Sources: Company Websites and Wissen Research Analysis.

Sources: Company Websites and Wissen Research Analysis.

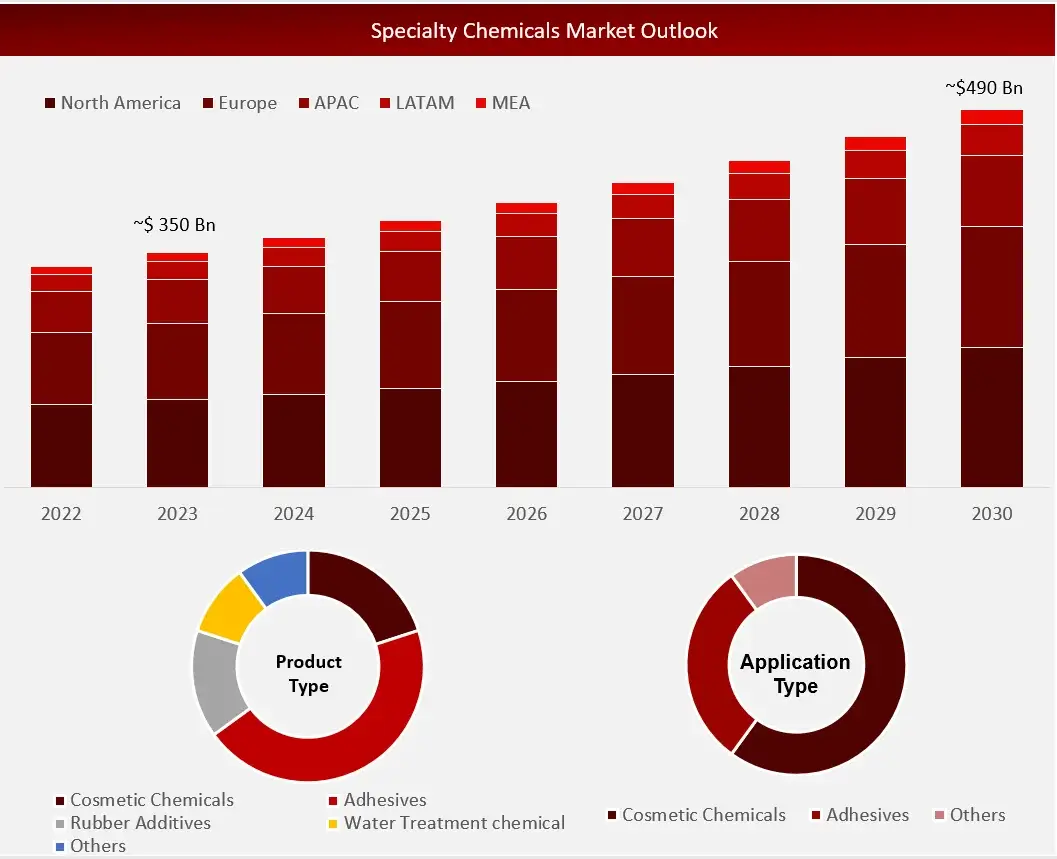

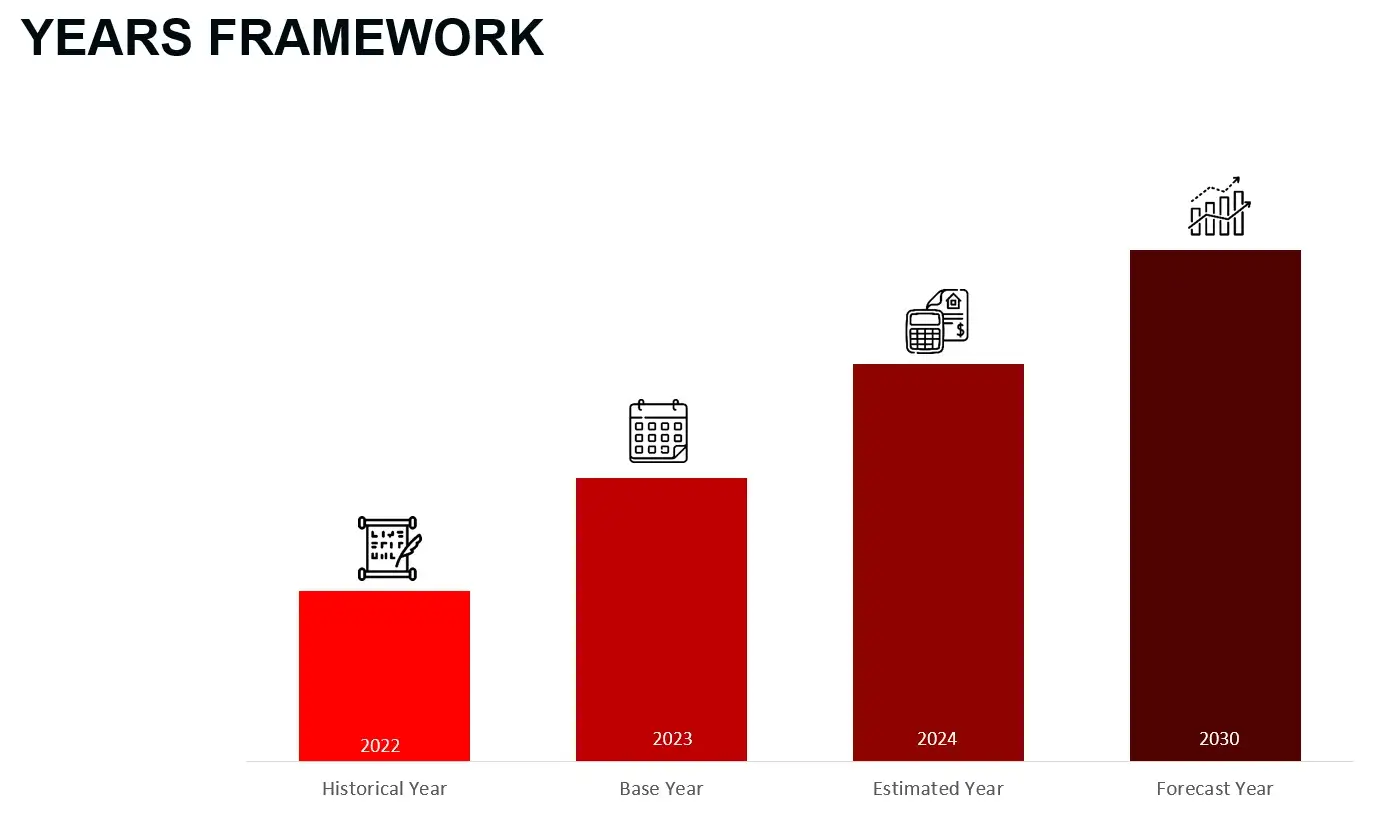

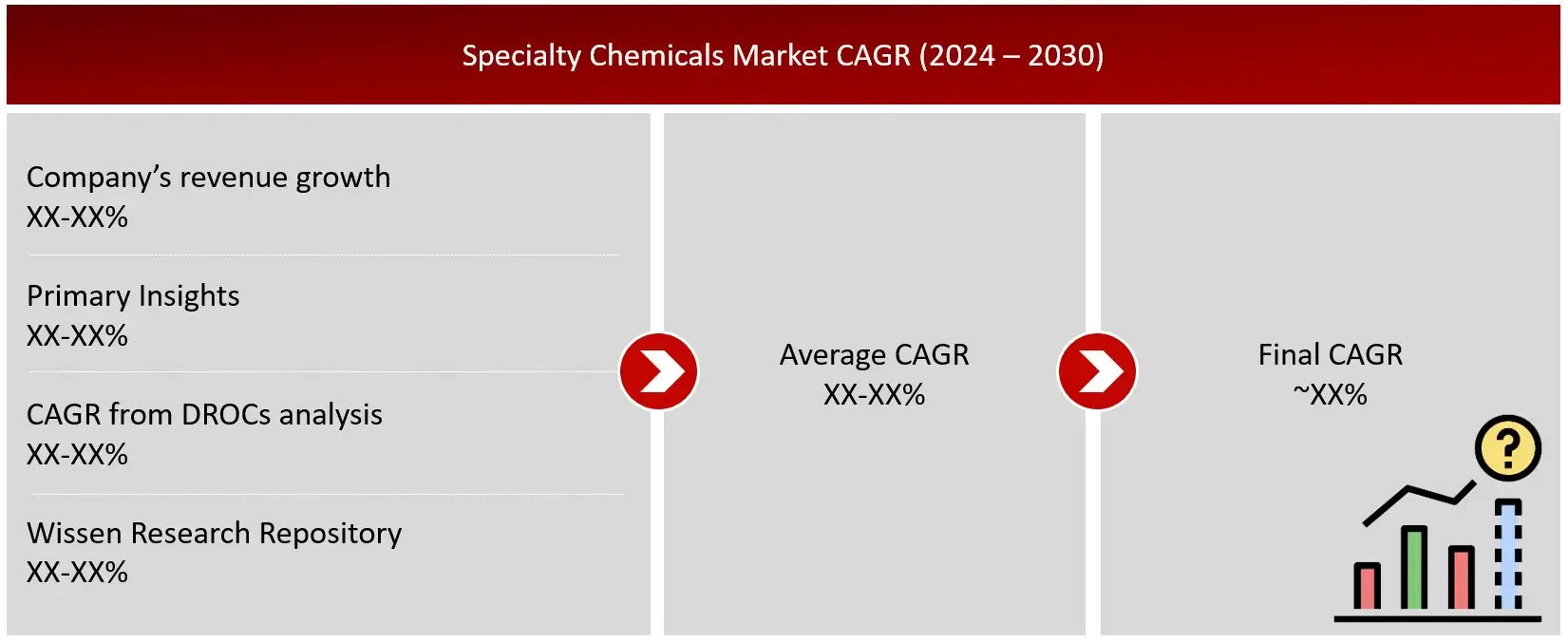

Wissen Research analyses that the specialty chemicals market is estimated at ~USD 350 billion in 2023 and is projected to reach ~USD 490 billion by 2030, expected to grow at a CAGR of ~5% during the forecast period, 2024-2030.

Specialty chemicals are also referred to as performance or effect chemicals. Some of the standard examples include essential oils, gelatin, castor oil, and collagen. Formulations are unique combinations of mixtures and molecules. The properties of individual molecules or combined mixtures and the arrangement of the mixtures affect the final product’s performance. Specialties are chemicals produced in limited amounts and cater to specific applications, in contrast to fine and commodity chemicals (as per CEFIC).

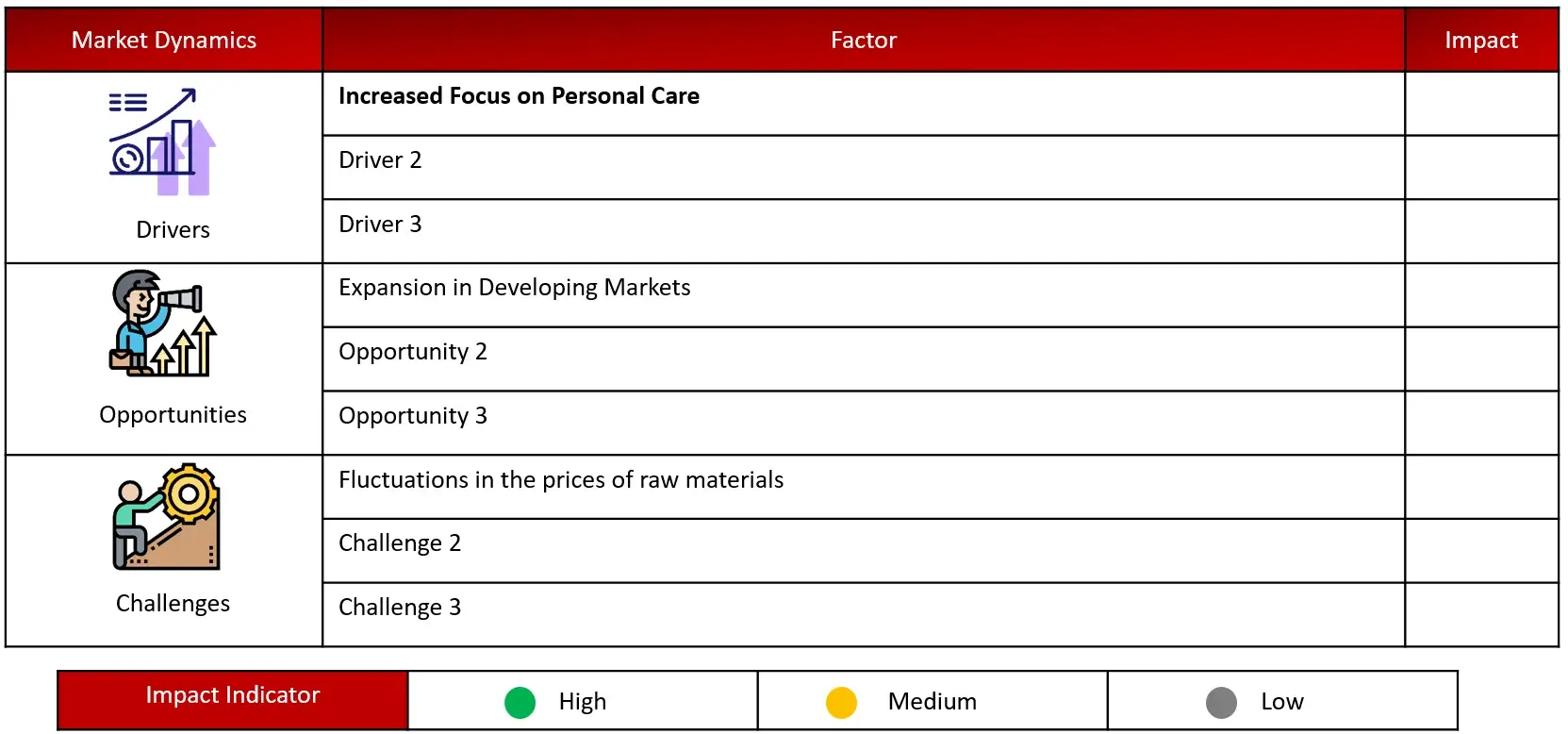

Driving Factor: Increased Focus on Personal Care

The rising demand for cosmetic chemicals is driven by the growth of the beauty and personal care sector as a whole. Consumers are more inclined to invest in high-quality and specialized personal care products due to increased disposable incomes. This higher financial capability enhances the ability to create and buy new cosmetic compounds. With an increasing number of consumers purchasing skincare and beauty products, the demand for cosmetic chemicals is growing, leading to companies developing new products to cater to various consumer preferences.

Opportunity: Expansion in Developing Markets

The increasing popularity of personalized beauty items provides chances to develop customized cosmetic ingredients that meet individual consumer needs. Furthermore, Advanced formulations and novel ingredients made possible by technological innovations can cater to specific consumer needs and preferences, providing product differentiation.

Challenge: Fluctuations in the prices of raw materials

Changes in the supply and cost of raw materials may influence both production and expenses. Supply chain interruptions, such as those resulting from political issues or natural calamities, can worsen these difficulties. Maintaining a steady level of quality and availability of specialty chemicals, particularly those with intricate or innovative compositions, can pose a major obstacle.

Sources: Company Websites and Wissen Research Analysis.

Sources: Company Websites and Wissen Research Analysis.

Cosmetic chemicals dominate the specialty chemicals market, based on product type.

