Remote Patient Monitoring: Market Size, Trend, Outlook by Products (Softwares & Services, Devices (Vital Signs Monitors and Special Monitors), Applications, End Users, Regions, Major Players – Global Forecast to 2030

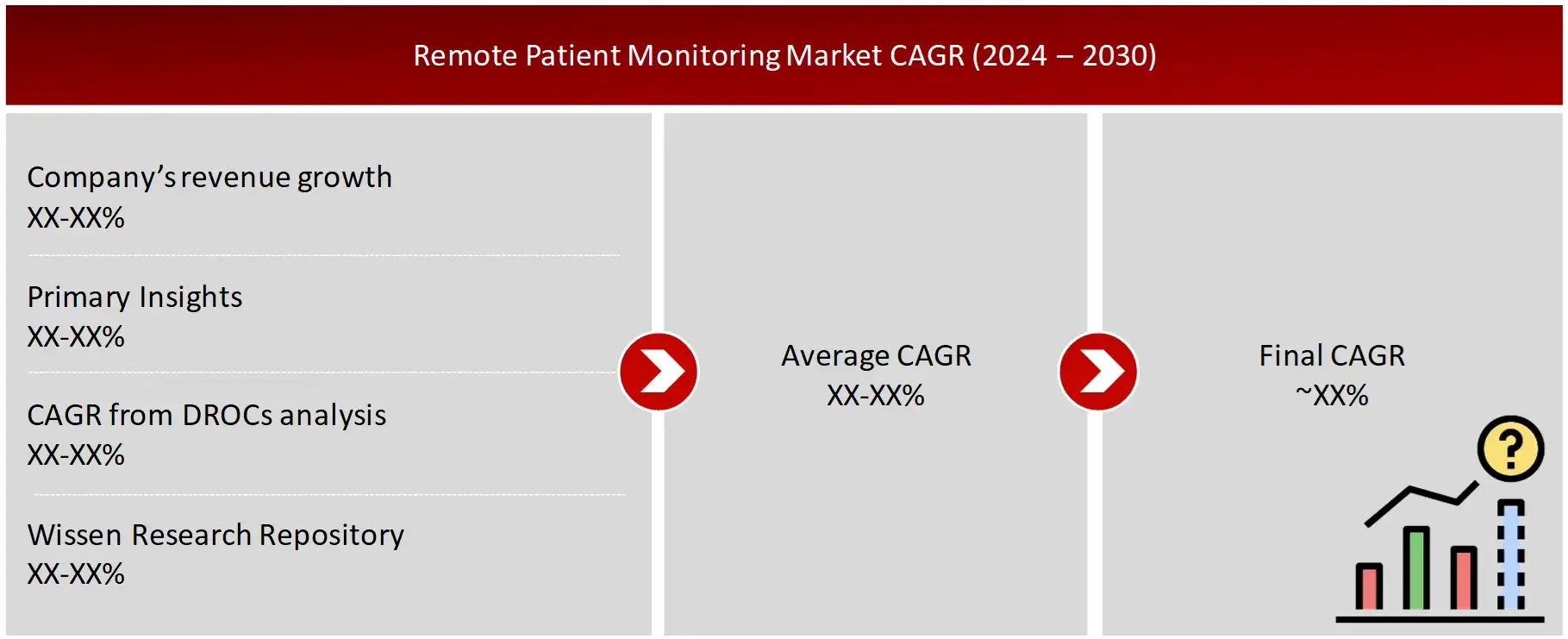

Wissen Research analyses that the global remote patient monitoring market is estimated at USD 40 billion in 2023 and is projected to reach USD 88 billion by 2030, expected to grow at a CAGR of 12% during the forecast period, 2024-2030.

Over the last decade, remote patient monitoring (RPM) has emerged as a transformative force in healthcare delivery across developed and developing nations. The RPM market encompasses a diverse array of digital health technologies, including wearable devices, biosensors, mobile health applications, and integrated software platforms that enable continuous patient monitoring outside traditional clinical settings. A recent study by the American Medical Association (AMA) revealed that approximately 85% of physicians in 2023 recognize RPM as beneficial for chronic disease management, with 60% actively implementing such solutions in their practice. The market is being primarily driven by the growing need to reduce hospital readmissions, enhance patient outcomes, and deliver cost-effective care while addressing the challenges of an aging population and rising chronic disease burden.

Further, the US with USD 26 billion market in 2024, holds majority share in the global remote patient monitoring market and is likely to remain the leading region growing a CAGR of 11.20% within this market, during the forecast period.

LUCRATIVE OPPORTUNITIES IN THE REMOTE PATIENT MONITORING MARKET

Strategic Activities

Drivers: Rising Demand For In-House Monitoring to Drive The Remote Patient Monitoring Market

The demand for in-house patient monitoring is a key driver in the remote patient monitoring (RPM) market, fueled by a shift toward patient-centred care. Many patients, especially those with chronic conditions like diabetes, hypertension, and heart disease, prefer the convenience of monitoring their health at home. This trend accelerated during the COVID-19 pandemic when healthcare systems increasingly adopted remote solutions to reduce patient visits and exposure. A Harvard Health Letter article states that nearly 50 million people in the United States currently use remote patient monitoring devices.

RPM offers numerous benefits, such as reducing hospital readmissions and improving patient outcomes. A study in the U.S. Department of Veterans Affairs Health Services found that RPM for chronic diseases reduced hospital admissions by up to 25% and cost savings of $2,000 per patient/year were observed. As the global population ages—expected to reach 1.4 billion people over 60 years of age by 2030—the demand for home-based monitoring will continue to grow.

