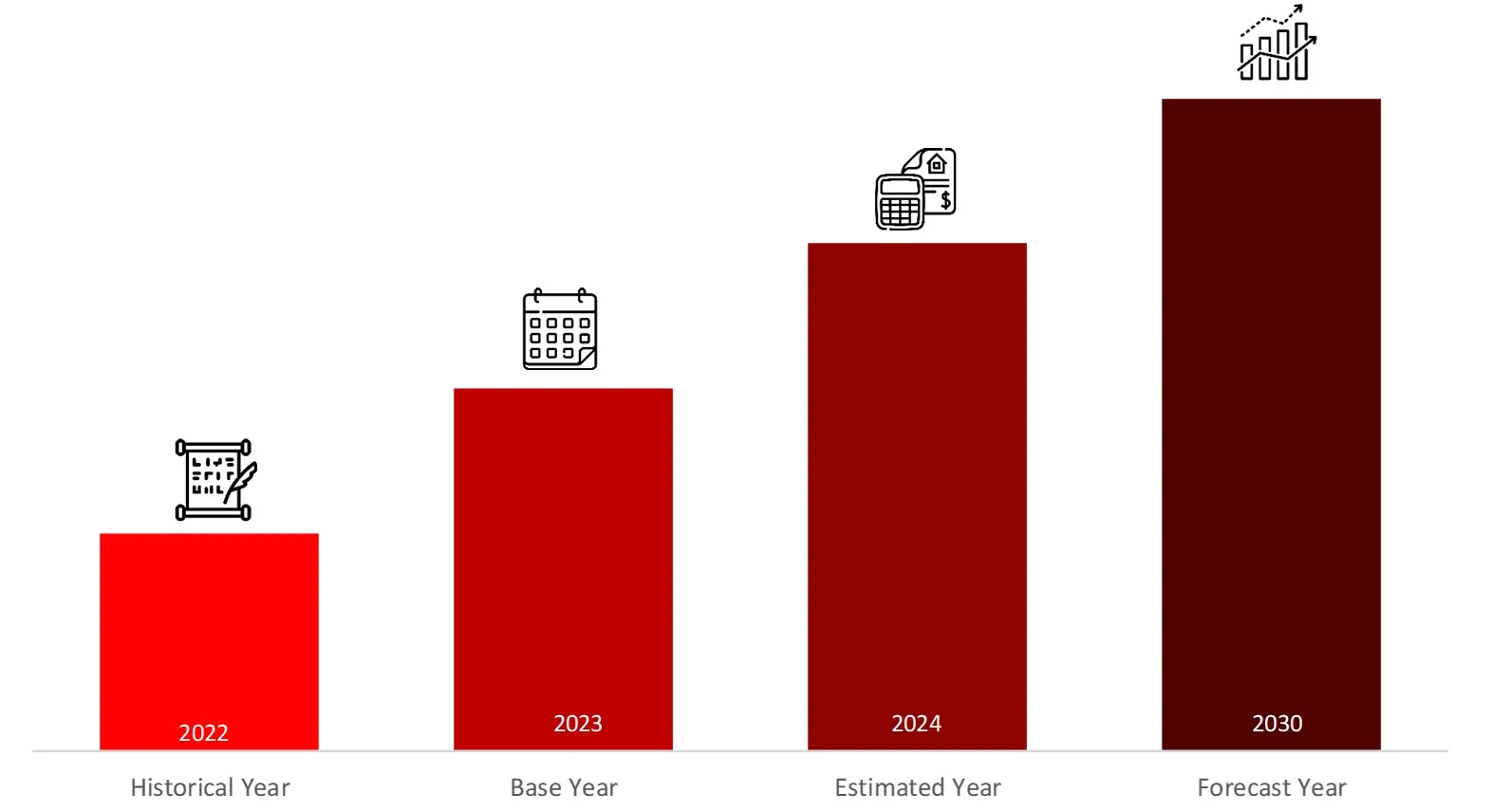

The global point of care testing market is estimated at USD 40.7 billion in 2023 and is projected to reach USD 60.2 billion by 2030, expected to grow at a CAGR of 7.5% during the forecast period, 2024-2030.

Over the past decade, point-of-care testing (POCT) has emerged as a transformative approach in diagnostics, enabling rapid, on-site testing and accelerating clinical decision-making. POCT spans a diverse range of applications, including blood glucose monitoring, infectious disease testing, and cardiac biomarker analysis, bringing critical diagnostic capabilities closer to the patient. For instance, Abbott’s i-STAT® system provides real-time results for blood gases, electrolytes, and cardiac markers in emergency settings, reducing turnaround time and improving patient outcomes. A 2023 study by the Clinical and Laboratory Standards Institute (CLSI) revealed that over 70% of hospitals worldwide now use POCT devices to support faster triage and personalized care, particularly in emergency and critical care units. The market’s growth is driven by the increasing prevalence of chronic and infectious diseases, growing demand for decentralized healthcare models, and advancements in portable, user-friendly diagnostic technologies such as Roche’s Cobas Liat® PCR system for infectious disease detection.

Further, the US with USD 14.4 billion market in 2023, holds majority share in the global point of care diagnostic market and is likely to remain the leading region growing a CAGR of 8.2% within this market, during the forecast period.

LUCRATIVE OPPORTUNITIES IN THE POINT OF CARE TESTING MARKET

STRATEGIC ACTIVITIES WITHIN THE POC MARKET

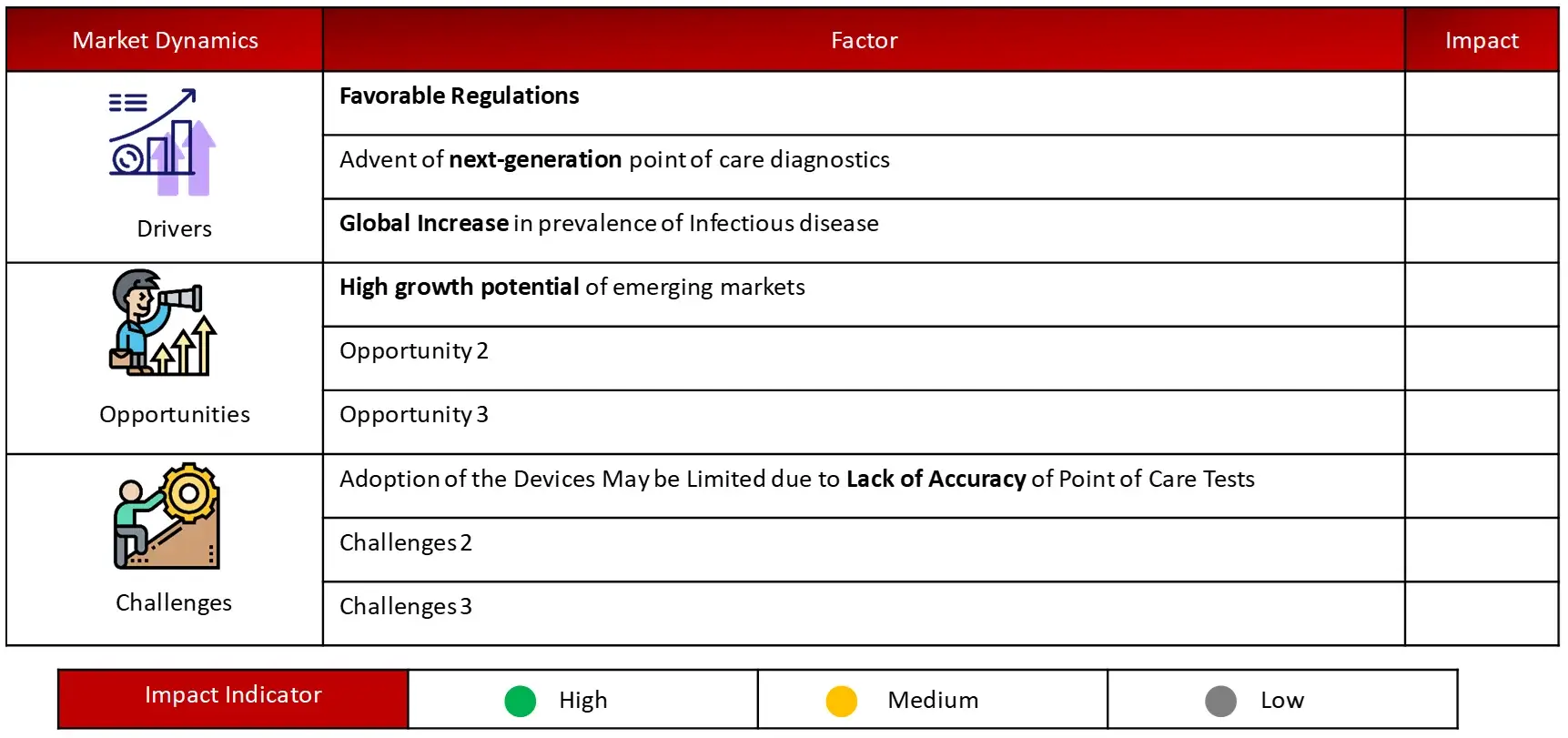

Drivers: Advent of Next-Generation POC Diagnostics Spurs Up Market Demand

The advent of next-generation point-of-care diagnostics is significantly boosting market demand in the point-of-care testing sector. These advanced technologies offer improved accuracy, faster results, and broader test menus, addressing key healthcare needs.

