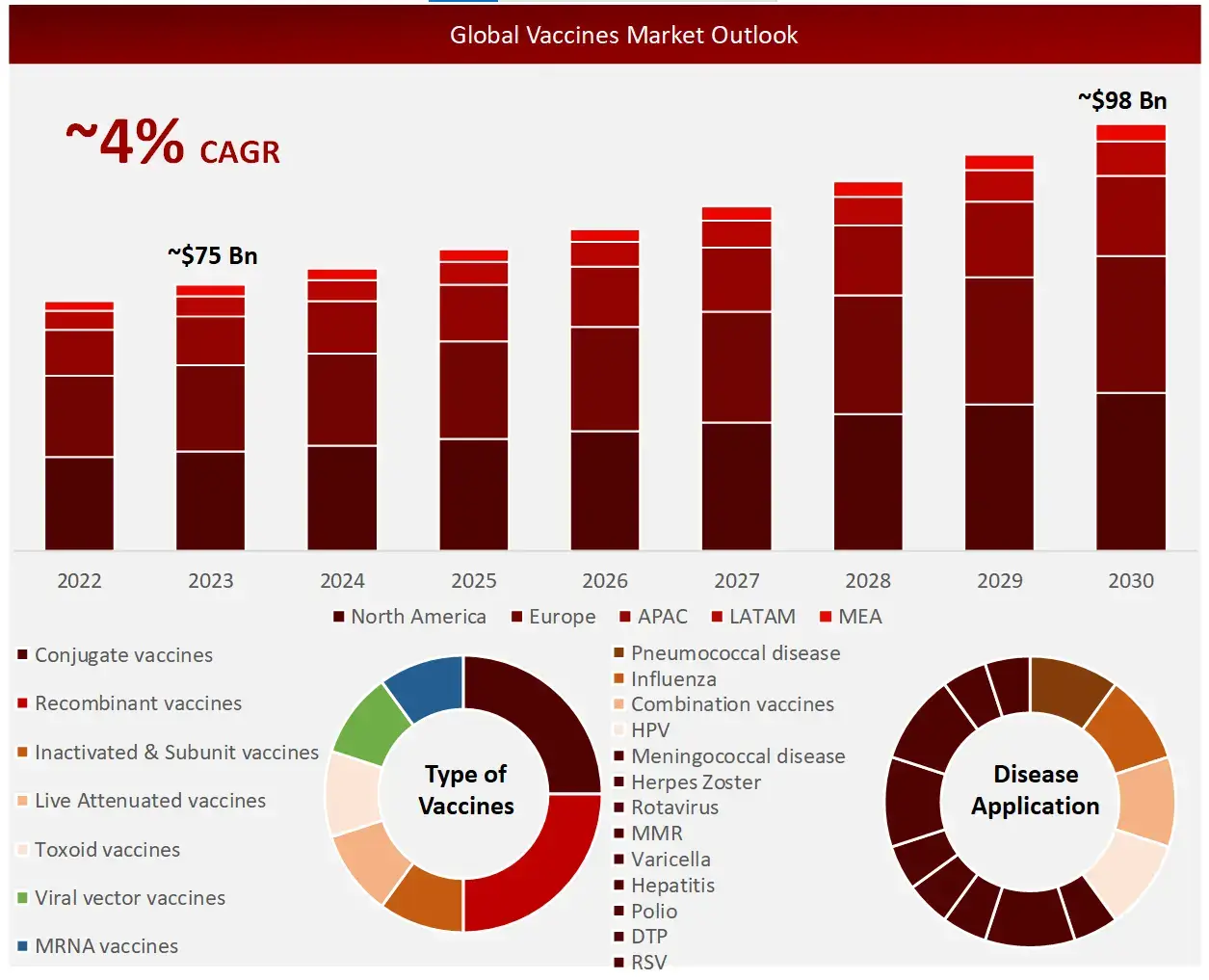

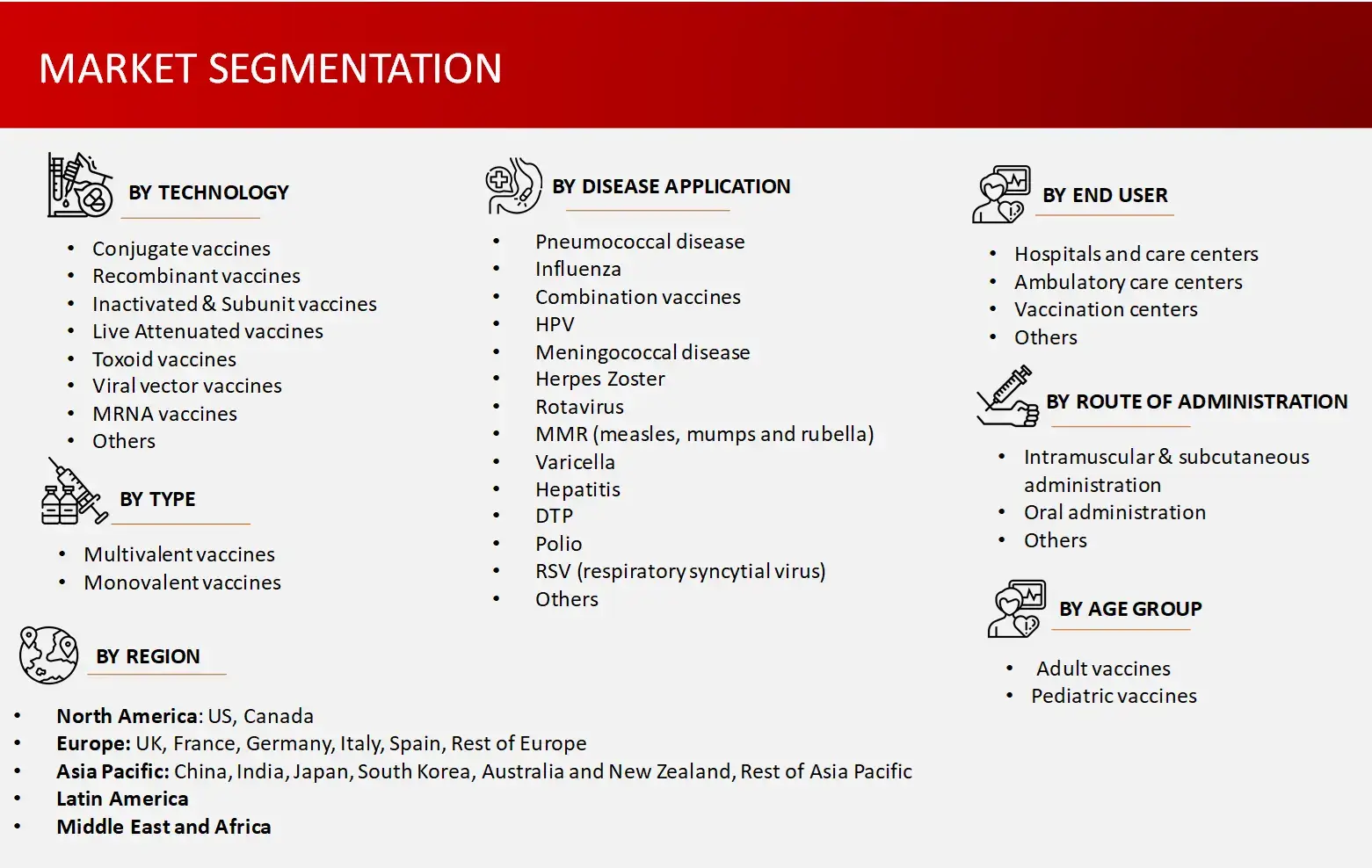

Vaccines: Market Size, Trend, by Application (Pneumococcal Disease, Influenza, Combination Vaccines, Polio etc.) Technology (Conjugate Vaccines, Recombinant Vaccines, Inactivated & Subunit Vaccines, Viral Vector Vaccines, mRNA Vaccines, etc.) End User, Region, Major Players – Global Forecast to 2030

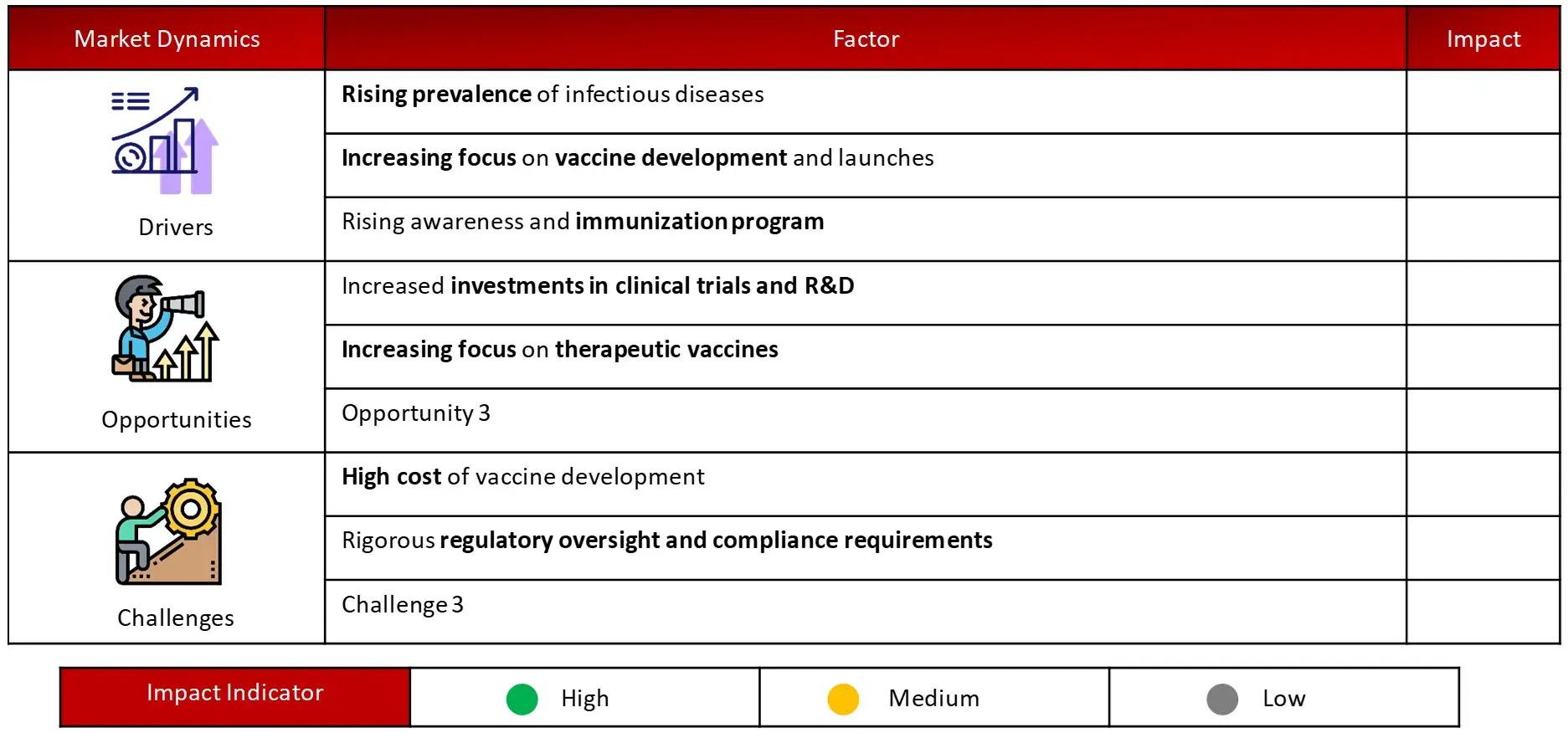

Key driving factors of vaccines market include rising prevalence of infectious disease, increasing focus on vaccine development and launches and rising awareness and immunization program

Challenges in the vaccines domain include high cost of vaccine development and rigorous regulatory oversight. The global vaccines market is estimated to be valued at ~ $75 Billion in 2023, and is expected to grow at a CAGR of ~4%. Conjugate vaccines have held the most significant share in the market since 2022, with North America dominating the regional market share.