Wearable devices, like smartwatches and medical sensors under the Blood glucose monitors, Cardiac rhythm monitors and pulse oximeter device sub categories, are also driving this shift by providing real-time data that healthcare providers can access for timely interventions. This preference for in-home care is reshaping healthcare delivery, making RPM a crucial part of the healthcare landscape.

Opportunities: Implementation of Supportive Central Data Management Systems in Remote Patient Monitoring Systems Market

The integration of supportive central data management systems represents a significant market opportunity in Remote Patient Monitoring (RPM), particularly as healthcare organizations increasingly leverage cloud-based platforms and advanced analytics. According to a recent Healthcare Information and Management Systems Society (HIMSS) survey, 76% of healthcare organizations that implemented centralized data management systems reported improved clinical decision-making and reduced time to intervention. These centralized systems enable seamless aggregation of patient data from multiple RPM devices, creating comprehensive health profiles that support more informed clinical decisions.

The opportunity lies in developing robust platforms that can not only collect and store vast amounts of patient data but also provide actionable insights through AI and machine learning algorithms. Modern central data management systems are evolving to include features like automated alert systems, predictive analytics, and integration with Electronic Health Records (EHRs). A notable example is the Mayo Clinic’s implementation of a centralized RPM data platform, which reduced hospital readmissions by 40% for high-risk cardiac patients through early intervention enabled by real-time data analysis. This demonstrates the significant potential for healthcare organizations to improve patient outcomes while reducing operational costs through effective data management systems in RPM deployments.

Challenges: Healthcare Frauds in Remote Patient Monitoring Through Compromised Patient Data

Healthcare fraud in Remote Patient Monitoring (RPM) presents a significant market challenge, particularly as the adoption of digital health solutions expands. Fraudulent activities include billing for non-existent patient monitoring sessions, falsifying patient data, and submitting claims for services not rendered. Common schemes involve providers billing for RPM services without proper patient consent, using automated systems to generate false readings, or charging for monitoring periods that exceed actual patient engagement times.

To combat this, healthcare organizations are implementing stricter verification protocols, real-time auditing systems, and advanced analytics to detect suspicious patterns, while regulatory bodies are increasing scrutiny and enforcement actions against RPM fraud perpetrators.

The remote patient monitoring market report offers information on the latest advancements in the industry, as well as product portfolio analysis, supply chain/value chain analysis, market share, and the effects of localized and domestic players. It also analyses potential revenue opportunities and changes in market regulations, as well as market size, category market growth, application dominance, product approvals, product launches, geographic expansions, and technological innovations. For an analyst brief and other information on the remote patient monitoring market, get in touch with Wissen Research. Our staff can assist you in making well-informed decisions that will lead to market expansion.

The remote patient monitoring market report offers information on the latest advancements in the industry, as well as product portfolio analysis, supply chain/value chain analysis, market share, and the effects of localized and domestic players. It also analyses potential revenue opportunities and changes in market regulations, as well as market size, category market growth, application dominance, product approvals, product launches, geographic expansions, and technological innovations. For an analyst brief and other information on the remote patient monitoring market, get in touch with Wissen Research. Our staff can assist you in making well-informed decisions that will lead to market expansion.

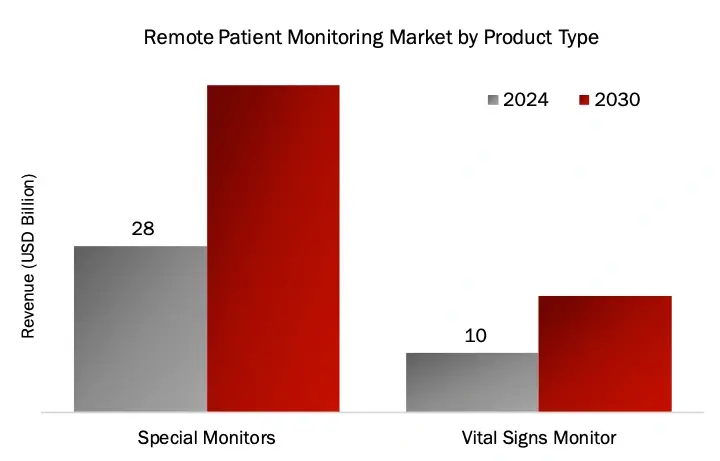

Remote Patient Monitoring Devices (Vital signs and Special monitors) Segment Dominated the Remote Patient Monitoring Market By Product Type In 2023

In 2023, RPM devices emerged as the dominant segment in the Remote Patient Monitoring market, primarily driven by the widespread adoption of blood glucose monitors, and cardiac monitoring devices under the Special monitors category. This growth is attributed to the increasing prevalence of chronic diseases and the growing acceptance of wearable technology among patients. For instance, continuous glucose monitoring devices saw particularly strong growth, with market leader Dexcom reporting a 31% increase in global device shipments in 2023.