The global specialty chemicals market is segmented by product into Cosmetic Chemicals, Adhesives, Institutional & Industrial Cleaners, Textile Chemical etc. In 2023, Cosmetic chemicals are the main focus in the specialty chemicals industry because of high consumer interest in personal care products, continuous advancements in formulas and delivery methods, strict regulations, and new market developments. The industry’s capacity to adjust to evolving consumer tastes, like the move towards natural and customized products, and its quick reaction to market trends, solidifies its top position in the specialty chemicals sector.

The skincare application segment is the most dominant based on Application

The specialty chemicals market in the cosmetic category is mostly led by skincare products because of strong customer demand, continuous innovation, rigorous regulations, and focus on trends like anti-aging and natural ingredients. Skincare’s prominent position in the market is strengthened by the variety of products available and increasing consumer knowledge.

Asia Pacific held the biggest market share for cosmetic chemicals market, based on Region

The fastest-growing economies in Asia Pacific include China, India, and countries in Southeast Asia. The expansion of the economy in these nations results in an increase in construction projects, the development of infrastructure, and the growth of urban areas, all of which boost the need for specialty chemicals. Specialty chemicals are utilized in final products as components to improve their performance, longevity, and shield them from harm. Additionally, the growing disposable income in this area aids in the rise of infrastructure and construction projects. Asian countries like India and China, with their inexpensive labor, entice large automotive companies to establish operational facilities there. The market for specialty chemicals in the Asia Pacific region is being primarily influenced by various factors, especially in automotive, construction, medical, packaging, and consumer goods applications.

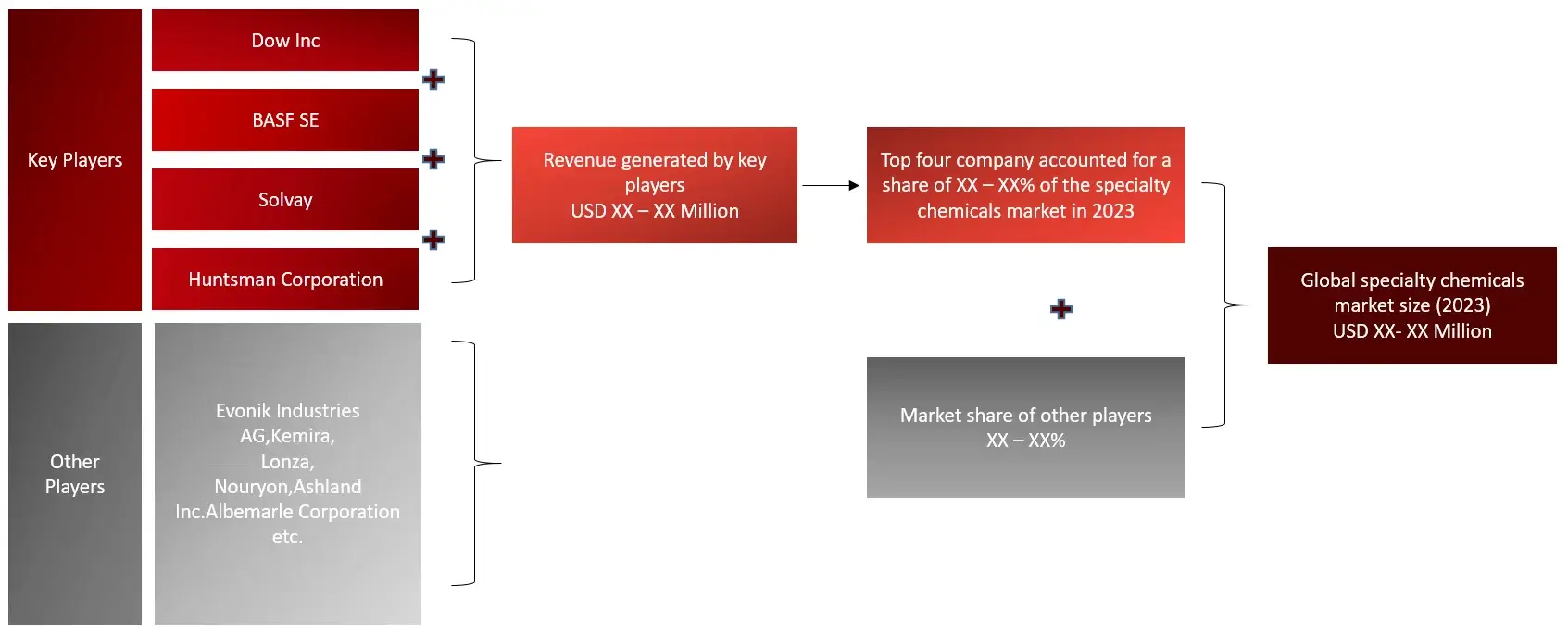

Major Companies and Market Share Insights in Specialty Chemical

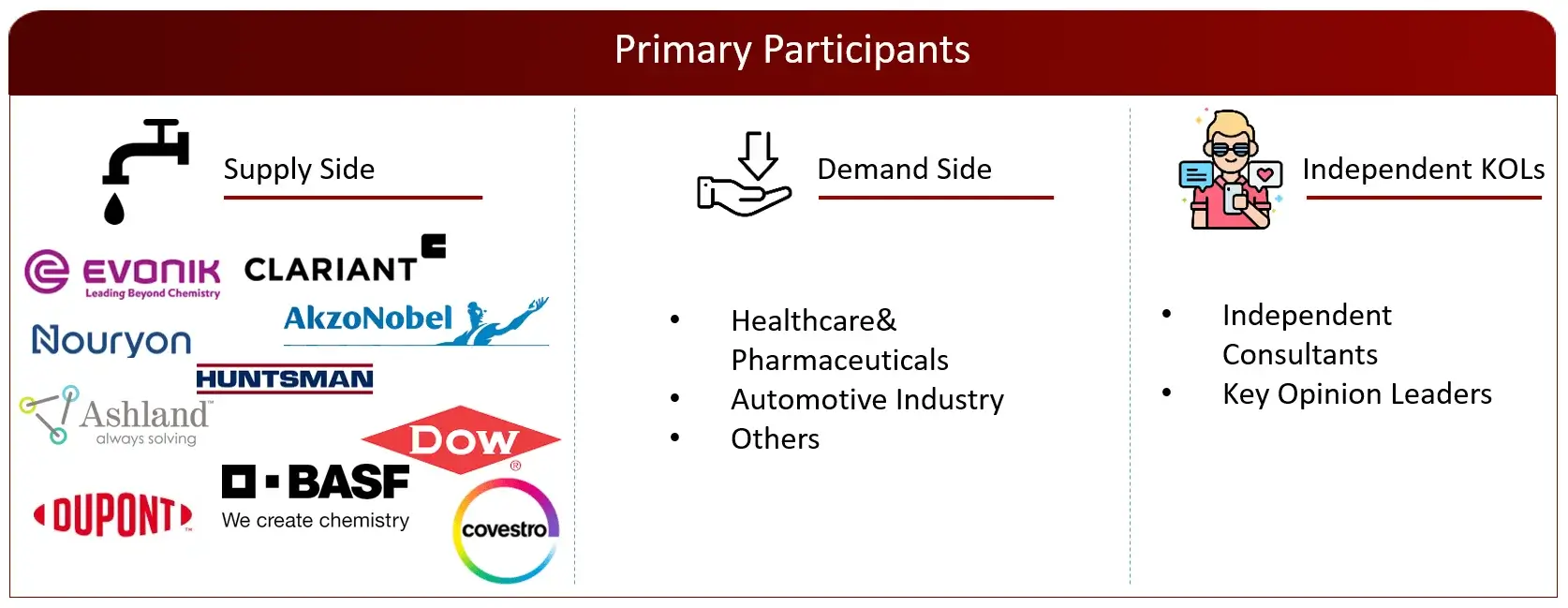

Major players operating in specialty chemicals market are Dow Inc., BASF SE., Solvay., Evonik Industries AG., Lanxess Ag., Huntsman Corporation., AkzoNobel N.V., SABIC (Saudi Basic Industries Corporation)., Clariant AG., and Arkema among others.

