Shale oil extraction has a history that dates back to 10th century when Masawaih al-Mardini, an Arabian physician, described a method for extracting oil from bituminous shale. The first patent for shale oil extraction was granted in 1684 to three individuals who discovered a technique to extract pitch, tar, and oil from a specific type of stone. Industrial-scale shale oil extraction began in France in 1838 with the Selligue process, developed by Alexander Selligue. This process was further refined in Scotland a decade later by James Young. During the late 19th century, shale oil plants were established in Australia, Brazil, Canada, and the United States. A significant advancement in extraction came in 1894 with the invention of the Pumpherston retort, which reduced the reliance on coal heat. This innovation marked the separation of oil shale industry from coal industry. However, the discovery of crude oil in Texas during the 1920s and the emergence of oil deposits in the Middle East caused a decline in the shale oil industry. In 1944, the United States resumed shale oil extraction as part of its Synthetic Liquid Fuels Program. These efforts persisted until the 1980s when a sharp decline in oil prices affected the viability of shale oil extraction.

Shale oil extraction has a long history with significant developments. In, 2002 and 2004, a demonstration scale processing plant utilizing the Alberta Taciuk Technology was implemented at Queensland in Australia. This plant produces over 1.5 billion barrels of shale oil. The technology used for in situ processing involves heating the oil shale underground through the injections of hot fluids into the rock formation or by utilizing linear or planar heating sources. In 2006, Shell planned a test using ICP technology (in situ conversion process) to produce 1500 barrels of shale oil over 70 years’ period. Similarly, in Israel, IEI, subsidiary of IDT crop implemented a project implementing ICP technology, horizontal wells and hot gas heating methods. Its aim is to produce 1500 barrels of oil. Technologies such directional drilling and hydraulic fracturing have propelled USA to become the world’s leading producer in 2018.

Notably, recent developments such as real time fluid tracking will greatly improve drilling operations. The integration of robotic technologies and artificial intelligence will enhance drilling precision. Oil field service providers are collaborating with major shale oil producers such as Shell and Chevron to develop autonomous drilling robots equipped with advanced sensors for faster drilling and real time monitoring of well conditions. Additionally, the implementation of drones for methane detection and surveillance is an emerging concept in the industry which can help reduce human error and scope of operation.

Types of shale oil

There are 3 types of shale oil.

1.Carbonate-rich shale: are made from high amounts of carbonate minerals.

2.Siliceous shale: Siliceous shale is rich in the mineral silica, or silicon dioxide. Siliceous shale formed from organisms such as algae, sponges, and microorganism’s is called radiolarians.

3.Cannel shale: is made from the remains of resin, spores, and corky materials from woody plants. It contains minerals such as inertinite and vitrinite. Cannel shale is rich in hydrogen, and burns easily.