Next-generation point-of-care devices incorporate features such as smartphone connectivity, cloud-based data management, and AI-driven analytics. For instance, some new molecular point-of-care platforms can detect multiple pathogens in under 30 minutes with over 95% accuracy. This technological leap is driving adoption across various healthcare settings, from hospitals to remote clinics, contributing to the market’s robust growth trajectory. Driven by such dynamics the market is expected to reach USD $60.2 billion by 2030.

Opportunities: Government Initiatives and Funding for Healthcare Innovations

Government initiatives and funding for healthcare innovation represent a significant opportunity for the Point of Care Testing (POCT) market. Many governments are prioritizing investments in healthcare technologies to improve diagnostic capabilities and patient outcomes. For example, the U.S. government has allocated over $2 billion in funding through initiatives like the National Institutes of Health (NIH) and the Biomedical Advanced Research and Development Authority (BARDA) to support innovations in diagnostics, including POCT (NIH). Similarly, the European Union’s Horizon Europe program has earmarked substantial funds to advance medical technologies, including point-of-care diagnostics (European Commission). These government-backed programs not only boost research and development but also facilitate the commercialization and adoption of advanced POCT solutions, driving market growth and expanding access to cutting-edge diagnostic tools.

Challenges: Limited Reimbursement Policies in Point of Care Testing Industry

Limited reimbursement policies significantly restrain the POCT market in the United States. Reimbursement for POCT varies widely across health plans, creating uncertainty for providers and manufacturers and potentially hindering adoption. Coverage decisions are often made at the individual health plan level, leading to inconsistencies in which POCTs are covered and under what conditions. For a test to be reimbursed, it typically must demonstrate clinical utility—meaning it must be actionable and improve health outcomes. Higher-priced tests, particularly those over $500, face stricter evidence requirements (Source: FDA).

The reimbursement process is further complicated by coding challenges. Tests billed under CPT Category III codes often require manual review, leading to delays and potential denials, which can discourage providers from offering POCT services (Source: American Medical Association). Lower-cost tests, priced under $50, are less likely to be evaluated for coverage, reducing their clinical adoption (Source: Centers for Medicare & Medicaid Services). Community pharmacies also face hurdles as they need certifications and may need to enroll as independent clinical laboratories to bill Medicare (Source: Medicare Administrative Contractors).

Overall, the complex reimbursement landscape, coupled with variability in coverage and rigorous evidence requirements, creates significant barriers to POCT adoption. These challenges impact the financial viability of POCT services, stifling innovation and limiting the potential benefits of rapid diagnostics in improving patient care and operational efficiency (Source: European Commission).

The point of care testing market report offers information on the latest advancements in the industry, as well as product portfolio analysis, supply chain/value chain analysis, market share, and the effects of localized and domestic players. It also analyses potential revenue opportunities and changes in market regulations, as well as market size, category market growth, application dominance, product approvals, product launches, geographic expansions, and technological innovations. For an analyst brief and other information on the point of care testing market, get in touch with Wissen Research. Our staff can assist you in making well-informed decisions that will lead to market expansion.

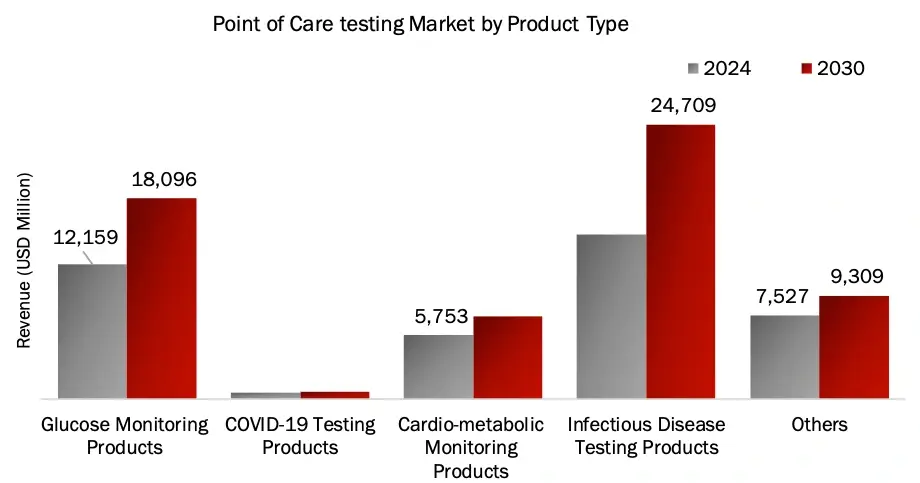

Infectious Disease Segment Dominated the POCT Market by Product Type in 2023

Based on product, the POCT market is segmented into glucose monitoring, covid-19 testing, cardio-metabolic testing, infectious disease testing and others. In 2023, the infectious disease segment accounted for the largest share of 30.4%.

This was driven by a complex interplay of factors, with industry leaders like Abbott (through its ID NOW™ platform), Roche (Cobas® systems), and Cepheid (GeneXpert®) dominating the landscape through their innovative molecular diagnostic platforms. The segment’s growth was significantly propelled by the widespread adoption of multiplex PCR systems, next-generation sequencing platforms, and rapid immunoassays, particularly during the COVID-19 pandemic when companies like bioMérieux (BioFire® FilmArray®) scaled their operations to meet unprecedented demand. The market was further strengthened by strategic product launches such as BD’s MAX™ platform for respiratory infections, alongside significant investments in point-of-care testing solutions that enhanced accessibility. This technological revolution in diagnostic capabilities, combined with the lingering effects of COVID-19, the rise in antimicrobial resistance testing requirements, and expanding healthcare infrastructure in emerging markets, has created a robust ecosystem where automated, high-throughput platforms are becoming increasingly central to clinical decision-making, solidifying the segment’s market leadership.

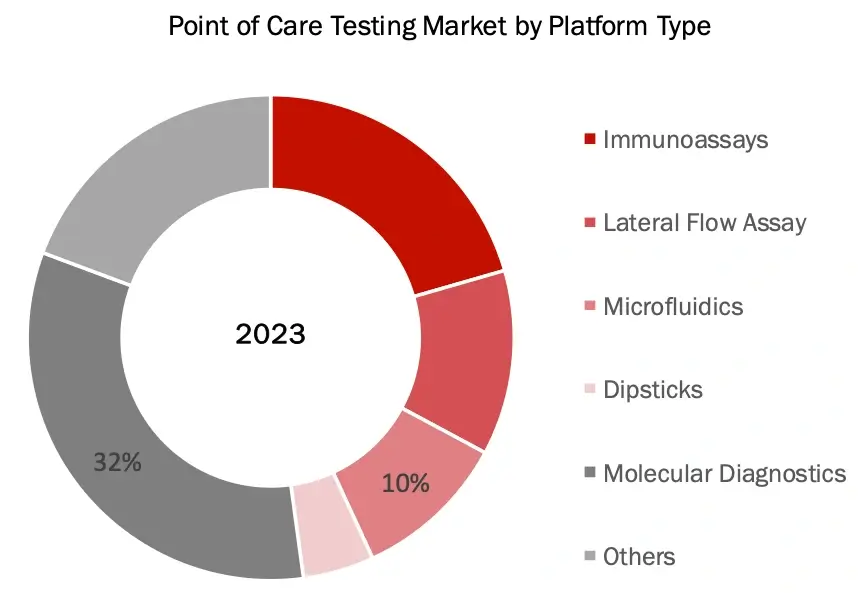

Molecular Diagnostics Market Segment Accounted for The Majority Share In The Point of Care Testing Market by Platform in 2023

Based on platform type, the POCT market is segmented into immunoassay, lateral flow assay, microfluidics, dipsticks, molecular diagnostics and others. In 2023, molecular diagnostics segment accounted for the largest share of 33.1%.

The large share of molecular diagnostics in the 2023 reflects its pivotal role in revolutionizing rapid diagnostics for infectious diseases, primarily led by industry giants like Cepheid (with its innovative GeneXpert Xpress® systems), Abbott (ID NOW™), and Roche (Liat® PCR platform). This segment’s exceptional growth was driven by breakthrough technologies in isothermal amplification and real-time PCR, exemplified by products like BioFire’s FilmArray® and Mesa Biotech’s Accula™ System, which deliver laboratory-quality molecular results in minutes rather than hours. The market’s expansion was further catalyzed by the COVID-19 pandemic, during which multiple companies introduced groundbreaking portable PCR platforms for home and clinical use. The segment’s success is also attributed to the integration of advanced features like cloud connectivity and AI-powered analytics, as demonstrated by Qiagen’s QIAstat-Dx® and Binx Health’s io® platform for STI testing, while continuous innovations in CRISPR-based diagnostics and automated sample processing have made molecular testing more accessible and user-friendly at the point of care. This technological convergence, coupled with increasing demand for rapid, accurate diagnostic solutions across various clinical settings, has solidified molecular diagnostics’ position as the leading platform in the POC testing market.

North America Held the Largest Market Share (39.2%) in POC testing Market in 2023

POC market analysis encompassed a detailed evaluation of five key regions: North America, Europe, Asia-Pacific, Middle East & Africa, and Latin America. These regions were assessed based on healthcare infrastructure, regulatory frameworks, technological advancements, and market trends. North America retained the largest market share of 39.2% in point of care testing in 2023, owing to its advanced healthcare infrastructure, early adoption of innovative imaging technologies, and the strong presence of leading market players like Abbott Laboratories, Siemens Healthineers, and Thermo-Fischer Scientific.

