Pharmaceutical Packaging Equipment Market by Product (Sachet Packaging, Soft-Tube Filling and Sealing, Blister Packaging), Formulation (Syrup Packaging, Tablet Packaging, Patch Filling), Technology, End User, Regions, Key Players – Global Forecast to 2030

Sources: Company Websites and Wissen Research Analysis.

Sources: Company Websites and Wissen Research Analysis.

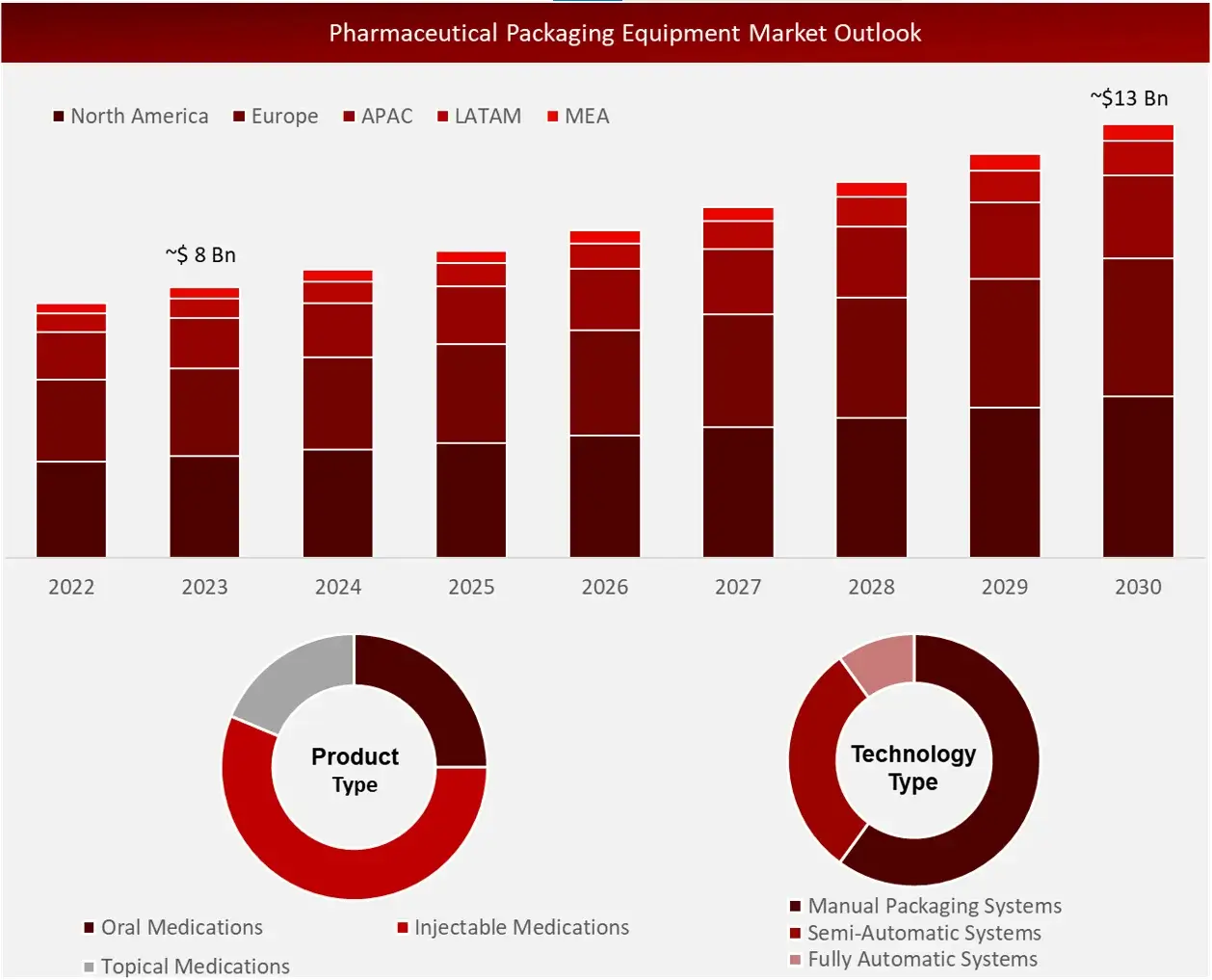

Wissen Research analyses that the pharmaceutical packaging equipment market is estimated at ~USD 8 billion in 2023 and is projected to reach ~USD 13 billion by 2030, expected to grow at a CAGR of ~7% during the forecast period, 2024-2030.

The sector for pharmaceutical packaging equipment includes the field responsible for creating, producing, and providing machinery utilized in packaging pharmaceutical items. This market is essential in making sure that medicines are packaged safely and effectively to preserve their effectiveness, adhere to regulations, and meet customer demands.