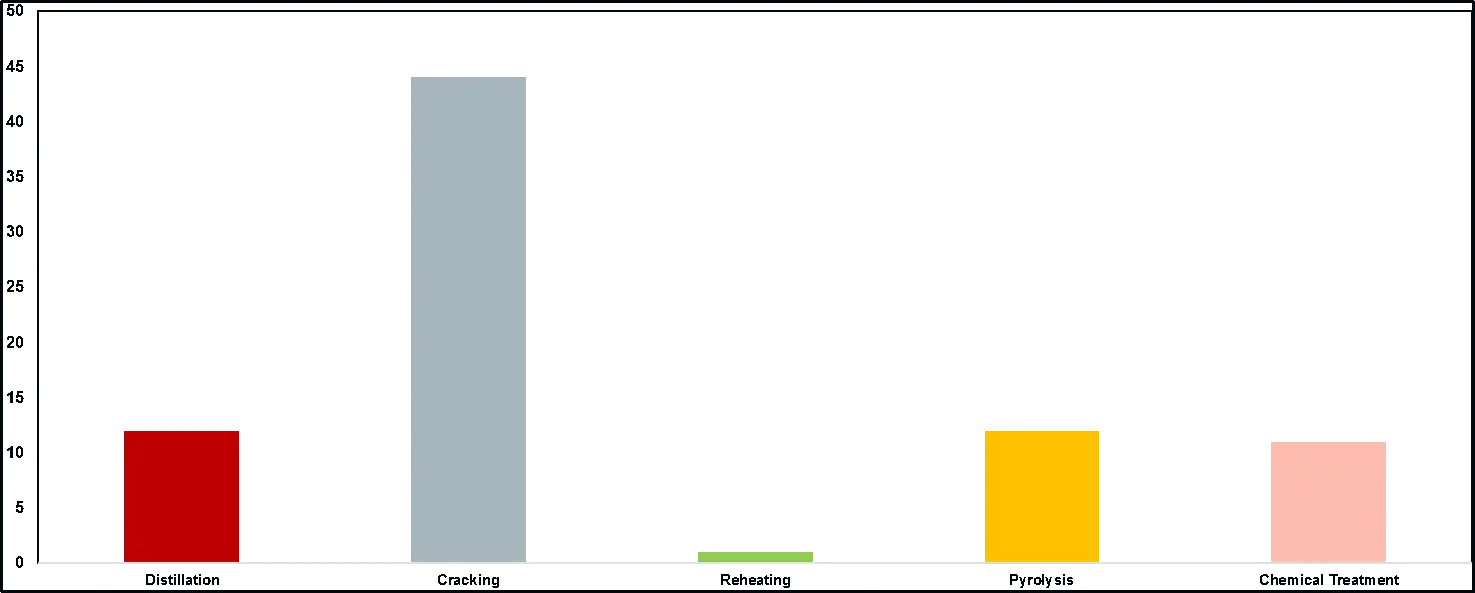

Refining technology analysis

Our report shows patents filed on technologies for shale oil refining.

