Rehabilitation Equipment Market by Product (Therapy, Mobility, Exercise, Daily Living Aids, Body Support Devices), Application Type (Occupational, Physical & Training, Strength, Endurance), End User (Rehabilitation Centers, Hospitals & Clinics, Physiotherapy Centers, Home-care settings), Regions, Key Players – Global Forecast to 2030

Sources: Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentation, Paid Database, and Wissen Research Analysis.

Sources: Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentation, Paid Database, and Wissen Research Analysis.

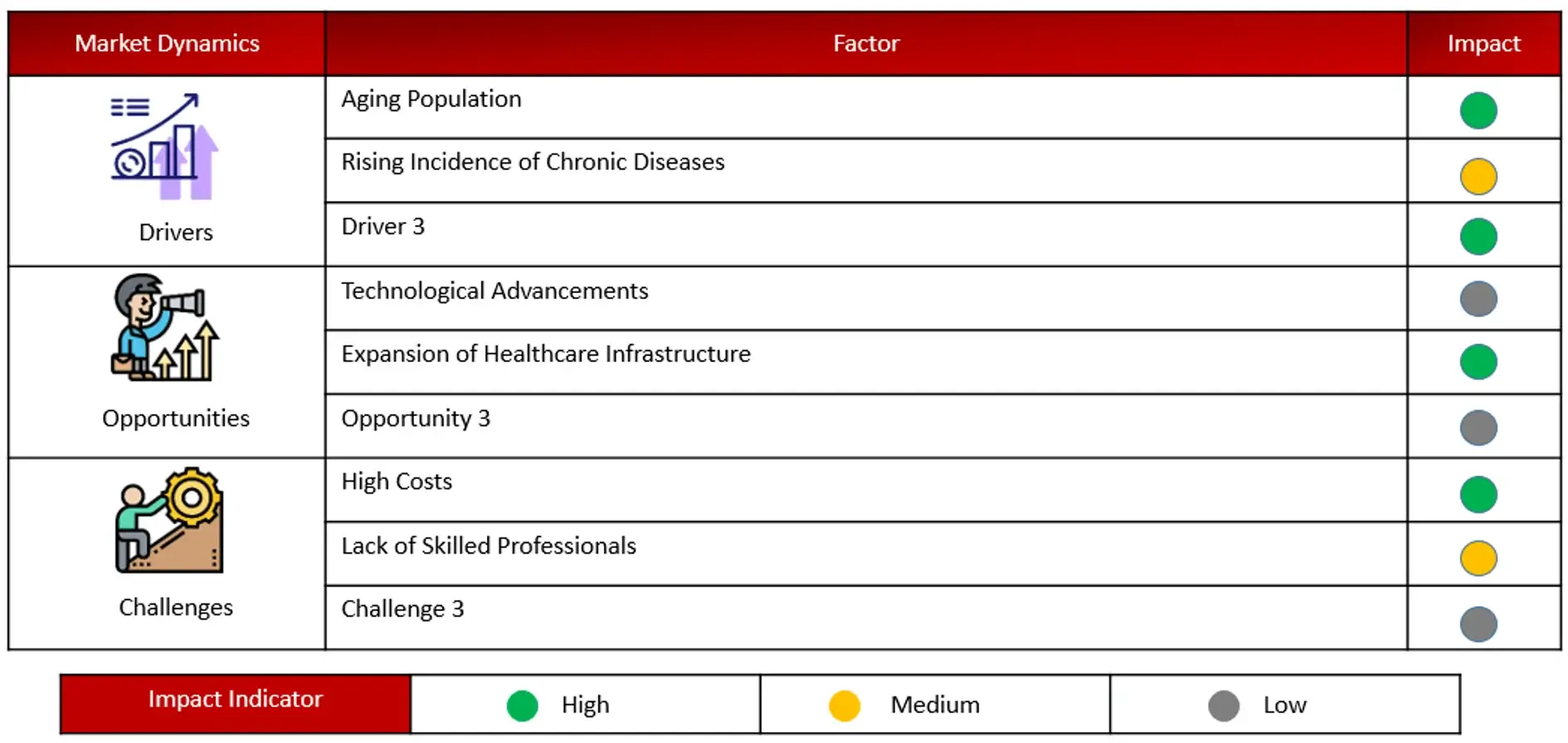

The research offers an in-depth analysis of industry trends, detailed pricing assessments, patent evaluations, insights from conferences and webinars, identification of key stakeholders, and a thorough understanding of market purchasing behaviors. Market growth is largely fueled by the rising incidence of chronic conditions like arthritis and cancer, which drive the need for rehabilitation therapies, the high risk of injuries to caregivers during patient handling, an expanding geriatric and obese population, and increased demand for rehabilitation services due to better access to healthcare. However, challenges such as reimbursement issues and difficulties in managing bariatric patients remain key obstacles in the market.