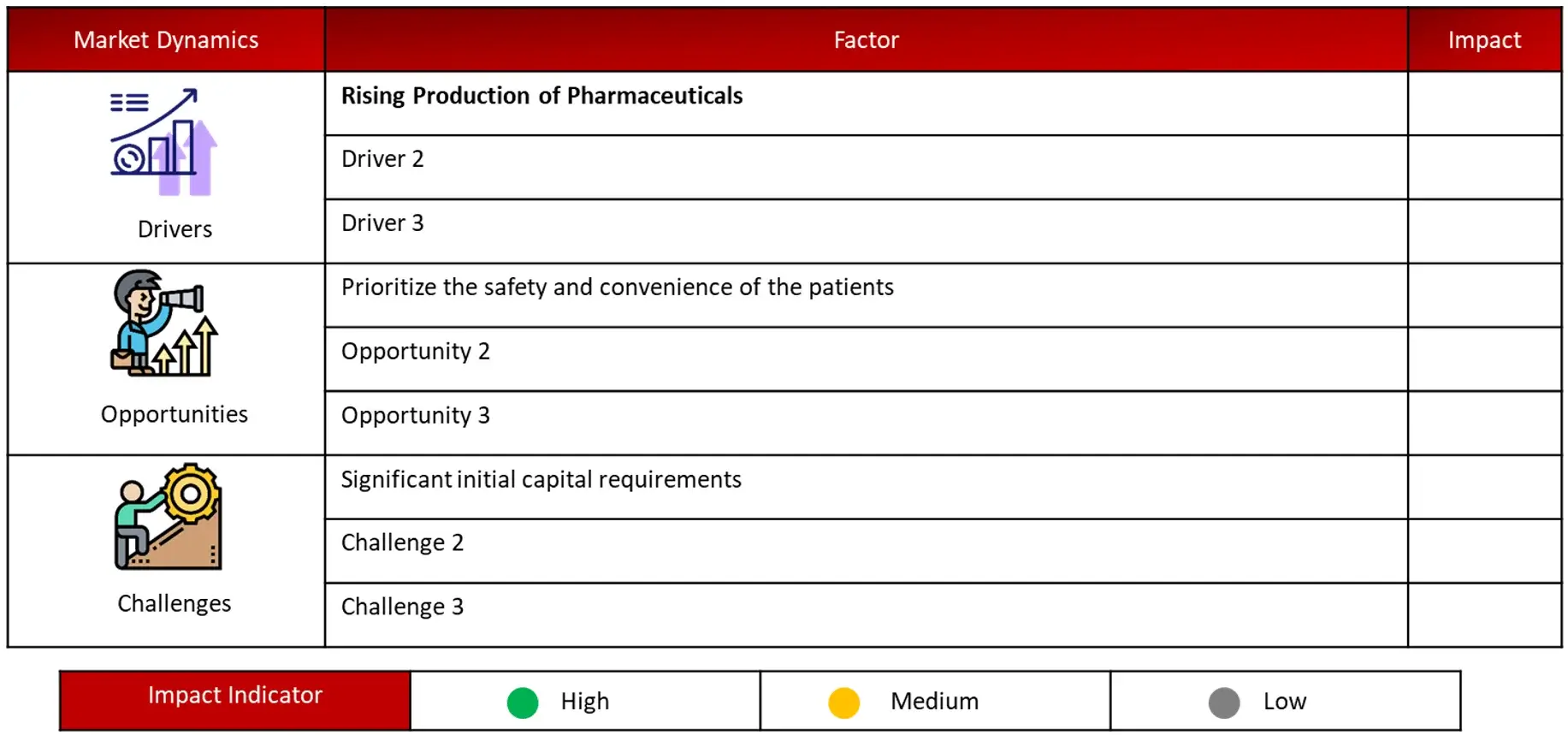

Driving Factor: Rising Production of Pharmaceuticals

The sales of pharmaceutical equipment worldwide are increasing due to reasons like an aging population, higher rates of chronic illnesses, and improved healthcare availability in developing areas. The increasing demand is causing pharmaceutical manufacturers to feel the need to enhance their production capacity. To meet the rising production needs, pharmaceutical companies are investing in high-tech packaging machinery. These machines improve both production efficiency and the quality and integrity of the packaged products. Thanks to automation and technological progress, contemporary packaging machinery is capable of processing high quantities of pharmaceuticals without compromising on strict quality requirements.

Opportunity: Prioritize the safety and convenience of the patients

The pharmaceutical sector is placing more attention on creating packaging solutions that prioritize safety, convenience, and usability for the patient. This is particularly important for groups like the elderly or those with disabilities, who may struggle with traditional packaging. Packaging designed with the patient in mind includes elements like simple-to-open packaging, explicit instructions, and tools to help with dosing to enhance medication compliance and lower the chances of medication mistakes. Furthermore, there are ongoing developments in packaging such as blister packs, unit-dose packaging, and smart packaging that include electronic monitoring to improve patient safety and convenience. This focus on packaging centered around the patient offers great potential for creativity and expansion in the market.

Challenge: Significant initial capital requirements

The pharmaceutical sector is famous for its significant hurdles for new entrants, especially with regards to the initial financial outlay. Small and medium-sized pharmaceutical companies may find the expenses related to acquiring and integrating advanced packaging machinery to be too high. These companies frequently work with limited budgets in comparison to bigger pharmaceutical companies, making it difficult to rationalize the initial cost of adopting new packaging technologies. Moreover, small and medium-sized businesses may not have the financial means and infrastructure required to facilitate the incorporation of advanced packaging machinery into their current processes, thus hindering market expansion.

Sources: Company Websites and Wissen Research Analysis.

Sources: Company Websites and Wissen Research Analysis.