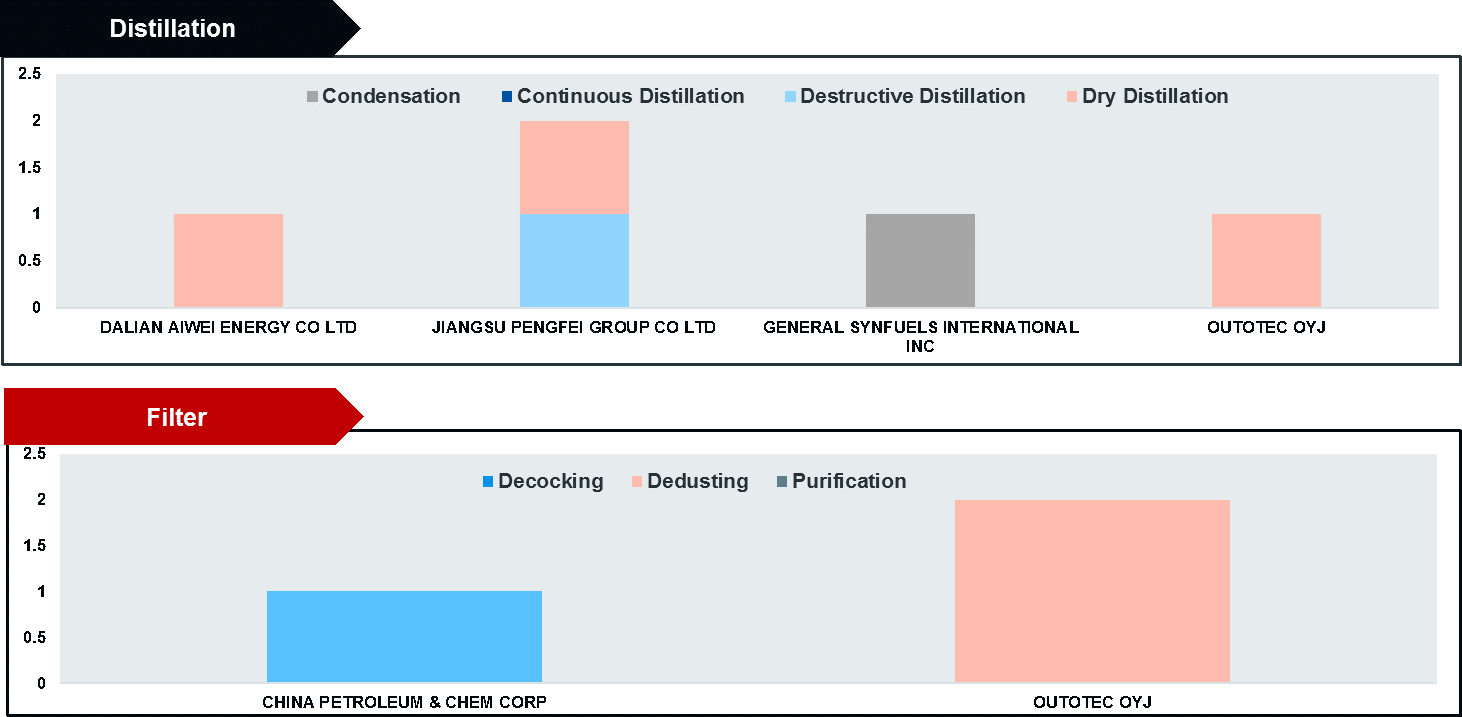

Distillation and filtration methods analysis

Our report shows the number of patents filed on the methods of distillation and filtration.