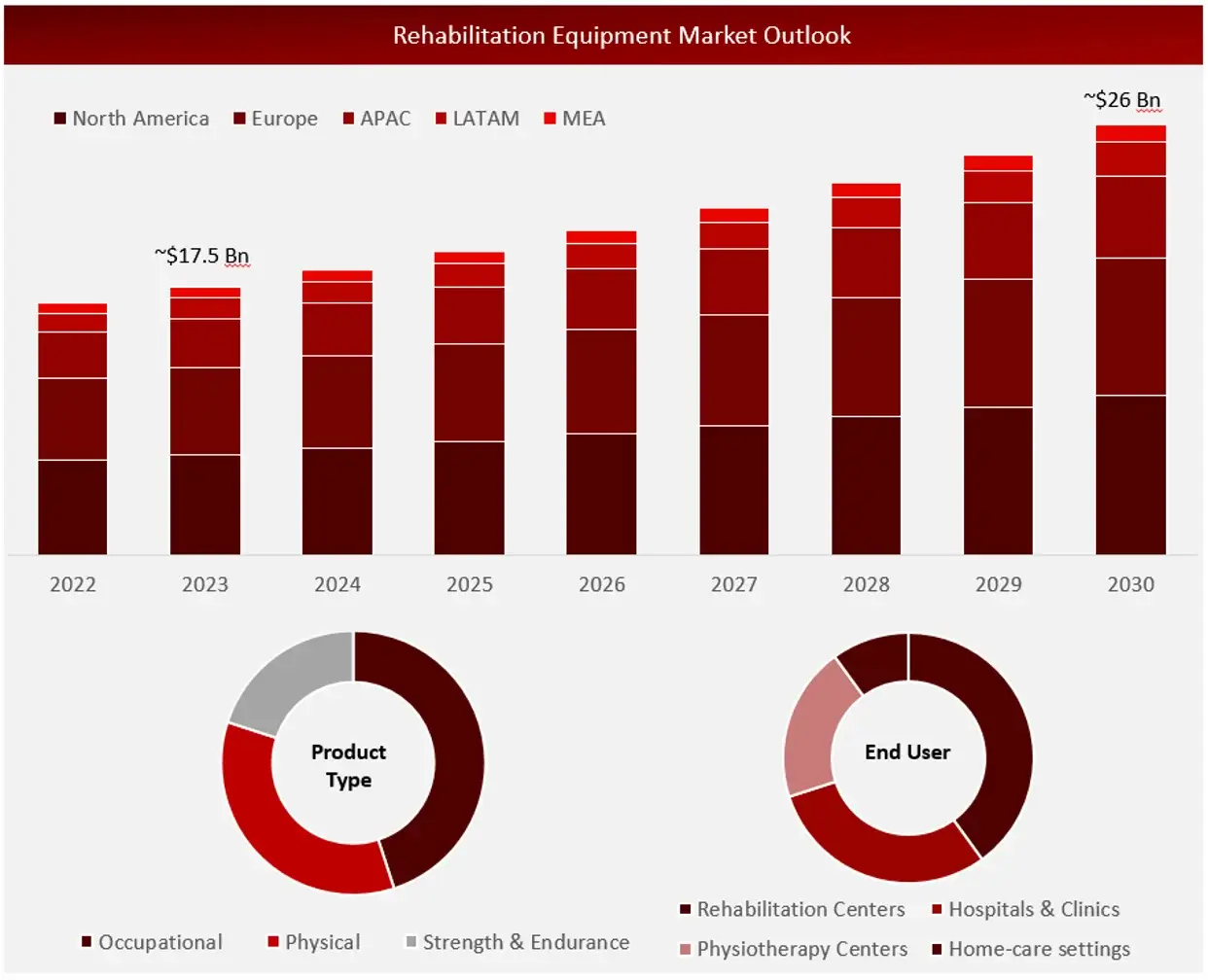

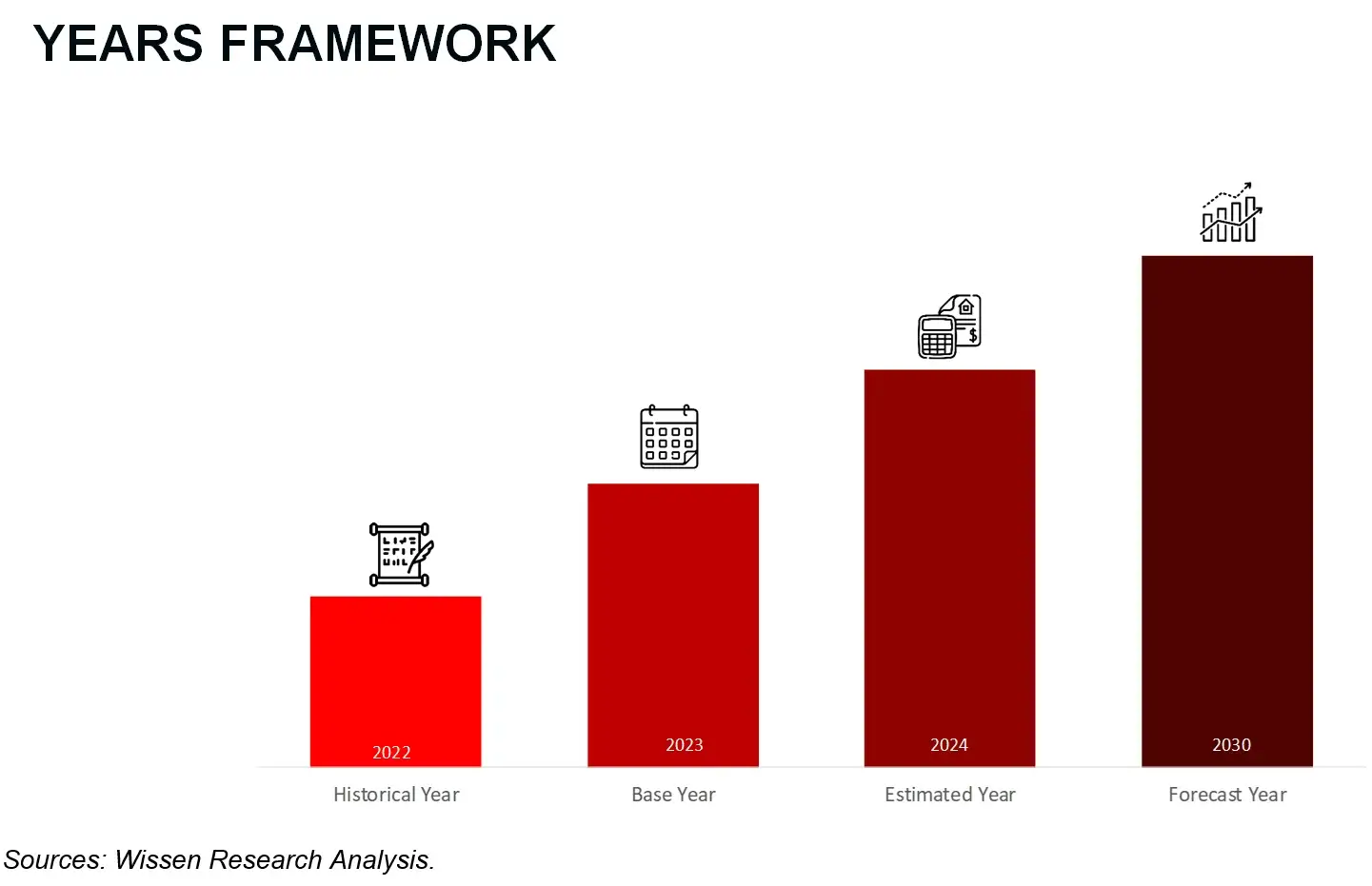

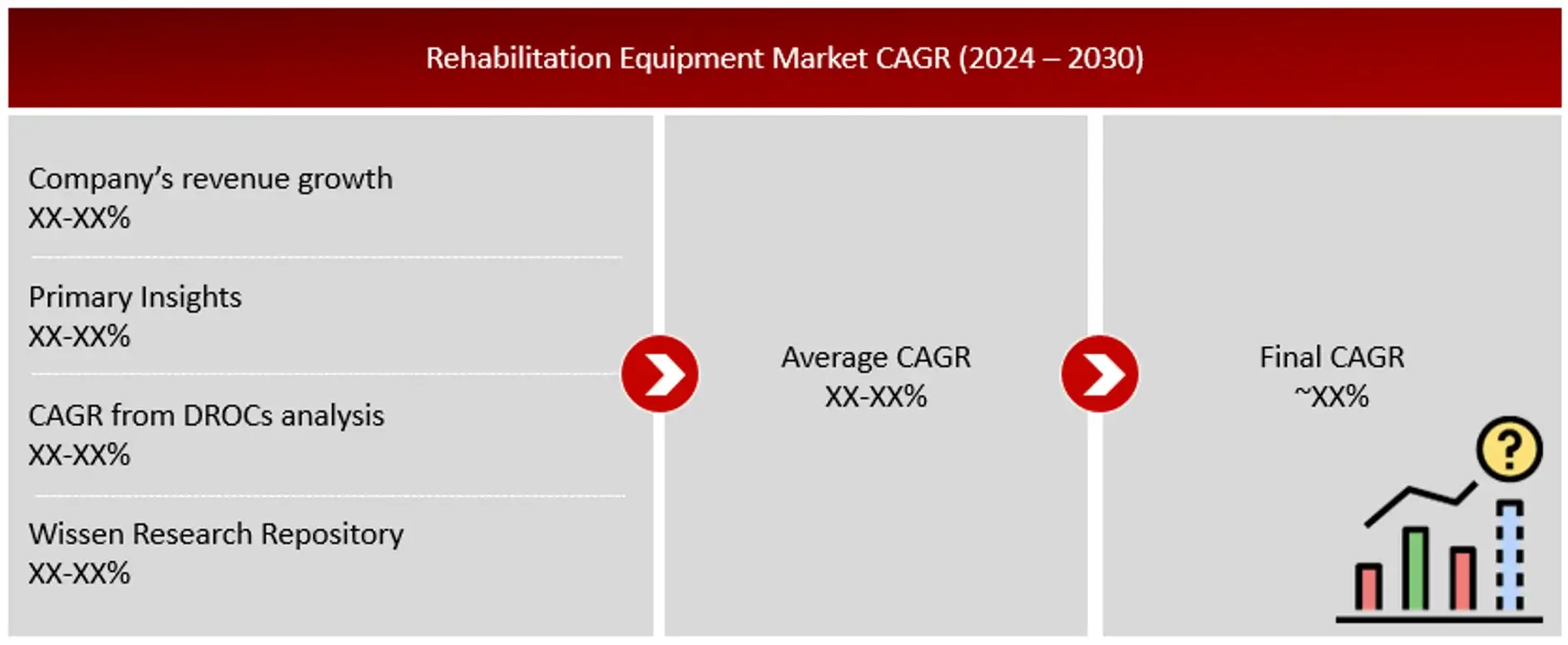

Wissen Research analyses that the rehabilitation equipment market is estimated at ~USD 17.5 billion in 2023 and is projected to reach ~USD 26 billion by 2030, expected to grow at a CAGR of ~6% during the forecast period, 2023-2030.

Driving Factor: Rising prevalence of chronic illnesses

Manually handling disabled patients poses a significant risk of severe musculoskeletal injuries for caregivers. This risk is particularly high during lateral transfers, where caregivers must extend their reach over a stretcher to move the patient, often requiring them to adopt awkward and strained postures. Such movements can lead to substantial discomfort and long-term injuries. Injuries sustained in healthcare settings come with both direct and indirect costs. Direct costs include the expenses related to medical treatment and the loss of workdays. Indirect costs, which are more challenging to quantify, involve the reduced functional capacity and overall productivity of caregivers, impacting the efficiency and quality of patient care.

Opportunity: Increasing need for home-based healthcare services

All over the world, governments are increasingly enacting regulations aimed at reducing both the duration and cost of healthcare treatments. Providing healthcare services at a patient’s home is generally more economical than institutional care, especially when informal care resources are utilized effectively. With advancements in technologies like remote patient monitoring, the home care sector is anticipated to experience substantial growth. This surge in home care demand will subsequently drive the need for specialized equipment, such as patient transfer devices, mobility aids, and medical beds. As more patients receive care at home, the market for these essential home care tools is expected to expand significantly in the coming years.

Challenge: Reimbursement limitations impact accessibility of costly rehab equipment

Reimbursement plays a crucial role in the adoption of rehabilitation equipment. Many products in this market come with a high price tag, making them potentially unaffordable for patients without reimbursement support. Organizations like Medicare and Medicaid in the U.S. offer only limited coverage for certain rehabilitation equipment, including hospital beds, patient lifts, commode chairs, crutches, walkers, and manual and electric wheelchairs and scooters. Additionally, this coverage is restricted to purchases or rentals from approved Medicare suppliers, who are bound by regulations to not charge more than the Medicare-approved amount for these items

Sources: Company Websites and Wissen Research Analysis.