Introduction

Market Definition

Specialty Chemicals are produced in lower volumes than commodity chemicals and are formulated for specific purposes or uses. Specialized properties are frequently present in them and they are utilized in specialized applications where performance qualities are essential. Specialty chemicals, as opposed to bulk chemicals, provide specific advantages customized for specific industrial processes or consumer requirements, rather than being used in large quantities for general purposes.

Sources: Company Websites and Wissen Research Analysis.

Sources: Wissen Research Analysis.

Key Stakeholders

Key objectives of the Study

Research Methodology

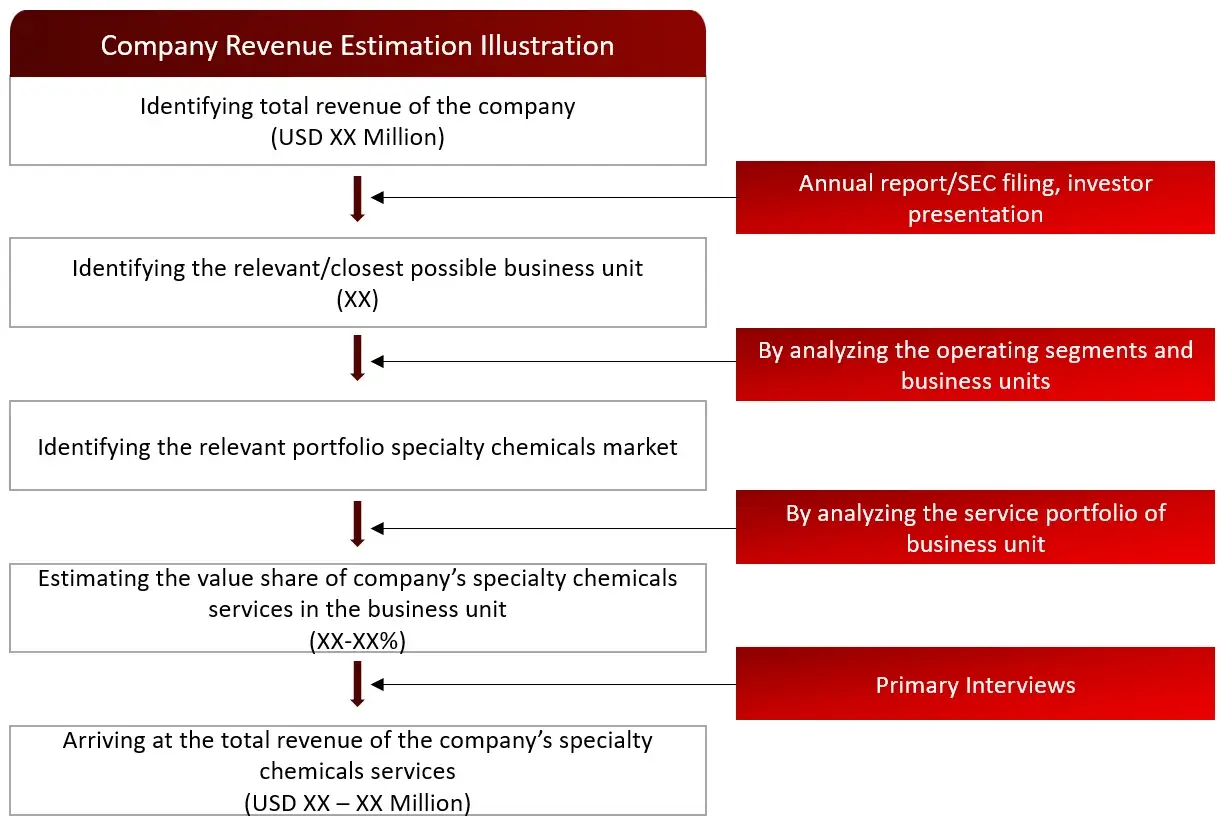

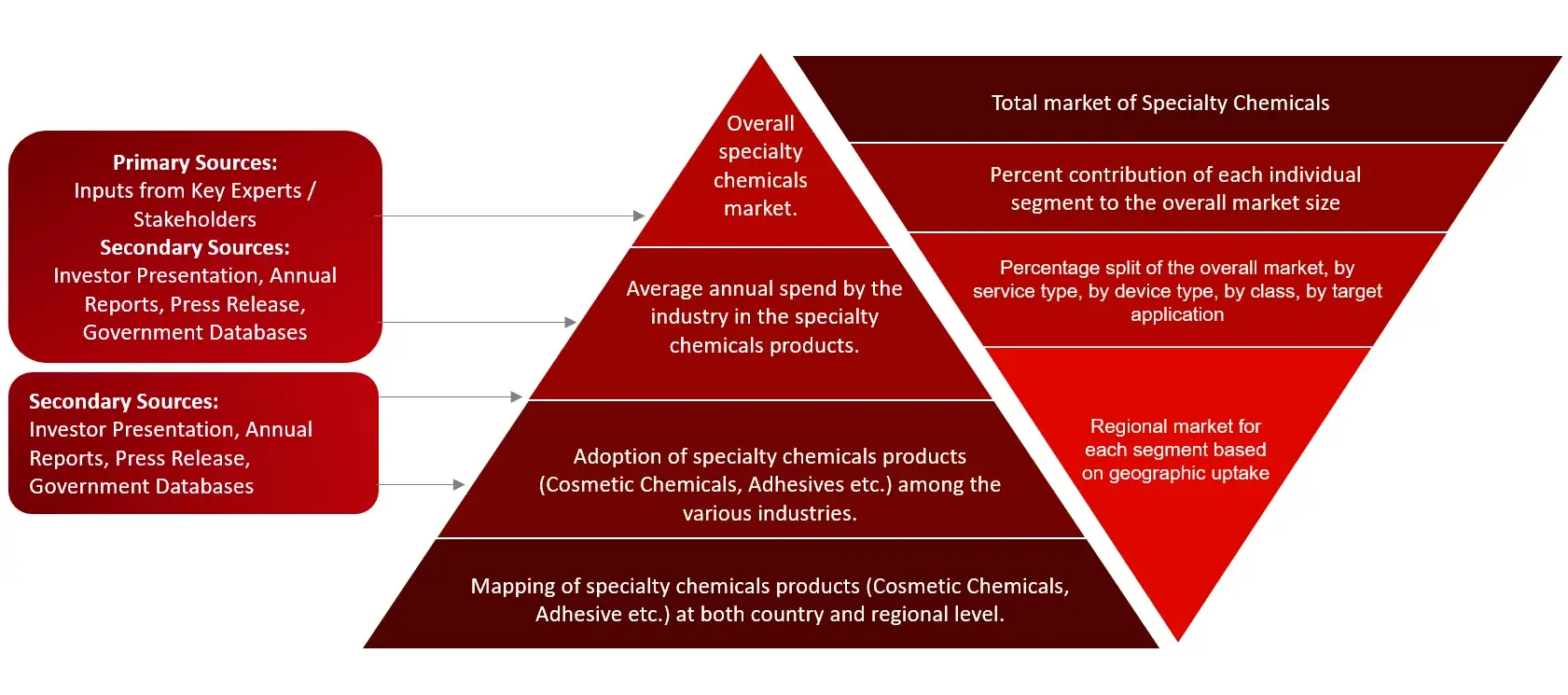

The aim of the study is to examine the key market forces such as drivers, opportunities, restraints, challenges, and strategies of key leaders. To monitor company advancements such as patents granted, product launches, expansions, and collaborations of key players, analyzing their competitive landscape based on various parameters of business and product strategy. Markey sizing will be estimated using top-down and bottom-up approaches. Using market breakdown and data triangulation techniques, market sizing of segments and sub-segments will be estimated.

