledge about the ophthalmic equipment market scenario through secondary research. A significant number of primary interviews will be conducted with stakeholders from both the demand and supply side (including various industry experts, such as Vice Presidents (VPs), Chief X Officers (CXOs), Directors from business development, marketing and product development teams, product manufacturers) across major countries of Europe, Asia Pacific, North America, Latin America, and Middle East and Africa. Primary data for this report will be collected through questionnaires, emails, and telephonic interviews.

FIGURE: BREAKDOWN OF PRIMARY INTERVIEWS FROM SUPPLY SIDE

FIGURE: BREAKDOWN OF PRIMARY INTERVIEWS FROM DEMAND SIDE

FIGURE: PROPOSED PRIMARY PARTICIPANTS FROM DEMAND AND SUPPLY SIDE

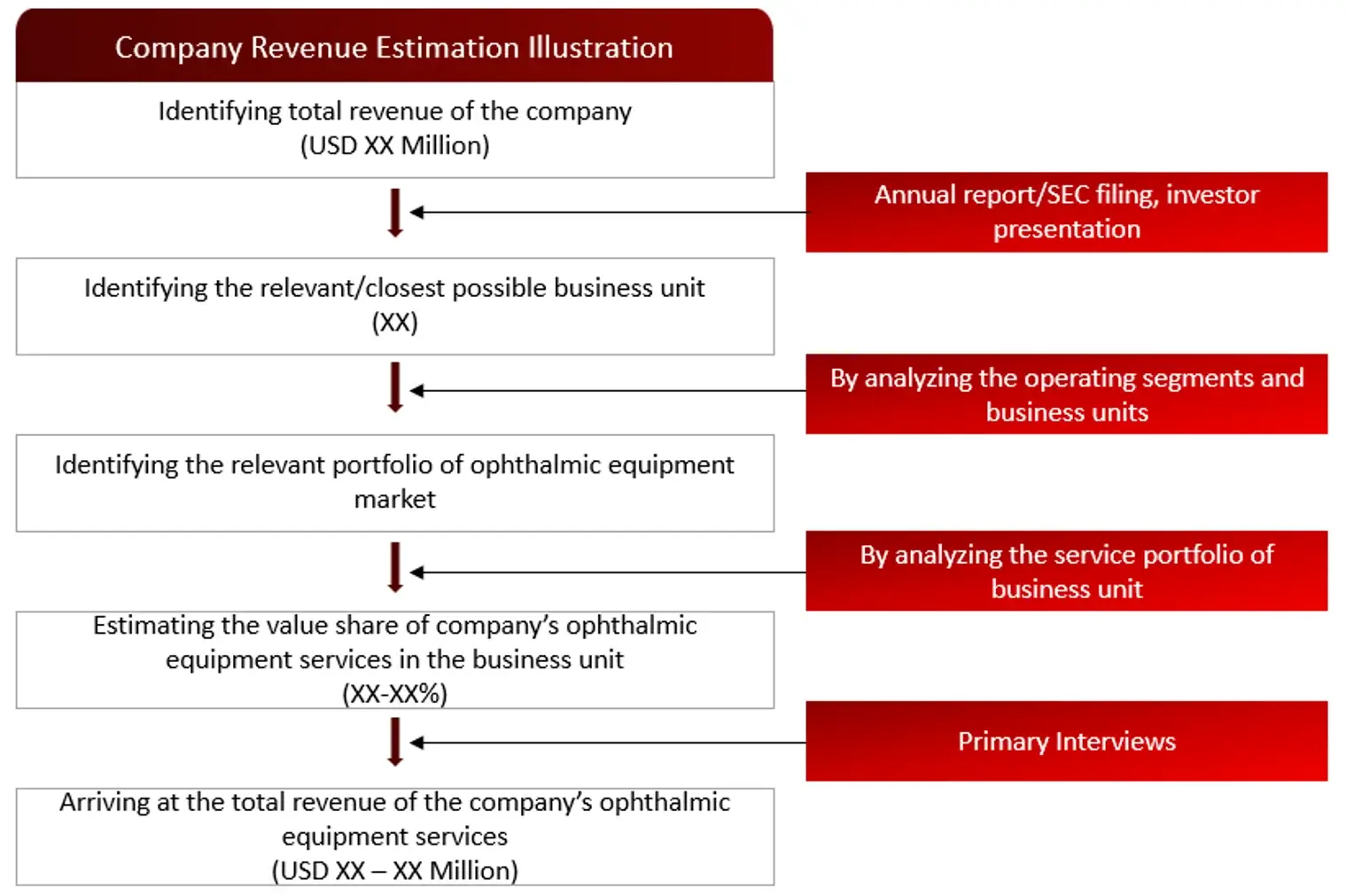

Market Size Estimation

All major manufacturers offering various ophthalmic equipment services will be identified at the global / regional level. Revenue mapping will be done for the major players, which will further be extrapolated to arrive at the global market value of each type of segment. The market value of ophthalmic equipment market will also split into various segments and sub segments at the region level based on:

FIGURE: REVENUE MAPPING BY COMPANY (ILLUSTRATION)

Sources: Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentation, Paid Database, and Wissen Research Analysis.