Sources: Company Websites and Wissen Research Analysis.

Therapy equipment leads market due to rising rehabilitation demand

The rehabilitation equipment market is divided into several categories, including therapy equipment, daily living aids, mobility equipment, exercise equipment, and body support devices. In 2021, the therapy equipment segment emerged as the largest shareholder in the global market. This growth is largely driven by the rising number of patients seeking physiotherapy and rehabilitation therapies. As more individuals turn to these therapeutic interventions for recovery and improvement, the demand for specialized therapy equipment is expanding worldwide. This trend reflects an increased emphasis on tailored therapeutic solutions to support patient rehabilitation and enhance overall recovery outcomes.

The physical rehabilitation and training segment is the largest application area

The rehabilitation equipment market is categorized by application into strength, endurance, and pain reduction; physical rehabilitation and training; and occupational rehabilitation and training. In 2021, the physical rehabilitation and training segment held the largest market share. This segment focuses on addressing conditions such as osteoarthritis, joint replacement, sports injuries, knee pain, back pain, carpal tunnel syndrome, Alzheimer’s disease, multiple sclerosis, and cerebral palsy. The rising prevalence of these conditions is driving substantial growth in the physical rehabilitation and training sector.

Europe is expected to experience the highest growth rate during the forecast period

Europe held the largest share of the global rehabilitation equipment market, driven by the significant contributions of economically stable and technologically advanced countries like Germany, the UK, and France. The growth in this region is fueled by an aging population and a rising prevalence of musculoskeletal disorders. Meanwhile, the Asia Pacific region is expected to experience the highest compound annual growth rate (CAGR) during the forecast period. This growth is attributed to increased healthcare spending and the expanding number of healthcare facilities across Asian countries.

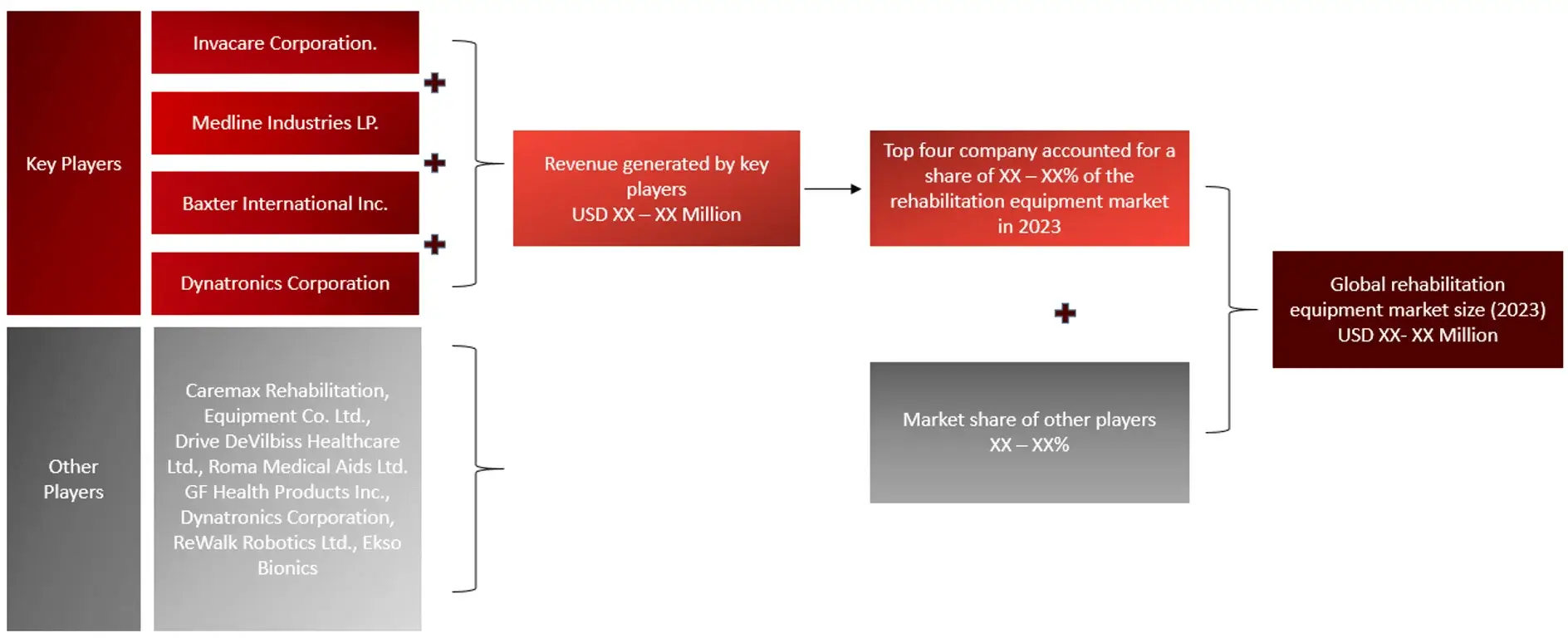

Major Companies and Market Share Insights in Rehabilitation Equipment Market

Major players operating in rehabilitation equipment market are Invacare Corporation (US), Baxter International Inc, Dynatronics Corporation, ReWalk Robotics (Israel), Medline Industries LP (US)., Caremax Rehabilitation Equipment Co. Ltd. (China), Drive DeVilbiss Healthcare Ltd. (US), Roma Medical Aids Ltd. (UK), GF Health Products Inc. (US), Dynatronics Corporation (US), ReWalk Robotics Ltd.(Israel), Ekso Bionics (US), among others.

Introduction

Market Definition

The rehabilitation equipment market refers to the industry focused on the production, distribution, and sale of devices and tools designed to assist individuals in recovering physical, mental, or cognitive abilities lost due to injury, illness, surgery, or aging. This market encompasses a wide range of products, including mobility aids (such as wheelchairs, walkers, and crutches), daily living aids, exercise equipment for physical therapy, orthotics and prosthetics, and devices that facilitate patient care and rehabilitation. The market serves hospitals, rehabilitation centers, home care settings, and individual consumers, and is influenced by factors such as the aging population, the rising incidence of chronic diseases, and increased access to healthcare services.