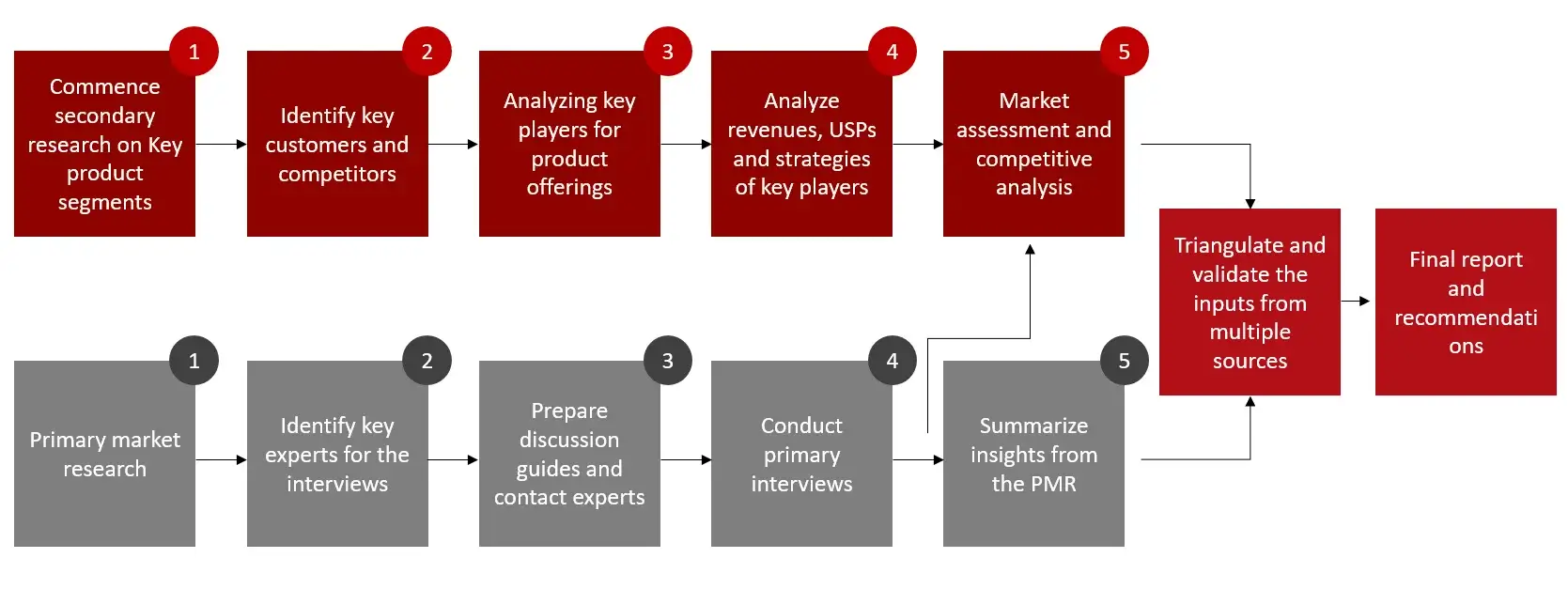

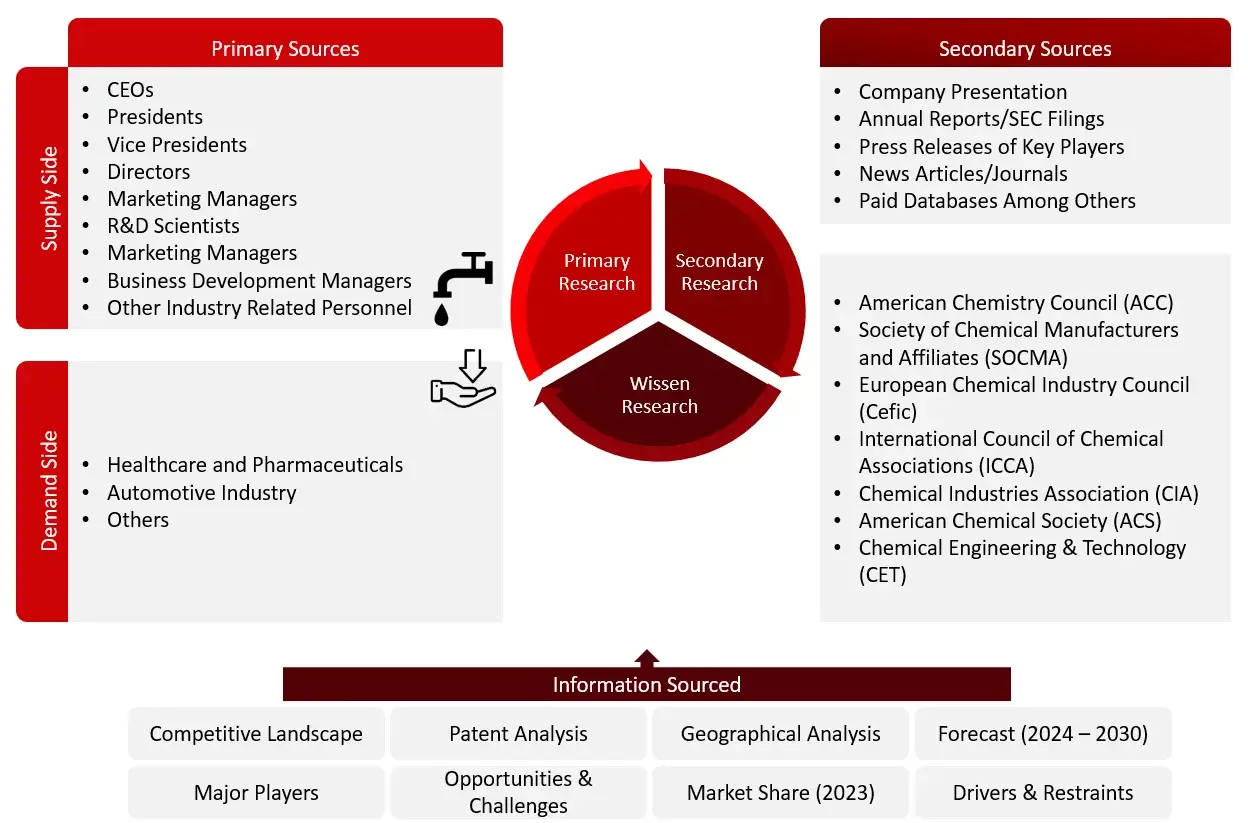

FIGURE: RESEARCH DESIGN

Sources: Wissen Research Analysis.

Research Approach

Collecting Secondary Data

The process of collating secondary research data involves the utilization of databases, secondary sources, annual reports, investor presentations, directories, and SEC filings of companies. Secondary research will be utilized to identify and gather information beneficial for the in-depth, technical, market-oriented, and commercial analysis of the minimally invasive surgery market. A database of the key industry leaders will also be compiled using secondary research.