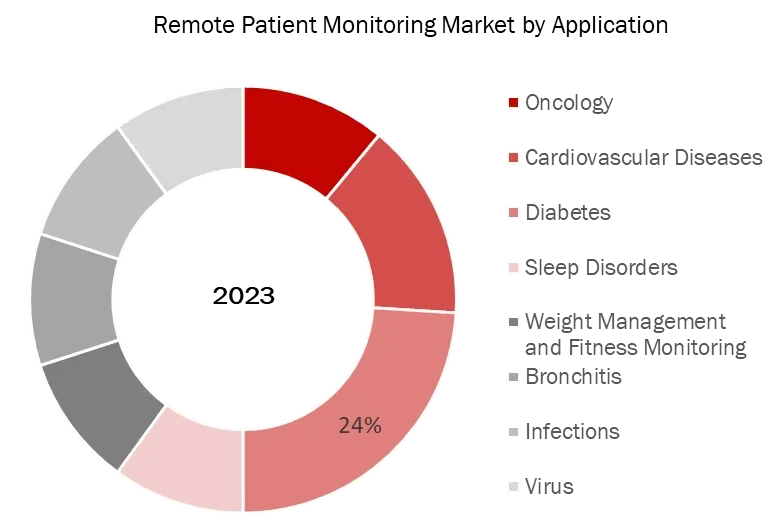

Diabetes Segment Accounted For The Majority Share In The Remote Patient Monitoring Market by Application in 2023

The diabetes segment maintained market leadership in the Remote Patient Monitoring market during 2023, driven by the escalating global diabetes prevalence and the critical need for continuous glucose monitoring. The International Diabetes Federation reports that approximately 537 million adults were living with diabetes in 2021, making consistent blood glucose monitoring essential for disease management. This segment’s dominance is reinforced by the widespread adoption of advanced continuous glucose monitoring (CGM) systems and connected insulin pumps that enable real-time data transmission to healthcare providers.

North America held the largest market share in remote patient monitoring in 2023

Remote patient monitoring market research included a comprehensive analysis of five key regions: North America, Europe, Asia-Pacific, Middle East and Africa, Latin America.All regions were evaluated based on these following factors- healthcare infrastructure, regulatory landscape, technological adoption, and market dynamics.

The research observed that North America held the largest share in the remote patient monitoring domain during the forecast period, primarily due to its advanced healthcare systems, high adoption rates, and the presence of major market players driving innovation in this sector.

Asia-Pacific is expected to experience the fastest growth in the remote patient monitoring market during the forecast period, driven by increasing adoption of digital health solutions and a growing geriatric population. The rising prevalence of chronic diseases and advancements in telehealth infrastructure further enhance the region’s market potential. Additionally, supportive government initiatives and increasing investments in healthcare technologies are likely to encourage stakeholders to focus on the development and deployment of innovative remote monitoring devices and solutions in this region.

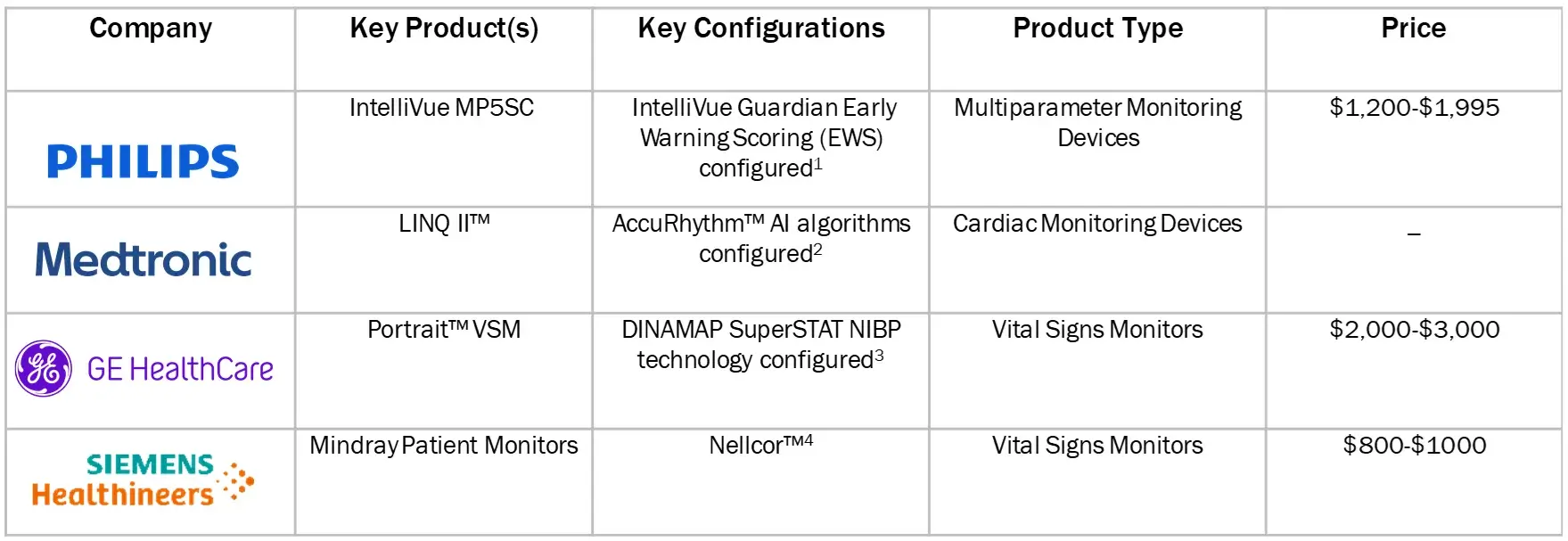

Major players operating in remote patient monitoring market are:

Other major players in remote patient monitoring market include(s): Resideo Life Care Solutions (US), Vivify Health, Inc. (US), Βιο-Βeat Technologies (Israel), Vitalconnect (US), Teladoc Health Inc. (US), Dexcom Inc. (US), Irhythm Technologies, Inc. (US),Vivalnk Inc. (US), Bardy Diagnsotics, Inc. (US), Health Beats (Singapore), Starling Medical (US), Alive Cor, Inc. (US)

Sources: Secondary Research, E-commerce platforms etc.