The labeling and serialization equipment is expected to experience the highest CAGR in pharmaceutical packaging equipment industry, based on product type.

The labeling and serialization equipment sector had the highest compound annual growth rate in the pharmaceutical packaging equipment market. Due to the fact that pharmaceutical & biopharmaceutical products are essential for maintaining and improving the health of humans and other living beings, pharmaceutical drug safety is regulated by strict quality requirements and standards set by government authorities. Taking these criteria into account, pharmaceutical items must be manufactured and packaged in a fully sterile setting. These elements are contributing to the expansion of this sector.

The Asia-Pacific region is experiencing fast growth and is projected to expand its market share

Asia-Pacific’s rapid growth in the pharmaceutical packaging equipment market is driven by its large and cost-effective manufacturing base, expanding healthcare sector, and advancements in packaging technology. Additionally, improving regulatory standards and market expansion opportunities contribute to the region’s increasing share in the global market. The combination of these factors positions Asia-Pacific as a key player in the pharmaceutical packaging industry, with continued growth expected in the coming years.

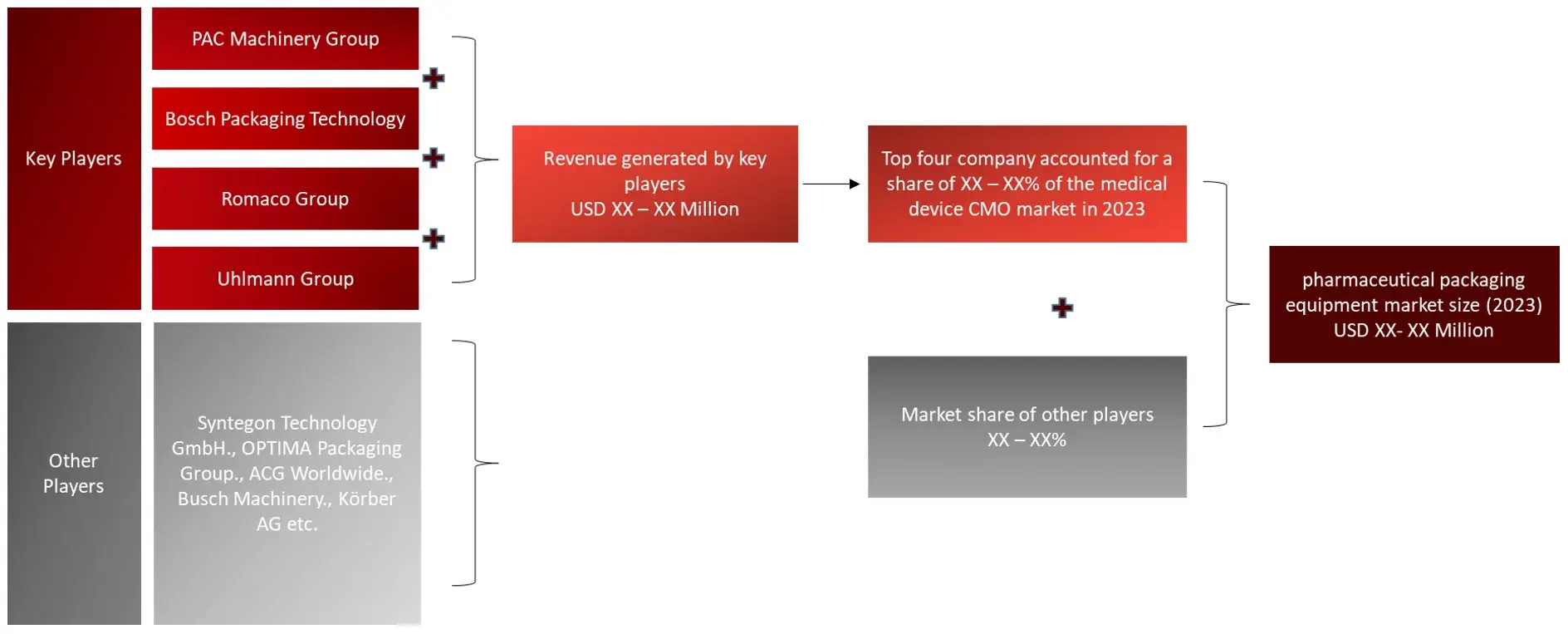

Major players operating in pharmaceutical packaging equipment market are Optima Packaging Group GmbH (Germany)., PAC Machinery Group (US)., Marchesini Group SPA (Italy)., MULTIVAC Group (Germany)., Bosch Packaging Technology (Germany)., Romaco Group(Germany) and Uhlmann Group (Germany) among others.

Recent Developments in Pharmaceutical Packaging Equipment Market :

Introduction

Market Definition

Pharmaceutical packaging machinery includes various types of equipment used in the pharmaceutical sector for the safe, secure, and efficient packaging of pharmaceutical products. This device is specifically crafted to meet the strict standards of the pharmaceutical industry, guaranteeing the safeguarding of goods from pollution, interference, and deterioration, all while preserving their excellence and reliability during the packaging procedure.

Sources: Company Websites and Wissen Research Analysis.

Sources: Company Websites and Wissen Research Analysis. Sources: Wissen Research Analysis.