Collecting Primary Data

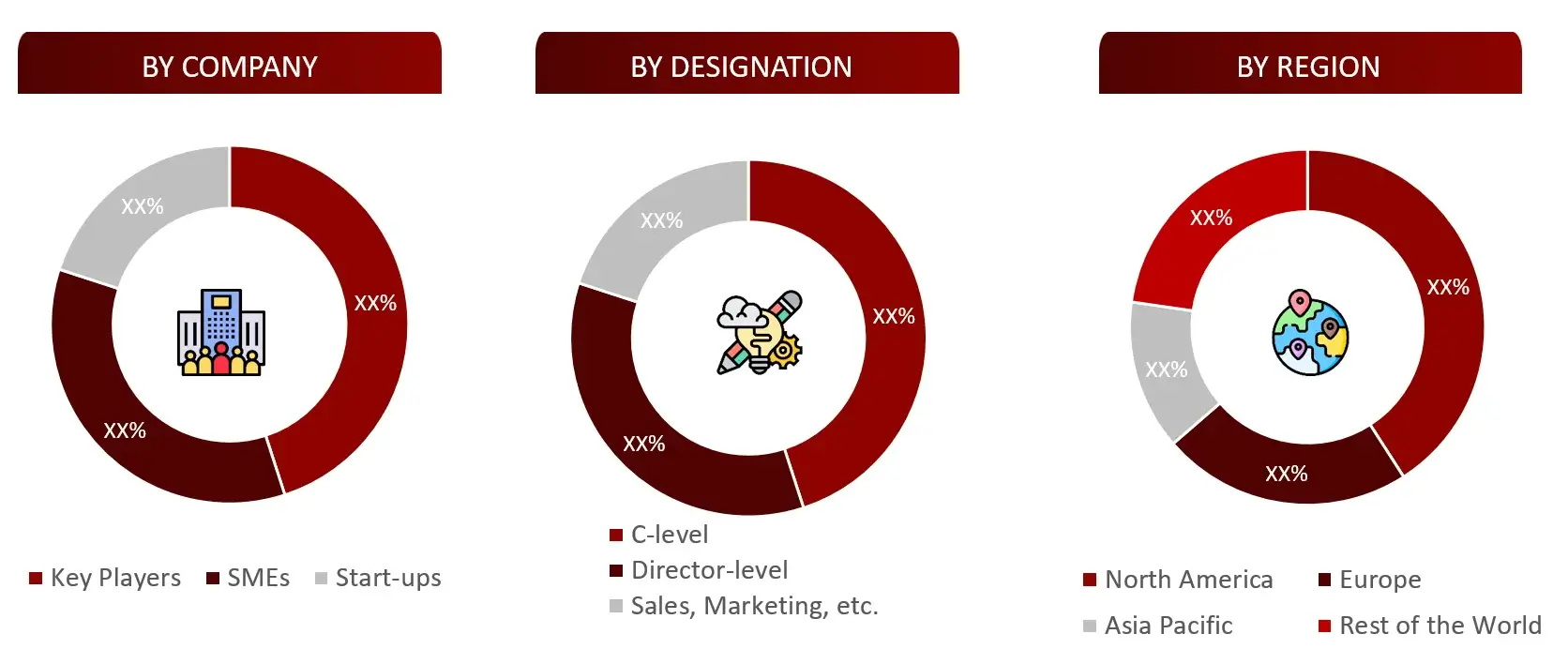

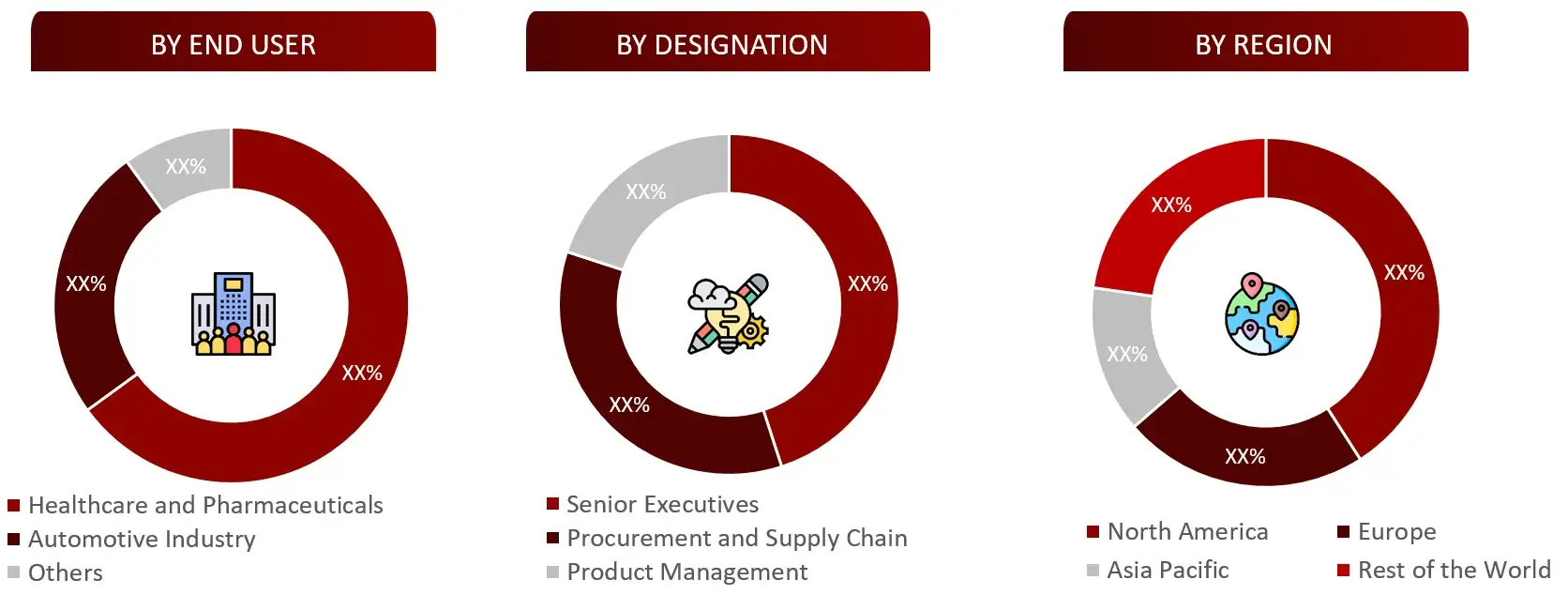

The primary research data will be conducted after acquiring knowledge about the specialty chemicals market scenario through secondary research. A significant number of primary interviews will be conducted with stakeholders from both the demand and supply side (including various industry experts, such as Vice Presidents (VPs), Chief X Officers (CXOs), Directors from business development, marketing and product development teams, product manufacturers) across major countries of Europe, Asia Pacific, North America, Latin America, and Middle East and Africa. Primary data for this report will be collected through questionnaires, emails, and telephonic interviews.

FIGURE: BREAKDOWN OF PRIMARY INTERVIEWS FROM SUPPLY SIDE

FIGURE: BREAKDOWN OF PRIMARY INTERVIEWS FROM DEMAND SIDE

FIGURE: PROPOSED PRIMARY PARTICIPANTS FROM DEMAND AND SUPPLY SIDE

Market Size Estimation

All major industries offering various specialty chemicals services will be identified at the global/ regional level. Revenue mapping will be done for the major players, which will further be extrapolated to arrive at the global market value of each type of segment. The market value of specialty chemicals market will also split into various segments and sub segments at the region level based on:

FIGURE: REVENUE MAPPING BY COMPANY (ILLUSTRATION)

Sources: Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentation, Paid Database, and Wissen Research Analysis.

Sources: Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentation, Paid Database, and Wissen Research Analysis.FIGURE: REVENUE SHARE ANALYSIS OF KEY PLAYERS (SUPPLY SIDE)

Sources: Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentation, Paid Database, and Wissen Research Analysis.

Sources: Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentation, Paid Database, and Wissen Research Analysis.FIGURE: MARKET SIZE ESTIMATION TOP-DOWN AND BOTTOM-UP APPROACH

Sources: Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentation, Paid Database, and Wissen Research Analysis.

Sources: Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentation, Paid Database, and Wissen Research Analysis.FIGURE: ANALYSIS OF DROCS FOR GROWTH FORECAST

Sources: American Chemistry Council (ACC)., Society of Chemical Manufacturers and Affiliates (SOCMA)., European Chemical Industry Council (Cefic)., International Council of Chemical Associations (ICCA)., Chemical Industries Association (CIA)., American Chemical Society (ACS)., Chemical Engineering & Technology (CET)., Company Website, Press Releases, Annual Reports, Paid Data Sources, and Wissen Research Analysis.

Sources: American Chemistry Council (ACC)., Society of Chemical Manufacturers and Affiliates (SOCMA)., European Chemical Industry Council (Cefic)., International Council of Chemical Associations (ICCA)., Chemical Industries Association (CIA)., American Chemical Society (ACS)., Chemical Engineering & Technology (CET)., Company Website, Press Releases, Annual Reports, Paid Data Sources, and Wissen Research Analysis.FIGURE: GROWTH FORECAST ANALYSIS UTILIZING MULTIPLE PARAMETERS

Sources: Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentation, Paid Database, and Wissen Research Analysis.