Sources: Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentation, Paid Database, and Wissen Research Analysis.FIGURE: REVENUE SHARE ANALYSIS OF KEY PLAYERS (SUPPLY SIDE)

Sources: Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentation, Paid Database, and Wissen Research Analysis.

Sources: Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentation, Paid Database, and Wissen Research Analysis.FIGURE: MARKET SIZE ESTIMATION TOP-DOWN AND BOTTOM-UP APPROACH

FIGURE: ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES FOR GROWTH FORECAST

Sources: Eyewear Manufacturers, University Health Centers, Colleges of Optometry and Medical Schools, Vision Care for Homeless People (VCHP), EyeCare America, Johnson & Johnson’s Health & Wellness Program, Orbis International, Pharmaceutical Companies Company Website, Press Releases, Annual Reports, Paid Data Sources, and Wissen Research Analysis.

Sources: Eyewear Manufacturers, University Health Centers, Colleges of Optometry and Medical Schools, Vision Care for Homeless People (VCHP), EyeCare America, Johnson & Johnson’s Health & Wellness Program, Orbis International, Pharmaceutical Companies Company Website, Press Releases, Annual Reports, Paid Data Sources, and Wissen Research Analysis.FIGURE: GROWTH FORECAST ANALYSIS UTILIZING MULTIPLE PARAMETERS

Sources: Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentation, Paid Database, and Wissen Research Analysis.

Sources: Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentation, Paid Database, and Wissen Research Analysis.Research Design

After arriving at the overall market size-using the market size estimation processes-the market will be split into several segments and sub segment. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub segment, the data triangulation, and market breakdown procedures will be employed, wherever applicable. The data will be triangulated by studying various factors and trends from both the demand and supply sides in the ophthalmic equipment market.

Sources: Eyewear Manufacturers, University Health Centers, Colleges of Optometry and Medical Schools, Vision Care for Homeless People (VCHP), EyeCare America, Johnson & Johnson’s Health & Wellness Program, Orbis International, Pharmaceutical Companies Company Website, Press Releases, Annual Reports, Paid Data Sources, and Wissen Research Analysis.

Sources: Eyewear Manufacturers, University Health Centers, Colleges of Optometry and Medical Schools, Vision Care for Homeless People (VCHP), EyeCare America, Johnson & Johnson’s Health & Wellness Program, Orbis International, Pharmaceutical Companies Company Website, Press Releases, Annual Reports, Paid Data Sources, and Wissen Research Analysis.1.1 Key Objectives