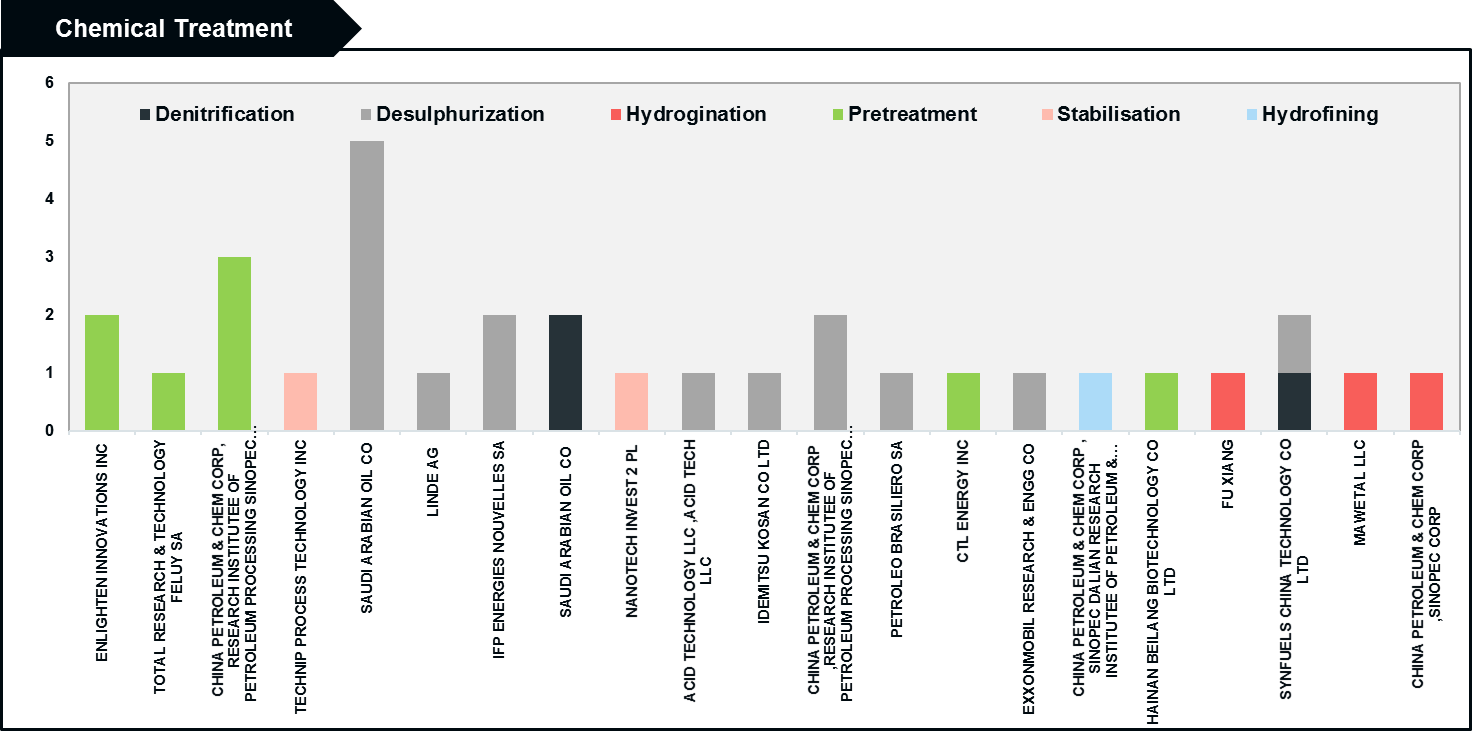

Chemical treatment methods analysis

Our report shows patents filed on different methods of shale oil chemical treatment.