Sources: Wissen Research Analysis.Key Stakeholders

Key objectives of the Study

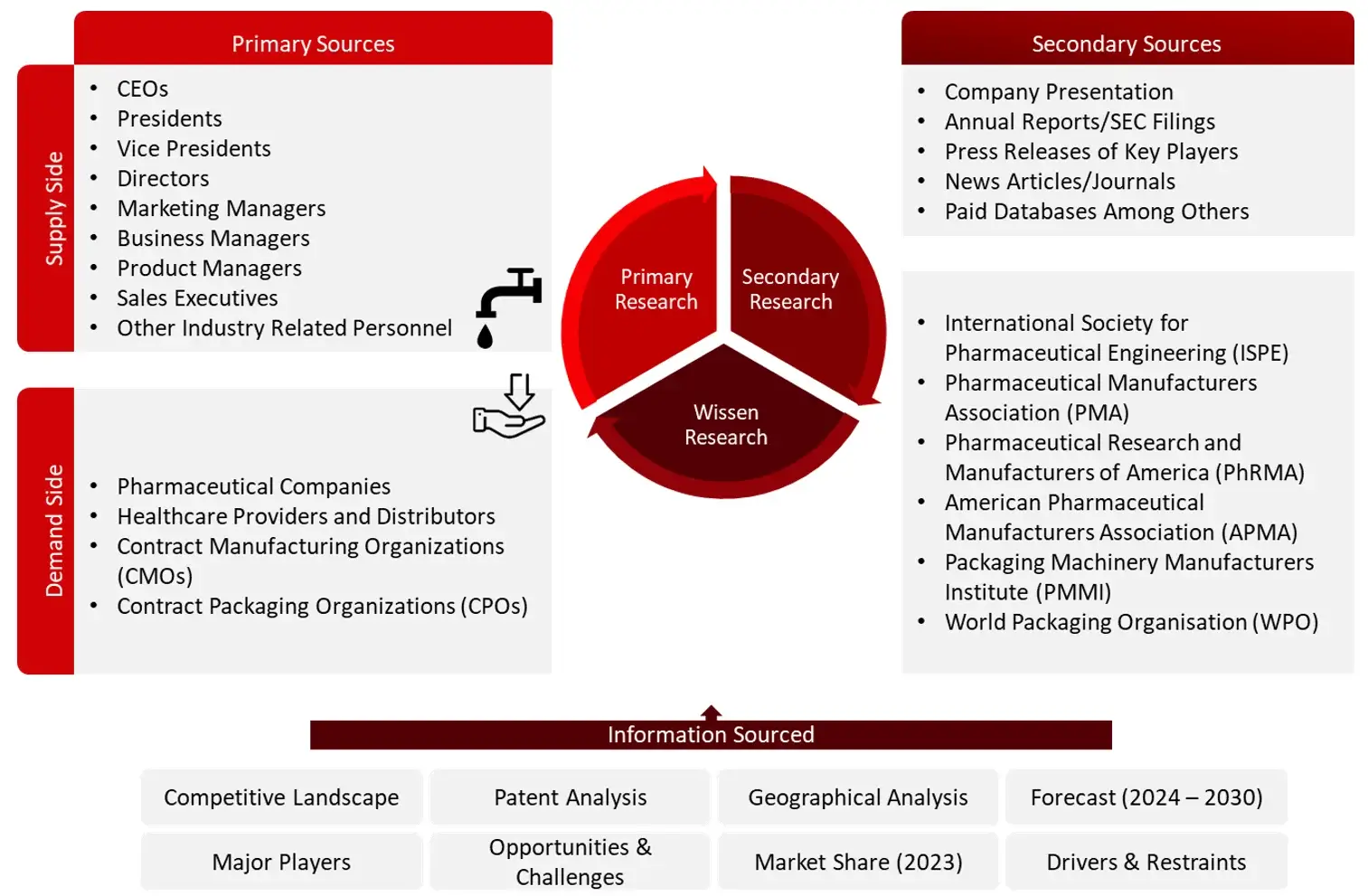

Research Methodology

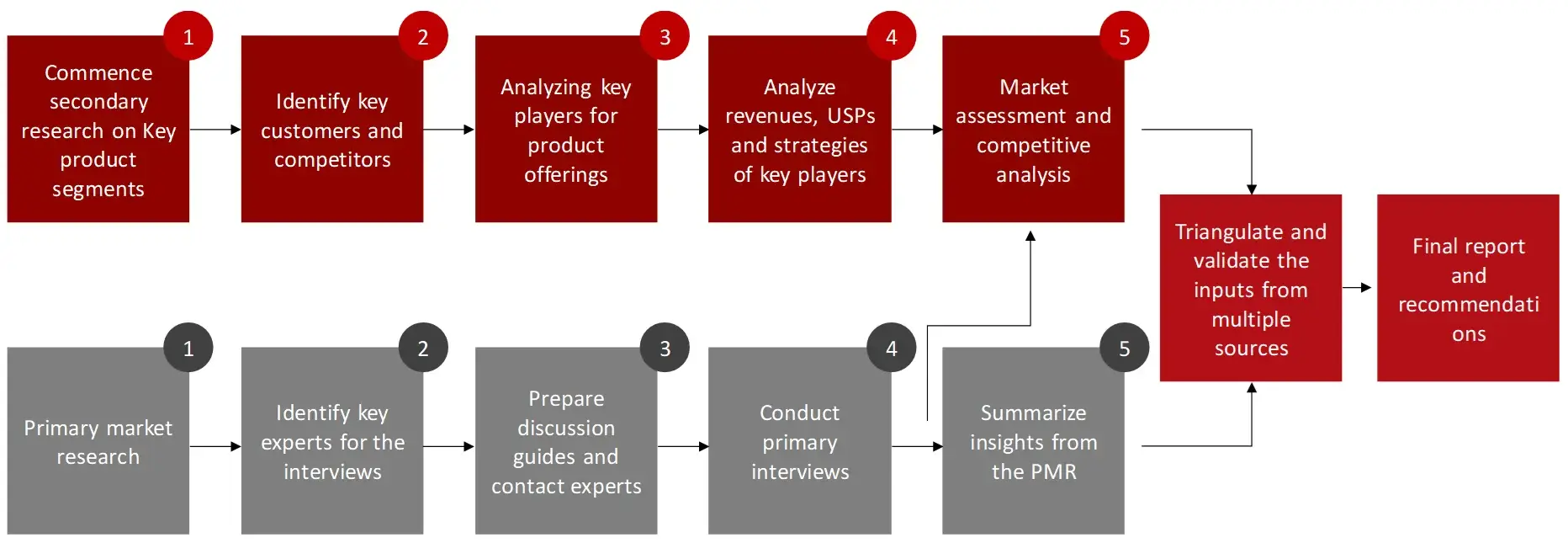

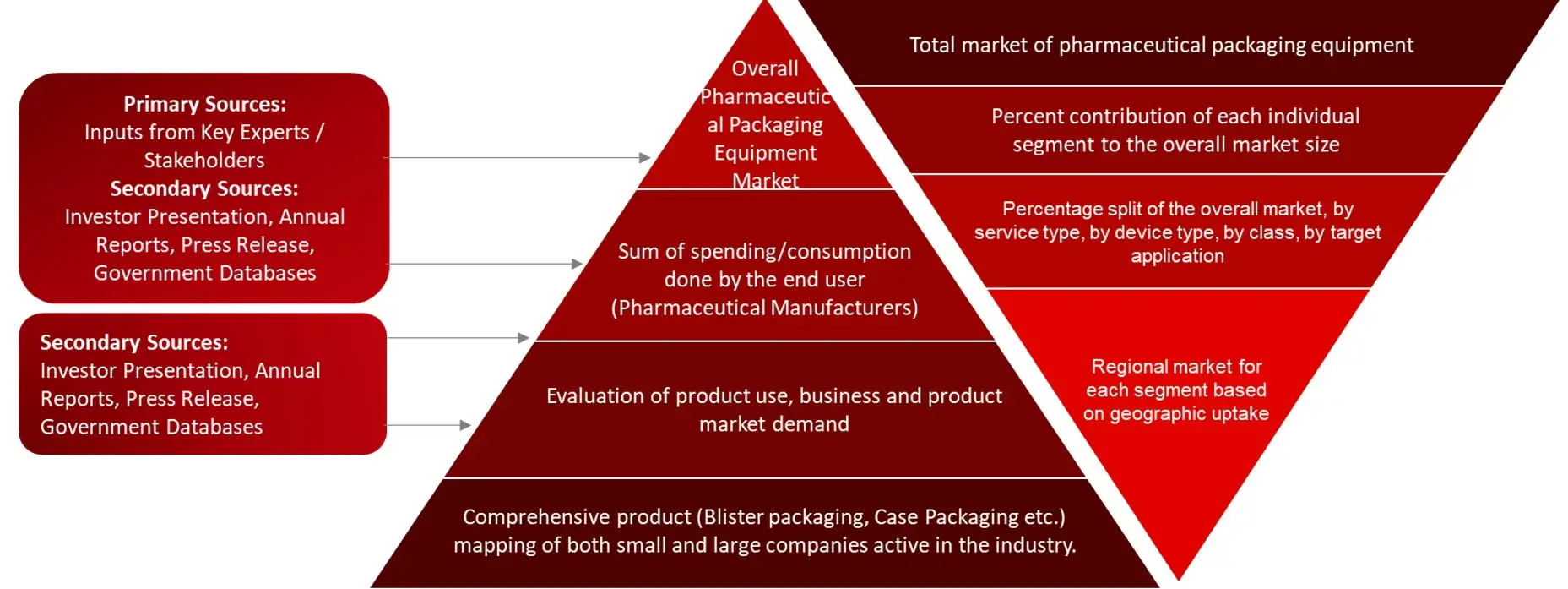

The aim of the study is to examine the key market forces such as drivers, opportunities, restraints, challenges, and strategies of key leaders. To monitor company advancements such as patents granted, product launches, expansions, and collaborations of key players, analyzing their competitive landscape based on various parameters of business and product strategy. Markey sizing will be estimated using top-down and bottom-up approaches. Using market breakdown and data triangulation techniques, market sizing of segments and sub-segments will be estimated.

FIGURE: RESEARCH DESIGN

Sources: Wissen Research Analysis.

Research Approach

Collecting Secondary Data

The process of collating secondary research data involves the utilization of databases, secondary sources, annual reports, investor presentations, directories, and SEC filings of companies. Secondary research will be utilized to identify and gather information beneficial for the in-depth, technical, market-oriented, and commercial analysis of the minimally invasive surgery market. A database of the key industry leaders will also be compiled using secondary research.