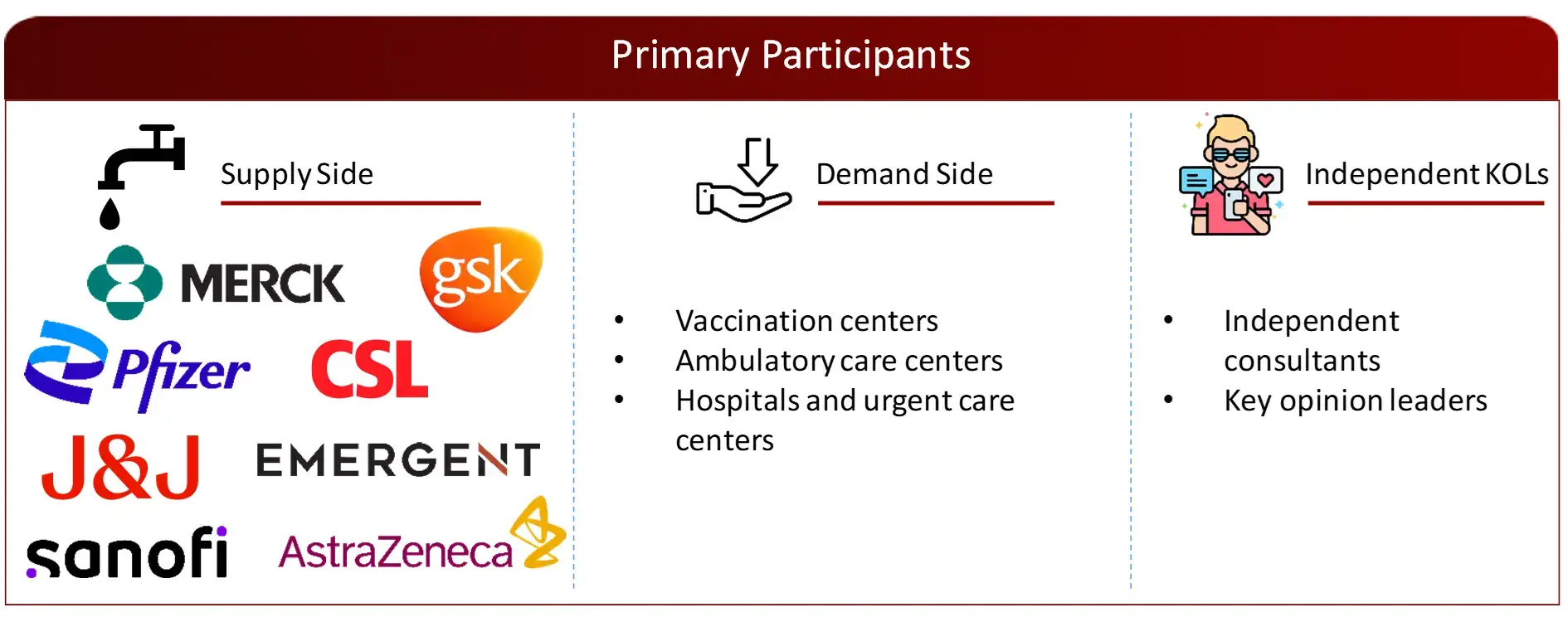

Key players functioning in vaccines sector are GSK plc, Johnsons & Johnsons, Merck, AstraZeneca, Pfizer and CSL. In recent strategic activities, GSK paid 400 Million Euros to CureVac to acquires full rights to develop, manufacture and commercialise globally mRNA candidate vaccines for influenza and COVID-19, including combinations. (July, 2024) and collaboration between Sanofi vaccines and Medidata, to deploy Medidata’s eCOA for vaccine studies. (Feb, 2024)

The vaccines market is experiencing substantial growth, driven by increasing awareness and widespread immunization programs. Global health initiatives have significantly boosted vaccine uptake, with the World Health Organization reporting that immunization prevents 4-5 million deaths annually. In 2022, the Global Vaccine Action Plan achieved 85% coverage for essential vaccines in over 125 countries.

Furthermore, public health campaigns have enhanced awareness, leading to higher vaccination rates. For instance, a 2023 study across 30 countries found that targeted awareness programs increased flu vaccination rates by 23% among high-risk populations. The COVID-19 pandemic has also heightened public understanding of vaccine importance, with over 13 billion doses administered globally as of 2023, demonstrating the critical role of immunization in public health and driving market expansion.

Major driving opportunity in vaccines market is due to increased investments in clinical trials and R&D. According to Wissen Research’s 2023 study, global pharmaceutical companies allocated over $35 billion to vaccine research, a ~40% increase from 2019 levels. This surge in funding has accelerated the development of novel vaccines, with over 250 candidates in various stages of clinical trials as of 2024.

Notably, mRNA technology, spotlighted during the COVID-19 pandemic, has opened new avenues for vaccine development across multiple diseases. A recent industry report revealed that 60% of major vaccine manufacturers have expanded their R&D facilities in the past two years. Additionally, public-private partnerships have flourished, with governments worldwide pledging $10 billion for vaccine research initiatives in 2023 alone. This influx of resources is driving innovation, potentially revolutionizing disease prevention and expanding the vaccine market’s scope.

High development costs can impede innovation and market growth. Developing a new vaccine typically costs between an estimate $200 million to $500 million, with some estimates reaching as high as $1 billion. This substantial investment is exacerbated by lengthy development timelines, often spanning 10-15 years from concept to market.

Furthermore, the complex manufacturing processes and stringent quality control measures add to the overall expense. For instance, a recent industry study by Wissen Research revealed that 40% of vaccine manufacturers reported a 30% increase in production costs over the past five years due to enhanced safety protocols and advanced technologies. These high costs can deter smaller companies from entering the market and limit the development of vaccines for less common diseases.

Conjugate vaccines dominated the vaccines market share in 2023

Vaccines include various technology types, including conjugate vaccines, recombinant vaccines, inactivated & subunit vaccines, live attenuated vaccines, toxoid vaccines, viral vector vaccines, MRNA vaccines, among others. Each category serves specific therapeutic needs across different disease applications. Among these, conjugate vaccines have held the largest market share, primarily due to the high global demand.

Covid-19 vaccines accounted for the largest share in 2023

Global vaccines market by application is segmented into a diverse indication spectrum, some of them are Covid-19, polio, rota virus, influenza, HPV, herpes zoster and others.

Among the aforementioned applications covid-19 segment dominated the market due to ongoing vaccination drives globally, to eradicate this viral disease.

Significant market share held by hospitals was observed in 2022

Vaccines serve a number of end-users such as hospitals, ambulatory facilities, vaccination centers.

The traditional healthcare facilities, i.e. hospitals remained the significant holder of user market share due to increase in the immunization drives globally, such as for Covid-19.

North America held the largest market share in vaccines in the forecast period

Vaccines market research included a comprehensive analysis of five key regions:

All regions were evaluated based on these following factors- healthcare infrastructure, regulatory landscape, technological adoption, and market dynamics.

The research observed that North America held the largest share in the vaccines domain during the forecast period, primarily due to its advanced healthcare systems, high adoption rates, and the presence of major market players driving innovation in this sector.