North America’s dominance in the 2023 POC market reflects its advanced healthcare infrastructure and early adoption of innovative testing platforms, led by key players like Abbott, Roche, and Becton, Dickinson and Company establishing strong market presence through products like i-STAT®, cobas® Liat®, and continuous glucose monitoring systems. Europe’s 26.2% share is driven by robust healthcare policies and increasing home testing adoption, while Asia Pacific’s 25.2% share demonstrates rapid growth potential fueled by improving healthcare access, rising chronic diseases, and significant investments in POC infrastructure, particularly in countries like China and India. This regional distribution is shaped by factors including reimbursement policies, regulatory frameworks, and the COVID-19 pandemic’s lasting impact on decentralized testing adoption, with emerging markets showing accelerated growth through expanding healthcare coverage and rising demand for rapid diagnostic solutions.

Major players operating in point of care diagnostic market are:

Other major players in point of care diagnostic market include(s):

Quidelortho Corporation (US),Werfen, S.A. (Spain), DiaSorin (Italy), Trinity Biotech PLC (Ireland), Boditech Med Inc. (South Korea), QIAGEN N.V (Germany), EKF Diagnostics Holdings PLC (United Kingdom)

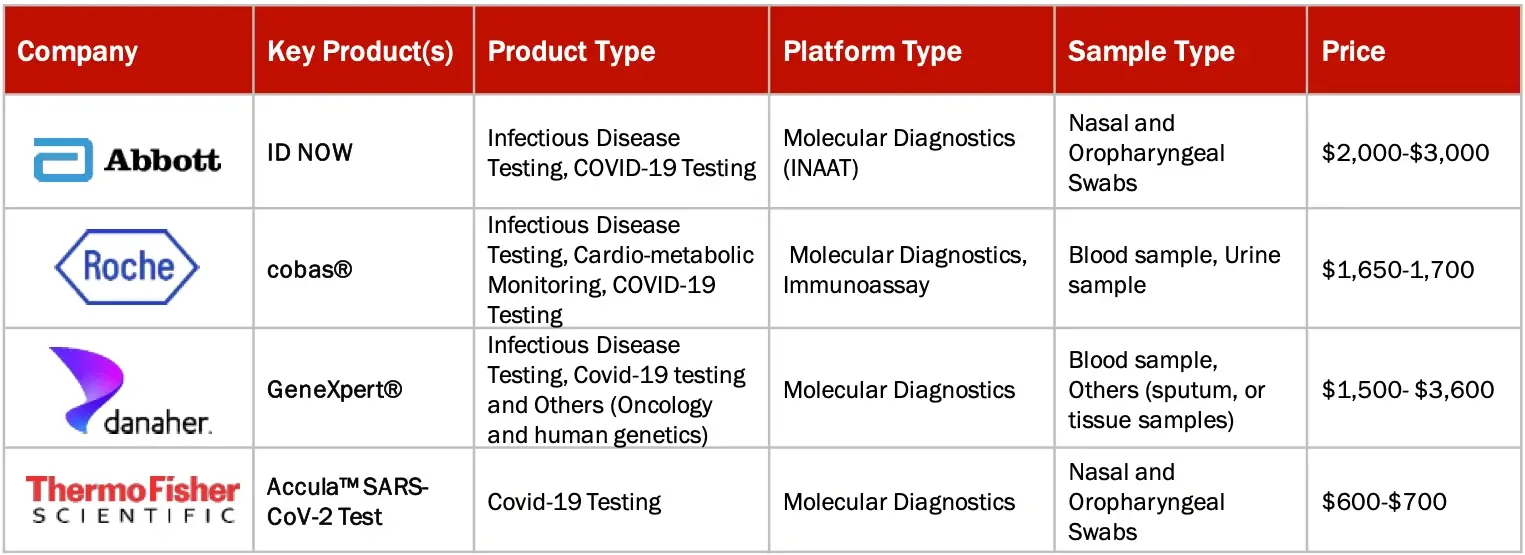

BRAND ANALYSIS: POC MARKET (MOLECULAR DIAGNOSTICS)

Sources: Secondary Research

Note: Above mention is non-exhaustive list of products offered by leading players

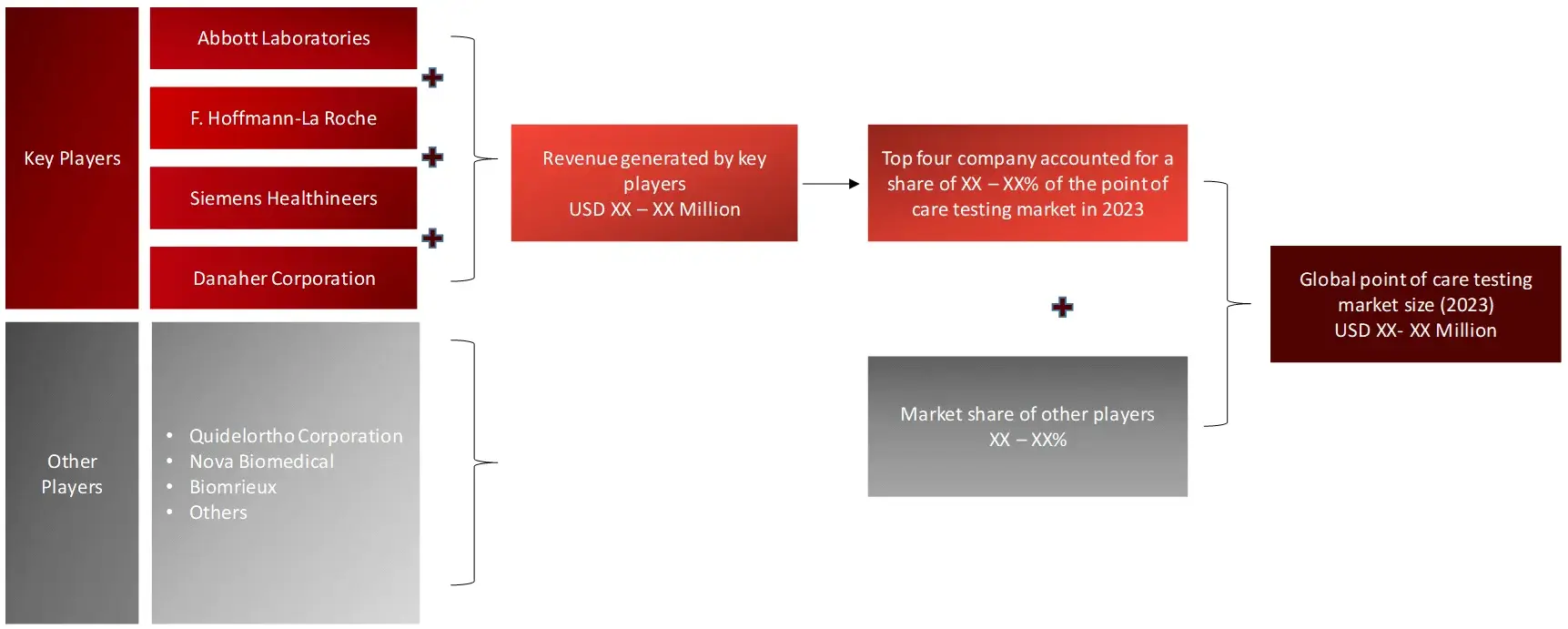

The overall point of care testing market is consolidated with five-six key players holding majority share (>45%) of the total point of care testing market.