Collecting Primary Data

The primary research data will be conducted after acquiring knowledge about the pharmaceutical packaging equipment market scenario through secondary research. A significant number of primary interviews will be conducted with stakeholders from both the demand and supply side (including various industry experts, such as Vice Presidents (VPs), Chief X Officers (CXOs), Directors from business development, marketing and product development teams, product manufacturers) across major countries of Europe, Asia Pacific, North America, Latin America, and Middle East and Africa. Primary data for this report will be collected through questionnaires, emails, and telephonic interviews.

FIGURE: BREAKDOWN OF PRIMARY INTERVIEWS FROM SUPPLY SIDE

FIGURE: BREAKDOWN OF PRIMARY INTERVIEWS FROM DEMAND SIDE

FIGURE: PROPOSED PRIMARY PARTICIPANTS FROM DEMAND AND SUPPLY SIDE

Note: Above mention companies are non-exhaustive.

Note: Above mention companies are non-exhaustive. Market Size Estimation

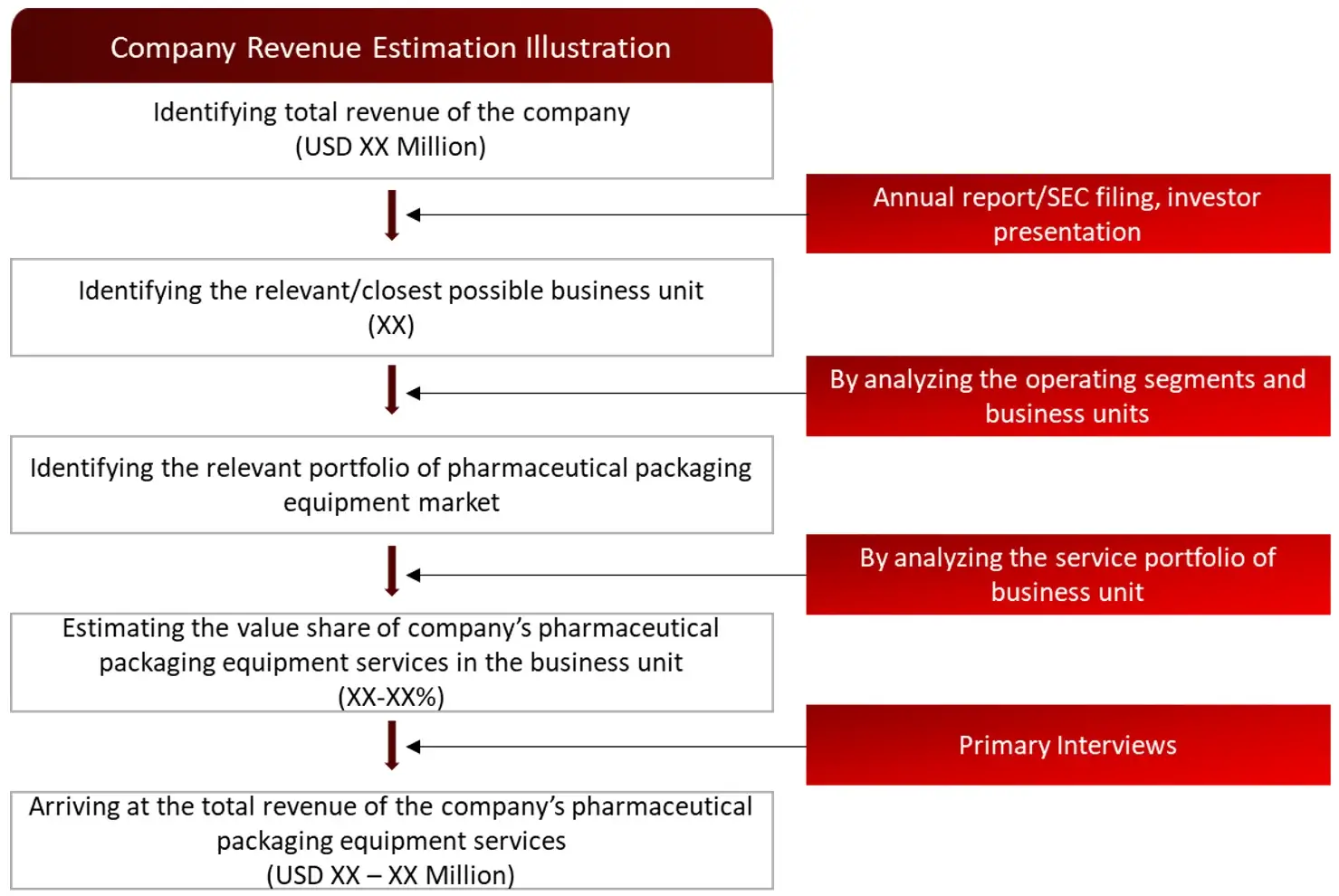

All major industries offering various pharmaceutical packaging equipment market sizing will be identified at the global/ regional level. Revenue mapping will be done for the major players, which will further be extrapolated to arrive at the global market value of each type of segment. The market value of pharmaceutical packaging equipment market will also split into various segments and sub segments at the region level based on:

FIGURE: REVENUE MAPPING BY COMPANY (ILLUSTRATION)

Sources: Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentation, Paid Database, and Wissen Research Analysis.