Sources: Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentation, Paid Database, and Wissen Research Analysis.Research Design

After arriving at the overall market size-using the market size estimation processes-the market will be split into several segments and sub segment. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub segment, the data triangulation, and market breakdown procedures will be employed, wherever applicable. The data will be triangulated by studying various factors and trends from both the demand and supply sides in the minimally invasive surgery market.

Sources: American Chemistry Council (ACC)., Society of Chemical Manufacturers and Affiliates (SOCMA)., European Chemical Industry Council (Cefic)., International Council of Chemical Associations (ICCA)., Chemical Industries Association (CIA)., American Chemical Society (ACS)., Chemical Engineering & Technology (CET)., Company Website, Press Releases, Annual Reports, Paid Data Sources, and Wissen Research Analysis.

Sources: American Chemistry Council (ACC)., Society of Chemical Manufacturers and Affiliates (SOCMA)., European Chemical Industry Council (Cefic)., International Council of Chemical Associations (ICCA)., Chemical Industries Association (CIA)., American Chemical Society (ACS)., Chemical Engineering & Technology (CET)., Company Website, Press Releases, Annual Reports, Paid Data Sources, and Wissen Research Analysis. 1.Introduction

1.1 Key Objectives

1.2 Definitions

1.2.1 In Scope

1.2.2 Out of Scope

1.3 Scope of the Report

1.4 Scope Related Limitations

1.5 Key Stakeholders

2. Research Methodology

2.1 Research Approach

2.2 Research Methodology / Design

2.3 Market Sizing Approach

2.3.1. Secondary Research

2.3.2 Primary Research

3. Executive Summary & Premium Content

3.1 Global Market Outlook

3.2 Key Market Findings

4. Patent Analysis

4.1 Patents Related to Specialty Chemicals devices

4.2 Patent Landscape and Intellectual Property Trends

5. Market Overview

5.1 Market Dynamics

5.1.1 Drivers/Opportunities

5.1.2 Restraints/Challenges

5.2 End User Perception

5.3 Need Gap

5.4 Supply Chain / Value Chain Analysis

5.5 Industry Trends

5.6 Porter’s Five Forces Analysis

5.6.1 Bargaining Power of Suppliers

5.6.2 Bargaining Power of Buyers

5.6.3 Threat of New Entrants

5.6.4 Threat of Substitute Products and Services

5.6.5 Degree of Competition

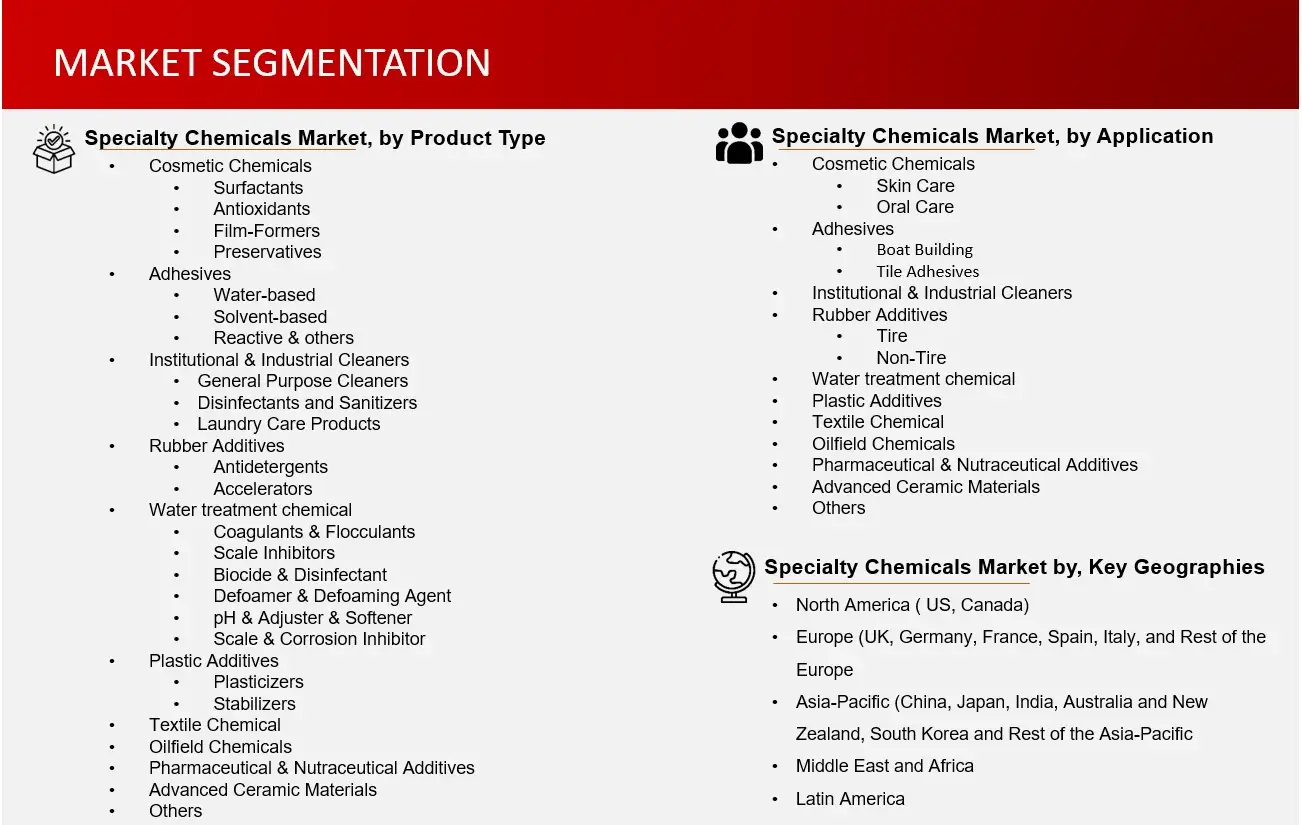

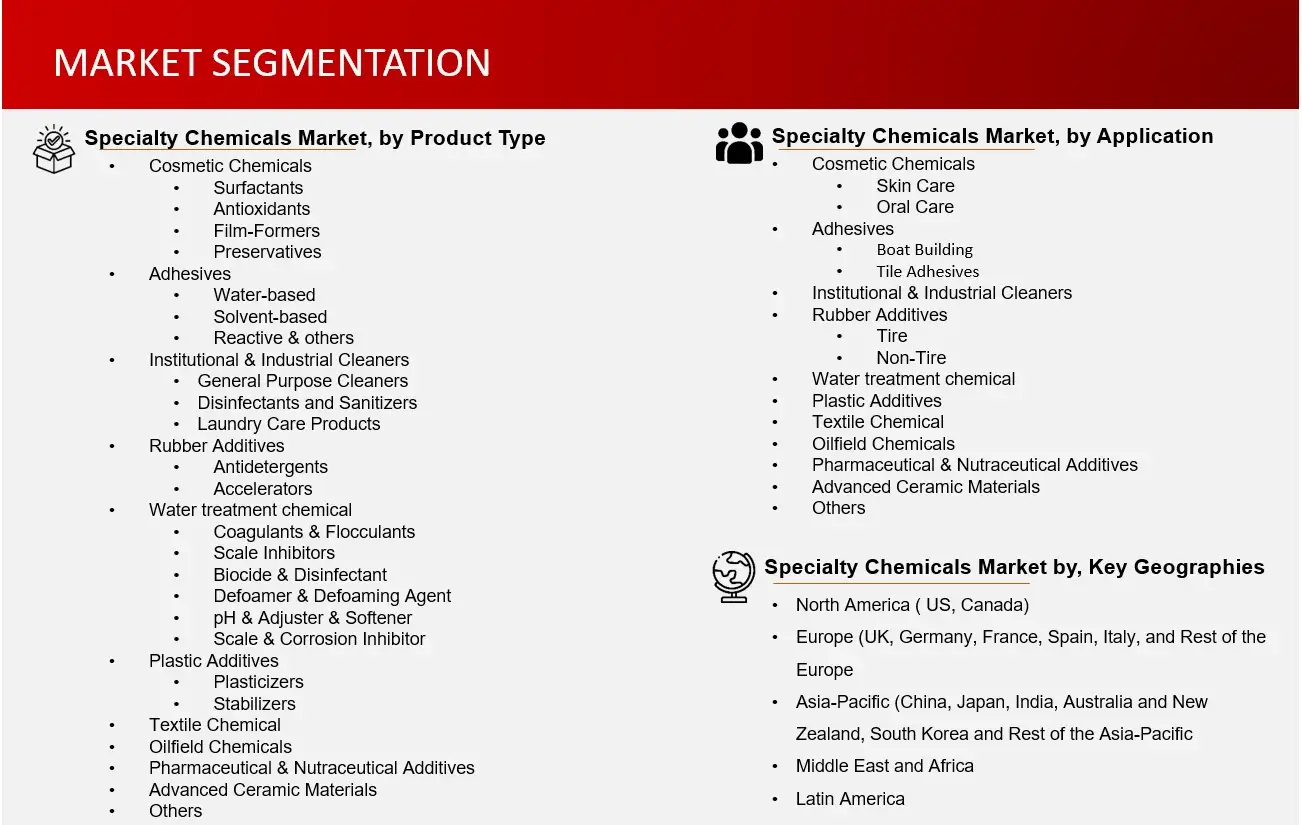

6. Specialty Chemicals Market, by Product Type (2023-2030, USD Million)

6.1 Cosmetic Chemicals

6.1.1 Surfactants

6.1.2 Antioxidants

6.1.3 Film-Formers

6.1.4 Preservatives

6.2 Adhesives

6.2.1 Water-based

6.2.2 Solvent-based

6.2.3 Hot-melt

6.2.4 Reactive & others

6.2.5 CT imaging

6.3 Institutional & Industrial Cleaners

6.3.1 General Purpose Cleaners

6.3.2 Disinfectants and Sanitizers

6.3.3 Laundry Care Product

6.4 Rubber Additives

6.4.1 Antidetergents

6.4.2 Accelerators

6.4.3 Processing Aid/ Promoters

6.4.4 Flame Retardants

6.5 Water treatment chemical

6.5.1 Coagulants & Flocculants

6.5.2 Scale Inhibitors

6.5.3 Biocide & Disinfectant

6.5.4 Defoamer & Defoaming Agent

6.5.5 pH & Adjuster & Softener

6.5.6 Scale & Corrosion Inhibitor

6.6 Plastic Additives

6.6.1 Plasticizers

6.6.2 Stabilizers

6.6.3 Flame Retardants

6.6.4 Impact Modifiers

6.6.5 Nucleating Agents

6.7 Textile Chemical

6.7.1 Colorants & Auxiliaries