Sources: Company Websites and Wissen Research Analysis.

Sources: Company Websites and Wissen Research Analysis.

Sources: Wissen Research Analysis.

Sources: Wissen Research Analysis.

Key Stakeholders

Key objectives of the Study

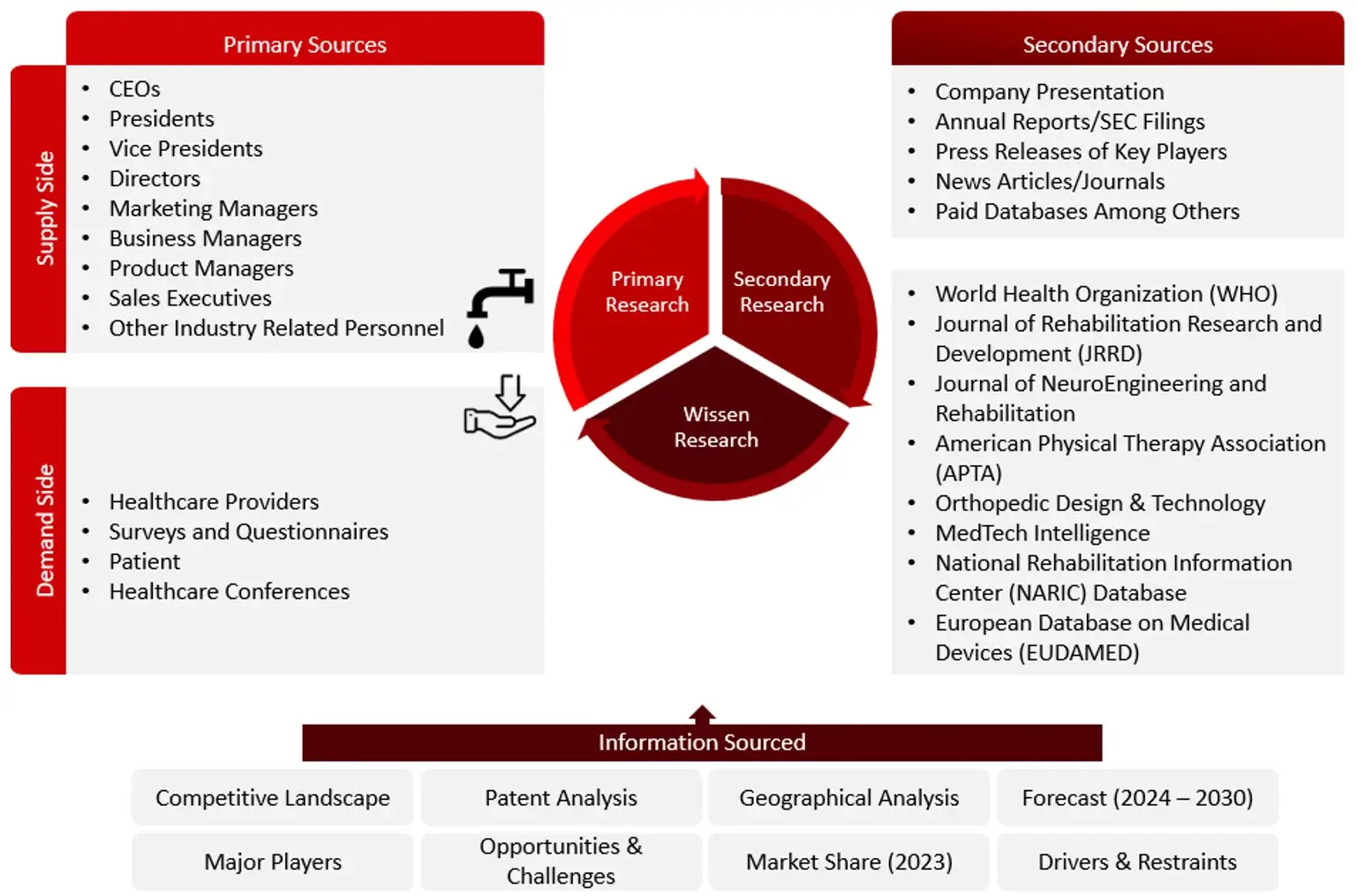

Research Methodology

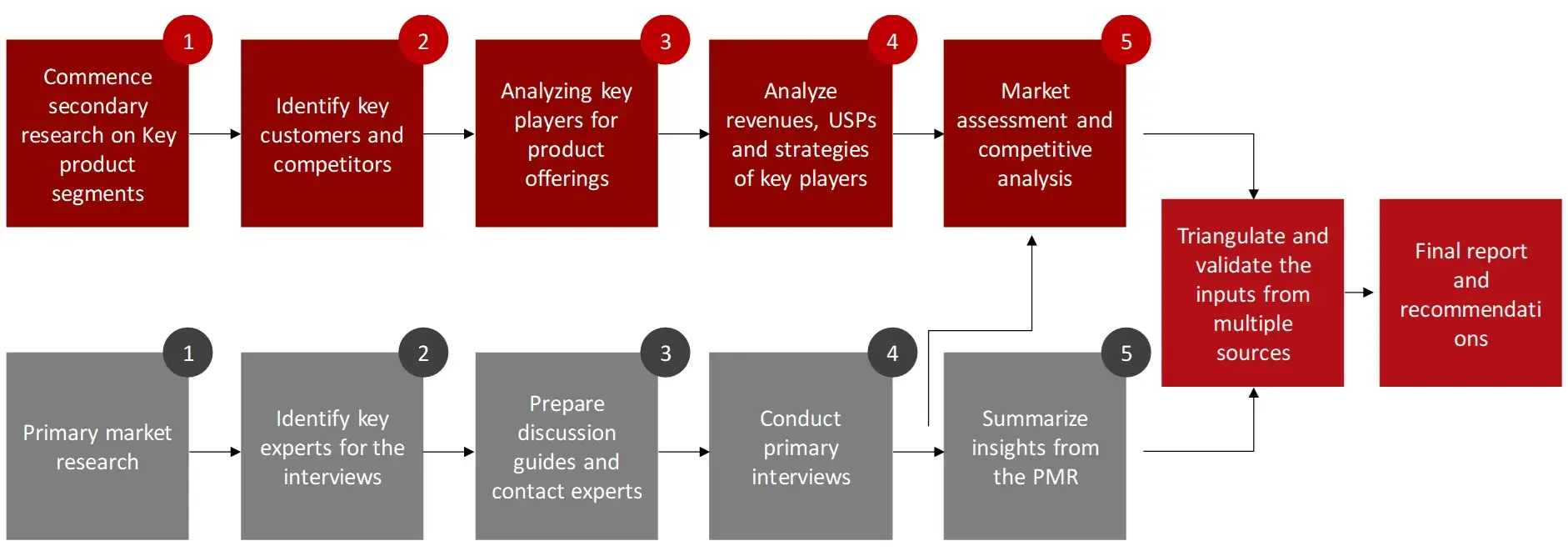

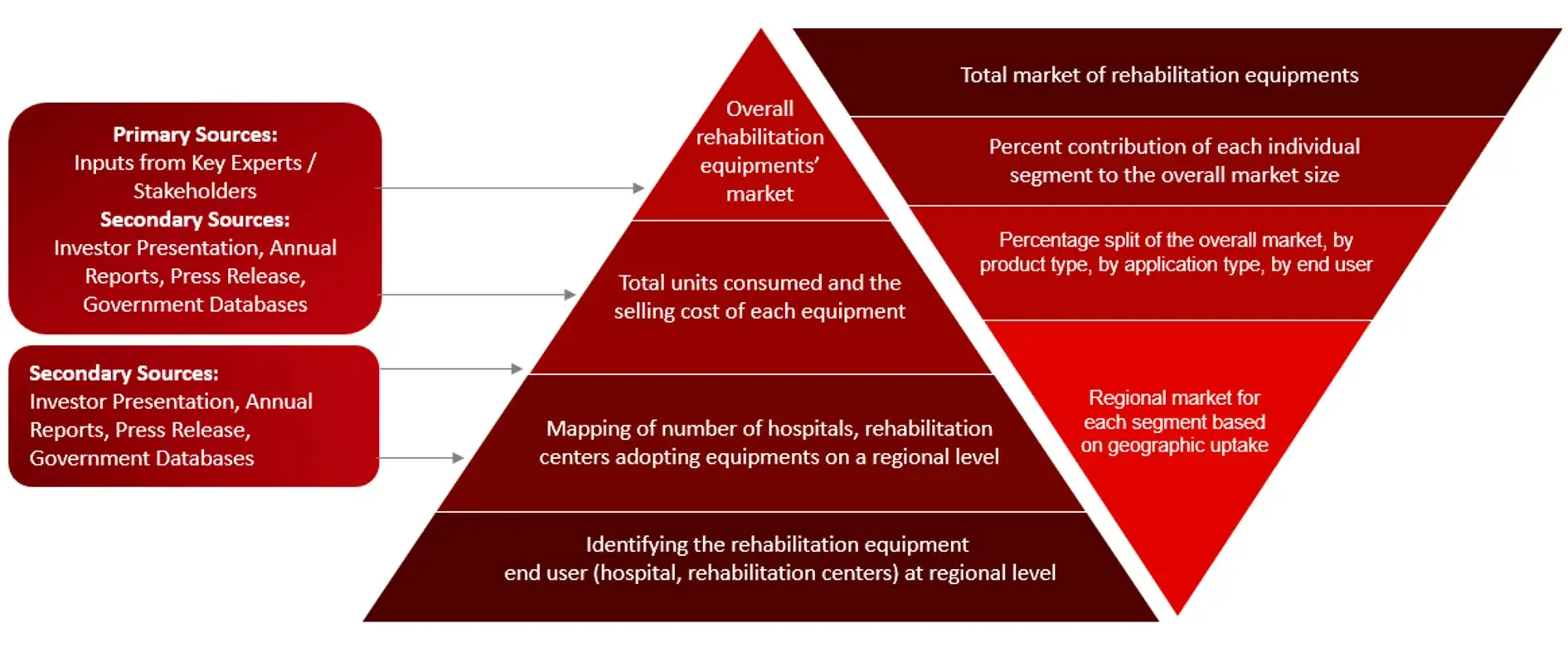

The aim of the study is to examine the key market forces such as drivers, opportunities, restraints, challenges, and strategies of key leaders. To monitor company advancements such as patents granted, product launches, expansions, and collaborations of key players, analyzing their competitive landscape based on various parameters of business and product strategy. Market sizing will be estimated using top-down and bottom-up approaches. Using market breakdown and data triangulation techniques, market sizing of segments and sub-segments will be estimated.

FIGURE: RESEARCH DESIGN

Sources: Wissen Research Analysis.

Sources: Wissen Research Analysis.

Research Approach

Collecting Secondary Data

The process of collating secondary research data involves the utilization of databases, secondary sources, annual reports, investor presentations, directories, and SEC filings of companies. Secondary research will be utilized to identify and gather information beneficial for the in-depth, technical, market-oriented, and commercial analysis of the rehabilitation equipment market. A database of the key industry leaders will also be compiled using secondary research.

Collecting Primary Data

The primary research data will be conducted after acquiring knowledge about the rehabilitation equipment market scenario through secondary research. A significant number of primary interviews will be conducted with stakeholders from both the demand and supply side (including various industry experts, such as Vice Presidents (VPs), Chief X Officers (CXOs), Directors from business development, marketing and product development teams, product manufacturers) across major countries of Europe, Asia Pacific, North America, Latin America, and Middle East and Africa. Primary data for this report will be collected through questionnaires, emails, and telephonic interviews.