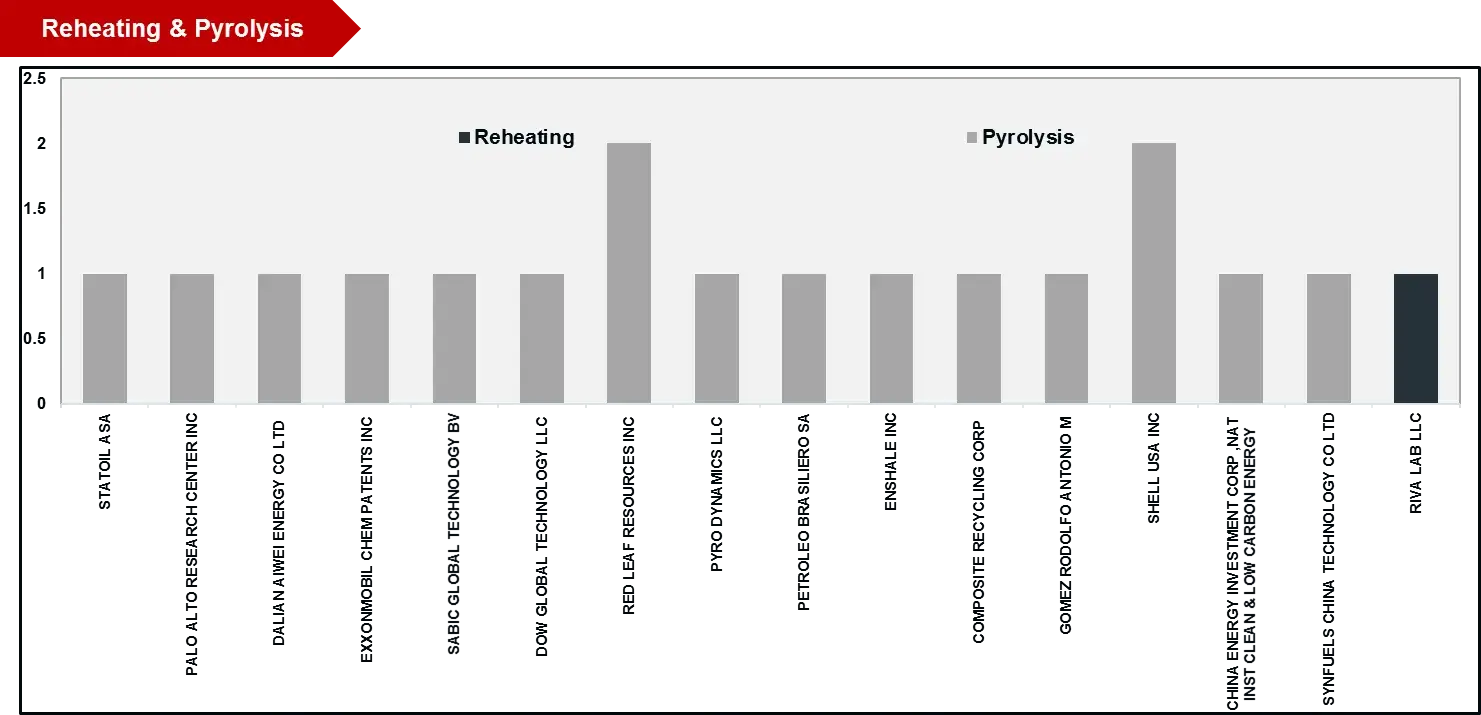

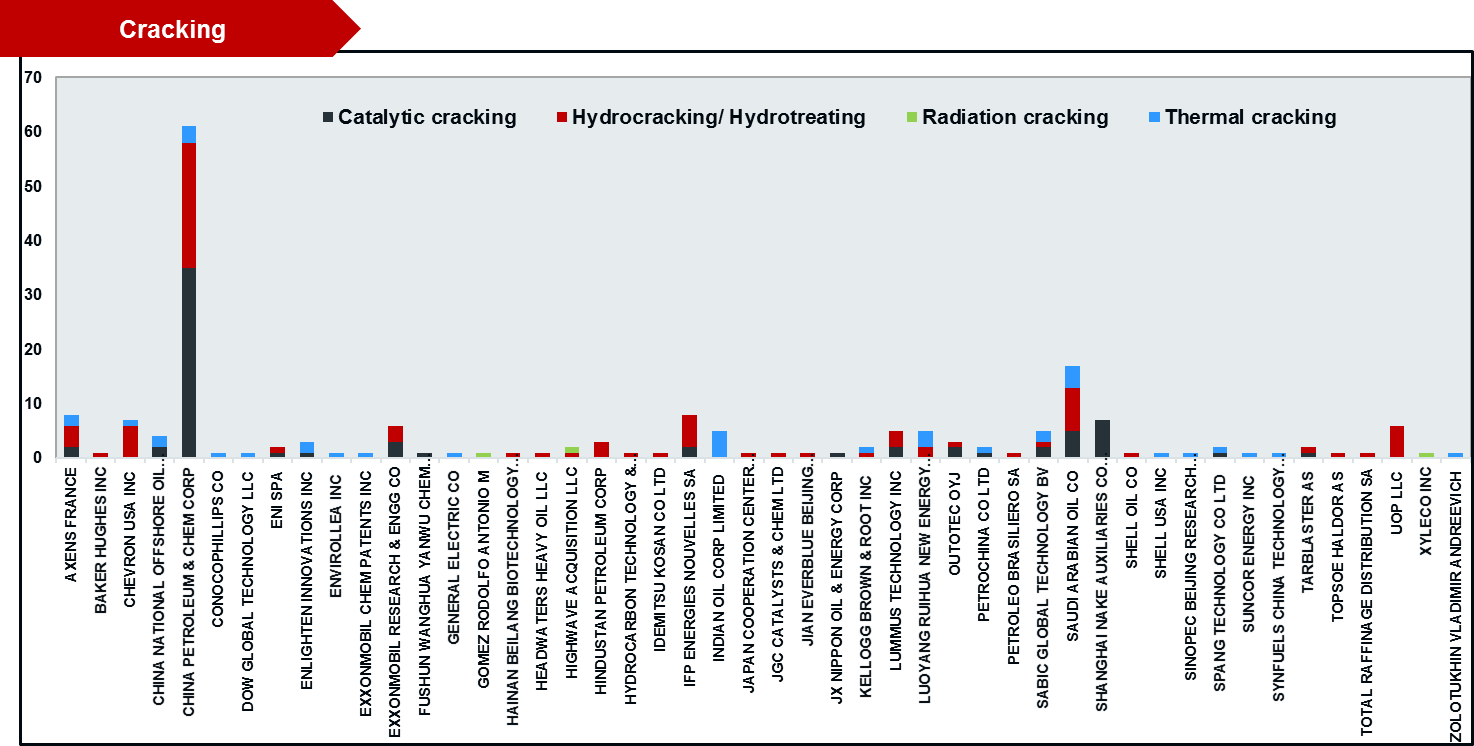

Reheating, pyrolysis, cracking analysis

Our report shows number of patents filed on reheating, pyrolysis and cracking techniques of refining shale oil.