1 EWS Identifies subtle changes in patients’ clinical status before evident clinical deterioration

2 AccuRhythm is an artificial intelligence (AI) system that applies deep learning algorithms to LINQ II insertable cardiac monitor (ICM) data flowing into the CareLink™ network.

3 DINAMAP is an advanced NIBP algorithm from GE Healthcare, can increase the overall speed and comfort of NIBP determinations, and accuracy.

4 Nellcor™ SatSeconds algorithm works on a basic formula — generating alarms based on the severity of a drop in SpO2 and the length of the drop.

Note: Above mention is non-exhaustive list of products offered by leading players

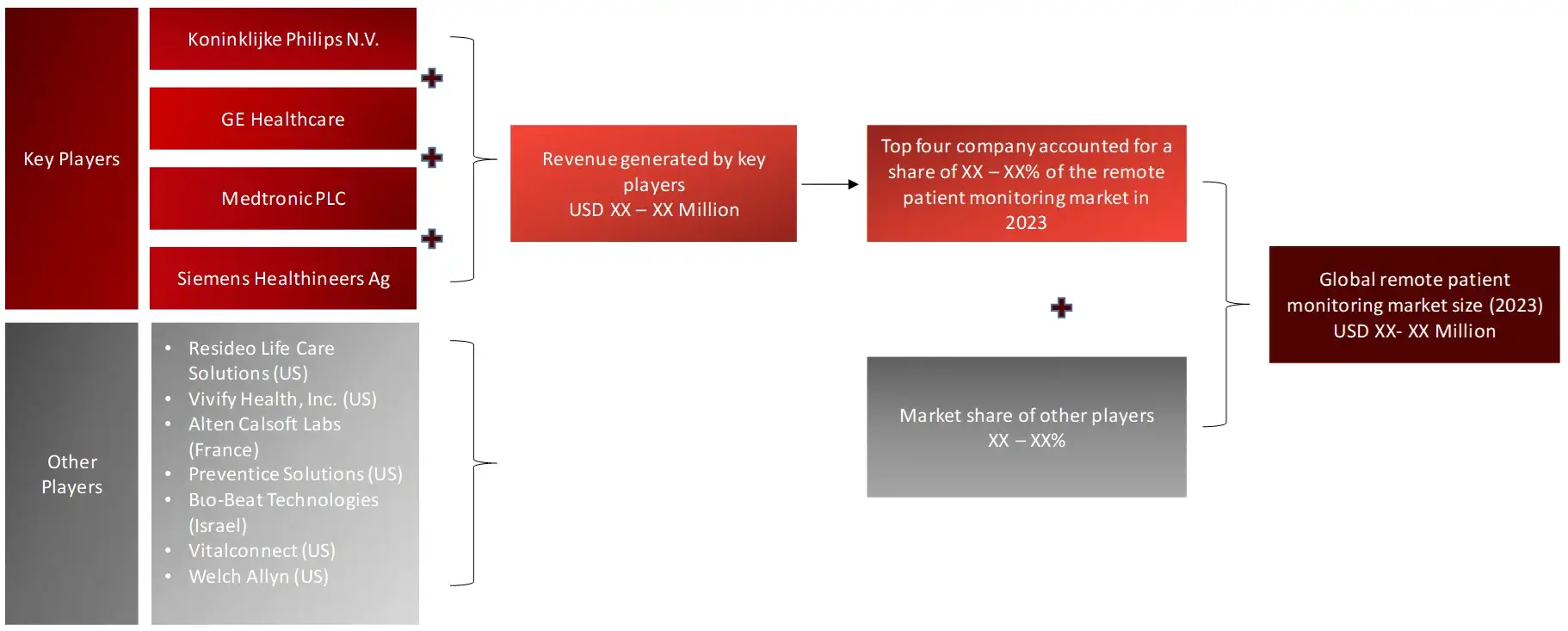

The overall remote patient monitoring market is consolidated with four key players holding majority share of the total remote patient monitoring market.