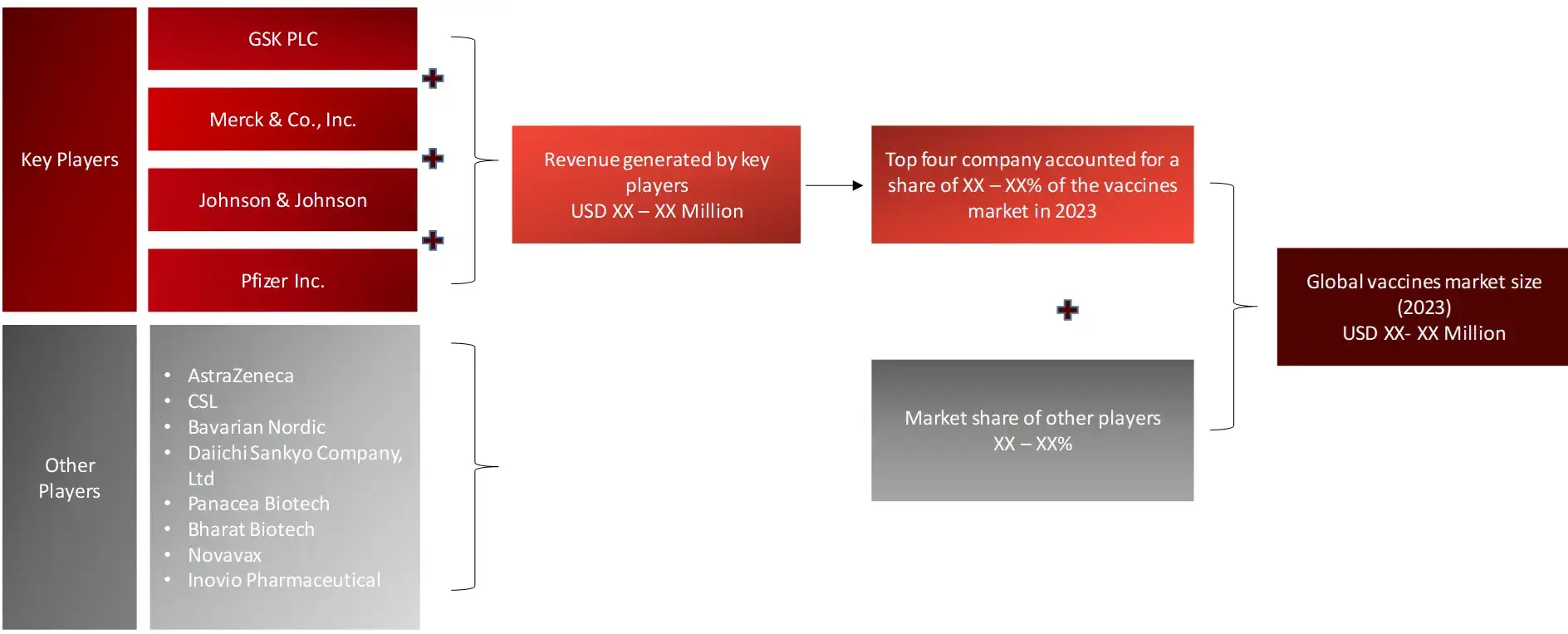

As per the historical and the base year of the report (2022 and 2023, respectively), key players in vaccines were GSK plc (UK), Merck & Co (Germany), Pfizer (US), CSL (Australia), Sanofi (France), Johnson & Johnson (US), Emergent (US), AstraZeneca (UK), Serum Institute of India (India), Bavarian Nordic (Denmark), Daiichi Sankyo Company (Japan), Panacea Biotech (India), Bharat Biotech (India), Novavax (US) and Inovio Pharmaceutical (US).

Introduction

Market Definition

Vaccines are a biological preparation that is used to stimulate body immune response against disease. This preparation consists of suspensions of weakened or killed microorganisms or toxins or other biological mixtures, such as those containing antibodies, lymphocytes or mRNA, administered primarily to prevent diseases.