6.7.2 Coating & Sizing Chemicals

6.7.3 Finishing Agents

6.7.4 Surfactants

6.7.5 Denim Finishing Agents

6.8 Oilfield Chemicals

6.8.1 Demulsifiers

6.8.2 Biocides

6.8.3 Friction Reducers

6.8.4 Inhibitors

6.8.5 Scavenger

6.8.6 Foamers

6.8.7 Rheology Modifiers

6.9 Pharmaceutical & Nutraceutical Additives

6.9.1 Active Pharmaceutical Ingredients (APIs)

6.9.2 Flavoring Agents

6.9.3 Colorants

6.9.4 Preservatives

6.9.5 Amino Acids

6.9.6 Probiotics

6.9.7 Vitamins and Minerals

6.9.8 Functional Foods

6.9.9 Herbal Extracts

6.9.10 Excipient Additives

6.10 Advanced Ceramic Materials

6.10.1 Alumina Ceramics

6.10.2 Silicon Carbide

6.10.3 Ceramic Matrix Composites

6.10.4 Optical Ceramics

6.10.5 Others (Dielectric Ceramics., Barium Titanate., Metal Matrix Composites etc.)

6.11 Others (Specialty Pulp & Paper Chemicals., Mining Chemicals etc.)

7. Specialty Chemicals Market, by Application Type (2023-2030, USD Million)

7.1 Introduction

7.2 Cosmetic Chemicals

7.2.1 Skin Care

7.2.2 Hair Care

7.2.3 Makeup

7.2.4 Oral Care

7.3 Adhesives

7.3.1 Boat Building

7.3.2 Tile Adhesives

7.3.3 Sealants

7.3.4 Food Packaging

7.4 Institutional & Industrial Cleaners

7.4.1 Food Service

7.4.2 Retail

7.4.3 Healthcare

7.4.4 Electronic Components

7.5 Rubber Additives

7.5.1 Tire

7.5.2 Non-Tire

7.6 Water treatment chemical

7.6.1 Power

7.6.2 Municipal

7.6.3 Oil& Gas

7.6.4 Mining & Mineral Processing

7.6.5 Food & Beverage

7.6.6 Pulp & Paper

7.7 Plastic Additives

7.7.1 Rubber Products

7.7.2 Packaging

7.7.3 Construction Materials

7.7.4 Electronics

7.7.5 Automotive Parts

7.8 Textile Chemical

7.8.1 Apparel

7.8.2 Technical Textiles

7.8.3 Home Furnishing

7.8.4 Medical Textiles

7.8.5 Health and Hygiene Products

7.9 Oilfield Chemicals

7.10 Pharmaceutical & Nutraceutical Additives

7.11 Advanced Ceramic Materials

7.12 Others

8. Specialty Chemicals Market, by Region (2023-2030, USD Million)

8.1 North America

8.1.1 US

8.1.2 Canada

8.2 Europe

8.2.1 Germany

8.2.2 France

8.2.3 Spain

8.2.4 Italy

8.2.5 UK

8.2.6 Rest of the Europe

8.3 Asia Pacific

8.3.1 China

8.3.2 Japan

8.3.3 India

8.3.4 Australia and New Zealand

8.3.5 South Korea

8.3.6 Rest of the Asia Pacific

8.4 Middle East and Africa

8.5 Latin America

9. Competitive Analysis

9.1 Key Players Footprint Analysis

9.2 Market Share Analysis

9.3 Key Brand Analysis

9.4 Regional Snapshot of Key Players

9.5 R&D Expenditure of Key Players

10. Company Profiles2

10.1 Evonik Industries AG

10.1.1 Business Overview

10.1.2 Product Portfolio

10.1.3 Financial Snapshot3

10.1.4 Recent Developments

10.1.5 SWOT Analysis

10.2 Solvay SA

10.3 Clariant AG

10.4 Dupont De Nemours, Inc.

10.5 Akzo Nobel N.V.

10.6 Kemira

10.7 BASF SE

10.8 LG Chem Ltd.

10.9 Croda International Plc

10.10 Huntsman International LLC

10.11 The Lubrizol Corporation

10.12 Albemarle Corporation

10.13 Lanxess Ag

10.14 Nouryon

10.15 Arkema

10.16 Ecolabs INC

10.17 Ashland INC

10.18 Lonza

10.19 B Fuller

10.20 Covestro Ag

10.21 Dow Inc

10.22 Brenntag AG

10.23 FMC Corporation

10.24 AkzoNobel N.V

10.25 SABIC (Saudi Basic Industries Corporation).,

10.26 Tosoh Corporation

11. Conclusion

12. Appendix

12.1 Industry Speak

12.2 Questionnaire

12.3 Available Custom Work

12.4 Adjacent Studies

12.5 Authors

13. References

Key Notes:

© Copyright 2024 – Wissen Research All Rights Reserved.