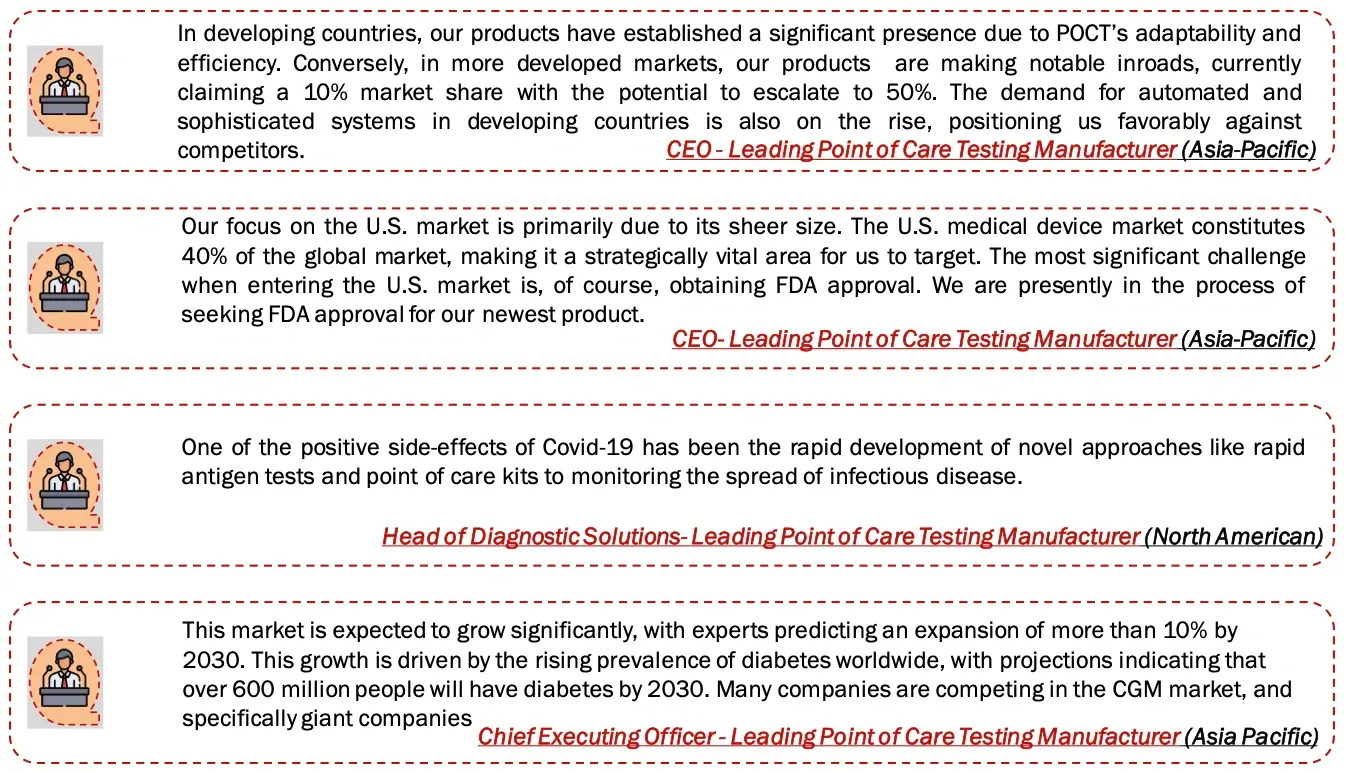

PRIMARY INSIGHTS FROM KEY OPINION LEADERS

Sources: Primary Research and Wissen Research Analysis.

Note: Above mention is non-exhaustive samples of the primary insights.

Particulars | Details |

Report | Point of Care Testing Market |

Forecast Period | 2024-2030 |

Base Year | 2023 |

Format | |

Estimated Market Size (2023) | USD 40.7 Billion |

CAGR (2024-2030) | 7.5% |

Number of Pages | 170 |

Number of Tables | 161 |

Number of Figures | 33 |

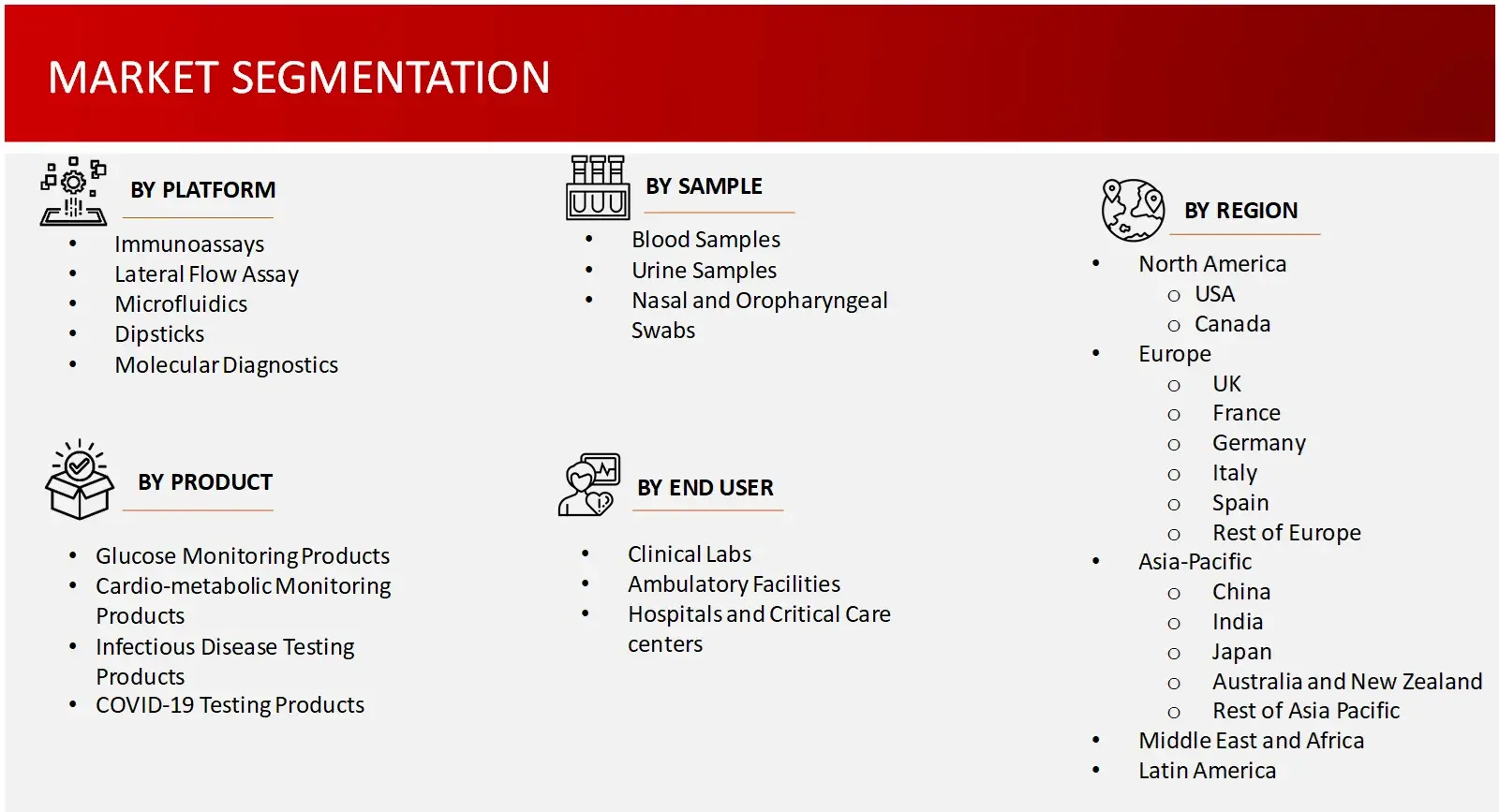

Key Segments | Point of Care Testing Market Product Outlook (Glucose Monitoring Products, COVID-19 Testing, Cardio-Metabolic Monitoring, Infectious Disease Testing, Coagulation Monitoring, Pregnancy and Fertility Testing, Tumour/Cancer Testing, Urinalysis, Cholesterol Testing, Haematology Testing, Drugs-of-Abuse Testing, Thyroid Stimulating Hormone (TSH) Testing, Faecal Occult Testing, Other products) Note: Other products include Autoimmune Disease Testing, Genetic Testing, Sepsis Biomarkers, Vitamin and Nutritional Testing, etc.

Point of Care Testing Market Platforms Outlook (Immunoassay, Lateral Flow Testing, Microfluidics, Dipsticks, Molecular Diagnostics) Point of Care Testing Market Sample Outlook (Blood Sample, Urine Sample, Nasal and Oropharyngeal Swabs and Other samples) Note: Other Samples include Faecal samples, Tissue samples, Sputum/Saliva, etc. Point of Care Testing Market End Users Outlook (Clinical Labs, Ambulatory Facilities, Hospitals and Critical Care Centres) |

Regions Covered |

|

Key Players Covered (Majority Share Holders) | Abbott Laboratories (US), F. Hoffmann-La Roche Ltd (Switzerland), Siemens Healthineers AG (Germany), Danaher Corporation (US), Becton, Dickinson and Company (US), Thermo Fisher Scientific Inc. (US), bioMérieux SA (France) |

Other Players Covered | QuidelOrtho Corporation (US), Werfen, S.A. (Spain), DiaSorin (Italy), Trinity Biotech PLC (Ireland), Boditech Med Inc. (South Korea), QIAGEN N.V (Germany), EKF Diagnostics Holdings PLC (United Kingdom) |

Introduction

Market Definition

Point-of-care testing (POCT) is revolutionizing healthcare delivery by bringing diagnostic capabilities directly to patient care sites. This market is experiencing rapid growth, driven by the rising prevalence of chronic conditions like diabetes, heart disease, and infectious illnesses. In the U.S. alone, CDC data from 2021 indicates that 38.4 million people have diabetes, highlighting the vast potential for POCT applications.

The POCT market’s expansion is fueled by key benefits including:

As healthcare systems worldwide seek to improve patient outcomes while managing costs, POCT offers a compelling solution. This technology enables quick decision-making, reduces hospital visits, and allows for more personalized treatment plans. With the global trend towards patient-centered care and the increasing need for efficient diagnostic tools, the POCT market is poised for continued growth and innovation across various healthcare settings.