FIGURE: VACCINES EQUIPMENT MARKET SEGMENT

Sources: Company Websites and Wissen Research Analysis

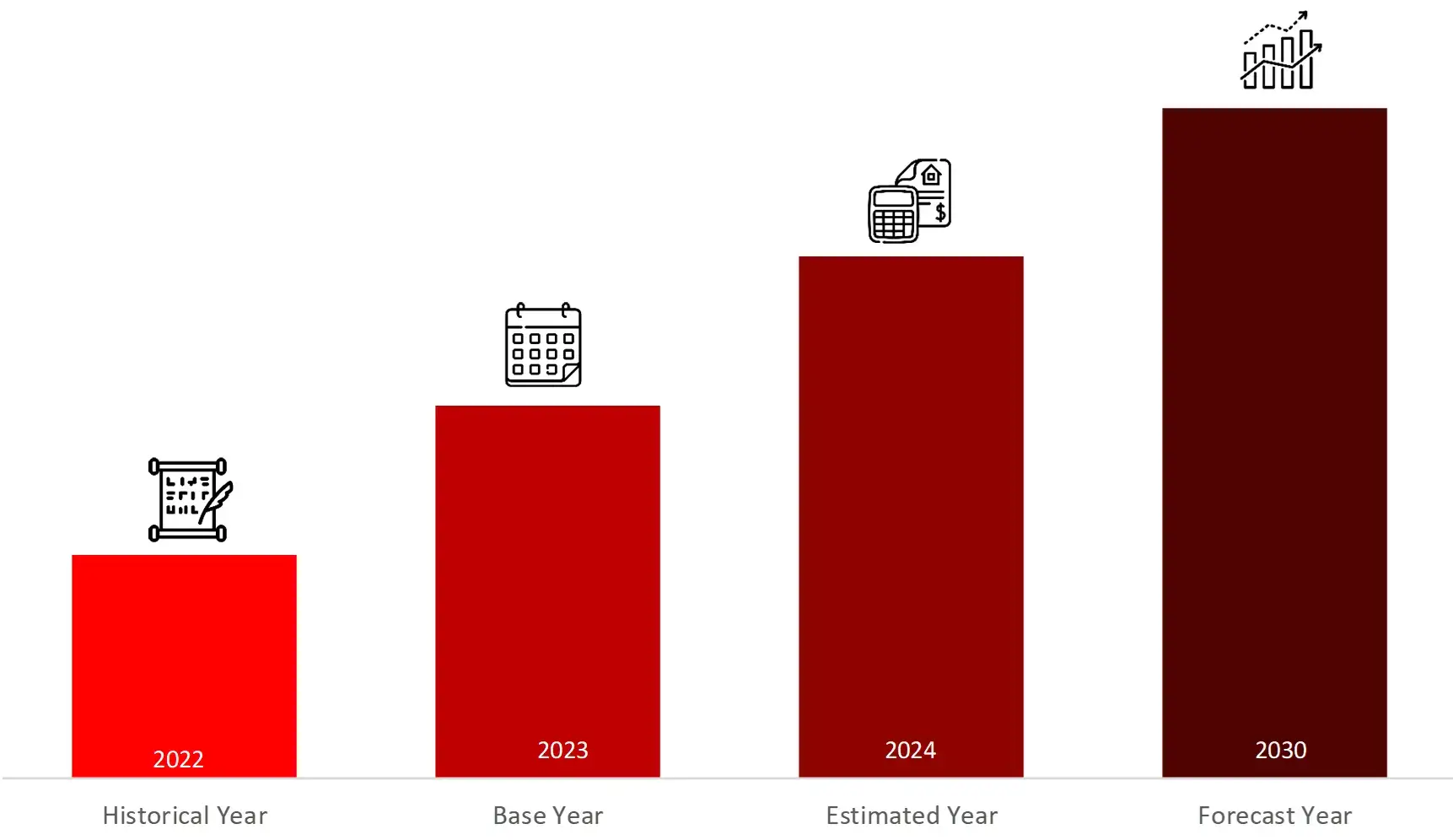

FIGURE: YEARS FRAMEWORK CONSIDERED IN THE STUDY

Sources: Wissen Research Analysis

Key Stakeholders

Key objectives of the Study

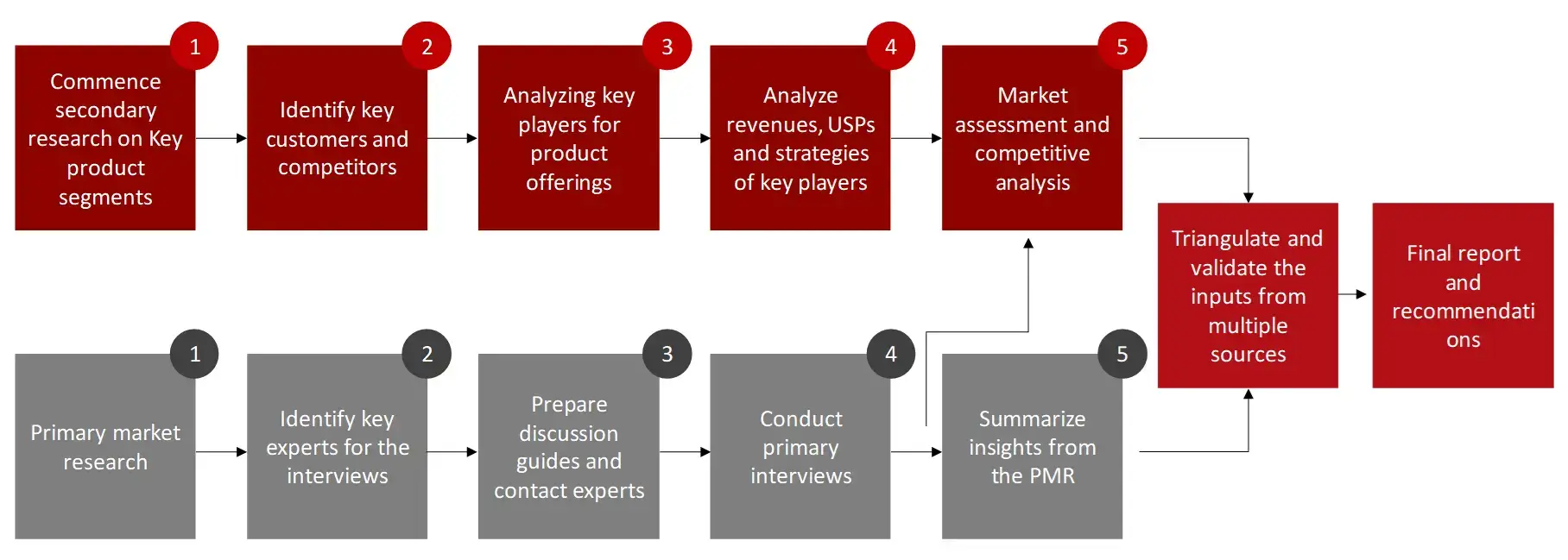

Research Methodology

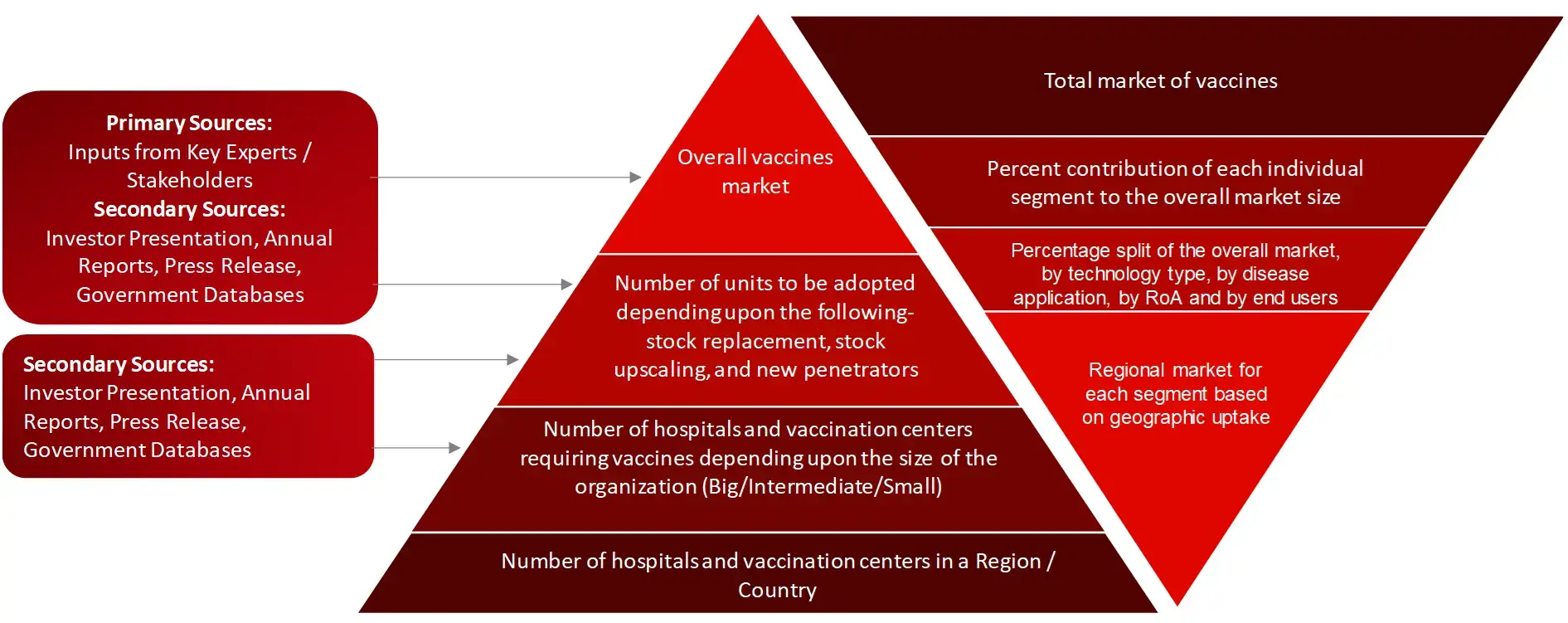

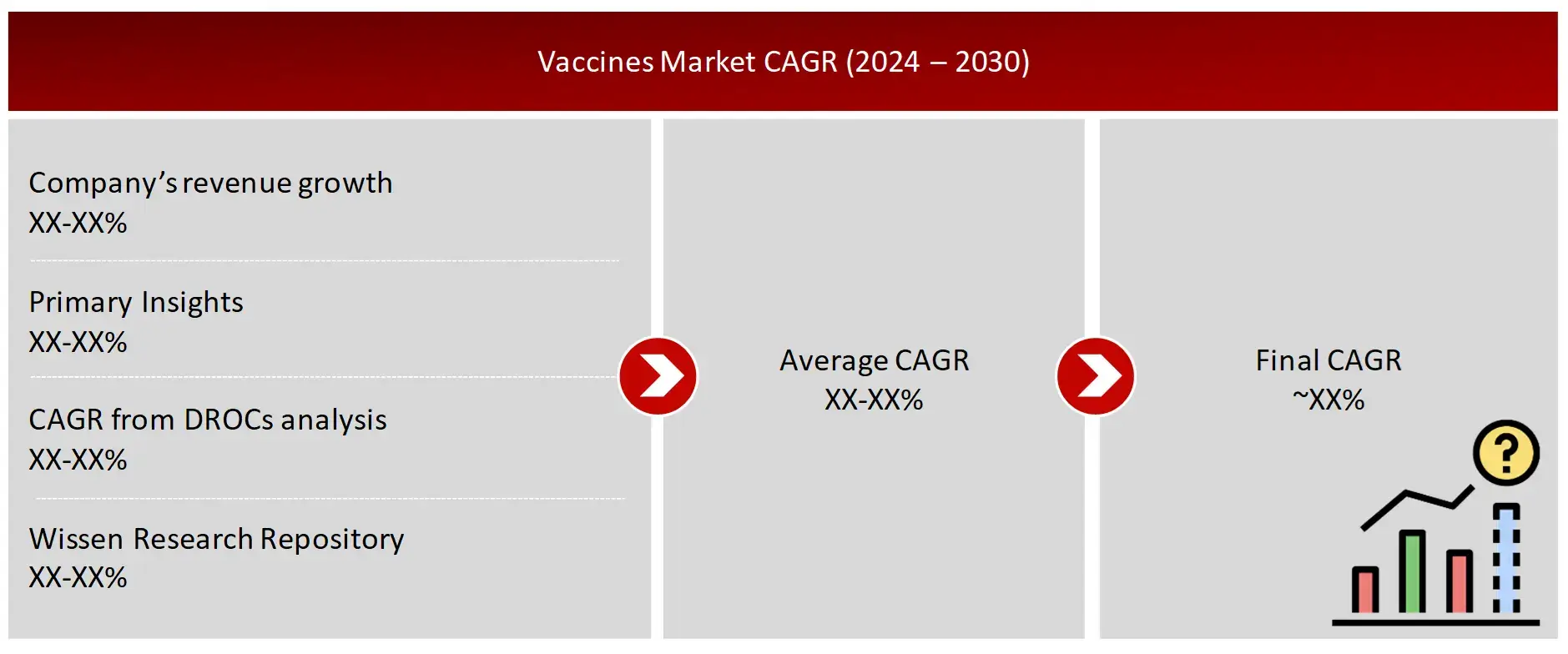

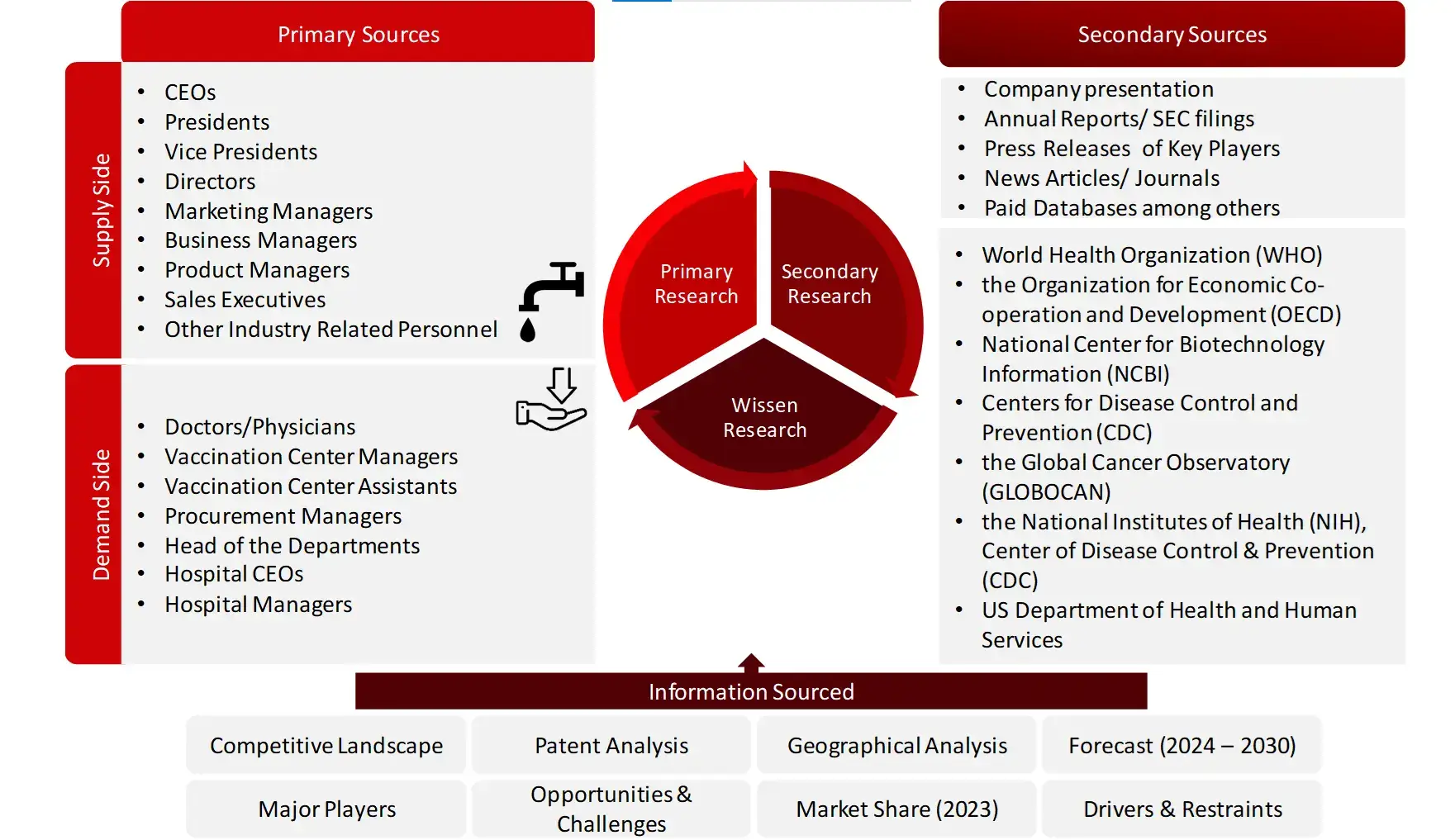

The objective of the study is to analyze the key market dynamics such as drivers, opportunities, challenges, restraints, and key player strategies. To track company developments such as product launches and approvals, expansions, and collaborations of the leading players, the competitive landscape of the vaccines market to analyze market players on various parameters within the broad categories of business and product strategy. Top-down and bottom-up approaches will be used to estimate the market size. To estimate the market size of segments and sub segments the market breakdown and data triangulation will be used.