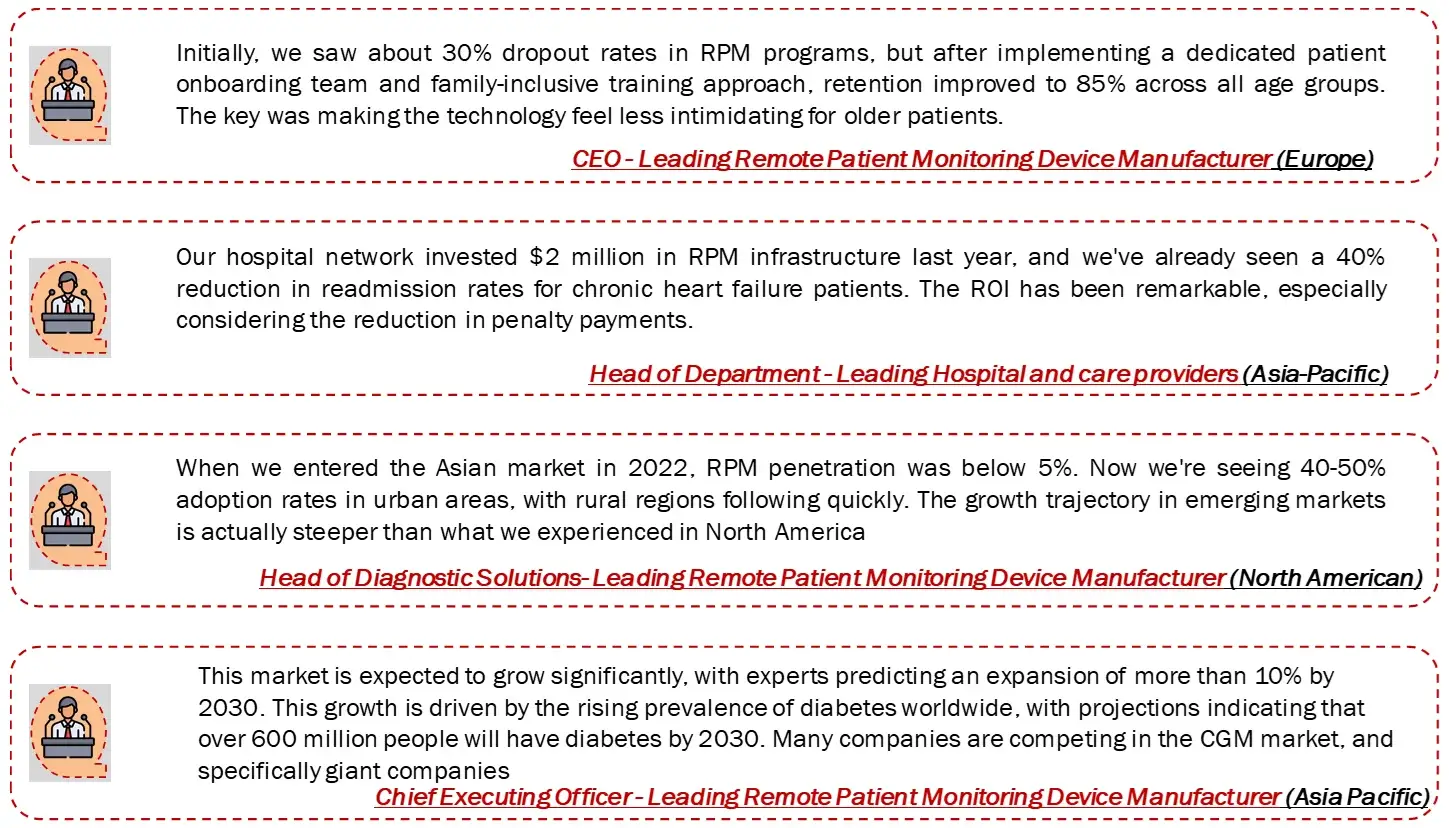

PRIMARY INSIGHTS FROM KEY OPINION LEADERS

Sources: Primary Research and Wissen Research Analysis.

Sources: Primary Research and Wissen Research Analysis.

Note: Above mention is non-exhaustive samples of the primary insights.

| Particulars | Details |

| Report | Remote Patient Monitoring Market |

| Forecast Period | 2024-2030 |

| Base Year | 2023 |

| Format | |

| Estimated Market Size (2023) | USD 40 Billion |

| CAGR (2024-2030) | 12% |

| Number of Pages | 177 |

| Number of Tables | 161 |

| Number of Figures | 33 |

| Key Segments | Remote Patient Monitoring Market Product Outlook (Remote Patient Monitoring Software and Services, Remote Patient Monitoring Devices and Other Monitoring Devices) Remote Patient Monitoring Market Application Outlook (Oncology, Cardiovascular Diseases, Diabetes, Sleep Disorders, Weight Management and Fitness Monitoring, Bronchitis, Infections, Virus, Dehydration, Hypertension, Others) Remote Patient Monitoring Market End User Outlook (Hospitals and Clinics, Home Care Setting , Long Term Care Centres, Ambulatory Care Centres) |

| Regions Covered |

|

| Key Players Covered (Majority Share Holders) | Koninklijke Philips N.V. (Netherlands), Medtronic (Ireland), GE Healthcare (US), Siemens Healthineers Ag (Germany), Omron Healthcare (Japan), Boston Scientific Corporation (US), Abbott Laboratories (US). |

| Other Players Covered | Resideo Life Care Solutions (US), Vivify Health, Inc. (US), Alten Calsoft Labs (France), Preventice Solutions (US), Βιο-Βeat Technologies (Israel), Vitalconnect (US), Welch Allyn (US), Teladoc Health Inc. (US), Dexcom Inc. (US), Irhythm Technologies, Inc. (US), Vivalnk Inc. (US), Bardy Diagnsotics, Inc. (US), Health Beats (Singapore), Starling Medical (US), Alive Cor, Inc. (US). |

Market Definition

Remote Patient Monitoring (RPM) is a technology-enabled healthcare delivery modality that leverages IoT-connected medical devices, biosensors, and telecommunications infrastructure to systematically capture, transmit, evaluate, and store physiological data from patients in non-clinical settings. This interoperable digital health solution facilitates continuous monitoring of vital biometrics, disease-specific parameters, and patient-reported outcomes through FDA-cleared devices and HIPAA-compliant platforms. The collected data undergoes algorithmic analysis to identify clinically significant trends and acute changes, enabling healthcare providers to implement timely interventions, adjust treatment protocols, and deliver evidence-based care management. RPM is particularly efficacious for chronic disease management, post-acute care transitions, and preventive healthcare delivery, demonstrating improved clinical outcomes, reduced hospital readmissions, and enhanced patient engagement through real-time bidirectional communication between providers and patients.