FIGURE: POINT-OF-CARE TESTING MARKET SEGMENT

FIGURE: YEARS FRAMEWORK CONSIDERED IN THE STUDY

Key Stakeholders

Key objectives of the Study

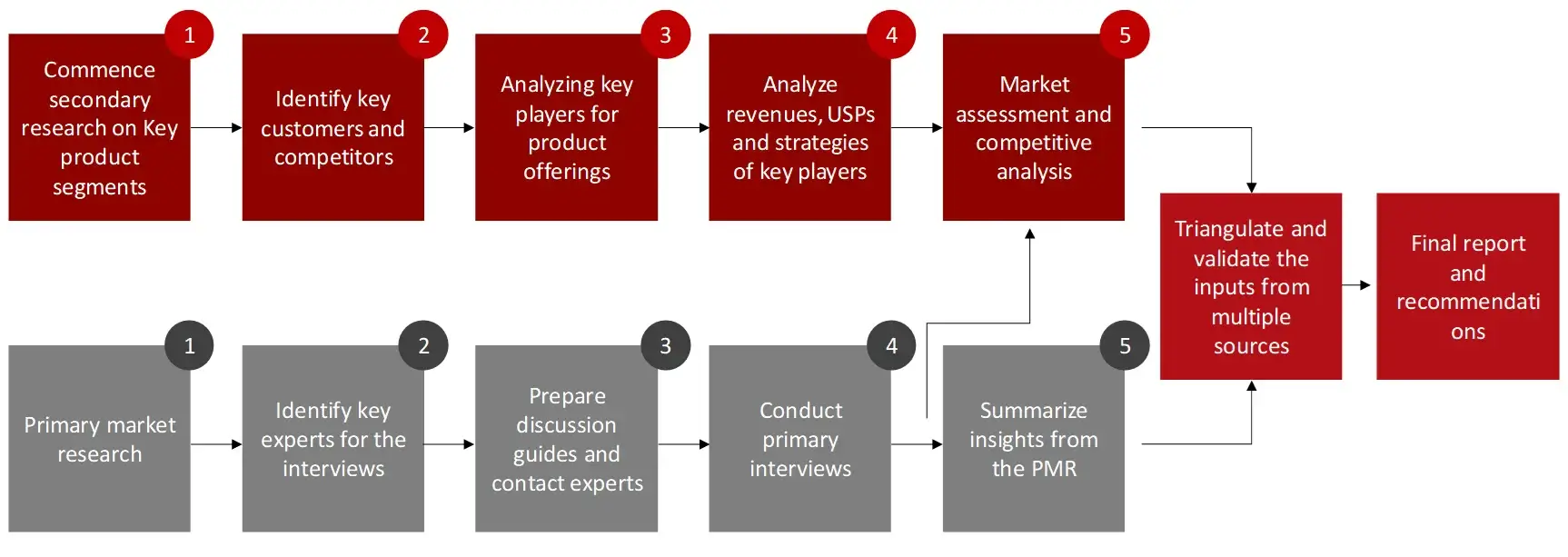

Research Methodology

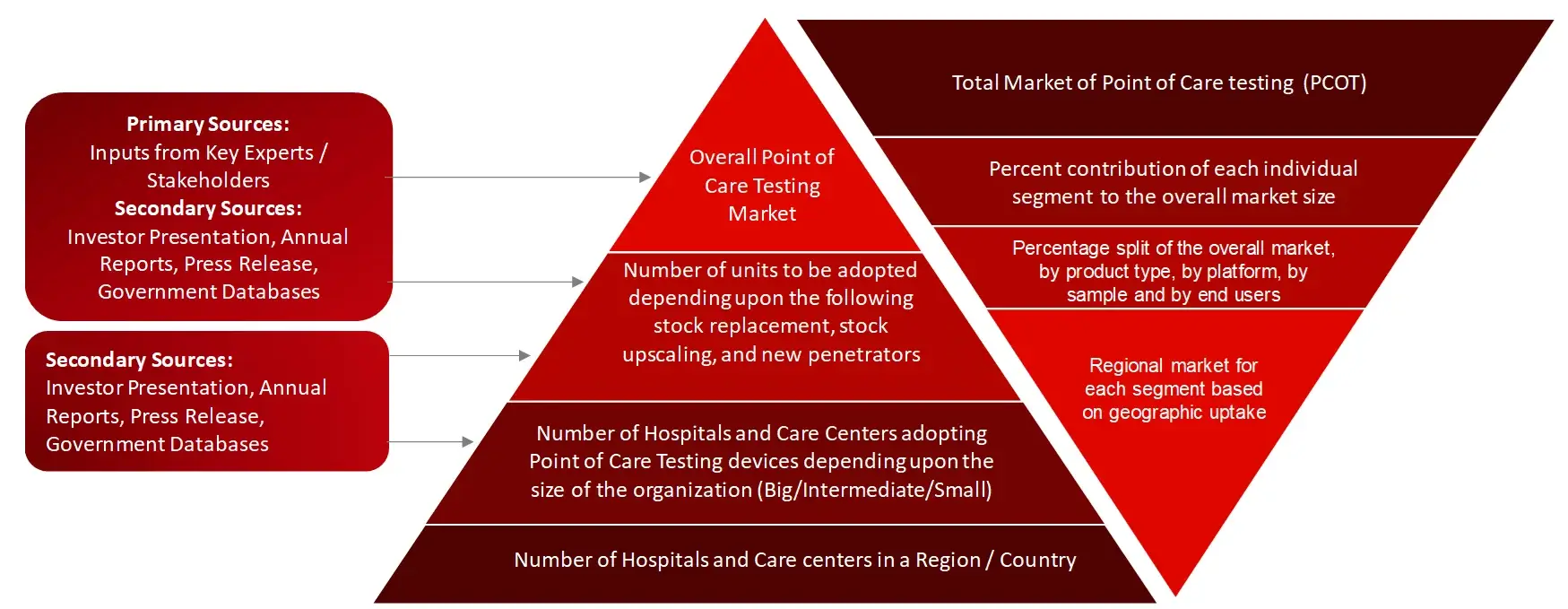

The objective of the study is to analyze the key market dynamics such as drivers, opportunities, challenges, restraints, and key player strategies. To track company developments such as product launches and approvals, expansions, and collaborations of the leading players, the competitive landscape of the point of care testing market to analyze market players on various parameters within the broad categories of business and product strategy. Top-down and bottom-up approaches will be used to estimate the market size. To estimate the market size of segments and sub segments the market breakdown and data triangulation will be used.

FIGURE: RESEARCH DESIGN

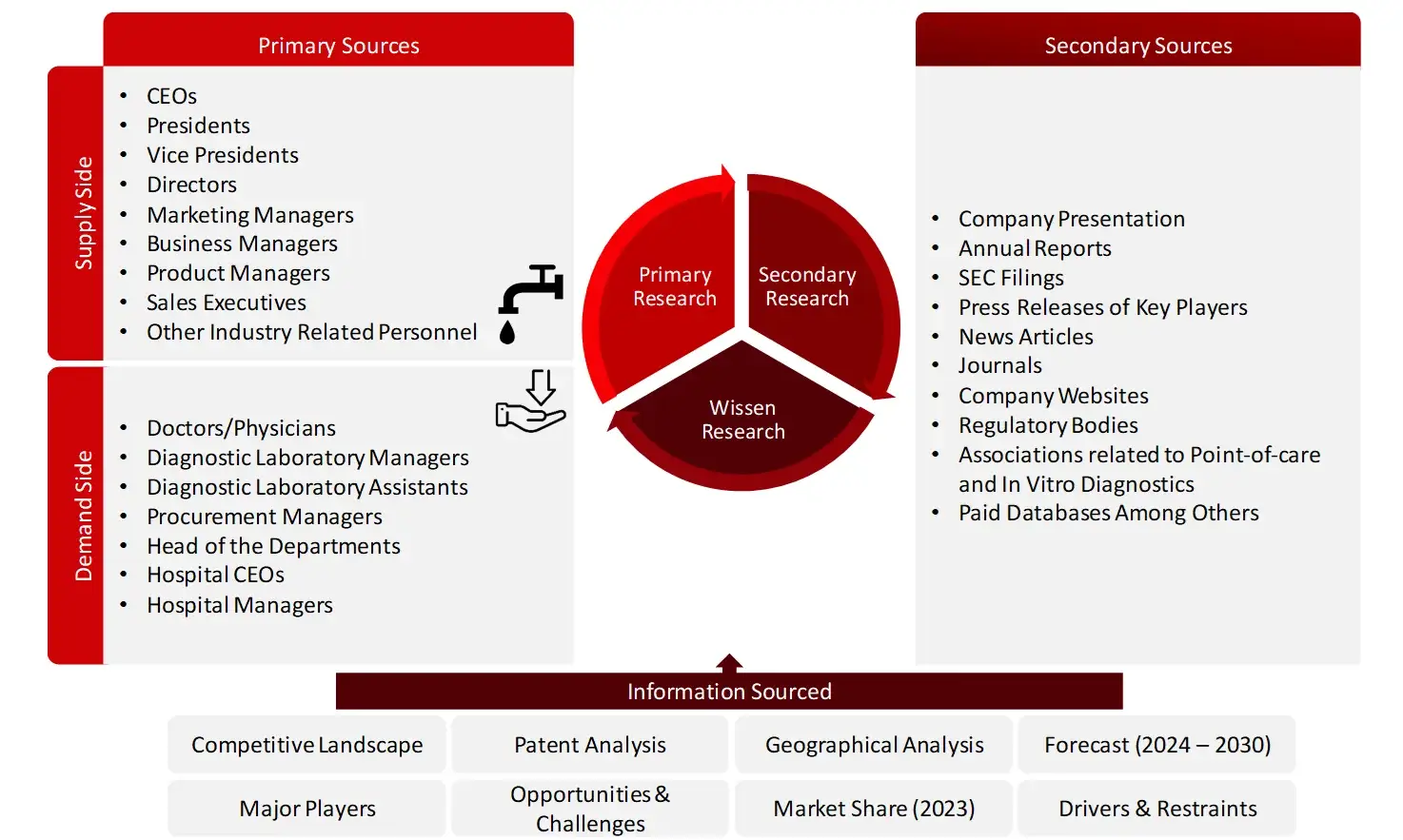

Research Approach

Collecting Secondary Data

The secondary research data collection process involves the usage of secondary sources, directories, databases, annual reports, investor presentations, and SEC filings of companies. Secondary research will be used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the point of care testing market. A database of the key industry leaders will also be prepared using secondary research.