FIGURE: BREAKDOWN OF PRIMARY INTERVIEWS FROM SUPPLY SIDE

FIGURE: BREAKDOWN OF PRIMARY INTERVIEWS FROM DEMAND SIDE

FIGURE: PROPOSED PRIMARY PARTICIPANTS FROM DEMAND AND SUPPLY SIDE

Note: Above mention companies are non-exhaustive.

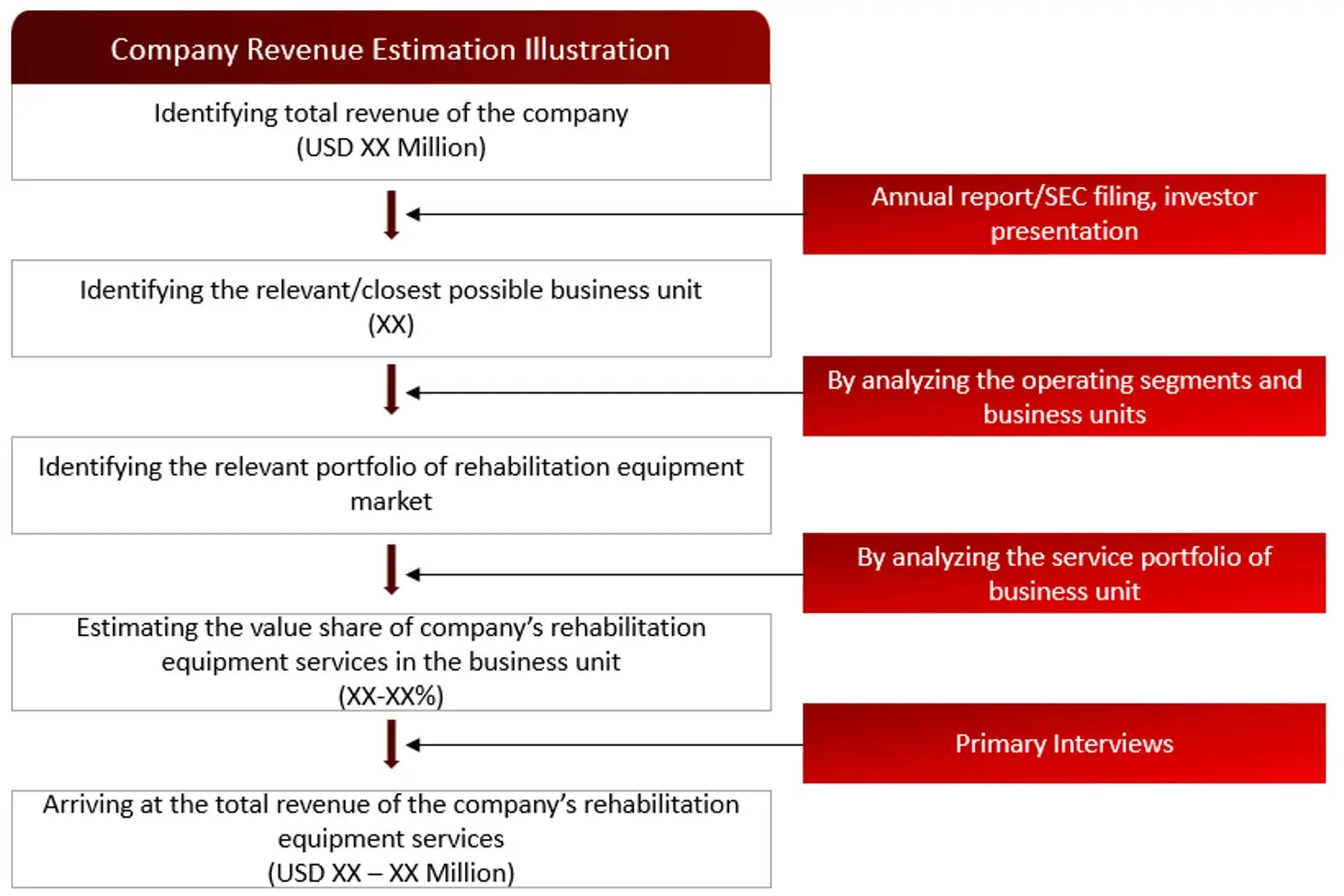

Market Size Estimation

All major manufacturers offering various rehabilitation equipment services will be identified at the global / regional level. Revenue mapping will be done for the major players, which will further be extrapolated to arrive at the global market value of each type of segment. The market value of rehabilitation equipment market will also split into various segments and sub segments at the region level based on:

FIGURE: REVENUE MAPPING BY COMPANY (ILLUSTRATION)

Sources: Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentation, Paid Database, and Wissen Research Analysis.

Sources: Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentation, Paid Database, and Wissen Research Analysis.

FIGURE: REVENUE SHARE ANALYSIS OF KEY PLAYERS (SUPPLY SIDE)

Sources: Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentation, Paid Database, and Wissen Research Analysis.

Sources: Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentation, Paid Database, and Wissen Research Analysis.

FIGURE: MARKET SIZE ESTIMATION TOP-DOWN AND BOTTOM-UP APPROACH

Sources: Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentation, Paid Database, and Wissen Research Analysis.

Sources: Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentation, Paid Database, and Wissen Research Analysis.

FIGURE: ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES FOR GROWTH FORECAST

Sources: World Health Organization (WHO), Journal of Rehabilitation Research and Development (JRRD), Journal of NeuroEngineering and Rehabilitation, American Physical Therapy Association (APTA), Orthopedic Design & Technology, MedTech Intelligence, National Rehabilitation Information Center (NARIC) Database, European Database on Medical Devices (EUDAMED) Health Organization Reports, Pharmaceutical Companies Company Website, Press Releases, Annual Reports, Paid Data Sources, and Wissen Research Analysis.

Sources: World Health Organization (WHO), Journal of Rehabilitation Research and Development (JRRD), Journal of NeuroEngineering and Rehabilitation, American Physical Therapy Association (APTA), Orthopedic Design & Technology, MedTech Intelligence, National Rehabilitation Information Center (NARIC) Database, European Database on Medical Devices (EUDAMED) Health Organization Reports, Pharmaceutical Companies Company Website, Press Releases, Annual Reports, Paid Data Sources, and Wissen Research Analysis.