The objective of the study is to analyze the key market dynamics such as drivers, opportunities, challenges, restraints, and key player strategies. To track company developments such as product launches and approvals, expansions, and collaborations of the leading players, the competitive landscape of the remote patient monitoring market to analyze market players on various parameters within the broad categories of business and product strategy. Top-down and bottom-up approaches will be used to estimate the market size. To estimate the market size of segments and sub segments the market breakdown and data triangulation will be used.

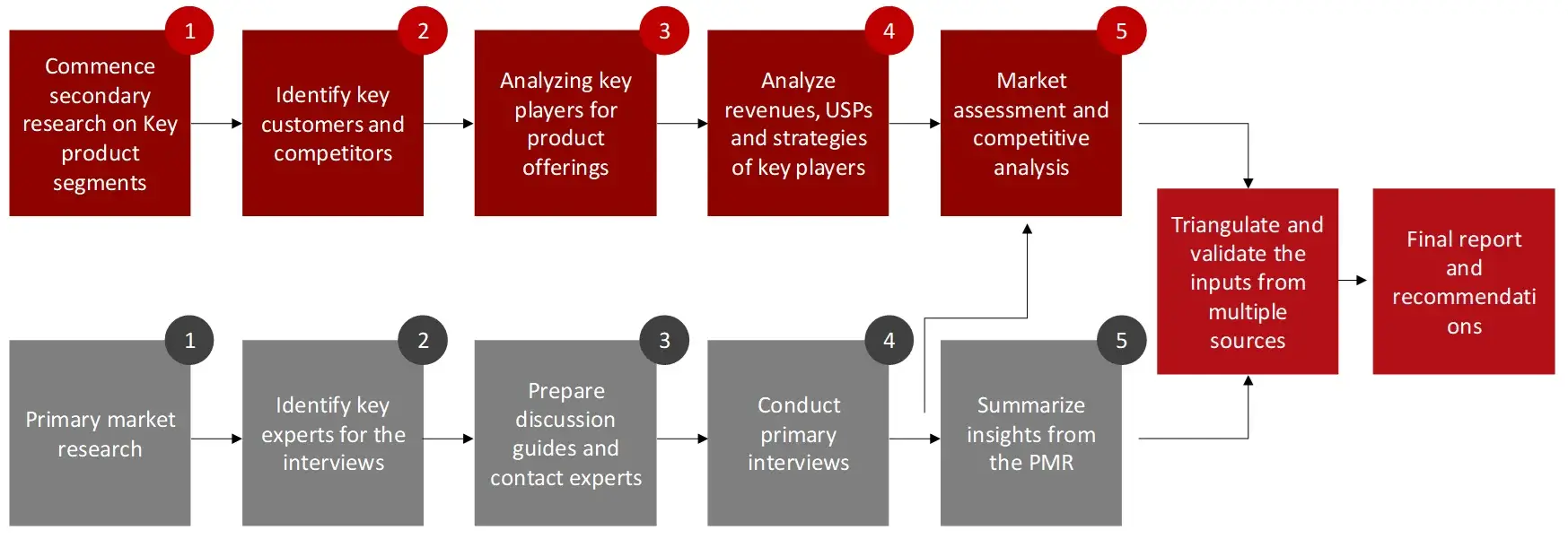

FIGURE: RESEARCH DESIGN

Sources: Wissen Research Analysis

Sources: Wissen Research Analysis

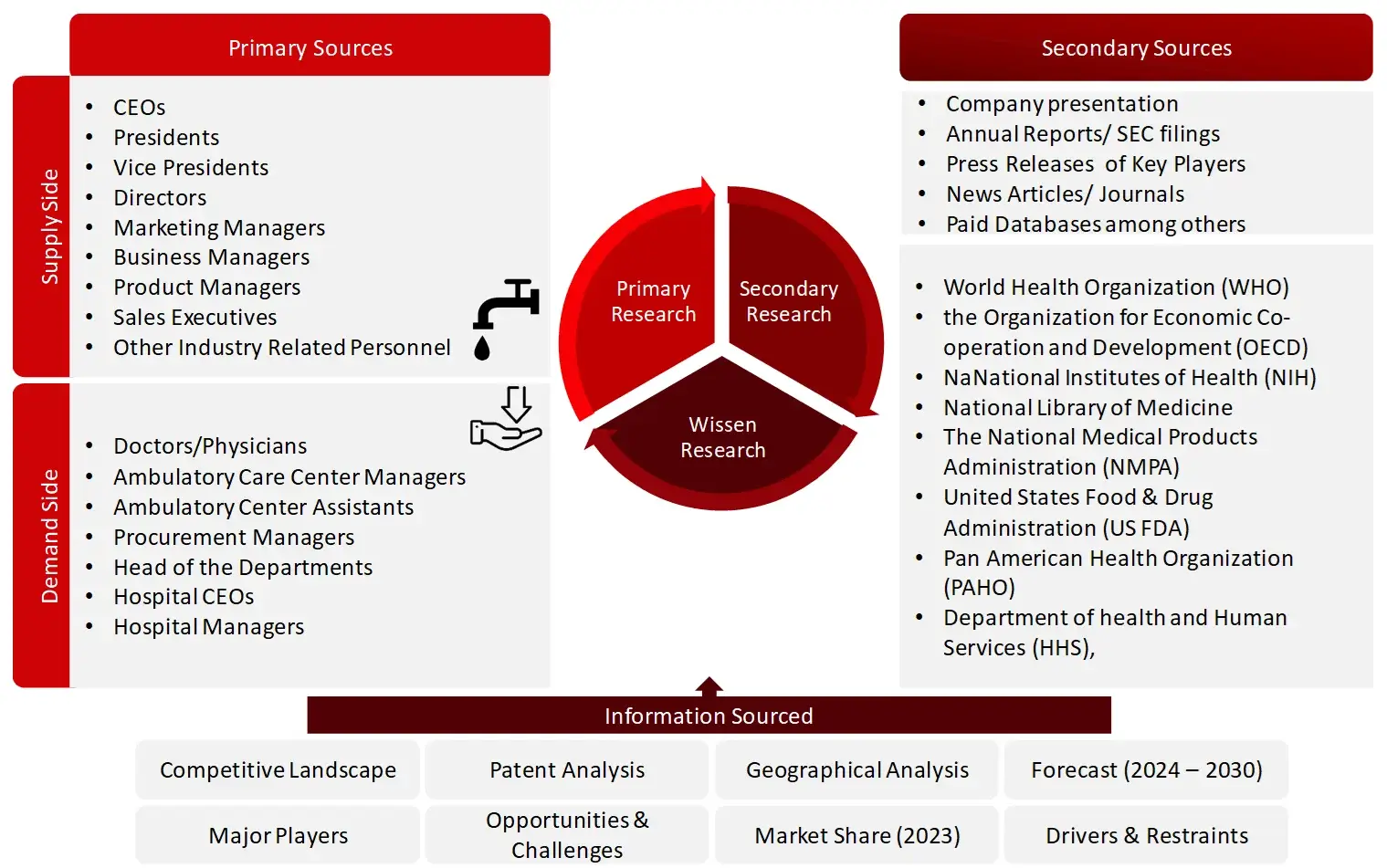

Collecting Secondary Data for Point of Care Testing Market

The secondary research data collection process involves the usage of secondary sources, directories, databases, annual reports, investor presentations, and SEC filings of companies. Secondary research will be used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the remote patient monitoring market. A database of the key industry leaders will also be prepared using secondary research.

Collecting Primary Data for Point of Care Testing Market

The primary research data will be conducted after acquiring knowledge about the remote patient monitoring market scenario through secondary research. A significant number of primary interviews will be conducted with stakeholders from both the demand side and supply side (including various industry experts, such as Directors, Chief X Officers (CXOs), Vice Presidents (VPs) from business development, marketing and product development teams, product manufacturers) across major countries of North America, Europe, Asia Pacific, and Rest of the World. Primary data for this report was collected through questionnaires, emails, and telephonic interviews.

All major manufacturers offering various remote patient monitoring will be identified at the global/regional level. Revenue mapping will be done for the major players, which will further be extrapolated to arrive at the global market value of each type of segment. The market value of remote patient monitoring market will also split into various segments and sub segments at the region level based on:

FIGURE: SUPPLY SIDE (ILLUSTRATION)

FIGURE: REVENUE SHARE ANALYSIS OF KEY PLAYERS (SUPPLY SIDE)

Sources: Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentation, Paid Database, and Wissen Research Analysis.

Sources: Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentation, Paid Database, and Wissen Research Analysis.

FIGURE: GROWTH FORECAST ANALYSIS UTILIZING MULTIPLE PARAMETERS

Research Design

After arriving at the overall market size-using the market size estimation processes-the market will be split into several segments and sub segment. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub segment, the data triangulation, and market breakdown procedures will be employed, wherever applicable. The data will be triangulated by studying various factors and trends from both the demand and supply sides in the remote patient monitoring market industry.

Sources: Company Website, Press Releases, Annual Reports, Paid Data Sources, and Wissen Research Analysis and the above mentioned sources

Sources: Company Website, Press Releases, Annual Reports, Paid Data Sources, and Wissen Research Analysis and the above mentioned sources