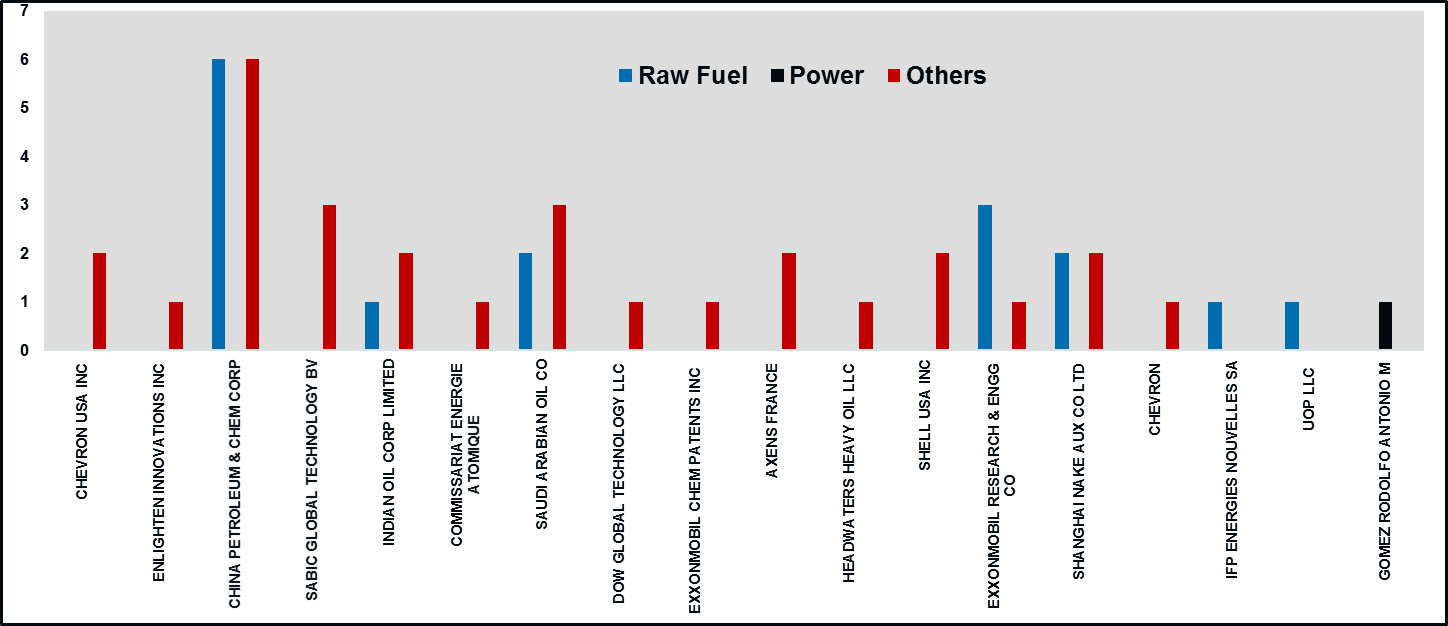

Application area analysis

Our report shows the number of patents filed by companies on different application areas of shale oil.

Extraction and refining companies

Our report shows the companies involved in extraction and refining methods

Refining and extraction methods analysis

Our report shows companies carrying out methods of shale oil refining (pyrolysis, hydrocracking) and extraction (Ex situ, In situ).