1.2 Definitions

1.2.1. In Scope

1.2.2. Out of Scope

1.3 Scope of the Report

1.4 Scope Related Limitations

1.5 Key Stakeholders

2. Research Methodology

2.1 Research Approach

2.2 Research Methodology / Design

2.3 Market Sizing Approach

2.3.1 Secondary Research

2.3.2 Primary Research

3. Executive Summary & Premium Content

3.1 Global Market Outlook

3.2 Key Market Findings

4. Market Overview

4.1 Market Dynamics

4.1.1 Drivers/Opportunities

4.1.2 Restraints/Challenges

4.2 End User Perception

4.3 Need Gap

4.4 Supply Chain / Value Chain Analysis

4.5 Industry Trends

4.6 Porter’s Five Forces Analysis

5. Patent Analysis

5.1 Patents Related to Ophthalmic Equipment Technologies/Devices

5.2. Patent Landscape and Intellectual Property Trends

6. Global Ophthalmic Equipment Market, by Product Type (2022-2030, USD Million)

6.1 Diagnostic and Monitoring Devices

6.1.1 Ophthalmic Ultrasound Imaging Systems

6.1.1.1 Ophthalmic A Scan Biometers

6.1.1.2 Ophthalmic B Scan Ultrasound

6.1.1.3 Ophthalmic Ubm Ultrasound

6.1.1.4 Ophthalmic Pachymeter

6.1.2 Optical Coherence Tomography Scanner

6.1.3 Fundus Camera

6.1.4 Ophthalmoscopes

6.1.5 Retinoscope

6.1.6 Phoropters

6.1.7 Specular Microscope

6.1.8 Perimeters/Visual Field Analysers

6.1.9 Tonometers

6.1.10 Slit Lamps

6.1.11 Lensmeter

6.1.12 Wavefront Aberrometer

6.1.13 Corneal Topography Systems

6.1.14 Autorefractors and Keratometers

6.1.15 Optical Biometry Systems

6.1.16 Chart Projectors

6.2 Surgical Devices

6.2.1 Cataract Surgery Devices

6.2.1.1 Intraocular Lens (IOLs)

6.2.1.2 Ophthalmic Viscoelastic Devices (OVDs)

6.2.1.3 Phacoemulsification Devices

6.2.1.4 Cataract Surgery Lasers

6.2.1.5 Intraocular Lens (IOL) Injectors

6.2.2 Vitreoretinal Surgery Devices

6.2.2.1 Vitrectomy Machines

6.2.2.2 Vitreoretinal Packs

6.2.2.3 Photocoagulation Lasers

6.2.2.4 Illumination Devices

6.2.2.5 Vitrectomy Probes

6.2.2.6 Backflush

6.2.2.7 Chandelier

6.2.3 Glaucoma Surgery Devices

6.2.3.1 Glaucoma Drainage Devices (GDDs)

6.2.3.2 Microinvasive Glaucoma Surgery Devices

6.2.3.3 Glaucoma Laser Systems

6.2.4 Refractive Surgery Devices

6.2.4.1 Excimer Lasers

6.2.4.2 Femtosecond Lasers

6.2.4.3 Other Lasers

6.2.5 Ophthalmic Microscopes

6.2.6 Accessories

6.2.6.1 Surgical Sets & Instruments

6.2.6.2 Tips & Handles

6.2.6.3 Scissors

6.2.6.4 Forceps

6.2.6.5 Spatulas

6.2.6.6 Macular Lenses

6.2.6.7 Cannulas

6.2.6.8 Other Ophthalmic Surgical Accessories

6.3 Vision Care

6.3.1 Contact Lenses

6.3.1.1 Soft

6.3.1.2 Rigid Gas Permeable (RGP)

6.3.1.3 Hybrid

6.3.2 Spectacles

7. Global Ophthalmic Equipment Market, by Application (2022-2030, USD Million)

7.1 Vision Care

7.2 Ophthalmic

7.3 Wound care

7.4 Cataract Surgery

7.5 Oculoplastic

7.6 Others (Pediatric, Veterinary, etc.)

8. Global Ophthalmic Equipment Market, by End User (2022-2030, USD Million)

8.1 Hospitals

8.2 Consumers

8.3 Speciality Clinics and Ambulatory Surgery Centers

8.4 Other End Users

9. Global Ophthalmic Equipment Market, by Region (2022-2030, USD Million)

9.1 North America

9.1.1 US

9.1.2 Canada

9.2 Europe

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 Italy

9.2.5 UK

9.2.6 Rest of the Europe

9.3 Asia Pacific

9.3.1 China

9.3.2 Japan

9.3.3 India

9.3.4 Australia and New Zealand

9.3.5 South Korea

9.3.6 Rest of the Asia Pacific

9.4 Middle East and Africa

9.5 Latin America

10. Competitive Analysis

10.1 Key Players Footprint Analysis

10.2 Market Share Analysis

10.3 Key Brand Analysis

10.4 Regional Snapshot of Key Players

10.5 R&D Expenditure of Key Players

11. Company Profiles2

11.1 Bausch + Lomb Corporation.

11.1.1 Business Overview

11.1.2 Product Portfolio

11.1.3 Financial Snapshot3

11.1.4 Recent Developments

11.1.5 SWOT Analysis

11.2 Johnson & Johnson

11.3 Alcon

11.4 Carl Zeiss Meditec AG

11.5 Glaukos Corporation

11.6 EssilorLuxottica

11.7 Hoya Corporation

11.8 The Cooper Companies, Inc.

11.9 Ziemer Ophthalmic Systems

11.10 Canon Inc.

11.11 Nidek Co., Ltd.

11.12 Coburn Technologies, Inc.

11.13 Topcon Corporation

11.14 Haag-Streit

11.15 Quantel Medical

11.16 FCI Ophthalmics

11.17 Staar Surgical

12. Conclusion

13. Appendix

13.1 Industry Speak

13.2 Questionnaire

13.3 Available Custom Work

13.4 Adjacent Studies

13.5 Authors

14. References

Key Notes:

© Copyright 2024 – Wissen Research All Rights Reserved.