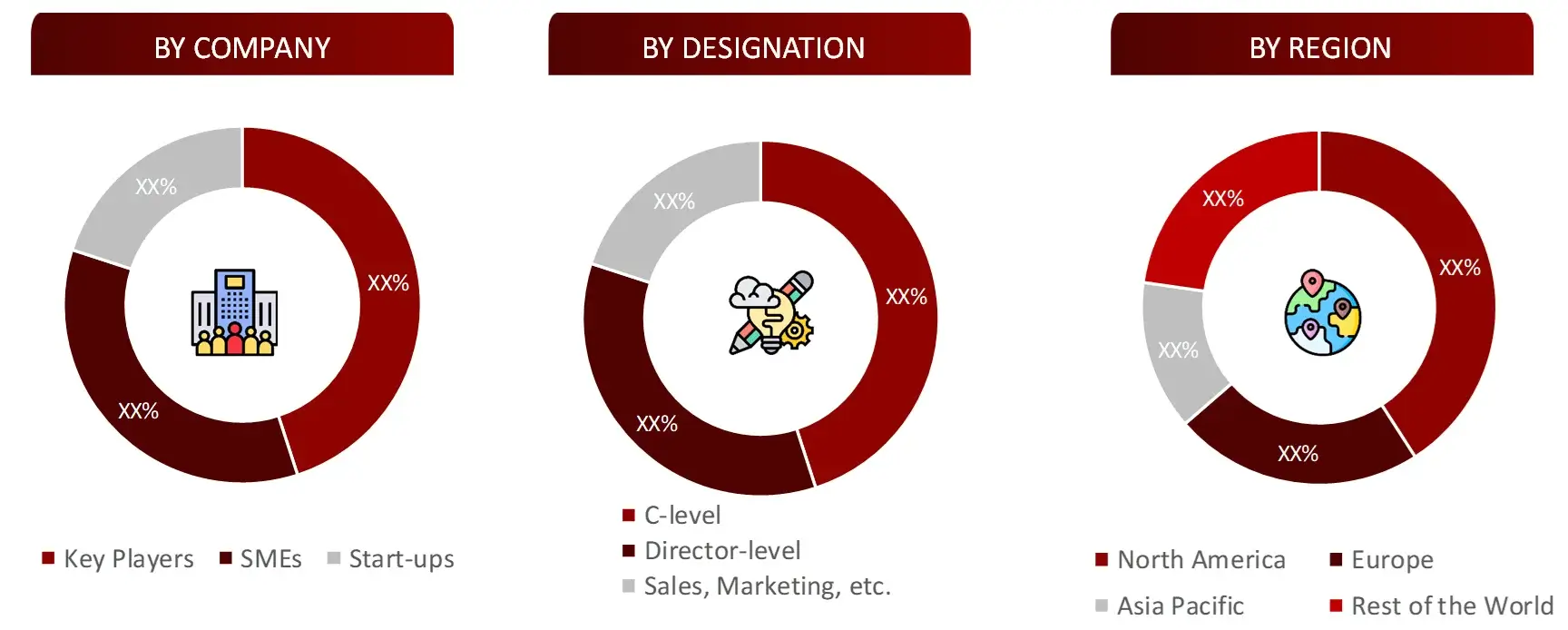

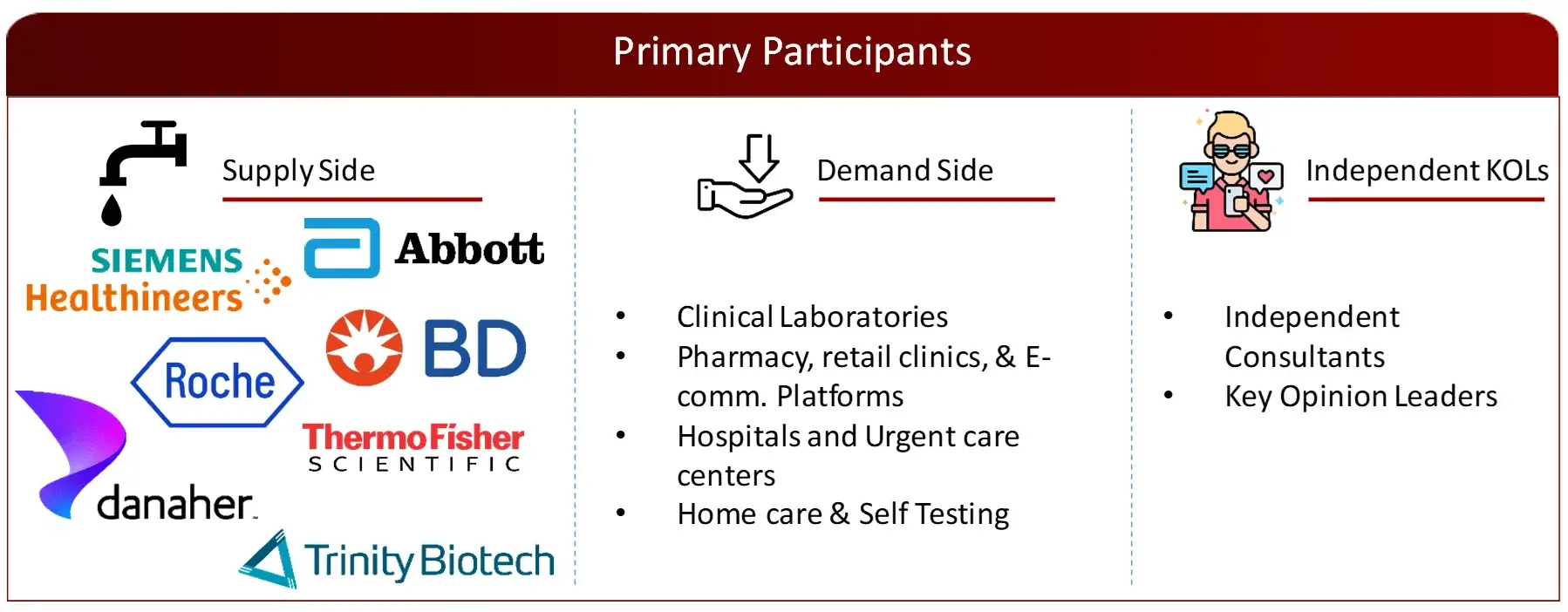

Collecting Primary Data

The primary research data will be conducted after acquiring knowledge about the point of care testing market scenario through secondary research. A significant number of primary interviews will be conducted with stakeholders from both the demand side and supply side (including various industry experts, such as Directors, Chief X Officers (CXOs), Vice Presidents (VPs) from business development, marketing and product development teams, product manufacturers) across major countries of North America, Europe, Asia Pacific, and Rest of the World. Primary data for this report was collected through questionnaires, emails, and telephonic interviews.