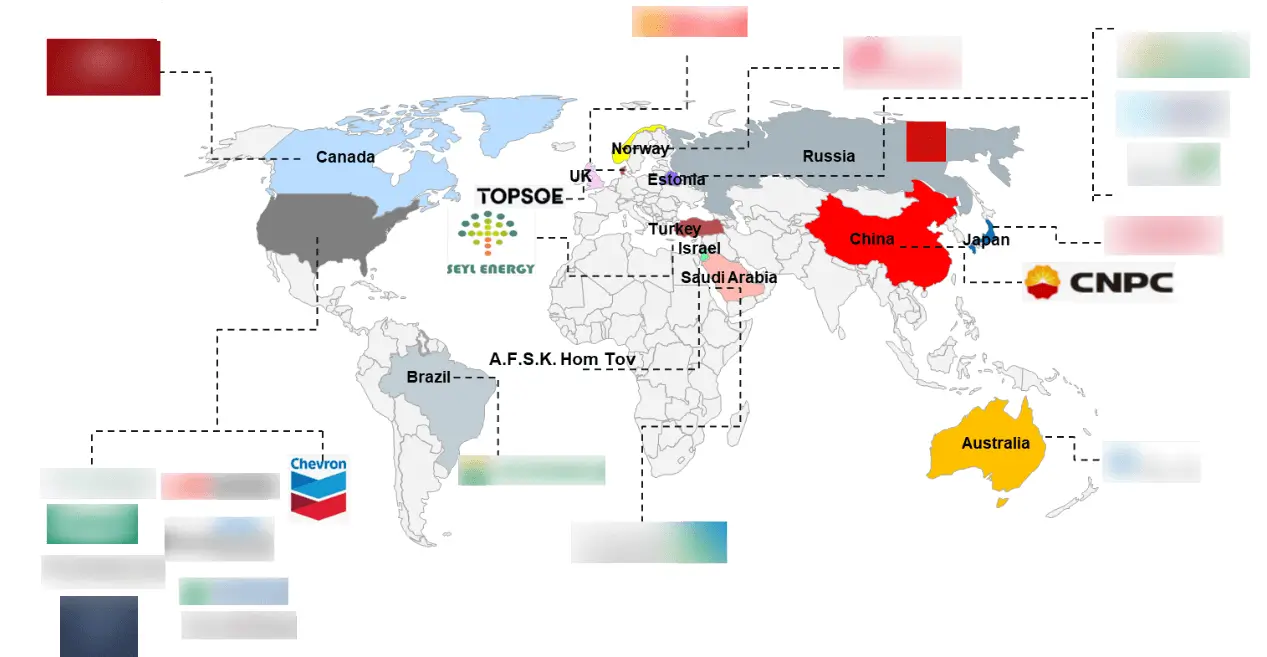

Geographical analysis

Companies with and without Processing methods

Our report shows companies across the globe, with and without shale oil processing facilities.

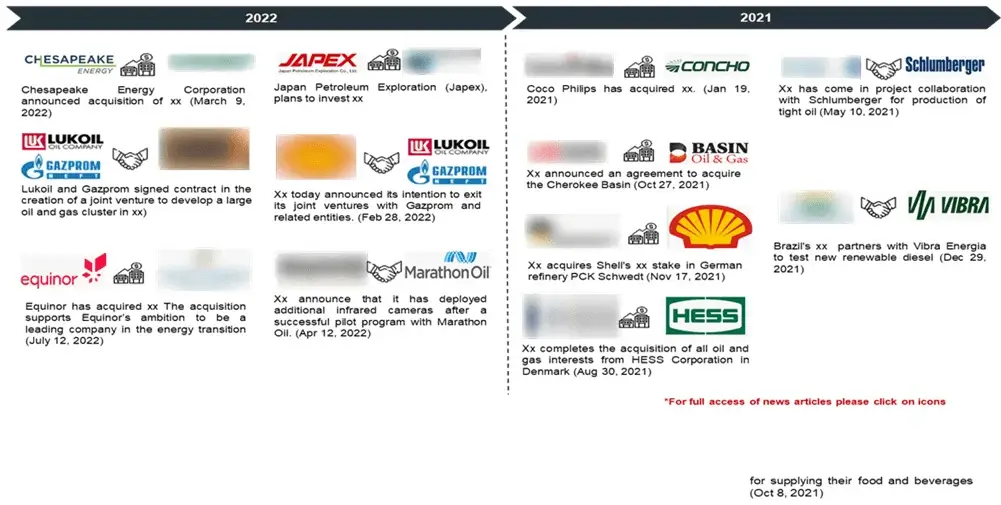

Strategic activities

Our report showcases strategic collaborations and acquisitions between companies in 2021 and 2022.

In order to give the most precise estimations and forecasts, Wissen Research uses an extensive and iterative research approach that is focused on reducing deviation. The company blends top-down and bottom-up methodologies for market segmentation and quantitative estimation. In addition, data triangulation, which examines the market from three separate angles, is a recurrent topic present in all of our research studies. Important components of the approach used for all of our studies include the following.:

Preliminary data mining

On a wide scale, unprocessed market data is collected. Continuous data filtering makes sure that only verified and authenticated sources are taken into account. Additionally, data is extracted from a wide range of reports in our repository and from a number of reputable premium databases. We gather information from raw material suppliers, distributors, and purchasers to help with this since understanding the entire value chain is crucial for a thorough understanding of the market.

Surveys, technical symposia, and trade magazines are used to gather information on technical concerns and trends. Technical information focusing on white space and freedom of movement is also obtained from an intellectual property standpoint. Additionally, information on the industry’s drivers, constraints, and pricing patterns is obtained. As a result, a variety of original data are included in the material that is then cross-validated and certified with published sources.

Statistical model

We use simulation models to generate our market projections and estimates. Every study receives a special model that is tailored to it. Data for market dynamics, the technology environment, application development, and pricing patterns are gathered and supplied into the model all at once for analysis. The relative relevance of these factors is investigated, and their impact on the forecast period is assessed, using correlation, regression, and time series analysis. The process of market forecasting combines technological analysis with economic strategies, practical business acumen, and subject expertise.