Sources: Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentation, Paid Database, and Wissen Research Analysis.FIGURE: REVENUE SHARE ANALYSIS OF KEY PLAYERS (SUPPLY SIDE)

Sources: Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentation, Paid Database, and Wissen Research Analysis.

Sources: Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentation, Paid Database, and Wissen Research Analysis.FIGURE: MARKET SIZE ESTIMATION TOP-DOWN AND BOTTOM-UP APPROACH

FIGURE: ANALYSIS OF DROCS FOR GROWTH FORECAST

Sources: International Society for Pharmaceutical Engineering (ISPE), Pharmaceutical Manufacturers Association (PMA), Pharmaceutical Research and Manufacturers of America (PhRMA), American Pharmaceutical Manufacturers Association (APMA), Packaging Machinery Manufacturers Institute (PMMI), World Packaging Organisation (WPO), Company Website, Press Releases, Annual Reports, Paid Data Sources, and Wissen Research Analysis.

Sources: International Society for Pharmaceutical Engineering (ISPE), Pharmaceutical Manufacturers Association (PMA), Pharmaceutical Research and Manufacturers of America (PhRMA), American Pharmaceutical Manufacturers Association (APMA), Packaging Machinery Manufacturers Institute (PMMI), World Packaging Organisation (WPO), Company Website, Press Releases, Annual Reports, Paid Data Sources, and Wissen Research Analysis.FIGURE: GROWTH FORECAST ANALYSIS UTILIZING MULTIPLE PARAMETERS

Sources: Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentation, Paid Database, and Wissen Research Analysis.

Sources: Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentation, Paid Database, and Wissen Research Analysis.Research Design

After arriving at the overall market size-using the market size estimation processes-the market will be split into several segments and sub segment. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub segment, the data triangulation, and market breakdown procedures will be employed, wherever applicable. The data will be triangulated by studying various factors and trends from both the demand and supply sides in the pharmaceutical packaging equipment market.

Sources: International Society for Pharmaceutical Engineering (ISPE), Pharmaceutical Manufacturers Association (PMA), Pharmaceutical Research and Manufacturers of America (PhRMA), American Pharmaceutical Manufacturers Association (APMA), Packaging Machinery Manufacturers Institute (PMMI), World Packaging Organisation (WPO), Company Website, Press Releases, Annual Reports, Paid Data Sources, and Wissen Research Analysis.

Sources: International Society for Pharmaceutical Engineering (ISPE), Pharmaceutical Manufacturers Association (PMA), Pharmaceutical Research and Manufacturers of America (PhRMA), American Pharmaceutical Manufacturers Association (APMA), Packaging Machinery Manufacturers Institute (PMMI), World Packaging Organisation (WPO), Company Website, Press Releases, Annual Reports, Paid Data Sources, and Wissen Research Analysis.1. Introduction