FIGURE: GROWTH FORECAST ANALYSIS UTILIZING MULTIPLE PARAMETERS

Sources: Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentation, Paid Database, and Wissen Research Analysis.

Sources: Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentation, Paid Database, and Wissen Research Analysis.

Research Design

After arriving at the overall market size-using the market size estimation processes-the market will be split into several segments and sub segment. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub segment, the data triangulation, and market breakdown procedures will be employed, wherever applicable. The data will be triangulated by studying various factors and trends from both the demand and supply sides in the rehabilitation equipment market.

Sources: World Health Organization (WHO), Journal of Rehabilitation Research and Development (JRRD), Journal of NeuroEngineering and Rehabilitation, American Physical Therapy Association (APTA), Orthopedic Design & Technology, MedTech Intelligence, National Rehabilitation Information Center (NARIC) Database, European Database on Medical Devices (EUDAMED) Health Organization Reports, Pharmaceutical Companies Company Website, Press Releases, Annual Reports, Paid Data Sources, and Wissen Research Analysis.

Sources: World Health Organization (WHO), Journal of Rehabilitation Research and Development (JRRD), Journal of NeuroEngineering and Rehabilitation, American Physical Therapy Association (APTA), Orthopedic Design & Technology, MedTech Intelligence, National Rehabilitation Information Center (NARIC) Database, European Database on Medical Devices (EUDAMED) Health Organization Reports, Pharmaceutical Companies Company Website, Press Releases, Annual Reports, Paid Data Sources, and Wissen Research Analysis.

1. Introduction

1.1 Key Objectives

1.2 Definitions

1.2.1 In Scope

1.2.2 Out of Scope

1.3 Scope of the Report

1.4 Scope Related Limitations

1.5 Key Stakeholders

2. Research Methodology

2.1 Research Approach

2.2 Research Methodology / Design

2.3 Market Sizing Approach

2.3.1 Secondary Research

2.3.2 Primary Research

3. Executive Summary & Premium Content

3.1 Global Market Outlook

3.2 Key Market Findings

4. Market Overview

4.1 Market Dynamics

4.1.1 Drivers/Opportunities

4.1.2 Restraints/Challenges

4.2 End User Perception

4.3 Need Gap

4.4 Supply Chain / Value Chain Analysis

4.5 Industry Trends

4.6 Pricing Analysis

4.7 Porter’s Five Forces Analysis

5. Patent Analysis

5.1. Patents Related to Rehabilitation Technologies/Devices

5.2. Patent Landscape and Intellectual Property Trends

6. Rehabilitation Equipment Market, by Product Type (2022-2030, USD Million)

6.1 Therapy Equipment

6.2 Mobility Equipment

6.2.1 Wheelchairs & Scooters

6.2.1.1 Powered Wheelchairs

6.2.1.2 Mobility Scooters

6.2.1.3 Manual Wheelchairs

6.2.2 Walking Assist Devices

6.2.2.1 Canes

6.2.2.2 Crutches

6.2.2.3 Walkers

6.3 Daily Living Aids

6.3.1 Medical Beds & Related Product

6.3.2 Bathroom and Toilet Assist Devices

6.3.3 Reading, Writing, and Computing Aids

6.3.4 Other Daily Living

6.4 Exercise Equipment

6.4.1 Lower-Body Exercise Equipment

6.4.2 Upper-Body Exercise Equipment

6.4.3 Full-Body Exercise Equipment

6.5 Body Support Devices

6.5.1 Patient Lifts

6.5.2 Slings

6.5.3 Other Body Support Devices

7. Rehabilitation Equipment Market, by Application (2022-2030, USD Million)

7.1 Occupational Rehabilitation & Training

7.2 Physical Rehabilitation & Training

7.3 Strength, Endurance, and Pain Reduction

8. Rehabilitation Equipment Market, by End User (2022-2030, USD Million)

8.1 Rehabilitation Centers

8.2 Hospitals & Clinics

8.3 Physiotherapy Centers

8.4 Home-care settings

8.5 Other End Users

9. Rehabilitation Equipment Market, by Region (2022-2030, USD Million)

9.1 North America

9.1.1 US

9.1.2 Canada

9.2 Europe

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 Italy

9.2.5 UK

9.2.6 Rest of the Europe

9.3 Asia Pacific

9.3.1 China

9.3.2 Japan

9.3.3 India

9.3.4 Australia and New Zealand

9.3.5 South Korea

9.3.6 Rest of the Asia Pacific

9.4 Middle East and Africa

9.5 Latin America

10. Competitive Analysis

10.1 Key Players Footprint Analysis

10.2 Market Share Analysis

10.3 Key Brand Analysis

10.4 Regional Snapshot of Key Players

10.5 R&D Expenditure of Key Players

11. Company Profiles2

11.1 Invacare Corporation

11.1.1 Business Overview

11.1.2 Product Portfolio

11.1.3 Financial Snapshot3

11.1.4 Recent Developments

11.1.5 SWOT Analysis

11.2 Caremax Rehabilitation Equipment Co. Ltd.,

11.3 ARJO

11.4 Medline Industries LP.

11.5 Baxter International Inc

11.6 Dynatronics Corporation

11.7 Permobil AB

11.8 ETAC Ab

11.9 Drive DeVilbiss Healthcare Ltd.

11.10 Roma Medical Aids Ltd.

11.11 GF Health Products Inc.

11.12 Dynatronics Corporation

11.13 ReWalk Robotics Ltd.

11.14 Ekso Bionics

11.15 DJO Global

11.16 Hospital Equipment Mfg. Co.

11.17 Zimmer MedizinSysteme GmbH

11.18 Maddak, Inc.

11.19 India Medico Instruments

12. Conclusion

13. Appendix

13.1 Industry Speak

13.2 Questionnaire

13.3 Available Custom Work

13.4 Adjacent Studies

13.5 Authors

14. References

Key Notes:

© Copyright 2024 – Wissen Research All Rights Reserved.