FIGURE: BREAKDOWN OF PRIMARY INTERVIEWS FROM SUPPLY SIDE

FIGURE: BREAKDOWN OF PRIMARY INTERVIEWS FROM DEMAND SIDE

FIGURE: PROPOSED PRIMARY PARTICIPANTS FROM DEMAND AND SUPPLY SIDE

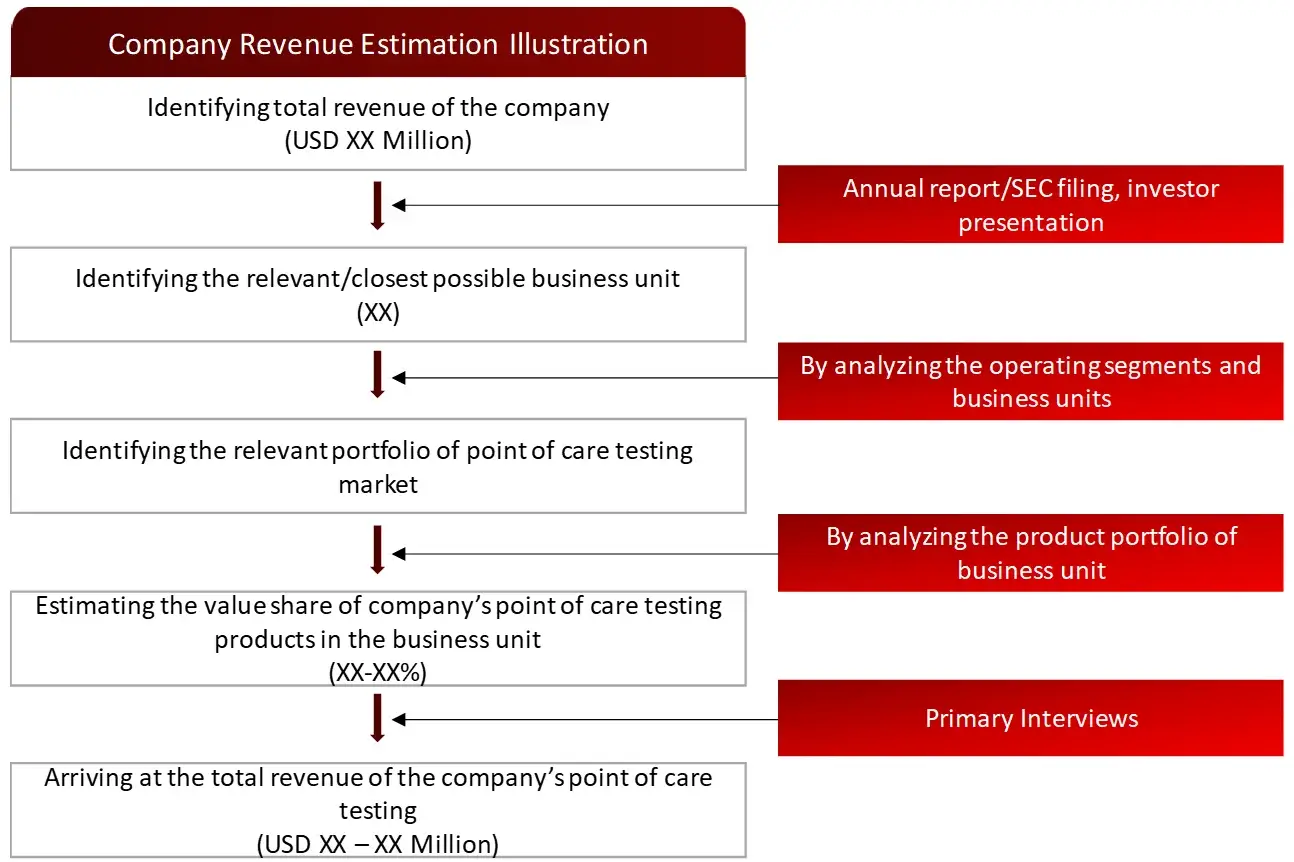

Market Size Estimation

Market Size Estimation

All major manufacturers offering various point of care testing systems will be identified at the global/regional level. Revenue mapping will be done for the major players, which will further be extrapolated to arrive at the global market value of each type of segment. The market value of point of care testing market will also split into various segments and sub segments at the region level based on:

Product and services mapping of various players for each type of point of care testing market at the regional-level

FIGURE: REVENUE MAPPING BY COMPANY (ILLUSTRATION)

FIGURE: REVENUE SHARE ANALYSIS OF KEY PLAYERS (SUPPLY SIDE)

FIGURE: MARKET SIZE ESTIMATION TOP-DOWN AND BOTTOM-UP APPROACH

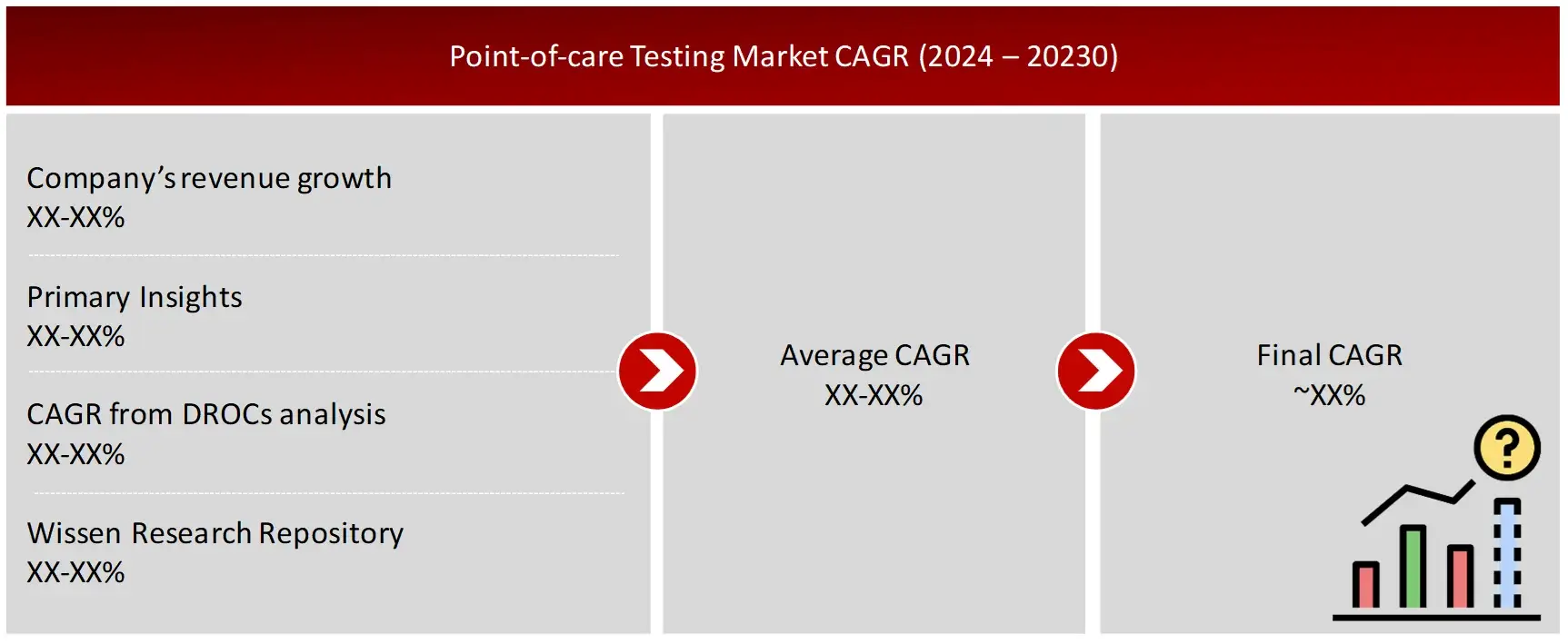

FIGURE: ANALYSIS OF DROCS FOR GROWTH FORECAST

FIGURE: GROWTH FORECAST ANALYSIS UTILIZING MULTIPLE PARAMETERS

Research Design

After arriving at the overall market size-using the market size estimation processes-the market will be split into several segments and sub segment. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub segment, the data triangulation, and market breakdown procedures will be employed, wherever applicable. The data will be triangulated by studying various factors and trends from both the demand and supply sides in the point of care testing market industry.

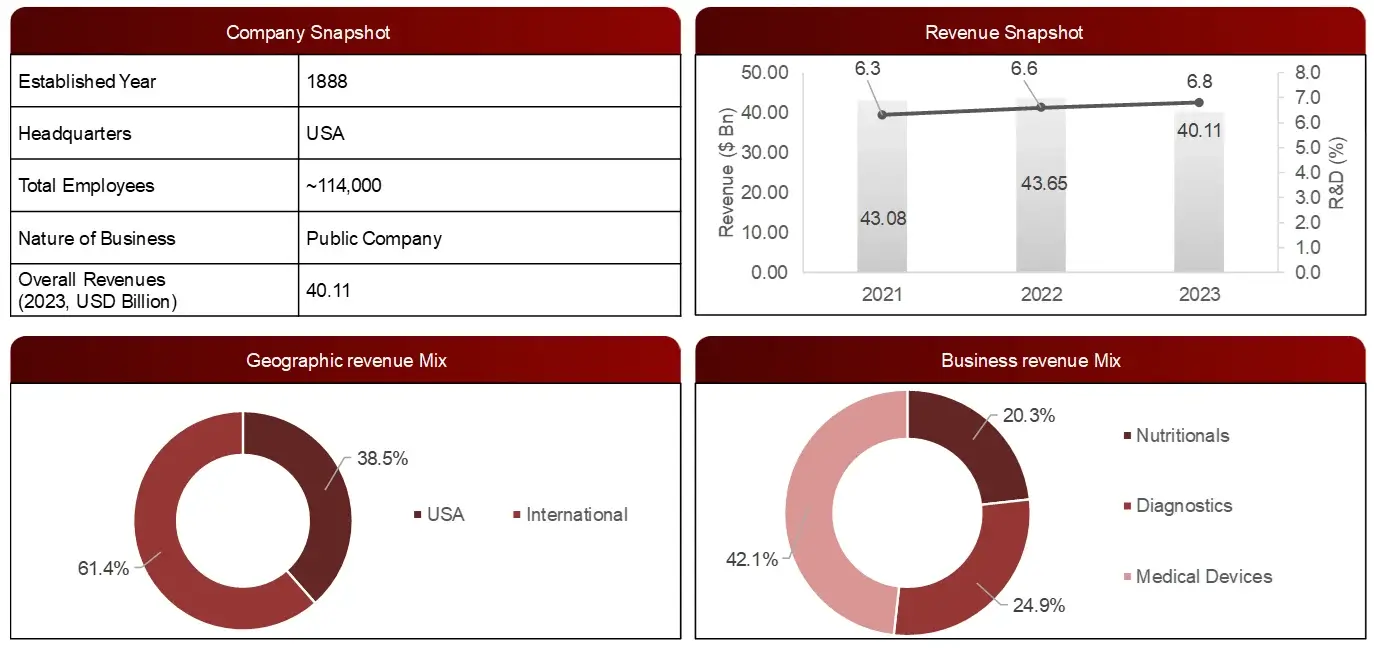

Sample Company Profile – Abbott Laboratories

Business Overview

Abbott Laboratories is an American multinational medical devices and health care. It develops and sells medical devices, diagnostics, branded generic medicines and nutritional products.

FIGURE: Financial Snapshot: Abbott Laboratories (2023)

Note: R&D expenditure is provided as % of the total revenue.