1. Introduction

1.1 Key Objectives

1.2 Definitions

1.2.1 In Scope

1.2.2 Out of Scope

1.3 Scope of the Report

1.4 Scope Related Limitations

1.5 Key Stakeholders

2. Research Methodology

2.1 Research Approach

2.2 Research Methodology / Design

2.3 Market Sizing Approach

2.3.1 Secondary Research

2.3.2 Primary Research

3. Executive Summary & Premium Content

3.1 Global Market Outlook

3.2 Key Market Findings

4. Market Overview

4.1 Market Dynamics

4.1.1 Drivers/Opportunities

4.1.2 Restraints/Challenges

4.2 End User Perception

4.3 Need Gap

4.4 Supply Chain / Value Chain Analysis

4.5 Industry Trends

4.6 Porter’s Five Forces Analysis

4.7 Pricing Analysis

4.8 Reimbursement Scenario

5. Patent Analysis

5.1 Top Assignees in Remote Patient Monitoring Market

5.2 Geography Focus of Top Assignees

5.3 Legal Status of Remote Patient Monitoring Patents

5.4 Assignee Segmentation

5.5 Network Analysis of Top Collaborating Entities in Remote Patient Monitoring Patent Applications

5.6 Technology Evolution in Remote Patient Monitoring

5.7 Key Patents in Remote Patient Monitoring

5.8 Patent Trends and Innovations

5.9 Key Players and Patent Portfolio Analysis

6. Remote Patient Monitoring Market, by Type (2023-2030, USD Million)

6.1 Software and Services

6.2 Devices

6.2.1 Vital Signs Monitors

6.2.1.1 Blood Pressure Monitor

6.2.1.2 Pulse Oximeter

6.2.1.3 Rate Monitor (ECG)

6.2.1.4 Temperature Monitor

6.2.1.5 Respiratory Rate Monitor

6.2.1.6 Brain Monitoring (EEG)

6.2.2 Special Monitors

6.2.2.1 Anesthesia Monitor

6.2.2.2 Blood Glucose Monitor

6.2.2.3 Cardiac Rhythm Monitor

6.2.2.4 Respiratory Monitor

6.2.2.4.1 Spirometers

6.2.2.4.2 Capnographs

6.2.2.5 Fetal Heart Monitor

6.2.2.6 Prothrombin Monitor

6.2.2.7 Multi Parameter Monitor (MPM)

6.2.3 Other Monitoring Devices

7. Remote Patient Monitoring Market, by Application (2023-2030, USD Million)

7.1 Oncology

7.2 Cardiovascular Diseases

7.3 Diabetes

7.4 Sleep Disorders

7.5 Weight Management and Fitness Monitoring

7.6 Bronchitis

7.7 Infections

7.8 Virus

7.9 Dehydration

7.10 Hypertension

7.11 Others

8. Remote Patient Monitoring Market, by End Users (2023-2030, USD Million)

8.1 Hospitals and Clinics

8.2 Home Care Setting

8.3 Long Term Care Centres

8.4 Ambulatory Care Centres

8.5 Others

9. Remote Patient Monitoring Market, by Region (2023-2030, USD Million)

9.1 North America

9.1.1 US

9.1.2 Canada

9.2 Europe

9.2.1 UK

9.2.2 France

9.2.3 Germany

9.2.4 Italy

9.2.5 Spain

9.2.6 Rest of Europe

9.3 Asia Pacific

9.3.1 China

9.3.2 India

9.3.3 Japan

9.3.4 South Korea

9.3.5 Australia and New Zealand

9.3.6 Rest of Asia Pacific

9.4 Middle East and Africa

9.5 Latin America

10. Competitive Analysis

10.1 Key Player’s Footprint Analysis

10.2 Market Share Analysis

10.3 Key Brand Analysis

10.4 Regional Snapshot of Key Players

10.5 R&D Expenditure of Key Players

11. Company Profiles2

11.1 Koninklijke Philips N.V. (Netherlands)

11.1.1 Business Overview

11.1.2 Product Portfolio

11.1.3 Financial Snapshot3

11.1.4 Recent Developments

11.1.5 SWOT Analysis

11.2 Medtronic (Ireland)

11.3 GE Healthcare (US)

11.4 Cerner Corporation (US)

11.5 Siemens Healthineers Ag (Germany)

11.6 Omron Healthcare (Japan)

11.7 Boston Scientific Corporation (US)

11.8 Abbott Laboratories (US)

11.9 Resideo Life Care Solutions (US)

11.10 Vivify Health, Inc. (US)

11.11 Alten Calsoft Labs (France)

11.12 Preventice Solutions (US)

11.13 Βιο-Βeat Technologies (Israel)

11.14 Vitalconnect (US)

11.15 Welch Allyn (US)

11.16 Teladoc Health Inc. (US)

11.17 Dexcom Inc. (US)

11.18 Irhythm Technologies, Inc. (US)

11.19 Vivalnk Inc. (US)

11.20 Bardy Diagnsotics, Inc. (US)

11.21 Others Key Players

11.21.1 Health Beats

11.21.2 Starling Medical

11.21.3 Alive Cor, Inc.

11.21.4 Αktiia

11.21.5 Τytocare

12. Appendix

12.1 Industry Speak

12.2 Questionnaire

12.3 Available Custom Work

12.4 Adjacent Studies

12.5 Authors

13. References

Key Notes:

Note 1 – Contents in the ToC / market segments are tentative and might change as the research proceeds.

Note 2 – List of companies is not exhaustive and might change during the course of study.

Note 3 – Details on key financials might not be captured in case of unlisted companies.

Note 4 – SWOT analysis will be provided for top 3-5 companies.

The global market for remote patient monitoring was valued at approximately USD40 billion in 2023, and is projected to increase to USD 44.8 billion in 2024.

The global remote patient monitoring market is anticipated to grow at an annual growth rate of 12% from 2024 to 2030 to reach USD 88 billion, by 2030.

The major end-users in the remote patient monitoring market include hospitals, clinics, homecare settings, and long-term care facilities, with homecare being a significant segment due to the increasing preference for at-home healthcare solutions. of approximately 8.0% during the forecast period.

Leading players within the remote patient monitoring market are Koninklijke Philips N.V. (Netherlands), Medtronic (Ireland), GE Healthcare (US), Cerner Corporation (US), Omron Healthcare (Japan).

The market is highly consolidated at top, comprising 10 key players with them holding almost 70% of the market, while it remains lightly fragmented at the lower levels, with numerous small and mid-sized companies operating at regional and national level.

The primary application areas within the remote patient monitoring market encompass Oncology, Cardiovascular Diseases, Diabetes, Sleep Disorders, Weight Management and Fitness Monitoring, Weight Management and Fitness Monitoring, Bronchitis, Infections. Notably, the demand in the continuous glucose monitoring category is anticipated to boost the diabetes segment’s growth, experiencing a CAGR of 15% between 2024 and 2030.

© Copyright 2024 – Wissen Research All Rights Reserved.