Econometric models are frequently used for short-term forecasting, but technology market models are typically employed for long-term forecasting. These are based on a confluence of the business environment, regulatory environment, economic projection, and technical landscape. In order to develop global estimates, it is preferable to estimate markets from the bottom up by integrating data from key regional markets. This is required to ensure accuracy and a complete comprehension of the subject. Among the variables taken into account for forecasting are:

scenario for raw materials and supply versus pricing patterns

Regulations and anticipated developments

We give these criteria weights and use weighted average analysis to assess their market influence in order to calculate the anticipated market growth rate.

Data Collection Matrix

Primary research | Secondary research |

|

|

1. Introduction

1.1 Scope of study

1.2 Objective

1.3 Technological Categorization

1.4 Inclusion & Exclusion

2. Overview of shale oil

2.1 Shale oil extraction/refining (history/present/future outlook)

2.2 Type of shale oil

2.3 Applications of shale oil

3. Patent bibliographic analysis

3.1 Top 10 key players

3.2 Filling trends in last decade

3.3 Legal status

3.4 Publication countries

3.5 Publication year

4. Patent based Technology Analysis

4.1 Refining technology analysis

4.1.1 Distillation

4.1.1.1 Total patent filings in distillation refining

4.1.1.2 Assignees w.r.t distillation patents

4.1.1.3 Technology breakdown (Patents and assignees in particular sub category)

4.1.1.3.1 Condensation

4.1.1.3.2 Continuous distillation

4.1.1.3.3 Destructive distillation

4.1.1.3.4 Dry distillation

4.1.2 Cracking

4.1.2.1 Total number fillings in cracking refining

4.1.2.2 Assignees w.r.t cracking patents

4.1.2.3 Technology breakdown (Patents and assignees in particular sub category)

4.1.2.3.1 Catalytic

4.1.2.3.2 Hydrocracking

4.1.2.3.3 Radiation

4.1.2.3.4 Thermal

4.1.3 Reheating

4.1.3.1 Total patent filings in reheating refining

4.1.3.2 Assignees w.r.t reheating patents

4.1.4 Pyrolysis

4.1.4.1 Total patent filings in pyrolysis refining

4.1.4.2 Assignees w.r.t pyrolysis patents

4.1.5 Chemical treatment

4.1.5.1 Total patent filings in Chemical Treatment

4.1.5.2 Assignees w.r.t Chemical Treatment

4.1.5.3 Technology breakdown (Patents and assignees in particular sub category)

4.1.5.3.1 Denitrification

4.1.5.3.2 Desulphurization

4.1.5.3.3 Hydrogenation

4.1.5.3.4 Pretreatment

4.1.5.3.5 Stabilization

4.1.5.3.6 Hydrofining

4.2 Shale oil analysis w.r.t End-Use Application

4.2.1 Raw fuel

4.2.2 Power

4.2.3 Others

5. Service analysis

5.1 Companies offering extraction services

5.1.1 Ex situ methods of extraction

5.1.2 In situ methods of extraction

5.2 Companies offering refining services

5.2.1 Pyrolysis

5.2.2 Hydrocracking

5.3 Companies offering both extraction & refining services

6. Geographical analysis

6.1 Companies with processing methods(Global)

6.2 Companies without processing methods

7. Market analysis

7.1 Drivers and restraints

7.2 Major players

7.3 Strategic activities (collaborations &acquisitions)

8. Conclusion

Key Highlights

S.No | Key highlight of Report | |

1 | Patent analysis | · Top10 key players · Filling trends in last decade · Legal status · Publication countries · Publication year |

2 | Product analysis | · Extraction and refining companies · Refining methods · Extraction methods |

3 | Geographical analysis | · Companies with processing methods · Companies without processing methods |

4 | Market analysis | · Drivers and restraints · Major players · Strategic activities |

Figure number | Description |

1 | Refining Technologies |

2 | Distillation & Filtration Methods |

3 | Methods of Chemical Treatment |

4 | Reheating & Pyrolysis |

5 | Cracking Types |

6 | Shale Oil Application Areas |

© Copyright 2024 – Wissen Research All Rights Reserved.