Product Portfolio

Key Product(s)/Technology(s) | Description |

BinaxNOW™ (COVID-19 testing kit) | The BinaxNOW COVID-19 Ag Card is a lateral flow immunoassay for the qualitative detection of the nucleocapsid protein antigen to SARS-CoV-2 directly from anterior nasal (nares) swab specimens. |

FreeStyle Libre | The FreeStyle Libre is a continuous glucose monitoring system, indicated for measuring interstitial fluid glucose levels in people (age 4 and older) with diabetes mellitus. |

ID NOW™ Influenza A & B 2 | The ID NOW™ Influenza A & B 2 assay delivers molecular flu results in 13 minutes or less on Abbott’s unique ID NOW™ platform; making it significantly faster than other molecular methods and more accurate than conventional rapid tests. |

i-STAT 1 | The i-STAT 1 is a portable blood analysis system that delivers lab-quality diagnostic results in minutes. This blood analyzer operates with the advanced technology of i-STAT test cartridges. Together, they create the i-STAT System — a point-of-care-testing platform that provides healthcare professionals with diagnostic information |

Cholestech LDX™ Analyzer | The Cholestech LDX™ Analyzer provides accurate, actionable, and readily accessible results that have set the standard in point-of-care lipid profile, cholesterol, and glucose testing. |

Recent Development(s)

Type of Development | Month | Year | Description | Impact |

FDA Clearance | April | 2024 | The company received FDA clearance for Point-of-Care TBI Test, expanding brain injury diagnostic portfolio. The test is developed in collaboration with the U.S. Department of Defense over the past decade, utilizes two key biomarkers: glial fibrillary acidic protein (GFAP) and ubiquitin C-terminal hydrolase L1 (UCH-L1). | The firm has further expanded and strengthened its PoC product portfolio. |

Marketing and Promotion Agreement | May | 2021 | Generic Pharmasec has entered into an agreement with Abbott Point of Care (APOC), the medical and diagnostics devices division of Abbott, for the distribution, marketing and promotion of the entire range of products by APOC in the entire country of India. The agreement covers the entire length and breadth of the country. | This will increase the companies penetration into the Indian market by at least 1,000 additional hospital set-ups in the next 24 months by creating long-term strategies for marketing and promotion. |

FDA Clearance | June | 2024 | The firm secured FDA clearance for two new Over-the-Counter Continuous Glucose Monitors: Lingo and Libre Rio. They target distinct markets, expanding access to FreeStyle Libre technology beyond traditional diabetes care | This FDA clearance positions the frim to tap into both the growing wellness market and the underserved segment of Type 2 diabetes patients. The move could potentially reshape the landscape of glucose monitoring. |

1. Introduction

1.1 Key Objectives

1.2 Definitions

1.2.1 In Scope

1.2.2 Out of Scope

1.3 Scope of the Report

1.4 Scope Related Limitations

1.5 Key Stakeholders

2. Research Methodology

2.1 Research Approach

2.2 Research Methodology / Design

2.3 Market Sizing Approach

2.3.1 Secondary Research

2.3.2 Primary Research

3. Executive Summary & Premium Content

3.1 Global Market Outlook

3.2 Key Market Findings

4. Market Overview

4.1 Market Dynamics

4.1.1 Drivers/Opportunities

4.1.2 Restraints/Challenges

4.2 End User Perception

4.3 Need Gap

4.4 Supply Chain / Value Chain Analysis

4.5 Industry Trends

4.6 Porter’s Five Forces Analysis

5. Patent Analysis

5.1 Patents Related to Point of Care Testing Technologies/Devices

5.2 Patent Landscape and Intellectual Property Trends

6. Point of Care Testing Market, by Product (2025-2030, USD Million)

6.1 Glucose Monitoring Products

6.1.1 Strips

6.1.2 Meters

6.1.3 Lancets and Lancing Devices

6.2 COVID-19 Testing Products

6.3 Cardio-metabolic Monitoring Products

6.3.1 Cardiac Markers

6.3.2 Electrolyte Tester

6.3.3 HBA1C Tester

6.4 Infectious Disease Testing Products

6.4.1 HIV Testing

6.4.2 Respiratory infection Testing

6.4.3 Hepatitis C Testing

6.4.4 Healthcare-Associated Infection Testing

6.4.5 Influenza Testing

6.4.6 Tropical Disease Testing

6.4.7 Sexually Transmitted Disease Testing

6.4.8 Tuberculosis

6.4.9 Clostridium Difficile Infection Testing

6.4.10 Other Infectious Disease Testing

6.5 Coagulation Monitoring Products

6.5.1 PT/INR Testing

6.5.2 ACT/APTT Testing

6.6 Pregnancy and Fertility Testing Products

6.6.1 Pregnancy Testing

6.6.2 Fertility Testing

6.7 Tumour/Cancer Testing Products

6.8 Urinalysis Testing Products

6.9 Cholesterol Testing Products

6.10 Haematology Testing Products

6.11 Drugs-of Abuse Testing Products

6.12 Thyroid Stimulating Hormone (TSH) Testing Products

6.13 Faecal Occult Testing Products

6.14 Other Products

7. Point of Care Testing Market, by Platform (2025-2030, USD Million)

7.1 Immunoassays

7.2 Lateral Flow Assay

7.3 Microfluidics

7.4 Dipsticks

7.5 Molecular Diagnostics

7.5.1 RT-PCR

7.5.2 INAAT

7.5.3 Others

8. Point of Care Testing Market, by Sample (2025-2030, USD Million)

8.1 Blood Samples

8.2 Urine Samples

8.3 Nasal and Oropharyngeal Swabs

8.4 Others

9. Point of Care Testing Market, by End Users (2025-2030, USD Million)

9.1 Clinical Labs

9.2 Ambulatory Facilities

9.3 Hospitals and Critical Care Centres

9.4 Others

10. Point of Care Testing Market, by Mode of Acquiring (2025-2030, USD Million)

10.1 OTC Testing Products

10.2 Prescription Based Testing Products

11. Point of Care Testing Market, by Region (2025-2030, USD Million)

11.1 North America

11.1.1 USA

11.1.2 Canada

11.2 Europe

11.2.1 UK

11.2.2 France

11.2.3 Germany

11.2.4 Italy

11.2.5 Spain

11.2.6 Rest of Europe

11.3 Asia-Pacific

11.3.1 China

11.3.2 India

11.3.3 Japan

11.3.4 Australia and New Zealand

11.3.5 Rest of Asia-Pacific

11.4 Middle East and Africa

11.5 Latin America

12. Competitive Analysis

12.1 Key Players Footprint Analysis

12.2 Market Share Analysis

12.3 Key Brand Analysis

12.4 Regional Snapshot of Key Players

12.5 R&D Expenditure of Key Players

13. Company Profiles2

13.1 Abbott Laboratories

13.1.1 Business Overview

13.1.2 Product Portfolio

13.1.3 Financial Snapshot3

13.1.4 Recent Developments

13.1.5 SWOT Analysis

13.2 F. Hoffmann-La Roche Ltd.

13.3 Siemens Healthineers

13.4 Danaher Corporation

13.5 Becton, Dickinson and Company

13.6 Thermo Fisher Scientific Inc.

13.7 Biomrieux

13.8 Quidelortho Corporation

13.9 Trinity Biotech PLC

13.10 Nova Biomedical

13.11 Others Key Players

14. Conclusion

15. Appendix

15.1 Industry Speak

15.2 Questionnaire

15.3 Available Custom Work

15.4 Adjacent Studies

15.5 Authors

16. References

Key Notes:

Note 1 – Contents in the ToC / market segments are tentative and might change as the research proceeds.

Note 2 – List of companies is not exhaustive and might change during the course of study.

Note 3 – Details on key financials might not be captured in case of unlisted companies.

Note 4 – SWOT analysis will be provided for top 3-5 companies.

Note 5 – In scope and out of scope will be provided in detail during the course of the study.

The global market for point of care testing was valued at approximately USD 40.7 billion in 2023, and is projected to increase to USD 40.8 billion in 2025.

The global point of cares testing market is anticipated to grow at an annual growth rate of 7.5% from 2024 to 2030 to reach USD 60.2 billion, by 2030.

The major end-users in the point of care testing market include clinical labs, ambulatory facilities, hospitals and critical care centres. Hospitals and critical care centres still being a significant segment due advanced infrastructure, higher patient intake, and ability to invest in cutting-edge diagnostic technologies for comprehensive diagnosis and treatment, holding over 40% of the market share.

Leading players within the point of care testing market are Abbott Laboratories (US), F. Hoffmann-La Roche Ltd (Switzerland), Siemens Healthineers AG (Germany), Danaher Corporation (US) and Becton, Dickinson and Company (US).

The market is highly consolidated at top, comprising 10 key players with them holding almost 65% of the market, while it remains lightly fragmented at the lower levels, with numerous small and mid-sized companies operating at regional and national level.

The major platform types in point of care (POC) testing are immunoassay, lateral flow assay, molecular diagnostics, microfluidics and dipsticks. Notably, the demand in rapid diagnostics for infectious diseases, the general miniaturization of the tests and the lower sample volume requirements is anticipated to boost the molecular diagnostics segment growth, experiencing a CAGR of >14% between 2024 and 2030.

© Copyright 2024 – Wissen Research All Rights Reserved.