1.1 Key Objectives

1.2 Definitions

1.2.1 In Scope

1.2.2 Out of Scope

1.3 Scope of the Report

1.4 Scope Related Limitations

1.5 Key Stakeholders

2. Research Methodology

2.1 Research Approach

2.2 Research Methodology / Design

2.3 Market Sizing Approach

2.3.1 Secondary Research

2.3.2 Primary Research

3. Executive Summary & Premium Content

3.1 Global Market Outlook

3.2 Key Market Findings

4. Patent Analysis

4.1 Patents Related to Pharmaceutical Packaging Equipment

4.2 Patent Landscape and Intellectual Property Trends

5. Market Overview

5.1 Market Dynamics

5.1.1 Drivers/Opportunities

5.1.2 Restraints/Challenges

5.2 End User Perception

5.3 Need Gap

5.4 Supply Chain / Value Chain Analysis

5.5 Industry Trends

5.6 Pricing Analysis

5.7 Technology Analysis

5.8 Trade Analysis

5.9 Porter’s Five Forces Analysis

5.9.1 Bargaining power of suppliers

5.9.2 Bargaining powers of customers

5.9.3 Threat of new entrants

5.9.4 Rivalry among existing players

5.9.5 Threat of substitutes

6. Pharmaceutical Packaging Equipment Market, by Product Type (2022-2030, USD Million)

6.1 Introduction

6.2 Primary packaging equipment

6.2.1 Sachet Packaging Equipment

6.2.2 Soft-Tube Filling and Sealing Equipment

6.2.3 Blister Packaging Equipment

6.2.4 Aseptic Filling and Sealing Equipment

6.2.5 Bottle Filling and Capping Equipment

6.2.6 Strip Packaging Equipment

6.2.7 Counting Equipment

6.3 Secondary packaging equipment

6.3.1 Case Packing Equipment

6.3.2 Cartoning Equipment

6.3.3 Wrapping Equipment

6.3.4 Palletizing and Depalletizing Equipment

6.3.5 Tray Packing Equipment

6.4 Labeling and Serialization Equipment

6.4.1 Bottle and Ampoule Labeling and Serialization Equipment

6.4.2 Carton Labeling and Serialization Equipment

6.4.3 Data Matrix Labeling and Serialization Equipment

6.5 Tertiary Packaging Equipment

6.5.1 Bulk Packaging Systems

6.5.2 Palletizing and Depalletizing Equipment

6.5.3 Shrink Wrapping Machines

6.6 Others (End-of-Line Packaging Equipment, Cleanroom and Sterile Packaging Equipment etc.)

7. Pharmaceutical Packaging Equipment Market, by Formulation (2022-2030, USD Million)

7.1 Introduction

7.2 Liquid Packaging Equipment

7.2.1 Syrup Packaging Equipment

7.2.2 Eye/Ear Drop Packaging Equipment

7.2.3 Aerosol Packaging Equipment

7.2.4 Aseptic Liquid Packaging Equipment

7.3 Solid Packaging Equipment

7.3.1 Tablet Packaging Equipment

7.3.2 Capsule Packaging Equipment

7.3.3 Granule Packaging Equipment

7.3.4 Powder Packaging Equipment

7.4 Semi-Solid Packaging Equipment

7.4.1 Ointment Packaging Equipment

7.4.2 Suppository Packaging Equipment

7.4.3 Cream Packaging Equipment

7.5 Transdermal Patch Packaging Equipment

7.5.1 Patch Filling Machines

7.5.2 Laminating Machines

7.5.3 Cutting Machines

7.5.4 Packaging Machines

7.6 Pouch and Sachet Packaging Equipment

7.6.1 Vertical Form-Fill-Seal (VFFS) Machines

7.6.2 Horizontal Form-Fill-Seal (HFFS) Machines

7.6.3 Sachet Filling Machines

7.7 Bulk Packaging Equipment

7.7.1 Bulk Bagging Equipment

7.7.2 Bulk Filler Systems

7.7.3 Palletizing Equipment

7.8 Device and Combination Product Packaging Equipment

7.8.1 Medical Device Packaging Machines

7.8.2 Combination Product Packaging

7.9 Others (Biologics and Biopharmaceuticals Packaging Equipment, Custom and Specialty Packaging Equipment etc.)

8. Pharmaceutical Packaging Equipment Market, by Technology (2022-2030, USD Million)

8.1 Manual Packaging Systems

8.2 Semi-Automatic Systems

8.3 Fully Automatic Systems

9. Pharmaceutical Packaging Equipment Market, by End User (2022-2030, USD Million)

9.1 Pharmaceutical Manufacturers

9.1.1 Large Pharmaceutical Companies

9.1.2 Small and Medium-sized Enterprises (SMEs)

9.2 Contract Packaging Organizations (CPOs)

9.3 Contract Manufacturing Organizations (CMOs)

9.4 Biopharmaceutical Companies

9.5 Healthcare and Hospital Pharmacies

9.6 Regulatory and Quality Assurance Bodies

9.7 Research and Development (R&D) Facilities

9.8 Others (wholesalers, distributors, and e-commerce platforms etc.)

10. Pharmaceutical Packaging Equipment Market, by Region (2022-2030, USD Million)

10.1 North America

10.1.1 US

10.1.2 Canada

10.2 Europe

10.2.1 Germany

10.2.2 France

10.2.3 Spain

10.2.4 Italy

10.2.5 UK

10.2.6 Rest of the Europe

10.3 Asia Pacific

10.3.1 China

10.3.2 Japan

10.3.3 India

10.3.4 Australia and New Zealand

10.3.5 South Korea

10.3.6 Rest of the Asia Pacific

10.4 Middle East and Africa

10.5 Latin America

11. Competitive Analysis

11.1 Key Players Footprint Analysis

11.2 Market Share Analysis

11.3 Key Brand Analysis

11.4 Regional Snapshot of Key Players

11.5 R&D Expenditure of Key Players

12. Company Profiles2

12.1 Syntegon Technology GmbH

12.1.1 Business Overview

12.1.2 Product Portfolio

12.1.3 Financial Snapshot3

12.1.4 Recent Developments

12.1.5 SWOT Analysis

12.2 Vanguard Pharmaceutical Machinery

12.3 OPTIMA Packaging Group

12.4 ACG Worldwide

12.5 Trustar Pharma Pack Equipment, Co. Ltd.

12.6 Busch Machinery

12.7 Inline Filling Systems

12.8 Duke Technologies

12.9 ARPAC LLC

12.10 ACIC Pharmaceuticals Inc.

12.11 M.A. INDUSTRIA MACCHINE AUTOMATICHE S.P.A.

12.12 Körber AG

12.13 Coesia S.p.A

12.14 Romaco Group

12.15 Uhlmann Group

12.16 Maquinaria Industries Dara, SL

12.17 MULTIVAC

12.18 Accutek packaging Companies

12.19 Vanguard Pharmaceutical Machinery, Inc.

12.20 OPTIMA

12.21 MG2 s.r.l.

12.22 ACIC Pharmaceuticals Inc.

12.23 AST, Inc.

12.24 NJM Packaging

12.25 Marchesini Group S.p.A

12.26 Harro Höfliger

12.27 Bausch + Ströbel

12.28 Coesia

12.29 Truking Technology Ltd.

13. Appendix

13.1 Industry Speak

13.2 Questionnaire

13.3 Available Custom Work

13.4 Adjacent Studies

13.5 Authors

14. References

Key Notes:

© Copyright 2024 – Wissen Research All Rights Reserved.