FIGURE: RESEARCH DESIGN

Sources: Wissen Research Analysis

Research Approach

Collecting Secondary Data

The secondary research data collection process involves the usage of secondary sources, directories, databases, annual reports, investor presentations, and SEC filings of companies. Secondary research will be used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the vaccines market. A database of the key industry leaders will also be prepared using secondary research.

Collecting Primary Data

The primary research data will be conducted after acquiring knowledge about the vaccines market scenario through secondary research. A significant number of primary interviews will be conducted with stakeholders from both the demand side and supply side (including various industry experts, such as Directors, Chief X Officers (CXOs), Vice Presidents (VPs) from business development, marketing and product development teams, product manufacturers) across major countries of North America, Europe, Asia Pacific, and Rest of the World. Primary data for this report was collected through questionnaires, emails, and telephonic interviews.

FIGURE: BREAKDOWN OF PRIMARY INTERVIEWS FROM SUPPLY SIDE

FIGURE: BREAKDOWN OF PRIMARY INTERVIEWS FROM DEMAND SIDE

FIGURE: PROPOSED PRIMARY PARTICIPANTS FROM DEMAND AND SUPPLY SIDE

Note: Above mentioned companies are non- exhaustive

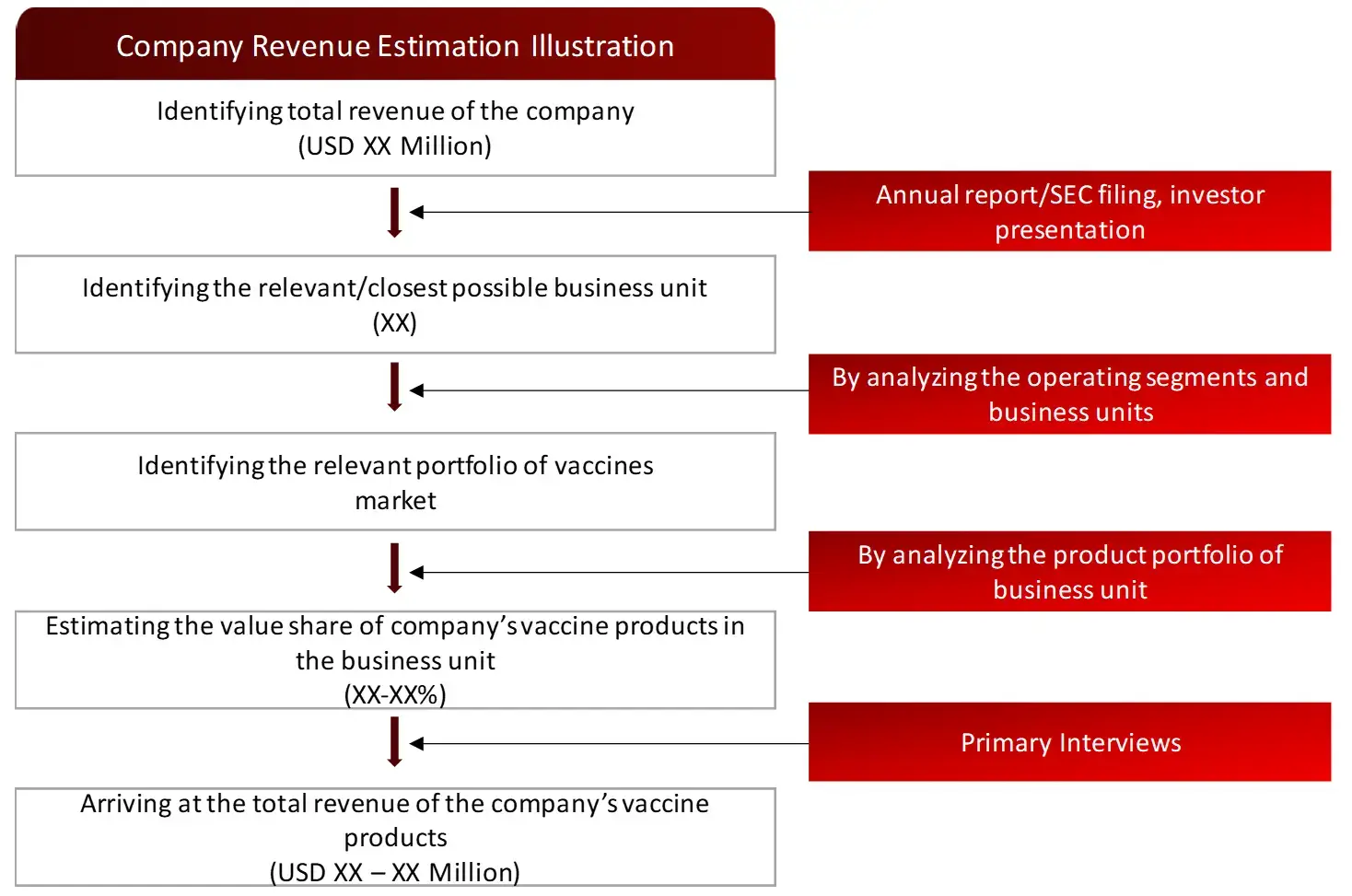

Market Size Estimation

All major manufacturers offering various vaccines will be identified at the global/regional level. Revenue mapping will be done for the major players, which will further be extrapolated to arrive at the global market value of each type of segment. The market value of vaccines market will also split into various segments and sub segments at the region level based on:

FIGURE: REVENUE MAPPING BY COMPANY (ILLUSTRATION)

FIGURE: REVENUE SHARE ANALYSIS OF KEY PLAYERS (SUPPLY SIDE)

FIGURE: MARKET SIZE ESTIMATION TOP-DOWN AND BOTTOM-UP APPROACH

FIGURE: ANALYSIS OF DROCS FOR GROWTH FORECAST

Sources: World Health Organization (WHO), the Organization for Economic Co-operation and Development (OECD), National Center for Biotechnology Information (NCBI), Centers for Disease Control and Prevention (CDC), the Global Cancer Observatory (GLOBOCAN), the National Institutes of Health (NIH), Center of Disease Control & Prevention (CDC), US Department of Health and Human Services, National Institutes of Health (NIH), National Library of Medicine, National Center for Biotechnology Information (NCBI), National Institute of Allergy and Infectious Diseases (NIAID), World Cancer Research Fund International (WCRF International), European Medicines Agency (EMA), The National Medical Products Administration (NMPA), Global Alliance for Vaccines and Immunization (GAVI), United States Food & Drug Administration (US FDA), Orange book, Purple book, Clinical trials.gov, Pan American Health Organization (PAHO), United Nation International Children’s Emergency Fund (UNICEF), Department of health and Human Services (HHS), International Society for Vaccines (ISV). The Central Drugs Standard Control Organization (CDSCO)

FIGURE: GROWTH FORECAST ANALYSIS UTILIZING MULTIPLE PARAMETERS

Research Design

After arriving at the overall market size-using the market size estimation processes-the market will be split into several segments and sub segment. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub segment, the data triangulation, and market breakdown procedures will be employed, wherever applicable. The data will be triangulated by studying various factors and trends from both the demand and supply sides in the vaccines market industry.

1. Introduction

1.1 Key objectives

1.2 Definitions

1.2.1 In scope

1.2.2 Out of scope

1.3 Scope of the report

1.4 Scope related limitations

1.5 Key stakeholders

2. Research Methodology

2.1 Research approach

2.2 Research methodology / design

2.3 Market sizing approach

2.3.1 Secondary research

2.3.2 Primary research

3. Executive Summary & Premium Content

3.1 Global market outlook

3.2 Key market findings

4.Market Overview

4.1 Market dynamics

4.1.1 Drivers/Opportunities

4.1.2 Restraints/Challenges

4.2 End user perception

4.3 Need gap

4.4 Supply chain / Value chain analysis

4.5 Industry trends

4.6 Porter’s Five Forces analysis

4.7 Pricing analysis

4.8 Reimbursement Scenario

5. Patent Analysis

5.1 Top Assignees in Vaccines Market

5.2 Geography Focus of Top Assignees

5.3 Legal Status of Vaccines Patents

5.4 Assignee Segmentation

5.5 Network Analysis of Top Collaborating Entities in Vaccines Patent Applications

5.6 Technology Evolution in Vaccines

5.7 Key Patents in Vaccines

5.8 Patent Trends and Innovations

5.9 Key Players and Patent Portfolio Analysis

6. Clinical Trial Analysis

6.1 Overview of vaccine clinical trials

6.2 Analysis by trial registration year

6.3 Analysis by phase of development

6.4 Analysis by number of patients enrolled

6.5 Analysis by status of trial

6.6 Analysis by study design

6.7 Analysis by intervention type

6.8 Analysis by geography

6.9 Analysis by key sponsors/collaborators

7. Vaccines Market, by Technology (2023-2030, USD Million)

7.1 Conjugate vaccines

7.2 Recombinant vaccines

7.3 Inactivated & Subunit vaccines

7.4 Live Attenuated vaccines

7.5 Toxoid vaccines

7.6 Viral vector vaccines

7.7 MRNA vaccines

7.8 Others

8. Vaccines Market, by Type (2023-2030, USD Million)

8.1 Multivalent vaccines

8.2 Monovalent vaccines

9. Vaccines Market, by Disease Application (2023-2030, USD Million)

9.1 Pneumococcal disease

9.2 Influenza

9.3 Combination vaccines

9.4 HPV

9.5 Meningococcal disease

9.6 Herpes Zoster

9.7 Rotavirus

9.8 MMR (measles, mumps and rubella)

9.9 Varicella

9.10 Hepatitis

9.11 DTP

9.12 Polio

9.13 RSV (respiratory syncytial virus)

9.14 Others

10. Vaccines Market, by Route of Administration (2023-2030, USD Million)

10.1 Intramuscular & subcutaneous administration

10.2 Oral administration

10.3 Others

11. Vaccines Market, by End Users (2023-2030, USD Million)

11.1 Hospitals and clinics

11.2 Ambulatory care centres

11.3 Vaccination centres

11.4 Others

12. Vaccines Market, by Age Group (2023-2030, USD Million)

12.1 Adult vaccines

12.2 Pediatric vaccines

13. Vaccines Market, by Region (2023-2030, USD Million)

13.1 North America

13.1.1 US

13.1.2 Canada

13.2 Europe

13.2.1 UK

13.2.2 France

13.2.3 Germany

13.2.4 Italy

13.2.5 Spain

13.2.6 Rest of Europe

13.3 Asia Pacific

13.3.1 China

13.3.2 India

13.3.3 Japan

13.3.4 South Korea

13.3.5 Australia and New Zealand

13.3.6 Rest of Asia Pacific

13.4 Middle East and Africa

13.5 Latin America

14. Competitive Analysis

14.1 Key player’s footprint analysis

14.2 Market share analysis

14.3 Key brand analysis

14.4 Regional snapshot of key players

14.5 R&D expenditure of key players

15. Company Profiles2

15.1 GSK PLC

15.1.1 Business overview

15.1.2 Product portfolio

15.1.3 Financial snapshot3

15.1.4 Recent developments

15.1.5 SWOT analysis

15.2 Merck & Co., Inc.

15.3 Pfizer Inc.

15.4 CSL

15.5 Sanofi

15.6 Johnson & Johnson, Inc.

15.7 Emergent

15.8 AstraZeneca

15.9 Serum Institute of India Pvt., Ltd.

15.10 Bavarian Nordic

15.11 Daiichi Sankyo Company, Ltd

15.12 Panacea Biotech

15.13 Bharat Biotech

15.14 Novavax

15.15 Inovio Pharmaceutical

15.16 Others Key Players

16. Appendix

16.1 Industry speak

16.2 Questionnaire

16.3 Available custom work

16.4 Adjacent studies

16.5 Authors

17. References

Key Notes:

© Copyright 2024 – Wissen Research All Rights Reserved.